Key Insights

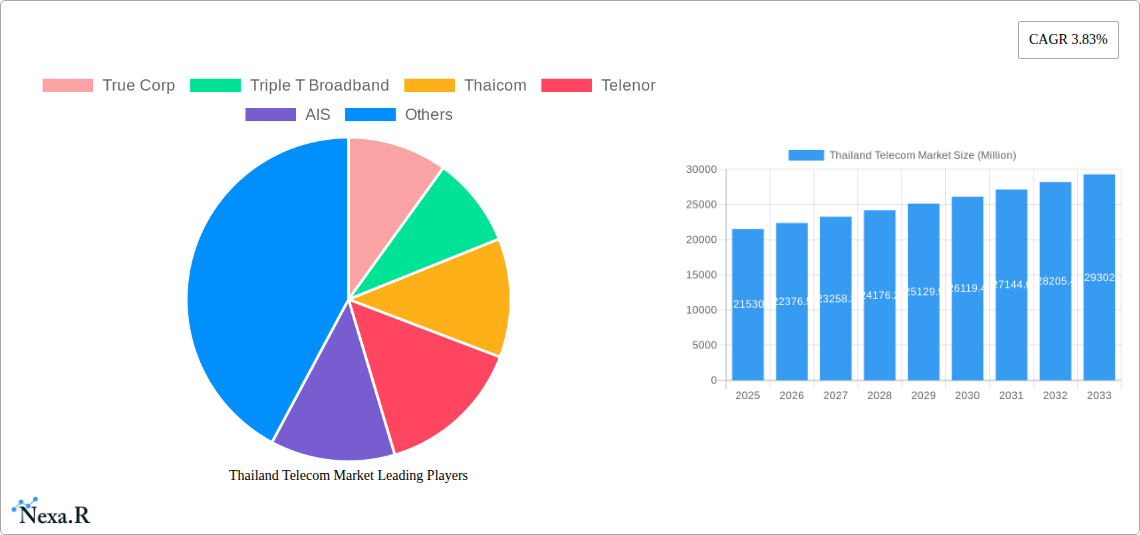

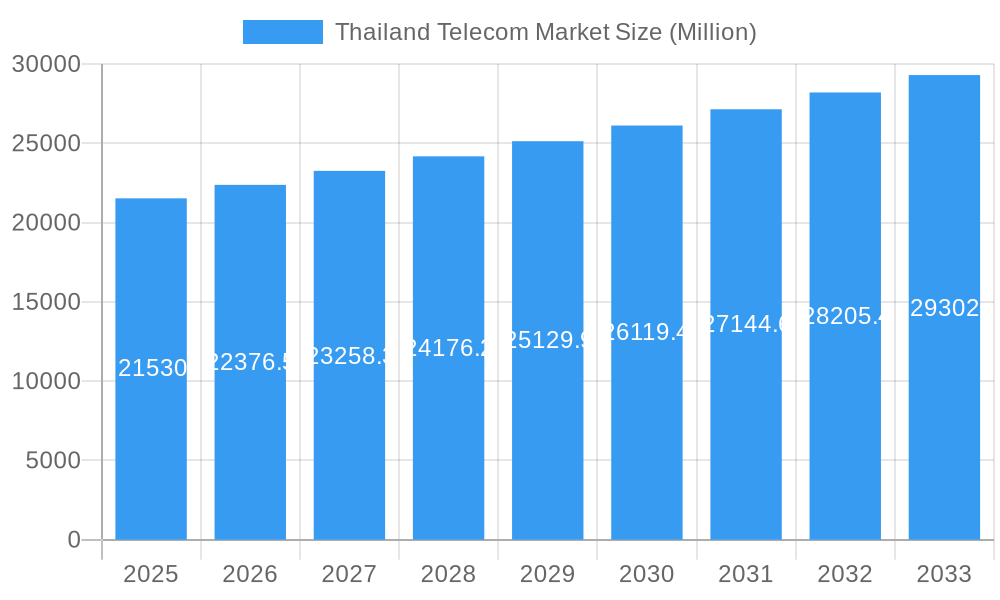

The Thailand telecom market, valued at $21.53 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.83% from 2025 to 2033. This growth is driven by increasing smartphone penetration, rising demand for high-speed data services (including Internet and handset data packages), and the expanding popularity of over-the-top (OTT) and pay-TV services. Key players like True Corp, AIS, DTAC, and CAT Telecom are fiercely competing, offering a range of voice, data, and bundled packages to cater to diverse consumer needs. The market's segmentation by service type (voice, data & messaging, OTT/PayTV) reflects the evolving consumption patterns, with data services experiencing significant traction fueled by increasing mobile video consumption and the growth of the digital economy. Competitive pricing strategies, coupled with network infrastructure investments, will be crucial for sustained growth. Regulatory changes impacting spectrum allocation and licensing could influence market dynamics. The robust growth observed in the historical period (2019-2024) provides a strong foundation for the projected expansion in the forecast period (2025-2033).

Thailand Telecom Market Market Size (In Billion)

The market's sustained growth is also underpinned by ongoing digital transformation initiatives within Thailand. Increased government investment in digital infrastructure, coupled with a young and tech-savvy population, fuels demand for advanced telecommunication services. However, challenges remain, such as addressing the digital divide in rural areas and managing potential cybersecurity threats. Furthermore, the market will be influenced by ongoing technological advancements like 5G deployment, which promises to improve network speeds and capacities further stimulating demand for data-intensive applications. The competitive landscape will likely see further consolidation and strategic alliances as operators strive for market share and operational efficiency. The success of individual players will depend on their ability to innovate, provide superior customer experience, and effectively manage operational costs within a dynamic regulatory environment.

Thailand Telecom Market Company Market Share

Thailand Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand telecom market, covering market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is invaluable for telecom operators, investors, and industry professionals seeking to understand the complexities and opportunities within this dynamic market. The report analyzes the parent market of telecommunications and the child markets of voice, data, and OTT/PayTV services.

Thailand Telecom Market Dynamics & Structure

This section delves into the intricate structure of the Thai telecom market, examining market concentration, technological advancements, regulatory landscapes, competitive dynamics, and market evolution. The analysis encompasses quantitative data, such as market share percentages and M&A deal volumes (in Million units), alongside qualitative factors influencing market behavior.

- Market Concentration: The Thai telecom market is characterized by a high level of concentration, with a few major players holding significant market share. The top three operators command approximately xx% of the market. This concentration is expected to remain relatively stable throughout the forecast period, with minor shifts resulting from strategic mergers and acquisitions.

- Technological Innovation: 5G deployment and the increasing adoption of fiber-optic infrastructure are key technological drivers. However, the high cost of infrastructure deployment and the need for skilled personnel present significant barriers to widespread adoption.

- Regulatory Framework: The regulatory environment in Thailand is generally supportive of market competition, although certain regulations regarding spectrum allocation and licensing can influence market dynamics. Recent regulatory changes have aimed to stimulate competition and promote investment in infrastructure.

- Competitive Substitutes: Over-the-top (OTT) services pose a significant competitive threat to traditional telecom services. This increasing competition is prompting incumbents to innovate and diversify their offerings.

- End-User Demographics: The market is characterized by a large and growing population of mobile phone users, with high penetration rates across various demographics. However, differences in adoption rates exist across rural and urban areas.

- M&A Trends: The past five years have witnessed xx M&A deals in the Thai telecom sector, primarily focused on consolidating market share and expanding service offerings. The forecast period anticipates xx more deals driven by expansion strategies.

Thailand Telecom Market Growth Trends & Insights

This section provides a detailed analysis of the Thailand telecom market's growth trajectory, exploring market size, adoption rates, technological disruptions, and consumer behavior. We leverage industry data and analysis to provide in-depth insights into the market’s evolution.

The market witnessed a CAGR of xx% during the historical period (2019-2024). The market size in 2024 was approximately xx million units, and it is projected to reach xx million units by 2025 and xx million units by 2033, driven by increasing smartphone penetration, expanding internet usage, and government initiatives promoting digital inclusion. Factors such as increased data consumption, the adoption of new technologies like 5G, and the rising popularity of OTT services have significantly influenced market expansion. Changes in consumer behavior, such as the increasing preference for bundled services and the adoption of digital payment methods, are also considered in this assessment.

Dominant Regions, Countries, or Segments in Thailand Telecom Market

This section focuses on identifying the leading regions or service segments driving market growth. It combines quantitative market share data with qualitative insights to reveal dominance factors and growth potential.

- Wireless: Data and Messaging Services: This segment is the key growth driver, exhibiting rapid expansion due to factors such as increasing smartphone penetration, data-hungry applications, and affordable data packages. The urban areas of Bangkok and other major cities are experiencing the highest growth. Growth is expected to be fuelled by affordable data packages and bundled services. Market share currently sits at approximately xx%.

- OTT and PayTV Services: This segment is experiencing significant growth, driven by the rising popularity of streaming services and increasing consumer preference for online entertainment. The market share of this segment is increasing at xx% annually. This increase is mainly due to changing consumer preferences towards online content and the availability of affordable streaming services.

- Voice Services: While showing a modest decline (xx% CAGR), voice services still contribute a considerable portion of the market due to continued demand for both fixed-line and mobile services.

Thailand Telecom Market Product Landscape

The Thailand telecom market offers a diverse range of products and services, including voice, data, and OTT services. Key technological advancements, such as 5G deployment and the increasing adoption of fiber-optic infrastructure, are significantly impacting product offerings. The focus is shifting towards providing high-speed data services, enhanced network coverage, and innovative value-added services to meet the evolving needs of consumers. Competition is pushing innovation in areas like bundled packages and personalized offerings.

Key Drivers, Barriers & Challenges in Thailand Telecom Market

Key Drivers:

- Rising Smartphone Penetration: The increase in smartphone users drives data consumption and revenue generation.

- Government Initiatives: Government support for digital transformation and infrastructure development positively impacts the market.

- 5G Deployment: The rollout of 5G technology opens up new opportunities for innovation and services.

Key Challenges:

- Infrastructure Gaps: Uneven infrastructure development across regions poses a challenge for service provision.

- Competition: Intense competition among operators pressures margins and necessitates innovative strategies.

- Regulatory Hurdles: Navigating the regulatory landscape can create complexities and delays in project implementation.

Emerging Opportunities in Thailand Telecom Market

Emerging opportunities in the Thailand telecom market include the growth of the Internet of Things (IoT), the expansion of 5G network coverage, and the increasing demand for cloud-based services. The untapped potential in rural areas presents a significant opportunity for expansion. Focus on providing affordable services, customized packages, and user-friendly platforms will be key to capitalizing on these opportunities.

Growth Accelerators in the Thailand Telecom Market Industry

Long-term growth in the Thailand telecom market will be fueled by continued investments in infrastructure, particularly 5G deployment, and the development of innovative services. Strategic partnerships between telecom operators and technology providers will also play a significant role in accelerating market growth. The expanding adoption of digital technologies across various sectors will further stimulate demand for telecom services.

Key Players Shaping the Thailand Telecom Market Market

- True Corp

- Triple T Broadband

- Thaicom

- Telenor

- AIS

- Cable Thai (CTH)

- TrueMove

- TT&T

- CAT Telecom

- DTAC

Notable Milestones in Thailand Telecom Market Sector

- September 2022: AIS partnered with ZTE Corporation to launch the 5G innovation hub named 5G A-Z Center in Thailand.

- October 2022: AIS partnered with Nokia to complete a 25G PON solution trial.

In-Depth Thailand Telecom Market Market Outlook

The future of the Thailand telecom market is promising, with significant growth potential driven by technological advancements, increasing digital adoption, and supportive government policies. Strategic partnerships and investments in infrastructure will be key to unlocking this potential. The continued expansion of 5G networks and the emergence of new technologies will create opportunities for innovation and market expansion. The focus will be on enhancing service quality, expanding coverage, and providing cost-effective solutions to meet the evolving needs of consumers and businesses.

Thailand Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Thailand Telecom Market Segmentation By Geography

- 1. Thailand

Thailand Telecom Market Regional Market Share

Geographic Coverage of Thailand Telecom Market

Thailand Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Workforce

- 3.4. Market Trends

- 3.4.1. Growing demand for Fixed Broadband Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 True Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Triple T Broadband

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Thaicom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telenor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AIS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cable Thai (CTH)*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TrueMove

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TT&T

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CAT Telecom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DTAC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 True Corp

List of Figures

- Figure 1: Thailand Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Thailand Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Thailand Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Thailand Telecom Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Telecom Market?

The projected CAGR is approximately 3.83%.

2. Which companies are prominent players in the Thailand Telecom Market?

Key companies in the market include True Corp, Triple T Broadband, Thaicom, Telenor, AIS, Cable Thai (CTH)*List Not Exhaustive, TrueMove, TT&T, CAT Telecom, DTAC.

3. What are the main segments of the Thailand Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Growing demand for Fixed Broadband Services.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Workforce.

8. Can you provide examples of recent developments in the market?

October 2022 - AIS partnered with Nokia to complete a 25G PON solution trial using the telco's existing optical line terminals (OLTs). Service providers can provide high-speed connectivity through a single fiber cable. This partnership aims to offer customers speeds of up to 25 Gbps on the existing platform without the need to install new fiber and also allow the telco to provide enterprises with a high-speed and low latency replacement for point-to-point (P2P) connections.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Telecom Market?

To stay informed about further developments, trends, and reports in the Thailand Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence