Key Insights

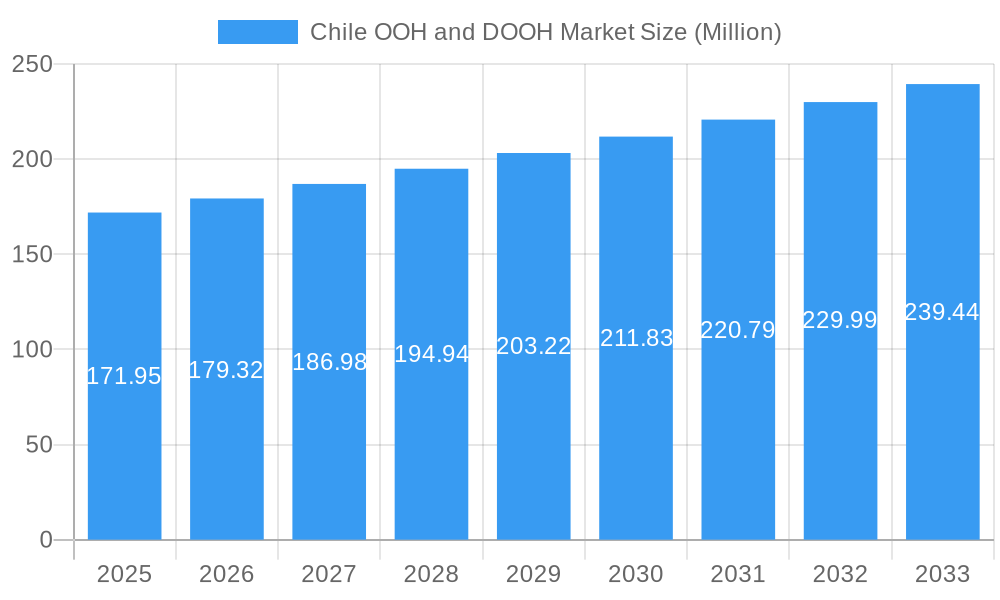

The Chilean Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for robust growth, projected to reach \$171.95 million by 2025. This expansion is fueled by a strong Compound Annual Growth Rate (CAGR) of 4.34% throughout the study period (2019-2033). A significant driver for this growth is the increasing adoption of Digital Out-of-Home (DOOH) advertising, particularly LED screens and programmatic OOH solutions. These technologies offer enhanced targeting capabilities, dynamic content delivery, and measurable campaign performance, making them highly attractive to advertisers seeking greater ROI. The integration of programmatic platforms allows for real-time bidding and automated campaign management, mirroring the efficiencies seen in digital advertising and attracting a broader range of advertisers.

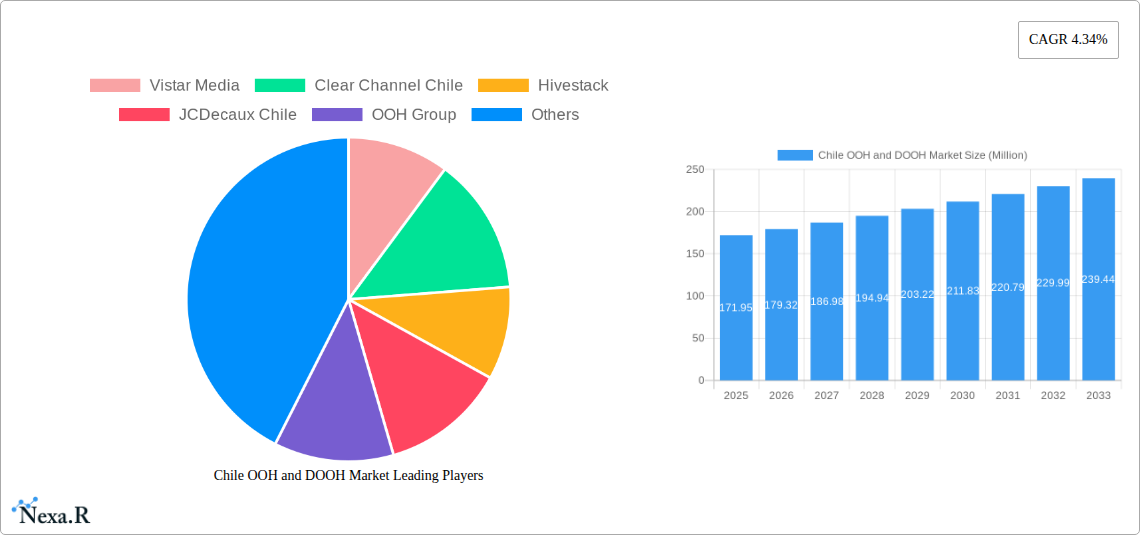

Chile OOH and DOOH Market Market Size (In Million)

The market segmentation highlights key areas of opportunity. Within the "Type" segment, Digital OOH (DOOH) is expected to dominate, encompassing LED screens, programmatic OOH, and other advanced digital formats. The "Application" segment showcases the widespread integration of OOH across various touchpoints, with billboards and transportation advertising (including airports and transit vehicles like buses) leading the charge. Street furniture and other place-based media also represent significant channels. In terms of "End-Use," the Automotive, Retail and Consumer Goods, Healthcare, and BFSI sectors are anticipated to be major contributors to market revenue, leveraging OOH and DOOH to connect with diverse consumer demographics. Leading companies in this space, such as Vistar Media, Clear Channel Chile, Hivestack, and JCDecaux Chile, are instrumental in shaping the market through innovation and strategic partnerships.

Chile OOH and DOOH Market Company Market Share

This comprehensive report offers an in-depth analysis of the dynamic Chile Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market. With meticulous research covering the historical period from 2019 to 2024, a base year of 2025, and a robust forecast period extending to 2033, this report provides actionable insights for advertisers, media owners, and industry stakeholders. Explore the evolving landscape of OOH advertising, driven by technological advancements and shifting consumer behaviors, and identify lucrative investment opportunities.

Chile OOH and DOOH Market Market Dynamics & Structure

The Chile OOH and DOOH market exhibits a moderately concentrated structure, with key players like Clear Channel Chile and JCDecaux Chile holding significant market shares. Technological innovation, particularly in programmatic DOOH, is a major driver, enhancing targeting capabilities and campaign effectiveness. The regulatory framework, while evolving, generally supports OOH advertising, though local permitting processes can present minor hurdles. Competitive product substitutes are primarily other digital advertising channels, but OOH's unique ability to capture attention in physical spaces remains a strong differentiator. End-user demographics are diverse, with a growing demand from the Automotive, Retail and Consumer Goods, and BFSI sectors for impactful brand presence. Mergers and acquisitions (M&A) trends, exemplified by Aleph Group's strategic expansion, indicate a consolidation phase aimed at increasing market reach and technological integration, with approximately 3-5 significant M&A activities anticipated within the forecast period.

- Market Concentration: Dominated by a few large players, but with increasing fragmentation due to digital innovation.

- Technological Innovation: High adoption of programmatic DOOH, programmatic OOH, and advanced data analytics for audience segmentation.

- Regulatory Framework: Generally favorable, with a focus on urban planning and public space utilization.

- Competitive Landscape: Intense competition from digital media, but unique reach and impact of OOH persist.

- End-User Demand: Strong growth from key sectors like Automotive, Retail, and BFSI.

- M&A Activity: Indicative of market maturity and pursuit of scale and technological synergy.

Chile OOH and DOOH Market Growth Trends & Insights

The Chile OOH and DOOH market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is fueled by an increasing adoption of digital OOH solutions, which are rapidly displacing traditional static billboards due to their flexibility, dynamic content capabilities, and measurability. The market size, estimated to be around $180 million in 2025, is expected to reach over $350 million by 2033. Technological disruptions, such as the integration of AI for real-time audience insights and dynamic content optimization, are revolutionizing campaign strategies. Consumer behavior shifts towards experiential marketing and a desire for contextually relevant advertising further bolster the appeal of DOOH. The convenience of programmatic buying platforms is also lowering entry barriers for smaller advertisers, contributing to market penetration.

- Market Size Evolution: A substantial upward trajectory driven by digital transformation.

- Adoption Rates: Rapid uptake of DOOH, especially programmatic DOOH, surpassing traditional OOH growth.

- Technological Disruptions: AI, programmatic buying, and data analytics are reshaping campaign execution.

- Consumer Behavior Shifts: Growing demand for immersive, personalized, and location-aware advertising.

- Market Penetration: Increased accessibility for a wider range of advertisers.

- CAGR: Estimated at 8.5% from 2025-2033.

Dominant Regions, Countries, or Segments in Chile OOH and DOOH Market

Within the Chilean OOH and DOOH market, Digital OOH (DOOH) is emerging as the dominant segment, driven by its superior engagement capabilities and flexibility. This dominance is particularly pronounced in urban centers like Santiago, where a high concentration of LED screens and programmatic OOH inventory is available. The "Transportation (Transit)" application, especially within airports and major bus terminals, represents a significant growth driver, offering captive audiences and high dwell times. The "Retail and Consumer Goods" end-user segment consistently leads in advertising spend, leveraging OOH and DOOH for product launches, promotions, and brand building.

Dominant Segment: Digital OOH (LED Screens) (Programmatic OOH, Others):

- Key Drivers: Dynamic content, real-time updates, audience targeting, measurability, and programmatic buying.

- Market Share Potential: Expected to capture over 60% of the total OOH market by 2028.

- Growth Factors: Increasing investment in digital infrastructure by media owners and advertiser demand for sophisticated campaign management.

Dominant Application: Transportation (Transit) (Airports, Others (Buses, etc.)):

- Key Drivers: High audience density, captive audiences, long dwell times, and integration with travel patterns.

- Market Share Potential: Significant contribution to DOOH revenue, especially in major transport hubs.

- Growth Factors: Expansion of public transportation networks and airport infrastructure projects.

Dominant End-User: Retail and Consumer Goods:

- Key Drivers: Need for broad reach, localized campaigns, and impulse purchase influence.

- Market Share Potential: Consistently the largest spending sector.

- Growth Factors: E-commerce integration, direct-to-consumer strategies, and experiential retail.

Chile OOH and DOOH Market Product Landscape

The product landscape of the Chile OOH and DOOH market is characterized by a rapid evolution towards intelligent and data-driven advertising solutions. Digital screens are increasingly equipped with advanced features like audience measurement sensors, enabling hyper-segmentation and personalized content delivery. Programmatic DOOH platforms allow for automated buying and real-time optimization of ad placements, mirroring the efficiencies of digital media. Innovative applications extend beyond static displays to encompass interactive digital billboards, augmented reality (AR) integrations, and even dynamic content triggered by weather or event data. The performance metrics are shifting from mere impressions to measurable outcomes, with a focus on viewability, engagement rates, and attribution modeling.

Key Drivers, Barriers & Challenges in Chile OOH and DOOH Market

Key Drivers:

- Technological Advancements: The proliferation of programmatic DOOH, AI-powered analytics, and programmatic OOH platforms are enhancing efficiency and targeting.

- Economic Growth: A stable Chilean economy fuels advertising spend across various sectors.

- Urbanization and Infrastructure Development: Increasing urban populations and infrastructure projects create more OOH inventory opportunities.

- Shifting Consumer Habits: A growing preference for experiential and visually engaging advertising.

Barriers & Challenges:

- Supply Chain Disruptions: While less prevalent than in other sectors, occasional delays in digital screen manufacturing or installation can occur, potentially impacting deployment timelines.

- Regulatory Hurdles: Navigating local zoning laws and obtaining permits for new installations can be time-consuming.

- Competitive Pressures: Intense competition from other digital advertising channels requires constant innovation and demonstration of ROI.

- Data Privacy Concerns: Ensuring compliance with data privacy regulations is crucial for programmatic DOOH.

- Initial Investment Costs: High upfront costs for digital OOH infrastructure can be a barrier for smaller media owners.

Emerging Opportunities in Chile OOH and DOOH Market

Emerging opportunities in the Chile OOH and DOOH market lie in leveraging the power of programmatic buying to reach niche audiences with highly targeted campaigns. The integration of OOH with mobile advertising through geo-fencing and location-based analytics presents a significant opportunity for creating seamless, omnichannel customer journeys. Furthermore, the expansion of DOOH into smaller cities and non-traditional locations, such as public transport hubs, shopping malls, and even gas stations, can unlock new advertiser segments. The growing demand for sustainable and eco-friendly advertising solutions also presents an opportunity for media owners who invest in energy-efficient digital displays and responsible media practices.

Growth Accelerators in the Chile OOH and DOOH Market Industry

Catalysts driving long-term growth in the Chile OOH and DOOH industry include the continued adoption of programmatic technologies, which enhance campaign automation and efficiency, leading to increased advertiser confidence. Strategic partnerships between media owners, technology providers, and data analytics firms are crucial for developing integrated solutions and proving the ROI of OOH advertising. Market expansion strategies, including the development of new inventory in underserved areas and the creation of innovative ad formats, will further fuel growth. The increasing sophistication of measurement tools, providing granular insights into campaign performance and audience engagement, is also a significant growth accelerator.

Key Players Shaping the Chile OOH and DOOH Market Market

- Vistar Media

- Clear Channel Chile

- Hivestack

- JCDecaux Chile

- OOH Group

- Taggify

- Lamar Media Corp

- Viva outdoor

- Dentsu Creative Chile

- Outdoor Media Buyers

Notable Milestones in Chile OOH and DOOH Market Sector

- July 2024: Aleph Group finalized its acquisition of Entravision Global Partners ("EGP"), significantly strengthening its presence in Latin American markets including Chile, Mexico, Brazil, Argentina, Colombia, Peru, Puerto Rico, and Ecuador. This move is expected to boost digital media platform connectivity for advertisers.

- November 2023: Clear Channel Outdoor Holdings, Inc. completed the sale of its French business and conducted a strategic review of its Latin American operations, which include Chile, Mexico, Brazil, and Peru. This indicates a potential restructuring and strategic refocusing for the company in the region.

In-Depth Chile OOH and DOOH Market Market Outlook

The future outlook for the Chile OOH and DOOH market is exceptionally bright, characterized by sustained growth and increasing sophistication. The ongoing digital transformation, coupled with the integration of AI and programmatic buying, will unlock new levels of efficiency and effectiveness for advertisers. Strategic partnerships and market expansion initiatives will continue to broaden the reach and impact of OOH advertising. The evolving consumer preferences towards immersive and contextual experiences will further cement the role of DOOH as a powerful medium for brand engagement. The market is poised to become a more data-driven and measurable advertising channel, offering unparalleled opportunities for brands to connect with their target audiences in the physical world.

Chile OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

1.3. By Appli

- 1.3.1. Billboard

-

1.3.2. Transportation (Transit)

- 1.3.2.1. Airports

- 1.3.2.2. Others (Buses, etc.)

- 1.3.3. Street Furniture

- 1.3.4. Other Place-Based Media

-

1.4. By End-U

- 1.4.1. Automotive

- 1.4.2. Retail and Consumer Goods

- 1.4.3. Healthcare

- 1.4.4. BFSI

- 1.4.5. Other End Users

Chile OOH and DOOH Market Segmentation By Geography

- 1. Chile

Chile OOH and DOOH Market Regional Market Share

Geographic Coverage of Chile OOH and DOOH Market

Chile OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Towards Digital Advertising Aided by Increased Spending on Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.1.3. By Appli

- 5.1.3.1. Billboard

- 5.1.3.2. Transportation (Transit)

- 5.1.3.2.1. Airports

- 5.1.3.2.2. Others (Buses, etc.)

- 5.1.3.3. Street Furniture

- 5.1.3.4. Other Place-Based Media

- 5.1.4. By End-U

- 5.1.4.1. Automotive

- 5.1.4.2. Retail and Consumer Goods

- 5.1.4.3. Healthcare

- 5.1.4.4. BFSI

- 5.1.4.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vistar Media

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clear Channel Chile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hivestack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JCDecaux Chile

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OOH Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Taggify

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lamar Media Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viva outdoor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dentsu Creative Chile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Outdoor Media Buyers*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vistar Media

List of Figures

- Figure 1: Chile OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Chile OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Chile OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Chile OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Chile OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Chile OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Chile OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 7: Chile OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Chile OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile OOH and DOOH Market?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Chile OOH and DOOH Market?

Key companies in the market include Vistar Media, Clear Channel Chile, Hivestack, JCDecaux Chile, OOH Group, Taggify, Lamar Media Corp, Viva outdoor, Dentsu Creative Chile, Outdoor Media Buyers*List Not Exhaustive.

3. What are the main segments of the Chile OOH and DOOH Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 171.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States.

6. What are the notable trends driving market growth?

Ongoing Shift Towards Digital Advertising Aided by Increased Spending on Smart City Projects.

7. Are there any restraints impacting market growth?

Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States.

8. Can you provide examples of recent developments in the market?

July 2024: Aleph Group, a global player in connecting major digital media platforms with advertisers and consumers, especially in emerging markets, has finalized its acquisition of Entravision Global Partners ("EGP"), the digital commercial arm of Entravision Communications Corporation. Some of the major markets strengthened by this acquisition in Latin America include Chile, Mexico, Brazil, Argentina, Colombia, Peru, Puerto Rico, and Ecuador, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Chile OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence