Key Insights

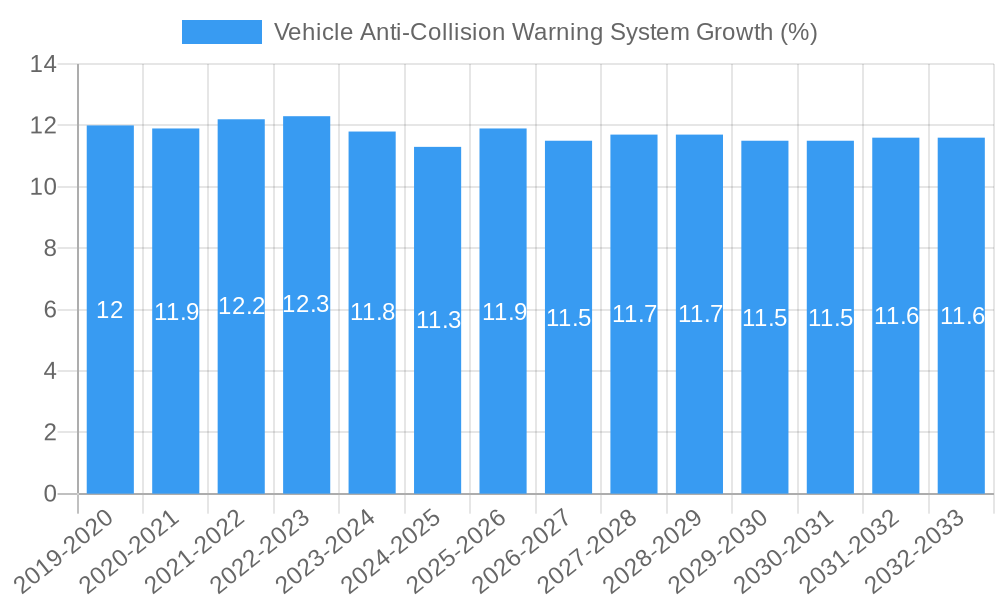

The global Vehicle Anti-Collision Warning System market is poised for substantial growth, projected to reach an estimated USD 3,500 million in 2025 with a compelling Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This robust expansion is primarily fueled by the escalating demand for enhanced safety features across all vehicle segments, driven by increasingly stringent government regulations promoting accident prevention and the growing adoption of advanced driver-assistance systems (ADAS). The Passenger Cars segment, constituting a significant portion of the market, is expected to lead this growth due to increasing consumer awareness and the integration of sophisticated collision avoidance technologies as standard or optional features. Forklifts and Trucks are also witnessing a surge in adoption, particularly in industrial and logistics sectors, where the risk of accidents involving heavy machinery and personnel is high, thus necessitating effective anti-collision solutions to minimize operational downtime and ensure worker safety.

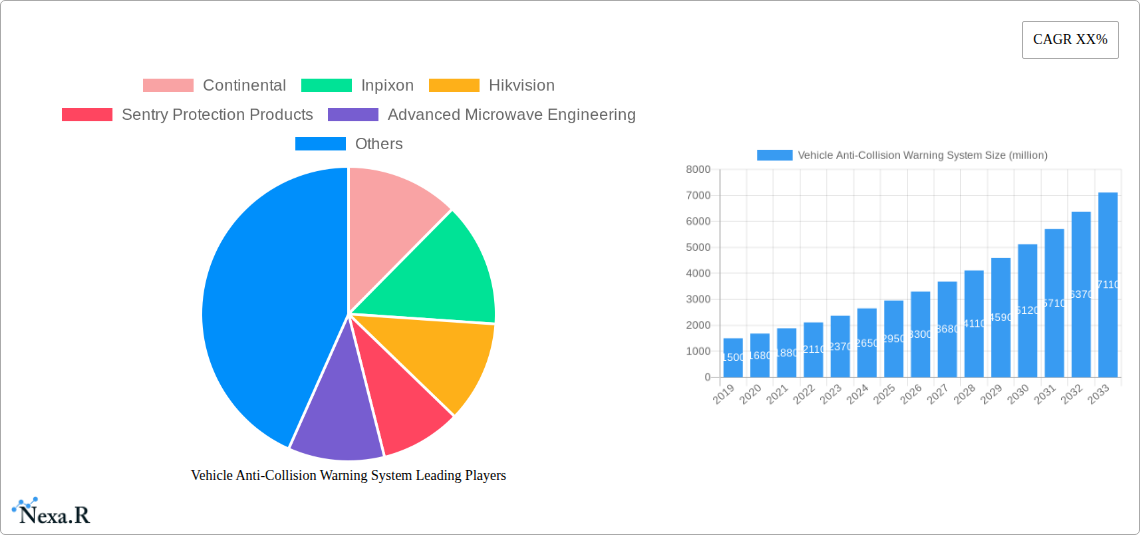

Further propelling the market forward are advancements in sensor technologies and the proliferation of smart infrastructure. Laser detection and Radar detection systems are becoming more refined, offering superior accuracy and reliability in various environmental conditions, thereby enhancing their appeal. The market is also benefiting from the growing integration of these warning systems with other vehicle electronics and connectivity solutions, paving the way for more intelligent and proactive safety measures. While the market benefits from strong growth drivers like enhanced safety and regulatory mandates, potential restraints include the initial cost of advanced systems and the complexity of integration, especially in older vehicle fleets. However, ongoing technological innovation and economies of scale are expected to mitigate these challenges, making vehicle anti-collision warning systems an indispensable component of modern transportation and industrial operations. Key players like Continental, Inpixon, Hikvision, and Mobileye are at the forefront of this innovation, introducing cutting-edge solutions and expanding their market presence.

Here is a comprehensive, SEO-optimized report description for the Vehicle Anti-Collision Warning System market, designed for immediate use.

Report Title: Global Vehicle Anti-Collision Warning System Market: Dynamics, Trends, and Forecast 2019-2033

Report Description:

Dive deep into the rapidly evolving Vehicle Anti-Collision Warning System (VCAWS) market with this definitive report. Covering the extensive study period of 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033, this analysis provides critical insights into market dynamics, growth trajectories, and competitive landscapes.

The Vehicle Anti-Collision Warning System market is experiencing significant expansion driven by increasing safety regulations, advancements in sensor technology, and a growing demand for intelligent transportation systems. This report offers a granular view of market segmentation by application, including Passenger Cars, Forklifts, Trucks, and Others, and by technology type, encompassing Laser Detection, Radar Detection, Special Label Detection, and Others.

We explore both the parent market of automotive safety systems and the specialized child market of VCAWS, highlighting their interconnectedness and growth potential. With an estimated market size projected to reach significant figures in million units, this report is an indispensable resource for industry stakeholders.

Key Features Include:

- Market Dynamics: Analysis of market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends.

- Growth Trends: In-depth analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, with specific metrics like CAGR and market penetration.

- Regional Dominance: Identification of leading regions, countries, and segments driving market growth, with an analysis of key drivers such as economic policies and infrastructure.

- Product Landscape: Detailed overview of product innovations, applications, and performance metrics, highlighting unique selling propositions and technological advancements.

- Drivers, Barriers & Challenges: Comprehensive outline of forces propelling the market, alongside an analysis of key challenges, restraints, supply chain issues, and regulatory hurdles.

- Emerging Opportunities: Identification of untapped markets, innovative applications, and evolving consumer preferences.

- Growth Accelerators: Discussion of catalysts driving long-term growth, including technological breakthroughs and strategic partnerships.

- Key Players: Profiles of leading companies shaping the market, such as Continental, Inpixon, Hikvision, Sentry Protection Products, Advanced Microwave Engineering, Claitec, TORSA, RealTrac, Olea Sensor Networks, GE Digital, Mobileye, ZoneSafe, Chang ying Technology, Nissan, Symeo, Woxu Wireless, Waytronic Security, Xesol Innovation, Rosco, Safe Drive Systems.

- Notable Milestones: A timeline of significant developments impacting market dynamics.

- Market Outlook: Strategic insights into future market potential.

This report delivers unparalleled data and analysis, utilizing historical data from 2019-2024 and providing precise forecasts for the future. Equip yourself with the knowledge to navigate and capitalize on the dynamic Vehicle Anti-Collision Warning System market.

Vehicle Anti-Collision Warning System Market Dynamics & Structure

The Vehicle Anti-Collision Warning System (VCAWS) market is characterized by a moderate to high level of concentration, with a few key players holding significant market share, particularly in the Radar Detection segment for Trucks and Passenger Cars. Technological innovation is the primary driver, fueled by advancements in Artificial Intelligence (AI), machine learning, and sensor fusion, enabling more accurate and comprehensive hazard detection. Regulatory frameworks, such as UNECE R152 and NHTSA mandates for advanced driver-assistance systems (ADAS), are increasingly pushing for wider adoption. Competitive product substitutes, while present in basic warning systems, are less effective against the sophisticated capabilities of modern VCAWS. End-user demographics are expanding from commercial fleets to individual consumers seeking enhanced safety. Mergers and acquisitions (M&A) are a growing trend, with larger automotive technology companies acquiring smaller, innovative startups to bolster their VCAWS portfolios.

- Market Concentration: Dominated by a few major automotive technology providers, with increasing fragmentation in niche applications.

- Technological Innovation Drivers: AI, LiDAR, radar, camera fusion, predictive analytics for collision avoidance.

- Regulatory Frameworks: Mandates for ADAS features, safety ratings by organizations like Euro NCAP and IIHS.

- Competitive Product Substitutes: Basic audible/visual alerts, driver attentiveness monitors.

- End-User Demographics: Commercial fleets (trucks, forklifts), passenger car owners, industrial safety managers.

- M&A Trends: Strategic acquisitions of sensor technology and software developers.

- Estimated M&A Deal Volume (2023-2024): Approximately 15-20 significant deals, valued in the hundreds of millions of USD.

Vehicle Anti-Collision Warning System Growth Trends & Insights

The Vehicle Anti-Collision Warning System (VCAWS) market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. This expansion is propelled by a confluence of factors including escalating global road safety concerns, stringent government regulations mandating the integration of advanced driver-assistance systems (ADAS), and a discernible shift in consumer preference towards vehicles equipped with superior safety features. The market size, estimated at over $5,000 million units in the base year 2025, is expected to reach significantly higher figures by 2033. Adoption rates are rapidly increasing across all vehicle segments, particularly in Trucks and Passenger Cars, where the potential for accident mitigation is highest. Technological disruptions, such as the integration of 5G connectivity for vehicle-to-everything (V2X) communication and the refinement of AI algorithms for predictive hazard identification, are further accelerating market penetration. Consumer behavior is evolving; safety is no longer a secondary consideration but a primary purchasing driver, with consumers actively seeking out vehicles equipped with comprehensive VCAWS. The widespread implementation of these systems is not only reducing accident severity and frequency but also contributing to lower insurance premiums for insured vehicles, thereby fostering a positive feedback loop for adoption. The growing awareness of the economic and societal costs of road accidents, coupled with the decreasing cost of sophisticated sensor technologies like radar and lidar, is democratizing access to these life-saving systems, paving the way for sustained market expansion.

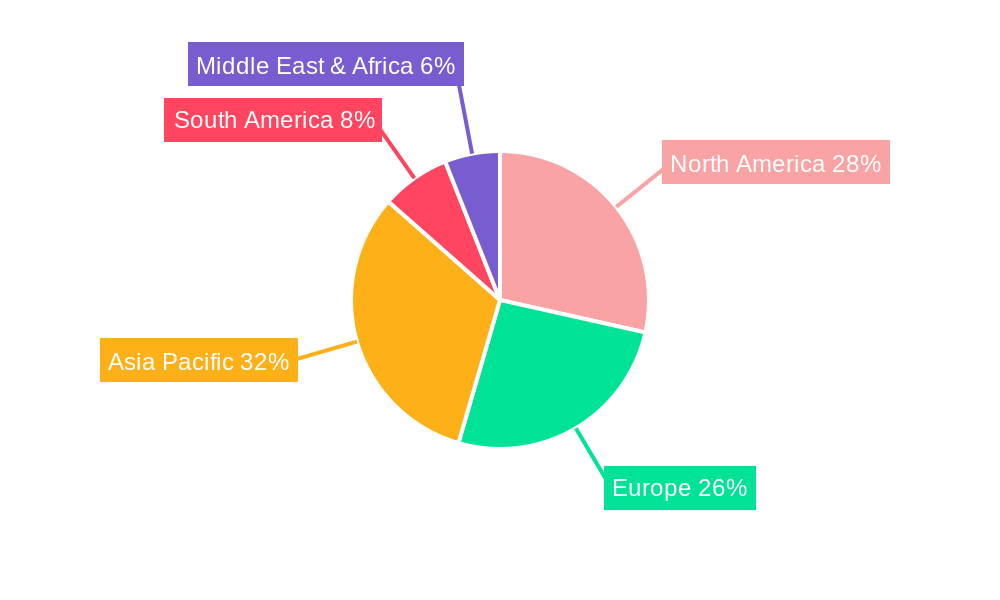

Dominant Regions, Countries, or Segments in Vehicle Anti-Collision Warning System

The Passenger Cars segment, driven by a substantial global vehicle parc and increasingly stringent safety mandates, is currently the dominant force within the Vehicle Anti-Collision Warning System (VCAWS) market. This dominance is particularly pronounced in North America and Europe, where regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) and the European New Car Assessment Programme (Euro NCAP) have been instrumental in driving the adoption of advanced safety features. For instance, the US mandates for Automatic Emergency Braking (AEB), a core component of VCAWS, have spurred significant market growth.

Within the Passenger Cars segment, Radar Detection technology is the most prevalent due to its robust performance in various weather conditions and its cost-effectiveness in mass production. Companies like Continental and Mobileye are key players, supplying integrated VCAWS solutions to major automotive manufacturers. The market share for VCAWS in new passenger vehicles is projected to exceed 70% by 2030.

Geographically, North America and Europe lead the VCAWS market due to strong economic policies supporting vehicle safety innovation, well-developed automotive industries, and high consumer disposable income for advanced vehicle features. Infrastructure development, including smart road initiatives, further complements the deployment of VCAWS. The growth potential in emerging economies, particularly in Asia-Pacific, is also substantial, driven by rapid industrialization and a growing awareness of road safety. For example, China's own safety standards are evolving, encouraging local and international manufacturers to integrate more advanced VCAWS.

- Dominant Application Segment: Passenger Cars (estimated market share exceeding 60% of the total VCAWS market in 2025).

- Key Drivers: Stringent safety regulations, high consumer demand for safety features, advanced ADAS integration.

- Market Penetration: Expected to reach over 85% in new passenger vehicles by 2033.

- Dominant Technology Type: Radar Detection (estimated market share exceeding 50% of the total VCAWS market in 2025).

- Key Drivers: Cost-effectiveness, reliable performance in diverse environmental conditions, maturity of the technology.

- Leading Regions: North America and Europe.

- Key Drivers: Supportive regulatory environments, high per capita income, strong automotive manufacturing base.

- Economic Policies: Government incentives for ADAS adoption, safety rating programs influencing consumer choice.

- Emerging Market Growth Potential: Asia-Pacific, particularly China and India, due to increasing vehicle production and rising safety consciousness.

Vehicle Anti-Collision Warning System Product Landscape

The Vehicle Anti-Collision Warning System (VCAWS) product landscape is defined by an increasing integration of sensor fusion and AI-driven decision-making. Leading manufacturers are offering sophisticated systems that combine radar, lidar, and camera data to create a comprehensive understanding of the vehicle's surroundings. These systems provide real-time alerts, ranging from simple audible warnings to haptic feedback in the steering wheel or seat, and in advanced implementations, can automatically initiate braking or evasive steering maneuvers. Innovations are focused on improving object detection accuracy in challenging conditions such as fog, heavy rain, and low light. For instance, companies like Mobileye are developing advanced camera-based systems with sophisticated algorithms to detect pedestrians, cyclists, and other vehicles with unparalleled precision. The performance metrics are constantly improving, with reduced false positive rates and enhanced detection ranges, signifying a shift from mere warning to proactive collision prevention.

Key Drivers, Barriers & Challenges in Vehicle Anti-Collision Warning System

Key Drivers:

- Mandatory Safety Regulations: Governments worldwide are increasingly mandating the integration of advanced driver-assistance systems (ADAS), including collision warning systems, driving rapid adoption.

- Rising Consumer Demand for Safety: Consumers are prioritizing vehicle safety, actively seeking out vehicles equipped with advanced warning and prevention technologies.

- Technological Advancements: Continuous improvements in sensor technology (radar, lidar, cameras), AI, and processing power enable more accurate and reliable VCAWS.

- Decreasing Component Costs: The declining price of sensors and processing units makes these systems more accessible for integration into a wider range of vehicles.

- Reduction in Accident Rates & Severity: Proven effectiveness of VCAWS in mitigating accidents, leading to lower insurance premiums and reduced societal costs.

Barriers & Challenges:

- High Initial Cost of Advanced Systems: While decreasing, the cost of cutting-edge VCAWS can still be a barrier for budget-conscious consumers and fleet operators.

- Complexity of Integration: Integrating sophisticated VCAWS into diverse vehicle platforms can be complex and time-consuming for automakers.

- Environmental Limitations of Sensors: Certain sensors may face performance degradation in extreme weather conditions (heavy snow, dense fog), impacting reliability.

- Data Privacy and Cybersecurity Concerns: The increasing connectivity of VCAWS raises concerns about data privacy and the potential for cyber-attacks.

- Consumer Education and Trust: Ensuring consumers understand the capabilities and limitations of VCAWS is crucial for optimal usage and trust.

- Supply Chain Disruptions: Global supply chain issues for critical electronic components can impact production and availability.

Emerging Opportunities in Vehicle Anti-Collision Warning System

Emerging opportunities in the Vehicle Anti-Collision Warning System (VCAWS) market lie in the expansion of VCAWS capabilities beyond simple collision alerts. There is a growing demand for predictive collision avoidance systems that leverage AI and V2X communication to anticipate potential hazards even before they become imminent threats. The integration of VCAWS with autonomous driving technologies presents a significant growth avenue, where these systems will form a foundational layer of safety for higher levels of automation. Furthermore, the development of specialized VCAWS for niche applications, such as construction sites (e.g., forklifts interacting with fixed obstacles and personnel), agricultural machinery, and off-road vehicles, offers untapped market potential. The increasing adoption of 5G networks will enable more robust V2X communication, allowing vehicles to communicate with each other and with infrastructure, thereby expanding the operational scope of VCAWS.

Growth Accelerators in the Vehicle Anti-Collision Warning System Industry

Several key growth accelerators are propelling the Vehicle Anti-Collision Warning System (VCAWS) industry forward. Firstly, the relentless push for enhanced vehicle safety by regulatory bodies worldwide, coupled with increasing consumer demand for safer transportation, acts as a primary catalyst. Secondly, ongoing advancements in sensor technologies, particularly the cost reduction and performance improvements in radar, lidar, and advanced camera systems, are making VCAWS more accessible and effective across a wider spectrum of vehicles. Thirdly, the burgeoning field of Artificial Intelligence and machine learning is enabling VCAWS to move from reactive alerts to proactive predictive safety measures. Finally, strategic partnerships between automotive manufacturers, Tier-1 suppliers, and technology providers are accelerating the development, integration, and mass production of sophisticated VCAWS, further driving market expansion.

Key Players Shaping the Vehicle Anti-Collision Warning System Market

- Continental

- Inpixon

- Hikvision

- Sentry Protection Products

- Advanced Microwave Engineering

- Claitec

- TORSA

- RealTrac

- Olea Sensor Networks

- GE Digital

- Mobileye

- ZoneSafe

- Chang ying Technology

- Nissan

- Symeo

- Woxu Wireless

- Waytronic Security

- Xesol Innovation

- Rosco

- Safe Drive Systems

Notable Milestones in Vehicle Anti-Collision Warning System Sector

- 2019: Introduction of stricter ADAS mandates by various automotive safety bodies, influencing OEM adoption strategies.

- 2020: Significant advancements in AI algorithms for object recognition and predictive analytics, enhancing VCAWS accuracy.

- 2021: Increased integration of sensor fusion technologies combining radar, lidar, and camera data in premium vehicle segments.

- 2022: Growing focus on V2X (Vehicle-to-Everything) communication capabilities to enhance VCAWS effectiveness through inter-vehicle and infrastructure communication.

- 2023: Expansion of VCAWS technology into mid-range and economy vehicle segments due to decreasing component costs.

- 2024 (Estimated): Greater adoption of sophisticated pedestrian and cyclist detection algorithms, responding to evolving safety concerns.

In-Depth Vehicle Anti-Collision Warning System Market Outlook

The Vehicle Anti-Collision Warning System (VCAWS) market outlook is exceptionally positive, characterized by sustained high growth and continuous innovation. The convergence of stricter safety regulations, escalating consumer expectations for safety features, and rapid technological advancements in AI and sensor technology are the primary drivers. The continued maturation and cost reduction of radar and camera systems will ensure their widespread integration across all vehicle segments, from passenger cars to commercial fleets. Furthermore, the nascent integration of VCAWS with evolving autonomous driving systems, alongside the promise of enhanced V2X communication, signifies a transformative future where VCAWS plays a pivotal role in creating a safer, more connected transportation ecosystem. Strategic collaborations and a focus on user experience will be crucial for capitalizing on emerging opportunities in niche markets and for ensuring broad market acceptance.

Vehicle Anti-Collision Warning System Segmentation

-

1. Application

- 1.1. Passenger Cars

- 1.2. Forklifts

- 1.3. Trucks

- 1.4. Others

-

2. Types

- 2.1. Laser Detection

- 2.2. Radar Detection

- 2.3. Special Label Detection

- 2.4. Others

Vehicle Anti-Collision Warning System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vehicle Anti-Collision Warning System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Anti-Collision Warning System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Cars

- 5.1.2. Forklifts

- 5.1.3. Trucks

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Laser Detection

- 5.2.2. Radar Detection

- 5.2.3. Special Label Detection

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vehicle Anti-Collision Warning System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Cars

- 6.1.2. Forklifts

- 6.1.3. Trucks

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Laser Detection

- 6.2.2. Radar Detection

- 6.2.3. Special Label Detection

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Vehicle Anti-Collision Warning System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Cars

- 7.1.2. Forklifts

- 7.1.3. Trucks

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Laser Detection

- 7.2.2. Radar Detection

- 7.2.3. Special Label Detection

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Vehicle Anti-Collision Warning System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Cars

- 8.1.2. Forklifts

- 8.1.3. Trucks

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Laser Detection

- 8.2.2. Radar Detection

- 8.2.3. Special Label Detection

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Vehicle Anti-Collision Warning System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Cars

- 9.1.2. Forklifts

- 9.1.3. Trucks

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Laser Detection

- 9.2.2. Radar Detection

- 9.2.3. Special Label Detection

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Vehicle Anti-Collision Warning System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Cars

- 10.1.2. Forklifts

- 10.1.3. Trucks

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Laser Detection

- 10.2.2. Radar Detection

- 10.2.3. Special Label Detection

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Continental

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inpixon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hikvision

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sentry Protection Products

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advanced Microwave Engineering

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Claitec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TORSA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RealTrac

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Olea Sensor Networks

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GE Digital

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mobileye

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ZoneSafe

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chang ying Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nissan

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Symeo

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Woxu Wireless

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Waytronic Security

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Xesol Innovation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Rosco

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Safe Drive Systems

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Continental

List of Figures

- Figure 1: Global Vehicle Anti-Collision Warning System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Vehicle Anti-Collision Warning System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Vehicle Anti-Collision Warning System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Vehicle Anti-Collision Warning System Revenue (million), by Types 2024 & 2032

- Figure 5: North America Vehicle Anti-Collision Warning System Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Vehicle Anti-Collision Warning System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Vehicle Anti-Collision Warning System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Vehicle Anti-Collision Warning System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Vehicle Anti-Collision Warning System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Vehicle Anti-Collision Warning System Revenue (million), by Types 2024 & 2032

- Figure 11: South America Vehicle Anti-Collision Warning System Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Vehicle Anti-Collision Warning System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Vehicle Anti-Collision Warning System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Vehicle Anti-Collision Warning System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Vehicle Anti-Collision Warning System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Vehicle Anti-Collision Warning System Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Vehicle Anti-Collision Warning System Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Vehicle Anti-Collision Warning System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Vehicle Anti-Collision Warning System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Vehicle Anti-Collision Warning System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Vehicle Anti-Collision Warning System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Vehicle Anti-Collision Warning System Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Vehicle Anti-Collision Warning System Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Vehicle Anti-Collision Warning System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Vehicle Anti-Collision Warning System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Vehicle Anti-Collision Warning System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Vehicle Anti-Collision Warning System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Vehicle Anti-Collision Warning System Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Vehicle Anti-Collision Warning System Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Vehicle Anti-Collision Warning System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Vehicle Anti-Collision Warning System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Vehicle Anti-Collision Warning System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Vehicle Anti-Collision Warning System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Anti-Collision Warning System?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Vehicle Anti-Collision Warning System?

Key companies in the market include Continental, Inpixon, Hikvision, Sentry Protection Products, Advanced Microwave Engineering, Claitec, TORSA, RealTrac, Olea Sensor Networks, GE Digital, Mobileye, ZoneSafe, Chang ying Technology, Nissan, Symeo, Woxu Wireless, Waytronic Security, Xesol Innovation, Rosco, Safe Drive Systems.

3. What are the main segments of the Vehicle Anti-Collision Warning System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Anti-Collision Warning System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Anti-Collision Warning System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Anti-Collision Warning System?

To stay informed about further developments, trends, and reports in the Vehicle Anti-Collision Warning System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence