Key Insights

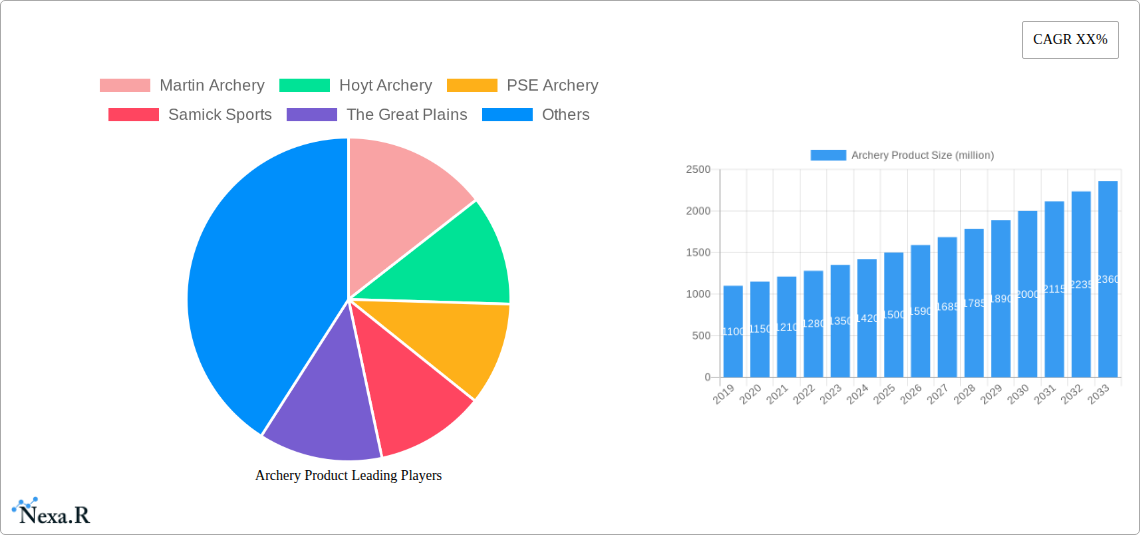

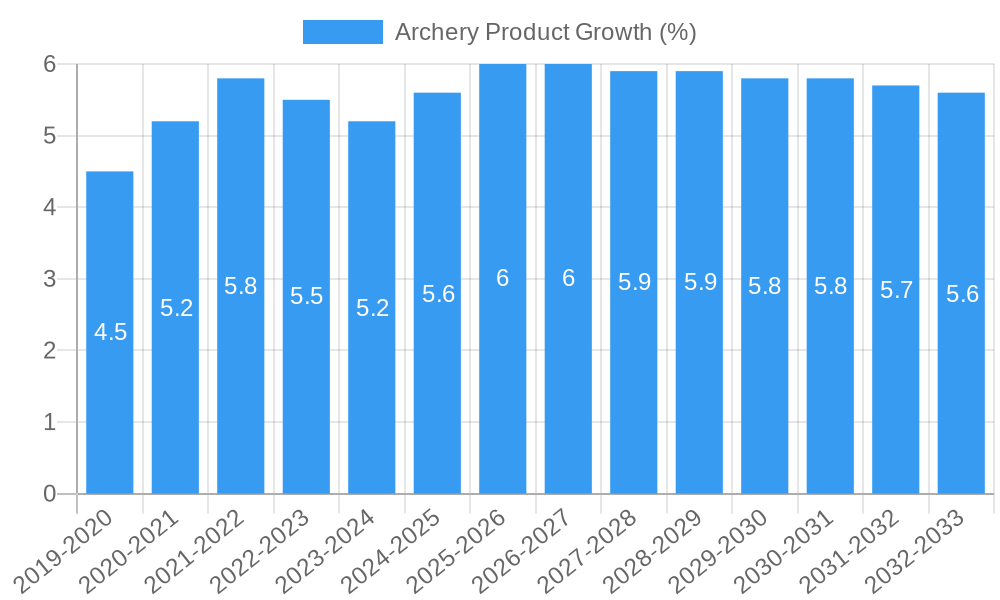

The global Archery Product market is projected to experience robust growth, reaching an estimated market size of approximately $1,500 million by 2025, and is poised for a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily driven by a growing interest in recreational archery, its increasing adoption in competitive sports, and a surge in hunting activities globally. The market encompasses a diverse range of products, including recurve bows, compound bows, longbows, arrows, and essential accessories. Compound bows, known for their precision and ease of use, are expected to dominate the market, followed by recurve bows which are gaining popularity in Olympic disciplines and traditional archery. The "Others" application segment, encompassing broader recreational and therapeutic uses, is also anticipated to contribute significantly to market development.

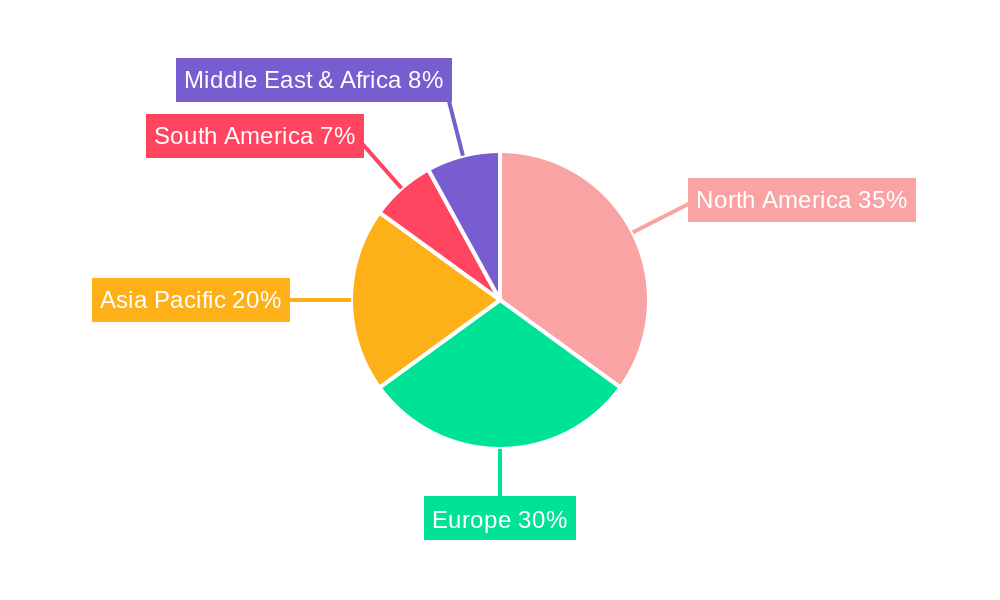

The market's upward trajectory is further supported by technological advancements in archery equipment, leading to lighter, more durable, and user-friendly designs. The rising popularity of archery-related entertainment, such as films and video games, is also indirectly fueling consumer interest. However, the market faces certain restraints, including the high initial cost of premium equipment and the need for specialized training, which can be a barrier for new entrants. Geographically, North America and Europe currently lead the market, owing to established archery cultures and higher disposable incomes. Asia Pacific, however, is emerging as a key growth region, propelled by increasing awareness, government initiatives promoting sports, and a growing middle class with an appetite for outdoor activities. Companies like Hoyt Archery, PSE Archery, and Mathews Archery are at the forefront, innovating and expanding their product portfolios to cater to this dynamic global demand.

Here is a compelling, SEO-optimized report description for the Archery Product Market, designed to maximize visibility and engage industry professionals.

Archery Product Market Dynamics & Structure

The global Archery Product market is characterized by a moderately concentrated competitive landscape, with key players like Hoyt Archery, PSE Archery, and Mathews Archery holding significant market share. Technological innovation remains a primary driver, with advancements in compound bow technology, lightweight arrow materials, and sophisticated sighting systems continuously enhancing product performance and user experience. Regulatory frameworks, particularly those related to hunting seasons and equipment standards, play a crucial role in shaping market access and product development. Competitive product substitutes, such as firearms for hunting and other recreational shooting sports, present a constant challenge, necessitating continuous innovation and emphasis on the unique benefits of archery. End-user demographics are shifting, with increasing participation from younger generations and a growing segment of female archers. Mergers and acquisitions (M&A) trends are also evident, as larger companies seek to consolidate their market position and acquire innovative technologies. For example, the global archery market size is projected to reach approximately 8,500 million units by 2025, with a significant portion of this driven by the hunting archery segment. M&A activities, though not always publicly disclosed, are indicative of the strategic moves to gain competitive advantage in the global archery equipment market.

- Market Concentration: Moderately concentrated with leading brands.

- Technological Innovation: Focus on compound bow advancements, materials science for arrows, and optics.

- Regulatory Impact: Hunting regulations and safety standards are key influencers.

- Competitive Substitutes: Firearms and other shooting sports present competition.

- End-User Demographics: Growing youth and female participation, increasing demand for recreational archery equipment.

- M&A Trends: Strategic consolidation and technology acquisition are observed.

Archery Product Growth Trends & Insights

The global Archery Product market is experiencing robust growth, propelled by a confluence of factors that are reshaping its trajectory. The compound bow market, in particular, is witnessing an upward trend, driven by its ease of use, increased accuracy, and versatility for both hunting and sport shooting. The global archery accessories market is also expanding in tandem, as archers invest in high-quality sights, stabilizers, rests, and quivers to optimize their performance. Consumer behavior is evolving, with a pronounced shift towards experiential activities and a greater appreciation for traditional sports. This has fueled demand for archery as a recreational pursuit, a competitive sport, and an ethical hunting method. The archery market forecast indicates a sustained Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, projecting the market value to ascend significantly. This growth is underpinned by increasing disposable incomes in emerging economies, leading to greater accessibility of archery hunting gear and archery shooting equipment. Furthermore, advancements in material science have led to the development of lighter, stronger, and more durable arrows and bows, enhancing user experience and broadening the appeal of archery. The archery market share is expected to see an increase in the accessories segment, as consumers seek to customize and upgrade their existing setups. The parent market of outdoor recreation and sports equipment provides a fertile ground for archery's expansion.

- Market Size Evolution: Steady growth projected, driven by compound bows and accessories.

- Adoption Rates: Increasing adoption for recreation, sport, and hunting.

- Technological Disruptions: Advancements in materials and bow technology.

- Consumer Behavior Shifts: Growing preference for experiential activities and traditional sports.

- CAGR: Estimated at 4.5% for the forecast period.

- Market Penetration: Expanding across various demographic groups.

Dominant Regions, Countries, or Segments in Archery Product

The North American region stands as the dominant force in the global Archery Product market, driven by a deeply ingrained culture of hunting and a burgeoning interest in archery as a competitive sport and recreational activity. Within this region, the United States represents a significant market share, fueled by extensive public lands open for hunting, strong advocacy groups promoting archery, and a well-established industry infrastructure. The Hunting application segment is particularly dominant, contributing approximately 55% to the overall market revenue. This is directly linked to the significant number of registered hunters and the demand for specialized archery hunting bows and archery hunting arrows. Compound bows are the leading type of archery product, accounting for over 70% of the market share, owing to their advanced features, ease of use, and effectiveness in hunting scenarios. The Archery Accessories segment also plays a pivotal role, with consumers investing heavily in high-performance sights, stabilizers, releases, and broadheads to enhance their hunting success and shooting accuracy. Economic policies supporting outdoor recreation and conservation efforts further bolster the market in North America.

In terms of growth potential, Europe is emerging as a significant contender, with countries like Germany and the United Kingdom showing increased adoption of archery for both sport and recreational purposes. The Shooting application segment, encompassing target archery and Olympic disciplines, is gaining traction globally, indicating a diversification of demand beyond traditional hunting. The child market for archery products is also witnessing expansion, with the introduction of specialized youth bows and educational programs fostering early engagement. The increasing popularity of archery-related media and sporting events is also contributing to broader market awareness and demand across all segments. The global archery equipment market is projected to reach 8,500 million units by 2025, with North America consistently holding the largest share. The parent market of sporting goods and outdoor equipment provides a broad base for archery product sales.

- Dominant Region: North America, specifically the United States.

- Key Application Segment: Hunting (approx. 55% market share).

- Dominant Product Type: Compound Bows (over 70% market share).

- Key Contributing Segment: Archery Accessories.

- Growth Potential Regions: Europe (Germany, UK).

- Emerging Application Segment: Shooting (target archery, sport shooting).

- Child Market Influence: Growing demand for youth-specific products.

Archery Product Product Landscape

The Archery Product landscape is characterized by continuous innovation in compound bow technology, focusing on lighter materials, increased speed, and enhanced adjustability. Recurve bows are seeing advancements in design for improved stability and accuracy, catering to traditional archers and Olympic disciplines. The arrow market is evolving with the introduction of new carbon composite materials, offering greater durability, consistency, and improved aerodynamic performance. Archery accessories are witnessing a surge in technological integration, with smart sights and advanced stabilization systems offering archers unparalleled customization and performance feedback. Unique selling propositions often revolve around precision engineering, ergonomic designs, and the integration of cutting-edge materials to provide archers with a competitive edge and an enhanced experience in hunting and sport shooting applications.

Key Drivers, Barriers & Challenges in Archery Product

Key Drivers: The Archery Product market is propelled by a growing interest in outdoor recreation and fitness activities, increasing participation in hunting as a sustainable food source and conservation practice, and the rising popularity of archery as a competitive sport. Technological advancements in compound bows and arrows, leading to improved performance and user experience, also serve as significant growth accelerators. Government initiatives promoting outdoor sports and the growth of the archery tourism sector further contribute to market expansion.

Key Barriers & Challenges: Supply chain disruptions and raw material price volatility can impact manufacturing costs and product availability. Stringent regulations in certain regions regarding hunting and equipment standards can pose challenges. Intense competition from established brands and the presence of substitute products like firearms necessitate continuous innovation and competitive pricing strategies. Furthermore, the perceived complexity of some archery equipment, particularly advanced compound bows, can be a barrier to entry for new consumers. The archery market share can be affected by these external factors.

Emerging Opportunities in Archery Product

Emerging opportunities lie in the development of smart archery technology that integrates digital features for performance tracking and training. The growing popularity of recreational archery ranges and indoor archery facilities presents a substantial untapped market, particularly in urban areas. There is also a burgeoning demand for sustainable and eco-friendly archery products, including biodegradable arrows and ethically sourced bow materials. Expanding the child market through educational programs and accessible starter kits offers significant long-term growth potential. Furthermore, the increasing adoption of archery for therapeutic and rehabilitative purposes opens new avenues for product development and market penetration.

Growth Accelerators in the Archery Product Industry

Long-term growth in the Archery Product industry is being significantly accelerated by technological breakthroughs in material science, leading to lighter, stronger, and more durable equipment. Strategic partnerships between archery manufacturers and outdoor lifestyle brands are expanding market reach and consumer engagement. The increasing focus on performance archery, driven by professional athletes and televised competitions, inspires greater consumer investment in high-end equipment. Furthermore, the expansion of archery into developing economies, coupled with targeted marketing campaigns aimed at diverse demographics, is unlocking new growth frontiers. The development of innovative archery accessories that enhance user experience and accuracy also acts as a significant catalyst.

Key Players Shaping the Archery Product Market

- Martin Archery

- Hoyt Archery

- PSE Archery

- Samick Sports

- The Great Plains

- Darton Archery

- Mathews Archery

- G5 Archery

- High Country Archery

- Carbon Tech

Notable Milestones in Archery Product Sector

- 2019: Launch of advanced carbon arrow technology by Carbon Tech, significantly improving arrow consistency and flight.

- 2020: Mathews Archery introduces groundbreaking compound bow models with enhanced dampening systems, reducing noise and vibration.

- 2021: PSE Archery innovates with lighter riser designs and more efficient cam systems in their compound bow offerings.

- 2022: Hoyt Archery expands its range of youth-focused bows, addressing the growing child market demand.

- 2023: Samick Sports focuses on enhancing recurve bow designs for competitive target archery, increasing their market share in this niche.

- 2024: G5 Archery releases a new line of advanced broadheads, demonstrating innovation in the archery hunting accessories segment.

In-Depth Archery Product Market Outlook

The future of the Archery Product market is exceptionally promising, driven by ongoing technological innovation, a deepening consumer connection with outdoor pursuits, and the expanding global appeal of archery. Growth accelerators such as the development of smart archery equipment, the rise of accessible indoor archery facilities, and a focus on sustainable products will continue to shape the market. Strategic market expansion into emerging economies and targeted engagement with the child market are poised to unlock significant future potential. The sustained demand for high-performance hunting archery gear and recreational archery equipment ensures a dynamic and evolving market landscape, ripe with opportunities for stakeholders.

Archery Product Segmentation

-

1. Application

- 1.1. Shooting

- 1.2. Hunting

- 1.3. Others

-

2. Types

- 2.1. Recurve

- 2.2. Compound Bows

- 2.3. Longbow

- 2.4. Arrows

- 2.5. Accessories

Archery Product Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Archery Product REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Archery Product Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Shooting

- 5.1.2. Hunting

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Recurve

- 5.2.2. Compound Bows

- 5.2.3. Longbow

- 5.2.4. Arrows

- 5.2.5. Accessories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Archery Product Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Shooting

- 6.1.2. Hunting

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Recurve

- 6.2.2. Compound Bows

- 6.2.3. Longbow

- 6.2.4. Arrows

- 6.2.5. Accessories

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Archery Product Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Shooting

- 7.1.2. Hunting

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Recurve

- 7.2.2. Compound Bows

- 7.2.3. Longbow

- 7.2.4. Arrows

- 7.2.5. Accessories

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Archery Product Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Shooting

- 8.1.2. Hunting

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Recurve

- 8.2.2. Compound Bows

- 8.2.3. Longbow

- 8.2.4. Arrows

- 8.2.5. Accessories

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Archery Product Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Shooting

- 9.1.2. Hunting

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Recurve

- 9.2.2. Compound Bows

- 9.2.3. Longbow

- 9.2.4. Arrows

- 9.2.5. Accessories

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Archery Product Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Shooting

- 10.1.2. Hunting

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Recurve

- 10.2.2. Compound Bows

- 10.2.3. Longbow

- 10.2.4. Arrows

- 10.2.5. Accessories

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Martin Archery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hoyt Archery

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PSE Archery

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samick Sports

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Great Plains

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Darton Archery

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mathews Archery

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 G5 Archery

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 High Country Archery

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Carbon Tech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Martin Archery

List of Figures

- Figure 1: Global Archery Product Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Archery Product Revenue (million), by Application 2024 & 2032

- Figure 3: North America Archery Product Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Archery Product Revenue (million), by Types 2024 & 2032

- Figure 5: North America Archery Product Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Archery Product Revenue (million), by Country 2024 & 2032

- Figure 7: North America Archery Product Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Archery Product Revenue (million), by Application 2024 & 2032

- Figure 9: South America Archery Product Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Archery Product Revenue (million), by Types 2024 & 2032

- Figure 11: South America Archery Product Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Archery Product Revenue (million), by Country 2024 & 2032

- Figure 13: South America Archery Product Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Archery Product Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Archery Product Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Archery Product Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Archery Product Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Archery Product Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Archery Product Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Archery Product Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Archery Product Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Archery Product Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Archery Product Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Archery Product Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Archery Product Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Archery Product Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Archery Product Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Archery Product Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Archery Product Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Archery Product Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Archery Product Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Archery Product Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Archery Product Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Archery Product Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Archery Product Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Archery Product Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Archery Product Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Archery Product Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Archery Product Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Archery Product Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Archery Product Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Archery Product Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Archery Product Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Archery Product Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Archery Product Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Archery Product Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Archery Product Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Archery Product Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Archery Product Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Archery Product Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Archery Product Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Archery Product Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Archery Product?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Archery Product?

Key companies in the market include Martin Archery, Hoyt Archery, PSE Archery, Samick Sports, The Great Plains, Darton Archery, Mathews Archery, G5 Archery, High Country Archery, Carbon Tech.

3. What are the main segments of the Archery Product?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Archery Product," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Archery Product report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Archery Product?

To stay informed about further developments, trends, and reports in the Archery Product, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence