Key Insights

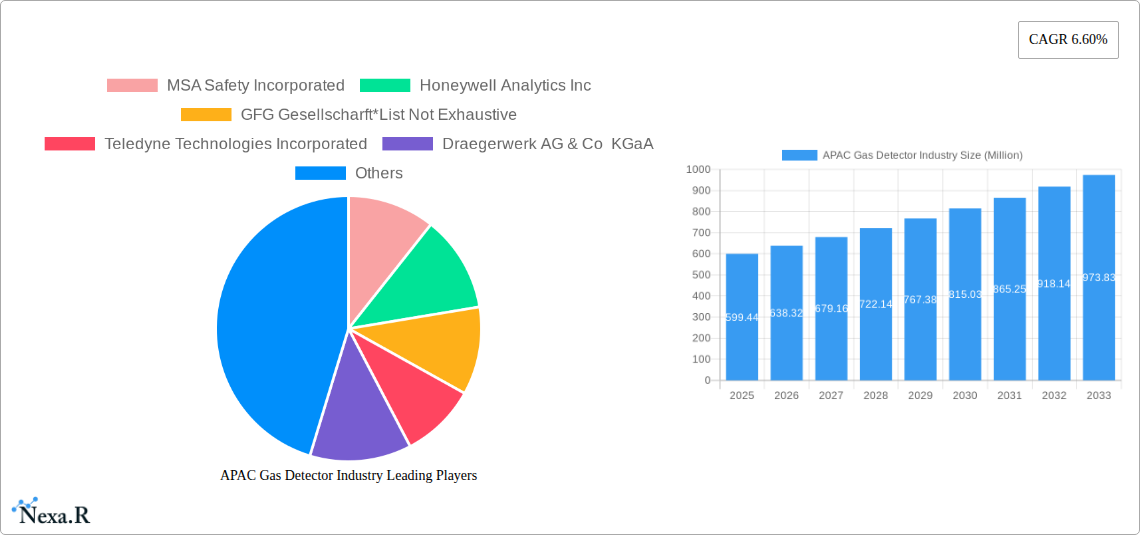

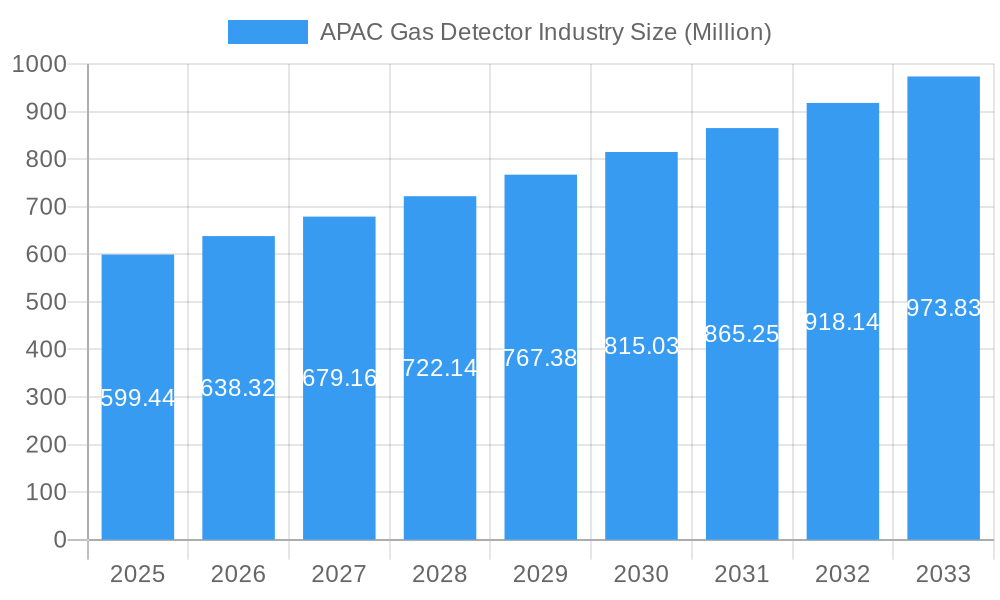

The APAC Gas Detector market is poised for substantial growth, projected to reach a market size of $599.44 million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 6.60% throughout the forecast period. This upward trajectory is fueled by increasing industrialization and stringent safety regulations across key sectors. The Oil & Gas and Chemical & Petrochemical industries remain dominant end-user segments, driven by the inherent risks associated with handling hazardous gases and the continuous need for robust monitoring solutions to ensure worker safety and environmental compliance. Furthermore, the burgeoning manufacturing sectors in countries like China and India, coupled with expanding infrastructure projects in regions such as ASEAN and Oceania, are creating a fertile ground for the adoption of both fixed and portable gas detection systems. The rising awareness regarding the health and safety implications of exposure to toxic and combustible gases is a significant catalyst, propelling demand for advanced and reliable gas detection technologies.

APAC Gas Detector Industry Market Size (In Million)

The market dynamics are further shaped by evolving technological advancements and strategic initiatives from key industry players. We anticipate a heightened demand for intelligent and connected gas detectors, incorporating features like IoT integration, remote monitoring capabilities, and advanced analytics. While the growing emphasis on safety and regulatory compliance acts as a strong driver, challenges such as the initial cost of sophisticated detection systems and the need for skilled maintenance personnel could present moderate restraints. However, the increasing cost-effectiveness of these technologies and the development of user-friendly solutions are expected to mitigate these concerns. The APAC region's diverse industrial landscape, encompassing nascent and established industries, offers a broad spectrum of opportunities for gas detector manufacturers and service providers, with a particular focus on catering to the specific needs of various end-user verticals.

APAC Gas Detector Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the APAC gas detector market, encompassing fixed and portable gas detectors, with a detailed breakdown by toxic gas detectors, combustible gas detectors, single-gas detectors, and multi-gas detectors. It examines key end-user verticals including oil and gas, chemical and petrochemical, water and wastewater, power generation, metals and mining, and food and beverage. Featuring an extensive APAC gas detector market size analysis from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033, this report provides critical insights for stakeholders.

APAC Gas Detector Industry Market Dynamics & Structure

The APAC gas detector industry is characterized by a moderately concentrated market, driven by stringent safety regulations and increasing industrialization across the region. Technological innovation, particularly in sensor accuracy and wireless connectivity, is a key differentiator. Regulatory frameworks mandating the use of gas detection systems in various hazardous environments, such as oil and gas safety equipment and chemical plant safety solutions, are significant growth catalysts. While direct product substitutes are limited for critical safety applications, advancements in overall safety management systems can influence adoption rates. End-user demographics are increasingly focused on worker safety and environmental compliance, pushing demand for advanced detection technologies. Mergers and acquisitions (M&A) activity, though not excessively high, plays a role in market consolidation and technology acquisition, with an estimated XX M&A deals observed during the historical period. Barriers to innovation include high R&D costs and the need for rigorous certification processes.

- Market Concentration: Moderately concentrated with a few key global players and a growing number of regional manufacturers.

- Technological Innovation Drivers: Advancements in electrochemical sensors, infrared technology, photoionization detectors (PIDs), and smart, connected gas detection solutions.

- Regulatory Frameworks: Strict adherence to national and international safety standards for industrial environments.

- Competitive Product Substitutes: Limited for essential safety functions, but integrated safety solutions are gaining traction.

- End-User Demographics: Growing emphasis on worker safety, environmental protection, and operational efficiency.

- M&A Trends: Strategic acquisitions to expand product portfolios and geographical reach.

APAC Gas Detector Industry Growth Trends & Insights

The APAC gas detector market is poised for substantial growth, projected to expand at a robust CAGR of XX% during the forecast period. This expansion is underpinned by increasing investments in infrastructure, industrial development, and a heightened awareness of workplace safety across burgeoning economies like China, India, and Southeast Asian nations. The adoption rates of both fixed and portable gas detectors are steadily rising, driven by evolving regulatory landscapes and the inherent risks associated with industries such as oil and gas upstream and downstream operations, petrochemical plant safety, and mining safety equipment. Technological disruptions, including the integration of IoT capabilities for real-time monitoring and data analytics, are transforming the market, enabling predictive maintenance and enhanced incident response. Consumer behavior is shifting towards proactive safety measures, favoring solutions that offer not just detection but also comprehensive data management and alert systems. The overall market size is estimated to reach approximately USD XX Million in 2025 and is projected to grow significantly by 2033.

Dominant Regions, Countries, or Segments in APAC Gas Detector Industry

Within the APAC gas detector industry, China stands out as the dominant country, fueled by its massive industrial base and aggressive pursuit of enhanced safety standards. The fixed gas detectors segment, particularly toxic gas detectors and combustible gas detectors, exhibits significant market share due to their critical role in continuous monitoring within high-risk industrial settings. The oil and gas and chemical and petrochemical end-user verticals are primary drivers of this dominance, demanding robust detection solutions for onshore and offshore operations, refineries, and chemical processing plants. Economic policies promoting industrial safety and substantial government investments in infrastructure development contribute significantly to market growth. Furthermore, the increasing adoption of advanced technologies and the presence of major manufacturing hubs in China bolster its leading position. The market share for China is estimated at XX% of the APAC market in 2025.

- Dominant Country: China, owing to its extensive industrialization and stringent safety mandates.

- Dominant Segment (Type): Fixed Gas Detectors (Toxic and Combustible Gas Detectors) due to their continuous monitoring applications.

- Dominant Segment (End-user Vertical): Oil and Gas and Chemical and Petrochemical sectors, driven by inherent hazards and regulatory requirements.

- Key Drivers:

- Government initiatives for industrial safety and accident prevention.

- Rapid infrastructure development and manufacturing growth.

- Increasing foreign investment in heavy industries.

- Technological advancements in detector reliability and connectivity.

APAC Gas Detector Industry Product Landscape

The APAC gas detector industry product landscape is characterized by continuous innovation focused on enhanced accuracy, reliability, and user-friendliness. Key product developments include the integration of advanced sensor technologies, such as photoionization detectors (PIDs) for volatile organic compounds (VOCs) and solid-state sensors for improved gas selectivity and longevity. Portable gas detectors are evolving with features like Bluetooth connectivity for data transfer, longer battery life, and compact, rugged designs suitable for harsh environments. Fixed detectors are increasingly incorporating intelligent features, including self-diagnostic capabilities, remote monitoring via cloud platforms, and integration with plant-wide safety systems. Applications range from leak detection in pipelines and process equipment to ensuring breathable air quality in confined spaces and monitoring emissions from industrial stacks. Performance metrics such as detection limits, response times, and sensor lifespan are continually being improved to meet stringent industry demands.

Key Drivers, Barriers & Challenges in APAC Gas Detector Industry

Key Drivers:

- Stringent Safety Regulations: Government mandates and international standards for industrial safety are a primary growth driver.

- Industrial Growth and Expansion: The burgeoning industrial sector across APAC necessitates robust gas detection solutions.

- Technological Advancements: Innovations in sensor technology and wireless connectivity enhance detector performance and adoption.

- Increased Awareness of Worker Safety: Companies are prioritizing the health and safety of their employees, leading to higher demand.

Barriers & Challenges:

- High Initial Investment Costs: Advanced gas detection systems can be expensive, posing a challenge for smaller enterprises.

- Skilled Workforce Shortage: A lack of trained personnel for installation, calibration, and maintenance of sophisticated equipment.

- Counterfeit Products: The presence of low-quality counterfeit detectors can compromise safety and erode market trust.

- Varying Regulatory Enforcement: Inconsistent enforcement of safety regulations across different countries within APAC can create market disparities.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of critical components.

Emerging Opportunities in the APAC Gas Detector Industry

Emerging opportunities within the APAC gas detector market lie in the growing demand for smart, connected gas detection systems. The integration of Internet of Things (IoT) technology enables real-time data monitoring, predictive analytics for equipment maintenance, and faster response to gas leak incidents. Untapped markets in developing nations within Southeast Asia and the Indian subcontinent present significant growth potential as industrialization accelerates. Furthermore, the increasing focus on environmental monitoring and compliance is creating opportunities for gas detectors capable of measuring a wider range of pollutants. The expansion of the renewable energy sector, including solar and wind farms, also presents new application areas for gas detection, particularly for safety during maintenance operations.

Growth Accelerators in the APAC Gas Detector Industry Industry

Several catalysts are accelerating the growth of the APAC gas detector industry. Technological breakthroughs in miniaturization, sensor sensitivity, and battery efficiency are making portable detectors more accessible and user-friendly. Strategic partnerships between technology providers and end-user industries are fostering the development of tailored solutions that address specific safety concerns. Market expansion strategies, including increased distribution networks and localized sales and service support, are crucial for penetrating diverse regional markets. The ongoing development of smart cities and smart industrial complexes will further drive the demand for integrated safety and monitoring systems, with gas detectors playing a pivotal role.

Key Players Shaping the APAC Gas Detector Industry Market

- MSA Safety Incorporated

- Honeywell Analytics Inc

- GFG Gesellscharft

- Teledyne Technologies Incorporated

- Draegerwerk AG & Co KGaA

- RKI Instruments Inc

- Crowncon Detection Instruments Limited

- Industrial Scientific Corporation

- Det-Tronics (a Carrier Company)

Notable Milestones in APAC Gas Detector Industry Sector

- June 2022: Industrial Scientific announced that the Radius BZ1 Area Monitor now supports hydrogen chloride (HCl), chlorine dioxide (ClO2), and infrared (IR) sensors within the removable SafeCore module, expanding its utility for fence line and perimeter monitoring, hot work, and other area monitoring applications.

- February 2022: Figaro Engineering, Japan-based Gas Sensors company, announced its new upcoming Lead-free Oxygen sensors, including Galvanic type and Potentiostatic Electrolysis type Oxygen Sensors, which are in final development.

- April 2022: Dräger released a new acoustic gas leak detector, the Dräger Polytron 8900 ultrasonic gas leak detector (UGLD) transmitter, an early warning area monitor for detecting high-pressure gas leaks in outdoor industrial process environments, responding to the sound of leaks rather than accumulated gas concentration.

In-Depth APAC Gas Detector Industry Market Outlook

The future outlook for the APAC gas detector market is exceptionally promising, driven by sustained industrial growth, unwavering commitment to safety, and rapid technological advancements. The increasing adoption of IoT-enabled smart gas detectors for predictive maintenance and real-time incident management will be a significant growth driver. Strategic initiatives focusing on expanding distribution channels into emerging economies and fostering collaborations for developing specialized detection solutions will further propel market penetration. The growing emphasis on environmental regulations and the need for precise monitoring of hazardous emissions will also create new avenues for market expansion, positioning the APAC region as a vital hub for innovation and demand in the global gas detector landscape.

APAC Gas Detector Industry Segmentation

-

1. Type

-

1.1. Fixed

- 1.1.1. Toxic Gas Detectors

- 1.1.2. Combustible Gas Detectors

-

1.2. Portable

- 1.2.1. Single-gas

- 1.2.2. Multi-gas

-

1.1. Fixed

-

2. End-user Verticals

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Water and Wastewater

- 2.4. Power Generation

- 2.5. Metals and Mining

- 2.6. Food and Beverage

- 2.7. Other En

APAC Gas Detector Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

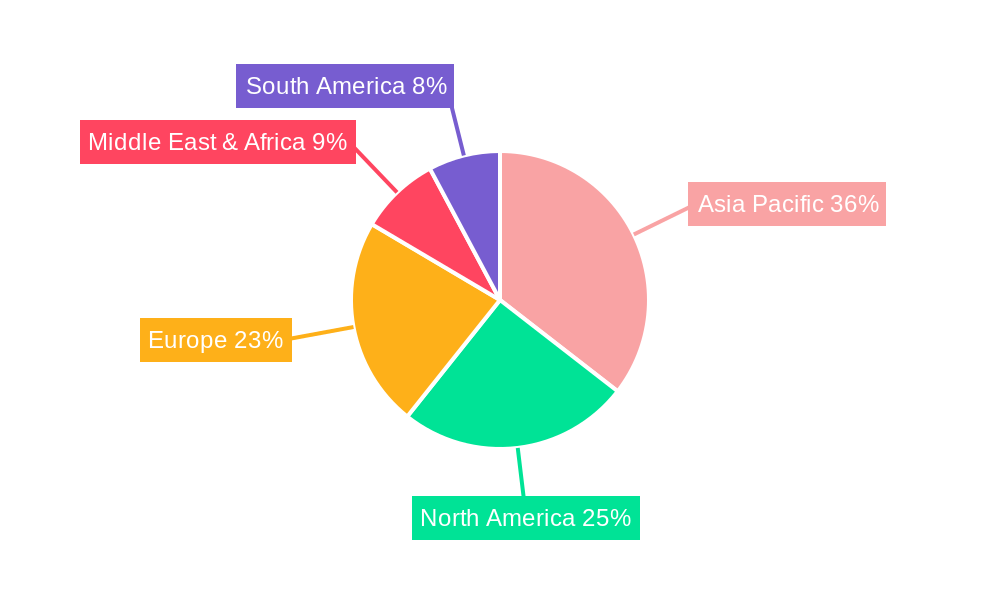

APAC Gas Detector Industry Regional Market Share

Geographic Coverage of APAC Gas Detector Industry

APAC Gas Detector Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Awareness on Worker Safety and Stringent Regulations; Steady Increase in the Industrial Sector in Key Emerging Countries in Asia-Pacific

- 3.2.2 Coupled with Expansion Projects

- 3.3. Market Restrains

- 3.3.1. Challenges Relating to Digital Transformation

- 3.4. Market Trends

- 3.4.1. Oil & Gas to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.1.1. Toxic Gas Detectors

- 5.1.1.2. Combustible Gas Detectors

- 5.1.2. Portable

- 5.1.2.1. Single-gas

- 5.1.2.2. Multi-gas

- 5.1.1. Fixed

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Water and Wastewater

- 5.2.4. Power Generation

- 5.2.5. Metals and Mining

- 5.2.6. Food and Beverage

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed

- 6.1.1.1. Toxic Gas Detectors

- 6.1.1.2. Combustible Gas Detectors

- 6.1.2. Portable

- 6.1.2.1. Single-gas

- 6.1.2.2. Multi-gas

- 6.1.1. Fixed

- 6.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.2.1. Oil and Gas

- 6.2.2. Chemical and Petrochemical

- 6.2.3. Water and Wastewater

- 6.2.4. Power Generation

- 6.2.5. Metals and Mining

- 6.2.6. Food and Beverage

- 6.2.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed

- 7.1.1.1. Toxic Gas Detectors

- 7.1.1.2. Combustible Gas Detectors

- 7.1.2. Portable

- 7.1.2.1. Single-gas

- 7.1.2.2. Multi-gas

- 7.1.1. Fixed

- 7.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.2.1. Oil and Gas

- 7.2.2. Chemical and Petrochemical

- 7.2.3. Water and Wastewater

- 7.2.4. Power Generation

- 7.2.5. Metals and Mining

- 7.2.6. Food and Beverage

- 7.2.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed

- 8.1.1.1. Toxic Gas Detectors

- 8.1.1.2. Combustible Gas Detectors

- 8.1.2. Portable

- 8.1.2.1. Single-gas

- 8.1.2.2. Multi-gas

- 8.1.1. Fixed

- 8.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.2.1. Oil and Gas

- 8.2.2. Chemical and Petrochemical

- 8.2.3. Water and Wastewater

- 8.2.4. Power Generation

- 8.2.5. Metals and Mining

- 8.2.6. Food and Beverage

- 8.2.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed

- 9.1.1.1. Toxic Gas Detectors

- 9.1.1.2. Combustible Gas Detectors

- 9.1.2. Portable

- 9.1.2.1. Single-gas

- 9.1.2.2. Multi-gas

- 9.1.1. Fixed

- 9.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.2.1. Oil and Gas

- 9.2.2. Chemical and Petrochemical

- 9.2.3. Water and Wastewater

- 9.2.4. Power Generation

- 9.2.5. Metals and Mining

- 9.2.6. Food and Beverage

- 9.2.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed

- 10.1.1.1. Toxic Gas Detectors

- 10.1.1.2. Combustible Gas Detectors

- 10.1.2. Portable

- 10.1.2.1. Single-gas

- 10.1.2.2. Multi-gas

- 10.1.1. Fixed

- 10.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.2.1. Oil and Gas

- 10.2.2. Chemical and Petrochemical

- 10.2.3. Water and Wastewater

- 10.2.4. Power Generation

- 10.2.5. Metals and Mining

- 10.2.6. Food and Beverage

- 10.2.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MSA Safety Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell Analytics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GFG Gesellscharft*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teledyne Technologies Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Draegerwerk AG & Co KGaA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RKI Instruments Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crowncon Detection Instruments Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Industrial Scientific Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Det-Tronics (a Carrier Company)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 MSA Safety Incorporated

List of Figures

- Figure 1: Global APAC Gas Detector Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 5: North America APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 6: North America APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: South America APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 11: South America APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 12: South America APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 17: Europe APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 18: Europe APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 23: Middle East & Africa APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 24: Middle East & Africa APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 29: Asia Pacific APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 30: Asia Pacific APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 3: Global APAC Gas Detector Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 12: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 18: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 30: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 39: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Gas Detector Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the APAC Gas Detector Industry?

Key companies in the market include MSA Safety Incorporated, Honeywell Analytics Inc, GFG Gesellscharft*List Not Exhaustive, Teledyne Technologies Incorporated, Draegerwerk AG & Co KGaA, RKI Instruments Inc, Crowncon Detection Instruments Limited, Industrial Scientific Corporation, Det-Tronics (a Carrier Company).

3. What are the main segments of the APAC Gas Detector Industry?

The market segments include Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 599.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness on Worker Safety and Stringent Regulations; Steady Increase in the Industrial Sector in Key Emerging Countries in Asia-Pacific. Coupled with Expansion Projects.

6. What are the notable trends driving market growth?

Oil & Gas to Register Significant Growth.

7. Are there any restraints impacting market growth?

Challenges Relating to Digital Transformation.

8. Can you provide examples of recent developments in the market?

June 2022 - Industrial Scientificannounced that the Radius BZ1 Area Monitor now supports hydrogen chloride (HCl), chlorine dioxide (ClO2), and infrared (IR) sensors within the removable SafeCore module. With these new sensor offerings, the Radius BZ1 can now be used more extensively to detect hazardous gases in the fence line and perimeter monitoring, hot work, and other area monitoring applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Gas Detector Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Gas Detector Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Gas Detector Industry?

To stay informed about further developments, trends, and reports in the APAC Gas Detector Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence