Key Insights

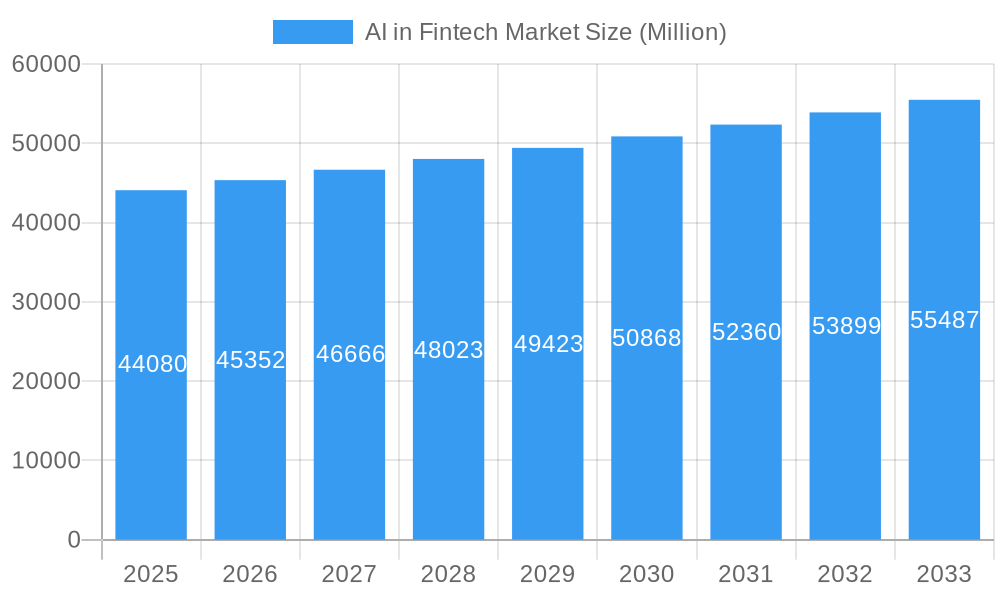

The Artificial Intelligence (AI) in Fintech market is poised for significant expansion, projecting a market size of 44.08 million by 2025. This growth is fueled by the increasing adoption of AI-powered solutions across various financial services sectors, driven by the need for enhanced efficiency, improved customer experiences, and robust risk management. Key drivers include the growing demand for personalized financial products, the imperative to combat sophisticated fraud, and the continuous evolution of regulatory frameworks that encourage technological innovation. The market is witnessing a compound annual growth rate (CAGR) of 2.91%, indicating a steady and sustained upward trajectory. This growth is further bolstered by advancements in machine learning and natural language processing, enabling financial institutions to leverage AI for more sophisticated analytics, automated customer service, and streamlined operational processes. The burgeoning fintech landscape, with its inherent agility and focus on digital transformation, serves as a fertile ground for AI integration, promising to redefine customer interactions and internal operations within the financial industry.

AI in Fintech Market Market Size (In Billion)

The AI in Fintech market encompasses a diverse range of segments, with "Solutions" and "Services" emerging as key offerings. Deployment models are predominantly shifting towards "Cloud" solutions, benefiting from scalability and cost-effectiveness, though "On-premise" deployments remain relevant for institutions with specific security and compliance needs. Application areas are vast, with "Chatbots" revolutionizing customer service, "Credit Scoring" models becoming more accurate and inclusive, and "Quantitative & Asset Management" leveraging AI for advanced portfolio optimization and trading strategies. "Fraud Detection" is another critical application, with AI algorithms identifying and preventing fraudulent activities with unprecedented speed and precision. Emerging trends indicate a greater emphasis on explainable AI (XAI) to build trust and transparency, along with the integration of AI into blockchain technology for enhanced security and efficiency in financial transactions. While significant opportunities exist, the market also faces challenges such as data privacy concerns, the need for specialized talent, and the initial investment required for AI implementation.

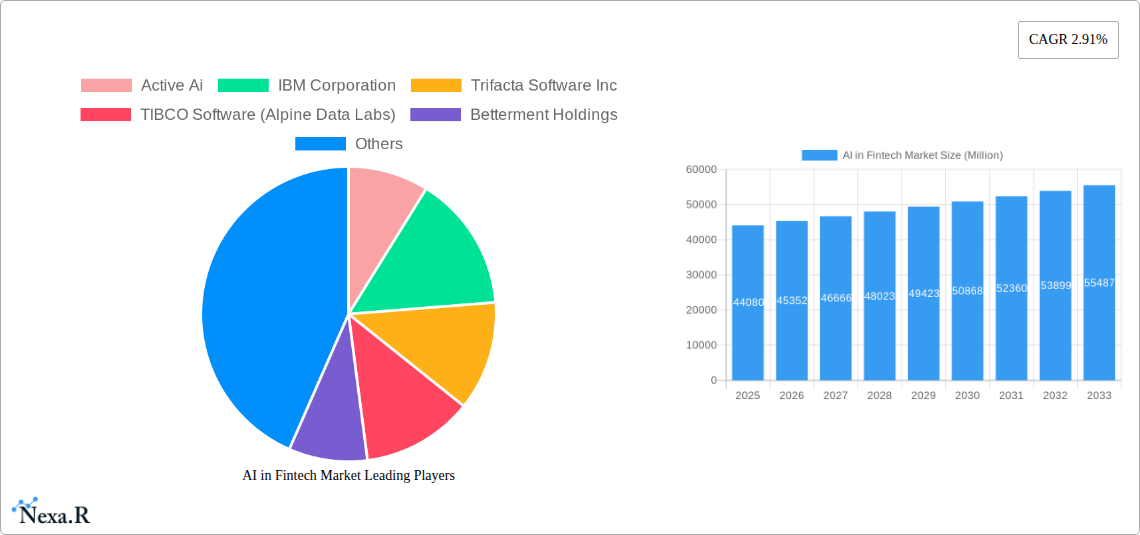

AI in Fintech Market Company Market Share

AI in Fintech Market: Comprehensive Growth Outlook & Strategic Insights (2019-2033)

This in-depth report provides a definitive analysis of the global AI in Fintech market, a rapidly expanding sector driven by advanced artificial intelligence solutions and machine learning applications. Explore the evolving landscape of financial technology, including AI-powered chatbots, sophisticated credit scoring models, and robust fraud detection systems. We delve into the critical applications of AI within quantitative and asset management, and beyond, examining the parent market and its intricate child markets. With detailed insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, and emerging opportunities, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to capitalize on the transformative power of AI in finance. The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025-2033, building upon historical data from 2019-2024. All values are presented in millions of units.

AI in Fintech Market Market Dynamics & Structure

The AI in Fintech market is characterized by a dynamic and evolving structure, influenced by intense technological innovation, stringent regulatory frameworks, and a highly competitive landscape. Market concentration varies across segments, with larger players like IBM Corporation and Microsoft Corporation dominating certain areas due to their extensive R&D investments and established cloud infrastructure. However, the proliferation of specialized startups is fostering a more fragmented and innovative environment, particularly in niche applications like AI fraud detection and personalized wealth management. Technological innovation is primarily driven by advancements in natural language processing (NLP), deep learning, and predictive analytics, enabling sophisticated AI solutions and services. Regulatory scrutiny, while increasing, is also shaping the market by promoting responsible AI development and data privacy, particularly in sensitive areas like credit scoring. Competitive product substitutes are emerging from both traditional financial institutions adopting AI and new fintech challengers.

- Market Concentration: Moderate to high in core AI technologies (e.g., NLP, ML platforms), with increasing fragmentation in specialized application segments.

- Technological Innovation Drivers: Advancements in deep learning algorithms, expanded access to big data, and increasing computational power fuel the development of sophisticated AI models.

- Regulatory Frameworks: Evolving regulations around data privacy (e.g., GDPR, CCPA) and AI ethics are shaping development and deployment strategies, particularly impacting credit scoring and fraud detection applications.

- Competitive Product Substitutes: AI-powered solutions are increasingly replacing manual processes and traditional analytical tools across various financial services.

- End-User Demographics: Growing adoption among both retail and institutional investors, with a demand for personalized financial advice, enhanced security, and seamless customer experiences through AI chatbots.

- M&A Trends: Significant consolidation and investment activity, with established tech giants and venture capitalists acquiring innovative fintech startups to enhance their AI capabilities. Deal volumes are expected to remain robust as companies seek to gain market share and access cutting-edge AI talent.

AI in Fintech Market Growth Trends & Insights

The AI in Fintech market is on a trajectory of exponential growth, driven by its capacity to revolutionize financial services across the board. The market size is projected to witness a significant expansion, fueled by increasing adoption rates of AI-powered solutions and services in banking, insurance, and investment management. Technological disruptions, such as the continuous refinement of machine learning algorithms and the integration of AI with blockchain technology, are unlocking new possibilities for efficiency, security, and personalization. Consumer behavior shifts are playing a crucial role, with a growing demand for hyper-personalized financial advice, instant loan approvals, and proactive fraud protection, all of which are effectively addressed by AI. The integration of AI into the core operations of financial institutions, from customer onboarding to complex trading strategies, is no longer a novelty but a strategic imperative.

The market is experiencing a compound annual growth rate (CAGR) of XX%, with projections indicating a market size of approximately USD 12,500 million in 2025, escalating to USD 35,000 million by 2033. This surge is propelled by several key trends:

- Enhanced Operational Efficiency: AI automates repetitive tasks, streamlines workflows, and reduces operational costs for financial institutions. This includes automating customer service through AI chatbots and optimizing back-office processes.

- Improved Risk Management: AI algorithms excel at analyzing vast datasets to identify potential risks, such as credit default, market volatility, and fraudulent activities, leading to more accurate credit scoring and robust fraud detection.

- Personalized Customer Experiences: AI enables hyper-personalization of financial products and services, from tailored investment recommendations for quantitative & asset management to customized loan offers, enhancing customer satisfaction and loyalty.

- Fraud Prevention and Security: The sophistication of AI in detecting and preventing financial fraud is a major growth driver. Real-time anomaly detection and predictive analytics are crucial in safeguarding financial assets and sensitive data.

- Regulatory Compliance: AI is increasingly used to automate compliance processes, monitor transactions for suspicious activity, and ensure adherence to evolving financial regulations, reducing the burden and cost of regtech.

- Democratization of Financial Services: AI-powered platforms are making sophisticated financial tools, such as robo-advisors and personalized investment strategies, accessible to a broader audience.

The penetration of AI solutions is deepening across all segments of the financial industry, with early adopters already realizing significant competitive advantages. As AI technology matures and becomes more accessible, its adoption is expected to accelerate, further solidifying its position as a cornerstone of the future financial landscape.

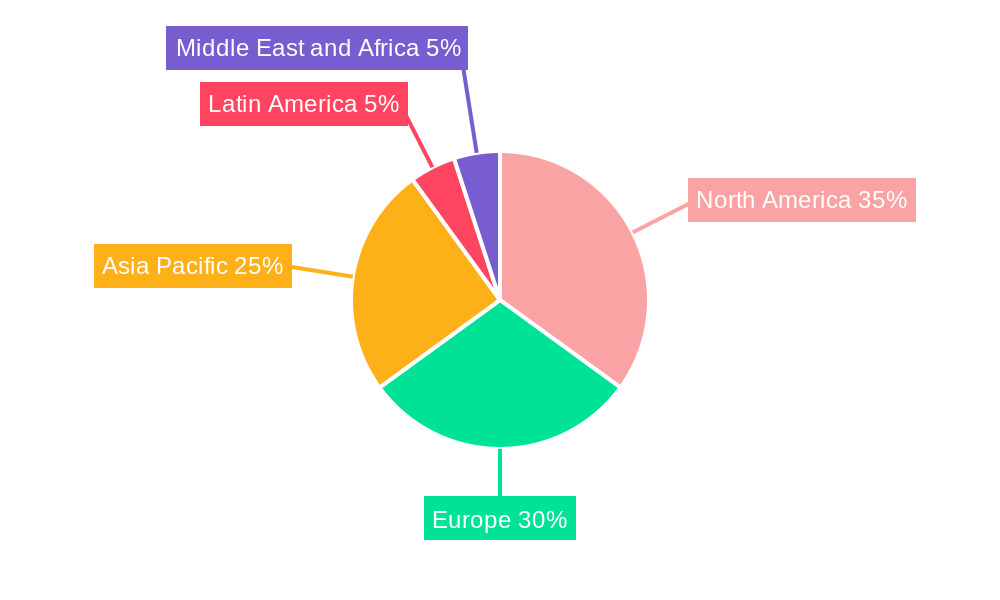

Dominant Regions, Countries, or Segments in AI in Fintech Market

North America, spearheaded by the United States, is currently the dominant region in the AI in Fintech market. This leadership is attributed to a confluence of factors including a mature financial ecosystem, a highly innovative technology sector, substantial venture capital funding, and a conducive regulatory environment that, while evolving, has historically fostered rapid technological adoption. The presence of major technology giants and a vibrant startup culture in areas like Silicon Valley and New York fuels constant innovation in AI solutions and services.

Within North America, the United States holds the lion's share of the market, driven by its advanced financial infrastructure and the early and widespread adoption of AI technologies across banking, investment management, and insurance. Key applications like fraud detection, credit scoring, and quantitative & asset management are particularly advanced and widely deployed.

- Key Drivers in North America:

- High concentration of financial institutions and technology firms.

- Strong government support for technological innovation and R&D.

- Significant investment in cloud infrastructure, facilitating cloud-based AI deployments.

- Consumer demand for personalized and efficient financial services.

- Robust talent pool of AI and data science professionals.

Another significant driver of market growth is the Solutions segment, which encompasses AI-powered software and platforms designed for various financial applications. This segment is outpacing the growth of Services, as financial institutions increasingly opt for integrated AI solutions to enhance their existing infrastructure. The cloud deployment model also dominates the market, offering scalability, flexibility, and cost-effectiveness compared to on-premise solutions.

Among the applications, Fraud Detection is a paramount segment, witnessing substantial investment due to the ever-increasing sophistication of financial crime. The ability of AI to identify anomalies and predict fraudulent activities in real-time is invaluable. Following closely is Credit Scoring, where AI is revolutionizing risk assessment, enabling faster and more accurate loan approvals, especially for individuals with limited credit history. Quantitative & Asset Management also represents a significant and growing application, with AI algorithms powering sophisticated trading strategies and portfolio management. Chatbots are transforming customer service, providing instant support and personalized interactions, contributing to improved customer satisfaction and operational efficiency.

The market share for these dominant segments is significant, with Solutions accounting for approximately XX% of the market and cloud deployment at XX%. Fraud Detection applications represent a substantial portion, estimated at XX%, with Credit Scoring at XX%, and Quantitative & Asset Management at XX%. The growth potential in these areas remains exceptionally high due to ongoing advancements in AI capabilities and increasing financial sector reliance on these technologies.

AI in Fintech Market Product Landscape

The AI in Fintech market is characterized by a dynamic product landscape focused on delivering intelligent, automated, and personalized financial solutions. Innovations are centered around enhancing efficiency, security, and customer experience. Key product categories include AI-driven platforms for credit scoring, real-time fraud detection systems leveraging machine learning, sophisticated quantitative & asset management tools, and conversational AI-powered chatbots for customer service. Companies are differentiating themselves through the advanced algorithms underpinning their offerings, the seamless integration capabilities with existing financial systems, and the demonstrable ROI they provide. Performance metrics often revolve around improved accuracy in risk assessment, reduction in false positives for fraud, enhanced portfolio returns, and increased customer engagement rates.

Key Drivers, Barriers & Challenges in AI in Fintech Market

The AI in Fintech market is propelled by a powerful combination of technological advancements and evolving market demands. Key drivers include the escalating need for enhanced operational efficiency through automation, the imperative to bolster security and combat sophisticated financial fraud, and the growing consumer expectation for personalized financial experiences. Furthermore, regulatory pressures to improve transparency and compliance are indirectly driving AI adoption.

- Key Drivers:

- Advancements in AI and ML algorithms.

- Big data availability and analytics capabilities.

- Demand for personalized financial services.

- Increased focus on fraud prevention and cybersecurity.

- Need for regulatory compliance and regtech solutions.

However, the market faces significant barriers and challenges that can hinder growth. These include the high cost of initial implementation and integration of AI systems, the scarcity of skilled AI talent, and concerns surrounding data privacy and security. Regulatory uncertainty and the ethical implications of AI decision-making also present considerable hurdles.

- Key Barriers & Challenges:

- High implementation and integration costs.

- Shortage of AI and data science expertise.

- Data privacy and security concerns.

- Regulatory hurdles and ethical considerations.

- Resistance to change within traditional financial institutions.

- Supply chain issues for specialized hardware.

Emerging Opportunities in AI in Fintech Market

Emerging opportunities within the AI in Fintech market are vast and diverse. There's a significant untapped potential in developing AI solutions for underserved markets, particularly in emerging economies, focusing on financial inclusion and microfinance. The application of AI in decentralized finance (DeFi) presents a frontier for innovation, promising enhanced security and efficiency. Furthermore, the increasing demand for explainable AI (XAI) in finance opens avenues for developing more transparent and trustworthy AI models, particularly for critical applications like credit scoring and fraud detection. The integration of AI with emerging technologies like quantum computing could unlock unprecedented analytical capabilities.

Growth Accelerators in the AI in Fintech Market Industry

Several catalysts are accelerating the growth of the AI in Fintech market. Continued advancements in AI algorithms, particularly in areas like reinforcement learning and generative AI, are leading to more sophisticated and capable solutions. Strategic partnerships and collaborations between established financial institutions and AI technology providers are crucial for driving widespread adoption and innovation. Furthermore, government initiatives and regulatory frameworks that encourage responsible AI development and data utilization are acting as significant growth accelerators. The increasing focus on AI-driven personalization and customer-centricity is also a major factor.

Key Players Shaping the AI in Fintech Market Market

- Active Ai

- IBM Corporation

- Trifacta Software Inc

- TIBCO Software (Alpine Data Labs)

- Betterment Holdings

- WealthFront Inc

- Microsoft Corporation

- Pefin Holdings LLC

- Sift Science Inc

- IPsoft Inc

- Amazon Web Services Inc

- Ripple Labs Inc

- Next IT Corporation

- Narrative Science

- Data Minr Inc

- Onfido

- Intel Corporation

- ComplyAdvantage com

- Zeitgold

Notable Milestones in AI in Fintech Market Sector

- Mar 2023: CSI partnered with Hawk AI to integrate advanced AML and fraud prevention technologies, utilizing AI/ML models for real-time detection and reporting of fraudulent activities.

- Jan 2023: Inscribe secured USD 25 million in funding to enhance its AI-powered fraud detection capabilities by parsing, classifying, and cross-matching financial onboarding documents.

In-Depth AI in Fintech Market Market Outlook

The future outlook for the AI in Fintech market is exceptionally robust, driven by continued technological innovation and increasing demand for intelligent financial solutions. Growth accelerators such as ongoing breakthroughs in AI algorithms, strategic alliances between tech firms and financial giants, and supportive governmental policies will further propel market expansion. The focus will increasingly shift towards hyper-personalization, enhanced cybersecurity through AI, and the democratization of advanced financial tools. Untapped markets and the evolving landscape of decentralized finance present significant opportunities for novel applications and sustained growth in the coming years.

AI in Fintech Market Segmentation

-

1. Type

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. Application

- 3.1. Chatbots

- 3.2. Credit Scoring

- 3.3. Quantitative & Asset Management

- 3.4. Fraud Detection

- 3.5. Other Applications

AI in Fintech Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

AI in Fintech Market Regional Market Share

Geographic Coverage of AI in Fintech Market

AI in Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Process Automation Among Financial Organizations; Increasing Availability of Data Sources

- 3.3. Market Restrains

- 3.3.1. Need for Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Fraud Detection is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Chatbots

- 5.3.2. Credit Scoring

- 5.3.3. Quantitative & Asset Management

- 5.3.4. Fraud Detection

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Chatbots

- 6.3.2. Credit Scoring

- 6.3.3. Quantitative & Asset Management

- 6.3.4. Fraud Detection

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Chatbots

- 7.3.2. Credit Scoring

- 7.3.3. Quantitative & Asset Management

- 7.3.4. Fraud Detection

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Chatbots

- 8.3.2. Credit Scoring

- 8.3.3. Quantitative & Asset Management

- 8.3.4. Fraud Detection

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Chatbots

- 9.3.2. Credit Scoring

- 9.3.3. Quantitative & Asset Management

- 9.3.4. Fraud Detection

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa AI in Fintech Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Chatbots

- 10.3.2. Credit Scoring

- 10.3.3. Quantitative & Asset Management

- 10.3.4. Fraud Detection

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Active Ai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trifacta Software Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TIBCO Software (Alpine Data Labs)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Betterment Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WealthFront Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pefin Holdings LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sift Science Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IPsoft Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amazon Web Services Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ripple Labs Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Next IT Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Narrative Science

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Data Minr Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Onfido

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Intel Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ComplyAdvantage com

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Zeitgold

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Active Ai

List of Figures

- Figure 1: Global AI in Fintech Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 13: Europe AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: Europe AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Asia Pacific AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Asia Pacific AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Latin America AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Latin America AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa AI in Fintech Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa AI in Fintech Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa AI in Fintech Market Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Middle East and Africa AI in Fintech Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Middle East and Africa AI in Fintech Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa AI in Fintech Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa AI in Fintech Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa AI in Fintech Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global AI in Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 19: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global AI in Fintech Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global AI in Fintech Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global AI in Fintech Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global AI in Fintech Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AI in Fintech Market?

The projected CAGR is approximately 2.91%.

2. Which companies are prominent players in the AI in Fintech Market?

Key companies in the market include Active Ai, IBM Corporation, Trifacta Software Inc, TIBCO Software (Alpine Data Labs), Betterment Holdings, WealthFront Inc *List Not Exhaustive, Microsoft Corporation, Pefin Holdings LLC, Sift Science Inc, IPsoft Inc, Amazon Web Services Inc, Ripple Labs Inc, Next IT Corporation, Narrative Science, Data Minr Inc, Onfido, Intel Corporation, ComplyAdvantage com, Zeitgold.

3. What are the main segments of the AI in Fintech Market?

The market segments include Type, Deployment, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Process Automation Among Financial Organizations; Increasing Availability of Data Sources.

6. What are the notable trends driving market growth?

Fraud Detection is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Need for Skilled Workforce.

8. Can you provide examples of recent developments in the market?

Mar 2023: CSI, an end-to-end fintech and regtech solution provider, partnered with Hawk AI, a global anti-money laundering (AML) and fraud prevention technologies for banks and payment processors, to provide its latest products, WatchDOG Fraud and WatchDOG AML. Artificial intelligence (AI) and machine learning (ML) models in the products enable multilayered, automated oversight that monitors, detects, and reports fraudulent or suspect activity in real time. WatchDOG Fraud detects fraudulent trends across all channels and payment types by monitoring transaction behavior.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AI in Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AI in Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AI in Fintech Market?

To stay informed about further developments, trends, and reports in the AI in Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence