Key Insights

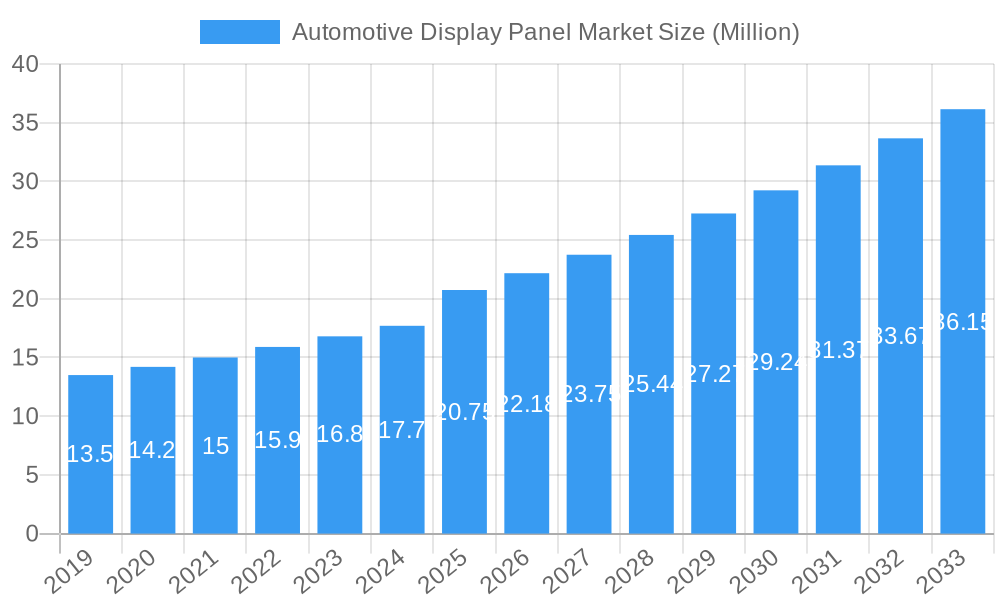

The global Automotive Display Panel market is poised for substantial growth, projected to reach $20.75 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.80% anticipated through 2033. This upward trajectory is primarily driven by the increasing integration of advanced display technologies in vehicles, enhancing both user experience and safety. The rising demand for sophisticated in-car infotainment systems, digital instrument clusters, and head-up displays (HUDs) fuels this expansion. Furthermore, stringent safety regulations and consumer expectations for premium automotive interiors are compelling manufacturers to adopt larger, higher-resolution, and more interactive displays. The market is witnessing a significant shift towards advanced display technologies like AMOLED and Oxide LCD, offering superior visual clarity, energy efficiency, and design flexibility compared to traditional a-Si LCDs. Automotive manufacturers are increasingly leveraging these technologies to create immersive and customizable digital cockpits, differentiating their offerings and meeting the evolving demands of tech-savvy consumers.

Automotive Display Panel Market Market Size (In Million)

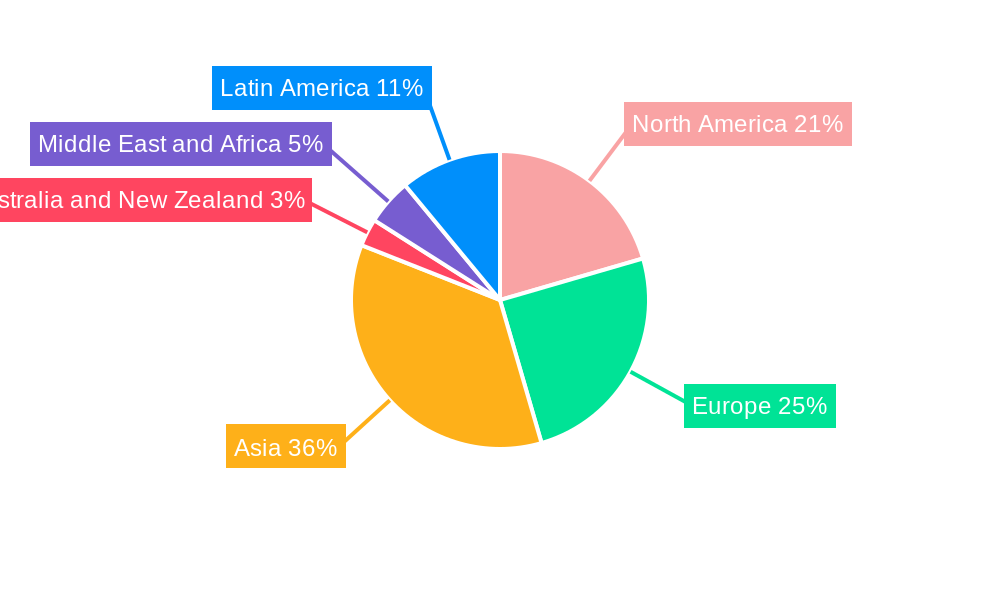

Key trends shaping the automotive display panel market include the growing adoption of curved and flexible displays, enabling more ergonomic and visually striking dashboard designs. The development of advanced driver-assistance systems (ADAS) also necessitates sophisticated display solutions for real-time information and alerts. While the market benefits from these drivers, it faces certain restraints such as the high cost of advanced display technologies and the complexity of integrating these systems seamlessly into vehicle architectures. Supply chain disruptions and the need for robust cybersecurity measures for connected vehicle displays also present challenges. Geographically, Asia is expected to dominate the market due to its strong automotive manufacturing base and burgeoning demand for technologically advanced vehicles. North America and Europe are also significant markets, driven by innovation and the adoption of premium features in their vehicle segments. The market’s robust growth is a testament to the indispensable role of advanced displays in shaping the future of automotive interiors.

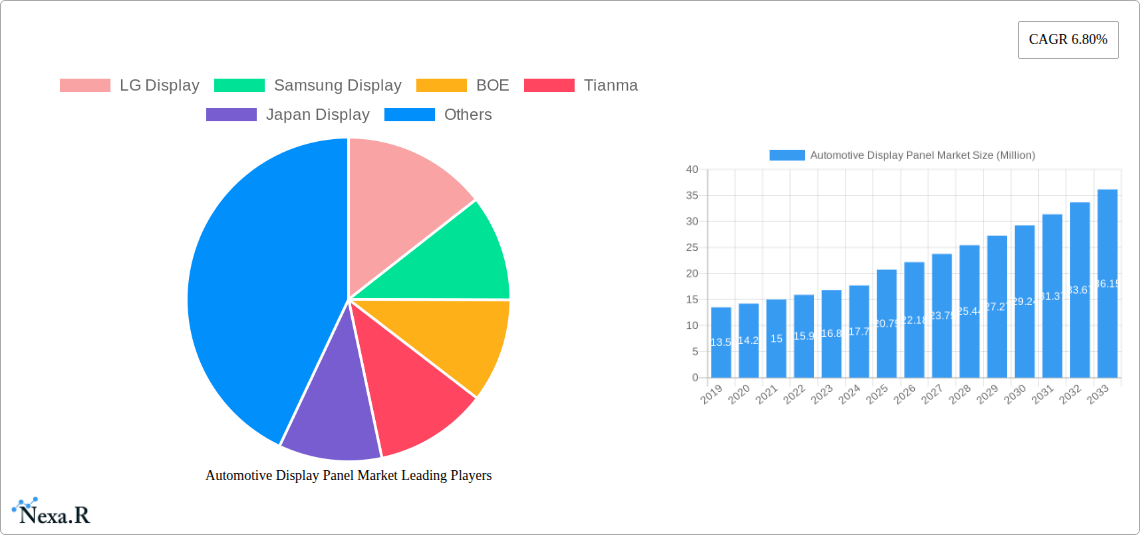

Automotive Display Panel Market Company Market Share

Automotive Display Panel Market: Comprehensive Analysis & Future Outlook (2019-2033)

This report offers an in-depth analysis of the global Automotive Display Panel Market, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, and key players. With a detailed forecast from 2025 to 2033, this study is an essential resource for stakeholders seeking to understand the evolving automotive display ecosystem. We cover parent and child market segments, integrating high-traffic keywords to maximize visibility and deliver actionable intelligence for industry professionals. All values are presented in Million Units.

Automotive Display Panel Market Market Dynamics & Structure

The Automotive Display Panel Market is characterized by intense competition and rapid technological evolution, driven by escalating demands for sophisticated in-vehicle infotainment and advanced driver-assistance systems. Market concentration is moderate, with a few dominant players like LG Display, Samsung Display, and BOE holding significant shares, alongside emerging contenders like Tianma and AUO. Technological innovation is a primary driver, with advancements in display technologies such as AMOLED and LTPS LCD enabling larger, higher-resolution, and more immersive visual experiences. Regulatory frameworks, particularly concerning automotive safety and cybersecurity, influence product development and integration. Competitive product substitutes are limited, as specialized automotive displays offer unique performance and durability features. End-user demographics are shifting, with younger generations demanding more personalized and interactive digital experiences within vehicles, pushing automakers to adopt more advanced display solutions. Mergers and acquisitions (M&A) are a notable trend, exemplified by AUO's acquisition of BHTC, aimed at strengthening upstream control and direct automaker relationships. The market is projected to see continued consolidation and strategic alliances as companies strive for competitive advantage.

- Market Concentration: Moderate, with key players like LG Display, Samsung Display, and BOE leading.

- Technological Innovation Drivers: Demand for larger screens, higher resolution, faster refresh rates, and enhanced color accuracy.

- Regulatory Frameworks: Focus on safety standards, energy efficiency, and cybersecurity for in-vehicle electronics.

- Competitive Product Substitutes: Limited, with automotive-grade displays offering superior robustness and performance.

- End-User Demographics: Increasing demand for seamless integration of digital life into vehicles, particularly from younger demographics.

- M&A Trends: Strategic acquisitions to gain market share, technological expertise, and direct access to OEMs.

Automotive Display Panel Market Growth Trends & Insights

The Automotive Display Panel Market is poised for substantial growth, fueled by the increasing integration of advanced technologies and the rising consumer preference for sophisticated in-vehicle experiences. The market size is expected to witness a significant expansion, driven by a robust CAGR of xx% during the forecast period. Adoption rates of large-format and multi-display setups are accelerating, particularly in premium and electric vehicle segments, where enhanced infotainment and digital cockpits are becoming standard features. Technological disruptions, such as the widespread adoption of AMOLED displays for their superior contrast ratios and flexibility, and the advancements in LTPS LCD technology for higher resolution and power efficiency, are reshaping the market landscape. Consumer behavior shifts are a pivotal factor; drivers and passengers now expect a digital-native experience within their vehicles, mirroring their smartphone and smart home ecosystems. This includes interactive touchscreens, augmented reality head-up displays, and personalized content delivery. The increasing complexity of vehicle architectures, with more electronic control units and data processing capabilities, necessitates advanced display solutions that can effectively communicate critical information and entertainment. The trend towards autonomous driving further amplifies the need for sophisticated displays that can present complex data in an easily digestible format, enhancing safety and user experience. The report will delve into the specific market penetration of various display technologies and applications, providing quantitative metrics to illustrate these growth trajectories.

Dominant Regions, Countries, or Segments in Automotive Display Panel Market

Asia Pacific stands out as the dominant region in the Automotive Display Panel Market, driven by its robust automotive manufacturing base, significant technological innovation, and substantial consumer demand. Within this region, China, South Korea, and Japan are key countries spearheading market growth. China's massive automotive production volume and its rapid adoption of advanced automotive technologies make it a pivotal market. South Korea, home to leading display manufacturers like LG Display and Samsung Display, benefits from strong partnerships with global automakers and continuous investment in cutting-edge display technologies. Japan contributes significantly through its established automotive industry and specialized display expertise from companies like Japan Display and Sharp Corporation.

Among the display panel technologies, AMOLED and LTPS LCD are witnessing the highest growth, capturing substantial market share. AMOLED displays are increasingly favored for their superior image quality, flexibility, and energy efficiency, making them ideal for premium infotainment systems and curved displays. LTPS LCD technology continues to be a strong contender due to its high resolution, fast response times, and cost-effectiveness, especially for instrument clusters and center stack displays.

In terms of applications, the Center Stack display segment is experiencing rapid expansion, becoming the central hub for infotainment, navigation, and vehicle controls. Instrument Clusters are also evolving from traditional analog gauges to fully digital, customizable displays, offering richer information to the driver. Heads-Up Displays (HUDs) are gaining traction, particularly augmented reality HUDs that project critical driving information directly into the driver's line of sight, enhancing safety and convenience. The continued integration of these advanced display solutions across various vehicle segments, coupled with favorable economic policies and supportive infrastructure for technology adoption, solidifies the dominance of Asia Pacific and specific high-growth segments within the Automotive Display Panel Market.

- Dominant Region: Asia Pacific

- Key Countries: China, South Korea, Japan

- Growth Drivers: Strong automotive manufacturing, technological innovation, high consumer demand, government support.

- Dominant Display Technologies:

- AMOLED: Superior image quality, flexibility, energy efficiency.

- LTPS LCD: High resolution, fast response times, cost-effectiveness.

- Dominant Applications:

- Center Stack Displays: Centralized hub for infotainment and vehicle controls.

- Instrument Clusters: Digital, customizable displays for driver information.

- Heads-Up Displays (HUDs): Enhanced safety and convenience with projected information.

Automotive Display Panel Market Product Landscape

The Automotive Display Panel Market product landscape is defined by continuous innovation aimed at enhancing user experience, safety, and vehicle aesthetics. Key product innovations include the development of larger, more integrated display units that span across the dashboard, transforming the cockpit into a digital hub. Advancements in display technologies like quantum dot enhancement film (QDEF) integrated into LCDs and the widespread adoption of AMOLED are delivering richer colors, deeper blacks, and improved brightness. Flexible and curved displays are enabling novel design possibilities for automakers, allowing for more ergonomic and visually appealing dashboard layouts. Performance metrics are increasingly focused on high definition (HD) and ultra-high definition (UHD) resolutions, wider viewing angles, and faster response times to support real-time information delivery and interactive features. The integration of advanced features such as local dimming for enhanced contrast in OLED displays and touch-sensitive surfaces with haptic feedback are also key differentiators.

Key Drivers, Barriers & Challenges in Automotive Display Panel Market

Key Drivers:

- Increasing Demand for In-Vehicle Infotainment (IVI) and Connectivity: Consumers expect seamless integration of digital services, leading automakers to equip vehicles with advanced displays.

- Rise of Electric and Autonomous Vehicles: These segments often feature more sophisticated digital cockpits and require advanced displays for critical information and enhanced user experience.

- Technological Advancements in Display Technology: Innovations like AMOLED, LTPS LCD, and advanced backlighting are enabling larger, higher-resolution, and more energy-efficient displays.

- Growing Emphasis on Vehicle Personalization: Customizable digital displays allow for tailored user experiences, a key differentiator for automotive brands.

Barriers & Challenges:

- High Development and Manufacturing Costs: Advanced display technologies are capital-intensive to develop and produce, impacting overall vehicle costs.

- Stringent Automotive-Grade Requirements: Displays must meet rigorous standards for durability, temperature resistance, vibration tolerance, and longevity, increasing complexity and cost.

- Supply Chain Disruptions and Component Shortages: The global electronics supply chain is vulnerable, leading to potential delays and price volatility for critical display components.

- Intense Competition and Price Pressures: The market is highly competitive, with significant pressure from both established players and new entrants, driving down margins.

Emerging Opportunities in Automotive Display Panel Market

Emerging opportunities in the Automotive Display Panel Market lie in the continued expansion of personalized digital cockpits, the integration of augmented reality (AR) for navigation and safety, and the development of sustainable and energy-efficient display solutions. The growing adoption of advanced driver-assistance systems (ADAS) and the eventual shift towards fully autonomous vehicles will necessitate more sophisticated and informative displays, including large-format panoramic screens and specialized driver monitoring systems. Untapped markets include the increasing demand for advanced display solutions in commercial vehicles and specialized transport. Evolving consumer preferences for ambient lighting integration and interactive passenger displays also present new avenues for product development.

Growth Accelerators in the Automotive Display Panel Market Industry

Long-term growth in the Automotive Display Panel Market will be accelerated by breakthroughs in micro-LED display technology, offering superior brightness, contrast, and lifespan. Strategic partnerships between display manufacturers and automotive OEMs are crucial for co-development and faster integration of new technologies. The increasing focus on in-car user experience as a key purchasing factor will drive further investment in immersive and intuitive display solutions. Market expansion strategies, particularly in emerging economies with rapidly growing automotive sectors, will also contribute significantly to overall market growth.

Key Players Shaping the Automotive Display Panel Market Market

- LG Display

- Samsung Display

- BOE

- Tianma

- Japan Display

- Innolux Corporation

- AUO

- Sharp Corporation

- Century

- Continental

- Nippon Seiki

- Denso

- Visteon

- Marelli

- Bosch

- Yazaki

- Faurecia

- Desay SV

- Foryou General Electronic

Notable Milestones in Automotive Display Panel Market Sector

- November 2023: Hyundai Mobis Co. developed an innovative premium display for vehicles, featuring quantum dot and local dimming technology. This high-definition, slim design display targets luxury vehicles and addresses the increasing demand for advanced in-vehicle infotainment and entertainment systems.

- October 2023: AUO announced its strategic move to work directly with automakers towards upstream production. This initiative aims to better grasp development trends for in-vehicle displays and enhance competitiveness against rivals. The company also finalized the acquisition of a 100% stake in German auto parts manufacturer BHTC, a supplier to Audi and other automakers.

In-Depth Automotive Display Panel Market Market Outlook

The future of the Automotive Display Panel Market is exceptionally promising, fueled by relentless technological innovation and evolving consumer expectations. Growth accelerators such as the integration of advanced AI-powered features, the increasing prevalence of multi-screen configurations, and the development of more sustainable display materials will shape the market's trajectory. Strategic alliances and R&D investments in next-generation display technologies like flexible OLEDs and transparent displays will unlock new application possibilities. The market is set to witness a significant upswing in demand for displays that offer enhanced safety functionalities, such as integrated AR capabilities and advanced driver monitoring systems, further solidifying its position as a critical component in the future of mobility.

Automotive Display Panel Market Segmentation

-

1. Display Panel

-

1.1. By Technology

- 1.1.1. a-Si LCD

- 1.1.2. Oxide LCD

- 1.1.3. LTPS LCD

- 1.1.4. AMOLED

-

1.1. By Technology

-

2. Display Console/Cluster

-

2.1. By Application

- 2.1.1. Instrument Cluster

- 2.1.2. Center Stack

- 2.1.3. Heads-up Display

- 2.1.4. Other Applications

-

2.1. By Application

Automotive Display Panel Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Automotive Display Panel Market Regional Market Share

Geographic Coverage of Automotive Display Panel Market

Automotive Display Panel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Connected Cars; Stringent Government Regulations to Reduce Car Accidents; Increasing Focus to Provide AR Experience

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Connected Cars; Stringent Government Regulations to Reduce Car Accidents; Increasing Focus to Provide AR Experience

- 3.4. Market Trends

- 3.4.1. The Heads-up Display Segment is Anticipated to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Display Panel

- 5.1.1. By Technology

- 5.1.1.1. a-Si LCD

- 5.1.1.2. Oxide LCD

- 5.1.1.3. LTPS LCD

- 5.1.1.4. AMOLED

- 5.1.1. By Technology

- 5.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 5.2.1. By Application

- 5.2.1.1. Instrument Cluster

- 5.2.1.2. Center Stack

- 5.2.1.3. Heads-up Display

- 5.2.1.4. Other Applications

- 5.2.1. By Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Middle East and Africa

- 5.3.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Display Panel

- 6. North America Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Display Panel

- 6.1.1. By Technology

- 6.1.1.1. a-Si LCD

- 6.1.1.2. Oxide LCD

- 6.1.1.3. LTPS LCD

- 6.1.1.4. AMOLED

- 6.1.1. By Technology

- 6.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 6.2.1. By Application

- 6.2.1.1. Instrument Cluster

- 6.2.1.2. Center Stack

- 6.2.1.3. Heads-up Display

- 6.2.1.4. Other Applications

- 6.2.1. By Application

- 6.1. Market Analysis, Insights and Forecast - by Display Panel

- 7. Europe Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Display Panel

- 7.1.1. By Technology

- 7.1.1.1. a-Si LCD

- 7.1.1.2. Oxide LCD

- 7.1.1.3. LTPS LCD

- 7.1.1.4. AMOLED

- 7.1.1. By Technology

- 7.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 7.2.1. By Application

- 7.2.1.1. Instrument Cluster

- 7.2.1.2. Center Stack

- 7.2.1.3. Heads-up Display

- 7.2.1.4. Other Applications

- 7.2.1. By Application

- 7.1. Market Analysis, Insights and Forecast - by Display Panel

- 8. Asia Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Display Panel

- 8.1.1. By Technology

- 8.1.1.1. a-Si LCD

- 8.1.1.2. Oxide LCD

- 8.1.1.3. LTPS LCD

- 8.1.1.4. AMOLED

- 8.1.1. By Technology

- 8.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 8.2.1. By Application

- 8.2.1.1. Instrument Cluster

- 8.2.1.2. Center Stack

- 8.2.1.3. Heads-up Display

- 8.2.1.4. Other Applications

- 8.2.1. By Application

- 8.1. Market Analysis, Insights and Forecast - by Display Panel

- 9. Australia and New Zealand Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Display Panel

- 9.1.1. By Technology

- 9.1.1.1. a-Si LCD

- 9.1.1.2. Oxide LCD

- 9.1.1.3. LTPS LCD

- 9.1.1.4. AMOLED

- 9.1.1. By Technology

- 9.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 9.2.1. By Application

- 9.2.1.1. Instrument Cluster

- 9.2.1.2. Center Stack

- 9.2.1.3. Heads-up Display

- 9.2.1.4. Other Applications

- 9.2.1. By Application

- 9.1. Market Analysis, Insights and Forecast - by Display Panel

- 10. Middle East and Africa Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Display Panel

- 10.1.1. By Technology

- 10.1.1.1. a-Si LCD

- 10.1.1.2. Oxide LCD

- 10.1.1.3. LTPS LCD

- 10.1.1.4. AMOLED

- 10.1.1. By Technology

- 10.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 10.2.1. By Application

- 10.2.1.1. Instrument Cluster

- 10.2.1.2. Center Stack

- 10.2.1.3. Heads-up Display

- 10.2.1.4. Other Applications

- 10.2.1. By Application

- 10.1. Market Analysis, Insights and Forecast - by Display Panel

- 11. Latin America Automotive Display Panel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Display Panel

- 11.1.1. By Technology

- 11.1.1.1. a-Si LCD

- 11.1.1.2. Oxide LCD

- 11.1.1.3. LTPS LCD

- 11.1.1.4. AMOLED

- 11.1.1. By Technology

- 11.2. Market Analysis, Insights and Forecast - by Display Console/Cluster

- 11.2.1. By Application

- 11.2.1.1. Instrument Cluster

- 11.2.1.2. Center Stack

- 11.2.1.3. Heads-up Display

- 11.2.1.4. Other Applications

- 11.2.1. By Application

- 11.1. Market Analysis, Insights and Forecast - by Display Panel

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 LG Display

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Samsung Display

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BOE

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tianma

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Japan Display

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Innolux Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 AUO

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sharp Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Century

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Continental

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nippon Seiki

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Denso

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Visteon

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Marelli

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Bosch

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Yazaki

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Faurecia

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Desay SV

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Foryou General Electronic

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.1 LG Display

List of Figures

- Figure 1: Global Automotive Display Panel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Automotive Display Panel Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Automotive Display Panel Market Revenue (Million), by Display Panel 2025 & 2033

- Figure 4: North America Automotive Display Panel Market Volume (Billion), by Display Panel 2025 & 2033

- Figure 5: North America Automotive Display Panel Market Revenue Share (%), by Display Panel 2025 & 2033

- Figure 6: North America Automotive Display Panel Market Volume Share (%), by Display Panel 2025 & 2033

- Figure 7: North America Automotive Display Panel Market Revenue (Million), by Display Console/Cluster 2025 & 2033

- Figure 8: North America Automotive Display Panel Market Volume (Billion), by Display Console/Cluster 2025 & 2033

- Figure 9: North America Automotive Display Panel Market Revenue Share (%), by Display Console/Cluster 2025 & 2033

- Figure 10: North America Automotive Display Panel Market Volume Share (%), by Display Console/Cluster 2025 & 2033

- Figure 11: North America Automotive Display Panel Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Automotive Display Panel Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Automotive Display Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Automotive Display Panel Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Automotive Display Panel Market Revenue (Million), by Display Panel 2025 & 2033

- Figure 16: Europe Automotive Display Panel Market Volume (Billion), by Display Panel 2025 & 2033

- Figure 17: Europe Automotive Display Panel Market Revenue Share (%), by Display Panel 2025 & 2033

- Figure 18: Europe Automotive Display Panel Market Volume Share (%), by Display Panel 2025 & 2033

- Figure 19: Europe Automotive Display Panel Market Revenue (Million), by Display Console/Cluster 2025 & 2033

- Figure 20: Europe Automotive Display Panel Market Volume (Billion), by Display Console/Cluster 2025 & 2033

- Figure 21: Europe Automotive Display Panel Market Revenue Share (%), by Display Console/Cluster 2025 & 2033

- Figure 22: Europe Automotive Display Panel Market Volume Share (%), by Display Console/Cluster 2025 & 2033

- Figure 23: Europe Automotive Display Panel Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Automotive Display Panel Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Automotive Display Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Automotive Display Panel Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Automotive Display Panel Market Revenue (Million), by Display Panel 2025 & 2033

- Figure 28: Asia Automotive Display Panel Market Volume (Billion), by Display Panel 2025 & 2033

- Figure 29: Asia Automotive Display Panel Market Revenue Share (%), by Display Panel 2025 & 2033

- Figure 30: Asia Automotive Display Panel Market Volume Share (%), by Display Panel 2025 & 2033

- Figure 31: Asia Automotive Display Panel Market Revenue (Million), by Display Console/Cluster 2025 & 2033

- Figure 32: Asia Automotive Display Panel Market Volume (Billion), by Display Console/Cluster 2025 & 2033

- Figure 33: Asia Automotive Display Panel Market Revenue Share (%), by Display Console/Cluster 2025 & 2033

- Figure 34: Asia Automotive Display Panel Market Volume Share (%), by Display Console/Cluster 2025 & 2033

- Figure 35: Asia Automotive Display Panel Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Automotive Display Panel Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Automotive Display Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Automotive Display Panel Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Automotive Display Panel Market Revenue (Million), by Display Panel 2025 & 2033

- Figure 40: Australia and New Zealand Automotive Display Panel Market Volume (Billion), by Display Panel 2025 & 2033

- Figure 41: Australia and New Zealand Automotive Display Panel Market Revenue Share (%), by Display Panel 2025 & 2033

- Figure 42: Australia and New Zealand Automotive Display Panel Market Volume Share (%), by Display Panel 2025 & 2033

- Figure 43: Australia and New Zealand Automotive Display Panel Market Revenue (Million), by Display Console/Cluster 2025 & 2033

- Figure 44: Australia and New Zealand Automotive Display Panel Market Volume (Billion), by Display Console/Cluster 2025 & 2033

- Figure 45: Australia and New Zealand Automotive Display Panel Market Revenue Share (%), by Display Console/Cluster 2025 & 2033

- Figure 46: Australia and New Zealand Automotive Display Panel Market Volume Share (%), by Display Console/Cluster 2025 & 2033

- Figure 47: Australia and New Zealand Automotive Display Panel Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Automotive Display Panel Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Automotive Display Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Automotive Display Panel Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Automotive Display Panel Market Revenue (Million), by Display Panel 2025 & 2033

- Figure 52: Middle East and Africa Automotive Display Panel Market Volume (Billion), by Display Panel 2025 & 2033

- Figure 53: Middle East and Africa Automotive Display Panel Market Revenue Share (%), by Display Panel 2025 & 2033

- Figure 54: Middle East and Africa Automotive Display Panel Market Volume Share (%), by Display Panel 2025 & 2033

- Figure 55: Middle East and Africa Automotive Display Panel Market Revenue (Million), by Display Console/Cluster 2025 & 2033

- Figure 56: Middle East and Africa Automotive Display Panel Market Volume (Billion), by Display Console/Cluster 2025 & 2033

- Figure 57: Middle East and Africa Automotive Display Panel Market Revenue Share (%), by Display Console/Cluster 2025 & 2033

- Figure 58: Middle East and Africa Automotive Display Panel Market Volume Share (%), by Display Console/Cluster 2025 & 2033

- Figure 59: Middle East and Africa Automotive Display Panel Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Automotive Display Panel Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Automotive Display Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Automotive Display Panel Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Latin America Automotive Display Panel Market Revenue (Million), by Display Panel 2025 & 2033

- Figure 64: Latin America Automotive Display Panel Market Volume (Billion), by Display Panel 2025 & 2033

- Figure 65: Latin America Automotive Display Panel Market Revenue Share (%), by Display Panel 2025 & 2033

- Figure 66: Latin America Automotive Display Panel Market Volume Share (%), by Display Panel 2025 & 2033

- Figure 67: Latin America Automotive Display Panel Market Revenue (Million), by Display Console/Cluster 2025 & 2033

- Figure 68: Latin America Automotive Display Panel Market Volume (Billion), by Display Console/Cluster 2025 & 2033

- Figure 69: Latin America Automotive Display Panel Market Revenue Share (%), by Display Console/Cluster 2025 & 2033

- Figure 70: Latin America Automotive Display Panel Market Volume Share (%), by Display Console/Cluster 2025 & 2033

- Figure 71: Latin America Automotive Display Panel Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Latin America Automotive Display Panel Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Latin America Automotive Display Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Latin America Automotive Display Panel Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 2: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 3: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 4: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 5: Global Automotive Display Panel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Display Panel Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 8: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 9: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 10: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 11: Global Automotive Display Panel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Automotive Display Panel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 14: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 15: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 16: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 17: Global Automotive Display Panel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Automotive Display Panel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 20: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 21: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 22: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 23: Global Automotive Display Panel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Automotive Display Panel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 26: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 27: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 28: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 29: Global Automotive Display Panel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Automotive Display Panel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 32: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 33: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 34: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 35: Global Automotive Display Panel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Automotive Display Panel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Automotive Display Panel Market Revenue Million Forecast, by Display Panel 2020 & 2033

- Table 38: Global Automotive Display Panel Market Volume Billion Forecast, by Display Panel 2020 & 2033

- Table 39: Global Automotive Display Panel Market Revenue Million Forecast, by Display Console/Cluster 2020 & 2033

- Table 40: Global Automotive Display Panel Market Volume Billion Forecast, by Display Console/Cluster 2020 & 2033

- Table 41: Global Automotive Display Panel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Automotive Display Panel Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Display Panel Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Automotive Display Panel Market?

Key companies in the market include LG Display, Samsung Display, BOE, Tianma, Japan Display, Innolux Corporation, AUO, Sharp Corporation, Century, Continental, Nippon Seiki, Denso, Visteon, Marelli, Bosch, Yazaki, Faurecia, Desay SV, Foryou General Electronic.

3. What are the main segments of the Automotive Display Panel Market?

The market segments include Display Panel, Display Console/Cluster.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Connected Cars; Stringent Government Regulations to Reduce Car Accidents; Increasing Focus to Provide AR Experience.

6. What are the notable trends driving market growth?

The Heads-up Display Segment is Anticipated to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Demand for Connected Cars; Stringent Government Regulations to Reduce Car Accidents; Increasing Focus to Provide AR Experience.

8. Can you provide examples of recent developments in the market?

November 2023: Hyundai Mobis Co. developed an innovative premium display for vehicles as automakers increasingly demand high-end products for in-vehicle infotainment and entertainment systems. The quantum dot and local dimming display are characterized by the large size of the screen, high definition, and slim design, using a fusion of innovative technologies targeting luxury vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Display Panel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Display Panel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Display Panel Market?

To stay informed about further developments, trends, and reports in the Automotive Display Panel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence