Key Insights

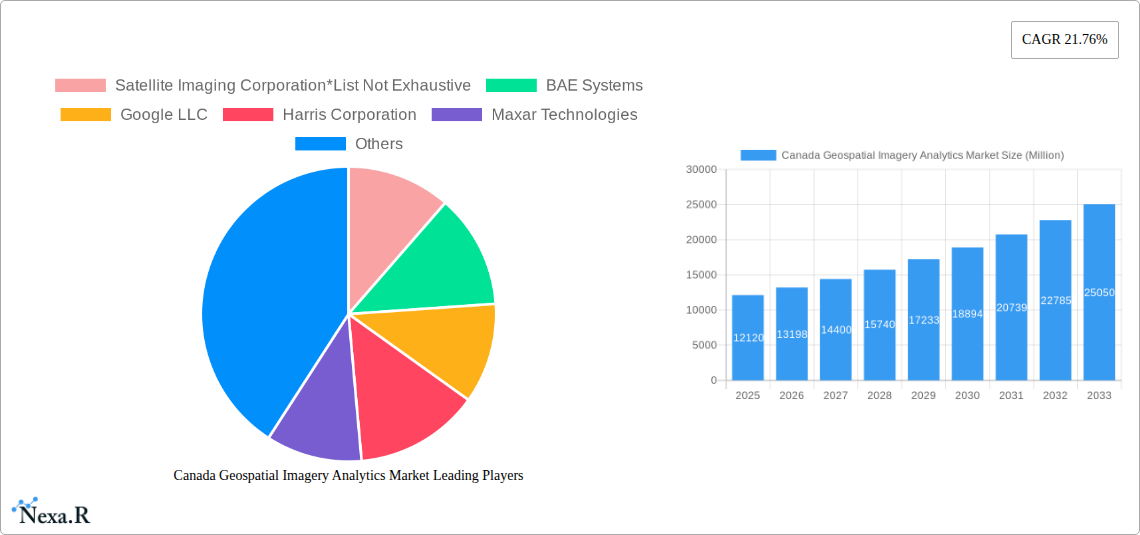

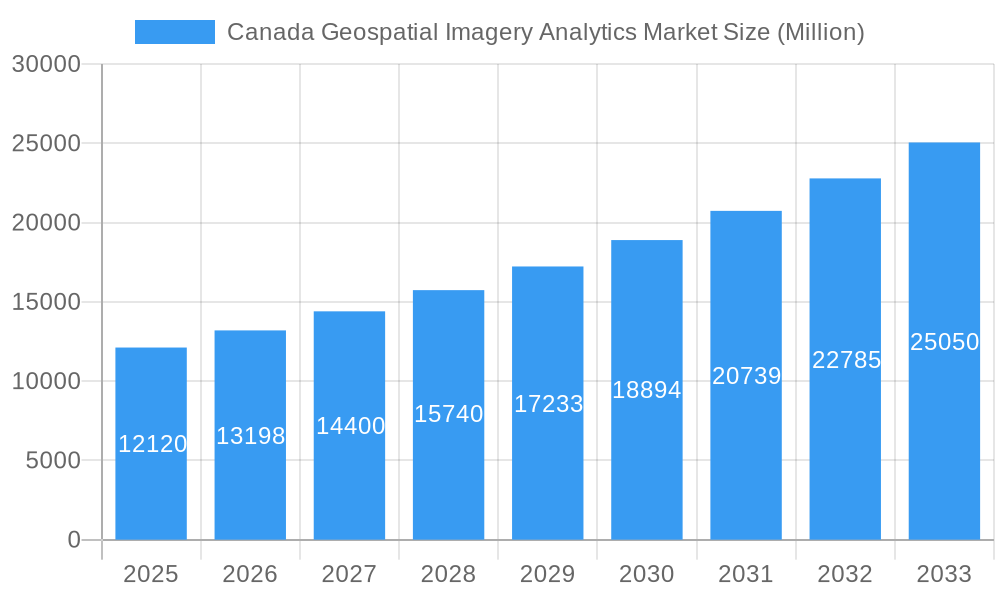

The Canadian geospatial imagery analytics market is poised for significant expansion, projected to reach an estimated $12.12 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 8.9% through 2033. This growth is propelled by an increasing demand for advanced analytical capabilities across various sectors. Key drivers include the growing adoption of remote sensing technologies for environmental monitoring, infrastructure development, and defense applications. The Canadian government's strategic investments in space programs and defense modernization further fuel this demand. Furthermore, the burgeoning use of artificial intelligence and machine learning within imagery analytics is enabling deeper insights and more accurate predictions, making these solutions indispensable for businesses and public entities alike. The market's expansion is also supported by the increasing availability of high-resolution satellite and aerial imagery, coupled with advancements in data processing and storage capabilities.

Canada Geospatial Imagery Analytics Market Market Size (In Billion)

The market is segmented across diverse applications, with Imagery Analytics and Video Analytics forming the core technological components. Deployment models are shifting towards Cloud solutions, offering scalability and cost-efficiency, though On-premise solutions retain relevance for organizations with strict data security requirements. Large Enterprises are currently the primary adopters, driven by their substantial data volumes and the complexity of their analytical needs. However, the growing affordability and accessibility of geospatial imagery analytics tools are creating significant opportunities within the SMEs segment. Key verticals driving adoption include Defense and Security, Environmental Monitoring, Government, and Engineering and Construction, with emerging applications in Insurance and Agriculture demonstrating considerable growth potential. Leading companies like Satellite Imaging Corporation, BAE Systems, Google LLC, and Maxar Technologies are actively shaping the market landscape through innovation and strategic partnerships, contributing to the overall dynamism and competitive nature of the Canadian geospatial imagery analytics sector.

Canada Geospatial Imagery Analytics Market Company Market Share

Canada Geospatial Imagery Analytics Market: Comprehensive Insights and Future Outlook (2019–2033)

This report provides an in-depth analysis of the Canada Geospatial Imagery Analytics Market, offering critical insights into its dynamics, growth trajectories, and future potential. With a study period spanning from 2019 to 2033, and a base year of 2025, this comprehensive report leverages advanced analytics and industry-specific data to forecast market evolution and identify key opportunities. Discover the driving forces behind the burgeoning Canadian geospatial imagery analytics sector, from technological advancements and evolving regulatory landscapes to emerging applications across diverse verticals.

Canada Geospatial Imagery Analytics Market Market Dynamics & Structure

The Canada Geospatial Imagery Analytics Market is characterized by a dynamic interplay of technological innovation, government initiatives, and increasing adoption across a spectrum of industries. Market concentration is moderate, with a few key players like Maxar Technologies and BAE Systems holding significant influence, while a growing number of innovative SMEs contribute to market vibrancy. Technological innovation is a primary driver, fueled by advancements in artificial intelligence (AI), machine learning (ML), and cloud computing, enhancing the accuracy and speed of imagery analysis. Regulatory frameworks, particularly those surrounding data privacy and national security, shape market entry and operational strategies. Competitive product substitutes, such as traditional surveying methods, are steadily being displaced by the efficiency and comprehensiveness of geospatial analytics. End-user demographics are shifting, with a broader acceptance of data-driven decision-making across all organization sizes, from Small and Medium-sized Enterprises (SMEs) to Large Enterprises. Mergers and Acquisitions (M&A) are a notable trend, as larger entities seek to consolidate market share and acquire specialized technological capabilities.

- Market Concentration: Moderate, with key players and a growing SME segment.

- Technological Innovation Drivers: AI, ML, cloud computing, high-resolution satellite technology.

- Regulatory Frameworks: Data privacy, national security, environmental regulations.

- Competitive Product Substitutes: Traditional surveying, manual data analysis.

- End-User Demographics: Growing adoption by SMEs and Large Enterprises.

- M&A Trends: Strategic acquisitions to enhance technological portfolios and market reach.

Canada Geospatial Imagery Analytics Market Growth Trends & Insights

The Canada Geospatial Imagery Analytics Market is poised for significant expansion, driven by increasing demand for actionable insights derived from satellite and aerial imagery. The market size is projected to grow substantially from an estimated USD 1.5 billion in 2025 to USD 4.2 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 13.9% during the forecast period (2025–2033). This growth trajectory is underpinned by a rapid acceleration in adoption rates across various sectors, including environmental monitoring, defense, and insurance. Technological disruptions, such as the integration of AI for automated feature extraction and predictive modeling, are revolutionizing how geospatial data is processed and utilized. Consumer behavior shifts are evident, with organizations increasingly prioritizing data-driven decision-making to enhance operational efficiency, mitigate risks, and identify new opportunities. The Canadian government's commitment to investing in satellite technology, exemplified by initiatives like Radarsat+, further bolsters the market by ensuring a consistent supply of high-quality Earth observation data. This increased data availability, coupled with advancements in analytical tools, is democratizing access to geospatial insights, making them more accessible and valuable to a wider array of users. The evolving landscape of cloud-based solutions is also a key enabler, providing scalable and cost-effective platforms for data storage and analysis, thereby fostering broader market penetration.

Dominant Regions, Countries, or Segments in Canada Geospatial Imagery Analytics Market

The Canada Geospatial Imagery Analytics Market exhibits strong growth across multiple segments, with certain areas demonstrating particular dominance. Within the Type segment, Imagery Analytics is currently the leading driver, accounting for an estimated 75% of the market share in 2025, due to its broad applicability in sectors like environmental monitoring and defense. However, Video Analytics is rapidly emerging as a high-growth area, projected to capture significant market share by 2033. The Deployment Mode is increasingly shifting towards Cloud solutions, which are expected to hold over 60% of the market by 2025, offering scalability, accessibility, and cost-effectiveness, while On-premise solutions remain relevant for highly sensitive government and defense applications. In terms of Organization Size, Large Enterprises currently dominate, contributing approximately 65% to the market revenue in 2025, owing to their larger budgets and more complex analytical needs. Nevertheless, the adoption by SMEs is projected to grow at a faster pace, driven by the availability of more affordable and user-friendly geospatial analytics platforms.

The Verticals segment showcases the widespread impact of geospatial imagery analytics. Defense and Security is a major contributor, benefiting from advanced surveillance, intelligence gathering, and threat assessment capabilities. Environmental Monitoring is another dominant sector, crucial for tracking climate change impacts, natural disasters, and resource management, with significant government investment supporting its growth. The Government vertical itself is a substantial consumer of geospatial data for urban planning, infrastructure development, and public safety. The Insurance sector is rapidly adopting these technologies for risk assessment, claims processing, and fraud detection, particularly after severe weather events. Agriculture is leveraging imagery analytics for precision farming, crop yield prediction, and pest management, leading to improved efficiency and sustainability.

- Leading Type: Imagery Analytics (75% market share in 2025), with Video Analytics showing rapid growth.

- Dominant Deployment Mode: Cloud solutions projected to exceed 60% market share by 2025.

- Primary Organization Size: Large Enterprises dominate, but SMEs exhibit higher growth rates.

- Key Verticals Driving Growth: Defense and Security, Environmental Monitoring, Government, Insurance, and Agriculture.

- Factors Contributing to Dominance: Government investments, critical need for data-driven decision-making, technological advancements, and increasing awareness of geospatial analytics benefits.

Canada Geospatial Imagery Analytics Market Product Landscape

The Canada Geospatial Imagery Analytics Market is distinguished by continuous product innovation, driven by the integration of advanced AI and ML algorithms. Key product offerings include sophisticated software platforms for image processing, feature extraction, and change detection. Applications are expanding rapidly, with specialized solutions emerging for precision agriculture, urban planning, environmental impact assessment, and infrastructure monitoring. Performance metrics are consistently improving, with enhanced spatial resolution, temporal frequency, and analytical accuracy. Unique selling propositions often lie in the ability to provide real-time insights, predictive analytics, and automated reporting. Technological advancements are focused on democratizing complex analytical capabilities, making them accessible to a broader range of users through intuitive interfaces and cloud-based deployment models.

Key Drivers, Barriers & Challenges in Canada Geospatial Imagery Analytics Market

The Canada Geospatial Imagery Analytics Market is propelled by several key drivers. Government investments in satellite technology and Earth observation are creating a robust data infrastructure. Advancements in AI and ML are enhancing the analytical capabilities and efficiency of imagery processing. The increasing need for data-driven decision-making across industries, from environmental monitoring to disaster management, further fuels demand. Growing awareness of the benefits of geospatial analytics in sectors like insurance and agriculture is also a significant catalyst.

However, the market faces several barriers and challenges. High initial investment costs for sophisticated software and hardware can be a restraint for some organizations, particularly SMEs. Data integration complexities, involving disparate data sources and formats, pose technical hurdles. Regulatory compliance, especially concerning data privacy and security, requires careful navigation. The shortage of skilled geospatial analysts and data scientists can limit adoption and effective utilization. Furthermore, competition from established players and the rapid pace of technological change necessitate continuous innovation and adaptation.

Emerging Opportunities in Canada Geospatial Imagery Analytics Market

Emerging opportunities in the Canada Geospatial Imagery Analytics Market are abundant, driven by evolving technological capabilities and unmet needs across various sectors. The growing demand for real-time disaster response and recovery solutions presents a significant avenue for growth. The application of AI-powered analytics in climate change adaptation and mitigation strategies, such as carbon footprint monitoring and sustainable resource management, is poised for expansion. The development of digital twin technologies for urban planning and infrastructure management offers innovative avenues for visualizing and analyzing complex environments. Furthermore, the untapped potential in niche markets like precision forestry, wildlife monitoring, and smart grid management provides fertile ground for specialized geospatial solutions. The increasing availability of open-source geospatial data and tools also democratizes access, fostering innovation and creating opportunities for smaller players.

Growth Accelerators in the Canada Geospatial Imagery Analytics Market Industry

Several key catalysts are accelerating long-term growth in the Canada Geospatial Imagery Analytics Market. Technological breakthroughs, particularly in areas like synthetic aperture radar (SAR) imaging, object recognition, and predictive AI, are continuously expanding the capabilities and applications of geospatial analytics. Strategic partnerships between technology providers, data aggregators, and end-users are crucial for developing tailored solutions and fostering wider market adoption. For instance, collaborations aimed at integrating geospatial data with IoT platforms are opening new frontiers for real-time monitoring and control. Market expansion strategies, including the development of accessible, subscription-based models and the provision of comprehensive training and support services, are making advanced geospatial analytics more attainable for a broader customer base. Continued government support through funding for research and development, along with initiatives promoting data sharing and accessibility, will also significantly boost market growth.

Key Players Shaping the Canada Geospatial Imagery Analytics Market Market

- Satellite Imaging Corporation

- BAE Systems

- Google LLC

- Harris Corporation

- Maxar Technologies

- ESRI Inc

- Trimble Inc

- Eos Data Analytics

Notable Milestones in Canada Geospatial Imagery Analytics Market Sector

- October 2023: Canada announced an investment of CAD 1.01 billion (USD 740.90 million) over 15 years in satellite technology, including the Radarsat+ initiative. This investment aims to enhance Earth observation data for tracking wildfires and environmental crises, and to gather critical information on oceans, land, climate, and populated areas, aiding in decision-making for emergencies and long-term environmental issues.

- December 2022: Carl Data Solutions, specializing in predictive analytics for Environmental Monitoring as a Service (EMaaS) and smart city applications, formed a strategic partnership with K2 Geospatial. This collaboration aims to leverage K2 Geospatial's JMap platform, utilized by over 500 organizations across North America and Europe, to integrate spatial analysis mapping within fully integrated IT ecosystems.

- September 2022: CAPE Analytics, a provider of AI-powered geospatial property intelligence, partnered with Canopy Weather, a weather technology firm. This collaboration launched a product focused on storm-related damage assessment, utilizing machine learning to predict post-storm roof damage likelihood with over 96% accuracy, facilitating automated claims processing.

In-Depth Canada Geospatial Imagery Analytics Market Market Outlook

The future outlook for the Canada Geospatial Imagery Analytics Market is exceptionally promising, driven by sustained innovation and expanding applications. Growth accelerators such as advancements in AI for predictive modeling and real-time analytics will continue to redefine market capabilities. Strategic collaborations, like those fostering integrated data solutions, will unlock new revenue streams and enhance market penetration. Furthermore, the increasing emphasis on environmental sustainability and climate resilience globally will fuel demand for advanced monitoring and analysis tools. The growing accessibility of cloud-based platforms and open-source data will empower a wider range of users, democratizing insights and fostering a more dynamic and competitive market landscape. Emerging opportunities in areas like smart cities, precision agriculture, and disaster management will further solidify the market's growth trajectory.

Canada Geospatial Imagery Analytics Market Segmentation

-

1. Type

- 1.1. Imagery Analytics

- 1.2. Video Analytics

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. Verticals

- 4.1. Insurance

- 4.2. Agriculture

- 4.3. Defense and Security

- 4.4. Environmental Monitoring

- 4.5. Engineering and Construction

- 4.6. Government

- 4.7. Other Verticals

Canada Geospatial Imagery Analytics Market Segmentation By Geography

- 1. Canada

Canada Geospatial Imagery Analytics Market Regional Market Share

Geographic Coverage of Canada Geospatial Imagery Analytics Market

Canada Geospatial Imagery Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Location-based Services; Technological Innovations in Geospatial Imagery Services

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Benefits of Geospatial Imagery Services

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of 5G in Canada is Boosting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Geospatial Imagery Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Imagery Analytics

- 5.1.2. Video Analytics

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Verticals

- 5.4.1. Insurance

- 5.4.2. Agriculture

- 5.4.3. Defense and Security

- 5.4.4. Environmental Monitoring

- 5.4.5. Engineering and Construction

- 5.4.6. Government

- 5.4.7. Other Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Satellite Imaging Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BAE Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Harris Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maxar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ESRI Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trimble Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eos Data Analytics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Satellite Imaging Corporation*List Not Exhaustive

List of Figures

- Figure 1: Canada Geospatial Imagery Analytics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Geospatial Imagery Analytics Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Deployment Mode 2020 & 2033

- Table 3: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 4: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Verticals 2020 & 2033

- Table 5: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Deployment Mode 2020 & 2033

- Table 8: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 9: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Verticals 2020 & 2033

- Table 10: Canada Geospatial Imagery Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Geospatial Imagery Analytics Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Canada Geospatial Imagery Analytics Market?

Key companies in the market include Satellite Imaging Corporation*List Not Exhaustive, BAE Systems, Google LLC, Harris Corporation, Maxar Technologies, ESRI Inc, Trimble Inc, Eos Data Analytics.

3. What are the main segments of the Canada Geospatial Imagery Analytics Market?

The market segments include Type, Deployment Mode, Organization Size, Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Location-based Services; Technological Innovations in Geospatial Imagery Services.

6. What are the notable trends driving market growth?

Increasing Adoption of 5G in Canada is Boosting the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness About Benefits of Geospatial Imagery Services.

8. Can you provide examples of recent developments in the market?

October 2023: Canada will invest CAD 1.01 billion (USD 740.90 million) in satellite technology over the next 15 years to boost the Earth observation data it uses to track wildfires and other environmental crises. The new initiative called Radarsat+ will gather information about Earth's oceans, land, climate, and populated areas. Data collected from earth observation technologies allows scientists to see how the planet changes and make decisions for emergencies like wildfires or longer-term issues like climate change.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Geospatial Imagery Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Geospatial Imagery Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Geospatial Imagery Analytics Market?

To stay informed about further developments, trends, and reports in the Canada Geospatial Imagery Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence