Key Insights

The global photographic equipment market is projected to experience substantial growth, with an estimated market size of $6.5 billion by the base year 2025. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.1%. This growth is propelled by escalating demand for superior imaging solutions across professional, content creation, and consumer sectors. Key drivers include technological advancements, such as the widespread adoption of mirrorless cameras and specialized lenses, alongside the influence of social media and content creation trends. The convenience of online retail further enhances market accessibility and product reach.

Photographic Equipment Industry Market Size (In Billion)

Innovation in sensor technology, AI-powered image processing, and the demand for compact, high-performance devices are shaping the photographic equipment landscape. While challenges like the cost of professional equipment and smartphone camera saturation exist, they are counterbalanced by the growth in advanced features and niche market accessories. The market is segmented by product type (Cameras, Lenses, Others) and distribution channel (Online Retail, Offline Retail), with online platforms showing significant expansion. Leading companies, including Canon, Nikon, Sony, and Fujifilm, are actively engaged in research and development to maintain market leadership across key regions.

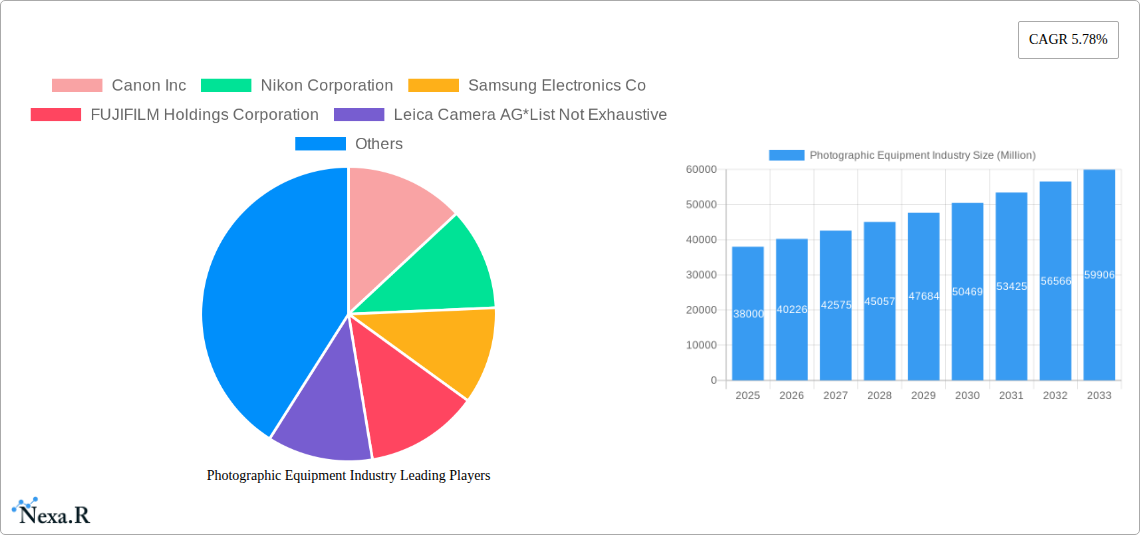

Photographic Equipment Industry Company Market Share

Photographic Equipment Industry Market Dynamics & Structure

The photographic equipment industry is characterized by a moderate market concentration, with a few dominant players like Canon Inc., Nikon Corporation, Sony Corporation, and FUJIFILM Holdings Corporation holding significant market share. Technological innovation remains a primary driver, fueled by advancements in sensor technology, AI-powered image processing, and miniaturization of equipment. The regulatory landscape is relatively stable, focusing on product safety standards and intellectual property rights. Competitive product substitutes are emerging from the smartphone camera segment, offering increasing quality and convenience, thus creating pressure on the dedicated camera market. End-user demographics are shifting, with a growing interest from content creators, professional photographers, and hobbyists seeking higher-quality imaging solutions. Mergers and acquisitions (M&A) activity, though not rampant, plays a role in market consolidation and strategic expansion. For instance, while the deal volume might be around 2-3 major transactions annually in the parent market, the child market might see more frequent smaller acquisitions.

- Market Concentration: Dominated by key players; moderate to high concentration.

- Technological Innovation: Driven by sensor resolution, AI image enhancement, lens optics, and video capabilities.

- Regulatory Frameworks: Primarily focused on safety compliance and IP protection.

- Competitive Substitutes: Advanced smartphone cameras are the primary substitute for casual photography.

- End-User Demographics: Diversified, including professionals, hobbyists, content creators, and a growing enthusiast segment.

- M&A Trends: Strategic acquisitions to gain technology or market access; an estimated 5-7 M&A deals in the parent market annually, with 10-15 smaller deals in niche segments.

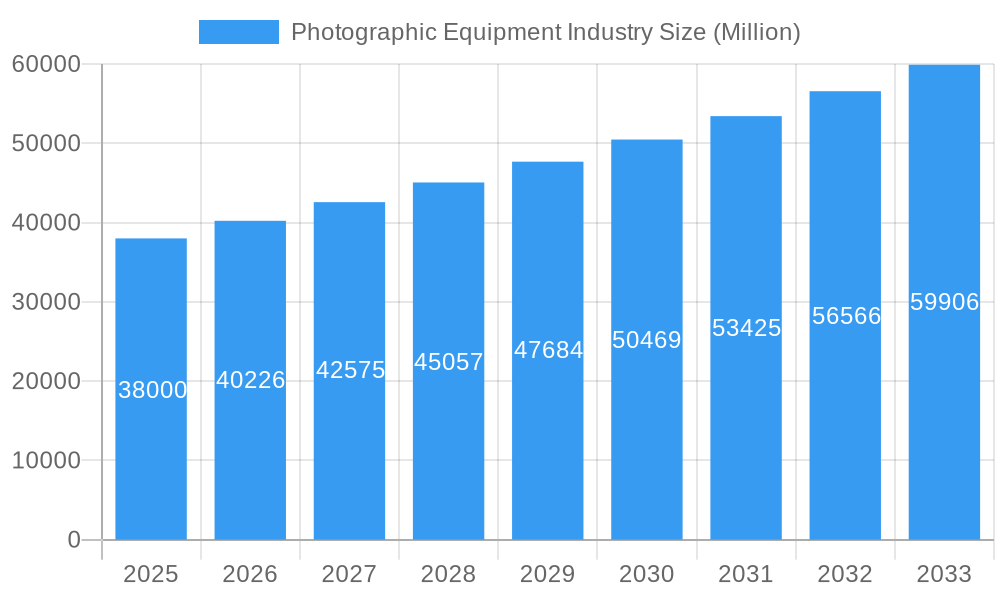

Photographic Equipment Industry Growth Trends & Insights

The global photographic equipment industry is poised for robust growth, projected to expand significantly from its current valuation. The parent market, encompassing professional and high-end consumer gear, is estimated to reach approximately USD 38,500 million in 2025, with a Compound Annual Growth Rate (CAGR) of around 4.5% during the forecast period of 2025-2033. The child market, which includes accessories, entry-level cameras, and related services, contributes an additional USD 15,200 million in 2025 and is expected to grow at a slightly higher CAGR of 5.2%. This expansion is underpinned by several key trends. Firstly, the increasing demand for high-quality visual content across social media platforms, streaming services, and professional media outlets is a major catalyst. Content creators and vloggers are investing in more advanced camera bodies and lenses to differentiate their work and deliver superior viewing experiences. This adoption rate is particularly high among younger demographics.

Secondly, technological disruptions are continuously reshaping the industry. Mirrorless camera technology has largely superseded DSLRs, offering smaller form factors, advanced autofocus systems, and superior video capabilities. Innovations in image stabilization, low-light performance, and artificial intelligence for image processing are enhancing user experience and image quality, encouraging upgrades. Furthermore, the integration of connectivity features, allowing for seamless photo sharing and remote camera control via smartphones, is boosting adoption rates, especially among casual photographers and hobbyists. Consumer behavior is also evolving; there's a growing appreciation for the creative control and image fidelity offered by dedicated cameras, even as smartphone capabilities improve. This shift is evident in the resurgence of interest in manual controls and advanced photographic techniques among a growing segment of photography enthusiasts. The market penetration of advanced photographic equipment is steadily increasing as affordability improves and the perceived value proposition strengthens.

The historical period (2019-2024) witnessed a significant shift towards mirrorless technology and a temporary slowdown due to global events, with the market size for photographic equipment fluctuating between USD 33,000 million and USD 36,000 million. However, the post-pandemic recovery and the sustained demand for visual content have propelled the industry back into a strong growth trajectory. The estimated market size for 2025 stands at USD 38,500 million for the parent market and USD 15,200 million for the child market, setting a positive outlook for the coming years.

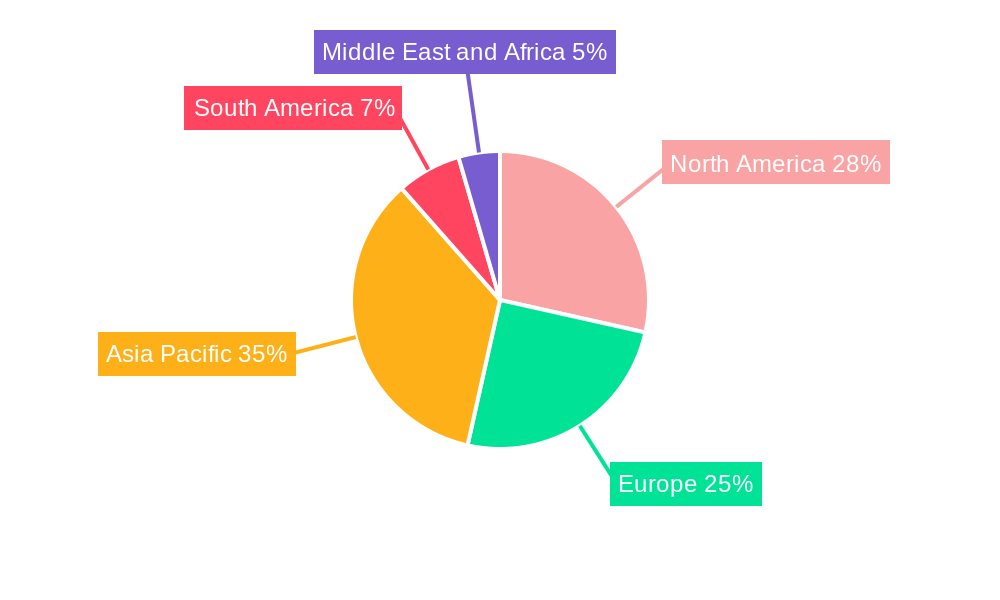

Dominant Regions, Countries, or Segments in Photographic Equipment Industry

North America, particularly the United States, stands as the dominant region driving growth in the global photographic equipment industry. In 2025, North America is projected to account for approximately 30% of the parent market's revenue, translating to an estimated USD 11,550 million, and around 32% of the child market, amounting to USD 4,864 million. This dominance is attributed to several interconnected factors. Firstly, the strong presence of a highly engaged creative professional community, including photographers, videographers, filmmakers, and content creators, fuels a consistent demand for high-end cameras, lenses, and accessories. The thriving digital media landscape and the constant need for visually compelling content across various platforms create a robust market for advanced imaging solutions.

Secondly, favorable economic policies and a high disposable income level within the region enable consumers to invest in premium photographic equipment. The cultural emphasis on capturing and sharing experiences, coupled with a well-established e-commerce infrastructure, further bolsters sales. Online retail channels, in particular, have seen significant growth, offering convenience and a wide selection of products. However, specialized brick-and-mortar stores catering to professionals and serious hobbyists still play a crucial role in providing expert advice and hands-on experience.

Within the Product Type segment, the Camera segment, valued at USD 22,000 million in 2025 for the parent market, and the Lens segment, valued at USD 13,000 million in 2025 for the parent market, are the primary growth drivers. The child market's camera segment is estimated at USD 8,000 million, and its lens segment at USD 4,500 million. The continuous innovation in mirrorless camera technology, offering superior image quality and advanced features, directly stimulates demand in North America. Similarly, the market for high-performance lenses, crucial for professional photography and videography, is substantial. The Distribution Channel of Online Retail is projected to capture over 60% of the total sales in 2025, driven by its accessibility and competitive pricing. However, Offline Retail, especially specialty stores, remains vital for customer education and demonstration of high-value equipment.

Photographic Equipment Industry Product Landscape

The photographic equipment industry is characterized by relentless product innovation, focusing on enhancing image quality, user experience, and versatility. Latest camera models boast higher megapixel counts, improved low-light performance, and advanced autofocus systems powered by AI, enabling sharper and more detailed images. Innovations in lens technology include wider apertures for superior bokeh, advanced coatings for reduced aberrations, and compact, weather-sealed designs. The "Others" category encompasses essential accessories like tripods, lighting equipment, and memory cards, all seeing advancements in durability, portability, and functionality. Unique selling propositions often lie in specialized features for specific applications, such as high-speed shooting for sports, exceptional video capabilities for filmmakers, and robust build quality for outdoor adventurers. Technological advancements are making sophisticated imaging tools more accessible and powerful than ever before.

Key Drivers, Barriers & Challenges in Photographic Equipment Industry

Key Drivers:

- Growing Demand for High-Quality Visual Content: Social media, streaming, and digital marketing fuel the need for professional-grade imagery.

- Technological Advancements: Innovations in sensor technology, AI, and mirrorless systems drive upgrades and adoption.

- Rise of Content Creators and Influencers: This demographic actively invests in sophisticated photographic gear.

- Increased Disposable Income: Enables consumers to purchase premium equipment.

Barriers & Challenges:

- Competition from Smartphone Cameras: Advancements in smartphone photography offer a compelling alternative for casual users.

- Economic Downturns and Inflation: Can reduce consumer spending on discretionary items like high-end equipment.

- Supply Chain Disruptions: Global events can impact the availability and cost of components.

- Complex Product Offerings: A wide range of products can overwhelm potential buyers.

- Technological Obsolescence: Rapid innovation can make older models quickly outdated, leading to depreciation.

Emerging Opportunities in Photographic Equipment Industry

Emerging opportunities lie in the burgeoning virtual and augmented reality (VR/AR) content creation market, demanding specialized 360-degree cameras and immersive imaging solutions. The increasing adoption of drone photography for various applications, including real estate, inspections, and filmmaking, presents another significant avenue. Furthermore, the growing trend of personalized photography experiences, including workshops and custom equipment configurations, caters to niche enthusiast segments. The expansion of AI-powered editing software and cloud-based image management services also creates opportunities for integration and bundled offerings.

Growth Accelerators in the Photographic Equipment Industry Industry

The long-term growth of the photographic equipment industry is being significantly accelerated by breakthroughs in artificial intelligence, particularly in image recognition, predictive autofocus, and automated editing tools, which enhance user experience and output quality. Strategic partnerships between camera manufacturers and software developers are creating integrated ecosystems, offering seamless workflows and added value to consumers. Furthermore, the expansion of rental and subscription models for high-end equipment is making professional tools more accessible, stimulating adoption and market penetration. The development of more sustainable manufacturing practices and eco-friendly materials is also becoming a growth accelerator as consumer awareness increases.

Key Players Shaping the Photographic Equipment Industry Market

- Canon Inc.

- Nikon Corporation

- Samsung Electronics Co.

- FUJIFILM Holdings Corporation

- Leica Camera AG

- Panasonic Corporation

- Sony Corporation

Notable Milestones in Photographic Equipment Industry Sector

- 2019: Launch of advanced mirrorless cameras with enhanced video capabilities and improved AI autofocus systems.

- 2020: Increased adoption of remote work and content creation led to a surge in demand for streaming-friendly cameras and accessories.

- 2021: Introduction of new sensor technologies offering superior dynamic range and low-light performance.

- 2022: Greater integration of computational photography features, blurring the lines between dedicated cameras and smartphones.

- 2023: Focus on sustainable product development and manufacturing practices gained traction among major manufacturers.

- 2024: Significant advancements in AI-powered image stabilization and object tracking across various camera models.

In-Depth Photographic Equipment Industry Market Outlook

The photographic equipment industry is on an upward trajectory, driven by the insatiable global demand for high-quality visual content and continuous technological innovation. Growth accelerators such as sophisticated AI integration for smarter imaging, strategic alliances between hardware and software providers, and the innovative expansion of equipment access through rental and subscription models are poised to propel the market forward. The industry's ability to adapt to evolving consumer preferences, particularly the burgeoning creator economy and the demand for immersive visual experiences, ensures a promising future with significant potential for market expansion and strategic diversification.

Photographic Equipment Industry Segmentation

-

1. Product Type

- 1.1. Camera

- 1.2. Lens

- 1.3. Others

-

2. Distribution Channel

- 2.1. Online Retail

- 2.2. Offline Retail

Photographic Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Photographic Equipment Industry Regional Market Share

Geographic Coverage of Photographic Equipment Industry

Photographic Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing sale of Photography Equipment’s from Online Retailing Channels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Camera

- 5.1.2. Lens

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail

- 5.2.2. Offline Retail

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Camera

- 6.1.2. Lens

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail

- 6.2.2. Offline Retail

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Camera

- 7.1.2. Lens

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail

- 7.2.2. Offline Retail

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Camera

- 8.1.2. Lens

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail

- 8.2.2. Offline Retail

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Camera

- 9.1.2. Lens

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail

- 9.2.2. Offline Retail

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Camera

- 10.1.2. Lens

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail

- 10.2.2. Offline Retail

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Canon Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nikon Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung Electronics Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FUJIFILM Holdings Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leica Camera AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sony Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Canon Inc

List of Figures

- Figure 1: Global Photographic Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Photographic Equipment Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 17: Europe Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: Europe Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 40: South America Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 41: South America Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: South America Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: South America Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East and Africa Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Photographic Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Photographic Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Germany Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Germany Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: France Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: France Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Italy Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Italy Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Russia Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Russia Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 40: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 41: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 45: China Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: China Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Japan Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: India Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: India Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Australia Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Australia Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 56: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 57: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Brazil Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Brazil Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Argentina Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Argentina Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 68: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 69: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 73: South Africa Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Saudi Arabia Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Saudi Arabia Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Rest of Middle East and Africa Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of Middle East and Africa Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Photographic Equipment Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Photographic Equipment Industry?

Key companies in the market include Canon Inc, Nikon Corporation, Samsung Electronics Co, FUJIFILM Holdings Corporation, Leica Camera AG*List Not Exhaustive, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Photographic Equipment Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Increasing sale of Photography Equipment’s from Online Retailing Channels.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Photographic Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Photographic Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Photographic Equipment Industry?

To stay informed about further developments, trends, and reports in the Photographic Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence