Key Insights

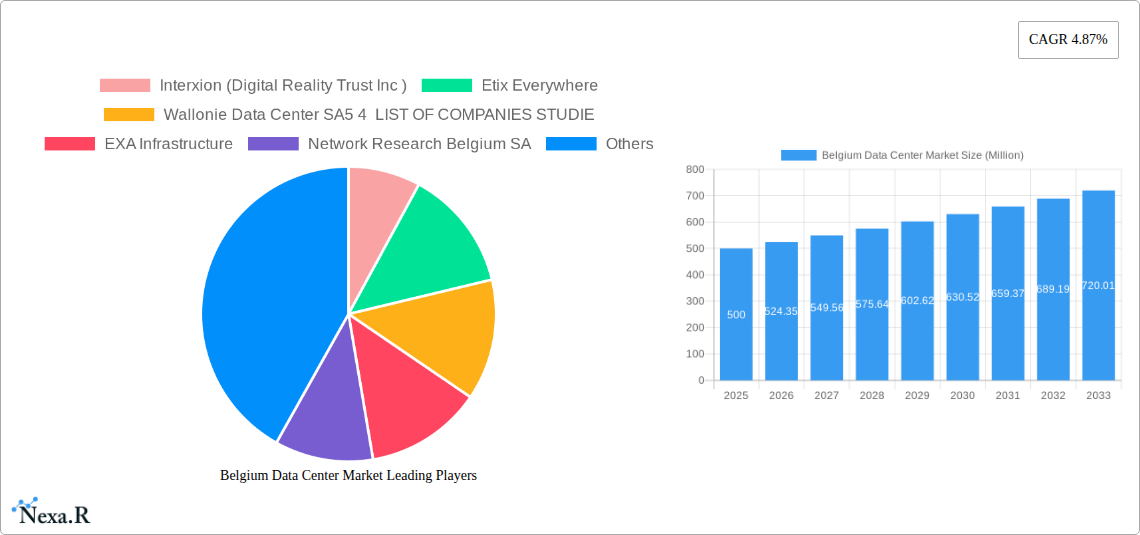

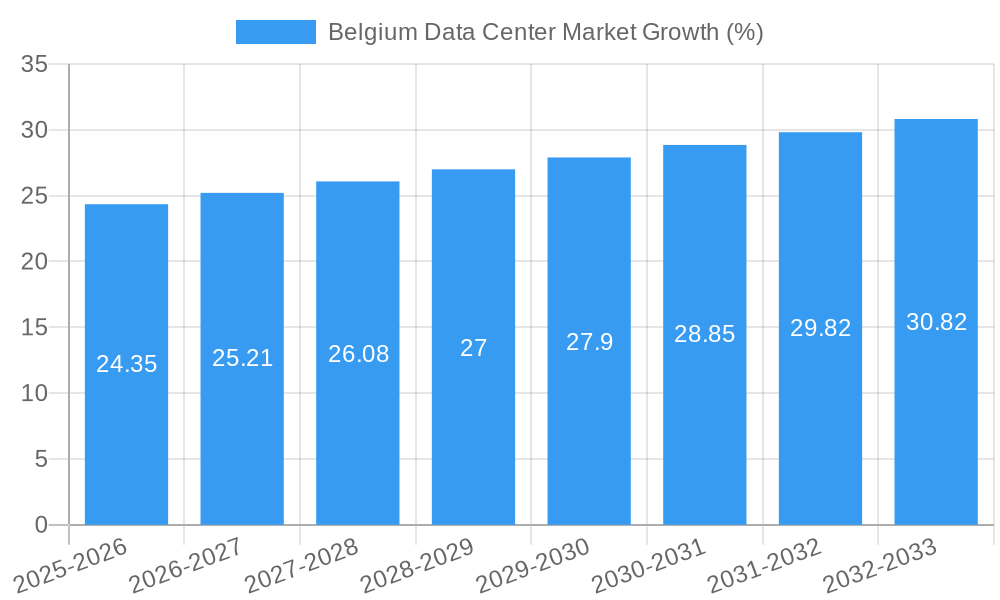

The Belgium data center market, valued at approximately €[Estimate based on context, e.g., €500 million] in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.87% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and big data analytics within Belgian businesses is a significant factor, demanding greater data storage and processing capabilities. Furthermore, the government's initiatives to foster digitalization and attract foreign investment in the technology sector are creating a favorable environment for data center development. The growth is further bolstered by the burgeoning e-commerce sector and the rising demand for high-speed internet connectivity, particularly in urban hotspots like Brussels. Segment analysis reveals a strong preference for large and mega data centers, driven by the economies of scale and the ability to cater to the expanding needs of major cloud providers and enterprises. While the non-utilized absorption segment currently holds a significant share, the increasing demand is anticipated to gradually shift this balance towards utilized capacity over the forecast period.

However, the market's growth trajectory isn't without challenges. Competition amongst established players like Interxion (Digital Realty Trust Inc.), Etix Everywhere, and Proximus S.A., along with new entrants, is intensifying. Securing sufficient skilled labor and navigating the complexities of energy consumption and sustainability regulations pose additional hurdles. Furthermore, the market faces the ongoing challenge of ensuring robust cybersecurity measures to protect sensitive data stored within these facilities. Despite these restraints, the long-term outlook for the Belgium data center market remains optimistic, driven by sustained investment in digital infrastructure and the ongoing digital transformation across various sectors within the Belgian economy. The market's future success hinges on addressing these challenges proactively and capitalizing on the significant opportunities presented by the country's growing digital landscape.

Belgium Data Center Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Belgium data center market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report segments the market by absorption (utilized and non-utilized), hotspot (Brussels and Rest of Belgium), data center size (small, medium, mega, massive, large), and tier type (Tier 1 and Tier). The total market value in 2025 is estimated at XX Million.

Belgium Data Center Market Dynamics & Structure

The Belgium data center market is characterized by a moderately concentrated landscape, with a mix of international and local players. Technological innovation, driven by increasing demand for cloud computing and edge data centers, is a key driver. Regulatory frameworks, while generally supportive of digital infrastructure development, are constantly evolving, influencing investment decisions and operational strategies. The market also faces competition from alternative solutions, such as colocation services, while M&A activity remains dynamic, reshaping the competitive landscape. The market is estimated to reach XX million by 2033.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share (xx%).

- Technological Innovation: Strong focus on edge computing, hyperscale data centers, and sustainable solutions. Barriers to innovation include high initial investment costs and a skilled workforce shortage.

- Regulatory Framework: Generally supportive, but subject to change. Data privacy regulations and cybersecurity standards are key considerations.

- Competitive Substitutes: Colocation services and cloud-based solutions pose competition.

- End-User Demographics: Diverse, ranging from telecommunications companies and financial institutions to government agencies and SMEs.

- M&A Trends: Significant M&A activity observed, driven by consolidation and expansion strategies. xx number of deals closed between 2019-2024, valued at an estimated XX million.

Belgium Data Center Market Growth Trends & Insights

The Belgium data center market has exhibited robust growth over the past years, driven by factors such as increasing digitalization, the expansion of cloud services, and the rise of 5G networks. The market is projected to maintain a strong CAGR of xx% during the forecast period (2025-2033), reaching XX million by 2033. This growth is fueled by the rising demand for data storage and processing capabilities across various sectors. Technological disruptions, such as the adoption of AI and IoT, further accelerate market expansion. Consumer behavior shifts towards digital services and increased reliance on online platforms are impacting data center usage patterns.

Dominant Regions, Countries, or Segments in Belgium Data Center Market

The Brussels region currently dominates the Belgium data center market, due to its established infrastructure, skilled workforce, and strong connectivity. The Utilized segment holds the largest market share due to increased demand from cloud providers and enterprises. Large and Mega data centers represent the largest share of the market, driven by hyperscale deployments.

- Key Drivers:

- Brussels Region: Strong connectivity, skilled workforce, and supportive government policies.

- Utilized Segment: Growing demand from cloud providers, enterprises, and government agencies.

- Large/Mega Data Centers: Preference for large-scale deployments for cost efficiency and scalability.

- Dominance Factors: Market share (xx% for Brussels), growth potential (xx% for Utilized segment).

Belgium Data Center Market Product Landscape

The Belgian data center market offers a diverse range of products and services, including colocation, cloud, and managed services. Recent innovations focus on energy efficiency, high-density computing, and advanced security features. Unique selling propositions frequently involve customized solutions and tailored service level agreements (SLAs) to meet client-specific needs. The market is witnessing increased adoption of modular data center designs for faster deployment and scalability.

Key Drivers, Barriers & Challenges in Belgium Data Center Market

Key Drivers:

- Increasing digitalization across various sectors

- Growth of cloud computing and the adoption of cloud-based services

- Expansion of 5G networks

Challenges:

- High capital expenditure (CAPEX) requirements

- Limited skilled labor available in the market

- Energy costs for data centers remain high. This is impacting the profitability of smaller data centers.

Emerging Opportunities in Belgium Data Center Market

The Belgian data center market presents several emerging opportunities, including the expansion of edge computing to support real-time data processing, the growth of specialized data centers for specific industries such as finance and healthcare, and the increasing demand for sustainable and environmentally friendly data center solutions. Furthermore, opportunities exist in the development of data center clusters and interconnected facilities to enhance efficiency and scalability.

Growth Accelerators in the Belgium Data Center Market Industry

Strategic partnerships between data center providers and technology companies, focusing on developing innovative solutions and expanding into new market segments, will serve as a crucial growth accelerator. Furthermore, investments in green energy sources and sustainable data center technologies will drive long-term growth while enhancing the environmental profile of the industry.

Key Players Shaping the Belgium Data Center Market Market

- Interxion (Digital Reality Trust Inc)

- Etix Everywhere

- Wallonie Data Center SA

- EXA Infrastructure

- Network Research Belgium SA

- ANTWERP DATACENTER (Datacenter United)

- Proximus S A

- LCL Belgium n v

- AtlasEdge Data Centres

- Lumen Technologies Inc

- KevlinX Belgium BVBA

- VPS House Technology Group LLC

Notable Milestones in Belgium Data Center Market Sector

- January 2022: Datacenter United acquires DC Star, expanding its data center portfolio to six locations.

- November 2021: Colt Data Centre Services sells its Belgium facility to AtlasEdge Data Centres.

- September 2021: HCL partners with Proximus to manage its private cloud infrastructure.

In-Depth Belgium Data Center Market Market Outlook

The Belgium data center market is poised for continued growth, driven by ongoing digital transformation and increasing demand for data storage and processing capabilities. Strategic investments in infrastructure upgrades, the adoption of advanced technologies, and the development of sustainable solutions will be crucial for realizing the full potential of this market. Opportunities for market expansion, particularly in edge computing and specialized data centers, are expected to attract further investment and competition.

Belgium Data Center Market Segmentation

-

1. Hotspot

- 1.1. Brussels

- 1.2. Rest of Belgium

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Belgium Data Center Market Segmentation By Geography

- 1. Belgium

Belgium Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Brussels

- 5.1.2. Rest of Belgium

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Interxion (Digital Reality Trust Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Etix Everywhere

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wallonie Data Center SA5 4 LIST OF COMPANIES STUDIE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EXA Infrastructure

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Network Research Belgium SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANTWERP DATACENTER (Datacenter United)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Proximus S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LCL Belgium n v

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AtlasEdge Data Centres

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lumen Technologies Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KevlinX Belgium BVBA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 VPS House Technology Group LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Interxion (Digital Reality Trust Inc )

List of Figures

- Figure 1: Belgium Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Belgium Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Belgium Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Belgium Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Belgium Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Belgium Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Belgium Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 9: Belgium Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 10: Belgium Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 11: Belgium Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 12: Belgium Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Data Center Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Belgium Data Center Market?

Key companies in the market include Interxion (Digital Reality Trust Inc ), Etix Everywhere, Wallonie Data Center SA5 4 LIST OF COMPANIES STUDIE, EXA Infrastructure, Network Research Belgium SA, ANTWERP DATACENTER (Datacenter United), Proximus S A, LCL Belgium n v, AtlasEdge Data Centres, Lumen Technologies Inc, KevlinX Belgium BVBA, VPS House Technology Group LLC.

3. What are the main segments of the Belgium Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2022: Belgian infrastructure investment firm TINC has invested in local data center firm Datacenter United to fund its acquisition of DC Star. Datacenter United has increased the number of data centers it manages to six. In addition to the three existing locations in Antwerp and Brussels, the three DC Star data centers in Burcht, Ghent and Oostkamp are now also part of the Datacenter United ecosystem.November 2021: Colt Data Centre Services (DCS) announced selling 12 colocation sites across Europe with AtlasEdge Data Centres, including the Belgium facility.September 2021: HCL signed partnership to run Proximus’ private cloud infrastructure. The partnership will be fully operational as of February 2022 and wfter which, Proximus’ IT infrastructure will be managed by HCL but remain in Proximus data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Data Center Market?

To stay informed about further developments, trends, and reports in the Belgium Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence