Key Insights

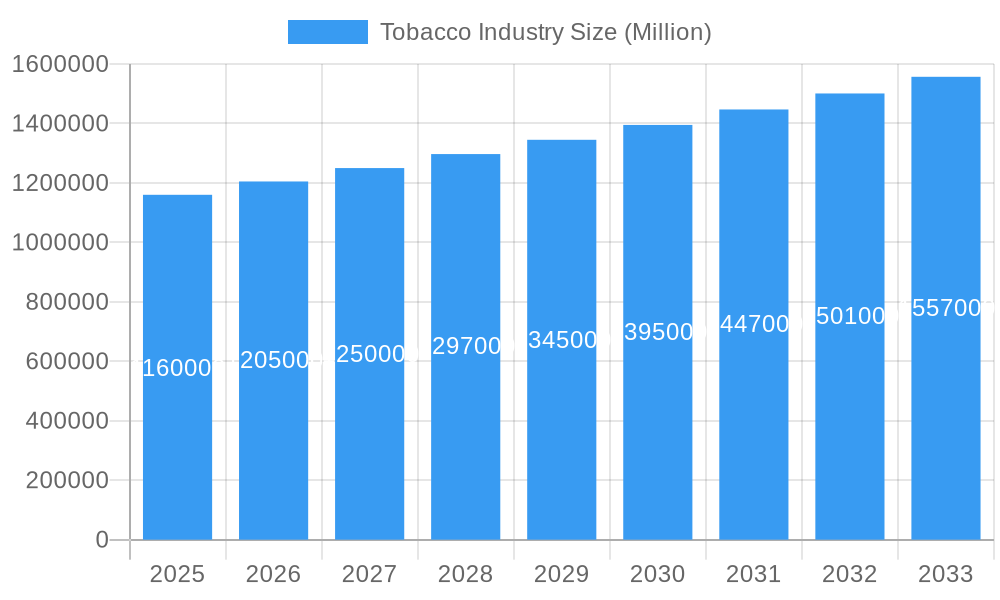

The global tobacco industry is projected for sustained growth, with an estimated market size of 1058.2 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.53% through 2033. Key growth drivers include rising disposable incomes in emerging markets, continued demand for traditional tobacco products, and the increasing adoption of next-generation nicotine products like heated tobacco and e-cigarettes, particularly within the "Smokeless Devices" category. Despite regulatory challenges and public health initiatives, the industry demonstrates resilience. A significant shift towards less harmful alternatives is fueling innovation and R&D. Strategic expansions into developing regions with favorable regulatory environments and growing middle-class populations are also contributing to market value. The "Waterpipes" segment, driven by specific cultural preferences, represents a growing niche.

Tobacco Industry Market Size (In Million)

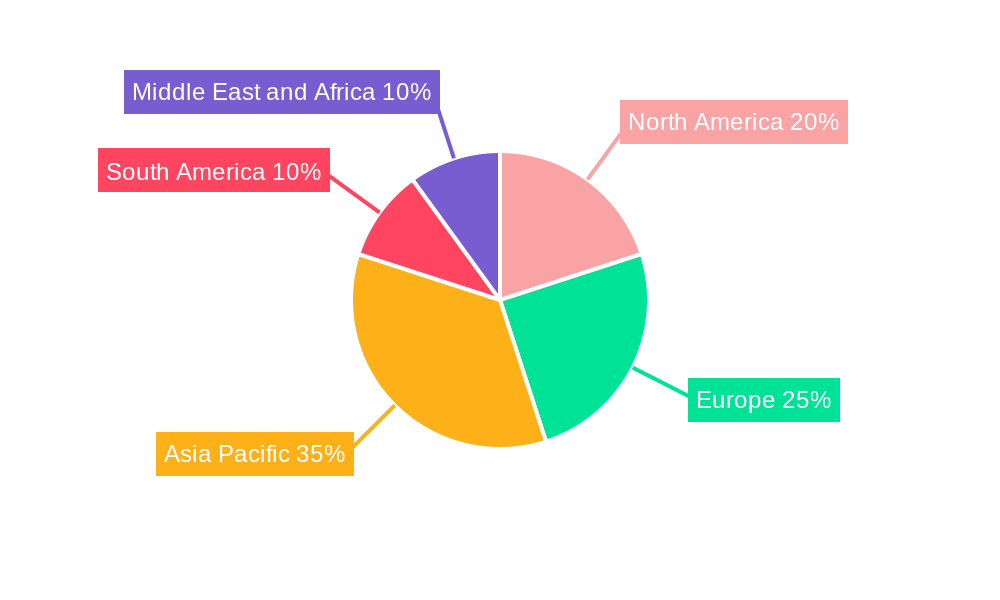

The distribution network for the tobacco industry continues to rely on traditional channels such as supermarkets and convenience stores. However, specialty retail and e-commerce platforms are experiencing increased adoption for premium products and alternative nicotine solutions, facilitating direct consumer engagement. Geographically, the Asia Pacific region, led by China and India, is expected to maintain its leading position in both production and consumption due to its large population and increasing urbanization. North America and Europe, despite strict regulations, are observing growth in premium cigar and advanced smokeless device segments. Market growth is moderated by stringent government regulations, excise taxes, and heightened health awareness. The industry's capacity for adaptation through product innovation, diversification into alternative nicotine offerings, and strategic market penetration will be crucial for long-term success.

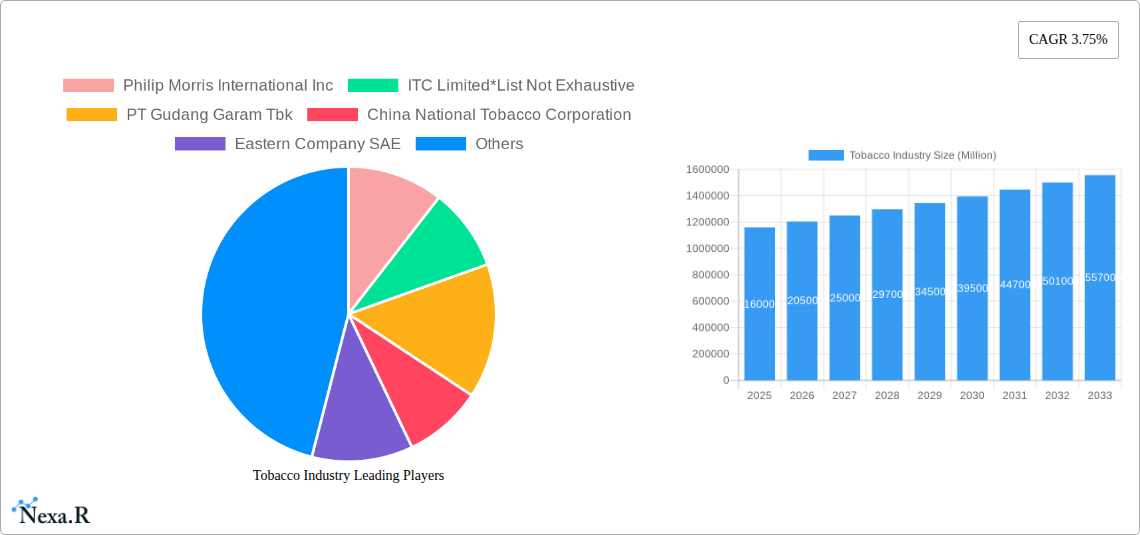

Tobacco Industry Company Market Share

Comprehensive Tobacco Industry Report: Market Dynamics, Growth Trends, and Key Players (2019-2033)

This in-depth report provides a panoramic view of the global tobacco industry, meticulously analyzing its current landscape and projecting future trajectories. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this comprehensive analysis delves into market dynamics, growth drivers, dominant regions, product innovations, and the strategic maneuvers of key industry players. We present quantitative insights in millions of units, offering actionable intelligence for stakeholders across the entire value chain.

Tobacco Industry Market Dynamics & Structure

The global tobacco market is characterized by a complex interplay of established players and evolving consumer preferences. Market concentration remains significant, with a few multinational corporations holding substantial market shares. Technological innovation is a pivotal driver, particularly in the development of reduced-harm products and novel delivery systems that aim to mitigate the risks associated with traditional smoking. Regulatory frameworks continue to shape market access and product development, with governments worldwide implementing stringent policies to control tobacco consumption. Competitive product substitutes are emerging, including a growing array of nicotine replacement therapies and alternative nicotine products. End-user demographics are shifting, with a discernible trend towards an aging consumer base in some mature markets and a growing youth demographic in emerging economies. Merger and acquisition (M&A) trends are indicative of strategic consolidation and diversification efforts, as companies seek to expand their product portfolios and geographic reach.

- Market Concentration: Dominated by major players, though regional variations exist.

- Technological Innovation: Focus on heated tobacco products (HTPs), e-cigarettes, and other novel nicotine delivery systems.

- Regulatory Frameworks: Evolving legislation impacting product marketing, sales, and composition.

- Competitive Product Substitutes: Rise of vaping devices, nicotine pouches, and oral nicotine products.

- End-User Demographics: Shifting consumer preferences influenced by health awareness and product innovation.

- M&A Trends: Strategic acquisitions and divestitures aimed at portfolio optimization and market expansion.

Tobacco Industry Growth Trends & Insights

The tobacco market size is projected to witness a steady evolution, driven by a combination of sustained demand for traditional products and the rapid adoption of innovative alternatives. While volume growth in conventional cigarettes may be constrained by regulatory pressures and health concerns, the segment of new generation products (NGPs), including heated tobacco and e-cigarettes, is experiencing robust adoption rates. Technological disruptions are fundamentally reshaping the industry, with significant investments pouring into research and development for less harmful alternatives. Consumer behavior shifts are a critical factor, with a growing segment of smokers seeking to reduce their exposure to combustion byproducts. The CAGR for the global tobacco industry is expected to be driven by these dual forces. Market penetration of NGPs is on an upward trajectory, indicating a significant transition within the consumer base.

The XXX (Specify the actual name of the data source or methodology here) reveals that the tobacco market outlook is one of dynamic transformation. The historical period (2019-2024) has laid the groundwork for current trends, with a gradual increase in the acceptance of alternative nicotine products. The base year of 2025 marks a pivotal point, from which the forecast period (2025-2033) will witness an accelerated shift. Consumption patterns are influenced by socio-economic factors, disposable incomes, and evolving lifestyle choices. The demand for premium tobacco products remains resilient in certain segments, while affordability remains a key consideration for a broader consumer base. The industry is also responding to a growing demand for personalized experiences and a wider variety of flavor profiles, particularly within the e-vapor and heated tobacco segments. Understanding these nuanced consumer preferences is paramount for sustained growth. The tobacco industry analysis highlights the increasing importance of digital engagement and direct-to-consumer strategies, alongside traditional retail channels.

Dominant Regions, Countries, or Segments in Tobacco Industry

The tobacco industry growth is not uniformly distributed, with several regions and product segments exhibiting distinct performance characteristics. Within Product Type, Cigarettes continue to hold a substantial market share globally, driven by long-standing consumer habits and established distribution networks. However, Smokeless Devices and Waterpipes are gaining traction in specific demographics and geographic locales, reflecting evolving smoking rituals and a desire for alternatives to combustion. The Distribution Channel landscape is equally diverse. Supermarkets/Hypermarkets and Convenience Stores remain critical for widespread accessibility of traditional tobacco products. Simultaneously, Specialty Stores are becoming increasingly important for the sale of premium cigars, niche tobacco products, and the rapidly expanding range of NGPs, offering a more curated consumer experience. Other Distribution Channels, including online sales and direct-to-consumer platforms, are witnessing significant growth, especially for e-cigarettes and heated tobacco products.

- Dominant Product Type Driver: Cigarettes maintain the largest market share due to established consumer bases and extensive availability.

- Emerging Product Segments: Smokeless Devices and Waterpipes are experiencing growth in niche markets and among specific consumer groups.

- Key Distribution Channels: Supermarkets/Hypermarkets and Convenience Stores are crucial for mass market reach of traditional products.

- Growth in Specialty Channels: Specialty Stores are vital for premium products and the burgeoning NGP market.

- Online and Direct-to-Consumer Growth: Other Distribution Channels are increasingly significant for e-commerce and personalized sales.

- Regional Dominance Factors: Economic policies, disposable income levels, regulatory environments, and cultural acceptance play a pivotal role in regional market performance. Emerging economies, particularly in Asia and Africa, often exhibit higher growth potential for traditional tobacco products, while developed markets are at the forefront of NGP adoption.

Tobacco Industry Product Landscape

The tobacco industry product landscape is undergoing a significant transformation driven by innovation. Traditional product offerings, such as cigarettes and cigars, are being complemented by a new generation of heated tobacco products (HTPs), e-cigarettes, and a variety of smokeless devices. These innovations aim to provide alternatives with potentially reduced risks compared to combustible tobacco. Performance metrics for these new products focus on user experience, battery life, vapor quality, and flavor delivery. Unique selling propositions often revolve around convenience, discretion, and a departure from the smell and ash associated with traditional smoking. Technological advancements in battery technology, heating elements, and e-liquid formulations are continually enhancing the appeal and functionality of these novel products, driving consumer interest and market penetration.

Key Drivers, Barriers & Challenges in Tobacco Industry

The tobacco industry is propelled by several key drivers, including a vast and established consumer base, ongoing product innovation, and resilient demand in emerging markets. Technological advancements in harm reduction products are a significant growth accelerator. Furthermore, the economic contributions of the industry, through taxation and employment, also play a role in its continued operation.

- Key Drivers:

- Established Consumer Base: Large global population accustomed to tobacco products.

- Product Innovation: Development of reduced-risk alternatives like HTPs and e-cigarettes.

- Emerging Market Demand: Growing disposable incomes and expanding consumer bases in developing economies.

- Technological Advancements: Improved product performance and user experience in NGPs.

Conversely, the industry faces considerable barriers and challenges. Stringent and evolving regulatory frameworks worldwide represent a major hurdle, impacting marketing, sales, and product development. Public health campaigns and increasing health consciousness among consumers are leading to reduced smoking rates in many developed nations. The illicit trade of tobacco products also poses a significant challenge, undermining legitimate businesses and government revenues.

- Key Barriers & Challenges:

- Regulatory Restrictions: Bans on advertising, plain packaging, and high taxation.

- Public Health Concerns: Growing awareness of smoking-related diseases and health risks.

- Illicit Trade: Smuggled and counterfeit products impacting market share and profitability.

- Competition from Alternatives: Increasing popularity of vaping and other nicotine products.

- Supply Chain Volatility: Potential disruptions due to climate change, geopolitical events, or disease outbreaks affecting tobacco cultivation.

Emerging Opportunities in Tobacco Industry

Emerging opportunities within the tobacco industry lie primarily in the continued development and global expansion of new generation products (NGPs). Untapped markets in regions with high smoking prevalence but lower NGP penetration represent significant growth potential. Evolving consumer preferences for personalized experiences and a wider array of flavor profiles, particularly within the e-vapor and heated tobacco segments, offer avenues for product differentiation and market capture. Furthermore, strategic partnerships with technology companies and pharmaceutical entities could unlock new avenues for innovation in nicotine delivery and harm reduction. The increasing focus on sustainability and ethical sourcing within the agricultural supply chain also presents an opportunity for companies to enhance their brand reputation and appeal to socially conscious consumers.

Growth Accelerators in the Tobacco Industry Industry

The tobacco industry is witnessing sustained growth acceleration fueled by several catalysts. The continued investment in research and development for innovative heated tobacco products (HTPs) and e-cigarettes is a primary driver, offering consumers potentially less harmful alternatives. Strategic partnerships and collaborations between established tobacco manufacturers and technology firms are fostering rapid product development and market penetration. Furthermore, the expansion of these NGPs into emerging markets, where regulatory frameworks are still developing, presents a substantial growth opportunity. Aggressive marketing and distribution strategies, coupled with attractive pricing, are also instrumental in accelerating adoption rates.

Key Players Shaping the Tobacco Industry Market

- Philip Morris International Inc.

- ITC Limited

- PT Gudang Garam Tbk

- China National Tobacco Corporation

- Eastern Company SAE

- Japan Tobacco Inc.

- KT&G Corp

- British American Tobacco plc

- Altria Group Inc.

- Imperial Brands plc

Notable Milestones in Tobacco Industry Sector

- November 2022: Philip Morris International Inc. launched BONDS by IQOS, its latest heat-not-burn tobacco heating system, featuring specially designed tobacco sticks called BLENDS.

- July 2022: British American Tobacco (BAT) announced the launch of gloTM hyper X2 in Tokyo, Japan, its latest innovation from the gloTM heated tobacco brand. The product features new, innovative, user-friendly features and a 'barrel styling' design shaped by consumer insights.

- August 2021: JT Group launched Ploom X, a next-generation heated tobacco device, in Japan. The Ploom X is available in convenience stores and select tobacco retail outlets across Japan.

In-Depth Tobacco Industry Market Outlook

The tobacco industry market outlook is one of dynamic evolution, with significant future potential rooted in the continued expansion of new generation products (NGPs). Growth accelerators like technological breakthroughs in harm reduction, strategic market expansion into emerging economies, and the adaptation to evolving consumer preferences for less harmful alternatives will define the sector. Companies that effectively navigate the complex regulatory landscape, invest in sustainable practices, and innovate their product offerings are poised for sustained success. The shift towards personalized nicotine experiences and a broader range of product formats will also be critical in capturing future market share, ensuring the industry's continued relevance in a health-conscious world.

Tobacco Industry Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigars and Cigarillos

- 1.3. Waterpipes

- 1.4. Smokeless Devices

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Other Distribution Channels

Tobacco Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Tobacco Industry Regional Market Share

Geographic Coverage of Tobacco Industry

Tobacco Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1 Rising Popularity for Low Tar

- 3.4.2 Nicotine Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigars and Cigarillos

- 5.1.3. Waterpipes

- 5.1.4. Smokeless Devices

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cigarettes

- 6.1.2. Cigars and Cigarillos

- 6.1.3. Waterpipes

- 6.1.4. Smokeless Devices

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cigarettes

- 7.1.2. Cigars and Cigarillos

- 7.1.3. Waterpipes

- 7.1.4. Smokeless Devices

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cigarettes

- 8.1.2. Cigars and Cigarillos

- 8.1.3. Waterpipes

- 8.1.4. Smokeless Devices

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cigarettes

- 9.1.2. Cigars and Cigarillos

- 9.1.3. Waterpipes

- 9.1.4. Smokeless Devices

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cigarettes

- 10.1.2. Cigars and Cigarillos

- 10.1.3. Waterpipes

- 10.1.4. Smokeless Devices

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Philip Morris International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ITC Limited*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Gudang Garam Tbk

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China National Tobacco Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eastern Company SAE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Tobacco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KT&G Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 British American Tobacco plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Altria Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Imperial Brands plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Philip Morris International Inc

List of Figures

- Figure 1: Global Tobacco Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Tobacco Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Tobacco Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Italy Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Russia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tobacco Industry?

The projected CAGR is approximately 2.53%.

2. Which companies are prominent players in the Tobacco Industry?

Key companies in the market include Philip Morris International Inc, ITC Limited*List Not Exhaustive, PT Gudang Garam Tbk, China National Tobacco Corporation, Eastern Company SAE, Japan Tobacco Inc, KT&G Corp, British American Tobacco plc, Altria Group Inc, Imperial Brands plc.

3. What are the main segments of the Tobacco Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1058.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Rising Popularity for Low Tar. Nicotine Products.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In November 2022, With its mix of specially designed tobacco sticks, BLENDS, Philip Morris International Inc. launched its latest heat-not-burn tobacco heating system, BONDS by IQOS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tobacco Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tobacco Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tobacco Industry?

To stay informed about further developments, trends, and reports in the Tobacco Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence