Key Insights

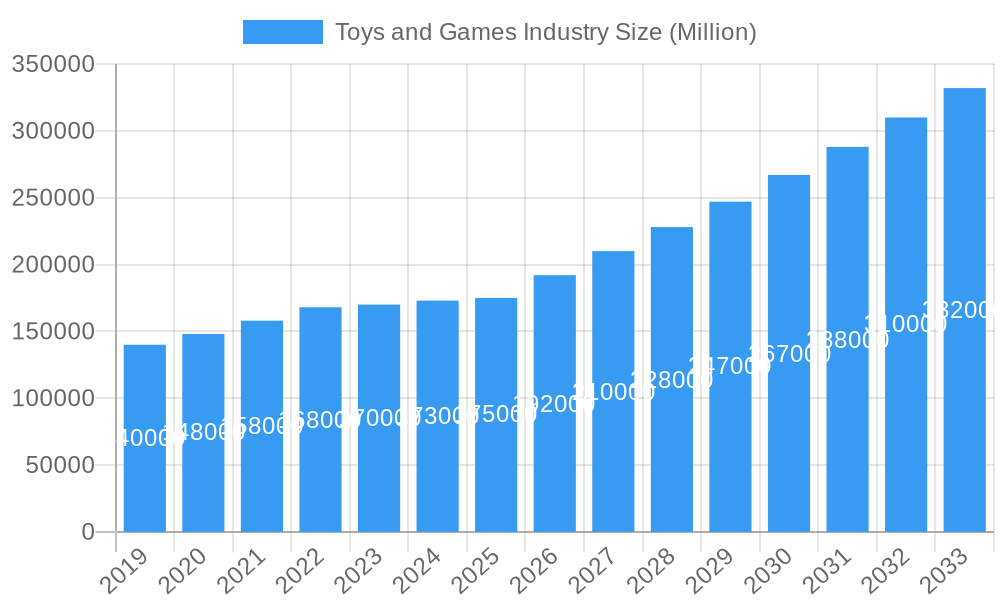

The global Toys and Games market is projected for substantial growth, reaching an estimated size of $1.7 billion in the base year of 2025 and expected to expand to over $3.3 billion by 2033, driven by a CAGR of 0.7%. Key growth factors include rising disposable incomes in emerging markets, fostering investment in educational toys, and a growing parental emphasis on screen-free, imaginative play. The resurgence of classic brands and the introduction of innovative, tech-integrated toys further contribute to market expansion. The sector is actively embracing digital platforms, including augmented and virtual reality, for both purchasing and interactive play experiences.

Toys and Games Industry Market Size (In Billion)

Evolving consumer preferences and technological advancements are shaping this dynamic market. The integration of the Internet of Things (IoT) into toys offers connected and interactive play experiences for a digitally native generation. However, the industry faces challenges such as intense competition from digital entertainment and gaming, necessitating continuous innovation. Supply chain disruptions and increasing raw material costs also pose strategic hurdles for manufacturers. The market is segmented by product type, with Video Games and Games & Puzzles being dominant categories. Distribution channels are increasingly shifting online, though physical retail remains significant for product exploration.

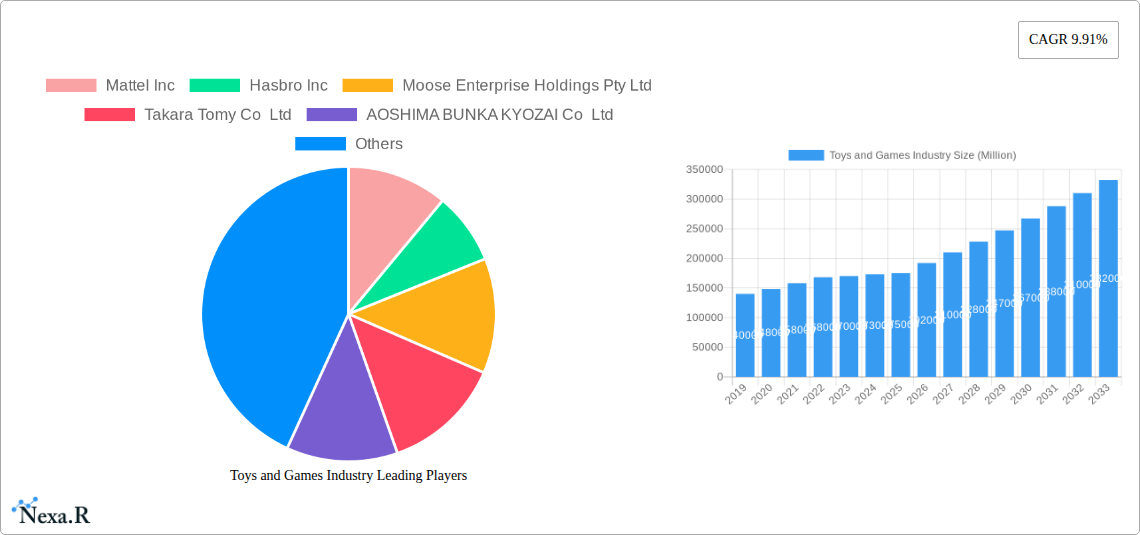

Toys and Games Industry Company Market Share

Toys and Games Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Toys and Games Industry, examining market dynamics, growth trajectories, regional dominance, product landscape, key players, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights for industry professionals, investors, and stakeholders. We delve into both parent and child markets, offering a holistic view of the sector's evolution. All quantitative values are presented in Million units, ensuring clarity and precision.

Toys and Games Industry Market Dynamics & Structure

The global Toys and Games Industry exhibits a dynamic market structure characterized by a blend of established giants and agile innovators. Market concentration varies across segments, with construction toys and video games often demonstrating higher consolidation due to significant R&D investments and brand loyalty. Technological innovation remains a primary driver, with advancements in AI, AR/VR, and sustainable materials revolutionizing product design and engagement. The industry is shaped by evolving regulatory frameworks, particularly concerning child safety standards and data privacy, influencing product development and marketing strategies. Competitive product substitutes are increasingly diverse, ranging from digital entertainment to experiential play, necessitating continuous product differentiation. End-user demographics are shifting, with a growing emphasis on educational toys and STEM-related products catering to a more informed and discerning consumer base. Mergers and acquisitions (M&A) trends are active, driven by companies seeking to expand their product portfolios, gain access to new technologies, and strengthen their market presence.

- Market Concentration: High in construction toys and video games, moderate in dolls and puzzles.

- Technological Innovation Drivers: AI integration for interactive play, AR/VR experiences, sustainable material adoption, and smart toy development.

- Regulatory Frameworks: Emphasis on child safety (e.g., ASTM F963, EN 71), data privacy, and ethical marketing.

- Competitive Product Substitutes: Digital apps, educational software, board games, outdoor recreational activities.

- End-User Demographics: Increasing demand for educational, eco-friendly, and inclusive toy options.

- M&A Trends: Strategic acquisitions to broaden product offerings, secure intellectual property, and enter emerging markets. Estimated M&A deal volume in the parent market is expected to be around 75 deals annually, with child market segments showing an average of 30 deals.

Toys and Games Industry Growth Trends & Insights

The Toys and Games Industry is poised for robust growth, driven by increasing disposable incomes, a rising birth rate in emerging economies, and a persistent demand for engaging and educational play experiences. The market size is projected to experience a significant upward trajectory, with the parent market expected to reach approximately USD 150,000 million by 2033, while the child market is anticipated to touch USD 80,000 million in the same period. Adoption rates for innovative products, particularly those incorporating digital elements and educational benefits, are on the rise. Technological disruptions, such as the integration of AI in interactive toys and the growing popularity of subscription-based gaming models, are reshaping consumer behavior. Parents are increasingly prioritizing toys that foster cognitive development, creativity, and problem-solving skills, leading to a surge in demand for STEM toys and educational games. The shift towards online purchasing channels continues to accelerate, offering greater convenience and wider product selection. The average annual growth rate (CAGR) for the global toys and games industry is estimated at 4.8% during the forecast period. Market penetration for licensed merchandise, particularly from popular movie and gaming franchises, remains strong, contributing significantly to overall market expansion.

- Market Size Evolution: Projected parent market size of USD 150,000 million by 2033; child market size of USD 80,000 million by 2033.

- Adoption Rates: High adoption for educational toys, STEM products, and digitally integrated play experiences.

- Technological Disruptions: AI-powered toys, AR/VR enhancements, and the influence of esports and mobile gaming on toy design.

- Consumer Behavior Shifts: Prioritization of educational value, sustainability, inclusivity, and digital connectivity in play.

- CAGR: Estimated at 4.8% for the global toys and games industry during 2025-2033.

- Market Penetration: Strong performance for licensed products and character-driven toy lines.

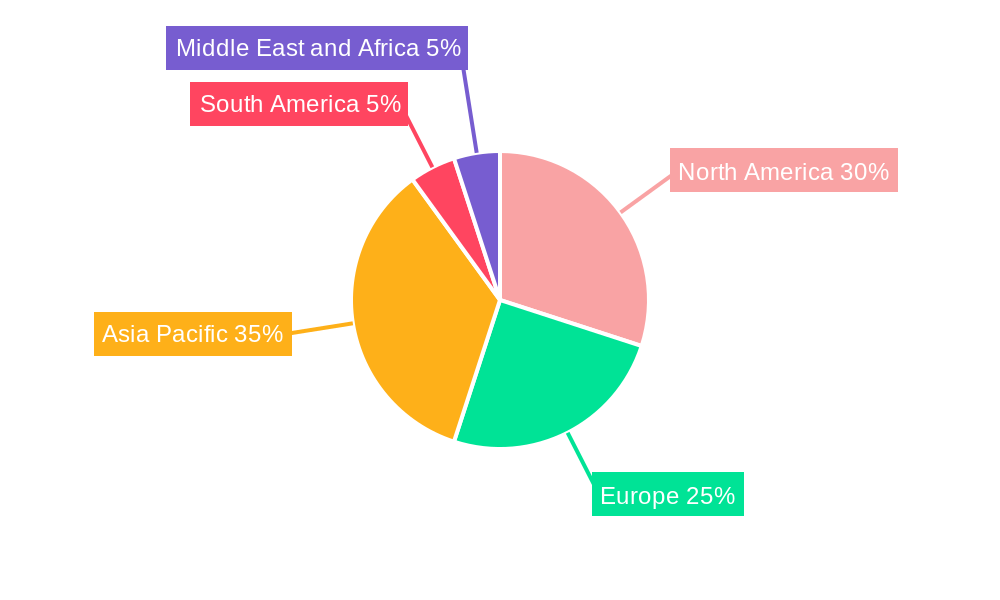

Dominant Regions, Countries, or Segments in Toys and Games Industry

North America, spearheaded by the United States, currently dominates the global Toys and Games Industry, with an estimated market share of 32% in the parent market and 30% in the child market. This dominance is attributed to a strong economy, high disposable incomes, and a culture that embraces innovation and consumer spending on entertainment. Europe, particularly Germany, the UK, and France, represents the second-largest market, accounting for approximately 25% of the parent market and 23% of the child market. Asia Pacific is the fastest-growing region, driven by economic expansion in China, India, and Southeast Asian countries, with an estimated market share of 20% in the parent market and 22% in the child market.

Within product segments, Video Games emerge as the leading category in terms of revenue and growth potential, capturing an estimated 35% of the parent market and 40% of the child market. The increasing penetration of smartphones and the popularity of online multiplayer games fuel this segment's dominance. Construction Toys follow closely, driven by the enduring appeal of brands like Lego and a growing demand for building and creative play experiences, holding approximately 18% of the parent market and 15% of the child market. Dolls and Accessories remain a significant segment, driven by popular franchises and aspirational play, with an estimated 12% share in the parent market and 14% in the child market.

Online Channels are rapidly gaining prominence as a distribution channel, accounting for an estimated 45% of sales in the parent market and 50% in the child market, reflecting changing consumer shopping habits. However, Offline Channels (traditional retail) still hold substantial importance, especially for impulse purchases and experiential shopping, comprising the remaining 55% and 50% respectively. Key drivers for regional dominance include robust retail infrastructure, effective marketing campaigns, and favorable government policies supporting the toy industry. The growth potential in emerging markets like Asia Pacific is substantial due to a growing middle class and increasing brand awareness.

- Leading Region: North America (especially the United States), followed by Europe and Asia Pacific.

- Dominant Segment (Product Type): Video Games, followed by Construction Toys and Dolls and Accessories.

- Dominant Channel: Online Channel is rapidly growing, but Offline Channel remains significant.

- Key Drivers: Economic policies, disposable income, consumer spending habits, retail infrastructure, brand recognition, and digital connectivity.

- Market Share: North America (Parent: 32%, Child: 30%), Europe (Parent: 25%, Child: 23%), Asia Pacific (Parent: 20%, Child: 22%).

- Segment Market Share: Video Games (Parent: 35%, Child: 40%), Construction Toys (Parent: 18%, Child: 15%), Dolls and Accessories (Parent: 12%, Child: 14%).

- Channel Market Share: Online Channel (Parent: 45%, Child: 50%), Offline Channel (Parent: 55%, Child: 50%).

Toys and Games Industry Product Landscape

The product landscape of the Toys and Games Industry is characterized by a continuous stream of innovation, driven by a desire to enhance engagement, educational value, and entertainment. We are witnessing a significant surge in smart toys that incorporate AI and connectivity, offering personalized play experiences and interactive learning opportunities. The application of augmented reality (AR) and virtual reality (VR) is transforming traditional toys into immersive digital adventures. Sustainable and eco-friendly materials are gaining traction, appealing to environmentally conscious consumers. The performance metrics for these products are increasingly measured by user engagement duration, educational outcomes, and positive consumer reviews. Unique selling propositions often revolve around brand licensing, developmental benefits, and novel gameplay mechanics. Technological advancements in areas like voice recognition, motion sensing, and haptic feedback are further enriching the play experience. The global market for smart toys is projected to reach approximately 8,500 million units by 2028, indicating a strong consumer appetite for technologically advanced play.

Key Drivers, Barriers & Challenges in Toys and Games Industry

The Toys and Games Industry is propelled by several key drivers that fuel its growth and evolution. Technological innovation, particularly in digital integration and smart toy development, is a primary catalyst. The increasing global birth rate and rising disposable incomes, especially in emerging economies, contribute significantly to market expansion. A growing emphasis on educational play and STEM learning among parents worldwide creates sustained demand for specific product categories. Furthermore, strong brand loyalty and the enduring appeal of licensed intellectual properties from movies, cartoons, and video games continue to drive sales.

However, the industry also faces significant barriers and challenges. Supply chain disruptions, exacerbated by global events, can impact production timelines and product availability, leading to increased costs. Stringent and evolving regulatory frameworks concerning product safety and child welfare necessitate continuous compliance efforts and can increase R&D expenses. Intense competitive pressure from both established players and new entrants, including digital alternatives, demands constant product innovation and effective marketing strategies. Economic downturns and fluctuations in consumer spending power can also pose a significant restraint on discretionary purchases like toys. The estimated cost of regulatory compliance for new product introductions can range from 5% to 15% of development budgets.

Emerging Opportunities in Toys and Games Industry

Emerging opportunities in the Toys and Games Industry are abundant, driven by evolving consumer preferences and technological advancements. The burgeoning market for subscription-based toy services and curated play boxes offers recurring revenue streams and personalized customer experiences. Untapped markets in developing regions present significant growth potential as disposable incomes rise. Innovative applications of AI and machine learning in toys for personalized learning and adaptive gameplay are gaining momentum. The demand for inclusive and diverse toys that represent a wider range of children is creating new product development avenues. Furthermore, the growing popularity of educational technology (EdTech) toys that seamlessly blend learning with play presents a substantial opportunity for market expansion. The estimated growth rate for the EdTech toy segment is expected to exceed 7% annually.

Growth Accelerators in the Toys and Games Industry Industry

Several catalysts are accelerating long-term growth in the Toys and Games Industry. Breakthroughs in miniaturization and battery technology are enabling the creation of more sophisticated and portable smart toys. Strategic partnerships between toy manufacturers and content creators, such as movie studios and gaming companies, amplify brand reach and product appeal. Market expansion strategies, particularly focusing on emerging economies with growing middle-class populations, are unlocking new consumer bases. The increasing adoption of e-commerce platforms and direct-to-consumer (DTC) models allows for greater market penetration and direct engagement with customers. The continuous integration of educational components and gamification principles into toy design is fostering a sustainable demand for learning-oriented play.

Key Players Shaping the Toys and Games Industry Market

- Mattel Inc

- Hasbro Inc

- Moose Enterprise Holdings Pty Ltd

- Takara Tomy Co Ltd

- AOSHIMA BUNKA KYOZAI Co Ltd

- Lego Group

- Simba-Dickie Group

- Tru Kids Inc

- Spin Master Ltd

- Bandai Namco Holdings Inc

Notable Milestones in Toys and Games Industry Sector

- October 2022: The Lego Group announced the Lego Marvel Studios Release, The Iron Man Hulkbuster set, featuring Iron Man as he appeared in Infinity Saga - Age of Ultron, a mega-hit film, boosting interest in collectible and licensed toy sets.

- September 2022: Mattel introduced Bruno the Brake Car, the first autistic character in the iconic Thomas & Friends franchise, signaling a growing industry trend towards inclusivity and representation in children's media and toys.

- September 2022: The Lego Group announced a new Lego Marvel Black Panther Set to celebrate one of the greatest Marvel superheroes of all time, underscoring the continued power of popular franchises in driving toy sales and engagement.

In-Depth Toys and Games Industry Market Outlook

The future outlook for the Toys and Games Industry is exceptionally promising, driven by sustained innovation and evolving consumer demands. The integration of advanced technologies like AI and AR/VR will continue to redefine play, offering more immersive and personalized experiences. The robust growth of the global middle class, particularly in emerging markets, will unlock significant new consumer bases. Strategic collaborations between toy companies and entertainment giants will ensure a steady stream of desirable licensed products. Furthermore, the increasing emphasis on educational and skill-building toys, aligning with global EdTech trends, will create a strong foundation for long-term market expansion. The industry's ability to adapt to changing consumer preferences for sustainability and inclusivity will be crucial for sustained success. The estimated total market value is projected to reach over USD 230,000 million by 2033.

Toys and Games Industry Segmentation

-

1. Product Type

- 1.1. Games and Puzzles

- 1.2. Video Games

- 1.3. Construction Toys

- 1.4. Dolls and Accessories

- 1.5. Outdoor and Sports Toys

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Online Channel

- 2.2. Offline Channel

Toys and Games Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Toys and Games Industry Regional Market Share

Geographic Coverage of Toys and Games Industry

Toys and Games Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Influence of Technology is Promoting Video Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Games and Puzzles

- 5.1.2. Video Games

- 5.1.3. Construction Toys

- 5.1.4. Dolls and Accessories

- 5.1.5. Outdoor and Sports Toys

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Channel

- 5.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Games and Puzzles

- 6.1.2. Video Games

- 6.1.3. Construction Toys

- 6.1.4. Dolls and Accessories

- 6.1.5. Outdoor and Sports Toys

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Channel

- 6.2.2. Offline Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Games and Puzzles

- 7.1.2. Video Games

- 7.1.3. Construction Toys

- 7.1.4. Dolls and Accessories

- 7.1.5. Outdoor and Sports Toys

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Channel

- 7.2.2. Offline Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Games and Puzzles

- 8.1.2. Video Games

- 8.1.3. Construction Toys

- 8.1.4. Dolls and Accessories

- 8.1.5. Outdoor and Sports Toys

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Channel

- 8.2.2. Offline Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Games and Puzzles

- 9.1.2. Video Games

- 9.1.3. Construction Toys

- 9.1.4. Dolls and Accessories

- 9.1.5. Outdoor and Sports Toys

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Channel

- 9.2.2. Offline Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Games and Puzzles

- 10.1.2. Video Games

- 10.1.3. Construction Toys

- 10.1.4. Dolls and Accessories

- 10.1.5. Outdoor and Sports Toys

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Channel

- 10.2.2. Offline Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mattel Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hasbro Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Moose Enterprise Holdings Pty Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Takara Tomy Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AOSHIMA BUNKA KYOZAI Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lego Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Simba-Dickie Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tru Kids Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spin Master Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bandai Namco Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mattel Inc

List of Figures

- Figure 1: Global Toys and Games Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Toys and Games Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 17: Europe Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: Europe Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 40: South America Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 41: South America Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: South America Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: South America Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East and Africa Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Toys and Games Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Toys and Games Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Toys and Games Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Spain Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Spain Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Germany Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Russia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Russia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 47: China Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: China Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Japan Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Japan Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: India Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: India Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Australia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Australia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 58: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 59: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 60: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 61: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 63: Brazil Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Brazil Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Argentina Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Argentina Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 70: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 71: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 72: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 73: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 74: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 75: South Africa Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: South Africa Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Saudi Arabia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Saudi Arabia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 79: Rest of Middle East and Africa Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Middle East and Africa Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Toys and Games Industry?

The projected CAGR is approximately 0.7%.

2. Which companies are prominent players in the Toys and Games Industry?

Key companies in the market include Mattel Inc, Hasbro Inc, Moose Enterprise Holdings Pty Ltd, Takara Tomy Co Ltd, AOSHIMA BUNKA KYOZAI Co Ltd, Lego Group, Simba-Dickie Group, Tru Kids Inc *List Not Exhaustive, Spin Master Ltd, Bandai Namco Holdings Inc.

3. What are the main segments of the Toys and Games Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Influence of Technology is Promoting Video Games.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

October 2022: The Lego Group announced the Lego Marvel Studios Release, The Iron Man Hulkbuster set, featuring Iron Man as he appeared in Infinity Saga - Age of Ultron, a mega-hit film.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Toys and Games Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Toys and Games Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Toys and Games Industry?

To stay informed about further developments, trends, and reports in the Toys and Games Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence