Key Insights

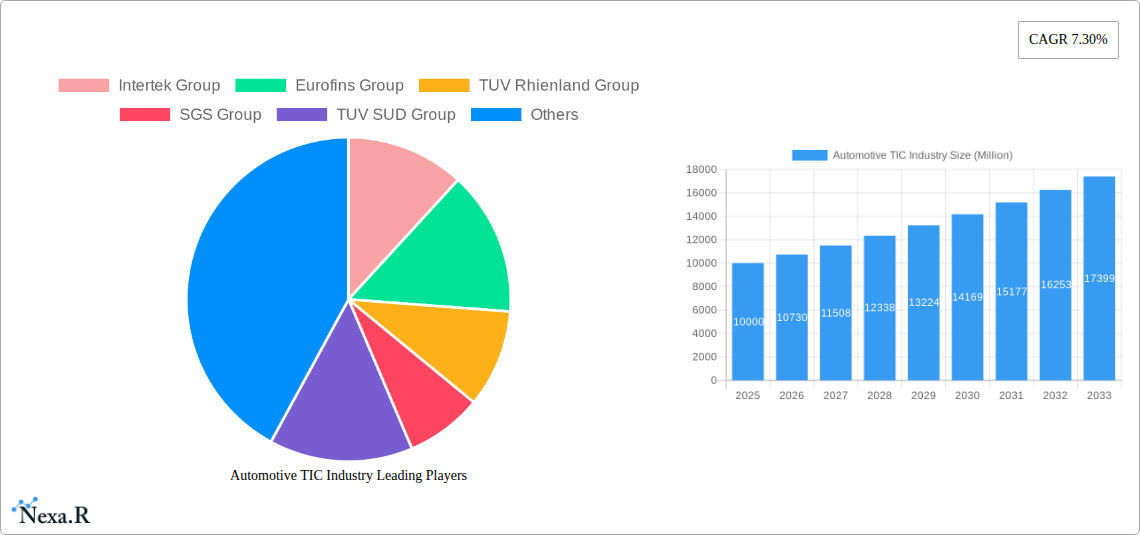

The global Automotive Testing, Inspection, and Certification (TIC) market is poised for significant expansion, driven by escalating vehicle safety mandates and stringent environmental regulations worldwide. Projections indicate a compound annual growth rate (CAGR) of 4.84% from a market size of 20.31 billion in the base year of 2025. This robust growth is fueled by the increasing technological sophistication of vehicles, including advanced driver-assistance systems (ADAS) and electric powertrains, which demand comprehensive testing and certification. While passenger vehicles represent a substantial segment, commercial vehicles are also contributing significantly due to evolving regulatory frameworks. The market is segmented by service type, with testing and inspection currently leading, followed by certification. However, ancillary services, such as auditing, consulting, and training, are expected to witness substantial growth as businesses prioritize continuous improvement and compliance support. Major industry players, including Intertek, Eurofins, TÜV Rheinland, SGS, TÜV SÜD, Dekra, Applus, TÜV Nord, and Bureau Veritas, are strategically investing in advanced capabilities and global reach to leverage these market dynamics. Geographically, North America and Europe currently dominate market share, with the Asia-Pacific region anticipated to exhibit the fastest growth, propelled by burgeoning vehicle production and intensifying regulatory oversight.

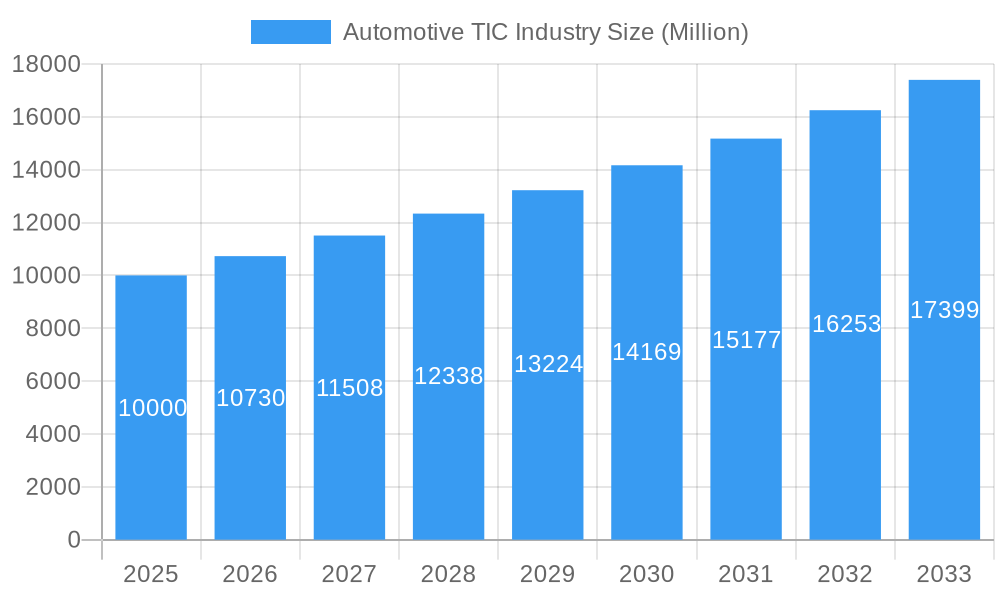

Automotive TIC Industry Market Size (In Billion)

The competitive environment is characterized by the presence of established global entities and specialized firms. Industry consolidation is probable, driven by the pursuit of enhanced scale and technological innovation. Despite potential challenges, such as high testing expenditures and the complexities of global regulatory alignment, the outlook remains highly positive. Technological advancements, heightened safety consciousness, and evolving emission standards are set to propel the Automotive TIC market's upward trajectory. Securing a competitive advantage will hinge on focusing on specialized testing domains, including automotive cybersecurity and autonomous driving technologies. The market's future success will be contingent on its agility in adapting to rapid technological shifts and effectively addressing emerging challenges related to sustainability and autonomous mobility.

Automotive TIC Industry Company Market Share

Automotive TIC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Automotive Testing, Inspection, and Certification (TIC) industry, covering market dynamics, growth trends, regional dominance, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by service type (Testing & Inspection, Certification, Others) and vehicle type (Passenger, Commercial), offering granular insights into this dynamic sector. This report projects xx Million units in the market by 2033.

Automotive TIC Industry Market Dynamics & Structure

The Automotive TIC industry is characterized by a moderately concentrated market structure with several global players dominating the landscape. Intertek Group, Eurofins Group, TÜV Rheinland Group, SGS Group, TÜV SÜD Group, DEKRA SE, Applus Group, TÜV Nord, and Bureau Veritas are key players, each vying for market share through strategic acquisitions, technological advancements, and geographic expansion. Market concentration is estimated at xx% in 2025, with the top 5 players holding a combined xx% market share.

- Technological Innovation: Autonomous driving, electrification, and connected car technologies are driving demand for sophisticated testing and certification services. This requires significant investment in advanced testing equipment and expertise.

- Regulatory Frameworks: Stringent emission standards, safety regulations, and cybersecurity requirements necessitate robust TIC services, shaping industry growth and compliance needs.

- Competitive Landscape: The market faces competition from smaller specialized firms and new entrants offering niche services, increasing the pressure to innovate and differentiate.

- M&A Activity: The industry witnesses consistent mergers and acquisitions, with companies expanding their service portfolios and geographical reach. Recent examples include Applus' acquisition of IMA Dresden in May 2021 and DEKRA's Apple MFi authorization in April 2021, demonstrating strategic growth through expansion. The number of M&A deals averaged xx per year during the historical period (2019-2024).

- End-User Demographics: The growth is influenced by the increasing production of passenger and commercial vehicles globally, particularly in developing economies with burgeoning automotive industries.

Automotive TIC Industry Growth Trends & Insights

The global Automotive TIC market experienced significant growth during the historical period (2019-2024), driven by factors including increasing vehicle production, stringent regulatory compliance needs, and technological advancements in automotive technologies. The market size is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. This growth is further fueled by the rising adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and connected car technologies, demanding rigorous testing and certification. Market penetration for comprehensive testing & certification services is expected to reach xx% by 2033. The adoption rate of new testing methodologies linked to EVs and autonomous technologies is showing a substantial increase, impacting the market landscape.

Dominant Regions, Countries, or Segments in Automotive TIC Industry

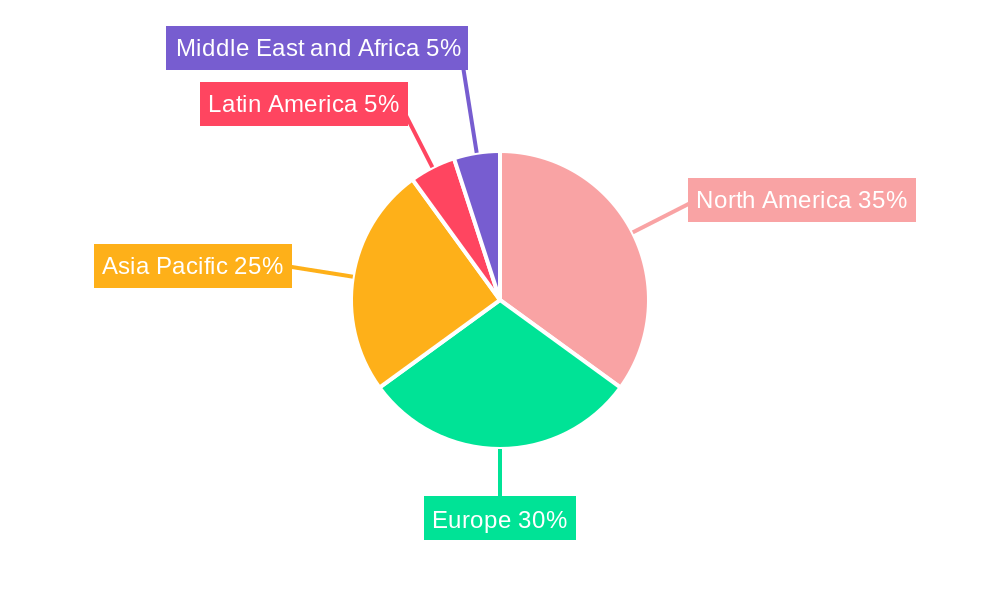

The global Automotive Testing, Inspection, and Certification (TIC) market is characterized by distinct regional dynamics and segment strengths. Currently, Europe and North America command the largest market share, underpinned by their well-established automotive manufacturing bases, robust regulatory frameworks mandating stringent safety and emission standards, and early adoption of advanced automotive technologies. In contrast, the Asia-Pacific region is witnessing the most dynamic growth, with China and India at the forefront. This surge is primarily driven by substantial increases in vehicle production volumes, significant investments in automotive infrastructure, and a growing domestic market demanding higher quality and compliance.

- By Service Type: The Testing & Inspection segment continues to dominate, owing to the continuous and high-volume nature of testing required across the entire vehicle lifecycle, from component validation to final assembly. The Certification segment is exhibiting considerable growth potential, propelled by the ever-evolving landscape of global and regional regulations that necessitate compliance for market access. The "Others" segment, which includes auditing, consulting, and training services, is expected to achieve moderate but steady growth as the automotive industry navigates increasingly complex operational and strategic challenges.

- By Vehicle Type: Passenger vehicles presently represent the largest segment within the Automotive TIC market. However, the commercial vehicle segment is experiencing a notable acceleration in demand for TIC services. This growth is directly linked to the increasing implementation of stricter safety, environmental, and operational efficiency standards for trucks, buses, and other commercial transport, ensuring their reliability and compliance on public roads.

Key Drivers for Regional Dominance and Segment Growth:

- Robust and expanding automotive production volumes, particularly in emerging economic powerhouses like the Asia-Pacific region.

- The unwavering stringency of government regulations concerning vehicle safety, emissions, and environmental impact, especially prevalent in established markets like Europe and North America.

- The accelerated adoption and integration of cutting-edge automotive technologies such as Electric Vehicles (EVs), Advanced Driver-Assistance Systems (ADAS), and the foundational elements of autonomous driving.

Automotive TIC Industry Product Landscape

The Automotive TIC industry offers a range of services, from basic testing and inspection to sophisticated certification and consulting. Key product innovations include advanced testing technologies for autonomous driving systems, battery testing for EVs, and cybersecurity assessment for connected cars. The industry focus is on providing efficient, reliable, and cost-effective services, incorporating the latest technologies to improve accuracy and speed. Unique selling propositions (USPs) often revolve around specialized expertise, fast turnaround times, and global reach.

Key Drivers, Barriers & Challenges in Automotive TIC Industry

Key Drivers Fueling Industry Momentum:

- The pervasive and ever-increasing demand for demonstrable vehicle safety and stringent compliance with environmental emission standards worldwide.

- The rapid and widespread adoption of advanced automotive technologies, including sophisticated Advanced Driver-Assistance Systems (ADAS) and the transformative shift towards Electric Vehicles (EVs).

- Continuous innovation and technological advancements in testing and inspection methodologies, leading to more efficient, accurate, and comprehensive service offerings.

Key Challenges and Restraints Impeding Growth:

- The significant capital expenditure required to acquire and maintain state-of-the-art testing equipment and facilities capable of handling next-generation automotive technologies.

- A persistent shortage of highly skilled and specialized professionals adept at performing complex testing and analysis in niche areas of automotive engineering and technology.

- Intense market competition among TIC providers, leading to considerable pressure on pricing structures and profit margins.

Emerging Opportunities in Automotive TIC Industry

The Automotive TIC landscape is ripe with emerging opportunities, driven by the relentless pace of technological innovation. Paramount among these are the critical areas of cybersecurity testing for increasingly connected vehicles, robust battery testing and validation services essential for the burgeoning electric vehicle market, and comprehensive validation of autonomous driving technologies. Geographically, expansion into rapidly developing emerging markets, particularly in Asia and Africa, presents substantial untapped potential for growth. Furthermore, specializing in TIC services for niche and specialized automotive segments, such as heavy-duty vehicles, agricultural machinery, or performance-oriented vehicles, offers focused and profitable avenues for market penetration and leadership.

Growth Accelerators in the Automotive TIC Industry

The sustained long-term growth of the Automotive TIC industry will be propelled by several key factors. Continued investment in and implementation of technological advancements in testing methodologies will be crucial for staying ahead of evolving vehicle complexities. Strategic and collaborative partnerships between TIC providers and automotive manufacturers will foster deeper integration and innovation. Furthermore, strategic expansion into new geographical markets with significant and growing automotive production capabilities will unlock new revenue streams. A dedicated commitment to research and development, particularly in groundbreaking areas like advanced autonomous vehicle testing protocols and sophisticated cybersecurity validation techniques, will be indispensable for maintaining a competitive edge and driving continuous innovation within the sector.

Key Players Shaping the Automotive TIC Industry Market

Notable Milestones in Automotive TIC Industry Sector

- May 2021: Applus acquired IMA Dresden, expanding its testing capabilities in structural and materials testing.

- April 2021: DEKRA became an MFi Authorized Test Laboratory, offering CarPlay certification services.

In-Depth Automotive TIC Industry Market Outlook

The Automotive TIC industry is poised for continued growth driven by technological advancements, regulatory changes, and the global expansion of the automotive sector. Strategic opportunities exist for companies focusing on specialized testing services for emerging automotive technologies, such as autonomous driving, electrification, and connectivity. Companies that can adapt quickly to the evolving needs of the automotive industry and invest in cutting-edge testing technologies will be best positioned for success.

Automotive TIC Industry Segmentation

-

1. Service Type

- 1.1. Testing & Inspection

- 1.2. Certification

- 1.3. Others

-

2. Vehicle Type

- 2.1. Passenger

- 2.2. Commercial

Automotive TIC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automotive TIC Industry Regional Market Share

Geographic Coverage of Automotive TIC Industry

Automotive TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Integration of Electronic Components in Automobiles; Trend Toward Digitization

- 3.3. Market Restrains

- 3.3.1. Lack of International Accepted Standards

- 3.4. Market Trends

- 3.4.1. Testing is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing & Inspection

- 5.1.2. Certification

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing & Inspection

- 6.1.2. Certification

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing & Inspection

- 7.1.2. Certification

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing & Inspection

- 8.1.2. Certification

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing & Inspection

- 9.1.2. Certification

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing & Inspection

- 10.1.2. Certification

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TUV Rhienland Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV SUD Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dekra SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Applus Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TUV Nord

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Intertek Group

List of Figures

- Figure 1: Global Automotive TIC Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: Europe Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Latin America Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Latin America Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Latin America Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive TIC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive TIC Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Automotive TIC Industry?

Key companies in the market include Intertek Group, Eurofins Group, TUV Rhienland Group, SGS Group, TUV SUD Group, Dekra SE, Applus Group, TUV Nord, Bureau Veritas.

3. What are the main segments of the Automotive TIC Industry?

The market segments include Service Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Integration of Electronic Components in Automobiles; Trend Toward Digitization.

6. What are the notable trends driving market growth?

Testing is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of International Accepted Standards.

8. Can you provide examples of recent developments in the market?

May 2021 - Applus acquired IMA Dresden, a leading testing laboratory in Europe which is a well-diversified structural and materials testing laboratory, with a good reputation for excellence and a European leader in most of its key markets of railway, aerospace & defense, wind power, building products, medical devices and automotive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive TIC Industry?

To stay informed about further developments, trends, and reports in the Automotive TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence