Key Insights

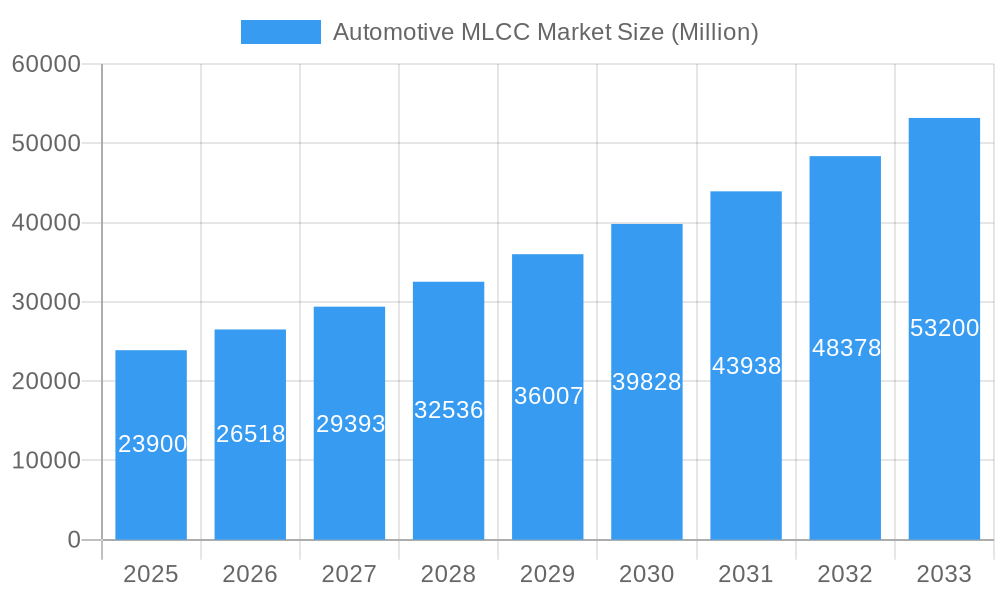

The Automotive MLCC Market is poised for significant expansion, with an estimated market size of $23.9 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 10.9% through 2033. This impressive growth trajectory is fueled by several key drivers, primarily the accelerating adoption of Electric Vehicles (EVs) and the increasing integration of advanced electronic systems in all vehicle types. The relentless demand for sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and sophisticated powertrain controls necessitates a substantial increase in the quantity and quality of MLCCs required per vehicle. Furthermore, the transition towards higher voltage architectures in EVs, to enhance range and charging efficiency, is a major catalyst, driving demand for MLCCs with higher voltage and capacitance ratings.

Automotive MLCC Market Market Size (In Billion)

The market's expansion is also underpinned by critical trends such as the miniaturization of electronic components, allowing for more integrated and space-efficient designs in increasingly complex automotive electronics. Innovations in dielectric materials and manufacturing processes are enabling MLCCs to meet stricter automotive requirements for reliability, temperature resistance, and performance under harsh operating conditions. While the market is experiencing strong tailwinds, certain restraints, such as supply chain volatility and the rising cost of raw materials, could present challenges. However, the overall outlook remains highly positive, driven by the fundamental technological advancements and regulatory pushes towards safer and more sustainable mobility solutions, making Automotive MLCCs an indispensable component for the future of the automotive industry.

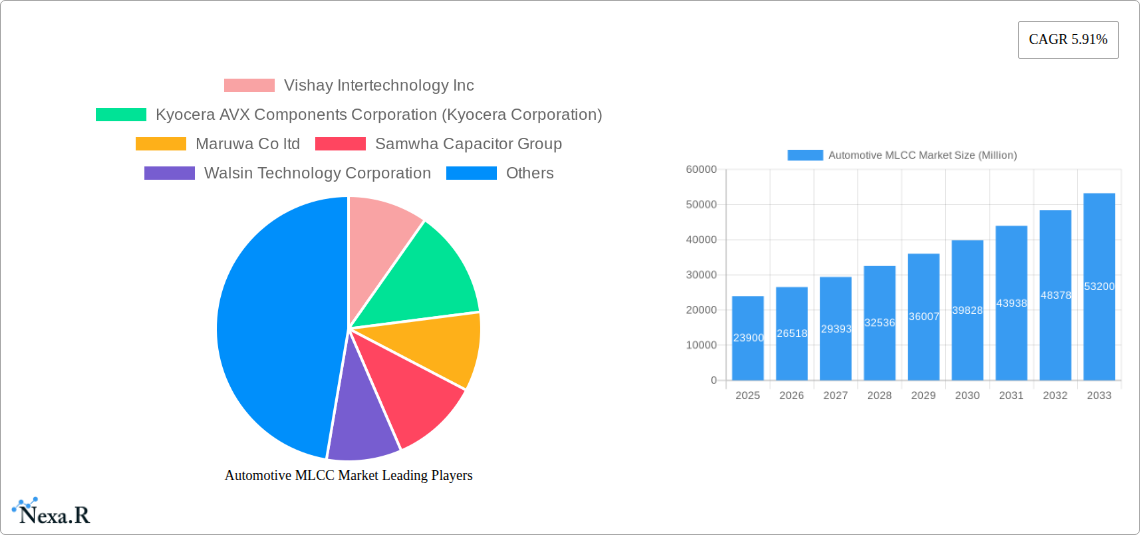

Automotive MLCC Market Company Market Share

Automotive MLCC Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Automotive MLCC (Multi-Layer Ceramic Capacitor) market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and future outlook. The report meticulously examines the market's evolution from 2019 to 2033, with a base year of 2025, and includes forecasts for the period 2025-2033. We leverage extensive data and analysis to deliver actionable intelligence for industry professionals, manufacturers, suppliers, and investors navigating the rapidly evolving automotive electronics sector.

The report dissects the market across various segments, including Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Vehicle, Two-Wheeler), Fuel Type (Electric Vehicle, Non-Electric Vehicle), Propulsion Type (BEV - Battery Electric Vehicle, FCEV - Fuel Cell Electric Vehicle, HEV - Hybrid Electric Vehicle, ICEV - Internal Combustion Engine Vehicle, PHEV - Plug-in Hybrid Electric Vehicle, Others), Component Type (ADAS, Infotainment, Powertrain, Safety System, Others), Case Size (0603, 0805, 1206, 1210, 1812, Others), Voltage (50V to 200V, Less than 50V, More than 200V), Capacitance (10 µF to 1000 µF, Less than 10 µF, More than 1000µF), and Dielectric Type (Class 1, Class 2). All values are presented in billion units.

Keywords: Automotive MLCC Market, MLCC for Electric Vehicles, MLCC for ADAS, Automotive Capacitors, Ceramic Capacitors Automotive, EV Powertrain MLCC, Safety System MLCC, Infotainment MLCC, High Voltage MLCC Automotive, Low Voltage MLCC Automotive, BEV MLCC, HEV MLCC, PHEV MLCC, ICEV MLCC, Automotive Electronics Market, Capacitor Market Growth, Vehicle Type MLCC, Component Type MLCC, Case Size MLCC, Dielectric Type MLCC, Market Dynamics Automotive MLCC, Growth Trends Automotive MLCC, Regional Analysis Automotive MLCC, Product Innovation Automotive MLCC, Key Players Automotive MLCC, Future Outlook Automotive MLCC.

Automotive MLCC Market Market Dynamics & Structure

The automotive MLCC market is characterized by a moderate to high concentration, with a few dominant players like Murata Manufacturing Co Ltd, TDK Corporation, and Taiyo Yuden Co Ltd holding significant market share. This concentration is driven by the substantial capital investment required for advanced manufacturing processes, stringent quality control, and R&D for cutting-edge automotive-grade components. Technological innovation is a primary driver, fueled by the relentless pursuit of miniaturization, higher performance, increased reliability, and enhanced thermal management for increasingly complex automotive electronic systems. Regulatory frameworks, particularly those focusing on vehicle safety and emissions, are indirectly shaping demand by mandating advanced electronic functionalities. Competitive product substitutes are limited for high-performance MLCCs in critical automotive applications due to their established reliability and miniaturization advantages. End-user demographics are shifting significantly, with a growing demand for EVs and ADAS features driving the need for specialized MLCCs. Mergers and acquisitions (M&A) trends are present, though less frequent, as larger players aim to consolidate their market position and expand their product portfolios.

- Market Concentration: Dominated by a few key players, necessitating strategic partnerships and competitive pricing.

- Technological Innovation Drivers: Miniaturization, higher voltage/capacitance ratings, improved thermal performance, and AEC-Q200 qualification.

- Regulatory Frameworks: Indirectly driving demand through mandates for safety, emissions control, and electrification.

- Competitive Product Substitutes: Limited for high-performance, reliability-critical automotive applications.

- End-User Demographics: Growing demand for EVs, ADAS, and connected car technologies.

- M&A Trends: Strategic acquisitions to enhance product offerings and market reach.

Automotive MLCC Market Growth Trends & Insights

The automotive MLCC market is experiencing robust growth, projected to reach significant market size in billion units by 2033. This expansion is propelled by the escalating adoption of electric and hybrid vehicles, which inherently require a higher number and more specialized MLCCs for their complex powertrains, battery management systems, and charging infrastructure. The proliferation of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies is another major catalyst, demanding sophisticated MLCCs for sensors, processors, and communication modules. Consumer behavior is shifting towards vehicles with enhanced safety features, personalized infotainment, and superior connectivity, all of which rely heavily on advanced electronic components like MLCCs.

Technological disruptions, such as the development of high-voltage MLCCs capable of handling the demands of 800V powertrains, are opening up new market segments. The continuous miniaturization trend allows for more functionality within the same or smaller vehicle footprints, driving the adoption of smaller case-size MLCCs. Market penetration of MLCCs in emerging automotive applications like advanced driver-assistance systems and in-car entertainment systems is steadily increasing. The compound annual growth rate (CAGR) of the automotive MLCC market is expected to remain strong throughout the forecast period, reflecting the industry's ongoing transition towards electrified and technologically advanced mobility solutions. Insights into consumer preferences for sustainable and technologically advanced vehicles directly correlate with the demand for these critical electronic components.

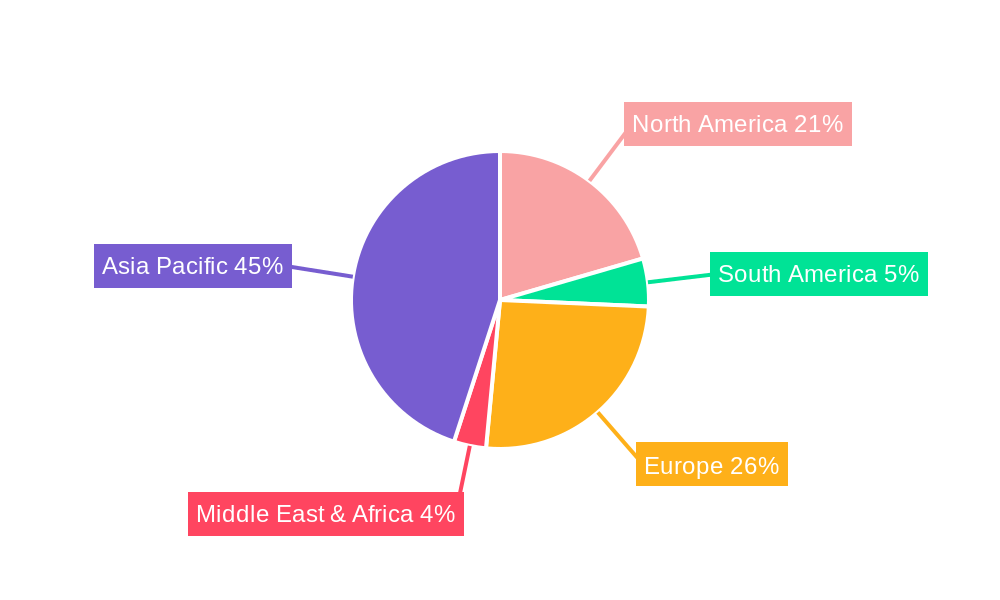

Dominant Regions, Countries, or Segments in Automotive MLCC Market

The Asia-Pacific region stands as the dominant force in the global automotive MLCC market, driven by its colossal automotive manufacturing base, particularly in countries like China, Japan, South Korea, and increasingly, India. The region benefits from a robust ecosystem of component manufacturers, significant investments in EV technology, and favorable government policies supporting automotive electrification. Within this region, China is a key growth engine, owing to its leading position in EV production and consumption, and its extensive network of domestic MLCC suppliers catering to both local and global automotive OEMs.

Several segments are crucial to this dominance:

Electric Vehicles (EVs) and Plug-in Hybrid Electric Vehicles (PHEVs): These fuel types are paramount, as they necessitate a substantially higher quantity and more sophisticated MLCCs for their intricate power electronics, battery management systems (BMS), and on-board chargers (OBCs). The rapid growth in EV sales globally, with a significant concentration in Asia, directly fuels demand.

Powertrain and ADAS Component Types: MLCCs used in powertrains for voltage regulation, filtering, and energy storage, along with those integrated into ADAS for sensors, radar, lidar, and control units, represent high-growth application areas. The increasing sophistication of ADAS features in passenger vehicles is a significant driver.

Higher Voltage Ratings (More than 200V): The migration towards higher voltage architectures in EVs, especially with the advent of 800V systems, is driving demand for MLCCs capable of handling these increased voltages, such as those from Murata's EVA series.

Class 2 Dielectric Type: These capacitors, particularly X7R and X5R dielectrics, are widely adopted due to their balance of capacitance density, cost-effectiveness, and acceptable temperature stability for a broad range of automotive applications.

Key Drivers in Asia-Pacific:

- High EV Production and Adoption Rates: China, South Korea, and Japan are global leaders.

- Strong Automotive Manufacturing Hubs: Presence of major global and local automotive OEMs.

- Government Support for EVs and Technology: Incentives and policies promoting electric mobility.

- Advanced Component Manufacturing Capabilities: Robust domestic supply chains for electronic components.

Growth Potential: Continued expansion of EV infrastructure and the increasing integration of advanced driver-assistance systems in vehicles manufactured in the region.

Automotive MLCC Market Product Landscape

The automotive MLCC market is witnessing continuous product innovation focused on meeting the evolving demands of modern vehicles. Manufacturers are developing ultra-compact MLCCs with higher capacitance and voltage ratings to support miniaturization trends and the increasing power requirements of electrified powertrains and advanced driver-assistance systems. Innovations include high-voltage MLCCs designed for 800V architectures and beyond, offering enhanced isolation and reliability for applications like On-Board Chargers (OBCs) and Inverters. Furthermore, advancements in dielectric materials and manufacturing processes are leading to improved performance under harsh automotive conditions, including wider operating temperature ranges and greater resistance to vibration and mechanical stress. The focus is on delivering components that are not only smaller and more powerful but also exceptionally reliable, contributing to the overall safety and functionality of automotive electronic systems.

Key Drivers, Barriers & Challenges in Automotive MLCC Market

Key Drivers:

- Electrification of Vehicles: The exponential growth of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is the primary driver, demanding a significantly higher number of MLCCs for battery management systems, powertrains, and charging circuits.

- Advancements in ADAS and Autonomous Driving: The increasing integration of sophisticated sensors, processors, and communication modules for ADAS and autonomous driving functionalities directly boosts demand for high-performance MLCCs.

- Miniaturization and Increased Functionality: The automotive industry's push for smaller, lighter, and more feature-rich vehicles necessitates the use of compact, high-performance MLCCs.

- Stringent Automotive Standards: The need for reliable and safe electronic components meeting strict automotive qualifications (e.g., AEC-Q200) drives innovation and demand for specialized MLCCs.

Barriers & Challenges:

- Supply Chain Volatility and Raw Material Costs: Fluctuations in the availability and pricing of key raw materials like ceramic powders and precious metals can impact production costs and lead times.

- Intense Competition and Pricing Pressure: The market is competitive, with established players and emerging manufacturers, leading to pricing pressures, especially for standard components.

- Technological Obsolescence: Rapid advancements in automotive technology can render older component designs obsolete, requiring continuous R&D investment.

- Stringent Quality Control and Reliability Requirements: Meeting the extremely high reliability and quality standards of the automotive industry requires significant investment in testing and validation.

- Geopolitical Instability and Trade Wars: Global supply chain disruptions, trade tensions, and regional conflicts can impact manufacturing and distribution networks.

Emerging Opportunities in Automotive MLCC Market

Emerging opportunities in the automotive MLCC market are closely tied to the rapid evolution of vehicle technology and consumer demands. The widespread adoption of higher voltage architectures (e.g., 800V and above) in EVs presents a significant opportunity for manufacturers of high-voltage MLCCs capable of providing enhanced isolation and reliability in demanding powertrain applications. The growing demand for advanced infotainment systems and in-cabin connectivity solutions also opens doors for specialized MLCCs with improved signal integrity and thermal performance. Furthermore, the increasing focus on vehicle-to-everything (V2X) communication technologies and the development of advanced sensors for next-generation ADAS systems will create new avenues for MLCC integration. The expansion of charging infrastructure for EVs and the development of wireless charging technologies also represent burgeoning markets for automotive-grade MLCCs.

Growth Accelerators in the Automotive MLCC Market Industry

Several key catalysts are accelerating the long-term growth of the automotive MLCC market. The global push towards decarbonization and emissions reduction targets is undeniably the most significant accelerator, driving the mass adoption of EVs and HEVs. Continuous technological breakthroughs in battery technology and EV powertrain efficiency necessitate more sophisticated and higher-performing MLCCs. Strategic partnerships between MLCC manufacturers and automotive OEMs are crucial for co-development and ensuring component compatibility with new vehicle platforms. Furthermore, market expansion strategies by leading players into emerging automotive markets and the development of next-generation MLCCs with enhanced functionalities (e.g., higher capacitance density, improved self-healing capabilities) are propelling sustained growth. The increasing integration of AI and machine learning in vehicle systems also drives demand for robust MLCCs in the associated electronic control units.

Key Players Shaping the Automotive MLCC Market Market

- Murata Manufacturing Co Ltd

- TDK Corporation

- Taiyo Yuden Co Ltd

- Samsung Electro-Mechanics

- Kyocera AVX Components Corporation (Kyocera Corporation)

- Vishay Intertechnology Inc

- Yageo Corporation

- Walsin Technology Corporation

- Würth Elektronik GmbH & Co KG

- Maruwa Co Ltd

- Samwha Capacitor Group

- Nippon Chemi-Con Corporation

Notable Milestones in Automotive MLCC Market Sector

- July 2023: KEMET, part of Yageo Corporation, developed the X7R automotive grade MLCC X7R. This MLCC is designed to meet high voltage requirements, ranging from 100pF-0.1uF with a DC voltage range of 500V-1kV, available in EIA 0603-1210 case sizes. Suitable for under-hood and in-cabin applications, these highlight the essential role of reliable capacitors in automotive safety and mission-critical systems.

- June 2023: Driven by demand for industrial equipment, a company introduced the NTS/NTF Series of SMD type MLCCs. Rated with 25 to 500 Vdc and a capacitance ranging from 0.010 to 47µF, these are utilized in on-board power supplies, voltage regulators, and DC-DC converter smoothing circuits.

- May 2023: Murata introduced its EVA series MLCCs, ideal for On-Board Chargers (OBC), Inverters, Battery Management Systems (BMS), and Wireless Power Transfer (WPT). These MLCCs support the 800V powertrain migration for increased isolation while meeting miniaturization needs.

In-Depth Automotive MLCC Market Market Outlook

The Automotive MLCC market is poised for significant expansion, driven by the unstoppable wave of vehicle electrification and the relentless advancement of automotive technologies. Future growth accelerators include the development of higher-density MLCCs that enable further miniaturization and integration of electronic systems, crucial for next-generation vehicles. Strategic collaborations between MLCC manufacturers and automotive OEMs will be pivotal in ensuring the seamless integration of these components into evolving vehicle architectures. Furthermore, the increasing demand for advanced driver-assistance systems, connected car features, and the development of autonomous driving capabilities will create sustained demand for high-performance and reliable MLCCs. The global shift towards sustainable mobility solutions, coupled with ongoing innovation in battery technology and charging infrastructure, solidifies the positive long-term outlook for the automotive MLCC market, presenting lucrative opportunities for stakeholders across the value chain.

Automotive MLCC Market Segmentation

-

1. Vehicle Type

- 1.1. Heavy Commercial Vehicle

- 1.2. Light Commercial Vehicle

- 1.3. Passenger Vehicle

- 1.4. Two-Wheeler

-

2. Fuel Type

- 2.1. Electric Vehicle

- 2.2. Non-Electric Vehicle

-

3. Propulsion Type

- 3.1. BEV - Battery Electric Vehicle

- 3.2. FCEV - Fuel Cell Electric Vehicle

- 3.3. HEV - Hybrid Electric Vehicle

- 3.4. ICEV - Internal Combustion Engine Vehicle

- 3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 3.6. Others

-

4. Component Type

- 4.1. ADAS

- 4.2. Infotainment

- 4.3. Powertrain

- 4.4. Safety System

- 4.5. Others

-

5. Case Size

- 5.1. 0 603

- 5.2. 0 805

- 5.3. 1 206

- 5.4. 1 210

- 5.5. 1 812

- 5.6. Others

-

6. Voltage

- 6.1. 50V to 200V

- 6.2. Less than 50V

- 6.3. More than 200V

-

7. Capacitance

- 7.1. 10 µF to 1000 µF

- 7.2. Less than 10 µF

- 7.3. More than 1000µF

-

8. Dielectric Type

- 8.1. Class 1

- 8.2. Class 2

Automotive MLCC Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive MLCC Market Regional Market Share

Geographic Coverage of Automotive MLCC Market

Automotive MLCC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology

- 3.3. Market Restrains

- 3.3.1. Rise of Alternative Technologies Such as Thermal Evaporation

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive MLCC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Heavy Commercial Vehicle

- 5.1.2. Light Commercial Vehicle

- 5.1.3. Passenger Vehicle

- 5.1.4. Two-Wheeler

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Electric Vehicle

- 5.2.2. Non-Electric Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.3.1. BEV - Battery Electric Vehicle

- 5.3.2. FCEV - Fuel Cell Electric Vehicle

- 5.3.3. HEV - Hybrid Electric Vehicle

- 5.3.4. ICEV - Internal Combustion Engine Vehicle

- 5.3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Component Type

- 5.4.1. ADAS

- 5.4.2. Infotainment

- 5.4.3. Powertrain

- 5.4.4. Safety System

- 5.4.5. Others

- 5.5. Market Analysis, Insights and Forecast - by Case Size

- 5.5.1. 0 603

- 5.5.2. 0 805

- 5.5.3. 1 206

- 5.5.4. 1 210

- 5.5.5. 1 812

- 5.5.6. Others

- 5.6. Market Analysis, Insights and Forecast - by Voltage

- 5.6.1. 50V to 200V

- 5.6.2. Less than 50V

- 5.6.3. More than 200V

- 5.7. Market Analysis, Insights and Forecast - by Capacitance

- 5.7.1. 10 µF to 1000 µF

- 5.7.2. Less than 10 µF

- 5.7.3. More than 1000µF

- 5.8. Market Analysis, Insights and Forecast - by Dielectric Type

- 5.8.1. Class 1

- 5.8.2. Class 2

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. North America

- 5.9.2. South America

- 5.9.3. Europe

- 5.9.4. Middle East & Africa

- 5.9.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive MLCC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Heavy Commercial Vehicle

- 6.1.2. Light Commercial Vehicle

- 6.1.3. Passenger Vehicle

- 6.1.4. Two-Wheeler

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Electric Vehicle

- 6.2.2. Non-Electric Vehicle

- 6.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.3.1. BEV - Battery Electric Vehicle

- 6.3.2. FCEV - Fuel Cell Electric Vehicle

- 6.3.3. HEV - Hybrid Electric Vehicle

- 6.3.4. ICEV - Internal Combustion Engine Vehicle

- 6.3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 6.3.6. Others

- 6.4. Market Analysis, Insights and Forecast - by Component Type

- 6.4.1. ADAS

- 6.4.2. Infotainment

- 6.4.3. Powertrain

- 6.4.4. Safety System

- 6.4.5. Others

- 6.5. Market Analysis, Insights and Forecast - by Case Size

- 6.5.1. 0 603

- 6.5.2. 0 805

- 6.5.3. 1 206

- 6.5.4. 1 210

- 6.5.5. 1 812

- 6.5.6. Others

- 6.6. Market Analysis, Insights and Forecast - by Voltage

- 6.6.1. 50V to 200V

- 6.6.2. Less than 50V

- 6.6.3. More than 200V

- 6.7. Market Analysis, Insights and Forecast - by Capacitance

- 6.7.1. 10 µF to 1000 µF

- 6.7.2. Less than 10 µF

- 6.7.3. More than 1000µF

- 6.8. Market Analysis, Insights and Forecast - by Dielectric Type

- 6.8.1. Class 1

- 6.8.2. Class 2

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Automotive MLCC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Heavy Commercial Vehicle

- 7.1.2. Light Commercial Vehicle

- 7.1.3. Passenger Vehicle

- 7.1.4. Two-Wheeler

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Electric Vehicle

- 7.2.2. Non-Electric Vehicle

- 7.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.3.1. BEV - Battery Electric Vehicle

- 7.3.2. FCEV - Fuel Cell Electric Vehicle

- 7.3.3. HEV - Hybrid Electric Vehicle

- 7.3.4. ICEV - Internal Combustion Engine Vehicle

- 7.3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 7.3.6. Others

- 7.4. Market Analysis, Insights and Forecast - by Component Type

- 7.4.1. ADAS

- 7.4.2. Infotainment

- 7.4.3. Powertrain

- 7.4.4. Safety System

- 7.4.5. Others

- 7.5. Market Analysis, Insights and Forecast - by Case Size

- 7.5.1. 0 603

- 7.5.2. 0 805

- 7.5.3. 1 206

- 7.5.4. 1 210

- 7.5.5. 1 812

- 7.5.6. Others

- 7.6. Market Analysis, Insights and Forecast - by Voltage

- 7.6.1. 50V to 200V

- 7.6.2. Less than 50V

- 7.6.3. More than 200V

- 7.7. Market Analysis, Insights and Forecast - by Capacitance

- 7.7.1. 10 µF to 1000 µF

- 7.7.2. Less than 10 µF

- 7.7.3. More than 1000µF

- 7.8. Market Analysis, Insights and Forecast - by Dielectric Type

- 7.8.1. Class 1

- 7.8.2. Class 2

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Automotive MLCC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Heavy Commercial Vehicle

- 8.1.2. Light Commercial Vehicle

- 8.1.3. Passenger Vehicle

- 8.1.4. Two-Wheeler

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Electric Vehicle

- 8.2.2. Non-Electric Vehicle

- 8.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.3.1. BEV - Battery Electric Vehicle

- 8.3.2. FCEV - Fuel Cell Electric Vehicle

- 8.3.3. HEV - Hybrid Electric Vehicle

- 8.3.4. ICEV - Internal Combustion Engine Vehicle

- 8.3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 8.3.6. Others

- 8.4. Market Analysis, Insights and Forecast - by Component Type

- 8.4.1. ADAS

- 8.4.2. Infotainment

- 8.4.3. Powertrain

- 8.4.4. Safety System

- 8.4.5. Others

- 8.5. Market Analysis, Insights and Forecast - by Case Size

- 8.5.1. 0 603

- 8.5.2. 0 805

- 8.5.3. 1 206

- 8.5.4. 1 210

- 8.5.5. 1 812

- 8.5.6. Others

- 8.6. Market Analysis, Insights and Forecast - by Voltage

- 8.6.1. 50V to 200V

- 8.6.2. Less than 50V

- 8.6.3. More than 200V

- 8.7. Market Analysis, Insights and Forecast - by Capacitance

- 8.7.1. 10 µF to 1000 µF

- 8.7.2. Less than 10 µF

- 8.7.3. More than 1000µF

- 8.8. Market Analysis, Insights and Forecast - by Dielectric Type

- 8.8.1. Class 1

- 8.8.2. Class 2

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Automotive MLCC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Heavy Commercial Vehicle

- 9.1.2. Light Commercial Vehicle

- 9.1.3. Passenger Vehicle

- 9.1.4. Two-Wheeler

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Electric Vehicle

- 9.2.2. Non-Electric Vehicle

- 9.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.3.1. BEV - Battery Electric Vehicle

- 9.3.2. FCEV - Fuel Cell Electric Vehicle

- 9.3.3. HEV - Hybrid Electric Vehicle

- 9.3.4. ICEV - Internal Combustion Engine Vehicle

- 9.3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 9.3.6. Others

- 9.4. Market Analysis, Insights and Forecast - by Component Type

- 9.4.1. ADAS

- 9.4.2. Infotainment

- 9.4.3. Powertrain

- 9.4.4. Safety System

- 9.4.5. Others

- 9.5. Market Analysis, Insights and Forecast - by Case Size

- 9.5.1. 0 603

- 9.5.2. 0 805

- 9.5.3. 1 206

- 9.5.4. 1 210

- 9.5.5. 1 812

- 9.5.6. Others

- 9.6. Market Analysis, Insights and Forecast - by Voltage

- 9.6.1. 50V to 200V

- 9.6.2. Less than 50V

- 9.6.3. More than 200V

- 9.7. Market Analysis, Insights and Forecast - by Capacitance

- 9.7.1. 10 µF to 1000 µF

- 9.7.2. Less than 10 µF

- 9.7.3. More than 1000µF

- 9.8. Market Analysis, Insights and Forecast - by Dielectric Type

- 9.8.1. Class 1

- 9.8.2. Class 2

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Automotive MLCC Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Heavy Commercial Vehicle

- 10.1.2. Light Commercial Vehicle

- 10.1.3. Passenger Vehicle

- 10.1.4. Two-Wheeler

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Electric Vehicle

- 10.2.2. Non-Electric Vehicle

- 10.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.3.1. BEV - Battery Electric Vehicle

- 10.3.2. FCEV - Fuel Cell Electric Vehicle

- 10.3.3. HEV - Hybrid Electric Vehicle

- 10.3.4. ICEV - Internal Combustion Engine Vehicle

- 10.3.5. PHEV - Plug-in Hybrid Electric Vehicle

- 10.3.6. Others

- 10.4. Market Analysis, Insights and Forecast - by Component Type

- 10.4.1. ADAS

- 10.4.2. Infotainment

- 10.4.3. Powertrain

- 10.4.4. Safety System

- 10.4.5. Others

- 10.5. Market Analysis, Insights and Forecast - by Case Size

- 10.5.1. 0 603

- 10.5.2. 0 805

- 10.5.3. 1 206

- 10.5.4. 1 210

- 10.5.5. 1 812

- 10.5.6. Others

- 10.6. Market Analysis, Insights and Forecast - by Voltage

- 10.6.1. 50V to 200V

- 10.6.2. Less than 50V

- 10.6.3. More than 200V

- 10.7. Market Analysis, Insights and Forecast - by Capacitance

- 10.7.1. 10 µF to 1000 µF

- 10.7.2. Less than 10 µF

- 10.7.3. More than 1000µF

- 10.8. Market Analysis, Insights and Forecast - by Dielectric Type

- 10.8.1. Class 1

- 10.8.2. Class 2

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vishay Intertechnology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kyocera AVX Components Corporation (Kyocera Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Maruwa Co ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samwha Capacitor Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Walsin Technology Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Samsung Electro-Mechanics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Würth Elektronik GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yageo Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taiyo Yuden Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TDK Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Murata Manufacturing Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nippon Chemi-Con Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Automotive MLCC Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive MLCC Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive MLCC Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive MLCC Market Revenue (undefined), by Fuel Type 2025 & 2033

- Figure 5: North America Automotive MLCC Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: North America Automotive MLCC Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 7: North America Automotive MLCC Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 8: North America Automotive MLCC Market Revenue (undefined), by Component Type 2025 & 2033

- Figure 9: North America Automotive MLCC Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: North America Automotive MLCC Market Revenue (undefined), by Case Size 2025 & 2033

- Figure 11: North America Automotive MLCC Market Revenue Share (%), by Case Size 2025 & 2033

- Figure 12: North America Automotive MLCC Market Revenue (undefined), by Voltage 2025 & 2033

- Figure 13: North America Automotive MLCC Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 14: North America Automotive MLCC Market Revenue (undefined), by Capacitance 2025 & 2033

- Figure 15: North America Automotive MLCC Market Revenue Share (%), by Capacitance 2025 & 2033

- Figure 16: North America Automotive MLCC Market Revenue (undefined), by Dielectric Type 2025 & 2033

- Figure 17: North America Automotive MLCC Market Revenue Share (%), by Dielectric Type 2025 & 2033

- Figure 18: North America Automotive MLCC Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: North America Automotive MLCC Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Automotive MLCC Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: South America Automotive MLCC Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: South America Automotive MLCC Market Revenue (undefined), by Fuel Type 2025 & 2033

- Figure 23: South America Automotive MLCC Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 24: South America Automotive MLCC Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 25: South America Automotive MLCC Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 26: South America Automotive MLCC Market Revenue (undefined), by Component Type 2025 & 2033

- Figure 27: South America Automotive MLCC Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 28: South America Automotive MLCC Market Revenue (undefined), by Case Size 2025 & 2033

- Figure 29: South America Automotive MLCC Market Revenue Share (%), by Case Size 2025 & 2033

- Figure 30: South America Automotive MLCC Market Revenue (undefined), by Voltage 2025 & 2033

- Figure 31: South America Automotive MLCC Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 32: South America Automotive MLCC Market Revenue (undefined), by Capacitance 2025 & 2033

- Figure 33: South America Automotive MLCC Market Revenue Share (%), by Capacitance 2025 & 2033

- Figure 34: South America Automotive MLCC Market Revenue (undefined), by Dielectric Type 2025 & 2033

- Figure 35: South America Automotive MLCC Market Revenue Share (%), by Dielectric Type 2025 & 2033

- Figure 36: South America Automotive MLCC Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: South America Automotive MLCC Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Automotive MLCC Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 39: Europe Automotive MLCC Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Europe Automotive MLCC Market Revenue (undefined), by Fuel Type 2025 & 2033

- Figure 41: Europe Automotive MLCC Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 42: Europe Automotive MLCC Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 43: Europe Automotive MLCC Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 44: Europe Automotive MLCC Market Revenue (undefined), by Component Type 2025 & 2033

- Figure 45: Europe Automotive MLCC Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 46: Europe Automotive MLCC Market Revenue (undefined), by Case Size 2025 & 2033

- Figure 47: Europe Automotive MLCC Market Revenue Share (%), by Case Size 2025 & 2033

- Figure 48: Europe Automotive MLCC Market Revenue (undefined), by Voltage 2025 & 2033

- Figure 49: Europe Automotive MLCC Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 50: Europe Automotive MLCC Market Revenue (undefined), by Capacitance 2025 & 2033

- Figure 51: Europe Automotive MLCC Market Revenue Share (%), by Capacitance 2025 & 2033

- Figure 52: Europe Automotive MLCC Market Revenue (undefined), by Dielectric Type 2025 & 2033

- Figure 53: Europe Automotive MLCC Market Revenue Share (%), by Dielectric Type 2025 & 2033

- Figure 54: Europe Automotive MLCC Market Revenue (undefined), by Country 2025 & 2033

- Figure 55: Europe Automotive MLCC Market Revenue Share (%), by Country 2025 & 2033

- Figure 56: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 57: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 58: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Fuel Type 2025 & 2033

- Figure 59: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 60: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 61: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 62: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Component Type 2025 & 2033

- Figure 63: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 64: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Case Size 2025 & 2033

- Figure 65: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Case Size 2025 & 2033

- Figure 66: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Voltage 2025 & 2033

- Figure 67: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 68: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Capacitance 2025 & 2033

- Figure 69: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Capacitance 2025 & 2033

- Figure 70: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Dielectric Type 2025 & 2033

- Figure 71: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Dielectric Type 2025 & 2033

- Figure 72: Middle East & Africa Automotive MLCC Market Revenue (undefined), by Country 2025 & 2033

- Figure 73: Middle East & Africa Automotive MLCC Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Asia Pacific Automotive MLCC Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 75: Asia Pacific Automotive MLCC Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 76: Asia Pacific Automotive MLCC Market Revenue (undefined), by Fuel Type 2025 & 2033

- Figure 77: Asia Pacific Automotive MLCC Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 78: Asia Pacific Automotive MLCC Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 79: Asia Pacific Automotive MLCC Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 80: Asia Pacific Automotive MLCC Market Revenue (undefined), by Component Type 2025 & 2033

- Figure 81: Asia Pacific Automotive MLCC Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 82: Asia Pacific Automotive MLCC Market Revenue (undefined), by Case Size 2025 & 2033

- Figure 83: Asia Pacific Automotive MLCC Market Revenue Share (%), by Case Size 2025 & 2033

- Figure 84: Asia Pacific Automotive MLCC Market Revenue (undefined), by Voltage 2025 & 2033

- Figure 85: Asia Pacific Automotive MLCC Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 86: Asia Pacific Automotive MLCC Market Revenue (undefined), by Capacitance 2025 & 2033

- Figure 87: Asia Pacific Automotive MLCC Market Revenue Share (%), by Capacitance 2025 & 2033

- Figure 88: Asia Pacific Automotive MLCC Market Revenue (undefined), by Dielectric Type 2025 & 2033

- Figure 89: Asia Pacific Automotive MLCC Market Revenue Share (%), by Dielectric Type 2025 & 2033

- Figure 90: Asia Pacific Automotive MLCC Market Revenue (undefined), by Country 2025 & 2033

- Figure 91: Asia Pacific Automotive MLCC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive MLCC Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive MLCC Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 3: Global Automotive MLCC Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 4: Global Automotive MLCC Market Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 5: Global Automotive MLCC Market Revenue undefined Forecast, by Case Size 2020 & 2033

- Table 6: Global Automotive MLCC Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 7: Global Automotive MLCC Market Revenue undefined Forecast, by Capacitance 2020 & 2033

- Table 8: Global Automotive MLCC Market Revenue undefined Forecast, by Dielectric Type 2020 & 2033

- Table 9: Global Automotive MLCC Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Global Automotive MLCC Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive MLCC Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 12: Global Automotive MLCC Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 13: Global Automotive MLCC Market Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 14: Global Automotive MLCC Market Revenue undefined Forecast, by Case Size 2020 & 2033

- Table 15: Global Automotive MLCC Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 16: Global Automotive MLCC Market Revenue undefined Forecast, by Capacitance 2020 & 2033

- Table 17: Global Automotive MLCC Market Revenue undefined Forecast, by Dielectric Type 2020 & 2033

- Table 18: Global Automotive MLCC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United States Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Mexico Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive MLCC Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Automotive MLCC Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 24: Global Automotive MLCC Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 25: Global Automotive MLCC Market Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 26: Global Automotive MLCC Market Revenue undefined Forecast, by Case Size 2020 & 2033

- Table 27: Global Automotive MLCC Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 28: Global Automotive MLCC Market Revenue undefined Forecast, by Capacitance 2020 & 2033

- Table 29: Global Automotive MLCC Market Revenue undefined Forecast, by Dielectric Type 2020 & 2033

- Table 30: Global Automotive MLCC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Brazil Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Argentina Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Automotive MLCC Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 35: Global Automotive MLCC Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 36: Global Automotive MLCC Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 37: Global Automotive MLCC Market Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 38: Global Automotive MLCC Market Revenue undefined Forecast, by Case Size 2020 & 2033

- Table 39: Global Automotive MLCC Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 40: Global Automotive MLCC Market Revenue undefined Forecast, by Capacitance 2020 & 2033

- Table 41: Global Automotive MLCC Market Revenue undefined Forecast, by Dielectric Type 2020 & 2033

- Table 42: Global Automotive MLCC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: United Kingdom Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Germany Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: France Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Italy Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Spain Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Benelux Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Nordics Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Automotive MLCC Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 53: Global Automotive MLCC Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 54: Global Automotive MLCC Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 55: Global Automotive MLCC Market Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 56: Global Automotive MLCC Market Revenue undefined Forecast, by Case Size 2020 & 2033

- Table 57: Global Automotive MLCC Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 58: Global Automotive MLCC Market Revenue undefined Forecast, by Capacitance 2020 & 2033

- Table 59: Global Automotive MLCC Market Revenue undefined Forecast, by Dielectric Type 2020 & 2033

- Table 60: Global Automotive MLCC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 61: Turkey Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Israel Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: GCC Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: North Africa Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 65: South Africa Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East & Africa Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 67: Global Automotive MLCC Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 68: Global Automotive MLCC Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 69: Global Automotive MLCC Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 70: Global Automotive MLCC Market Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 71: Global Automotive MLCC Market Revenue undefined Forecast, by Case Size 2020 & 2033

- Table 72: Global Automotive MLCC Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 73: Global Automotive MLCC Market Revenue undefined Forecast, by Capacitance 2020 & 2033

- Table 74: Global Automotive MLCC Market Revenue undefined Forecast, by Dielectric Type 2020 & 2033

- Table 75: Global Automotive MLCC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 76: China Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 77: India Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Japan Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 79: South Korea Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: ASEAN Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 81: Oceania Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: Rest of Asia Pacific Automotive MLCC Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive MLCC Market?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the Automotive MLCC Market?

Key companies in the market include Vishay Intertechnology Inc, Kyocera AVX Components Corporation (Kyocera Corporation), Maruwa Co ltd, Samwha Capacitor Group, Walsin Technology Corporation, Samsung Electro-Mechanics, Würth Elektronik GmbH & Co KG, Yageo Corporatio, Taiyo Yuden Co Ltd, TDK Corporation, Murata Manufacturing Co Ltd, Nippon Chemi-Con Corporation.

3. What are the main segments of the Automotive MLCC Market?

The market segments include Vehicle Type, Fuel Type, Propulsion Type, Component Type, Case Size, Voltage, Capacitance, Dielectric Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rise of Alternative Technologies Such as Thermal Evaporation.

8. Can you provide examples of recent developments in the market?

July 2023: KEMET, part of the Yageo Corporation developed the X7R automotive grade MLCC X7R. This MLCC is designed to meet the high voltage requirements of automotive subsystems, ranging from 100pF-0.1uF and with a DC voltage range of 500V-1kV. The range of cases available is EIA 0603-1210, and is suitable for both automotive under hoods and in-cabin applications. These MLCCs demonstrate the essential and reliable nature of capacitors, which are essential for the mission and safety of automotive subsystems.June 2023: The growing demand for industrial equipments has driven the company to introduce NTS/NTF NTS/NTF Series of SMD type MLCC. These capacitors are rated with 25 to 500 Vdc with a capacitance ranging from 0.010 to 47µF. These MLCCs are used in on-board power supplies,voltage regulators for computers,smoothing circuit of DC-DC converters,etc.May 2023: Murata has introduced its EVA series MLCC's and these are suitable for a range of applications, including On-Board Charger (OBC), Inverter (Inverter/DC/DC Converter), Battery Management System (BMS) and Wireless Power Transfer (WPT) implementations. These MLCCs are suitable for the increased isolation required by the 800V Powertrain Migration, while also meeting the miniaturization needs of modern automotive systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive MLCC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive MLCC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive MLCC Market?

To stay informed about further developments, trends, and reports in the Automotive MLCC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence