Key Insights

The African telecommunication towers market, valued at approximately $101.2 billion in 2025, is poised for substantial expansion. Projected to grow at a compound annual growth rate (CAGR) of 3.4% from 2025 to 2033, this growth is propelled by escalating mobile device adoption and surging data consumption across the continent. Government-led digital inclusion initiatives and network expansion efforts in underserved regions further fuel demand. The widespread deployment of 4G and the emerging 5G networks necessitate enhanced tower infrastructure to support higher bandwidth demands. Additionally, the burgeoning mobile money and e-commerce sectors underscore the critical need for robust and extensive network connectivity, reinforcing the telecommunication towers market's upward trajectory. Leading entities such as American Tower Corporation, Helios Towers, and IHS Towers are strategically investing in expanding their tower portfolios throughout Africa.

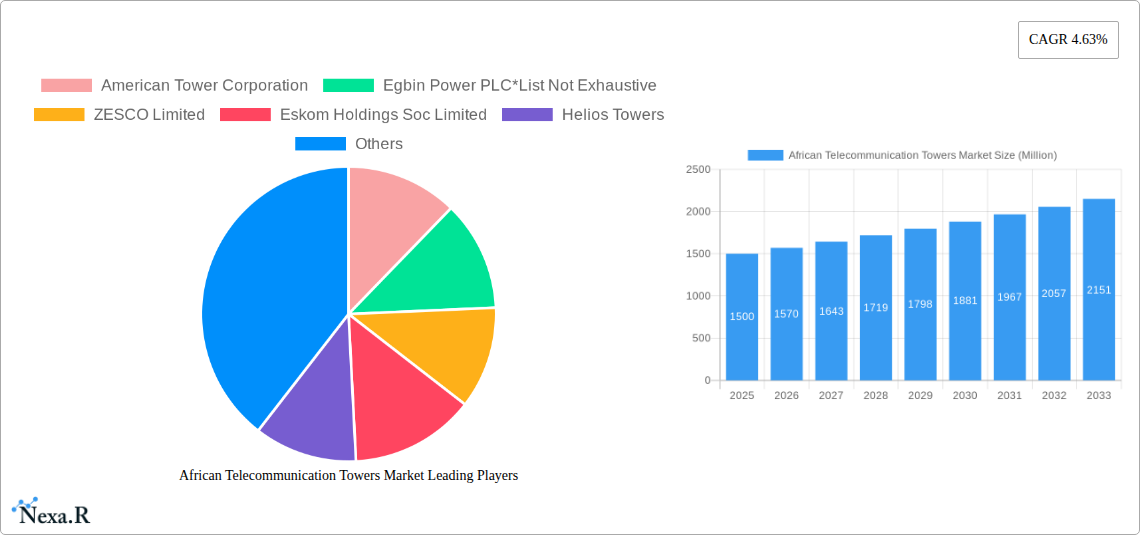

African Telecommunication Towers Market Market Size (In Billion)

Despite its promising outlook, the market faces certain obstacles. High initial capital outlays for tower construction and deployment, particularly in remote or challenging terrains, represent a significant restraint. Navigating complex regulatory environments and bureaucratic procedures can also hinder market progress. Power infrastructure limitations in specific areas present operational challenges for telecommunication towers. Intense competition among established and emerging tower companies shapes a dynamic market. Nevertheless, the long-term prospects for the African telecommunication towers market remain exceptionally strong, driven by the continent's ongoing digital transformation and the persistent demand for dependable connectivity. Market segmentation by tower type (e.g., macrocells, small cells), power source (e.g., renewable energy), and geographical focus (e.g., South Africa, Kenya, Nigeria) reveals a diverse and opportunity-rich sector.

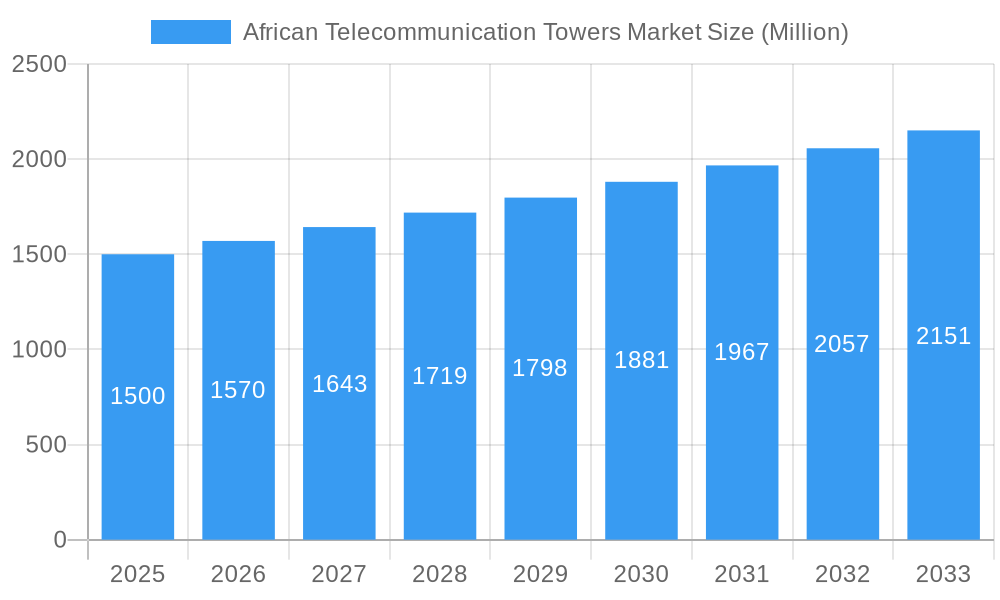

African Telecommunication Towers Market Company Market Share

African Telecommunication Towers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the African telecommunication towers market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages extensive data and expert insights to offer invaluable intelligence for industry professionals, investors, and strategists. The total market value in 2025 is estimated at xx Million units.

African Telecommunication Towers Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the African telecommunication towers market. The market is characterized by a moderate level of concentration, with key players including American Tower Corporation, IHS Towers, and Helios Towers holding significant market share. However, the presence of numerous smaller independent operators and national players contributes to a dynamic competitive environment.

- Market Concentration: xx% market share held by top 5 players in 2025.

- Technological Innovation: 5G deployment is a major driver, alongside the increasing demand for improved network coverage and capacity. However, challenges remain in terms of infrastructure development and technological adoption across diverse geographic regions.

- Regulatory Framework: Varying regulatory landscapes across African nations influence market access, investment, and operational costs. Harmonization of regulations is crucial for fostering market growth.

- Competitive Product Substitutes: Fiber optic networks and satellite communication present alternative solutions, but the ubiquitous nature of cellular networks continues to drive tower demand.

- End-User Demographics: Growth is driven by increasing mobile penetration rates and data consumption across various demographics in both urban and rural areas.

- M&A Trends: The market has witnessed a significant number of mergers and acquisitions (xx deals in the past 5 years), reflecting consolidation among major players and expansion strategies.

African Telecommunication Towers Market Growth Trends & Insights

The African telecommunication towers market exhibits robust growth, driven by rising mobile subscriptions, expanding data usage, and government initiatives promoting digital infrastructure. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a strong CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the increasing adoption of smartphones and mobile broadband services across the continent. Technological disruptions, such as the rollout of 5G networks, are further accelerating market expansion. Changing consumer behaviour, including increased reliance on mobile devices for communication, entertainment, and commerce, also contributes to this positive trajectory. Market penetration rates continue to rise, exceeding xx% in several key markets, indicating ample opportunities for future growth.

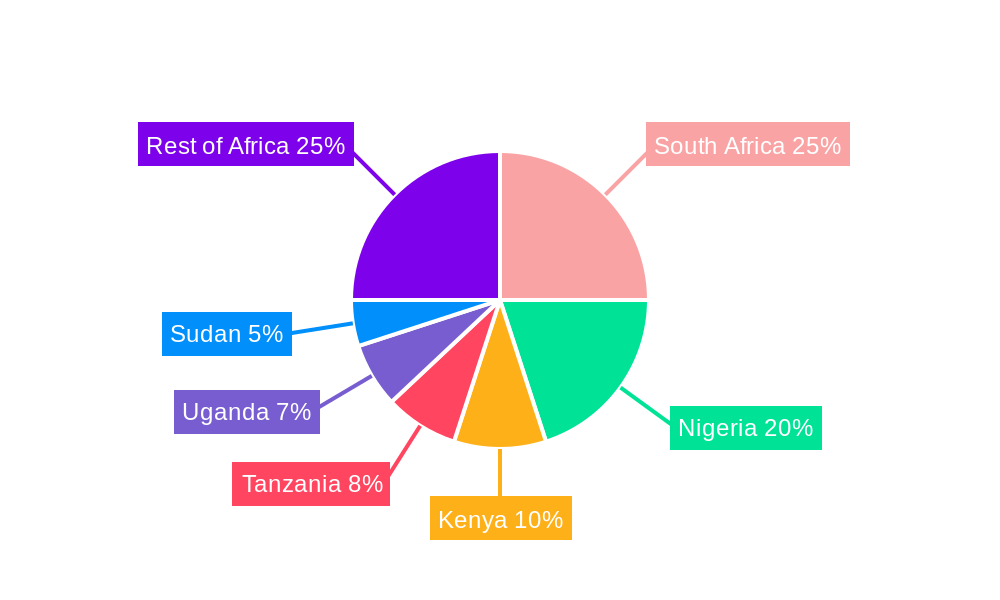

Dominant Regions, Countries, or Segments in African Telecommunication Towers Market

The African telecommunication towers market is characterized by diverse growth patterns across various regions and segments. While specific data on installed capacity by country is not available, the report identifies Nigeria, South Africa, Kenya, and Egypt as key markets.

- By Type: The market is segmented by tower type (e.g., monopole, lattice, guyed), with xx Million units being monopole tower type in 2025, making it the dominant type.

- By Generation Source: The power source for towers (e.g., grid power, diesel generators, renewable sources) significantly impacts operational costs and environmental impact. Growth in renewable energy sources is expected to boost the market size in the future.

- By Country (Installed Capacity in GW): While precise figures for installed capacity are unavailable, Nigeria, South Africa, and Kenya are likely to be among the leading countries based on their population sizes, mobile penetration rates, and economic development levels. Further research is needed for the exact figures.

The dominance of specific regions and countries is driven by factors such as government policies supporting infrastructure development, economic growth, and increasing mobile penetration rates.

African Telecommunication Towers Market Product Landscape

The African telecommunication towers market features a diverse range of products, including traditional steel towers and increasingly innovative solutions such as colocation facilities and small cell deployments. These advancements improve network efficiency and capacity, offering enhanced connectivity. Unique selling propositions involve optimizing site selection, improving power efficiency, and providing flexible leasing options to mobile network operators. Technological advancements focus on improving durability, reducing environmental footprint, and ensuring efficient power management.

Key Drivers, Barriers & Challenges in African Telecommunication Towers Market

Key Drivers:

- Growing mobile penetration and data consumption.

- Government initiatives to improve digital infrastructure.

- Expanding 4G and 5G network deployments.

Challenges:

- Regulatory hurdles: Inconsistent regulatory frameworks across different countries create difficulties for investment and deployment.

- Infrastructure limitations: Lack of reliable power supply and inadequate road networks hinder the construction and maintenance of towers, especially in remote areas.

- High capital expenditure: The initial investment costs associated with tower construction can be substantial, creating barriers for entry and hindering growth for small players. The cost associated is xx million units in 2025.

Emerging Opportunities in African Telecommunication Towers Market

- Rural connectivity: Expanding network coverage into underserved rural areas presents a significant opportunity.

- Small cell deployments: The deployment of small cells offers increased network capacity in high-density areas.

- Tower colocation: Sharing infrastructure reduces operational costs for multiple mobile network operators.

Growth Accelerators in the African Telecommunication Towers Market Industry

Long-term growth is fueled by increased investments in telecommunications infrastructure, technological innovation driving efficiency, and strategic partnerships between tower companies and mobile network operators. The growing adoption of innovative technologies like 5G and the expansion of mobile money services further accelerate growth.

Key Players Shaping the African Telecommunication Towers Market Market

- American Tower Corporation

- Egbin Power PLC

- ZESCO Limited

- Eskom Holdings Soc Limited

- Helios Towers

- IHS Towers (IHS Holdings Ltd)

Notable Milestones in African Telecommunication Towers Market Sector

- April 2023: Egbin Power PLC announces the construction of a 1,900MW gas-fuelled power plant in Lagos, Nigeria, potentially impacting energy supply for towers.

- March 2023: Axian Telecom's network upgrade in Madagascar with Ericsson enhances network performance and potentially increases demand for tower infrastructure.

In-Depth African Telecommunication Towers Market Market Outlook

The future of the African telecommunication towers market is bright, driven by continued growth in mobile subscriptions, data demand, and the expanding reach of 5G networks. Strategic partnerships, investments in renewable energy sources for powering towers, and improved regulatory frameworks will be key to unlocking the market's vast potential. The market is poised for significant expansion, creating opportunities for both established players and new entrants to thrive.

African Telecommunication Towers Market Segmentation

-

1. Ownership

- 1.1. Operator Owned

- 1.2. Joint Venture

- 1.3. Private Owned

- 1.4. MNO Captive

-

2. Fuel Type

- 2.1. Renewable

- 2.2. Non-Renewable

-

3. Market Outlook

-

3.1. Cost of

- 3.1.1. Off-grid

- 3.1.2. Bad-grid

- 3.2. Green En

- 3.3. Key Developments and Trends

-

3.1. Cost of

-

4. Type

- 4.1. Generation

- 4.2. Distribution

-

5. Generation Source

- 5.1. Renewable

- 5.2. Hydro

- 5.3. Other Generation Sources

African Telecommunication Towers Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

African Telecommunication Towers Market Regional Market Share

Geographic Coverage of African Telecommunication Towers Market

African Telecommunication Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Penetration of Smartphones5.1.2 5G Deployments Driving Momentum for Tower Leasing; Evolution of Mobile Networks and Rapid Rise in Data Traffic

- 3.3. Market Restrains

- 3.3.1. Heavy Capex Associated with Advanced Telecom Infrastructure

- 3.4. Market Trends

- 3.4.1. Private Owned Telecom Towers to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Telecommunication Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator Owned

- 5.1.2. Joint Venture

- 5.1.3. Private Owned

- 5.1.4. MNO Captive

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Renewable

- 5.2.2. Non-Renewable

- 5.3. Market Analysis, Insights and Forecast - by Market Outlook

- 5.3.1. Cost of

- 5.3.1.1. Off-grid

- 5.3.1.2. Bad-grid

- 5.3.2. Green En

- 5.3.3. Key Developments and Trends

- 5.3.1. Cost of

- 5.4. Market Analysis, Insights and Forecast - by Type

- 5.4.1. Generation

- 5.4.2. Distribution

- 5.5. Market Analysis, Insights and Forecast - by Generation Source

- 5.5.1. Renewable

- 5.5.2. Hydro

- 5.5.3. Other Generation Sources

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Tower Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Egbin Power PLC*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZESCO Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eskom Holdings Soc Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Helios Towers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IHS Towers (IHS Holdings Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Tower Corporation

List of Figures

- Figure 1: African Telecommunication Towers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: African Telecommunication Towers Market Share (%) by Company 2025

List of Tables

- Table 1: African Telecommunication Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: African Telecommunication Towers Market Volume Thousand Forecast, by Ownership 2020 & 2033

- Table 3: African Telecommunication Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: African Telecommunication Towers Market Volume Thousand Forecast, by Fuel Type 2020 & 2033

- Table 5: African Telecommunication Towers Market Revenue billion Forecast, by Market Outlook 2020 & 2033

- Table 6: African Telecommunication Towers Market Volume Thousand Forecast, by Market Outlook 2020 & 2033

- Table 7: African Telecommunication Towers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: African Telecommunication Towers Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 9: African Telecommunication Towers Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 10: African Telecommunication Towers Market Volume Thousand Forecast, by Generation Source 2020 & 2033

- Table 11: African Telecommunication Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: African Telecommunication Towers Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 13: African Telecommunication Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 14: African Telecommunication Towers Market Volume Thousand Forecast, by Ownership 2020 & 2033

- Table 15: African Telecommunication Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 16: African Telecommunication Towers Market Volume Thousand Forecast, by Fuel Type 2020 & 2033

- Table 17: African Telecommunication Towers Market Revenue billion Forecast, by Market Outlook 2020 & 2033

- Table 18: African Telecommunication Towers Market Volume Thousand Forecast, by Market Outlook 2020 & 2033

- Table 19: African Telecommunication Towers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: African Telecommunication Towers Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 21: African Telecommunication Towers Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 22: African Telecommunication Towers Market Volume Thousand Forecast, by Generation Source 2020 & 2033

- Table 23: African Telecommunication Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: African Telecommunication Towers Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 25: Nigeria African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nigeria African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 27: South Africa African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Africa African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 29: Egypt African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Egypt African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 31: Kenya African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Kenya African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 33: Ethiopia African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Ethiopia African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 35: Morocco African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Morocco African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 37: Ghana African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Ghana African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 39: Algeria African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Algeria African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 41: Tanzania African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Tanzania African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 43: Ivory Coast African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Ivory Coast African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Telecommunication Towers Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the African Telecommunication Towers Market?

Key companies in the market include American Tower Corporation, Egbin Power PLC*List Not Exhaustive, ZESCO Limited, Eskom Holdings Soc Limited, Helios Towers, IHS Towers (IHS Holdings Ltd).

3. What are the main segments of the African Telecommunication Towers Market?

The market segments include Ownership, Fuel Type, Market Outlook, Type, Generation Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 101.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Penetration of Smartphones5.1.2 5G Deployments Driving Momentum for Tower Leasing; Evolution of Mobile Networks and Rapid Rise in Data Traffic.

6. What are the notable trends driving market growth?

Private Owned Telecom Towers to Register Significant Growth.

7. Are there any restraints impacting market growth?

Heavy Capex Associated with Advanced Telecom Infrastructure.

8. Can you provide examples of recent developments in the market?

April 2023: Egbin Power PLC announced the construction of its Power Station in Lagos, Nigeria, with a 1,900MW gas-fuelled power plant. The project is now undergoing permitting. It will be built in a single step. The project's development is anticipated to begin in 2024, with commercial operations beginning in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Telecommunication Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Telecommunication Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Telecommunication Towers Market?

To stay informed about further developments, trends, and reports in the African Telecommunication Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence