Key Insights

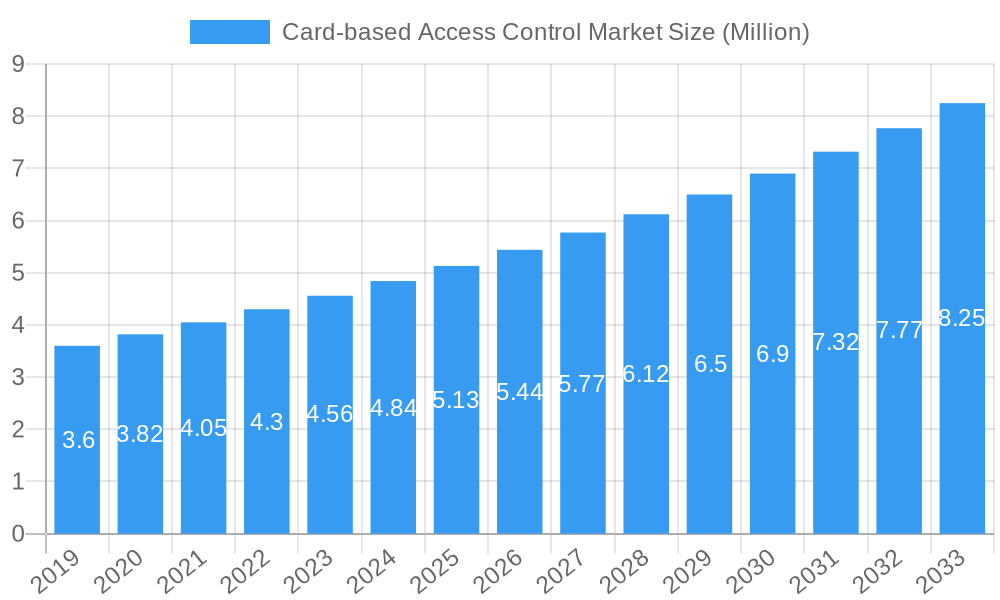

The Card-based Access Control Market is poised for substantial growth, projected to reach an estimated value of $5.40 million, driven by a robust Compound Annual Growth Rate (CAGR) of 6.40% over the forecast period of 2019-2033, with a strong emphasis on the base year of 2025. This expansion is primarily fueled by escalating security concerns across diverse sectors, including BFSI, government, and commercial offices, necessitating sophisticated yet user-friendly access management solutions. The increasing adoption of advanced card technologies, such as contactless smart cards and RFID proximity cards, plays a pivotal role in this market surge, offering enhanced security features, faster transaction times, and greater convenience compared to traditional swipe cards. Furthermore, the growing demand for integrated security systems that combine access control with other surveillance and safety measures is also a significant contributor to market dynamics. The proliferation of smart city initiatives and the Internet of Things (IoT) is also creating new avenues for card-based access control systems, enabling seamless integration with other smart building functionalities.

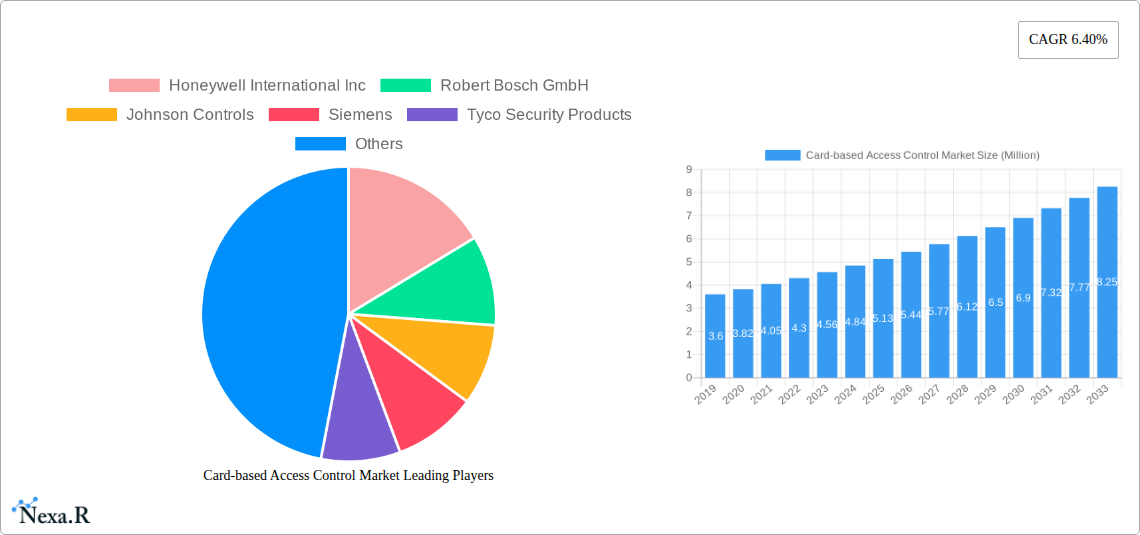

Card-based Access Control Market Market Size (In Million)

The market is segmented across various card types, including swipe cards, RFID proximity cards, and smart cards (both contact and contactless), catering to a wide spectrum of security requirements and budgets. The end-user verticals represent a diverse landscape, with significant contributions expected from Retail, BFSI, Government and Commercial Offices, Military and Defense, Entertainment and Media, and Healthcare. The BFSI sector, in particular, is a major driver due to stringent regulatory compliance and the need to protect sensitive financial data. The government and military sectors are also investing heavily in advanced access control systems to bolster national security. While the market exhibits strong growth potential, certain restraints, such as the initial implementation costs of advanced systems and evolving cybersecurity threats, need to be addressed by vendors to ensure widespread adoption and continued market dominance. The competitive landscape is characterized by the presence of established global players and emerging regional companies, all vying for market share through innovation, strategic partnerships, and product diversification.

Card-based Access Control Market Company Market Share

Card-based Access Control Market: Comprehensive Industry Report & Future Outlook (2019–2033)

Unlock critical insights into the global Card-based Access Control Market with this definitive report. Covering the comprehensive study period of 2019–2033, with a base and estimated year of 2025, this analysis delves deep into the evolving landscape of secure access solutions. We provide a granular examination of market size, growth drivers, segmentation, and competitive dynamics, offering actionable intelligence for stakeholders navigating this rapidly expanding sector. This report is indispensable for businesses seeking to capitalize on the increasing demand for advanced security and access management systems, projected to reach $XX Billion by 2033.

Card-based Access Control Market Dynamics & Structure

The Card-based Access Control Market is characterized by moderate concentration, with a strong emphasis on technological innovation as a primary driver. Leading players like Honeywell International Inc., Robert Bosch GmbH, Johnson Controls, Siemens, and Tyco Security Products are continuously investing in R&D to introduce advanced solutions. Regulatory frameworks, particularly concerning data privacy and security standards, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as biometric and mobile access control, are increasingly influencing market strategies, pushing card-based solutions to integrate enhanced functionalities. End-user demographics are diverse, spanning retail, BFSI, government, healthcare, and military sectors, each with unique security requirements. Merger and acquisition (M&A) trends indicate strategic consolidation, with companies aiming to expand their product portfolios and geographical reach. The market is projected to witness an M&A deal volume of XX deals between 2025 and 2033, reflecting a healthy consolidation phase. Innovation barriers include the high cost of developing cutting-edge technologies and the need for interoperability across different systems.

- Market Concentration: Moderate, with key global players dominating.

- Technological Innovation Drivers: Demand for enhanced security, integration with IoT, and user convenience.

- Regulatory Frameworks: GDPR, CCPA, and industry-specific security mandates influence development.

- Competitive Product Substitutes: Biometrics, mobile credentials, and facial recognition.

- End-user Demographics: Broad, with increasing adoption in sensitive sectors.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

Card-based Access Control Market Growth Trends & Insights

The global Card-based Access Control Market is poised for substantial growth, driven by escalating security concerns and the increasing need for robust identity and access management solutions. The market size is estimated to expand from $XX Billion in 2025 to $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates are steadily increasing across various end-user verticals, fueled by government mandates for secure facilities and growing awareness of the vulnerabilities associated with traditional access methods. Technological disruptions, such as the integration of AI for anomaly detection and the advancement of RFID and smart card technologies, are reshaping the competitive landscape. Consumer behavior shifts are also playing a significant role, with a growing preference for seamless and secure access experiences that can be managed remotely. The penetration of smart cards, offering enhanced encryption and multi-application capabilities, is projected to rise significantly. Furthermore, the increasing adoption of cloud-based access control management systems is streamlining operations and providing scalability for businesses of all sizes. The convergence of physical and digital security is creating new avenues for growth, with card-based systems increasingly integrated into broader cybersecurity frameworks. This integration ensures a comprehensive security posture for organizations.

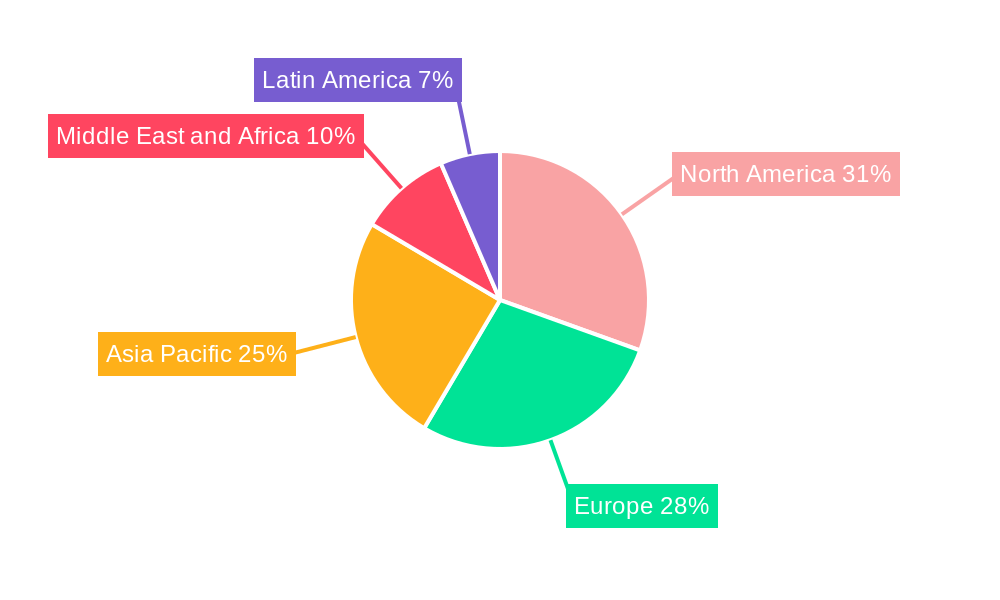

Dominant Regions, Countries, or Segments in Card-based Access Control Market

North America currently holds a dominant position in the Card-based Access Control Market, driven by significant investments in smart city initiatives, stringent government security regulations, and a high concentration of BFSI and corporate sectors demanding advanced access solutions. The United States, in particular, accounts for a substantial market share, estimated at XX% of the global market. Economic policies that encourage technological adoption and robust infrastructure development further solidify its leadership.

Within the Card Type segment, Smart cards (contact and contactless) are the most dominant, projected to capture XX% of the market by 2025. Their advanced security features, including encryption and multi-functionality for payment and identification, make them highly sought after. RFID Proximity Cards follow, offering a balance of convenience and security for many applications.

In terms of End-user Vertical, the Government and Commercial Offices segment is a primary growth driver, accounting for an estimated XX% of the market. This is attributed to the need for secure access in sensitive government facilities, large corporate campuses, and data centers. The BFSI sector also represents a significant market share due to the critical need for highly secure access to financial data and facilities. The Healthcare sector is emerging as a strong growth segment, driven by the increasing demand for patient privacy and the secure access to medical records and sensitive areas.

- Dominant Region: North America, with the United States leading.

- Leading Card Type: Smart cards (contact and contactless), driven by advanced security and multi-functionality.

- Key End-user Vertical: Government and Commercial Offices, followed closely by BFSI, due to stringent security requirements.

- Growth Potential: Rapid expansion in Healthcare and Military & Defense sectors.

Card-based Access Control Market Product Landscape

The Card-based Access Control Market is witnessing a surge in product innovations focused on enhancing security, user experience, and integration capabilities. Manufacturers are developing advanced smart cards with enhanced encryption algorithms and multi-factor authentication features, moving beyond traditional magnetic stripe and barcode technologies. The integration of near-field communication (NFC) technology into cards and readers is facilitating seamless mobile access and contactless transactions. Product performance metrics are increasingly evaluated on factors such as read range, data transfer speed, security protocol adherence, and durability. Unique selling propositions often lie in the ability to combine access control with other functionalities, such as cashless payments, time and attendance tracking, and building management systems, within a single card. Technological advancements are also focusing on the development of secure credential management platforms, enabling centralized control and monitoring of access privileges.

Key Drivers, Barriers & Challenges in Card-based Access Control Market

Key Drivers: The Card-based Access Control Market is propelled by a confluence of factors, including the escalating global threat landscape necessitating enhanced physical security measures, and the growing demand for convenient and reliable authentication methods. Technological advancements in smart card and RFID technology, offering superior security and functionality, are significant catalysts. Government mandates and industry compliance requirements, particularly in critical infrastructure and sensitive sectors like BFSI and healthcare, further drive adoption. The increasing adoption of IoT devices and smart buildings also creates a demand for integrated access control systems.

Barriers & Challenges: Despite robust growth, the market faces several challenges. The high initial investment cost for advanced card-based access control systems can be a deterrent for small and medium-sized enterprises. Competition from alternative access control technologies, such as biometric and mobile solutions, presents a constant pressure. Supply chain disruptions and the availability of secure card components can impact production and pricing. Furthermore, the need for continuous software updates and system maintenance to address evolving security threats adds to the operational complexity and cost. Regulatory hurdles in specific regions regarding data privacy and the secure handling of cardholder information also pose challenges.

Emerging Opportunities in Card-based Access Control Market

Emerging opportunities within the Card-based Access Control Market lie in the expanding adoption of contactless smart cards for a wider array of applications beyond simple access, including secure cashless payments in retail and event venues. The growing trend towards hybrid access control systems, seamlessly integrating card-based solutions with mobile credentials and biometrics, presents a significant untapped market. Furthermore, the increasing demand for secure access in remote work environments and for the Internet of Things (IoT) devices offers new avenues for innovation. The development of highly secure, personalized smart cards for specific niche markets, such as educational institutions and healthcare facilities, also represents a promising growth area.

Growth Accelerators in the Card-based Access Control Market Industry

The long-term growth of the Card-based Access Control Market is being significantly accelerated by continuous technological breakthroughs in contactless technologies and advanced encryption methods, leading to more secure and versatile card solutions. Strategic partnerships between card manufacturers, reader providers, and software developers are fostering interoperability and the creation of comprehensive security ecosystems. Market expansion strategies, particularly targeting emerging economies with a growing focus on security and digitalization, are crucial growth accelerators. The increasing integration of access control systems with broader building management and security platforms is also driving demand and creating new revenue streams.

Key Players Shaping the Card-based Access Control Market Market

- Honeywell International Inc.

- Robert Bosch GmbH

- Johnson Controls

- Siemens

- Tyco Security Products

- IDEMIA

- Mantra Softech India Private Limited

- Gemalto (3M Cogent)

- eSSL

- Realtime Biometric

- IDCUBE

- HID Global Corporation

Notable Milestones in Card-based Access Control Market Sector

- May 2024: Akuvox unveiled its latest smart access control lineup, including the A01, A02, A03, and A05 access control terminals, and the A092 door controller. These offerings cater to both residential and commercial segments, with terminals supporting PIN code (A02 exclusively), RFID card, and mobile access. The A05 features a 5-inch touchscreen and dual cameras, supporting advanced authentication methods like face recognition, NFC, QR code, RFID cards, and mobile app authentication.

- February 2024: Hikvision introduced its latest line of professional access control products, featuring enhanced web-based management, versatile authentication methods, specialized access applications, and integrated security solutions, marking a significant advancement in access management.

In-Depth Card-based Access Control Market Market Outlook

The future outlook for the Card-based Access Control Market remains exceptionally bright, fueled by persistent global security concerns and the relentless pace of technological innovation. Growth accelerators such as the widespread adoption of advanced smart card technologies with enhanced encryption and multi-application capabilities are critical. The ongoing trend towards hybrid access control solutions, integrating cards with mobile and biometric authentication, will unlock substantial new market segments. Strategic partnerships and collaborations will foster seamless integration and create robust, end-to-end security solutions, further solidifying the market's expansion and ensuring its continued relevance in safeguarding physical and digital assets worldwide.

Card-based Access Control Market Segmentation

-

1. Card Type

- 1.1. Swipe Crads

- 1.2. RFID Proximity Crads

- 1.3. Smart card (contact and contactless)

-

2. End-user Vertical

- 2.1. Retail

- 2.2. BFSI

- 2.3. Government and Commercial Offices

- 2.4. Military and Defense

- 2.5. Entertainment and Media

- 2.6. Healthcare

- 2.7. Others

Card-based Access Control Market Segmentation By Geography

- 1. Americas

- 2. Asia

- 3. Australia

- 4. New Zealand

- 5. Europe

- 6. Middle East and Africa

Card-based Access Control Market Regional Market Share

Geographic Coverage of Card-based Access Control Market

Card-based Access Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Evolution of Smart Card Technology in Access Control; Increasing Need for Enhanced Security and Government Policies for Security Concerns

- 3.3. Market Restrains

- 3.3.1. The Evolution of Smart Card Technology in Access Control; Increasing Need for Enhanced Security and Government Policies for Security Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Smart Card Promotes Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. Swipe Crads

- 5.1.2. RFID Proximity Crads

- 5.1.3. Smart card (contact and contactless)

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Retail

- 5.2.2. BFSI

- 5.2.3. Government and Commercial Offices

- 5.2.4. Military and Defense

- 5.2.5. Entertainment and Media

- 5.2.6. Healthcare

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Asia

- 5.3.3. Australia

- 5.3.4. New Zealand

- 5.3.5. Europe

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Americas Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Card Type

- 6.1.1. Swipe Crads

- 6.1.2. RFID Proximity Crads

- 6.1.3. Smart card (contact and contactless)

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Retail

- 6.2.2. BFSI

- 6.2.3. Government and Commercial Offices

- 6.2.4. Military and Defense

- 6.2.5. Entertainment and Media

- 6.2.6. Healthcare

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Card Type

- 7. Asia Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Card Type

- 7.1.1. Swipe Crads

- 7.1.2. RFID Proximity Crads

- 7.1.3. Smart card (contact and contactless)

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Retail

- 7.2.2. BFSI

- 7.2.3. Government and Commercial Offices

- 7.2.4. Military and Defense

- 7.2.5. Entertainment and Media

- 7.2.6. Healthcare

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Card Type

- 8. Australia Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Card Type

- 8.1.1. Swipe Crads

- 8.1.2. RFID Proximity Crads

- 8.1.3. Smart card (contact and contactless)

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Retail

- 8.2.2. BFSI

- 8.2.3. Government and Commercial Offices

- 8.2.4. Military and Defense

- 8.2.5. Entertainment and Media

- 8.2.6. Healthcare

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Card Type

- 9. New Zealand Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Card Type

- 9.1.1. Swipe Crads

- 9.1.2. RFID Proximity Crads

- 9.1.3. Smart card (contact and contactless)

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Retail

- 9.2.2. BFSI

- 9.2.3. Government and Commercial Offices

- 9.2.4. Military and Defense

- 9.2.5. Entertainment and Media

- 9.2.6. Healthcare

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Card Type

- 10. Europe Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Card Type

- 10.1.1. Swipe Crads

- 10.1.2. RFID Proximity Crads

- 10.1.3. Smart card (contact and contactless)

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Retail

- 10.2.2. BFSI

- 10.2.3. Government and Commercial Offices

- 10.2.4. Military and Defense

- 10.2.5. Entertainment and Media

- 10.2.6. Healthcare

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Card Type

- 11. Middle East and Africa Card-based Access Control Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Card Type

- 11.1.1. Swipe Crads

- 11.1.2. RFID Proximity Crads

- 11.1.3. Smart card (contact and contactless)

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Retail

- 11.2.2. BFSI

- 11.2.3. Government and Commercial Offices

- 11.2.4. Military and Defense

- 11.2.5. Entertainment and Media

- 11.2.6. Healthcare

- 11.2.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Card Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Robert Bosch GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnson Controls

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siemens

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tyco Security Products

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 IDEMIA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mantra Softech India Private Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Gemalto (3M Cogent)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 eSSL

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Realtime Biometric

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 IDCUBE

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 HID Global Corporation*List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Card-based Access Control Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Card-based Access Control Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Americas Card-based Access Control Market Revenue (Million), by Card Type 2025 & 2033

- Figure 4: Americas Card-based Access Control Market Volume (Billion), by Card Type 2025 & 2033

- Figure 5: Americas Card-based Access Control Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 6: Americas Card-based Access Control Market Volume Share (%), by Card Type 2025 & 2033

- Figure 7: Americas Card-based Access Control Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: Americas Card-based Access Control Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 9: Americas Card-based Access Control Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: Americas Card-based Access Control Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: Americas Card-based Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Americas Card-based Access Control Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Americas Card-based Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Americas Card-based Access Control Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Asia Card-based Access Control Market Revenue (Million), by Card Type 2025 & 2033

- Figure 16: Asia Card-based Access Control Market Volume (Billion), by Card Type 2025 & 2033

- Figure 17: Asia Card-based Access Control Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 18: Asia Card-based Access Control Market Volume Share (%), by Card Type 2025 & 2033

- Figure 19: Asia Card-based Access Control Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 20: Asia Card-based Access Control Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 21: Asia Card-based Access Control Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 22: Asia Card-based Access Control Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 23: Asia Card-based Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Card-based Access Control Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Card-based Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Card-based Access Control Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Australia Card-based Access Control Market Revenue (Million), by Card Type 2025 & 2033

- Figure 28: Australia Card-based Access Control Market Volume (Billion), by Card Type 2025 & 2033

- Figure 29: Australia Card-based Access Control Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 30: Australia Card-based Access Control Market Volume Share (%), by Card Type 2025 & 2033

- Figure 31: Australia Card-based Access Control Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 32: Australia Card-based Access Control Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 33: Australia Card-based Access Control Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 34: Australia Card-based Access Control Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 35: Australia Card-based Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Australia Card-based Access Control Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Australia Card-based Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Australia Card-based Access Control Market Volume Share (%), by Country 2025 & 2033

- Figure 39: New Zealand Card-based Access Control Market Revenue (Million), by Card Type 2025 & 2033

- Figure 40: New Zealand Card-based Access Control Market Volume (Billion), by Card Type 2025 & 2033

- Figure 41: New Zealand Card-based Access Control Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 42: New Zealand Card-based Access Control Market Volume Share (%), by Card Type 2025 & 2033

- Figure 43: New Zealand Card-based Access Control Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 44: New Zealand Card-based Access Control Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 45: New Zealand Card-based Access Control Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 46: New Zealand Card-based Access Control Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 47: New Zealand Card-based Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 48: New Zealand Card-based Access Control Market Volume (Billion), by Country 2025 & 2033

- Figure 49: New Zealand Card-based Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: New Zealand Card-based Access Control Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Europe Card-based Access Control Market Revenue (Million), by Card Type 2025 & 2033

- Figure 52: Europe Card-based Access Control Market Volume (Billion), by Card Type 2025 & 2033

- Figure 53: Europe Card-based Access Control Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 54: Europe Card-based Access Control Market Volume Share (%), by Card Type 2025 & 2033

- Figure 55: Europe Card-based Access Control Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Europe Card-based Access Control Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 57: Europe Card-based Access Control Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Europe Card-based Access Control Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Europe Card-based Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Europe Card-based Access Control Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Europe Card-based Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Card-based Access Control Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Card-based Access Control Market Revenue (Million), by Card Type 2025 & 2033

- Figure 64: Middle East and Africa Card-based Access Control Market Volume (Billion), by Card Type 2025 & 2033

- Figure 65: Middle East and Africa Card-based Access Control Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 66: Middle East and Africa Card-based Access Control Market Volume Share (%), by Card Type 2025 & 2033

- Figure 67: Middle East and Africa Card-based Access Control Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 68: Middle East and Africa Card-based Access Control Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 69: Middle East and Africa Card-based Access Control Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 70: Middle East and Africa Card-based Access Control Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 71: Middle East and Africa Card-based Access Control Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Card-based Access Control Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Middle East and Africa Card-based Access Control Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Card-based Access Control Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Card-based Access Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Card-based Access Control Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 8: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 9: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Card-based Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Card-based Access Control Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 14: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 15: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 17: Global Card-based Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Card-based Access Control Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 20: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 21: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Card-based Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Card-based Access Control Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 26: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 27: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Card-based Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Card-based Access Control Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 32: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 33: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 34: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Card-based Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Card-based Access Control Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Card-based Access Control Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 38: Global Card-based Access Control Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 39: Global Card-based Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 40: Global Card-based Access Control Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 41: Global Card-based Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Card-based Access Control Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Card-based Access Control Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Card-based Access Control Market?

Key companies in the market include Honeywell International Inc, Robert Bosch GmbH, Johnson Controls, Siemens, Tyco Security Products, IDEMIA, Mantra Softech India Private Limited, Gemalto (3M Cogent), eSSL, Realtime Biometric, IDCUBE, HID Global Corporation*List Not Exhaustive.

3. What are the main segments of the Card-based Access Control Market?

The market segments include Card Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.40 Million as of 2022.

5. What are some drivers contributing to market growth?

The Evolution of Smart Card Technology in Access Control; Increasing Need for Enhanced Security and Government Policies for Security Concerns.

6. What are the notable trends driving market growth?

Increasing Adoption of Smart Card Promotes Market Growth.

7. Are there any restraints impacting market growth?

The Evolution of Smart Card Technology in Access Control; Increasing Need for Enhanced Security and Government Policies for Security Concerns.

8. Can you provide examples of recent developments in the market?

May 2024: Akuvox has unveiled its latest smart access control lineup, featuring the A01, A02, A03, and A05 access control terminals, alongside the A092 door controller. These offerings cater to both residential and commercial segments. The A01, A02, and A03 terminals from Akuvox offer traditional PIN code (A02 exclusively), RFID card authentication, and mobile access. On the other hand, the A05, equipped with a 5-inch touchscreen and dual cameras, provides a more advanced feature set, supporting face recognition, NFC, QR code, RFID cards, and mobile app authentication.February 2024: Hikvision recently introduced its latest line of professional access control products, marking a notable advancement in access management. These new offerings boast enhanced features, such as web-based management, versatile authentication methods, specialized access applications, and integrated security solutions. The unveiling took place at a worldwide online event, where Hikvision's access control experts not only highlighted current industry trends but also showcased the brand's cutting-edge innovations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Card-based Access Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Card-based Access Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Card-based Access Control Market?

To stay informed about further developments, trends, and reports in the Card-based Access Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence