Key Insights

The Africa Data Center Market is projected for substantial growth, reaching an estimated market size of $3.49 billion by 2024, with a robust Compound Annual Growth Rate (CAGR) of 11.79%. This expansion is driven by the increasing demand for cloud computing services across sectors like BFSI, government, and telecommunications. Digital transformation initiatives, rising internet penetration, and mobile data consumption are fueling the need for scalable data infrastructure. The adoption of hyperscale and wholesale colocation models, along with investments in advanced connectivity, further supports market development.

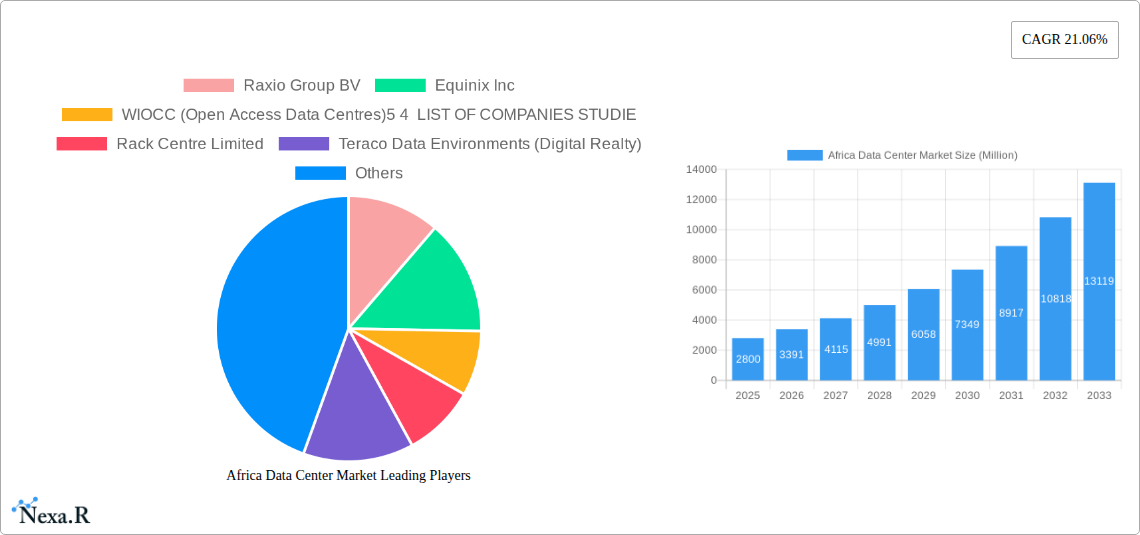

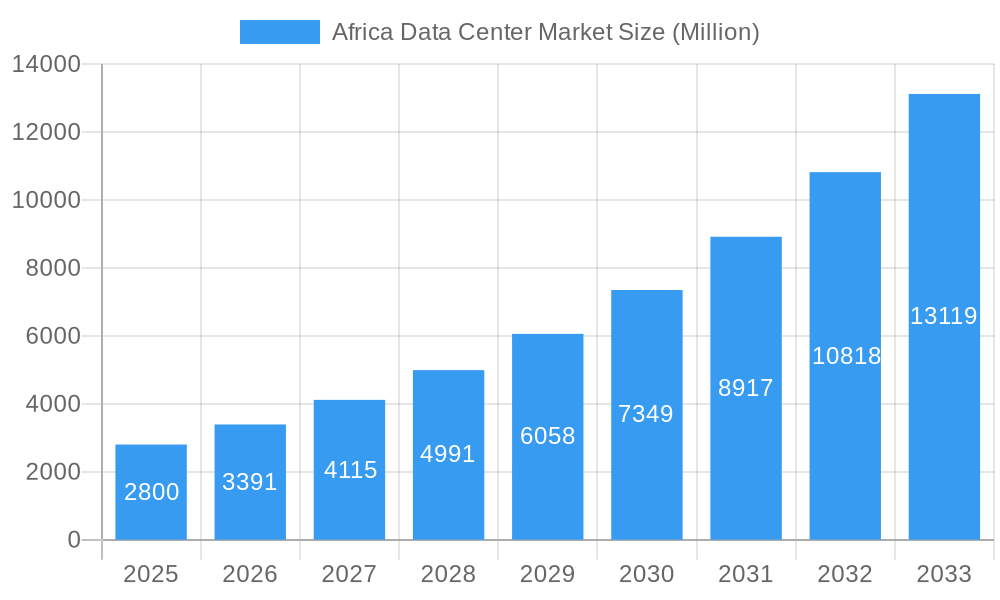

Africa Data Center Market Market Size (In Billion)

Key trends include a rising preference for Tier 3 and Tier 4 data centers to ensure high availability. Infrastructure development and digital innovation in nations such as Nigeria, South Africa, Egypt, and Kenya are significant growth drivers. Challenges like inconsistent power supply and high electricity costs persist, alongside the need for skilled IT professionals. Despite these, the market's potential remains strong, driven by digitalization and connectivity.

Africa Data Center Market Company Market Share

This report provides an in-depth analysis of the Africa Data Center Market, examining key drivers like digital transformation, cloud adoption, and hyperscale demand. It covers insights into Africa's data center infrastructure, colocation services, and cloud data centers across various data center sizes and tier types. The study, covering a historical period (2019-2024) and a forecast period (2025-2033) with a base year of 2024, offers actionable intelligence on market dynamics, growth trends, regional dominance, and key players in Africa's digital infrastructure.

Africa Data Center Market Market Dynamics & Structure

The Africa Data Center Market is characterized by increasing market concentration as major players expand their footprint and forge strategic alliances. Technological innovation drivers, such as the deployment of advanced cooling systems and renewable energy solutions, are crucial for sustainability and operational efficiency. Regulatory frameworks are evolving to support digital growth, though varying regulatory hurdles across nations present challenges. Competitive product substitutes, primarily from on-premises solutions, are diminishing as the benefits of colocation and hyperscale facilities become more apparent. End-user demographics are shifting towards a greater demand for high-density, low-latency solutions, driven by the burgeoning BFSI, Cloud, and Telecom sectors. M&A trends are on the rise as established international players seek to acquire local expertise and market access, further consolidating the market.

- Market Concentration: Growing dominance of a few key providers in major hubs.

- Technological Drivers: Focus on energy efficiency, AI integration, and software-defined infrastructure.

- Regulatory Landscape: Emerging data localization laws and digital infrastructure policies.

- Competitive Landscape: Shift from captive infrastructure to outsourced solutions.

- End-User Evolution: Increased demand for scalable and secure digital environments.

- M&A Activity: Strategic acquisitions to gain market share and expand service offerings.

Africa Data Center Market Growth Trends & Insights

The Africa Data Center Market is poised for remarkable expansion, driven by a confluence of factors including increasing internet penetration, a burgeoning youth population, and a surge in digital services across various industries. The market size evolution is projected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period, fueled by the growing adoption of cloud computing by businesses of all sizes. Adoption rates for colocation and hyperscale services are accelerating as organizations recognize the cost-effectiveness and scalability benefits compared to building and managing their own infrastructure. Technological disruptions, such as the widespread deployment of subsea cables and the increasing demand for edge computing solutions, are further catalyzing growth. Consumer behavior shifts are also playing a pivotal role, with a growing reliance on digital platforms for communication, commerce, and entertainment, necessitating robust and reliable data center infrastructure. Market penetration is expected to deepen, especially in previously underserved regions, as investments flow into developing digital ecosystems.

- Market Size Trajectory: Significant CAGR expected due to escalating digital demands.

- Cloud Adoption: Accelerated migration of workloads to cloud platforms.

- Hyperscale Demand: Increasing need for massive-scale data processing and storage.

- Connectivity Advancements: Expansion of fiber optic networks and subsea cable landings.

- Edge Computing Growth: Demand for localized data processing to reduce latency.

- Digital Transformation Initiatives: Government and private sector investments in digital infrastructure.

Dominant Regions, Countries, or Segments in Africa Data Center Market

South Africa continues to be the dominant force in the Africa Data Center Market, driven by its advanced infrastructure, established digital ecosystem, and significant foreign investment. The Hyperscale colocation type is witnessing the most substantial growth, catering to the immense capacity demands of global cloud providers and large enterprises. Within data center sizes, Mega and Large facilities are leading the charge, reflecting the need for significant power and space. The Tier 3 and Tier 4 segments are increasingly crucial as end-users prioritize reliability and high availability for critical operations. The BFSI and Cloud sectors are the primary end-users, demanding secure and scalable solutions to support their digital-first strategies. However, other regions like Nigeria, Kenya, and Egypt are rapidly emerging as significant growth hubs, attracting substantial investment and developing their own data center ecosystems. The Telecom sector also plays a vital role, providing the foundational connectivity for data center operations.

- Dominant Country: South Africa, with leading investments and infrastructure.

- Leading Colocation Type: Hyperscale, accommodating large-scale cloud provider needs.

- Key Data Center Sizes: Mega and Large facilities for extensive capacity.

- Critical Tier Types: Tier 3 and Tier 4 for enhanced reliability and uptime.

- Primary End-Users: BFSI and Cloud sectors driving demand for advanced services.

- Emerging Markets: Nigeria, Kenya, and Egypt showing rapid growth potential.

- Infrastructure Enabler: Telecom sector’s critical role in connectivity.

Africa Data Center Market Product Landscape

The Africa Data Center Market's product landscape is evolving to meet the demands for higher density, improved energy efficiency, and enhanced security. Innovations in cooling technologies, such as liquid cooling and free cooling systems, are becoming prevalent to manage the thermal challenges of modern IT equipment. Advancements in power distribution units (PDUs), uninterruptible power supplies (UPS), and backup generators are crucial for ensuring business continuity. Furthermore, the integration of AI and machine learning in data center management software offers predictive maintenance and operational optimization. Unique selling propositions often revolve around modular designs, scalability, and compliance with international standards, catering to diverse end-user needs across various segments.

Key Drivers, Barriers & Challenges in Africa Data Center Market

The primary forces propelling the Africa Data Center Market include rapid digitalization across industries, a growing young and tech-savvy population, and increasing foreign direct investment in digital infrastructure. The expansion of subsea cable networks is significantly improving international connectivity, a key enabler for data center operations. Furthermore, government initiatives promoting digital transformation and foreign investment are creating a conducive environment for growth.

However, several challenges and restraints impede market expansion. Supply chain issues, particularly for specialized equipment and skilled labor, can lead to project delays and increased costs. Regulatory hurdles, including varying data localization laws and complex permitting processes, create uncertainty for investors. High energy costs and unreliable power grids in certain regions necessitate significant investment in redundant power solutions, increasing operational expenses. Competitive pressures from both established international players and emerging local providers also shape the market dynamics.

Emerging Opportunities in Africa Data Center Market

Emerging opportunities in the Africa Data Center Market are vast and varied. The increasing demand for edge data centers in underserved urban and rural areas presents a significant growth avenue, supporting low-latency applications like IoT and autonomous systems. The development of sustainably powered data centers utilizing renewable energy sources like solar and wind is a key trend, aligning with global environmental goals and attracting ESG-focused investors. Furthermore, the expansion of cloud services tailored for African businesses, coupled with increased adoption of AI and Big Data analytics, will drive demand for specialized infrastructure. Untapped markets in regions beyond the current hubs offer substantial potential for early movers.

Growth Accelerators in the Africa Data Center Market Industry

Several catalysts are accelerating the growth of the Africa Data Center Market. Technological breakthroughs in energy-efficient cooling and power management systems are making data center operations more sustainable and cost-effective. Strategic partnerships between global hyperscalers, local telcos, and infrastructure providers are crucial for expanding reach and capacity. Market expansion strategies focused on developing new digital hubs in key African cities are attracting significant investment. The increasing trend of digitalization of government services and the rise of the digital economy are creating a persistent demand for robust data center infrastructure.

Key Players Shaping the Africa Data Center Market Market

- Raxio Group BV

- Equinix Inc

- WIOCC (Open Access Data Centres)

- Rack Centre Limited

- Teraco Data Environments (Digital Realty)

- Business Connexion (Pty) Ltd

- Vantage Data Centers LLC

- ONIX Data Center

- Digital Parks Africa (Pty) Ltd

- Digital Realty Trust Inc

- Africa Data Centres (Cassava Technologies)

Notable Milestones in Africa Data Center Market Sector

- February 2023: Company announces plans to open a new data center in Senegal, strategically located near the 2Africa submarine cable landing station.

- December 2022: Equinix, Inc. invests USD 160 Million in Johannesburg to expand its African presence beyond Nigeria, Ghana, and Côte d'Ivoire. The new JN1 facility (4.0 MW) will offer over 20,000 gross sq ft of colocation space, with plans for further phases to reach a 20.0 MW retail complex.

- November 2022: Teraco begins construction of a new hyperscale data center facility with a 30 MW critical power load at its Isando Campus in Ekurhuleni, South Africa. The JB5 plant, expected to be completed by 2024, incorporates advanced, eco-friendly cooling and water management designs.

In-Depth Africa Data Center Market Market Outlook

The Africa Data Center Market outlook is exceptionally positive, driven by sustained investment and an ever-increasing demand for digital services. Growth accelerators such as the continuous rollout of high-speed internet infrastructure, particularly subsea cables, and the expansion of cloud services will fuel further development. Strategic partnerships between global players and local entities will continue to drive market penetration into new territories. The focus on sustainable operations, through the adoption of renewable energy, will not only address environmental concerns but also enhance the long-term viability of data center investments. Emerging opportunities in edge computing and specialized services for sectors like fintech and e-commerce present lucrative avenues for future growth, positioning Africa as a key frontier for data center innovation and expansion.

Africa Data Center Market Segmentation

-

1. Data Center Size

- 1.1. Large

- 1.2. Massive

- 1.3. Medium

- 1.4. Mega

- 1.5. Small

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

- 3.1. Non-Utilized

-

4. Colocation Type

- 4.1. Hyperscale

- 4.2. Retail

- 4.3. Wholesale

-

5. End User

- 5.1. BFSI

- 5.2. Cloud

- 5.3. Government

- 5.4. Manufacturing

- 5.5. Media & Entertainment

- 5.6. Telecom

- 5.7. Other End User

Africa Data Center Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Data Center Market Regional Market Share

Geographic Coverage of Africa Data Center Market

Africa Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 5.1.1. Large

- 5.1.2. Massive

- 5.1.3. Medium

- 5.1.4. Mega

- 5.1.5. Small

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Non-Utilized

- 5.4. Market Analysis, Insights and Forecast - by Colocation Type

- 5.4.1. Hyperscale

- 5.4.2. Retail

- 5.4.3. Wholesale

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. BFSI

- 5.5.2. Cloud

- 5.5.3. Government

- 5.5.4. Manufacturing

- 5.5.5. Media & Entertainment

- 5.5.6. Telecom

- 5.5.7. Other End User

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Raxio Group BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WIOCC (Open Access Data Centres)5 4 LIST OF COMPANIES STUDIE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rack Centre Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teraco Data Environments (Digital Realty)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Business Connexion (Pty) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vantage Data Centers LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ONIX Data Center

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Digital Parks Africa (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Digital Realty Trust Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Africa Data Centres (Cassava Technologies)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Raxio Group BV

List of Figures

- Figure 1: Africa Data Center Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Data Center Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 2: Africa Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 3: Africa Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 4: Africa Data Center Market Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 5: Africa Data Center Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Africa Data Center Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Africa Data Center Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 8: Africa Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 9: Africa Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 10: Africa Data Center Market Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 11: Africa Data Center Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Africa Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: South Africa Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Egypt Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Morocco Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Ghana Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Algeria Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Tanzania Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Ivory Coast Africa Data Center Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Market?

The projected CAGR is approximately 11.79%.

2. Which companies are prominent players in the Africa Data Center Market?

Key companies in the market include Raxio Group BV, Equinix Inc, WIOCC (Open Access Data Centres)5 4 LIST OF COMPANIES STUDIE, Rack Centre Limited, Teraco Data Environments (Digital Realty), Business Connexion (Pty) Ltd, Vantage Data Centers LLC, ONIX Data Center, Digital Parks Africa (Pty) Ltd, Digital Realty Trust Inc, Africa Data Centres (Cassava Technologies).

3. What are the main segments of the Africa Data Center Market?

The market segments include Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

February 2023: The company has announced plans of opening a new data center in Senegal, the facility would be in close proximity to the cable landing station having 2Africa submarine cable.December 2022: With a USD 160 million data center investment in JOHANNESBURG, Equinix, Inc., a provider of digital infrastructure, wants to expand its presence on the African continent beyond its current locations in NIGERIA, GHANA, and Côte d'Ivoire. In mid-2024, the brand-new data center is anticipated to open in South Africa; JN1, a new 4.0 MW data center, will offer more than 20,000 gross square feet of colocation space and 690+ cabinets. Also, there will be two further phases of development. The fully completed 20.0 MW retail complex will offer more than 100,000 gross square feet of colocation space and 3,450+ cabinets.November 2022: A new hyperscale data center facility with a 30 MW critical power load has begun construction at Teraco's Isando Campus in Ekurhuleni, South Africa, east of Johannesburg. The JB5 plant will use the most up-to-date, ecologically friendly cooling and water management designs, and it is expected to finish by 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence