Key Insights

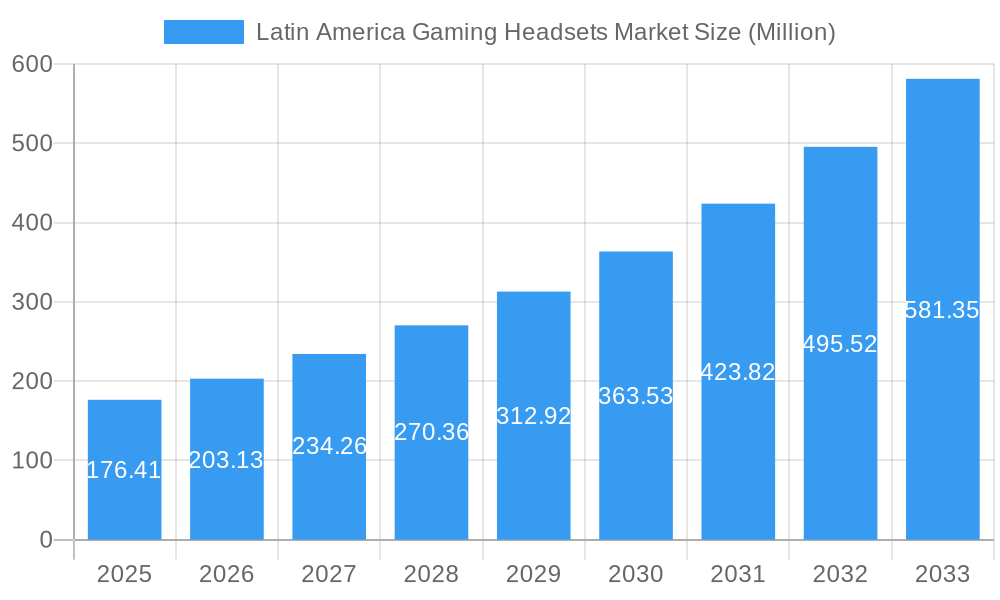

The Latin American gaming headset market, valued at $176.41 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.23% from 2025 to 2033. This surge is driven by several key factors. The rising popularity of esports and competitive gaming across Latin America fuels demand for high-quality audio equipment. Increased smartphone penetration and affordable internet access are expanding the gaming audience, particularly among younger demographics. Furthermore, the increasing adoption of cloud gaming services is reducing the barrier to entry for gamers, further boosting headset sales. Technological advancements, such as the introduction of immersive surround sound and noise-canceling features in gaming headsets, are also contributing to market expansion. While the market faces challenges like economic fluctuations in certain Latin American countries and competition from cheaper alternatives, the overall growth trajectory remains positive, fueled by a passionate and growing gaming community.

Latin America Gaming Headsets Market Market Size (In Million)

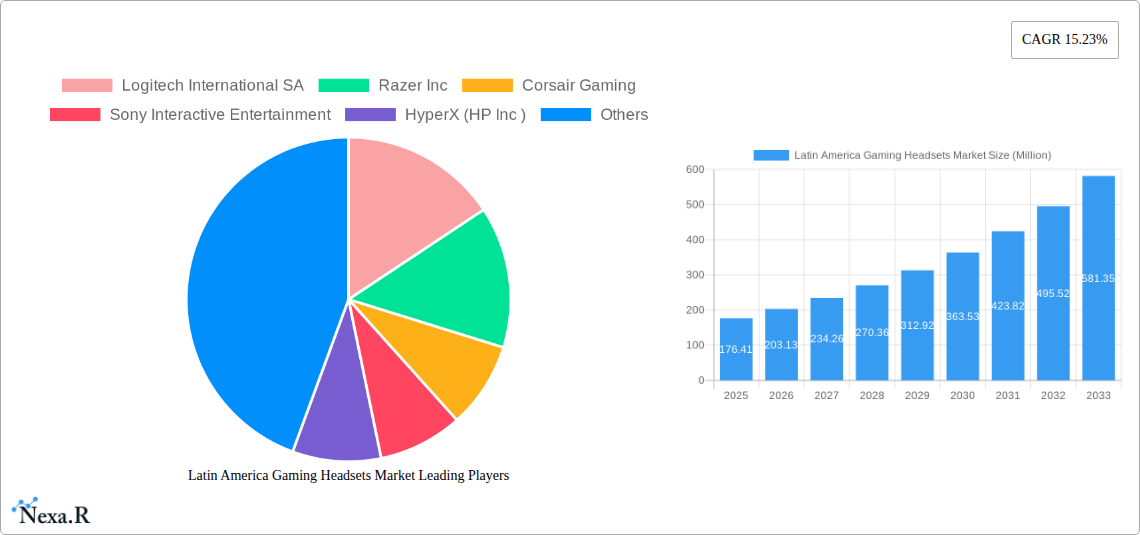

The market is segmented by product type (wired, wireless, etc.), platform compatibility (PC, consoles, mobile), price range, and distribution channel (online, offline). Major players like Logitech, Razer, Corsair, Sony, HyperX, ASUS, Microsoft, Harman, SteelSeries, and Turtle Beach are competing for market share through product innovation, branding, and strategic partnerships. Regional variations exist, with countries like Brazil and Mexico expected to dominate the market due to their larger gaming populations and higher disposable incomes. Future market growth will likely depend on the continued expansion of broadband internet access, the affordability of gaming hardware, and the sustained popularity of esports within the region. The market is poised for significant growth as the gaming ecosystem in Latin America continues to mature.

Latin America Gaming Headsets Market Company Market Share

Latin America Gaming Headsets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America gaming headsets market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report dissects market dynamics, growth trends, dominant segments, and key players shaping this rapidly evolving landscape. The report meticulously analyzes the parent market (Latin America Consumer Electronics Market) and the child market (Latin America Gaming Peripherals Market) to offer a holistic view. The projected market size for Latin America Gaming Headsets will reach xx million units by 2033.

Latin America Gaming Headsets Market Dynamics & Structure

This section analyzes the competitive intensity, technological advancements, regulatory landscape, substitute products, and end-user demographics within the Latin America gaming headsets market. The market exhibits a (xx)% market concentration with the top 5 players holding (xx)% of the market share.

- Market Concentration: Moderately concentrated, with key players holding significant market share.

- Technological Innovation: Driven by advancements in audio technology, noise cancellation, and wireless connectivity. Innovation barriers include high R&D costs and maintaining competitive pricing.

- Regulatory Frameworks: Vary across Latin American countries, impacting import/export and product safety standards.

- Competitive Product Substitutes: Include standard headphones and earbuds, posing a challenge to dedicated gaming headsets.

- End-User Demographics: Primarily driven by young adults (18-35 years), with a growing segment of older gamers.

- M&A Trends: Over the historical period (2019-2024), an estimated xx M&A deals occurred in the Latin American gaming peripherals market, indicating a moderately active consolidation phase.

Latin America Gaming Headsets Market Growth Trends & Insights

This section analyzes the historical and projected growth trajectory of the Latin America gaming headsets market. The market exhibited a CAGR of xx% during the historical period (2019-2024), driven by factors like increasing internet penetration, rising disposable incomes, and growing popularity of esports. The adoption rate of gaming headsets has seen a significant increase, particularly in urban areas. Technological disruptions, such as the shift towards wireless connectivity and the integration of advanced audio features, are further fueling market expansion. Consumer behaviour is shifting towards premium headsets with superior audio quality and enhanced comfort. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033.

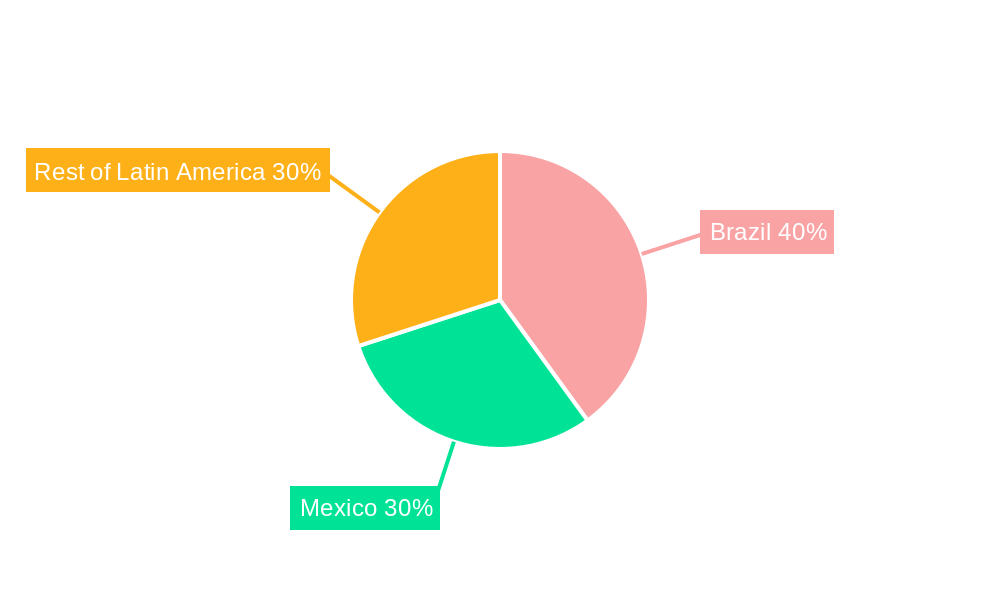

Dominant Regions, Countries, or Segments in Latin America Gaming Headsets Market

This section pinpoints the key regions and countries driving the Latin America gaming headsets market growth. Brazil, Mexico, and Argentina are the leading markets, accounting for (xx)% of total sales.

- Key Drivers:

- Brazil: Strong gaming community, high internet penetration, and growing disposable income.

- Mexico: Expanding esports scene and increasing adoption of gaming consoles and PCs.

- Argentina: Relatively high per capita gaming expenditure and a growing interest in esports.

- Dominance Factors: Market size, consumer preferences, economic conditions, and government support for the gaming industry contribute to regional dominance. Growth potential is largely influenced by factors such as economic growth, infrastructure development, and expanding digitalization initiatives.

Latin America Gaming Headsets Market Product Landscape

The Latin America gaming headsets market offers a diverse range of products, from entry-level wired headsets to premium wireless models with advanced features like noise cancellation, surround sound, and customizable RGB lighting. Key product innovations focus on improved comfort, enhanced audio quality, and seamless integration with gaming platforms. Unique selling propositions often center around immersive audio experiences, durable construction, and competitive pricing.

Key Drivers, Barriers & Challenges in Latin America Gaming Headsets Market

Key Drivers: The market is primarily driven by the increasing popularity of online gaming, the growth of esports, the rising adoption of gaming consoles and PCs, and advancements in audio technology. Government initiatives promoting digitalization also contribute to market expansion.

Key Challenges: Supply chain disruptions, fluctuating currency exchange rates, and intense competition from established players pose significant challenges. High import tariffs in some countries also hinder market growth. The impact of these challenges is estimated to reduce the overall market growth by (xx)% during the forecast period.

Emerging Opportunities in Latin America Gaming Headsets Market

Emerging opportunities lie in untapped markets in smaller Latin American countries, the growing demand for VR/AR gaming headsets, and the increasing preference for customized and personalized gaming accessories. The integration of smart features and improved compatibility with mobile gaming platforms present further expansion avenues.

Growth Accelerators in the Latin America Gaming Headsets Market Industry

Technological advancements, strategic partnerships between headset manufacturers and gaming companies, and expansion into new markets are key growth accelerators. Investment in marketing and distribution networks will further propel market growth.

Key Players Shaping the Latin America Gaming Headsets Market Market

Notable Milestones in Latin America Gaming Headsets Market Sector

- May 2024: Sonos launched the Sonos Ace headphones, challenging existing market leaders with its focus on comfort, durability, and premium audio.

- April 2024: Meta announced plans to extend its Meta Horizon OS to external hardware manufacturers, opening up opportunities for new VR headset development.

In-Depth Latin America Gaming Headsets Market Outlook

The Latin America gaming headsets market presents significant long-term growth potential, driven by sustained growth in the gaming industry, technological innovations, and increasing consumer spending. Strategic partnerships and expansion into emerging markets will be crucial for achieving continued success. The market is projected to witness strong growth in the coming years, presenting substantial opportunities for both established players and new entrants.

Latin America Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Latin America Gaming Headsets Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Gaming Headsets Market Regional Market Share

Geographic Coverage of Latin America Gaming Headsets Market

Latin America Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Integration of Newer Technologies Like 3D and AR/VR Gaming is Expected to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sony Interactive Entertainment

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (HP Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASUS Computer International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harman International Industries Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SteelSeries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turtle Beach Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: Latin America Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Gaming Headsets Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 2: Latin America Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 3: Latin America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 4: Latin America Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 5: Latin America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: Latin America Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Latin America Gaming Headsets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Latin America Gaming Headsets Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Latin America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 10: Latin America Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 11: Latin America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 12: Latin America Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 13: Latin America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Latin America Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 15: Latin America Gaming Headsets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Gaming Headsets Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: Brazil Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Brazil Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Argentina Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Chile Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Chile Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Colombia Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Colombia Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Peru Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Peru Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Venezuela Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Venezuela Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Ecuador Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ecuador Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Bolivia Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Bolivia Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Paraguay Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Paraguay Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Gaming Headsets Market?

The projected CAGR is approximately 15.23%.

2. Which companies are prominent players in the Latin America Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUS Computer International, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the Latin America Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 176.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Integration of Newer Technologies Like 3D and AR/VR Gaming is Expected to Drive Market Growth.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

May 2024: Sonos made its foray into the headphone market with the debut of its inaugural model, the Sonos Ace. These headphones are positioned as a blend of comfort, durability, and top-tier audio quality, appealing to users who value both performance and sustainability. In a direct challenge to heavyweights like Apple's AirPods Max and Bose's QuietComfort Ultra, Sonos Ace headphones feature a construction of lightweight materials and plush memory foam, all wrapped in vegan leather. Moreover, their fold-flat design enhances portability and convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Latin America Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence