Key Insights

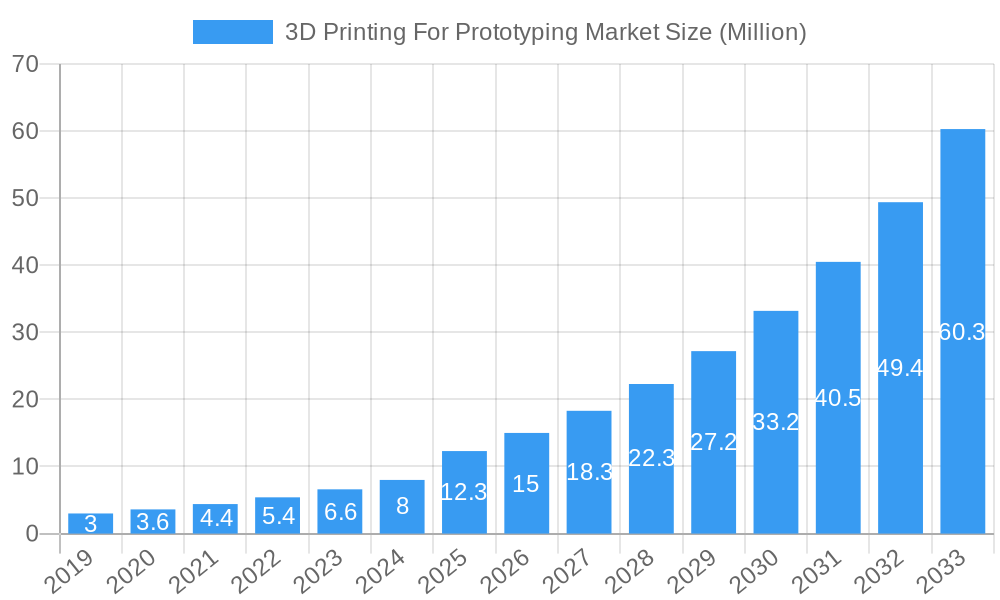

The 3D printing for prototyping market is poised for explosive growth, projected to reach a substantial \$12.30 million in 2025 and expand at an impressive Compound Annual Growth Rate (CAGR) of 21.19% through 2033. This robust expansion is fueled by key drivers such as the increasing demand for rapid prototyping across diverse industries to accelerate product development cycles, significant technological advancements in 3D printing materials and processes, and the inherent cost-effectiveness and design flexibility offered by additive manufacturing. Companies are increasingly leveraging 3D printing to create intricate and functional prototypes, thereby reducing time-to-market and enhancing innovation. The market's trajectory is further bolstered by emerging trends like the integration of artificial intelligence (AI) and machine learning (ML) for optimized design and print parameters, the growing adoption of multi-material printing capabilities, and the increasing use of advanced materials like high-performance polymers and metals for more sophisticated prototypes.

3D Printing For Prototyping Market Market Size (In Million)

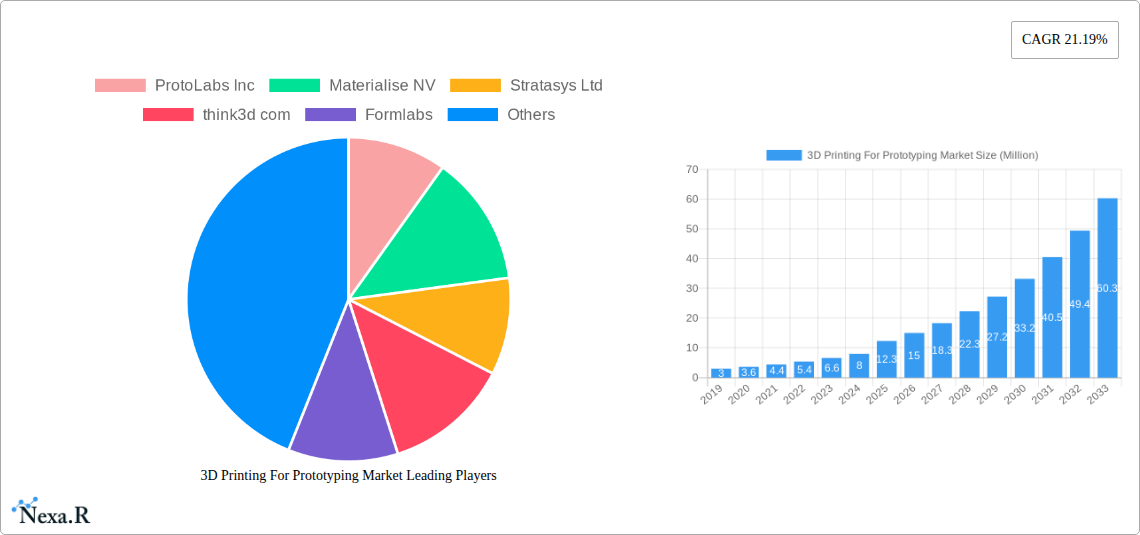

While the growth is substantial, certain restraints may influence the pace, including the initial capital investment required for advanced 3D printing equipment and the ongoing need for skilled personnel to operate and maintain these systems. However, the overwhelming benefits in terms of speed, customization, and cost reduction for prototyping purposes are expected to outweigh these challenges. The market is segmented across various technologies, including Stereolithography, Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), Digital Light Processing (DLP), and Binder Jetting, with each offering unique advantages for different prototyping needs. Material types range from metals and polymers to ceramics, catering to a wide spectrum of application requirements. Key end-user industries driving this demand include aerospace and defense, automotive, healthcare, and consumer goods and electronics, all seeking to streamline their innovation pipelines through rapid prototyping solutions. Prominent companies such as ProtoLabs Inc., Materialise NV, Stratasys Ltd., and Formlabs are at the forefront, innovating and expanding their offerings to meet this surging market demand.

3D Printing For Prototyping Market Company Market Share

3D Printing for Prototyping Market: Accelerating Innovation & Revolutionizing Product Development (2019-2033)

This comprehensive report delves into the dynamic landscape of the 3D Printing for Prototyping market, a critical sector fueling rapid product development and innovation across diverse industries. With a study period spanning from 2019 to 2033, including a detailed forecast from 2025 to 2033 and a deep dive into the historical context from 2019-2024, this analysis provides unparalleled insights into market size, growth drivers, technological advancements, and competitive strategies. We present a meticulous examination of parent and child market segments, offering a granular understanding of where opportunities lie. The report quantifies key values in Million units for clarity and actionable intelligence.

3D Printing For Prototyping Market Market Dynamics & Structure

The 3D printing for prototyping market is characterized by a moderately fragmented structure, with a blend of large established players and agile niche providers. Technological innovation serves as the primary engine of growth, pushing the boundaries of material science and printing capabilities. Regulatory frameworks are gradually evolving to address quality, safety, and intellectual property concerns, particularly in highly regulated sectors like healthcare and aerospace. Competitive product substitutes are emerging, but the speed, cost-effectiveness, and customization offered by 3D printing for rapid prototyping remain significant competitive advantages. End-user demographics are expanding beyond traditional engineering departments to include design teams, R&D labs, and even individual inventors. Merger and acquisition (M&A) trends are prevalent as larger companies seek to consolidate their market position, acquire cutting-edge technologies, and expand their service offerings. For instance, ProtoLabs Inc. and Stratasys Ltd. are key entities actively participating in this consolidation.

- Market Concentration: Moderate fragmentation with leading players holding significant but not dominant market share.

- Technological Innovation Drivers: Advancements in materials (metals, advanced polymers), printer speed, resolution, and multi-material capabilities.

- Regulatory Frameworks: Ongoing development and adaptation for safety, standardization, and IP protection.

- Competitive Product Substitutes: Traditional manufacturing methods are still relevant but challenged by 3D printing's agility.

- End-User Demographics: Broadening adoption across various professional and educational domains.

- M&A Trends: Strategic acquisitions for technology and market expansion, with an estimated 15-25 significant M&A deals annually over the historical period.

3D Printing For Prototyping Market Growth Trends & Insights

The 3D printing for prototyping market is experiencing robust growth, driven by an escalating demand for faster product development cycles and the imperative to reduce time-to-market. Global adoption rates are surging as more industries recognize the transformative potential of additive manufacturing for creating complex geometries and customized components efficiently. Technological disruptions, such as the development of novel photopolymer resins and high-performance metal alloys, are continuously expanding the application scope of 3D printing in prototyping. Consumer behavior shifts, influenced by the desire for personalized products and the increasing accessibility of 3D printing technologies, are also contributing to market expansion. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18-22% from 2025 to 2033. In 2025, the market size is estimated to be around $8,500 Million units, with projections to reach approximately $30,000 Million units by 2033. Market penetration, particularly within the automotive and healthcare sectors, is expected to exceed 60% for rapid prototyping applications by 2033.

- Market Size Evolution: Significant expansion driven by increasing adoption and technological advancements.

- Adoption Rates: Rapidly increasing across diverse industries, from established enterprises to startups.

- Technological Disruptions: Continuous innovation in materials, software, and hardware enhancing capabilities and applications.

- Consumer Behavior Shifts: Growing demand for customization, on-demand production, and faster product availability.

- Estimated Market Size (2025): $8,500 Million units.

- Projected Market Size (2033): $30,000 Million units.

- Projected CAGR (2025-2033): 18-22%.

- Market Penetration (Healthcare & Automotive Prototyping by 2033): > 60%.

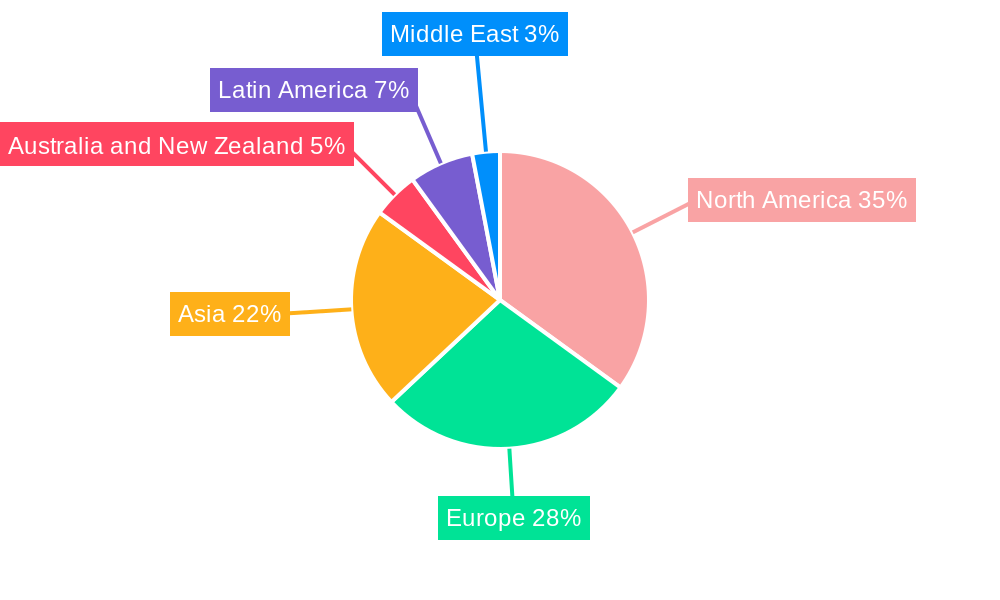

Dominant Regions, Countries, or Segments in 3D Printing For Prototyping Market

North America currently leads the 3D printing for prototyping market, driven by its strong industrial base, significant investment in R&D, and a robust ecosystem of technology providers and end-users. The United States, in particular, exhibits high adoption rates across the automotive, aerospace, and healthcare sectors. Europe follows closely, with Germany and the UK being key contributors, supported by advanced manufacturing initiatives and a strong presence of automotive and industrial companies. Asia-Pacific is emerging as a rapidly growing region, fueled by increasing manufacturing capabilities, government support for technological innovation, and a burgeoning consumer electronics market.

Technology Segment Dominance:

- Fused Deposition Modeling (FDM): Continues to be a dominant technology due to its accessibility, affordability, and wide range of material options for functional prototyping. Its versatility makes it ideal for creating prototypes with diverse mechanical properties. Estimated market share in 2025 for FDM prototyping is approximately 25-30%.

- Stereolithography (SLA) & Digital Light Processing (DLP): These resin-based technologies are crucial for high-resolution, detailed prototypes, particularly favored in consumer goods, dental, and medical device prototyping. Their ability to produce smooth surfaces and intricate designs positions them strongly.

- Selective Laser Sintering (SLS): Gaining traction for producing strong, durable functional prototypes, especially in the automotive and aerospace industries where performance is critical.

Material Type Dominance:

- Polymer: Remains the most dominant material type due to its cost-effectiveness, ease of use, and a vast array of formulations suitable for various prototyping needs. This segment accounted for an estimated 60-65% of the market in 2025.

- Metal: Witnessing significant growth for high-fidelity, functional prototypes in demanding applications like aerospace and automotive, though at a higher cost.

End-user Industry Dominance:

- Automotive: A primary driver of the 3D printing for prototyping market, utilizing it extensively for design validation, functional testing, and creating complex internal components. The sector is estimated to hold a 25-30% market share in 2025.

- Aerospace and Defense: Relies on 3D printing for lightweight, high-strength prototypes and complex part development.

- Healthcare: Rapidly adopting 3D printing for patient-specific anatomical models, surgical guides, and medical device prototyping.

3D Printing For Prototyping Market Product Landscape

The product landscape of the 3D printing for prototyping market is defined by continuous innovation, offering enhanced speed, precision, and material diversity. Companies like Formlabs are pushing the boundaries with high-speed resin printers like the Form 4, enabling professionals to accelerate design iterations and reduce time-to-market. Stratasys Ltd. offers a broad portfolio of FDM and PolyJet technologies catering to a wide range of prototyping requirements, from visual models to functional testing. Material advancements, such as the development of advanced engineering polymers and metals by ProtoLabs Inc., allow for the creation of prototypes that closely mimic the performance of final production parts. The integration of sophisticated software for design, simulation, and print preparation further streamlines the prototyping workflow, enabling complex geometries and functional part creation with greater efficiency.

Key Drivers, Barriers & Challenges in 3D Printing For Prototyping Market

Key Drivers:

- Accelerated Product Development Cycles: The paramount driver, enabling businesses to bring new products to market faster.

- Reduced Prototyping Costs: Significant cost savings compared to traditional tooling and manufacturing methods for low-volume iterations.

- Design Freedom and Complexity: Ability to create intricate designs and geometries not possible with conventional manufacturing.

- Technological Advancements: Continuous improvements in printer speed, resolution, materials, and software capabilities.

- Industry 4.0 Initiatives: Integration of 3D printing into smart manufacturing ecosystems.

Barriers & Challenges:

- Material Limitations: While expanding, the range of materials with specific performance characteristics can still be a constraint for certain applications.

- Scalability for Mass Production: 3D printing is primarily suited for prototyping and low-volume production, not yet fully replacing mass manufacturing.

- Post-Processing Requirements: Many 3D printed parts require post-processing, adding time and cost to the workflow.

- Intellectual Property Concerns: Ensuring the security and protection of designs during the digital fabrication process.

- Skilled Workforce: A need for trained personnel to operate and maintain advanced 3D printing systems.

Emerging Opportunities in 3D Printing For Prototyping Market

Emerging opportunities lie in the increasing demand for hyper-personalized prototypes across various sectors, especially in healthcare for patient-specific devices and in the consumer goods industry for customized products. The development of novel, high-performance materials that mimic end-use properties is opening doors for more sophisticated functional prototyping. The expansion of 3D printing services for startups and small and medium-sized enterprises (SMEs) provides a significant growth avenue, democratizing access to advanced prototyping capabilities. Furthermore, the integration of AI and machine learning in optimizing print parameters and predicting part performance presents a transformative opportunity for enhancing the efficiency and reliability of the prototyping process. The development of metal 3D printing for advanced functional prototypes is also a key growth area.

Growth Accelerators in the 3D Printing For Prototyping Market Industry

The long-term growth of the 3D printing for prototyping market is being significantly accelerated by breakthroughs in materials science, enabling the creation of stronger, lighter, and more functional prototypes. Strategic partnerships between technology providers and industry leaders, such as the collaboration between Cubicure and HARTING AG, are fostering innovation and opening new application areas. Market expansion through the development of more accessible and user-friendly 3D printing solutions is democratizing access to this technology. The increasing adoption of additive manufacturing in research and development, coupled with government initiatives promoting advanced manufacturing, further acts as a catalyst for sustained growth.

Key Players Shaping the 3D Printing For Prototyping Market Market

- ProtoLabs Inc.

- Materialise NV

- Stratasys Ltd.

- think3d com

- Formlabs

- HLH Prototypes Co Ltd

- Sopan Infotech

- PLM Group

- Sculpteo

- Fathom Digital Manufacturing

Notable Milestones in 3D Printing For Prototyping Market Sector

- July 2024: Cubicure partnered with HARTING AG to pioneer the 3D printing of Laser Direct Structuring (LDS) materials, promising superior resolution and smooth surfaces for MID prototypes, leading to significant time savings in prototype production.

- April 2024: Formlabs unveiled Form 4, a revolutionary resin 3D printer featuring its Low Force Display (LFD) print engine, offering up to five times faster print speeds and enhancing professional productivity and market entry acceleration.

In-Depth 3D Printing For Prototyping Market Market Outlook

The future outlook for the 3D printing for prototyping market remains exceptionally bright, driven by its indispensable role in the modern product development lifecycle. Growth accelerators such as advancements in multi-material printing, biodegradable and sustainable materials, and the increasing adoption of distributed manufacturing models will continue to fuel expansion. Strategic opportunities lie in further integrating AI for design optimization and predictive maintenance of 3D printing systems, alongside continued efforts to reduce post-processing times and costs. The ongoing evolution of end-user industries' needs, demanding faster innovation and more customized solutions, will ensure that 3D printing for prototyping remains a cornerstone of industrial progress and technological advancement for years to come.

3D Printing For Prototyping Market Segmentation

-

1. Technology

- 1.1. Stereolithography

- 1.2. Selective Laser Sintering (SLS)

- 1.3. Fused Deposition Modeling (FDM)

- 1.4. Digital Light Processing (DLP)

- 1.5. Binder Jetting

- 1.6. Other Technologies

-

2. Material Type

- 2.1. Metal

- 2.2. Polymer

- 2.3. Ceramic

- 2.4. Other Material Types

-

3. End-user Industry

- 3.1. Aerospace and Defense

- 3.2. Automotive

- 3.3. Healthcare

- 3.4. Consumer Good and Electronics

- 3.5. Other End-user Industries

3D Printing For Prototyping Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East

3D Printing For Prototyping Market Regional Market Share

Geographic Coverage of 3D Printing For Prototyping Market

3D Printing For Prototyping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations

- 3.3. Market Restrains

- 3.3.1. Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Segment is Expected to Observe Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereolithography

- 5.1.2. Selective Laser Sintering (SLS)

- 5.1.3. Fused Deposition Modeling (FDM)

- 5.1.4. Digital Light Processing (DLP)

- 5.1.5. Binder Jetting

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Polymer

- 5.2.3. Ceramic

- 5.2.4. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace and Defense

- 5.3.2. Automotive

- 5.3.3. Healthcare

- 5.3.4. Consumer Good and Electronics

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereolithography

- 6.1.2. Selective Laser Sintering (SLS)

- 6.1.3. Fused Deposition Modeling (FDM)

- 6.1.4. Digital Light Processing (DLP)

- 6.1.5. Binder Jetting

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Metal

- 6.2.2. Polymer

- 6.2.3. Ceramic

- 6.2.4. Other Material Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace and Defense

- 6.3.2. Automotive

- 6.3.3. Healthcare

- 6.3.4. Consumer Good and Electronics

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereolithography

- 7.1.2. Selective Laser Sintering (SLS)

- 7.1.3. Fused Deposition Modeling (FDM)

- 7.1.4. Digital Light Processing (DLP)

- 7.1.5. Binder Jetting

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Metal

- 7.2.2. Polymer

- 7.2.3. Ceramic

- 7.2.4. Other Material Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace and Defense

- 7.3.2. Automotive

- 7.3.3. Healthcare

- 7.3.4. Consumer Good and Electronics

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereolithography

- 8.1.2. Selective Laser Sintering (SLS)

- 8.1.3. Fused Deposition Modeling (FDM)

- 8.1.4. Digital Light Processing (DLP)

- 8.1.5. Binder Jetting

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Metal

- 8.2.2. Polymer

- 8.2.3. Ceramic

- 8.2.4. Other Material Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace and Defense

- 8.3.2. Automotive

- 8.3.3. Healthcare

- 8.3.4. Consumer Good and Electronics

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereolithography

- 9.1.2. Selective Laser Sintering (SLS)

- 9.1.3. Fused Deposition Modeling (FDM)

- 9.1.4. Digital Light Processing (DLP)

- 9.1.5. Binder Jetting

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Metal

- 9.2.2. Polymer

- 9.2.3. Ceramic

- 9.2.4. Other Material Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace and Defense

- 9.3.2. Automotive

- 9.3.3. Healthcare

- 9.3.4. Consumer Good and Electronics

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stereolithography

- 10.1.2. Selective Laser Sintering (SLS)

- 10.1.3. Fused Deposition Modeling (FDM)

- 10.1.4. Digital Light Processing (DLP)

- 10.1.5. Binder Jetting

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Metal

- 10.2.2. Polymer

- 10.2.3. Ceramic

- 10.2.4. Other Material Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Aerospace and Defense

- 10.3.2. Automotive

- 10.3.3. Healthcare

- 10.3.4. Consumer Good and Electronics

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Stereolithography

- 11.1.2. Selective Laser Sintering (SLS)

- 11.1.3. Fused Deposition Modeling (FDM)

- 11.1.4. Digital Light Processing (DLP)

- 11.1.5. Binder Jetting

- 11.1.6. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Material Type

- 11.2.1. Metal

- 11.2.2. Polymer

- 11.2.3. Ceramic

- 11.2.4. Other Material Types

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Aerospace and Defense

- 11.3.2. Automotive

- 11.3.3. Healthcare

- 11.3.4. Consumer Good and Electronics

- 11.3.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ProtoLabs Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Materialise NV

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Stratasys Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 think3d com

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Formlabs

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 HLH Prototypes Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sopan Infotech

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 PLM Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sculpteo

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Fathom Digital Manufacturing*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 ProtoLabs Inc

List of Figures

- Figure 1: Global 3D Printing For Prototyping Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global 3D Printing For Prototyping Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America 3D Printing For Prototyping Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America 3D Printing For Prototyping Market Volume (Billion), by Technology 2025 & 2033

- Figure 5: North America 3D Printing For Prototyping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America 3D Printing For Prototyping Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America 3D Printing For Prototyping Market Revenue (Million), by Material Type 2025 & 2033

- Figure 8: North America 3D Printing For Prototyping Market Volume (Billion), by Material Type 2025 & 2033

- Figure 9: North America 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: North America 3D Printing For Prototyping Market Volume Share (%), by Material Type 2025 & 2033

- Figure 11: North America 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: North America 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: North America 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America 3D Printing For Prototyping Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America 3D Printing For Prototyping Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America 3D Printing For Prototyping Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America 3D Printing For Prototyping Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe 3D Printing For Prototyping Market Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe 3D Printing For Prototyping Market Volume (Billion), by Technology 2025 & 2033

- Figure 21: Europe 3D Printing For Prototyping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe 3D Printing For Prototyping Market Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe 3D Printing For Prototyping Market Revenue (Million), by Material Type 2025 & 2033

- Figure 24: Europe 3D Printing For Prototyping Market Volume (Billion), by Material Type 2025 & 2033

- Figure 25: Europe 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 26: Europe 3D Printing For Prototyping Market Volume Share (%), by Material Type 2025 & 2033

- Figure 27: Europe 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: Europe 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 29: Europe 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe 3D Printing For Prototyping Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe 3D Printing For Prototyping Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe 3D Printing For Prototyping Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe 3D Printing For Prototyping Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia 3D Printing For Prototyping Market Revenue (Million), by Technology 2025 & 2033

- Figure 36: Asia 3D Printing For Prototyping Market Volume (Billion), by Technology 2025 & 2033

- Figure 37: Asia 3D Printing For Prototyping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia 3D Printing For Prototyping Market Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia 3D Printing For Prototyping Market Revenue (Million), by Material Type 2025 & 2033

- Figure 40: Asia 3D Printing For Prototyping Market Volume (Billion), by Material Type 2025 & 2033

- Figure 41: Asia 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Asia 3D Printing For Prototyping Market Volume Share (%), by Material Type 2025 & 2033

- Figure 43: Asia 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Asia 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 45: Asia 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia 3D Printing For Prototyping Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia 3D Printing For Prototyping Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia 3D Printing For Prototyping Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia 3D Printing For Prototyping Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by Technology 2025 & 2033

- Figure 53: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by Material Type 2025 & 2033

- Figure 56: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by Material Type 2025 & 2033

- Figure 57: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 58: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by Material Type 2025 & 2033

- Figure 59: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 60: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 61: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America 3D Printing For Prototyping Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: Latin America 3D Printing For Prototyping Market Volume (Billion), by Technology 2025 & 2033

- Figure 69: Latin America 3D Printing For Prototyping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Latin America 3D Printing For Prototyping Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: Latin America 3D Printing For Prototyping Market Revenue (Million), by Material Type 2025 & 2033

- Figure 72: Latin America 3D Printing For Prototyping Market Volume (Billion), by Material Type 2025 & 2033

- Figure 73: Latin America 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 74: Latin America 3D Printing For Prototyping Market Volume Share (%), by Material Type 2025 & 2033

- Figure 75: Latin America 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 76: Latin America 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 77: Latin America 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Latin America 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Latin America 3D Printing For Prototyping Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America 3D Printing For Prototyping Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Latin America 3D Printing For Prototyping Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America 3D Printing For Prototyping Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East 3D Printing For Prototyping Market Revenue (Million), by Technology 2025 & 2033

- Figure 84: Middle East 3D Printing For Prototyping Market Volume (Billion), by Technology 2025 & 2033

- Figure 85: Middle East 3D Printing For Prototyping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 86: Middle East 3D Printing For Prototyping Market Volume Share (%), by Technology 2025 & 2033

- Figure 87: Middle East 3D Printing For Prototyping Market Revenue (Million), by Material Type 2025 & 2033

- Figure 88: Middle East 3D Printing For Prototyping Market Volume (Billion), by Material Type 2025 & 2033

- Figure 89: Middle East 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 90: Middle East 3D Printing For Prototyping Market Volume Share (%), by Material Type 2025 & 2033

- Figure 91: Middle East 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 92: Middle East 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 93: Middle East 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Middle East 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Middle East 3D Printing For Prototyping Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East 3D Printing For Prototyping Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Middle East 3D Printing For Prototyping Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East 3D Printing For Prototyping Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 3: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 11: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 19: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 20: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 21: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 23: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 27: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 28: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 29: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 31: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 34: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 35: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 36: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 37: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 39: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 42: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 43: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 44: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 45: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 47: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 50: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 51: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 52: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 53: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 54: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 55: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing For Prototyping Market?

The projected CAGR is approximately 21.19%.

2. Which companies are prominent players in the 3D Printing For Prototyping Market?

Key companies in the market include ProtoLabs Inc, Materialise NV, Stratasys Ltd, think3d com, Formlabs, HLH Prototypes Co Ltd, Sopan Infotech, PLM Group, Sculpteo, Fathom Digital Manufacturing*List Not Exhaustive.

3. What are the main segments of the 3D Printing For Prototyping Market?

The market segments include Technology, Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations.

6. What are the notable trends driving market growth?

Aerospace and Defense Segment is Expected to Observe Significant Growth.

7. Are there any restraints impacting market growth?

Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations.

8. Can you provide examples of recent developments in the market?

July 2024: Cubicure partnered with HARTING AG, a specialist in 3D Mechatronic Integrated Device (MID) solutions, to pioneer the 3D printing of Laser Direct Structuring (LDS) materials. The companies noted that previous attempts at 3D printing MID prototypes faced challenges related to resolution and material compatibility. However, this new technology promises direct 3D printing of LDS materials, boasting superior resolution and smooth surfaces. Furthermore, the printed materials can be effortlessly integrated into HARTING's existing LDS process, leading to notable time savings in producing prototypes and small series runs.April 2024: Formlabs unveiled Form 4, the pinnacle of speed and reliability in 3D printing. With its proprietary Low Force Display (LFD) print engine, Formlabs set a new standard in professional resin 3D printing. Boasting print speeds up to five times faster, the Form 4 enhances productivity, empowering professionals to embrace design risks and expedite their market entry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing For Prototyping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing For Prototyping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing For Prototyping Market?

To stay informed about further developments, trends, and reports in the 3D Printing For Prototyping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence