Key Insights

The global Biotechnology Market is projected for substantial growth, expected to reach $1,770 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 13.5%. This expansion is attributed to increasing demand for advanced healthcare solutions, pharmaceutical innovations, and sustainable industrial practices. Key growth factors include the rising incidence of chronic diseases, a focus on personalized medicine, and significant R&D investments by leading biotechnology firms. Advancements in Nanobiotechnology, Tissue Engineering and Regeneration, and DNA Sequencing are creating new therapeutic and diagnostic possibilities.

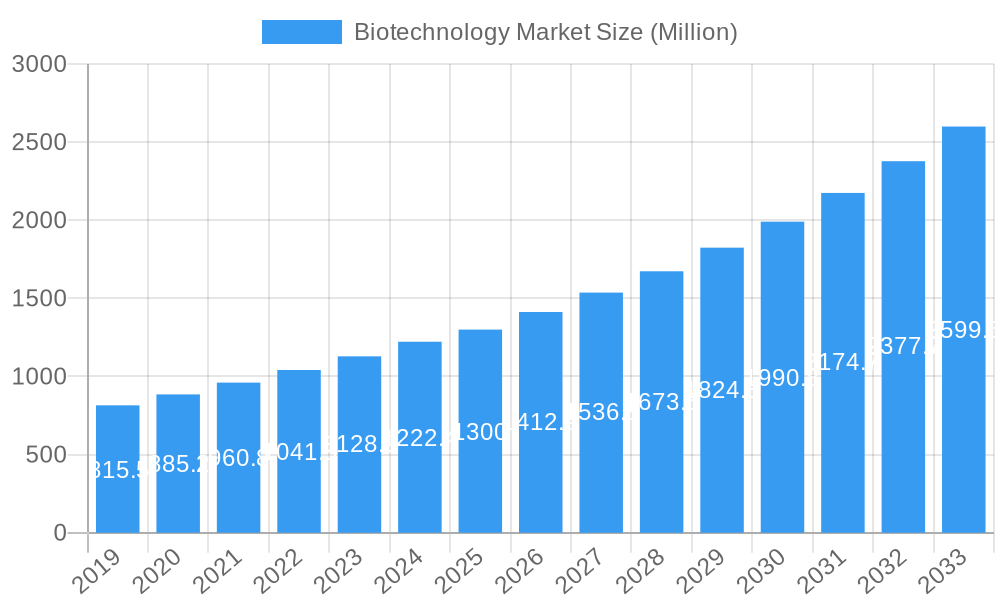

Biotechnology Market Market Size (In Million)

The market is segmented across various applications, with Healthcare being the primary segment due to its role in addressing unmet medical needs. The Food & Beverage, Natural Resources and Environment, and Industrial Processing sectors also offer significant growth potential through enhanced efficiency and novel product development. While market growth is robust, stringent regulations and high R&D costs present potential challenges. However, continuous technological innovation and increasing global demand are expected to ensure a dynamic market future. Key players such as Johnson & Johnson, Roche Holdings AG, and Novartis International are instrumental in shaping market trends.

Biotechnology Market Company Market Share

Global Biotechnology Market: Trends, Opportunities, and Forecasts 2025-2033

This comprehensive report provides an in-depth analysis of the global biotechnology market, covering market size, share, and growth from 2019 to 2033, with a specific forecast for 2025-2033. It explores key innovations including nanobiotechnology, tissue engineering, DNA sequencing, cell-based assays, chromatography, and fermentation.

The report details biotechnology applications across healthcare, food & beverage, natural resources, industrial processing, and bioinformatics. It identifies leading companies such as Johnson & Johnson, Roche Holdings AG, and Novartis International, among others, and their market impact. Understanding market drivers, barriers, and opportunities, along with parent and child market dynamics, is crucial for strategic navigation and investment in the biotechnology sector.

Biotechnology Market Market Dynamics & Structure

The global biotechnology market is characterized by a moderate to high degree of concentration, with a few leading players dominating significant market share in specialized segments. Technological innovation serves as the primary engine for market expansion, fueled by substantial R&D investments in areas like gene editing, personalized medicine, and synthetic biology. Stringent regulatory frameworks, particularly in the healthcare and pharmaceutical sectors, play a crucial role in shaping product development and market entry. The competitive landscape is dynamic, with a continuous influx of novel products and substitutes emerging from both established companies and agile startups. End-user demographics are diversifying, with increasing demand from healthcare providers, agricultural enterprises, and industrial manufacturers. Mergers and acquisitions (M&A) activity remains robust, indicative of a consolidating industry seeking to acquire new technologies, expand product portfolios, and enhance market reach.

- Market Concentration: High for certain therapeutic areas and technologies, moderate overall.

- Technological Innovation Drivers: Gene editing (CRISPR), mRNA technology, biomanufacturing advancements, AI in drug discovery.

- Regulatory Frameworks: FDA, EMA, and other national bodies with evolving guidelines for novel therapies and diagnostics.

- Competitive Product Substitutes: Bio-based alternatives to traditional chemicals, advanced diagnostics replacing older methods.

- End-User Demographics: Growing demand from pharmaceutical, agricultural, environmental, and industrial sectors.

- M&A Trends: Strategic acquisitions for pipeline expansion and technological integration.

Biotechnology Market Growth Trends & Insights

The biotechnology market has demonstrated consistent and robust growth, driven by an escalating need for innovative solutions across healthcare, agriculture, and industrial applications. The market size has seen significant expansion over the historical period (2019-2024), with projections indicating sustained upward trajectory through 2033. Adoption rates for biotechnology-derived products and services are on the rise, propelled by increasing global health awareness, advancements in genetic engineering, and a growing demand for sustainable and eco-friendly solutions. Technological disruptions, such as the rapid development and deployment of mRNA vaccines and the increasing accessibility of DNA sequencing, are fundamentally reshaping the industry's landscape. Consumer behavior shifts, particularly a greater acceptance of genetically modified organisms (GMOs) in food and a demand for personalized healthcare treatments, are also contributing to market expansion.

The base year 2025 is expected to witness a substantial market valuation, with the forecast period 2025–2033 poised for a Compound Annual Growth Rate (CAGR) of approximately 12.5%, reaching an estimated market size of USD 1,350,000 million by 2033. This growth is underpinned by continued investments in biopharmaceuticals, an expanding pipeline of novel biologics, and the increasing application of biotechnology in areas like industrial enzymes and biofuels. The penetration of advanced diagnostic tools and personalized therapies is accelerating, further bolstering market growth. Market players are focusing on strategic collaborations and R&D to address unmet medical needs and create sustainable solutions for various industries. The impact of genomics, proteomics, and bioinformatics on drug discovery and development continues to be a major growth catalyst.

Dominant Regions, Countries, or Segments in Biotechnology Market

The North America region stands as a dominant force in the global biotechnology market, driven by a strong ecosystem of research institutions, venture capital funding, and leading pharmaceutical and biotech companies. The United States, in particular, spearheads this dominance with its extensive investments in R&D, a well-established regulatory framework, and a high concentration of innovative biotech startups and established corporations. Within the Technology segment, DNA Sequencing and Cell-based Assays are pivotal drivers of growth, enabling advancements in diagnostics, drug discovery, and personalized medicine. In terms of Applications, Healthcare remains the largest and most influential segment, accounting for a significant portion of the market revenue, fueled by the demand for novel therapeutics, vaccines, and advanced diagnostic tools.

- Leading Region: North America, with the United States as the primary contributor.

- Key Technology Segments Driving Growth:

- DNA Sequencing: Facilitates genomic research, personalized medicine, and disease diagnostics. Market share estimated at 18% for 2025.

- Cell-based Assays: Crucial for drug screening, toxicity testing, and research. Estimated market share of 15% for 2025.

- Nanobiotechnology: Emerging applications in targeted drug delivery and medical imaging. Expected to grow at a CAGR of 15.2%.

- Dominant Application Segment:

- Healthcare: Accounts for over 65% of the total market application revenue. Driven by demand for biopharmaceuticals, diagnostics, and gene therapies.

- Factors Contributing to Dominance:

- Robust government funding for scientific research.

- Presence of world-renowned academic institutions and research centers.

- Significant venture capital investment in early-stage biotech companies.

- Favorable regulatory pathways for innovative medical products.

- High prevalence of chronic diseases driving demand for advanced treatments.

Biotechnology Market Product Landscape

The biotechnology market is characterized by a rapidly evolving product landscape, with continuous innovation driving the development of novel therapeutics, diagnostics, and industrial solutions. Key product categories include biologics, vaccines, gene therapies, diagnostic kits, and biomanufactured industrial products. Innovations in gene editing technologies like CRISPR-Cas9 have opened avenues for treating genetic disorders, while advancements in mRNA technology have revolutionized vaccine development. The market also sees a surge in personalized medicine solutions, tailored to individual genetic profiles, and the development of biosimilars, offering cost-effective alternatives to established biologics. Product performance is measured by efficacy, safety, specificity, and cost-effectiveness, with ongoing efforts to improve these metrics through rigorous research and development.

Key Drivers, Barriers & Challenges in Biotechnology Market

The biotechnology market is propelled by several key drivers, including increasing global demand for advanced healthcare solutions, significant investments in research and development, favorable government policies promoting innovation, and the growing prevalence of chronic diseases. Technological advancements, particularly in genomics, proteomics, and synthetic biology, are crucial catalysts. For instance, the development of novel gene therapies is addressing previously untreatable genetic conditions.

However, the market faces substantial barriers and challenges. High research and development costs, coupled with lengthy and complex regulatory approval processes, pose significant hurdles. Intellectual property protection and patent cliffs can also impact market profitability. Supply chain disruptions for specialized raw materials and skilled workforce shortages in areas like bioprocessing are further challenges. Competitive pressures from both established players and emerging startups, alongside ethical considerations surrounding genetic modifications and data privacy, also shape market dynamics.

Emerging Opportunities in Biotechnology Market

Emerging opportunities in the biotechnology market are abundant, driven by unmet medical needs and the pursuit of sustainable solutions. The expansion of personalized medicine, leveraging genetic data to tailor treatments, represents a significant growth area. Advancements in regenerative medicine and tissue engineering hold promise for treating degenerative diseases and injuries. The application of biotechnology in the agri-food sector, focusing on sustainable crop production and novel food sources, is also gaining momentum. Furthermore, the development of novel diagnostics for early disease detection and the use of biosensors for environmental monitoring present untapped markets. The growing interest in bio-based chemicals and materials offers substantial potential for the industrial biotechnology segment.

Growth Accelerators in the Biotechnology Market Industry

Several factors are acting as significant growth accelerators for the biotechnology market. Continued advancements in genomic and proteomic technologies are enabling a deeper understanding of biological processes, leading to the discovery of new drug targets and therapeutic approaches. Strategic partnerships and collaborations between academic institutions, research organizations, and private companies are fostering innovation and accelerating the translation of research into marketable products. Government initiatives, including funding for R&D and supportive regulatory frameworks, are further stimulating growth. The increasing adoption of artificial intelligence and machine learning in drug discovery and development is also speeding up the identification of promising candidates and optimizing clinical trial designs.

Key Players Shaping the Biotechnology Market Market

- Johnson & Johnson

- Roche Holdings AG

- Novartis International

- Amgen Inc

- Gilead Science Inc

- Moderna Inc

- Biogen Inc

- Regeneron Pharmaceuticals Inc

- CRISPR Therapeutics AG

- Vertex Pharmaceuticals Inc

- Biocon Ltd

- Lonza Group AG

Notable Milestones in Biotechnology Market Sector

- June 2024: Johnson & Johnson announced the acquisition of Proteologix Inc., a privately-held biotechnology company focused on bispecific antibodies for immune-mediated diseases, for USD 850 million. This acquisition enhances J&J's bispecific antibody program capabilities.

- May 2024: Merck announced the acquisition of Eyebiotech Limited, a privately held ophthalmology-focused biotechnology company, for up to USD 3 billion, including an upfront payment of USD 1.3 billion and potential milestone payments.

- January 2024: GNT partnered with Plume Biotechnology, a UK-based startup focused on fermentation science and bioprocessing for natural colors, to develop new plant-based Exberry colors for food and beverages using fermentation.

In-Depth Biotechnology Market Market Outlook

The biotechnology market is poised for substantial future growth, driven by an unwavering commitment to innovation and the persistent demand for advanced solutions across critical sectors. The ongoing advancements in genetic engineering, coupled with the increasing application of AI and machine learning, are set to accelerate the discovery and development of novel therapeutics and diagnostics. Strategic collaborations and the expansion into emerging markets will further fuel this growth. The continued focus on addressing unmet medical needs, particularly in areas like rare diseases and oncology, alongside the growing importance of sustainable bioprocessing and bio-based products, ensures a dynamic and expanding future for the biotechnology industry, with significant opportunities for investment and market penetration.

Biotechnology Market Segmentation

-

1. Technology

- 1.1. Nanobiotechnology

- 1.2. Tissue Engineering and Regeneration

- 1.3. DNA Sequencing

- 1.4. Cell-based Assays

- 1.5. Chromatography

- 1.6. Fermentation

- 1.7. Others

-

2. Application

- 2.1. Healthcare

- 2.2. Food & Beverage

- 2.3. Natural Resources and Environment

- 2.4. Industrial Processing

- 2.5. Bioinformatics

- 2.6. Others

Biotechnology Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Biotechnology Market Regional Market Share

Geographic Coverage of Biotechnology Market

Biotechnology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Presence Of Favorable Government Initiatives; Growing Healthcare Expenditure Boosting Development Of Effective Personalized Diagnostic & Therapeutic Procedures For Cancer; Rising Demand For Agro-Based Products

- 3.3. Market Restrains

- 3.3.1. Presence Of Favorable Government Initiatives; Growing Healthcare Expenditure Boosting Development Of Effective Personalized Diagnostic & Therapeutic Procedures For Cancer; Rising Demand For Agro-Based Products

- 3.4. Market Trends

- 3.4.1. Healthcare Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Nanobiotechnology

- 5.1.2. Tissue Engineering and Regeneration

- 5.1.3. DNA Sequencing

- 5.1.4. Cell-based Assays

- 5.1.5. Chromatography

- 5.1.6. Fermentation

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Healthcare

- 5.2.2. Food & Beverage

- 5.2.3. Natural Resources and Environment

- 5.2.4. Industrial Processing

- 5.2.5. Bioinformatics

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Nanobiotechnology

- 6.1.2. Tissue Engineering and Regeneration

- 6.1.3. DNA Sequencing

- 6.1.4. Cell-based Assays

- 6.1.5. Chromatography

- 6.1.6. Fermentation

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Healthcare

- 6.2.2. Food & Beverage

- 6.2.3. Natural Resources and Environment

- 6.2.4. Industrial Processing

- 6.2.5. Bioinformatics

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Nanobiotechnology

- 7.1.2. Tissue Engineering and Regeneration

- 7.1.3. DNA Sequencing

- 7.1.4. Cell-based Assays

- 7.1.5. Chromatography

- 7.1.6. Fermentation

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Healthcare

- 7.2.2. Food & Beverage

- 7.2.3. Natural Resources and Environment

- 7.2.4. Industrial Processing

- 7.2.5. Bioinformatics

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Nanobiotechnology

- 8.1.2. Tissue Engineering and Regeneration

- 8.1.3. DNA Sequencing

- 8.1.4. Cell-based Assays

- 8.1.5. Chromatography

- 8.1.6. Fermentation

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Healthcare

- 8.2.2. Food & Beverage

- 8.2.3. Natural Resources and Environment

- 8.2.4. Industrial Processing

- 8.2.5. Bioinformatics

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Nanobiotechnology

- 9.1.2. Tissue Engineering and Regeneration

- 9.1.3. DNA Sequencing

- 9.1.4. Cell-based Assays

- 9.1.5. Chromatography

- 9.1.6. Fermentation

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Healthcare

- 9.2.2. Food & Beverage

- 9.2.3. Natural Resources and Environment

- 9.2.4. Industrial Processing

- 9.2.5. Bioinformatics

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Nanobiotechnology

- 10.1.2. Tissue Engineering and Regeneration

- 10.1.3. DNA Sequencing

- 10.1.4. Cell-based Assays

- 10.1.5. Chromatography

- 10.1.6. Fermentation

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Healthcare

- 10.2.2. Food & Beverage

- 10.2.3. Natural Resources and Environment

- 10.2.4. Industrial Processing

- 10.2.5. Bioinformatics

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East and Africa Biotechnology Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Nanobiotechnology

- 11.1.2. Tissue Engineering and Regeneration

- 11.1.3. DNA Sequencing

- 11.1.4. Cell-based Assays

- 11.1.5. Chromatography

- 11.1.6. Fermentation

- 11.1.7. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Healthcare

- 11.2.2. Food & Beverage

- 11.2.3. Natural Resources and Environment

- 11.2.4. Industrial Processing

- 11.2.5. Bioinformatics

- 11.2.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Johnson & Johnson

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Roche Holdings AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Novartis International

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Amgen Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gilead Science Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Moderna Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Biogen Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Regeneron Pharmaceuticals Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CRISPR Therapeutics AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Vertex Pharmaceuticals Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Biocon Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Lonza Group AG*List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Johnson & Johnson

List of Figures

- Figure 1: Global Biotechnology Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Biotechnology Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Biotechnology Market Revenue (billion), by Technology 2025 & 2033

- Figure 4: North America Biotechnology Market Volume (Trillion), by Technology 2025 & 2033

- Figure 5: North America Biotechnology Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Biotechnology Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Biotechnology Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Biotechnology Market Volume (Trillion), by Application 2025 & 2033

- Figure 9: North America Biotechnology Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Biotechnology Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Biotechnology Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Biotechnology Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Biotechnology Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Biotechnology Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Biotechnology Market Revenue (billion), by Technology 2025 & 2033

- Figure 16: Europe Biotechnology Market Volume (Trillion), by Technology 2025 & 2033

- Figure 17: Europe Biotechnology Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Biotechnology Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe Biotechnology Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Biotechnology Market Volume (Trillion), by Application 2025 & 2033

- Figure 21: Europe Biotechnology Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Biotechnology Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Biotechnology Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Biotechnology Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe Biotechnology Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Biotechnology Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Biotechnology Market Revenue (billion), by Technology 2025 & 2033

- Figure 28: Asia Biotechnology Market Volume (Trillion), by Technology 2025 & 2033

- Figure 29: Asia Biotechnology Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Biotechnology Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Biotechnology Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Biotechnology Market Volume (Trillion), by Application 2025 & 2033

- Figure 33: Asia Biotechnology Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Biotechnology Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Biotechnology Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Biotechnology Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Asia Biotechnology Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Biotechnology Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Biotechnology Market Revenue (billion), by Technology 2025 & 2033

- Figure 40: Australia and New Zealand Biotechnology Market Volume (Trillion), by Technology 2025 & 2033

- Figure 41: Australia and New Zealand Biotechnology Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Australia and New Zealand Biotechnology Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Australia and New Zealand Biotechnology Market Revenue (billion), by Application 2025 & 2033

- Figure 44: Australia and New Zealand Biotechnology Market Volume (Trillion), by Application 2025 & 2033

- Figure 45: Australia and New Zealand Biotechnology Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Australia and New Zealand Biotechnology Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Australia and New Zealand Biotechnology Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Biotechnology Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Biotechnology Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Biotechnology Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Biotechnology Market Revenue (billion), by Technology 2025 & 2033

- Figure 52: Latin America Biotechnology Market Volume (Trillion), by Technology 2025 & 2033

- Figure 53: Latin America Biotechnology Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Latin America Biotechnology Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Latin America Biotechnology Market Revenue (billion), by Application 2025 & 2033

- Figure 56: Latin America Biotechnology Market Volume (Trillion), by Application 2025 & 2033

- Figure 57: Latin America Biotechnology Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Latin America Biotechnology Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Latin America Biotechnology Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Latin America Biotechnology Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Latin America Biotechnology Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Biotechnology Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Biotechnology Market Revenue (billion), by Technology 2025 & 2033

- Figure 64: Middle East and Africa Biotechnology Market Volume (Trillion), by Technology 2025 & 2033

- Figure 65: Middle East and Africa Biotechnology Market Revenue Share (%), by Technology 2025 & 2033

- Figure 66: Middle East and Africa Biotechnology Market Volume Share (%), by Technology 2025 & 2033

- Figure 67: Middle East and Africa Biotechnology Market Revenue (billion), by Application 2025 & 2033

- Figure 68: Middle East and Africa Biotechnology Market Volume (Trillion), by Application 2025 & 2033

- Figure 69: Middle East and Africa Biotechnology Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Biotechnology Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Biotechnology Market Revenue (billion), by Country 2025 & 2033

- Figure 72: Middle East and Africa Biotechnology Market Volume (Trillion), by Country 2025 & 2033

- Figure 73: Middle East and Africa Biotechnology Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Biotechnology Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 3: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 5: Global Biotechnology Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Biotechnology Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 9: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 11: Global Biotechnology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Biotechnology Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 15: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 17: Global Biotechnology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Biotechnology Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 21: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 23: Global Biotechnology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Biotechnology Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 27: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 29: Global Biotechnology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Biotechnology Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 32: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 33: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 35: Global Biotechnology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Biotechnology Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Biotechnology Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 38: Global Biotechnology Market Volume Trillion Forecast, by Technology 2020 & 2033

- Table 39: Global Biotechnology Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Biotechnology Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 41: Global Biotechnology Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Biotechnology Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biotechnology Market?

The projected CAGR is approximately 13.5%.

2. Which companies are prominent players in the Biotechnology Market?

Key companies in the market include Johnson & Johnson, Roche Holdings AG, Novartis International, Amgen Inc, Gilead Science Inc, Moderna Inc, Biogen Inc, Regeneron Pharmaceuticals Inc, CRISPR Therapeutics AG, Vertex Pharmaceuticals Inc, Biocon Ltd, Lonza Group AG*List Not Exhaustive.

3. What are the main segments of the Biotechnology Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1770 billion as of 2022.

5. What are some drivers contributing to market growth?

Presence Of Favorable Government Initiatives; Growing Healthcare Expenditure Boosting Development Of Effective Personalized Diagnostic & Therapeutic Procedures For Cancer; Rising Demand For Agro-Based Products.

6. What are the notable trends driving market growth?

Healthcare Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Presence Of Favorable Government Initiatives; Growing Healthcare Expenditure Boosting Development Of Effective Personalized Diagnostic & Therapeutic Procedures For Cancer; Rising Demand For Agro-Based Products.

8. Can you provide examples of recent developments in the market?

June 2024: Johnson & Johnson announced the acquisition of Proteologix Inc., a privately-held biotechnology company focused on bispecific antibodies for immune-mediated diseases, for USD 850 million. Beyond PX-128 and PX-130, this acquisition will provide Johnson & Johnson with eight other bispecific antibody programs with applications across various other diseases, further boosting the Company’s capabilities to create novel bispecific programs.May 2024: Merck announced the acquisition of Eyebiotech Limited, a privately held ophthalmology-focused biotechnology company. Under the terms of the agreement, the company, through its subsidiary, will acquire all shares of EyeBio for up to USD 3 billion, including an upfront payment of USD 1.3 billion in cash and a further potential USD 1.7 billion in developmental, regulatory, and commercial milestone payments.January 2024: GNT partnered with Plume Biotechnology, a UK-based startup focused on fermentation science and bioprocessing for natural colors, to develop a new plant-based Exberry color for food and beverages using fermentation. The partnership will enable GNT to expand its plant-based Exberry options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biotechnology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biotechnology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biotechnology Market?

To stay informed about further developments, trends, and reports in the Biotechnology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence