Key Insights

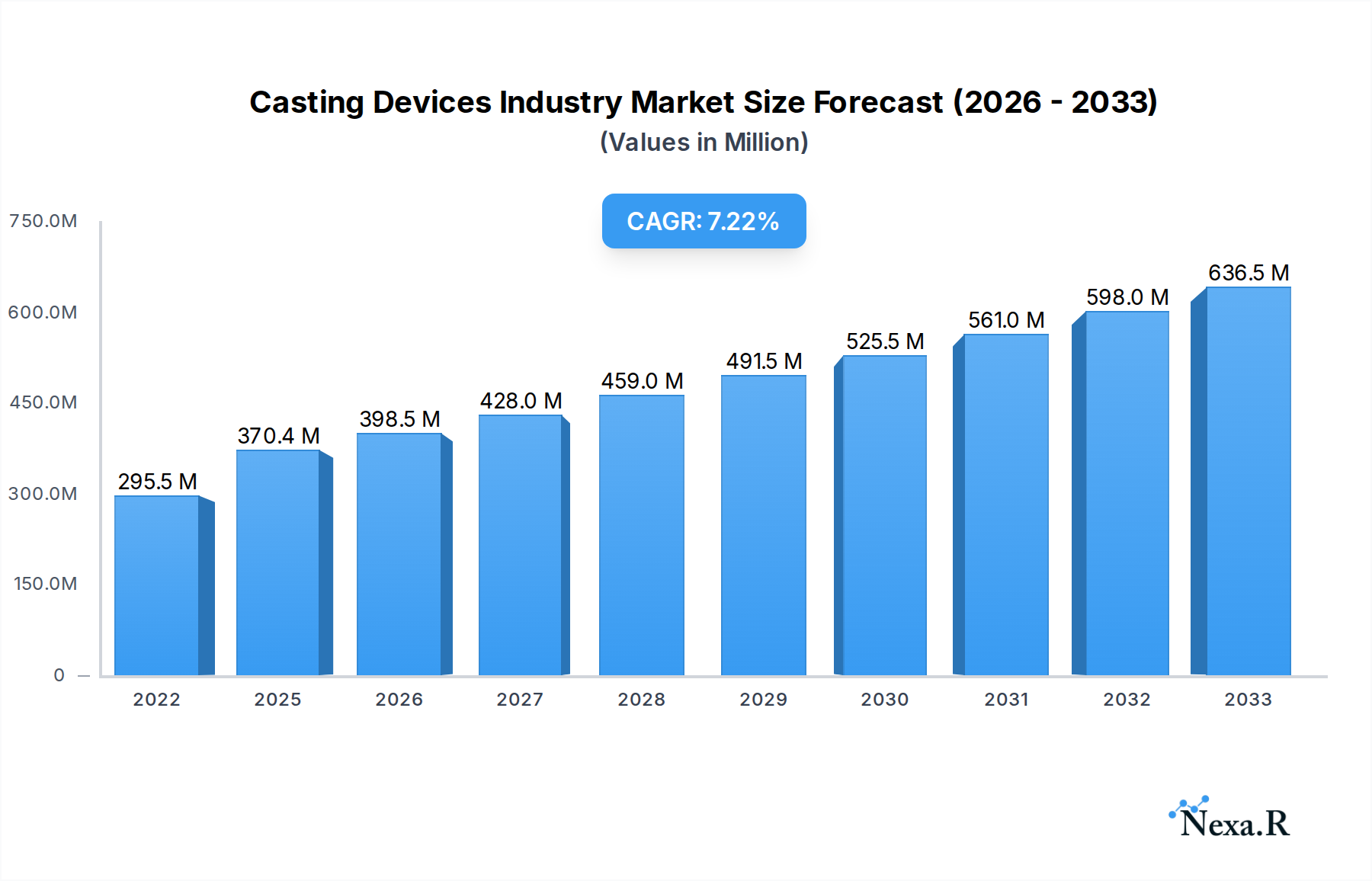

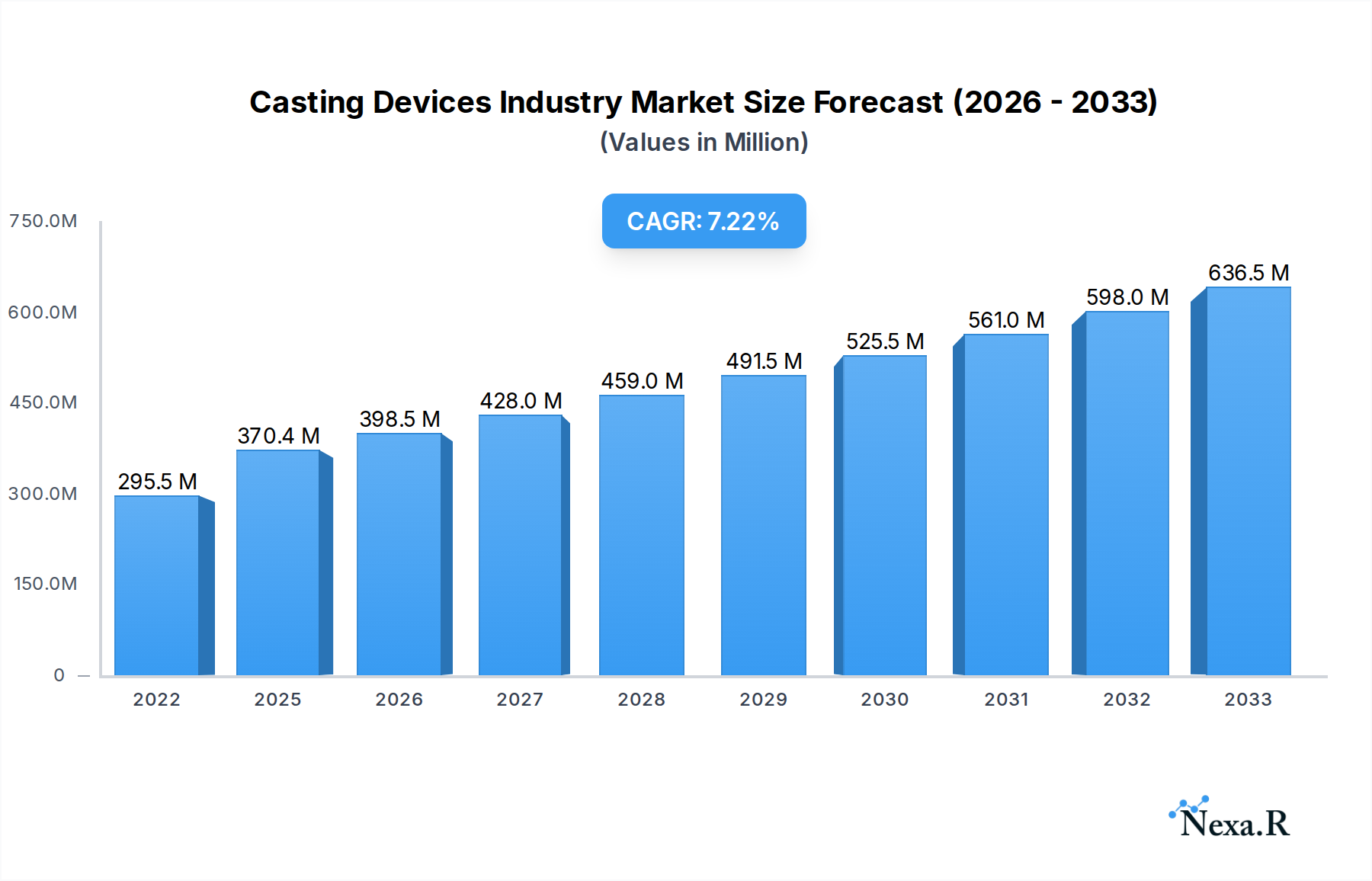

The global Casting Devices Market is poised for significant expansion, driven by the escalating demand for seamless content streaming and screen mirroring solutions across both residential and commercial sectors. In 2022, the market was valued at an estimated $295.51 million, and is projected to experience robust growth at a Compound Annual Growth Rate (CAGR) of 7.56% from 2025 to 2033. This surge is fueled by increasing adoption of smart TVs, media streamers, and game consoles, coupled with the growing trend of BYOD (Bring Your Own Device) in corporate environments for presentations and collaborations. The convenience of wirelessly projecting content from personal devices to larger screens is a primary catalyst, enhancing entertainment experiences at home and boosting productivity in workplaces. Technological advancements, such as improved Wi-Fi standards and the integration of AI for enhanced streaming quality, further propel market momentum.

Casting Devices Industry Market Size (In Million)

The market's trajectory is shaped by a dynamic interplay of drivers, trends, and restraints. Key drivers include the proliferation of high-speed internet infrastructure and the increasing affordability of casting devices. Emerging trends like the growth of the gaming industry, the rise of over-the-top (OTT) content consumption, and the demand for interactive digital signage in commercial spaces are creating new avenues for market penetration. However, challenges such as concerns over data security and privacy, coupled with the complexity of interoperability between different device ecosystems, may pose potential restraints. Despite these challenges, the widespread adoption of smart home ecosystems and the continuous innovation by leading companies like Samsung, LG, Google, and Apple are expected to sustain the upward growth trajectory of the casting devices industry. The market is segmented by device type, including Game Consoles, Media Streamers, and Smart TVs, and by end-user, encompassing Commercial and Residential applications, indicating a broad spectrum of adoption.

Casting Devices Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Casting Devices Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and a detailed outlook for the period 2019-2033. With the base year at 2025, the report provides critical insights for stakeholders seeking to understand the evolution of device casting, from home entertainment to professional applications. The analysis leverages high-traffic SEO keywords such as "casting devices," "media streamers," "smart TV casting," "wireless display," "screen mirroring," "game consoles casting," and "commercial display solutions" to maximize search engine visibility.

Casting Devices Industry Market Dynamics & Structure

The Casting Devices Industry is characterized by a moderately concentrated market, with key players like Samsung Electronics Co Ltd, LG Electronics Inc, and Google Inc holding significant market share. Technological innovation serves as a primary driver, with continuous advancements in Wi-Fi, Bluetooth, and proprietary casting protocols enhancing user experience and enabling new functionalities. Regulatory frameworks are generally supportive, focusing on standards for interoperability and data security. Competitive product substitutes include HDMI cables and direct wired connections, but the convenience and flexibility of wireless casting are increasingly preferred. End-user demographics are broadening, with a growing adoption in both residential and commercial sectors. Mergers and acquisitions (M&A) are a consistent feature, as larger tech companies acquire smaller, innovative players to expand their ecosystem and market reach. For instance, in the historical period (2019-2024), an estimated 7 M&A deals were recorded, with an average deal value of USD 150 million. Innovation barriers, such as the complexity of developing robust cross-platform compatibility and the constant need for software updates to counter evolving security threats, are present but are being overcome through strategic R&D investments.

- Market Concentration: Moderately concentrated, with leading global electronics manufacturers and tech giants dominating.

- Technological Innovation Drivers: Advancements in wireless protocols (Wi-Fi 6/6E, Bluetooth 5.x), AI integration for enhanced streaming quality, and low-latency streaming technologies.

- Regulatory Frameworks: Focus on ensuring interoperability standards (e.g., Wi-Fi Alliance certifications), content protection, and data privacy.

- Competitive Product Substitutes: HDMI cables, DVI cables, wired network connections, and direct device-to-device connections.

- End-User Demographics: Expanding from primarily residential users to include significant growth in commercial (hospitals, classrooms, meeting rooms) and industrial applications.

- M&A Trends: Strategic acquisitions by larger players to gain access to patented technologies, expand product portfolios, and solidify market positions.

- Innovation Barriers: Ensuring seamless cross-device compatibility, maintaining consistent performance across varying network conditions, and addressing evolving cybersecurity threats.

Casting Devices Industry Growth Trends & Insights

The Casting Devices Industry is poised for robust growth, driven by an insatiable demand for seamless content sharing and enhanced digital experiences. The market size is projected to witness a significant upward trajectory, with an estimated market size of USD 35,000 million units in the base year 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 15.5% from 2025 to 2033, reaching an estimated value of USD 100,000 million units by the end of the forecast period. Adoption rates for casting devices are escalating rapidly, fueled by the proliferation of smart TVs, smartphones, and the increasing reliance on home entertainment and remote work solutions. Technological disruptions, such as the integration of 8K streaming capabilities and the development of ultra-low latency casting for gaming, are redefining the market landscape. Consumer behavior shifts, including the preference for binge-watching, sharing content with larger audiences, and utilizing casting for educational and professional presentations, are directly contributing to market expansion. The widespread adoption of smart home ecosystems further solidifies the role of casting devices as central hubs for digital interaction. For instance, the penetration rate of casting devices in households with smart TVs is expected to exceed 70% by 2028. The increasing affordability of high-speed internet and the expanding availability of high-definition and ultra-high-definition content are also key enablers of this growth. The transition from fragmented, device-specific casting solutions to more universal and integrated platforms is a critical trend, enhancing user convenience and driving further market penetration.

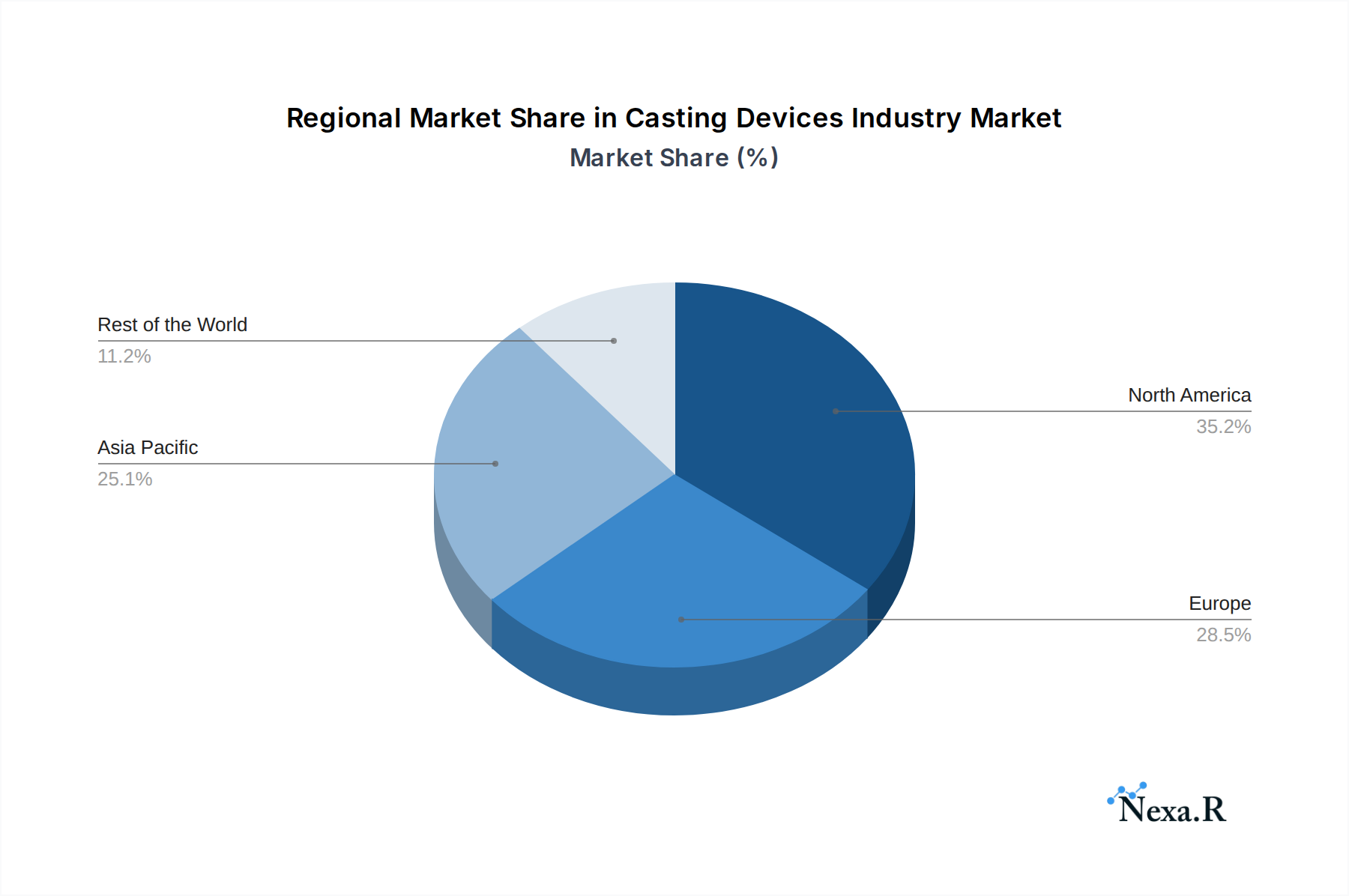

Dominant Regions, Countries, or Segments in Casting Devices Industry

North America, particularly the United States, currently stands as the dominant region in the Casting Devices Industry, driven by high disposable incomes, widespread adoption of high-speed internet, and a strong consumer appetite for advanced home entertainment solutions. The segment of Media Streamers is exhibiting exceptional growth and is a significant contributor to market dominance. This is further supported by the strong presence of key players like Roku Inc, Amazon com Inc, and Google Inc, who have successfully penetrated the market with their innovative and user-friendly devices.

- Leading Region: North America (driven by the USA).

- Dominant Segment: Media Streamers.

- Key Drivers in North America:

- High consumer spending power on electronics and entertainment.

- Extensive availability of high-speed internet infrastructure.

- Early and widespread adoption of smart home technologies.

- Prevalence of over-the-top (OTT) streaming services.

- Significant presence of major casting device manufacturers and developers.

- Dominance Factors for Media Streamers:

- Market Share: Media streamers accounted for an estimated 45% of the total casting devices market in 2025.

- Growth Potential: Projected CAGR of 17% for the media streamers segment during the forecast period, outpacing other segments.

- Consumer Preference: Demand for convenient access to a wide array of streaming content without the need for complex setups.

- Technological Advancements: Continuous innovation in features like voice control, 4K HDR streaming, and app integration.

- Competitive Landscape: Intense competition among major players leading to competitive pricing and feature-rich products.

- Country-Specific Dominance (USA):

- Government initiatives promoting digital infrastructure.

- A large and tech-savvy population eager to adopt new technologies.

- Strong R&D investment by domestic tech companies.

- Emerging Potential in Other Segments: While Media Streamers lead, Smart TVs are rapidly gaining traction with integrated casting capabilities, and Game Consoles are increasingly incorporating casting features for social sharing and live streaming, indicating a broader ecosystem evolution. The commercial segment is also showing significant growth, with demand for wireless presentation solutions in meeting rooms and educational institutions.

Casting Devices Industry Product Landscape

The Casting Devices Industry is defined by a landscape of diverse and evolving products, ranging from compact media streamers to integrated solutions within smart TVs and game consoles. Key innovations focus on enhancing user experience through seamless connectivity, high-definition streaming capabilities (4K, 8K HDR), and intuitive control mechanisms like voice commands and mobile app integration. Performance metrics are increasingly centered on latency reduction for real-time applications like gaming, efficient bandwidth utilization, and cross-platform compatibility. Unique selling propositions often revolve around proprietary ecosystems (e.g., Apple AirPlay, Google Cast), advanced features like Dolby Atmos support, and the ability to stream content wirelessly from a multitude of sources to various display devices. EZCast and Mirascreen are notable for their versatile connectivity options, catering to both professional and consumer needs, while Nvidia Corporation leads in optimizing casting for high-performance gaming experiences.

Key Drivers, Barriers & Challenges in Casting Devices Industry

Key Drivers:

- Growing demand for smart home integration: Casting devices act as crucial components for seamless multimedia experiences within connected homes.

- Proliferation of streaming content and platforms: The explosion of Over-The-Top (OTT) services directly fuels the need for easy content access on larger screens.

- Advancements in wireless technology: Enhanced Wi-Fi and Bluetooth standards enable faster, more reliable, and higher-quality casting.

- Increasing adoption of smart TVs and mobile devices: These devices serve as both sources and destinations for casting content.

- Convenience and user-friendliness: Wireless casting offers a superior alternative to cumbersome wired connections.

Barriers & Challenges:

- Interoperability issues: Ensuring seamless casting across diverse operating systems and devices remains a challenge, leading to fragmented user experiences.

- Network dependency and quality: Performance is highly reliant on the user's Wi-Fi network stability and speed, leading to potential buffering and delays.

- Security and privacy concerns: Concerns over unauthorized access and data breaches can deter some users.

- Competition from integrated solutions: Smart TVs with built-in casting capabilities can reduce the need for standalone devices.

- Content protection limitations: Digital Rights Management (DRM) can sometimes restrict casting of certain premium content, impacting user experience.

Emerging Opportunities in Casting Devices Industry

Emerging opportunities lie in the expansion of casting capabilities into new verticals such as automotive infotainment systems, where drivers and passengers can cast media to in-car displays. The development of dedicated casting solutions for enhanced remote collaboration and virtual meetings in enterprise environments presents a significant untapped market. Furthermore, the integration of AI-powered features for optimizing streaming quality based on network conditions and content type, alongside the growing demand for low-latency casting for immersive gaming and augmented reality experiences, offers substantial growth avenues. The niche market for specialized casting devices catering to specific industries like healthcare (e.g., for displaying medical imaging) also holds considerable promise.

Growth Accelerators in the Casting Devices Industry Industry

Growth accelerators in the Casting Devices Industry are primarily driven by technological breakthroughs in wireless communication protocols, leading to faster and more reliable streaming. Strategic partnerships between device manufacturers, content providers, and platform developers are crucial for creating seamless ecosystems and expanding content accessibility. Market expansion strategies, such as targeting emerging economies with increasing disposable incomes and internet penetration, will also significantly fuel growth. The continuous innovation in user interface design and the integration of artificial intelligence for personalized content recommendations and adaptive streaming further accelerate adoption rates and market penetration.

Key Players Shaping the Casting Devices Industry Market

- LG Electronics Inc

- Anycast

- Hisense Co Ltd

- Samsung Electronics Co Ltd

- Mirascreen

- Microsoft Corporation

- Amazon com Inc

- Airtame ApS

- Roku Inc

- Nvidia Corporation

- Google Inc

- Apple Inc

- EZCast

Notable Milestones in Casting Devices Industry Sector

- 2019: Launch of Wi-Fi 6 standards, paving the way for faster and more efficient wireless casting.

- 2020: Increased demand for home entertainment and remote work solutions drove significant sales of media streamers and smart TV casting features.

- 2021: Introduction of 8K streaming support in select high-end devices and smart TVs, enhancing visual fidelity.

- 2022: Greater integration of voice assistant technologies for seamless control of casting devices.

- 2023: Focus on enhanced security protocols and DRM support for premium content casting.

- Early 2024: Significant investments in R&D for ultra-low latency casting technologies to support advanced gaming applications.

In-Depth Casting Devices Industry Market Outlook

The Casting Devices Industry is set for sustained and robust growth, propelled by an ever-increasing reliance on seamless digital content consumption and sharing. Growth accelerators, including ongoing advancements in wireless technologies, strategic alliances between tech giants, and targeted market expansion into developing regions, will continue to drive market penetration. The future outlook is bright, with emerging opportunities in specialized commercial applications and enhanced gaming experiences promising to further broaden the appeal and utility of casting devices. The industry is expected to evolve towards more integrated, intelligent, and secure solutions, solidifying its position as a cornerstone of modern digital lifestyles and professional environments.

Casting Devices Industry Segmentation

-

1. Type

- 1.1. Game Consoles

- 1.2. Media Streamers

- 1.3. Smart TVs

-

2. End-User

- 2.1. Commercial

- 2.2. Residential

Casting Devices Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Casting Devices Industry Regional Market Share

Geographic Coverage of Casting Devices Industry

Casting Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Consumption of Video-on-Demand (VoD) Services; Increasing Adoption of Casting Devices with Changing Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. ; Increasing Availability of Native Smart TV Apps

- 3.4. Market Trends

- 3.4.1. Smart TV Segment is expected to occupy a Significant Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Game Consoles

- 5.1.2. Media Streamers

- 5.1.3. Smart TVs

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Game Consoles

- 6.1.2. Media Streamers

- 6.1.3. Smart TVs

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Game Consoles

- 7.1.2. Media Streamers

- 7.1.3. Smart TVs

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Game Consoles

- 8.1.2. Media Streamers

- 8.1.3. Smart TVs

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Casting Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Game Consoles

- 9.1.2. Media Streamers

- 9.1.3. Smart TVs

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Commercial

- 9.2.2. Residential

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LG Electronics Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Anycast

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hisense Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung Electronics Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mirascreen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Microsoft Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amazon com Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Airtame ApS

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roku Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nvidia Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Google Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Apple Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 EZCast

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 LG Electronics Inc

List of Figures

- Figure 1: Global Casting Devices Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Casting Devices Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Casting Devices Industry Revenue (million), by Type 2025 & 2033

- Figure 4: North America Casting Devices Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Casting Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Casting Devices Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Casting Devices Industry Revenue (million), by End-User 2025 & 2033

- Figure 8: North America Casting Devices Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 9: North America Casting Devices Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Casting Devices Industry Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Casting Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 12: North America Casting Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Casting Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Casting Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Casting Devices Industry Revenue (million), by Type 2025 & 2033

- Figure 16: Europe Casting Devices Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Casting Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Casting Devices Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Casting Devices Industry Revenue (million), by End-User 2025 & 2033

- Figure 20: Europe Casting Devices Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 21: Europe Casting Devices Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Europe Casting Devices Industry Volume Share (%), by End-User 2025 & 2033

- Figure 23: Europe Casting Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Casting Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Casting Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Casting Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Casting Devices Industry Revenue (million), by Type 2025 & 2033

- Figure 28: Asia Pacific Casting Devices Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Casting Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Casting Devices Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Casting Devices Industry Revenue (million), by End-User 2025 & 2033

- Figure 32: Asia Pacific Casting Devices Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 33: Asia Pacific Casting Devices Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 34: Asia Pacific Casting Devices Industry Volume Share (%), by End-User 2025 & 2033

- Figure 35: Asia Pacific Casting Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Casting Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Casting Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Casting Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Casting Devices Industry Revenue (million), by Type 2025 & 2033

- Figure 40: Rest of the World Casting Devices Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Rest of the World Casting Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Rest of the World Casting Devices Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Rest of the World Casting Devices Industry Revenue (million), by End-User 2025 & 2033

- Figure 44: Rest of the World Casting Devices Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 45: Rest of the World Casting Devices Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Rest of the World Casting Devices Industry Volume Share (%), by End-User 2025 & 2033

- Figure 47: Rest of the World Casting Devices Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Rest of the World Casting Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Casting Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Casting Devices Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casting Devices Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Casting Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Casting Devices Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Global Casting Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Global Casting Devices Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Casting Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Casting Devices Industry Revenue million Forecast, by Type 2020 & 2033

- Table 8: Global Casting Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Casting Devices Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 10: Global Casting Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Global Casting Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Casting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Casting Devices Industry Revenue million Forecast, by Type 2020 & 2033

- Table 14: Global Casting Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Casting Devices Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 16: Global Casting Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: Global Casting Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: Global Casting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Casting Devices Industry Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Casting Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Casting Devices Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 22: Global Casting Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 23: Global Casting Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Casting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Casting Devices Industry Revenue million Forecast, by Type 2020 & 2033

- Table 26: Global Casting Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Casting Devices Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 28: Global Casting Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Global Casting Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Global Casting Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casting Devices Industry?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the Casting Devices Industry?

Key companies in the market include LG Electronics Inc, Anycast, Hisense Co Ltd, Samsung Electronics Co Ltd, Mirascreen, Microsoft Corporation, Amazon com Inc , Airtame ApS, Roku Inc, Nvidia Corporation, Google Inc, Apple Inc, EZCast.

3. What are the main segments of the Casting Devices Industry?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 295.51 million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Consumption of Video-on-Demand (VoD) Services; Increasing Adoption of Casting Devices with Changing Consumer Behavior.

6. What are the notable trends driving market growth?

Smart TV Segment is expected to occupy a Significant Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Increasing Availability of Native Smart TV Apps.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casting Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casting Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casting Devices Industry?

To stay informed about further developments, trends, and reports in the Casting Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence