Key Insights

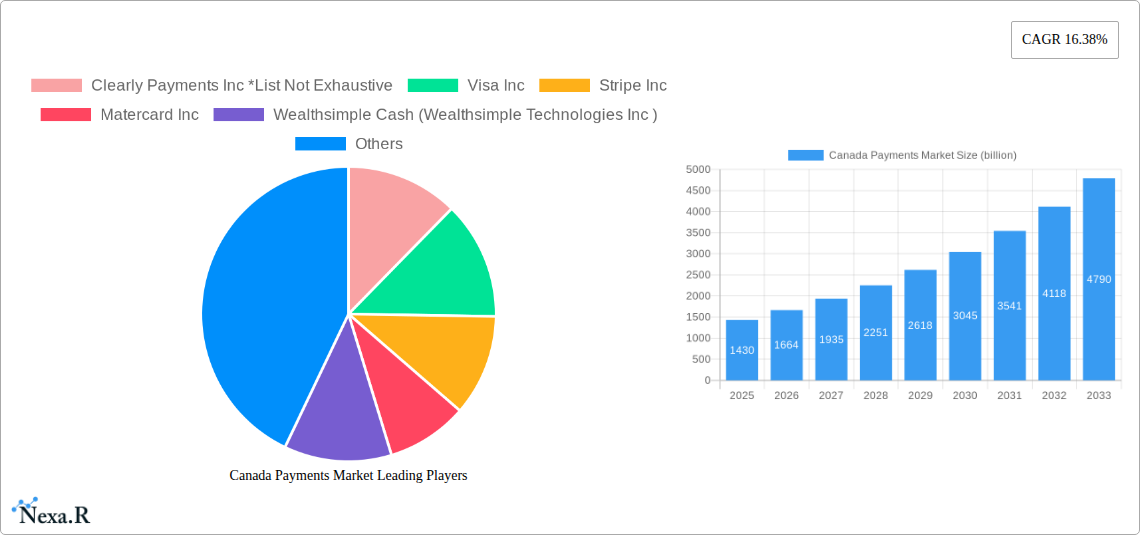

The Canadian payments market is poised for significant expansion, projecting a market size of $1.43 billion by 2025, driven by a robust CAGR of 16.38%. This impressive growth trajectory, expected to continue through 2033, is fueled by several dynamic factors. The increasing adoption of digital payment methods, spurred by evolving consumer preferences for convenience and speed, is a primary driver. Innovations in fintech, the proliferation of mobile wallets, and the growing acceptance of contactless payments at the point of sale are fundamentally reshaping transaction landscapes across various sectors. Furthermore, the surge in e-commerce activities, accelerated by global events and shifting consumer habits, necessitates a more sophisticated and accessible payment infrastructure. Government initiatives promoting digital inclusion and a reduction in reliance on cash further bolster this upward trend, creating a fertile ground for payment service providers and technology developers alike.

Canada Payments Market Market Size (In Billion)

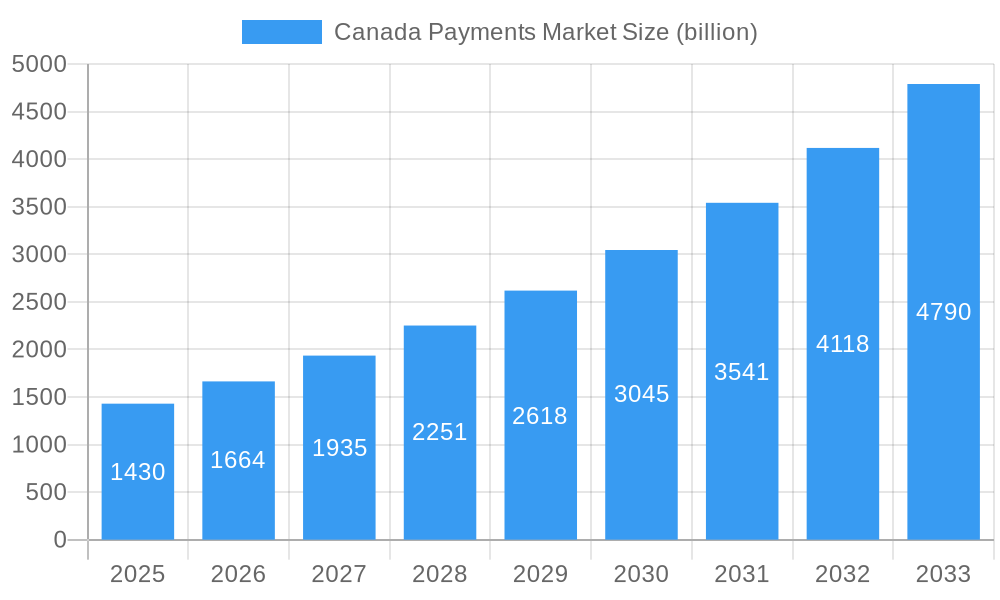

The market segmentation reveals a clear shift towards digital and card-based transactions. Within the Point of Sale (POS) segment, Digital Wallets, including mobile wallets, are capturing significant market share, indicating a consumer preference for seamless and secure mobile payment experiences. Card payments remain a strong contender, while cash transactions are anticipated to diminish. The Online Sale segment, though less detailed, is also a crucial growth area, with "Others" encompassing a broad range of online payment solutions catering to diverse e-commerce needs. Key end-user industries such as Retail and Entertainment are leading the charge in adopting advanced payment solutions, followed by Healthcare and Hospitality, all seeking to enhance customer experience and operational efficiency through streamlined payment processes. Major players like Visa Inc., Mastercard Inc., PayPal, and Stripe Inc. are at the forefront, innovating and expanding their offerings to meet the escalating demand.

Canada Payments Market Company Market Share

This comprehensive report offers an in-depth analysis of the Canadian payments market, providing critical insights into its evolution, key players, and future trajectory. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this report is an essential resource for stakeholders seeking to understand the dynamic Canadian payment landscape. We dissect parent and child markets, exploring the intricate relationships between various payment modes, end-user industries, and technological advancements that are reshaping how Canadians transact. Leveraging high-traffic keywords such as "Canadian digital payments," "fintech Canada," "online payment solutions Canada," "mobile wallets Canada," and "payment processing Canada," this report is optimized for maximum search engine visibility, ensuring industry professionals can easily access valuable market intelligence.

Canada Payments Market Market Dynamics & Structure

The Canadian payments market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, yet fostering an environment ripe for technological innovation. The proliferation of fintech startups and the increasing adoption of digital payment solutions are key drivers, pushing established financial institutions to adapt and innovate. Regulatory frameworks, while evolving to accommodate new technologies, also play a crucial role in shaping market access and competition. Competitive product substitutes are emerging rapidly, particularly in the digital wallet and buy now, pay later (BNPL) segments, challenging traditional card-based transactions. End-user demographics are shifting towards a younger, digitally-savvy population that demands seamless, instant, and secure payment experiences. Mergers and acquisitions (M&A) activity, while not at peak levels, signifies strategic consolidation and expansion efforts by key entities aiming to broaden their service offerings and market reach. The influence of these dynamics is projected to continue reshaping the market, driving further integration and specialization.

- Market Concentration: Dominated by major financial institutions and payment processors, with a growing presence of agile fintech companies.

- Technological Innovation Drivers: Increased adoption of mobile payments, real-time payment systems, and AI-powered fraud detection are transforming transaction experiences.

- Regulatory Frameworks: Payments Canada’s modernization initiatives and evolving consumer protection laws are influencing operational standards and market entry.

- Competitive Product Substitutes: Digital wallets, P2P payment apps, and BNPL solutions are directly competing with traditional credit and debit card payments.

- End-User Demographics: A strong preference for convenience and speed among millennials and Gen Z is accelerating the shift towards digital and contactless payments.

- M&A Trends: Strategic acquisitions by larger players to gain access to new technologies and customer bases are expected to continue.

Canada Payments Market Growth Trends & Insights

The Canada payments market is poised for significant expansion, driven by a confluence of accelerating digital adoption, evolving consumer preferences, and robust technological advancements. The market size is projected to witness a compound annual growth rate (CAGR) of approximately 9.5% over the forecast period (2025-2033), reaching an estimated value of $3.5 trillion in 2025 and a projected $7.2 trillion by 2033. This growth trajectory is underpinned by a fundamental shift in consumer behavior, with an increasing reliance on digital channels for both everyday purchases and online commerce. The convenience and security offered by digital wallets, contactless card payments, and integrated online payment solutions are compelling consumers to move away from traditional cash transactions. Furthermore, the ongoing development and implementation of real-time payment systems are set to revolutionize transaction speeds, enabling instant fund transfers and irrevocability, thereby fostering greater efficiency and trust within the ecosystem. The penetration of mobile devices and the increasing sophistication of payment platforms are creating a fertile ground for innovative payment solutions to flourish, catering to diverse end-user needs across retail, healthcare, and hospitality sectors. This sustained growth is also fueled by the ongoing modernization of payment infrastructure by key industry bodies, ensuring scalability and security for future transaction volumes.

Dominant Regions, Countries, or Segments in Canada Payments Market

The Canadian payments market exhibits distinct regional and segmental dominance, with urban centers and specific payment modes leading the charge in transaction volume and innovation. Within the Mode of Payment, Point of Sale (POS) transactions continue to be a major driver, primarily propelled by Card Pay and the rapidly expanding Digital Wallet segment, which includes mobile wallets. These segments collectively represent over 75% of POS transaction value in Canada. The convenience and security of tap-to-pay functionalities and the seamless integration of mobile payment apps like Apple Pay and Google Pay have significantly contributed to their dominance, especially in retail and hospitality.

The Online Sale segment, while still smaller than POS in overall transaction value, is experiencing explosive growth, driven by the burgeoning e-commerce sector. The Others category within online sales, encompassing various digital payment gateways and alternative payment methods, is capturing an increasing share as businesses adopt more diversified online checkout options.

From an End-user Industry perspective, Retail remains the largest contributor to payment volumes, given its high transaction frequency. However, the Entertainment and Hospitality sectors are showing accelerated growth, fueled by the increasing adoption of digital ticketing, booking platforms, and contactless payment solutions for services. The Healthcare sector is also witnessing a surge in digital payment adoption for appointment bookings, co-pays, and online prescription services, driven by a need for efficiency and patient convenience.

- Leading Payment Mode: Card Pay and Digital Wallets at Point of Sale, driven by widespread adoption of contactless technology and smartphone penetration.

- Fastest Growing Segment: Online Sales, fueled by the expansion of e-commerce and the demand for diverse digital payment options.

- Key End-User Industries: Retail continues to dominate due to transaction volume, while Entertainment and Hospitality show significant growth potential driven by digital service adoption.

- Regional Dominance: Major metropolitan areas like Toronto, Vancouver, and Montreal exhibit the highest concentration of digital payment adoption and transaction volumes due to higher population density and technological infrastructure.

- Growth Potential: Emerging markets and smaller businesses are increasingly adopting digital payment solutions, indicating a broad-based growth trajectory across the country.

Canada Payments Market Product Landscape

The Canadian payments market is characterized by a vibrant product landscape focused on enhancing transaction speed, security, and user experience. Innovation is rampant in the development of integrated payment solutions that offer merchants omnichannel capabilities, allowing them to process payments seamlessly across both physical and online channels. Digital wallets are continuously evolving with added features like loyalty programs and budgeting tools, while Buy Now, Pay Later (BNPL) services are gaining traction by offering flexible installment payment options directly at checkout. The emphasis is on frictionless payments, with advancements in biometric authentication and tokenization bolstering security. This product evolution is geared towards meeting the demand for convenient, secure, and adaptable payment methods across all consumer touchpoints.

Key Drivers, Barriers & Challenges in Canada Payments Market

Key Drivers:

- Technological Advancements: Proliferation of mobile devices, contactless payment technology, and the development of real-time payment systems are fundamentally transforming how Canadians transact.

- Evolving Consumer Behavior: Increasing demand for convenience, speed, and digital-first experiences from a digitally native population.

- E-commerce Growth: The sustained expansion of online retail necessitates robust and diverse online payment solutions.

- Government Initiatives: Modernization efforts by Payments Canada and supportive regulatory environments for fintech innovation.

Barriers & Challenges:

- Cybersecurity Threats: The increasing volume of digital transactions presents growing challenges in safeguarding sensitive financial data against sophisticated cyberattacks, impacting consumer trust and potentially leading to significant financial losses.

- Regulatory Hurdles: Navigating evolving regulations around data privacy, anti-money laundering (AML), and consumer protection can pose compliance challenges and increase operational costs for payment providers.

- Infrastructure Limitations: While improving, certain regions may still face infrastructure limitations that impact the reliable deployment of advanced payment technologies, particularly in remote areas.

- Interoperability Issues: Ensuring seamless interoperability between various payment systems, legacy infrastructure, and emerging platforms remains a persistent challenge, hindering a truly unified payment ecosystem.

Emerging Opportunities in Canada Payments Market

Emerging opportunities in the Canada payments market lie in the continued expansion of niche digital payment solutions and the underserved segments of the population. The demand for specialized payment services within industries like the gig economy and small businesses offers significant potential for tailored fintech offerings. Furthermore, the growing interest in cryptocurrencies and blockchain technology presents an avenue for innovation in alternative payment rails and cross-border transactions, though regulatory clarity is still evolving. The increasing focus on financial inclusion also presents opportunities for developing accessible and affordable payment solutions for unbanked and underbanked populations.

Growth Accelerators in the Canada Payments Market Industry

The long-term growth of the Canada Payments Market is being significantly accelerated by several key factors. The ongoing government-backed modernization of payment infrastructure, particularly the development of the Real-Time Rail (RTR) system, is a major catalyst, promising to enhance efficiency and enable near-instantaneous fund transfers. Strategic partnerships between traditional financial institutions and innovative fintech companies are also crucial, fostering the integration of new technologies and expanding service offerings to a wider customer base. Furthermore, the increasing adoption of embedded finance, where payment functionalities are integrated directly into non-financial platforms and services, is creating new transaction channels and driving widespread digital payment utilization across various consumer touchpoints.

Key Players Shaping the Canada Payments Market Market

- Clearly Payments Inc

- Visa Inc

- Stripe Inc

- Matercard Inc

- Wealthsimple Cash (Wealthsimple Technologies Inc )

- PayPal

- American Express Company

- Apple Pay (Apple Inc )

- Interac Corp

- Google Pay (Google LLC)

Notable Milestones in Canada Payments Market Sector

- May 2022: WooCommerce and Affirm deepened their partnership, allowing WooCommerce merchants in the U.S. and Canada (via PayBright) to offer consumers installment payment plans, enhancing e-commerce flexibility.

- April 2022: Payments Canada partnered with Tata Consultancy Services (TCS) to transform payment system operations and implement the Real-Time Rail (RTR), aiming for near-instantaneous payment capabilities for Canadians.

- January 2022: Merrco Payments Inc. enhanced its PayHQ platform, enabling technology partners and merchants to process integrated payments legally, securely, and seamlessly across the U.S. and Canada, supporting omnichannel payment processing.

In-Depth Canada Payments Market Market Outlook

The Canada Payments Market is on an upward trajectory, driven by a robust ecosystem of innovation and evolving consumer demands. The widespread adoption of digital payment methods, coupled with ongoing infrastructure upgrades like the Real-Time Rail, will continue to fuel market expansion. Strategic collaborations between established financial players and agile fintech firms will unlock new revenue streams and enhance customer accessibility. Furthermore, the increasing integration of payment solutions into various digital platforms, a concept known as embedded finance, is set to create novel transaction opportunities and solidify the dominance of digital payments across all facets of the Canadian economy. The market's outlook is exceptionally positive, promising sustained growth and transformation.

Canada Payments Market Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Canada Payments Market Segmentation By Geography

- 1. Canada

Canada Payments Market Regional Market Share

Geographic Coverage of Canada Payments Market

Canada Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Proliferation of E-commerce

- 3.2.2 Including the Rise of M-commerce

- 3.2.3 is expected to drive the Payments Market; Enablement Programs by Key Retailers and Government encouraging digitization of the market; Growth of Real-time Payments

- 3.2.4 especially Buy Now Pay Later and Rise of Real-Time Rail Payments in Canada

- 3.3. Market Restrains

- 3.3.1. High Implementation and Maintenance Cost

- 3.4. Market Trends

- 3.4.1 High Proliferation of E-commerce

- 3.4.2 Including the Rise of M-commerce

- 3.4.3 is expected to drive the Payments Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Clearly Payments Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Visa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stripe Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matercard Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wealthsimple Cash (Wealthsimple Technologies Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PayPal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American Express Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apple Pay (Apple Inc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Interac Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Google Pay (Google LLC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Clearly Payments Inc *List Not Exhaustive

List of Figures

- Figure 1: Canada Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Payments Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 2: Canada Payments Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Canada Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Payments Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 5: Canada Payments Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Canada Payments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Payments Market?

The projected CAGR is approximately 16.38%.

2. Which companies are prominent players in the Canada Payments Market?

Key companies in the market include Clearly Payments Inc *List Not Exhaustive, Visa Inc, Stripe Inc, Matercard Inc, Wealthsimple Cash (Wealthsimple Technologies Inc ), PayPal, American Express Company, Apple Pay (Apple Inc ), Interac Corp, Google Pay (Google LLC).

3. What are the main segments of the Canada Payments Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.43 billion as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of E-commerce. Including the Rise of M-commerce. is expected to drive the Payments Market; Enablement Programs by Key Retailers and Government encouraging digitization of the market; Growth of Real-time Payments. especially Buy Now Pay Later and Rise of Real-Time Rail Payments in Canada.

6. What are the notable trends driving market growth?

High Proliferation of E-commerce. Including the Rise of M-commerce. is expected to drive the Payments Market.

7. Are there any restraints impacting market growth?

High Implementation and Maintenance Cost.

8. Can you provide examples of recent developments in the market?

May 2022 - WooCommerce, the flexible, open-source commerce solution built on WordPress, and Affirm, the payment network that empowers consumers and helps merchants drive growth, today announced a deepened partnership to provide WooCommerce merchants the opportunity to offer consumers the ability to pay over time through Affirm. Eligible WooCommerce businesses will now be able to seamlessly offer Affirm at checkout in a few simple clicks in the U.S. and Canada via PayBright, an Affirm company and one of Canada's leading providers of installment payment plans.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Payments Market?

To stay informed about further developments, trends, and reports in the Canada Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence