Key Insights

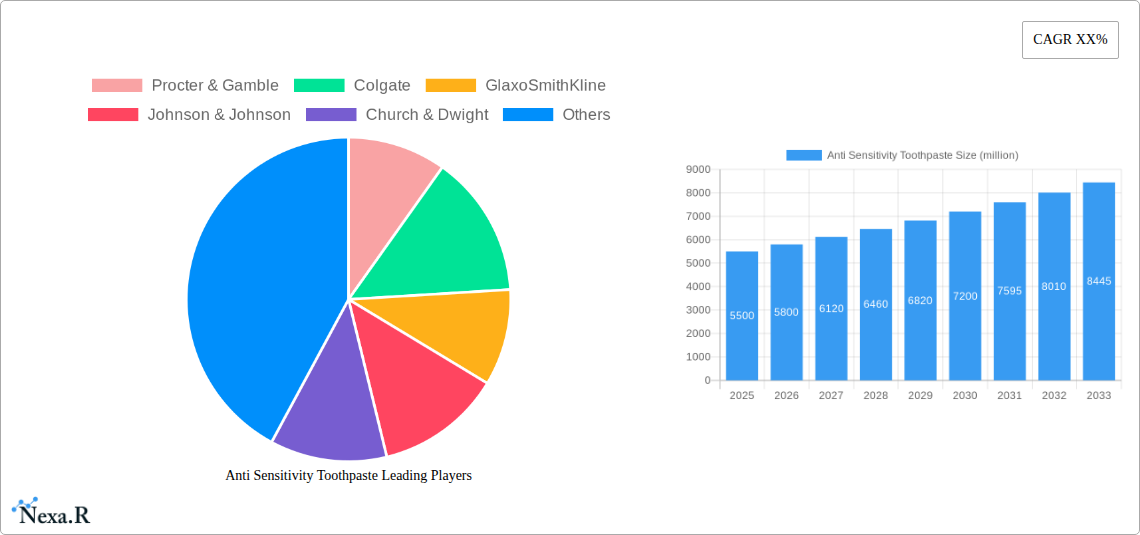

The global Anti-Sensitivity Toothpaste market is poised for robust growth, projected to reach an estimated market size of approximately $5.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 5.5% anticipated through 2033. This upward trajectory is primarily fueled by an increasing global awareness of oral hygiene, coupled with a rising prevalence of tooth sensitivity, often exacerbated by dietary habits and modern lifestyles. Consumers are becoming more proactive in seeking specialized oral care solutions, driving demand for anti-sensitivity toothpastes that offer targeted relief and long-term protection. The market's expansion is also supported by continuous innovation from leading manufacturers, who are investing in research and development to introduce advanced formulations with enhanced efficacy and additional benefits like enamel strengthening and gum health. Furthermore, the growing accessibility of these specialized toothpastes through various sales channels, including pharmacies, retail outlets, and increasingly, online platforms, contributes significantly to market penetration and consumer convenience.

Key growth drivers for the anti-sensitivity toothpaste market include the expanding middle-class populations in emerging economies, who are increasingly adopting Westernized oral care practices and investing in premium personal care products. The rising disposable incomes in these regions are creating a fertile ground for market expansion. Moreover, the aesthetic appeal of a healthy smile, coupled with targeted marketing campaigns by key players, is encouraging a broader consumer base to prioritize oral health and seek solutions for sensitivity. Conversely, challenges such as the availability of generic and low-cost alternatives, coupled with potential price sensitivity among a segment of consumers, could temper growth. However, the growing preference for natural and organic oral care ingredients presents a significant trend, with manufacturers increasingly incorporating plant-based formulations and sustainable packaging to appeal to eco-conscious consumers. The market is characterized by a diverse product portfolio, encompassing toothpaste, mouthwash, and teeth whitening products, with toothpaste holding the dominant share due to its daily usage and widespread adoption.

Comprehensive Market Report: Anti Sensitivity Toothpaste (2019–2033)

This in-depth market research report provides a critical analysis of the global Anti Sensitivity Toothpaste market, offering a detailed outlook from 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033. It meticulously examines market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and the strategic landscape shaped by leading industry players. This report is designed for industry professionals seeking actionable insights and a profound understanding of the anti-sensitivity toothpaste sector and its broader oral care market context.

Anti Sensitivity Toothpaste Market Dynamics & Structure

The global Anti Sensitivity Toothpaste market is characterized by a moderate to high concentration, with major players like Procter & Gamble, Colgate-Palmolive, GlaxoSmithKline, and Unilever holding significant shares. Technological innovation, particularly in ingredient formulation and delivery mechanisms for pain relief, is a primary driver. Regulatory frameworks, often overseen by bodies like the FDA in the US and EMA in Europe, govern product claims and ingredient safety, influencing product development and market entry. Competitive product substitutes include desensitizing rinses, gels, and in-office treatments, which compete for consumer attention and spending. End-user demographics reveal a growing population of older adults experiencing increased tooth sensitivity, alongside a younger demographic seeking preventative oral care solutions. Mergers and acquisitions (M&A) trends, while not as rampant as in some other consumer goods sectors, do occur as larger companies seek to acquire innovative technologies or expand their product portfolios. For instance, smaller specialized brands may be acquired to leverage their niche expertise.

- Market Concentration: Moderate to High, with established players dominating.

- Technological Innovation: Focus on novel desensitizing agents (e.g., potassium nitrate, strontium chloride, NovaMin) and improved delivery systems.

- Regulatory Frameworks: Stringent guidelines for efficacy claims and safety, impacting product development timelines.

- Competitive Substitutes: Dental rinses, professional treatments, and other oral hygiene products.

- End-User Demographics: Aging population and health-conscious younger consumers.

- M&A Trends: Strategic acquisitions to gain technological edge or market share.

Anti Sensitivity Toothpaste Growth Trends & Insights

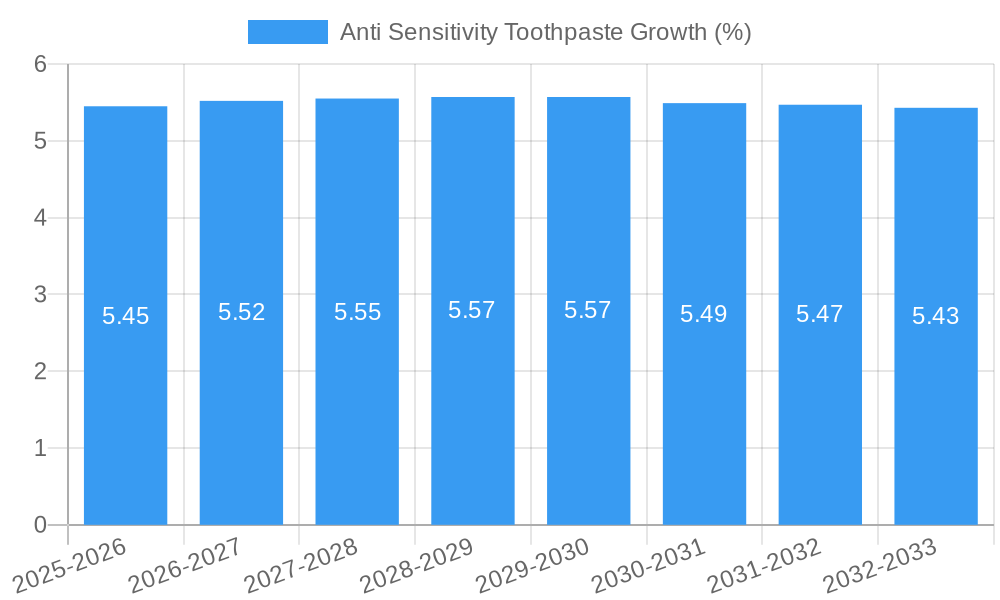

The Anti Sensitivity Toothpaste market is projected to experience robust growth, fueled by an increasing awareness of oral health and the rising prevalence of tooth sensitivity, a condition affecting an estimated 45 million people in the US alone. The market size, valued at approximately $3,800 million in 2025, is expected to expand at a Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period, reaching an estimated $5,800 million by 2033. This growth is underpinned by evolving consumer behavior, with a greater emphasis on preventative care and a willingness to invest in specialized oral hygiene products. Technological disruptions, such as advancements in nanodentistry and the development of bio-active ingredients that actively repair dentin tubules, are significantly influencing product efficacy and consumer adoption rates. The penetration of anti-sensitivity toothpaste within the broader toothpaste market, currently estimated at around 20%, is anticipated to climb as more consumers seek targeted solutions for their oral discomfort. The accessibility of these products through various distribution channels, including online platforms, further facilitates market penetration. Consumer demand for natural and organic formulations, while still a niche, is also emerging as a significant trend influencing product development.

- Market Size Evolution: Projected to grow from $3,800 million in 2025 to $5,800 million by 2033.

- CAGR: Approximately 5.5% from 2025–2033.

- Adoption Rates: Driven by increasing awareness of oral health and sensitivity treatment.

- Technological Disruptions: Innovations in bio-active ingredients and advanced delivery systems.

- Consumer Behavior Shifts: Greater preference for preventative and specialized oral care.

- Market Penetration: Expected to increase as awareness and product availability grow.

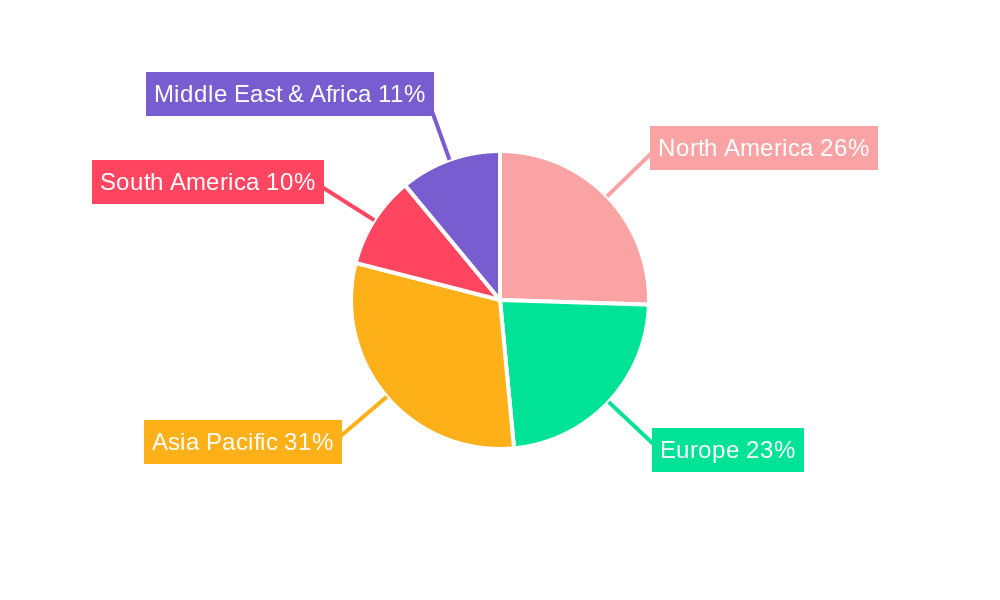

Dominant Regions, Countries, or Segments in Anti Sensitivity Toothpaste

North America, particularly the United States and Canada, is a dominant region in the global Anti Sensitivity Toothpaste market, driven by high disposable incomes, a strong emphasis on personal healthcare, and a well-established dental care infrastructure. The market in this region is projected to account for approximately 30% of the global market share in 2025, valued at around $1,140 million. Key drivers include a high prevalence of tooth sensitivity, advanced consumer awareness regarding oral health, and the widespread availability of premium and specialized dental care products. Furthermore, significant investments in research and development by major players headquartered in the region contribute to continuous product innovation and market expansion.

Application:

- Pharmacy: A leading application segment, valued at $1,330 million in 2025, due to the direct recommendation of dentists and pharmacists, and the perceived efficacy of prescription-strength or specialized formulations.

- Retail and Convenience Stores: A significant segment, estimated at $1,026 million in 2025, benefiting from broad consumer access and impulse purchases.

- Online Store: Experiencing rapid growth, projected at $836 million in 2025, driven by convenience, wider product selection, and competitive pricing.

Types:

- Toothpaste: The dominant product type, representing an estimated $3,420 million in 2025 of the overall anti-sensitivity market, due to its daily usage and primary role in oral hygiene.

- Mouthwash: A growing segment, valued at $190 million in 2025, offering supplementary relief and enhanced oral care.

- Teeth Whitening Products: A smaller but emerging segment, contributing $190 million in 2025, as consumers seek dual-action products.

Anti Sensitivity Toothpaste Product Landscape

The product landscape of anti-sensitivity toothpaste is characterized by continuous innovation aimed at enhanced efficacy and consumer appeal. Leading brands offer formulations with advanced ingredients like stannous fluoride, potassium nitrate, and strontium chloride, designed to occlude dentinal tubules and reduce nerve transmission. Newer technologies are exploring bioactive glass and nano-hydroxyapatite for superior remineralization and tubule occlusion. Applications range from daily use toothpastes to specialized serums and rinses designed for rapid relief. Performance metrics focus on reduction in pain scores, improved dentin sealing, and long-term sensitivity management. Unique selling propositions often highlight rapid action, long-lasting protection, and natural ingredient profiles.

Key Drivers, Barriers & Challenges in Anti Sensitivity Toothpaste

Key Drivers:

- Increasing Prevalence of Tooth Sensitivity: Growing awareness and diagnosis of dentin hypersensitivity directly fuels demand.

- Technological Advancements: Development of more effective desensitizing agents and delivery systems.

- Rising Disposable Incomes: Enables consumers to invest in premium oral care products.

- Focus on Preventive Healthcare: Consumers are increasingly prioritizing proactive oral health management.

Barriers & Challenges:

- Regulatory Hurdles: Stringent approval processes for new active ingredients and efficacy claims can delay market entry.

- Consumer Skepticism: Some consumers may remain unconvinced about the effectiveness of over-the-counter products.

- Price Sensitivity: Premium-priced anti-sensitivity toothpastes can face resistance in certain price-sensitive markets.

- Competition from Professional Treatments: In-office desensitizing procedures offer an alternative, albeit more expensive, solution.

- Supply Chain Disruptions: Global logistics and raw material availability can impact production and cost.

Emerging Opportunities in Anti Sensitivity Toothpaste

Emerging opportunities lie in the development of personalized oral care solutions, leveraging AI and genetic profiling to tailor toothpaste formulations for individual needs. The growing demand for natural and organic anti-sensitivity products presents a significant untapped market. Expansion into emerging economies with increasing disposable incomes and growing oral healthcare awareness offers substantial growth potential. Innovations in smart packaging that can indicate product expiry or monitor usage could also enhance consumer engagement. Furthermore, the integration of anti-sensitivity benefits into broader oral care routines, such as mouthwash and dental floss, presents avenues for cross-selling and market diversification.

Growth Accelerators in the Anti Sensitivity Toothpaste Industry

Growth accelerators in the anti-sensitivity toothpaste industry are intrinsically linked to continuous innovation in ingredient efficacy and consumer accessibility. The development of novel bioactive compounds that actively promote dentin remineralization and provide sustained desensitization is a key catalyst. Strategic partnerships between toothpaste manufacturers and dental professional organizations can significantly boost product adoption through endorsements and educational initiatives. Furthermore, aggressive marketing campaigns highlighting the tangible benefits and rapid relief offered by advanced formulations, coupled with expanding distribution channels, particularly through e-commerce platforms and direct-to-consumer models, are crucial for market expansion and long-term growth.

Key Players Shaping the Anti Sensitivity Toothpaste Market

Procter & Gamble, Colgate-Palmolive, GlaxoSmithKline, Johnson & Johnson, Church & Dwight, Unilever, Perrigo, Sanofi, GoSmile, Henkel, Jordan, Kao Corporation, Dabur, The Himalaya Drug Company, Prestige Brands Holdings, Waterpik, TePe Oral Hygiene Products, Tom's of Maine, Darlie, Yunnan Baiyao, Liangmianzhen.

Notable Milestones in Anti Sensitivity Toothpaste Sector

- 2019: Launch of new formulations featuring advanced potassium nitrate and stannous fluoride blends, demonstrating improved efficacy.

- 2020: Increased consumer demand for home-based oral care solutions boosted sales of anti-sensitivity toothpastes.

- 2021: Introduction of bio-active glass technology in select premium toothpastes, offering superior tubule occlusion.

- 2022: Significant growth in online sales channels for specialized oral care products, including anti-sensitivity toothpastes.

- 2023: Emergence of natural ingredient-focused anti-sensitivity toothpastes gaining market traction.

- 2024: Expansion of product lines by major players to include dual-action toothpastes with whitening and sensitivity relief benefits.

In-Depth Anti Sensitivity Toothpaste Market Outlook

The future outlook for the Anti Sensitivity Toothpaste market is exceptionally promising, driven by sustained innovation and increasing consumer demand for effective oral care solutions. Growth accelerators such as advanced ingredient technologies, strategic market expansion into developing economies, and heightened consumer awareness regarding oral health will continue to propel the market forward. Opportunities in personalized oral care and eco-friendly product development will further shape the competitive landscape. The market is poised for continued strong performance, solidifying its position as a vital segment within the broader global oral care industry.

Anti Sensitivity Toothpaste Segmentation

-

1. Application

- 1.1. Pharmacy

- 1.2. Retail and Convenience Stores

- 1.3. Online Store

- 1.4. Others

-

2. Types

- 2.1. Toothpaste

- 2.2. Mouthwash

- 2.3. Mouth Freshener

- 2.4. Teeth Whitening Products

- 2.5. Others

Anti Sensitivity Toothpaste Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Anti Sensitivity Toothpaste REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Sensitivity Toothpaste Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmacy

- 5.1.2. Retail and Convenience Stores

- 5.1.3. Online Store

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Toothpaste

- 5.2.2. Mouthwash

- 5.2.3. Mouth Freshener

- 5.2.4. Teeth Whitening Products

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Anti Sensitivity Toothpaste Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmacy

- 6.1.2. Retail and Convenience Stores

- 6.1.3. Online Store

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Toothpaste

- 6.2.2. Mouthwash

- 6.2.3. Mouth Freshener

- 6.2.4. Teeth Whitening Products

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Anti Sensitivity Toothpaste Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmacy

- 7.1.2. Retail and Convenience Stores

- 7.1.3. Online Store

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Toothpaste

- 7.2.2. Mouthwash

- 7.2.3. Mouth Freshener

- 7.2.4. Teeth Whitening Products

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Anti Sensitivity Toothpaste Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmacy

- 8.1.2. Retail and Convenience Stores

- 8.1.3. Online Store

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Toothpaste

- 8.2.2. Mouthwash

- 8.2.3. Mouth Freshener

- 8.2.4. Teeth Whitening Products

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Anti Sensitivity Toothpaste Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmacy

- 9.1.2. Retail and Convenience Stores

- 9.1.3. Online Store

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Toothpaste

- 9.2.2. Mouthwash

- 9.2.3. Mouth Freshener

- 9.2.4. Teeth Whitening Products

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Anti Sensitivity Toothpaste Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmacy

- 10.1.2. Retail and Convenience Stores

- 10.1.3. Online Store

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Toothpaste

- 10.2.2. Mouthwash

- 10.2.3. Mouth Freshener

- 10.2.4. Teeth Whitening Products

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Procter & Gamble

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Colgate

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GlaxoSmithKline

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson & Johnson

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Church & Dwight

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unilever

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Perrigo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sanofi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GoSmile

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henkel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jordan

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kao Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dabur

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 The Himalaya Drug

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Prestige Brands Holdings

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 water pik

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 TePe Oral Hygiene Products

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Tom's of Maine

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Darlie

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Yunnan Baiyao

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Liangmianzhen

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Procter & Gamble

List of Figures

- Figure 1: Global Anti Sensitivity Toothpaste Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Anti Sensitivity Toothpaste Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Anti Sensitivity Toothpaste Revenue (million), by Application 2024 & 2032

- Figure 4: North America Anti Sensitivity Toothpaste Volume (K), by Application 2024 & 2032

- Figure 5: North America Anti Sensitivity Toothpaste Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Anti Sensitivity Toothpaste Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Anti Sensitivity Toothpaste Revenue (million), by Types 2024 & 2032

- Figure 8: North America Anti Sensitivity Toothpaste Volume (K), by Types 2024 & 2032

- Figure 9: North America Anti Sensitivity Toothpaste Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Anti Sensitivity Toothpaste Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Anti Sensitivity Toothpaste Revenue (million), by Country 2024 & 2032

- Figure 12: North America Anti Sensitivity Toothpaste Volume (K), by Country 2024 & 2032

- Figure 13: North America Anti Sensitivity Toothpaste Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Anti Sensitivity Toothpaste Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Anti Sensitivity Toothpaste Revenue (million), by Application 2024 & 2032

- Figure 16: South America Anti Sensitivity Toothpaste Volume (K), by Application 2024 & 2032

- Figure 17: South America Anti Sensitivity Toothpaste Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Anti Sensitivity Toothpaste Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Anti Sensitivity Toothpaste Revenue (million), by Types 2024 & 2032

- Figure 20: South America Anti Sensitivity Toothpaste Volume (K), by Types 2024 & 2032

- Figure 21: South America Anti Sensitivity Toothpaste Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Anti Sensitivity Toothpaste Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Anti Sensitivity Toothpaste Revenue (million), by Country 2024 & 2032

- Figure 24: South America Anti Sensitivity Toothpaste Volume (K), by Country 2024 & 2032

- Figure 25: South America Anti Sensitivity Toothpaste Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Anti Sensitivity Toothpaste Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Anti Sensitivity Toothpaste Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Anti Sensitivity Toothpaste Volume (K), by Application 2024 & 2032

- Figure 29: Europe Anti Sensitivity Toothpaste Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Anti Sensitivity Toothpaste Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Anti Sensitivity Toothpaste Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Anti Sensitivity Toothpaste Volume (K), by Types 2024 & 2032

- Figure 33: Europe Anti Sensitivity Toothpaste Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Anti Sensitivity Toothpaste Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Anti Sensitivity Toothpaste Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Anti Sensitivity Toothpaste Volume (K), by Country 2024 & 2032

- Figure 37: Europe Anti Sensitivity Toothpaste Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Anti Sensitivity Toothpaste Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Anti Sensitivity Toothpaste Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Anti Sensitivity Toothpaste Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Anti Sensitivity Toothpaste Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Anti Sensitivity Toothpaste Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Anti Sensitivity Toothpaste Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Anti Sensitivity Toothpaste Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Anti Sensitivity Toothpaste Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Anti Sensitivity Toothpaste Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Anti Sensitivity Toothpaste Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Anti Sensitivity Toothpaste Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Anti Sensitivity Toothpaste Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Anti Sensitivity Toothpaste Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Anti Sensitivity Toothpaste Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Anti Sensitivity Toothpaste Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Anti Sensitivity Toothpaste Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Anti Sensitivity Toothpaste Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Anti Sensitivity Toothpaste Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Anti Sensitivity Toothpaste Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Anti Sensitivity Toothpaste Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Anti Sensitivity Toothpaste Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Anti Sensitivity Toothpaste Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Anti Sensitivity Toothpaste Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Anti Sensitivity Toothpaste Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Anti Sensitivity Toothpaste Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Anti Sensitivity Toothpaste Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Anti Sensitivity Toothpaste Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Anti Sensitivity Toothpaste Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Anti Sensitivity Toothpaste Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Anti Sensitivity Toothpaste Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Anti Sensitivity Toothpaste Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Anti Sensitivity Toothpaste Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Anti Sensitivity Toothpaste Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Anti Sensitivity Toothpaste Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Anti Sensitivity Toothpaste Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Anti Sensitivity Toothpaste Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Anti Sensitivity Toothpaste Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Anti Sensitivity Toothpaste Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Anti Sensitivity Toothpaste Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Anti Sensitivity Toothpaste Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Anti Sensitivity Toothpaste Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Anti Sensitivity Toothpaste Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Anti Sensitivity Toothpaste Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Anti Sensitivity Toothpaste Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Anti Sensitivity Toothpaste Volume K Forecast, by Country 2019 & 2032

- Table 81: China Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Anti Sensitivity Toothpaste Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Anti Sensitivity Toothpaste Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Sensitivity Toothpaste?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Anti Sensitivity Toothpaste?

Key companies in the market include Procter & Gamble, Colgate, GlaxoSmithKline, Johnson & Johnson, Church & Dwight, Unilever, Perrigo, Sanofi, GoSmile, Henkel, Jordan, Kao Corporation, Dabur, The Himalaya Drug, Prestige Brands Holdings, water pik, TePe Oral Hygiene Products, Tom's of Maine, Darlie, Yunnan Baiyao, Liangmianzhen.

3. What are the main segments of the Anti Sensitivity Toothpaste?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Sensitivity Toothpaste," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Sensitivity Toothpaste report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Sensitivity Toothpaste?

To stay informed about further developments, trends, and reports in the Anti Sensitivity Toothpaste, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence