Key Insights

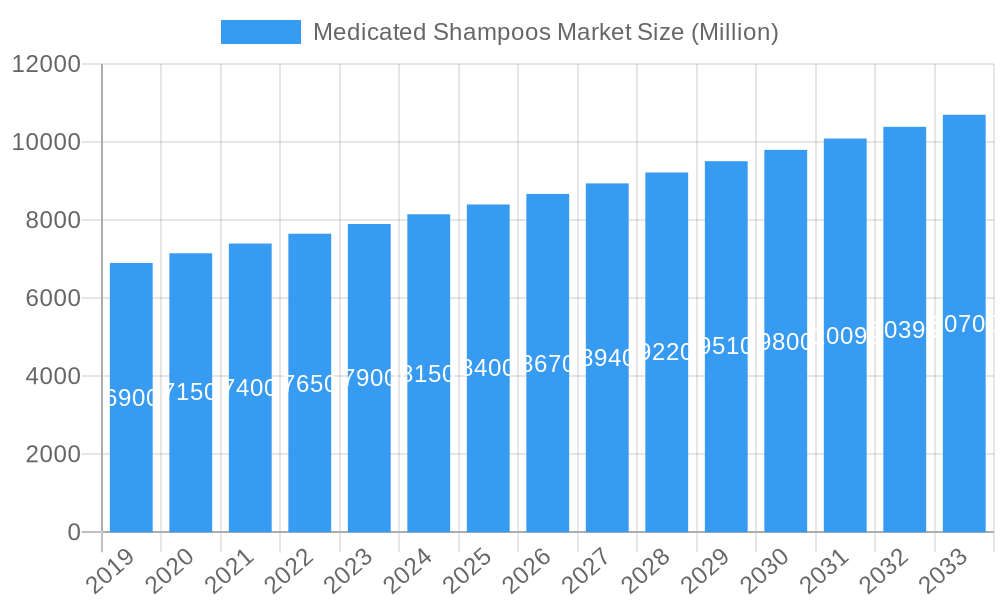

The global Medicated Shampoos Market is projected to reach $12.51 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.15% through 2033. This growth is propelled by heightened consumer awareness of scalp health and the effectiveness of medicated shampoos in addressing dermatological issues like dandruff, psoriasis, and fungal infections. The increasing incidence of these scalp conditions, often linked to stress, pollution, and lifestyle factors, is driving demand for targeted therapeutic solutions. Advances in dermatological research and the development of advanced formulations with key ingredients such as ketoconazole, selenium sulfide, and salicylic acid are also bolstering market expansion. The growing preference for accessible over-the-counter (OTC) dermatological treatments further enhances the market's appeal.

Medicated Shampoos Market Market Size (In Billion)

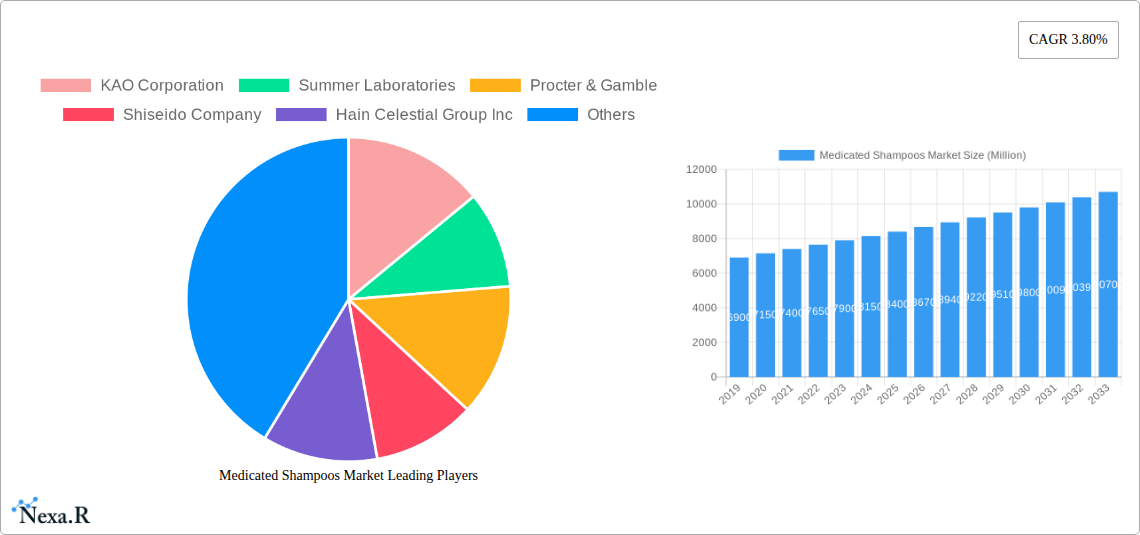

The medicated shampoos market is shaped by evolving consumer preferences and strategic initiatives from key industry players. While supermarkets, hypermarkets, and pharmacies remain primary distribution channels, the online retail sector is rapidly emerging as a significant growth driver due to convenience and expanded product availability. Leading companies including KAO Corporation, Summer Laboratories, Procter & Gamble, Shiseido Company, Hain Celestial Group Inc., Kramer Laboratories Inc. (NIZORAL), and Johnson & Johnson are actively innovating their product portfolios to meet diverse consumer needs and regional market demands. The Asia Pacific region, particularly China and India, is identified as a high-growth area, attributed to rising disposable incomes, increasing health consciousness, and a growing prevalence of scalp disorders. Market restraints, such as the availability of generic alternatives and the perception of medicated shampoos as solely for severe conditions, are being mitigated through strategic marketing and the development of formulations suitable for everyday use and milder scalp concerns.

Medicated Shampoos Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Medicated Shampoos Market, detailing its dynamics, key growth trends, dominant segments, product offerings, and future projections. Designed for industry professionals, researchers, and stakeholders, this report utilizes high-impact keywords for optimal search engine visibility and provides actionable market intelligence.

Medicated Shampoos Market Dynamics & Structure

The Medicated Shampoos Market is characterized by a moderately concentrated structure, with a few major players holding significant market share, alongside a growing number of niche and regional brands. Technological innovation is a key driver, with ongoing research and development focused on new active ingredients, improved delivery systems, and enhanced efficacy for treating various scalp and hair conditions such as dandruff, psoriasis, seborrheic dermatitis, and hair loss. Regulatory frameworks, particularly stringent in developed regions like North America and Europe, play a crucial role in product approval and market entry, influencing formulation and labeling. Competitive product substitutes, including medicated conditioners, topical treatments, and prescription medications, present a constant challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are evolving, with increasing awareness of scalp health and a growing demand for targeted solutions across age groups. Mergers and Acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain access to new technologies, and consolidate market presence. For instance, a recent M&A deal might have involved a larger corporation acquiring a smaller, innovative company in the antifungal shampoo segment, aiming to bolster its position in the anti-dandruff market. The market concentration is estimated to be around 60% held by the top five players. The volume of M&A deals in the historical period (2019-2024) was approximately 12, involving an estimated transaction value of $500 Million units. Innovation barriers include the high cost of clinical trials and the lengthy approval processes for new drug formulations.

Medicated Shampoos Market Growth Trends & Insights

The Medicated Shampoos Market is poised for robust growth, driven by escalating consumer awareness regarding scalp health and the increasing prevalence of dermatological conditions affecting hair and scalp. Projections indicate a market size evolution from an estimated $5,500 Million units in the base year 2025 to a projected $9,200 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.7% during the forecast period 2025–2033. The adoption rates for specialized medicated shampoos are steadily rising, propelled by endorsements from healthcare professionals and the accessibility of over-the-counter (OTC) formulations. Technological disruptions are contributing significantly, with advancements in nanotechnology for enhanced ingredient penetration and the development of gentler, more effective formulations without harsh chemicals. Consumer behavior shifts are also a pivotal factor; individuals are increasingly proactive in seeking solutions for persistent scalp issues rather than solely relying on cosmetic shampoos. This trend is further amplified by the growing online accessibility of product information and the ability to compare efficacy and ingredients, fostering informed purchasing decisions. Market penetration for medicated shampoos in urban areas is estimated to be around 55% and is projected to grow. The rise of personalized medicine and the demand for dermatologically tested products are key indicators of this evolving consumer landscape. The market is witnessing a surge in demand for specialized shampoos targeting specific conditions like psoriasis, eczema, and fungal infections, moving beyond the primary segment of anti-dandruff treatments.

Dominant Regions, Countries, or Segments in Medicated Shampoos Market

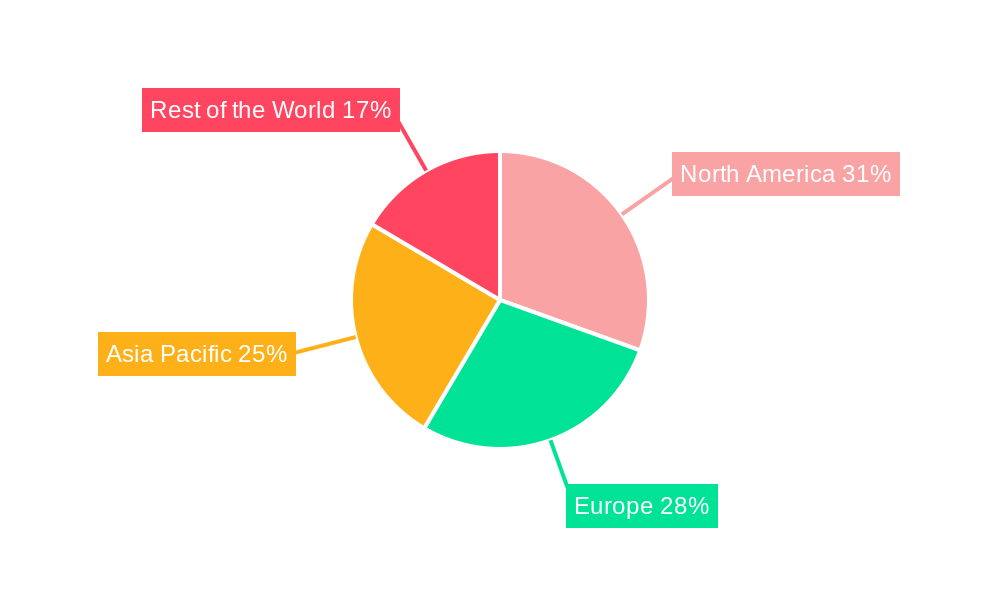

The Pharmacies distribution channel is emerging as the dominant segment within the Medicated Shampoos Market, exhibiting significant growth potential and market share. This dominance is fueled by the inherent trust consumers place in pharmacies for health-related products and the pharmacist's role in recommending appropriate treatments for scalp conditions. North America, particularly the United States, stands out as the leading region, driven by a high prevalence of dermatological issues, a well-established healthcare infrastructure, and significant consumer spending on personal care and health products.

Pharmacies:

- Key Drivers: Pharmacist recommendations, doctor's prescriptions, consumer trust in healthcare-associated outlets, availability of specialized formulations.

- Market Share (Estimated): Forecasted to hold approximately 35% of the total market share in 2025, with a projected CAGR of 7.2% during the forecast period.

- Growth Potential: High due to increasing awareness of scalp health and the desire for clinically proven solutions.

North America:

- Dominance Factors: High incidence of dandruff, psoriasis, and other scalp conditions; advanced healthcare systems; robust R&D investments; strong presence of key global players.

- Market Share (Estimated): Estimated to account for 30% of the global market in 2025.

- Economic Policies: Favorable regulatory environments for OTC drug approvals contribute to market expansion.

- Infrastructure: Well-developed retail and pharmacy chains ensure widespread product availability.

Online Stores:

- Key Drivers: Convenience, wider product selection, competitive pricing, access to niche brands, direct-to-consumer (DTC) sales models.

- Market Share (Estimated): Expected to grow significantly, reaching around 25% by 2033 from an estimated 20% in 2025.

- Growth Potential: Significant, especially among younger demographics and in regions with limited physical retail access.

Supermarket/Hypermarket:

- Key Drivers: Impulse purchases, wide availability, competitive pricing for mass-market medicated shampoos.

- Market Share (Estimated): Expected to maintain a stable share, around 15% in 2025.

- Growth Potential: Moderate, largely driven by promotional activities and brand visibility.

The dominance of pharmacies is further solidified by the increasing demand for prescription-strength OTC medicated shampoos and the growing trend of self-medication for common scalp ailments.

Medicated Shampoos Market Product Landscape

The Medicated Shampoos Market is characterized by a diverse product landscape focused on treating a spectrum of scalp and hair conditions. Innovations revolve around the development of advanced formulations incorporating potent active ingredients like Ketoconazole, Selenium Sulfide, Zinc Pyrithione, and Salicylic Acid, alongside natural and botanical extracts for enhanced efficacy and reduced side effects. Performance metrics emphasize rapid symptom relief, long-term scalp health improvement, and gentle cleansing. Unique selling propositions often highlight hypoallergenic properties, sulfate-free formulations, and targeted action against specific issues such as fungal infections, itching, and hair thinning. Technological advancements are evident in microencapsulation techniques for sustained release of active ingredients and the integration of pH-balancing properties for optimal scalp environment.

Key Drivers, Barriers & Challenges in Medicated Shampoos Market

Key Drivers:

- Increasing Prevalence of Scalp Conditions: Rising incidence of dandruff, psoriasis, seborrheic dermatitis, and fungal infections globally.

- Growing Consumer Awareness: Enhanced understanding of scalp health and the benefits of specialized medicated shampoos.

- Technological Advancements: Development of novel formulations and delivery systems for improved efficacy.

- Accessible Over-the-Counter (OTC) Availability: Wider availability of medicated shampoos without prescription, driving self-medication.

- Rising Disposable Incomes: Increased spending capacity on premium and specialized personal care products.

Barriers & Challenges:

- Stringent Regulatory Approvals: Lengthy and costly processes for obtaining market authorization for new active ingredients and formulations.

- Intense Competition: Presence of numerous established brands and generic alternatives leading to price pressures.

- Consumer Perception & Trust: Overcoming the perception of medicated shampoos as harsh or only for severe conditions.

- Supply Chain Disruptions: Potential for raw material shortages and logistical issues impacting production and distribution.

- Counterfeit Products: The proliferation of counterfeit medicated shampoos can erode brand trust and patient safety. The market faces an estimated 10% impact from counterfeit products annually.

Emerging Opportunities in Medicated Shampoos Market

Emerging opportunities in the Medicated Shampoos Market lie in the growing demand for natural and organic formulations with scientifically proven efficacy, catering to the health-conscious consumer. The expansion into emerging economies, particularly in Asia-Pacific and Latin America, presents significant untapped markets with increasing disposable incomes and rising awareness of personal grooming and health. Innovations in personalized scalp care, leveraging AI and diagnostic tools to recommend tailored medicated shampoo solutions, represent a futuristic frontier. Furthermore, the development of specialized medicated shampoos for specific age groups, such as pediatric or geriatric populations, offers niche market potential. The integration of advanced delivery systems for targeted action and prolonged efficacy will also drive growth.

Growth Accelerators in the Medicated Shampoos Market Industry

The long-term growth of the Medicated Shampoos Market is being accelerated by significant technological breakthroughs in biotechnology and dermatology, leading to the identification of novel active ingredients and more effective treatment methodologies. Strategic partnerships between pharmaceutical companies, dermatologists, and cosmetic brands are fostering collaborative research and development, leading to innovative product launches that address unmet needs. Market expansion strategies focused on underserved regions and demographics, coupled with robust marketing campaigns highlighting product efficacy and safety, are crucial growth catalysts. The increasing focus on preventative scalp care and the integration of medicated shampoos into holistic hair wellness routines are also contributing to sustained market expansion.

Key Players Shaping the Medicated Shampoos Market Market

- KAO Corporation

- Summer Laboratories

- Procter & Gamble

- Shiseido Company

- Hain Celestial Group Inc

- Kramer Laboratories Inc (NIZORAL)

- Johnson & Johnson

Notable Milestones in Medicated Shampoos Market Sector

- 2019: Launch of novel anti-fungal shampoo formulations with enhanced efficacy by KAO Corporation.

- 2020: Procter & Gamble expands its Head & Shoulders clinical solutions range with new prescription-strength formulations.

- 2021: Hain Celestial Group Inc. focuses on expanding its natural and organic medicated shampoo portfolio.

- 2022: Kramer Laboratories Inc. sees significant growth for Nizoral as a leading anti-dandruff solution.

- 2023: Johnson & Johnson continues to innovate in the pediatric medicated shampoo segment.

- 2024: Shiseido Company announces advancements in scalp microbiome research for new product development.

In-Depth Medicated Shampoos Market Market Outlook

The future outlook for the Medicated Shampoos Market is exceptionally promising, driven by a confluence of sustained demand for effective scalp treatment solutions and continuous innovation. Growth accelerators, including advanced R&D in dermatological science, strategic collaborations, and targeted market expansion, will continue to propel the industry forward. The increasing consumer inclination towards scientifically backed products and the growing accessibility of specialized treatments through both traditional and online channels present substantial strategic opportunities. The market is set to witness an increased focus on personalized medicine and sustainable product development, further enhancing its appeal and market penetration. The projected market size of $9,200 Million units by 2033 signifies robust growth and enduring relevance.

Medicated Shampoos Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarket/Hypermarket

- 1.2. Pharmacies

- 1.3. Online Stores

- 1.4. Other Distribution Channels

Medicated Shampoos Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Medicated Shampoos Market Regional Market Share

Geographic Coverage of Medicated Shampoos Market

Medicated Shampoos Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medicated Shampoos Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarket/Hypermarket

- 5.1.2. Pharmacies

- 5.1.3. Online Stores

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Medicated Shampoos Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarket/Hypermarket

- 6.1.2. Pharmacies

- 6.1.3. Online Stores

- 6.1.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Europe Medicated Shampoos Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarket/Hypermarket

- 7.1.2. Pharmacies

- 7.1.3. Online Stores

- 7.1.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Asia Pacific Medicated Shampoos Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarket/Hypermarket

- 8.1.2. Pharmacies

- 8.1.3. Online Stores

- 8.1.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Rest of the World Medicated Shampoos Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarket/Hypermarket

- 9.1.2. Pharmacies

- 9.1.3. Online Stores

- 9.1.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 KAO Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Summer Laboratories

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Procter & Gamble

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shiseido Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hain Celestial Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kramer Laboratories Inc (NIZORAL

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson & Johnson

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 KAO Corporation

List of Figures

- Figure 1: Global Medicated Shampoos Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Medicated Shampoos Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 3: North America Medicated Shampoos Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Medicated Shampoos Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Medicated Shampoos Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Medicated Shampoos Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: Europe Medicated Shampoos Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Europe Medicated Shampoos Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Medicated Shampoos Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Medicated Shampoos Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Asia Pacific Medicated Shampoos Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Asia Pacific Medicated Shampoos Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Medicated Shampoos Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Medicated Shampoos Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Rest of the World Medicated Shampoos Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Rest of the World Medicated Shampoos Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Medicated Shampoos Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medicated Shampoos Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Medicated Shampoos Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Medicated Shampoos Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Medicated Shampoos Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Medicated Shampoos Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Medicated Shampoos Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Germany Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Medicated Shampoos Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Medicated Shampoos Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Medicated Shampoos Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Medicated Shampoos Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: South America Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Middle East and Africa Medicated Shampoos Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medicated Shampoos Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Medicated Shampoos Market?

Key companies in the market include KAO Corporation, Summer Laboratories, Procter & Gamble, Shiseido Company, Hain Celestial Group Inc, Kramer Laboratories Inc (NIZORAL, Johnson & Johnson.

3. What are the main segments of the Medicated Shampoos Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure.

6. What are the notable trends driving market growth?

Increasing Expenditure on Hair Care Products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medicated Shampoos Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medicated Shampoos Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medicated Shampoos Market?

To stay informed about further developments, trends, and reports in the Medicated Shampoos Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence