Key Insights

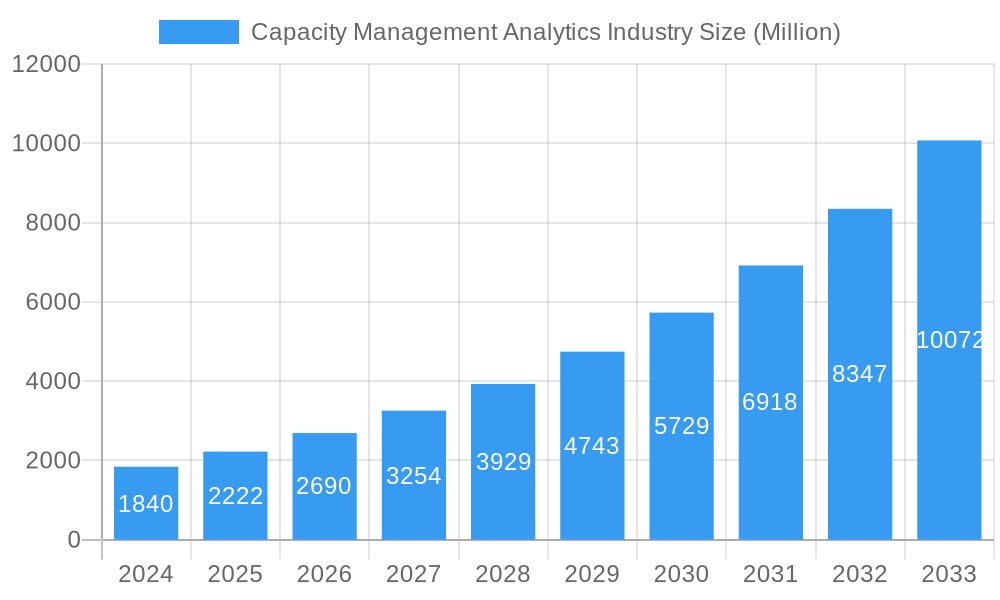

The Capacity Management Analytics market is experiencing robust expansion, projected to reach $1.84 billion in 2024 and continue its impressive trajectory with a Compound Annual Growth Rate (CAGR) of 20.75%. This surge is primarily fueled by the escalating need for efficient resource utilization and performance optimization across diverse industries. Organizations are increasingly recognizing the critical role of data-driven insights to proactively identify bottlenecks, predict future resource demands, and ensure seamless operations, especially within the rapidly evolving IT & Telecom sector. Furthermore, the burgeoning adoption of cloud infrastructure and the growing complexity of IT environments are acting as significant catalysts, compelling businesses to invest in sophisticated analytics solutions to manage their dynamic resource landscapes effectively. The healthcare industry's drive for enhanced patient care through optimized IT resources, alongside manufacturing's pursuit of operational excellence and BFSI's demand for robust, scalable systems, further underscore the market's broad appeal.

Capacity Management Analytics Industry Market Size (In Billion)

Emerging trends such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into capacity management platforms are set to revolutionize the market, enabling predictive analytics and automated resource provisioning. While the adoption of advanced solutions is largely driven by the aforementioned factors, certain restraints like the initial cost of implementation and the scarcity of skilled professionals capable of managing and interpreting complex analytics data could pose challenges. However, the significant market potential, coupled with a strong forecast period extending through 2033, indicates a healthy and dynamic landscape. Key players are actively innovating to address these challenges and capitalize on the opportunities, leading to a competitive environment that fosters continuous development and a widening array of sophisticated solutions for businesses seeking to master their resource capacities.

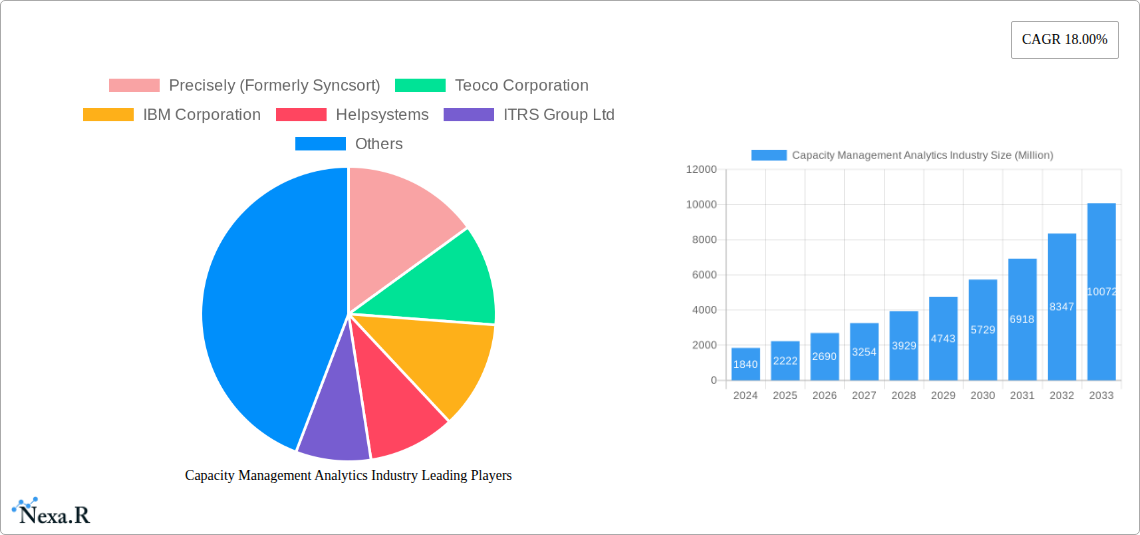

Capacity Management Analytics Industry Company Market Share

Here is a comprehensive, SEO-optimized report description for the Capacity Management Analytics Industry, incorporating high-traffic keywords, parent/child market distinctions, and all specified requirements.

This in-depth report provides a definitive analysis of the Capacity Management Analytics Industry, offering critical insights into market dynamics, growth trajectories, regional dominance, and key players. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving IT infrastructure management and performance monitoring landscape. We delve into the critical role of resource optimization, predictive analytics, and cloud capacity planning in driving business efficiency and cost reduction across diverse sectors.

Capacity Management Analytics Industry Market Dynamics & Structure

The Capacity Management Analytics Industry exhibits a moderately concentrated market structure, with leading vendors continuously innovating to meet the escalating demands of digital transformation. Technological innovation serves as a primary driver, fueled by advancements in AI, machine learning, and big data analytics, enabling more sophisticated workload management and performance forecasting. Regulatory frameworks, particularly concerning data privacy and security, subtly influence adoption patterns, emphasizing compliant and secure capacity planning solutions. Competitive product substitutes, ranging from manual tracking methods to integrated IT operations management suites, present a dynamic landscape. End-user demographics are increasingly skewed towards digitally mature enterprises across the IT & Telecom, BFSI, and Healthcare sectors, actively seeking robust cloud resource management. Mergers and acquisitions (M&A) trends are notable, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, the historical period has seen an estimated XX billion in M&A deal volumes, reflecting a growing appetite for integrated solutions. Key innovation barriers include the complexity of integrating legacy systems with modern analytics platforms and the significant upfront investment required for advanced infrastructure analytics.

- Market Concentration: Moderately concentrated, with key players investing heavily in R&D for advanced analytics.

- Technological Innovation Drivers: AI/ML for predictive insights, big data processing for comprehensive monitoring, automation of capacity planning tasks.

- Regulatory Frameworks: Emphasis on data security, privacy compliance, and IT governance influencing solution architectures.

- Competitive Product Substitutes: Integrated ITOM suites, specialized monitoring tools, manual spreadsheet-based tracking.

- End-User Demographics: Primarily large enterprises in IT & Telecom, BFSI, and Healthcare; growing adoption in Manufacturing and Government.

- M&A Trends: Strategic acquisitions to enhance feature sets, gain market share, and offer end-to-end solutions.

Capacity Management Analytics Industry Growth Trends & Insights

The Capacity Management Analytics Industry is poised for substantial expansion, driven by the relentless surge in data volumes and the increasing complexity of IT environments. The global market size for capacity management analytics is projected to witness a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period, escalating from an estimated $XX billion in the base year 2025 to a projected $XX billion by 2033. This growth is underpinned by accelerating adoption rates of cloud computing, hybrid cloud strategies, and multi-cloud deployments, necessitating sophisticated cloud capacity optimization. Technological disruptions, including the rise of edge computing and the Internet of Things (IoT), are introducing new layers of data and resource demands, further amplifying the need for advanced analytics. Consumer behavior shifts towards proactive performance management and cost-efficiency are compelling organizations to invest in solutions that offer predictive insights and automated remediation. Market penetration is deepening across all end-user industries, with early adopters in IT & Telecom and BFSI demonstrating higher maturity levels in leveraging these analytics for strategic decision-making. The increasing reliance on digital services and the imperative for high availability and optimal performance are fundamental catalysts for sustained market growth.

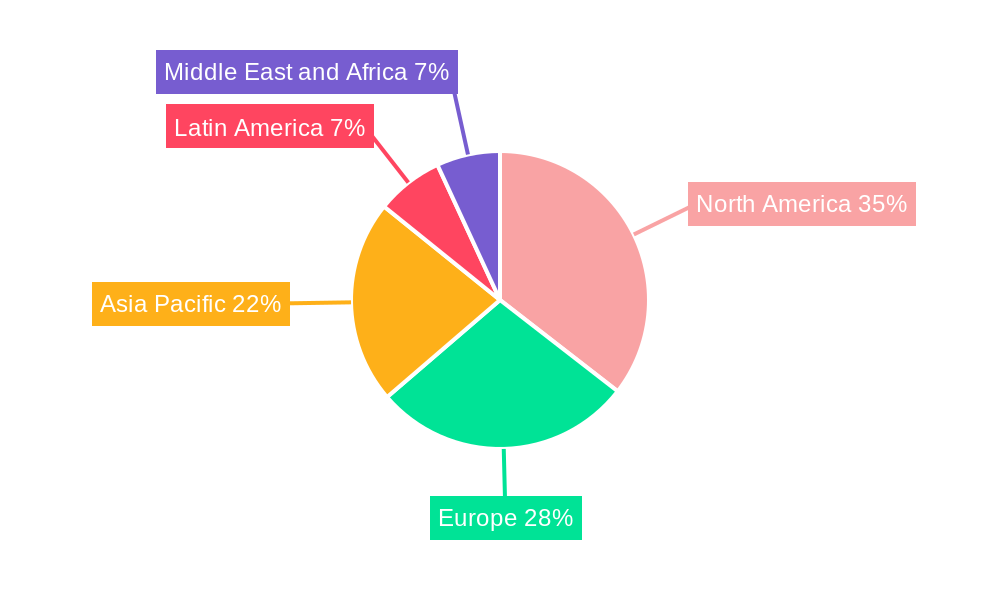

Dominant Regions, Countries, or Segments in Capacity Management Analytics Industry

The North America region is currently the dominant force in the Capacity Management Analytics Industry, primarily driven by its mature IT infrastructure, significant investments in digital transformation, and a high concentration of leading technology companies. The United States, in particular, spearheads this dominance due to its robust economic policies supporting technological innovation and substantial government initiatives aimed at modernizing critical infrastructure. The Cloud deployment segment is the primary growth engine within this region, reflecting the widespread adoption of cloud-native architectures and hybrid cloud models for enhanced scalability and flexibility.

- North America's Dominance: Driven by advanced technological adoption, a strong presence of key vendors, and significant R&D investments.

- Market Share: Estimated XX% of the global market in 2025.

- Growth Potential: Fueled by ongoing digital transformation and cloud migration initiatives.

- Cloud Deployment Segment: The leading segment due to its inherent scalability and cost-efficiency advantages for managing dynamic workloads.

- Adoption Drivers: Increased reliance on SaaS, PaaS, and IaaS; need for dynamic resource allocation.

- Market Share: Projected to capture XX% of the total market by 2033.

- IT & Telecom End-User Industry: This sector consistently leads in the adoption of capacity management analytics, driven by the need for high performance, scalability, and cost optimization in network infrastructure and service delivery.

- Key Drivers: Exponential data growth, increasing demand for bandwidth, and the imperative to maintain service level agreements (SLAs).

- Market Share: Expected to account for approximately XX% of the overall market by 2033.

- Other Significant Regions: Europe and Asia-Pacific are emerging as strong contenders, with increasing investments in digital infrastructure and a growing number of businesses migrating to the cloud.

Capacity Management Analytics Industry Product Landscape

The Capacity Management Analytics Industry product landscape is characterized by sophisticated platforms offering advanced capabilities such as real-time monitoring, predictive analytics, automated resource allocation, and intelligent workload balancing. Innovations are focused on AI-driven anomaly detection, proactive issue resolution, and seamless integration with existing IT operations tools, including cloud management platforms and DevOps pipelines. Key applications range from optimizing server utilization and storage capacity to forecasting network bandwidth needs and managing complex microservices environments. Unique selling propositions often lie in the granularity of insights, the accuracy of predictive models, and the ability to deliver actionable recommendations for cost savings and performance improvements. Technological advancements are increasingly emphasizing self-healing capabilities and intelligent automation, reducing the manual effort required for effective capacity planning and resource management.

Key Drivers, Barriers & Challenges in Capacity Management Analytics Industry

Key Drivers:

The Capacity Management Analytics Industry is propelled by several key drivers, including the escalating volume and complexity of data generated by digital operations, the widespread adoption of cloud and hybrid cloud environments requiring optimized resource allocation, and the critical need for enhanced IT performance and availability to ensure business continuity. The pursuit of operational efficiency and cost reduction further fuels demand for sophisticated analytics that can identify underutilized resources and prevent over-provisioning.

Barriers & Challenges:

Significant challenges include the complexity of integrating advanced analytics tools with legacy IT systems, the scarcity of skilled professionals capable of leveraging these sophisticated platforms effectively, and the substantial upfront investment required for advanced IT analytics software. Data silos across disparate systems and the need for robust data governance also present hurdles. Furthermore, increasing cybersecurity threats necessitate that capacity management solutions are inherently secure, adding another layer of complexity. Supply chain issues are less prevalent for software-centric solutions but can impact hardware dependencies. Regulatory hurdles, though not direct restraints, necessitate adherence to evolving compliance standards. Competitive pressures from both established vendors and emerging startups can impact pricing and innovation cycles.

Emerging Opportunities in Capacity Management Analytics Industry

Emerging opportunities within the Capacity Management Analytics Industry lie in the burgeoning field of AIOps (Artificial Intelligence for IT Operations), where predictive insights are being deeply embedded into automated workflows for self-managing IT infrastructure. The expanding IoT ecosystem presents a significant untapped market for managing distributed and resource-constrained devices. Furthermore, the growing demand for sustainable IT operations and energy efficiency analytics offers a new niche for specialized capacity planning tools. The increasing adoption of serverless computing and containerization technologies also creates a need for more granular and dynamic capacity management solutions.

Growth Accelerators in the Capacity Management Analytics Industry Industry

Several growth accelerators are shaping the future of the Capacity Management Analytics Industry. Technological breakthroughs in AI and machine learning are enabling more accurate predictive modeling and automated anomaly detection, significantly enhancing the value proposition. Strategic partnerships between analytics vendors and cloud providers are creating more integrated and seamless solutions, driving adoption. Market expansion strategies, including targeting emerging economies and smaller businesses with scalable solutions, are also crucial. The increasing focus on FinOps (Cloud Financial Operations) is creating a strong demand for analytics that can provide clear visibility into cloud spend and identify optimization opportunities.

Key Players Shaping the Capacity Management Analytics Industry Market

- Precisely (Formerly Syncsort)

- Teoco Corporation

- IBM Corporation

- Helpsystems

- ITRS Group Ltd

- Hewlett Packard Enterprise Company

- Broadcom Inc

- BMC Software Inc

- Riverbed Technology Inc

- NetApp Inc

- CPT Global Limited

- VMware Inc

Notable Milestones in Capacity Management Analytics Industry Sector

- 2020: Increased focus on AI/ML integration for predictive analytics in major vendor product releases.

- 2021: Significant M&A activity as larger players consolidated to offer comprehensive IT operations management suites.

- 2022: Growing emphasis on cloud-native capacity management solutions and hybrid cloud support.

- 2023: Rise of AIOps platforms gaining traction for proactive issue resolution and automation.

- 2024: Increased demand for granular cost optimization analytics, particularly in public cloud environments.

In-Depth Capacity Management Analytics Industry Market Outlook

The Capacity Management Analytics Industry is set for a period of sustained and robust growth, driven by the persistent digital transformation across all sectors. Future market potential is immense, particularly in the realm of intelligent automation and self-healing IT infrastructures. Strategic opportunities lie in developing specialized solutions for emerging technologies like edge computing and quantum computing, as well as catering to the specific needs of industries with highly dynamic resource demands. The continued evolution of cloud architectures, including multi-cloud and sovereign cloud initiatives, will necessitate increasingly sophisticated and adaptable capacity management analytics. Vendors that can offer seamless integration, actionable insights, and demonstrable ROI through cost savings and performance enhancements will be best positioned to capitalize on this evolving market.

Capacity Management Analytics Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. End-user Industry

- 2.1. IT & Telecom

- 2.2. Healthcare

- 2.3. Manufacturing

- 2.4. BFSI

- 2.5. Government

- 2.6. Other End-user Industries

Capacity Management Analytics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Capacity Management Analytics Industry Regional Market Share

Geographic Coverage of Capacity Management Analytics Industry

Capacity Management Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Need for Optimization and Effective Utilization of IT Infrastructures; Increasing Complexities in IT Infrastructures

- 3.3. Market Restrains

- 3.3.1. ; Lower Adoption Among the SMEs

- 3.4. Market Trends

- 3.4.1. Manufacturing Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Capacity Management Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT & Telecom

- 5.2.2. Healthcare

- 5.2.3. Manufacturing

- 5.2.4. BFSI

- 5.2.5. Government

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Capacity Management Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT & Telecom

- 6.2.2. Healthcare

- 6.2.3. Manufacturing

- 6.2.4. BFSI

- 6.2.5. Government

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Capacity Management Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT & Telecom

- 7.2.2. Healthcare

- 7.2.3. Manufacturing

- 7.2.4. BFSI

- 7.2.5. Government

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Capacity Management Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT & Telecom

- 8.2.2. Healthcare

- 8.2.3. Manufacturing

- 8.2.4. BFSI

- 8.2.5. Government

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Capacity Management Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT & Telecom

- 9.2.2. Healthcare

- 9.2.3. Manufacturing

- 9.2.4. BFSI

- 9.2.5. Government

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Capacity Management Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. IT & Telecom

- 10.2.2. Healthcare

- 10.2.3. Manufacturing

- 10.2.4. BFSI

- 10.2.5. Government

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Precisely (Formerly Syncsort)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teoco Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Helpsystems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ITRS Group Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hewlett Packard Enterprise Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Broadcom Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BMC Software Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Riverbed Technology Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NetApp Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CPT Global Limited*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 VMware Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Precisely (Formerly Syncsort)

List of Figures

- Figure 1: Global Capacity Management Analytics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Capacity Management Analytics Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 3: North America Capacity Management Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Capacity Management Analytics Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Capacity Management Analytics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Capacity Management Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Capacity Management Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Capacity Management Analytics Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 9: Europe Capacity Management Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Capacity Management Analytics Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Capacity Management Analytics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Capacity Management Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Capacity Management Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Capacity Management Analytics Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Capacity Management Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Capacity Management Analytics Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Capacity Management Analytics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Capacity Management Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Capacity Management Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Capacity Management Analytics Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 21: Latin America Capacity Management Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Latin America Capacity Management Analytics Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Latin America Capacity Management Analytics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Capacity Management Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Capacity Management Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Capacity Management Analytics Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 27: Middle East and Africa Capacity Management Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East and Africa Capacity Management Analytics Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Capacity Management Analytics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Capacity Management Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Capacity Management Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 2: Global Capacity Management Analytics Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 5: Global Capacity Management Analytics Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 8: Global Capacity Management Analytics Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 11: Global Capacity Management Analytics Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 14: Global Capacity Management Analytics Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 17: Global Capacity Management Analytics Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Capacity Management Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Capacity Management Analytics Industry?

The projected CAGR is approximately 20.75%.

2. Which companies are prominent players in the Capacity Management Analytics Industry?

Key companies in the market include Precisely (Formerly Syncsort), Teoco Corporation, IBM Corporation, Helpsystems, ITRS Group Ltd, Hewlett Packard Enterprise Company, Broadcom Inc, BMC Software Inc, Riverbed Technology Inc, NetApp Inc, CPT Global Limited*List Not Exhaustive, VMware Inc.

3. What are the main segments of the Capacity Management Analytics Industry?

The market segments include Deployment , End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Need for Optimization and Effective Utilization of IT Infrastructures; Increasing Complexities in IT Infrastructures.

6. What are the notable trends driving market growth?

Manufacturing Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Lower Adoption Among the SMEs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Capacity Management Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Capacity Management Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Capacity Management Analytics Industry?

To stay informed about further developments, trends, and reports in the Capacity Management Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence