Key Insights

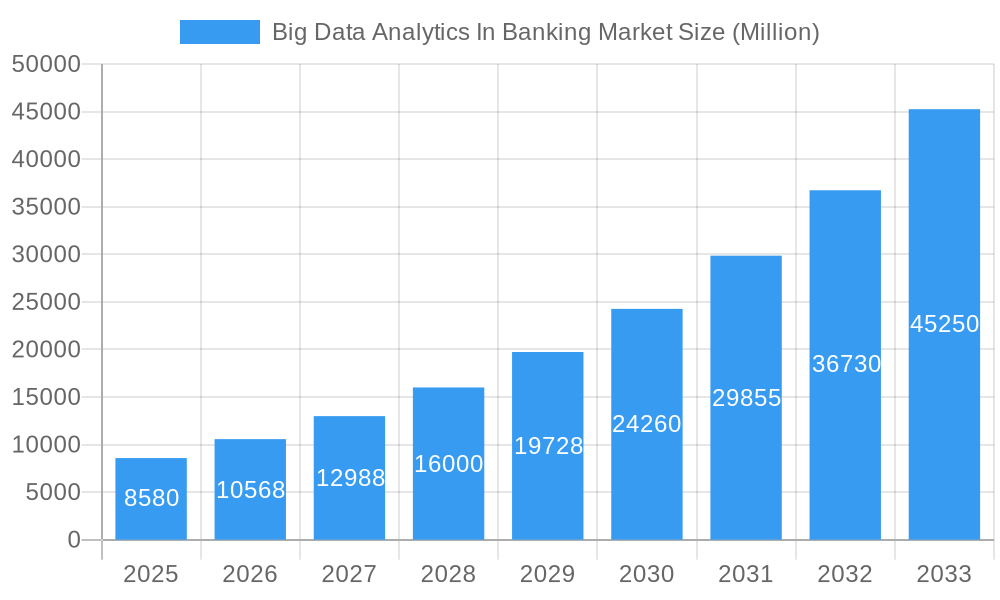

The Big Data Analytics in Banking market is experiencing explosive growth, projected to reach \$8.58 billion in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 23.11% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing need for improved fraud detection and risk management is a primary factor, with banks leveraging big data analytics to identify and mitigate fraudulent activities more effectively. Furthermore, the demand for personalized customer experiences is driving adoption, as banks use data analytics to tailor products and services to individual customer needs and preferences, enhancing customer satisfaction and loyalty. Regulatory compliance requirements also play a significant role, pushing banks to invest in advanced analytics solutions to ensure adherence to evolving data privacy and security regulations. The market is segmented by solution type, with Data Discovery and Visualization (DDV) and Advanced Analytics (AA) representing key components. DDV solutions provide banks with tools to explore and visualize large datasets, while AA solutions enable more sophisticated predictive modeling and insights. North America currently holds a significant market share, driven by early adoption of big data technologies and a robust regulatory environment. However, growth is expected to be strong across all regions, particularly in Asia Pacific and Europe, as banks in these regions increasingly adopt advanced analytics capabilities.

Big Data Analytics In Banking Market Market Size (In Billion)

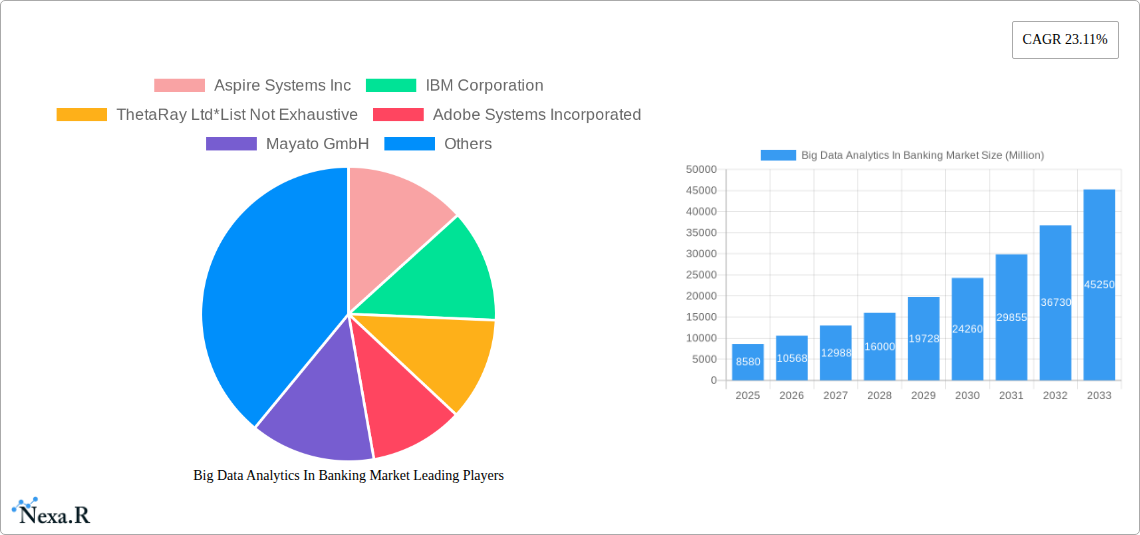

The competitive landscape is characterized by a mix of established technology providers and specialized banking solutions companies. Key players such as IBM, Oracle, and SAP are leveraging their existing infrastructure and expertise to cater to the growing demand. Meanwhile, specialized firms like Aspire Systems and ThetaRay are focusing on niche solutions, offering targeted applications for fraud detection and risk management. The continued development and adoption of cloud-based analytics platforms will significantly impact market growth in the coming years. This trend will enable banks to scale their analytics capabilities more efficiently and reduce infrastructure costs. The rise of artificial intelligence (AI) and machine learning (ML) within big data analytics will further enhance capabilities, leading to more accurate predictions and improved decision-making. While data security and privacy concerns represent potential restraints, robust regulatory frameworks and innovative security solutions are mitigating these risks, enabling the continuous expansion of this critical market segment.

Big Data Analytics In Banking Market Company Market Share

Big Data Analytics in Banking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Big Data Analytics in Banking market, encompassing market dynamics, growth trends, regional segmentation (by solution type: Data Discovery and Visualization (DDV) and Advanced Analytics (AA)), competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market size is valued in million units.

Big Data Analytics In Banking Market Market Dynamics & Structure

The Big Data Analytics in Banking market is experiencing significant growth, driven by the increasing need for efficient risk management, personalized customer experiences, and regulatory compliance. Market concentration is moderately high, with a few major players holding substantial market share, while numerous smaller companies cater to niche segments. Technological innovation, particularly in areas like AI and machine learning, is a key driver, constantly improving the accuracy and speed of data analysis. However, regulatory frameworks, such as GDPR and CCPA, impose constraints on data usage and necessitate robust security measures. The competitive landscape is characterized by both established players and emerging fintech companies, with competitive substitutes arising from open-source analytics platforms. End-user demographics are evolving, with banks increasingly prioritizing digital customer engagement strategies. M&A activity in this space is robust, with larger companies acquiring smaller firms for their technological expertise and market reach.

- Market Concentration: Moderately high, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Rapid advancements in AI, Machine Learning, and cloud computing are key drivers.

- Regulatory Framework: GDPR, CCPA, and other regulations influence data usage and security practices.

- Competitive Substitutes: Open-source analytics platforms pose a competitive threat.

- End-User Demographics: Increasing adoption by banks of digital customer engagement strategies.

- M&A Trends: Significant M&A activity, with xx deals recorded in the past 5 years.

Big Data Analytics In Banking Market Growth Trends & Insights

The Big Data Analytics in Banking market is projected to experience significant growth during the forecast period, driven by factors such as increasing volumes of financial data, the rising adoption of digital banking channels, and the need for advanced fraud detection and risk mitigation strategies. The market size is estimated at xx million in 2025 and is projected to reach xx million by 2033, exhibiting a CAGR of xx%. This growth is fueled by technological advancements like AI and machine learning, enhancing the accuracy and efficiency of data analysis. Consumer behavior shifts towards personalized services and seamless digital experiences necessitate sophisticated data analysis. Adoption rates are increasing across all banking segments, with a particularly strong uptake in areas such as customer relationship management and fraud detection. Technological disruptions, such as the emergence of blockchain technology and the increasing use of cloud-based solutions, are further accelerating market growth.

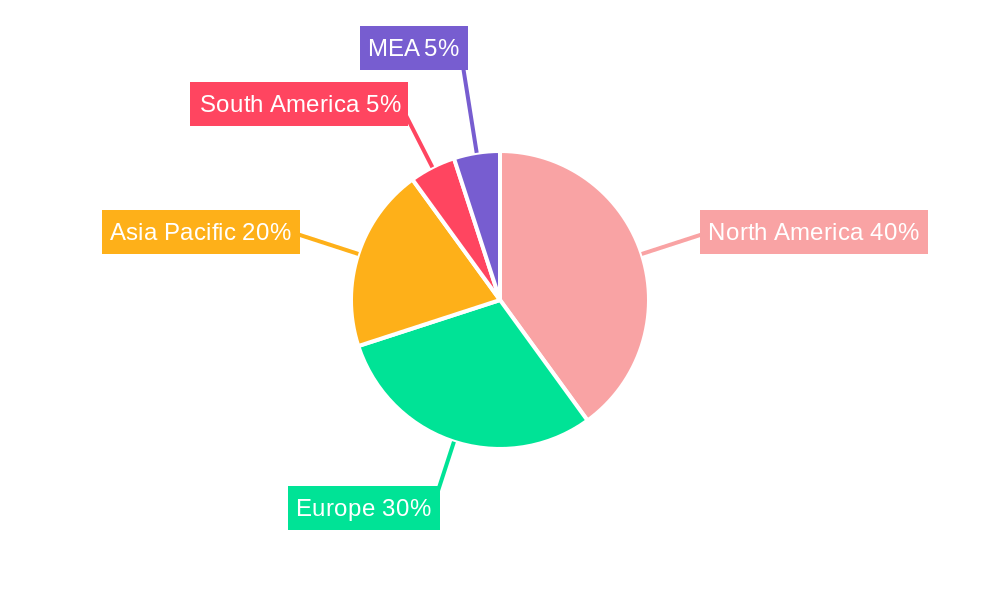

Dominant Regions, Countries, or Segments in Big Data Analytics In Banking Market

North America currently dominates the Big Data Analytics in Banking market, driven by robust technological infrastructure, early adoption of advanced analytics, and a high concentration of major banking institutions. However, regions like Asia-Pacific are experiencing rapid growth, fueled by increasing digitalization and rising fintech investments. Within solution types, Advanced Analytics (AA) holds a larger market share than Data Discovery and Visualization (DDV), reflecting the increasing demand for predictive modeling and sophisticated risk assessment tools.

- North America: High market share driven by technological advancements and high adoption rates.

- Asia-Pacific: Fastest-growing region due to increasing digitalization and fintech investments.

- Europe: Significant market presence, impacted by stringent data privacy regulations.

- By Solution Type: Advanced Analytics (AA) holds a larger market share than Data Discovery and Visualization (DDV).

- Key Drivers: Strong technological infrastructure, government support for digitalization, and high investments in fintech.

Big Data Analytics In Banking Market Product Landscape

The Big Data Analytics in Banking market offers a diverse range of products, including data warehousing solutions, predictive modeling tools, fraud detection systems, and customer relationship management (CRM) platforms. These products leverage advanced technologies such as AI, machine learning, and natural language processing to provide actionable insights from vast datasets. Key performance metrics include accuracy rates, processing speed, and scalability. Unique selling propositions often revolve around specialized features for specific banking needs, such as real-time fraud detection or personalized customer recommendations. Continuous innovation leads to improvements in analytical capabilities, security features, and user experience.

Key Drivers, Barriers & Challenges in Big Data Analytics In Banking Market

Key Drivers:

- Increasing need for regulatory compliance and risk management.

- Growing demand for personalized customer experiences.

- Advances in AI, Machine Learning, and cloud computing.

- Rise of digital banking and mobile payments.

Challenges & Restraints:

- High implementation costs and complexity.

- Data security and privacy concerns.

- Lack of skilled professionals.

- Integration challenges with legacy systems.

- Regulatory hurdles and compliance complexities, potentially impacting xx% of new implementations.

Emerging Opportunities in Big Data Analytics In Banking Market

- Growing adoption of cloud-based solutions.

- Increasing use of blockchain technology for secure transactions.

- Expansion into emerging markets with high growth potential.

- Development of specialized AI-driven tools for tasks such as credit scoring and loan underwriting.

- Increased focus on ethical and responsible use of AI in banking.

Growth Accelerators in the Big Data Analytics In Banking Market Industry

Strategic partnerships between banking institutions and technology providers are fueling market expansion. Technological breakthroughs, particularly in AI and machine learning, are continuously enhancing the capabilities of Big Data analytics solutions. Market expansion into underserved regions and the development of tailored solutions for specific banking needs are also driving growth. The increasing adoption of cloud-based platforms offers scalability and cost-effectiveness, accelerating market penetration.

Key Players Shaping the Big Data Analytics In Banking Market Market

- Aspire Systems Inc

- IBM Corporation

- ThetaRay Ltd

- Adobe Systems Incorporated

- Mayato GmbH

- Microstrategy Inc

- Alteryx Inc

- Oracle Corporation

- Mastercard Inc

- SAP SE

Notable Milestones in Big Data Analytics In Banking Market Sector

- March 2023: Alteryx earned the Google Cloud Ready - AlloyDB Designation, enhancing data access capabilities for customers.

- January 2023: Aspire Systems achieved AWS Advanced Consulting Partner status, strengthening its cloud solutions offerings.

In-Depth Big Data Analytics In Banking Market Market Outlook

The Big Data Analytics in Banking market is poised for sustained growth, driven by continuous technological innovation and increasing demand for advanced analytics capabilities. Strategic partnerships and the expansion into new markets will play a key role in shaping future market dynamics. The focus on enhancing data security and privacy will remain crucial, necessitating robust solutions and regulatory compliance. The long-term potential is significant, with opportunities for companies that can offer innovative, scalable, and secure solutions tailored to the evolving needs of the banking industry.

Big Data Analytics In Banking Market Segmentation

-

1. Solution Type

- 1.1. Data Discovery and Visualization (DDV)

- 1.2. Advanced Analytics (AA)

Big Data Analytics In Banking Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Big Data Analytics In Banking Market Regional Market Share

Geographic Coverage of Big Data Analytics In Banking Market

Big Data Analytics In Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enforcement of Government Initiatives; Risk Management and Internal Controls Across the Bank to Witness the Growth; Increasing Volume of Data Generated by Banks

- 3.3. Market Restrains

- 3.3.1. 7.1 Lack of General Awareness And Expertise7.2 Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Risk Management and Internal Controls Across the Bank to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Data Discovery and Visualization (DDV)

- 5.1.2. Advanced Analytics (AA)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. North America Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution Type

- 6.1.1. Data Discovery and Visualization (DDV)

- 6.1.2. Advanced Analytics (AA)

- 6.1. Market Analysis, Insights and Forecast - by Solution Type

- 7. Europe Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution Type

- 7.1.1. Data Discovery and Visualization (DDV)

- 7.1.2. Advanced Analytics (AA)

- 7.1. Market Analysis, Insights and Forecast - by Solution Type

- 8. Asia Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution Type

- 8.1.1. Data Discovery and Visualization (DDV)

- 8.1.2. Advanced Analytics (AA)

- 8.1. Market Analysis, Insights and Forecast - by Solution Type

- 9. Australia and New Zealand Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution Type

- 9.1.1. Data Discovery and Visualization (DDV)

- 9.1.2. Advanced Analytics (AA)

- 9.1. Market Analysis, Insights and Forecast - by Solution Type

- 10. Latin America Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution Type

- 10.1.1. Data Discovery and Visualization (DDV)

- 10.1.2. Advanced Analytics (AA)

- 10.1. Market Analysis, Insights and Forecast - by Solution Type

- 11. Middle East and Africa Big Data Analytics In Banking Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Solution Type

- 11.1.1. Data Discovery and Visualization (DDV)

- 11.1.2. Advanced Analytics (AA)

- 11.1. Market Analysis, Insights and Forecast - by Solution Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Aspire Systems Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IBM Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ThetaRay Ltd*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Adobe Systems Incorporated

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mayato GmbH

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microstrategy Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Alteryx Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Oracle Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mastercard Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAP SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Aspire Systems Inc

List of Figures

- Figure 1: Global Big Data Analytics In Banking Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Big Data Analytics In Banking Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 3: North America Big Data Analytics In Banking Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 4: North America Big Data Analytics In Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Big Data Analytics In Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Big Data Analytics In Banking Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 7: Europe Big Data Analytics In Banking Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 8: Europe Big Data Analytics In Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Big Data Analytics In Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Big Data Analytics In Banking Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 11: Asia Big Data Analytics In Banking Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 12: Asia Big Data Analytics In Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Big Data Analytics In Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Big Data Analytics In Banking Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 15: Australia and New Zealand Big Data Analytics In Banking Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 16: Australia and New Zealand Big Data Analytics In Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Big Data Analytics In Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Big Data Analytics In Banking Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 19: Latin America Big Data Analytics In Banking Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 20: Latin America Big Data Analytics In Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Big Data Analytics In Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Big Data Analytics In Banking Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 23: Middle East and Africa Big Data Analytics In Banking Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 24: Middle East and Africa Big Data Analytics In Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Big Data Analytics In Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 4: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 6: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 8: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 10: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 12: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 14: Global Big Data Analytics In Banking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Big Data Analytics In Banking Market?

The projected CAGR is approximately 23.11%.

2. Which companies are prominent players in the Big Data Analytics In Banking Market?

Key companies in the market include Aspire Systems Inc, IBM Corporation, ThetaRay Ltd*List Not Exhaustive, Adobe Systems Incorporated, Mayato GmbH, Microstrategy Inc, Alteryx Inc, Oracle Corporation, Mastercard Inc, SAP SE.

3. What are the main segments of the Big Data Analytics In Banking Market?

The market segments include Solution Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Enforcement of Government Initiatives; Risk Management and Internal Controls Across the Bank to Witness the Growth; Increasing Volume of Data Generated by Banks.

6. What are the notable trends driving market growth?

Risk Management and Internal Controls Across the Bank to Witness the Growth.

7. Are there any restraints impacting market growth?

7.1 Lack of General Awareness And Expertise7.2 Data Security Concerns.

8. Can you provide examples of recent developments in the market?

March 2023 - Alteryx has declared that it had successfully earned the Google Cloud Ready - AlloyDB Designation. Customers may access data from various databases using Alteryx's growing library of connectors, enabling them to use more data than ever before. Cloud Ready - AlloyDB is a new moniker for the products offered by Google Cloud's technology partners that interact with AlloyDB. By receiving this recognition, Alteryx has worked closely with Google Cloud to incorporate support for AlloyDB into its solutions and fine-tune its current capabilities for the best results.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Big Data Analytics In Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Big Data Analytics In Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Big Data Analytics In Banking Market?

To stay informed about further developments, trends, and reports in the Big Data Analytics In Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence