Key Insights

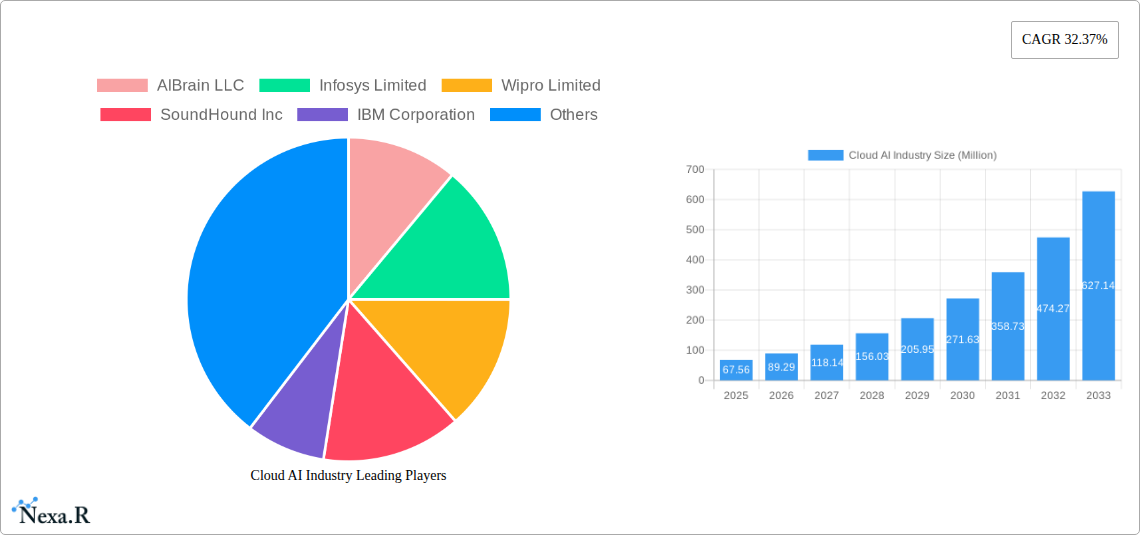

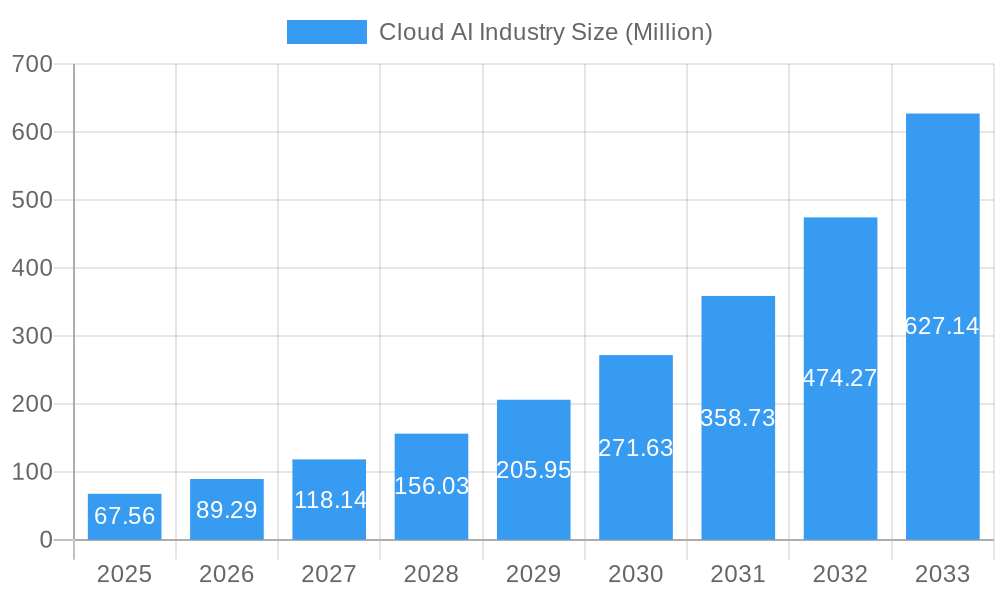

The Cloud AI industry is experiencing an unprecedented surge, projected to reach a market size of $67.56 billion. This remarkable growth is fueled by a staggering Compound Annual Growth Rate (CAGR) of 32.37%, indicating a highly dynamic and rapidly expanding sector. This expansion is primarily driven by the increasing adoption of cloud-based artificial intelligence solutions across various industries, including BFSI, Healthcare, Automotive, Retail, Government, and Education. The inherent scalability, cost-effectiveness, and accessibility of cloud infrastructure are enabling organizations of all sizes to leverage advanced AI capabilities, from machine learning and natural language processing to computer vision and predictive analytics. The demand for intelligent automation, personalized customer experiences, and data-driven decision-making further propels the market forward. The proliferation of AI-powered services and solutions, coupled with significant investments in research and development by major technology players, is creating a fertile ground for innovation and market penetration.

Cloud AI Industry Market Size (In Million)

Key trends shaping the Cloud AI landscape include the rise of hybrid and multi-cloud AI strategies, offering greater flexibility and vendor independence. The development of specialized AI models tailored for specific industry needs, such as fraud detection in finance or diagnostic assistance in healthcare, is also a significant trend. Furthermore, the increasing focus on AI governance, ethics, and responsible AI practices is becoming paramount as the technology integrates more deeply into critical business processes. While the market is characterized by robust growth, certain restraints, such as data privacy concerns, regulatory complexities, and the need for skilled AI professionals, warrant careful consideration. However, the overwhelming benefits of cloud AI in terms of enhanced efficiency, improved operational agility, and the creation of new revenue streams are expected to outweigh these challenges, ensuring sustained and accelerated growth in the coming years. The competitive landscape is dominated by major tech giants like Google, Microsoft, and Amazon, alongside specialized AI solution providers, all vying to capture market share through continuous innovation and strategic partnerships.

Cloud AI Industry Company Market Share

Cloud AI Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Cloud AI Industry, offering critical insights into its market dynamics, growth trajectories, regional dominance, product landscape, key players, and future potential. Leveraging extensive data from the Historical Period (2019-2024) and projecting through the Forecast Period (2025-2033), with 2025 as the Base Year and Estimated Year, this report is designed for industry professionals seeking a strategic advantage. We delve into parent and child market segments, quantifying values in Million Units to offer precise and actionable intelligence.

Cloud AI Industry Market Dynamics & Structure

The Cloud AI industry is characterized by a dynamic and evolving structure, driven by rapid technological advancements and increasing adoption across diverse sectors. Market concentration is influenced by the presence of major cloud providers and AI specialists, with a competitive landscape shaped by innovation and strategic partnerships. Technological innovation serves as a primary driver, with continuous development in machine learning, natural language processing, and computer vision fueling new applications and services. Regulatory frameworks, though nascent in some areas, are gradually taking shape, aiming to ensure ethical AI deployment and data privacy. Competitive product substitutes exist, primarily from on-premise AI solutions and specialized AI platforms, but the scalability, flexibility, and cost-effectiveness of cloud AI often provide a distinct advantage. End-user demographics are broadening, with an increasing number of enterprises across all sizes embracing AI for operational efficiency and business transformation. Mergers and acquisitions (M&A) activity remains robust, as larger players seek to consolidate market share, acquire innovative technologies, and expand their service portfolios.

- Market Concentration: Dominated by hyperscale cloud providers and a growing ecosystem of AI-focused startups.

- Technological Innovation Drivers: Advancements in ML algorithms, deep learning, NLP, and computer vision.

- Regulatory Frameworks: Evolving regulations concerning data privacy, AI ethics, and algorithmic bias.

- Competitive Product Substitutes: On-premise AI solutions, niche AI software, and in-house AI development.

- End-User Demographics: Expanding across BFSI, Healthcare, Automotive, Retail, Government, Education, and Other Verticals.

- M&A Trends: Ongoing consolidation and strategic acquisitions to gain technological prowess and market reach.

Cloud AI Industry Growth Trends & Insights

The Cloud AI Industry is poised for substantial growth, projected to witness a significant CAGR of XX% from 2025 to 2033. This expansion is fueled by the accelerating adoption of AI-powered solutions and services across virtually every business vertical. The market size evolution indicates a dramatic increase, moving from an estimated $XXX Million in 2025 to a projected $XXX Million by 2033. Adoption rates are surging as organizations recognize the transformative potential of cloud AI in areas such as predictive analytics, customer service automation, and intelligent process optimization. Technological disruptions, including the rise of generative AI, explainable AI (XAI), and edge AI, are further pushing the boundaries of what's possible, creating new market opportunities and enhancing existing applications.

Consumer behavior shifts are also playing a crucial role. Businesses are increasingly demanding personalized customer experiences, efficient operational workflows, and data-driven decision-making capabilities – all of which are expertly delivered through cloud AI solutions. The proliferation of data, coupled with the decreasing cost of cloud computing and AI processing power, makes cloud AI an increasingly accessible and indispensable tool for enterprises of all sizes. From enhancing diagnostic accuracy in healthcare to optimizing supply chains in retail and personalizing financial advice in BFSI, the penetration of cloud AI is deepening across the economic landscape. The ability to scale AI capabilities on demand, without significant upfront infrastructure investment, makes cloud AI a highly attractive proposition for companies looking to innovate and stay competitive.

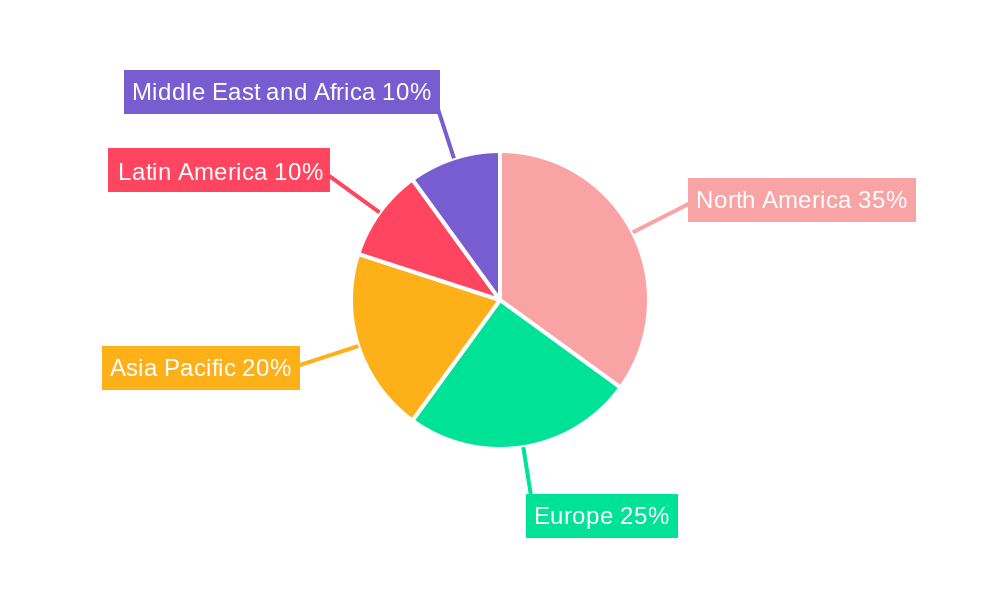

Dominant Regions, Countries, or Segments in Cloud AI Industry

The Cloud AI Industry exhibits significant regional variations in terms of growth and adoption. North America, particularly the United States, currently stands as the dominant region, driven by a mature technology ecosystem, substantial venture capital investment in AI startups, and a strong concentration of leading technology companies. This dominance is further bolstered by robust government initiatives supporting AI research and development, and a business environment that readily embraces innovation. The BFSI and Healthcare sectors in North America are leading the charge in Cloud AI adoption, leveraging AI for fraud detection, risk assessment, personalized financial services, advanced diagnostics, and drug discovery.

Key Drivers of Dominance in North America:

- Advanced Technological Infrastructure: Widespread availability of high-speed internet and cloud computing resources.

- Innovation Hubs: Presence of major tech giants and thriving startup ecosystems.

- Investment Landscape: Significant venture capital funding for AI and cloud technologies.

- Skilled Workforce: Availability of AI researchers, data scientists, and cloud engineers.

- Regulatory Support: Favorable policies and initiatives promoting AI adoption.

Dominant Segments:

- Type: The Solution segment, encompassing AI platforms, machine learning services, and specialized AI tools, is experiencing rapid growth, closely followed by the Service segment, which includes AI consulting, implementation, and managed services.

- End-user Vertical: BFSI and Healthcare are leading verticals, with substantial investments in AI for their core operations. Retail is also a significant contributor, driven by e-commerce and personalization trends.

The market share for cloud AI solutions in North America is estimated to be XX% of the global market in 2025, with projected growth fueled by continued innovation and increasing enterprise adoption. The region's commitment to AI research and development positions it to maintain its leading stance in the foreseeable future.

Cloud AI Industry Product Landscape

The Cloud AI industry's product landscape is characterized by a continuous stream of innovative offerings that blend advanced artificial intelligence capabilities with the scalability and accessibility of cloud infrastructure. Key product categories include AI-powered analytics platforms, machine learning-as-a-service (MLaaS), natural language processing (NLP) tools, computer vision solutions, and intelligent automation software. These products are designed to address a wide array of business needs, from enhancing customer engagement with AI chatbots and personalized recommendations to optimizing operational efficiency through predictive maintenance and supply chain management. Unique selling propositions often lie in the ease of integration, the ability to handle massive datasets, and the development of specialized AI models tailored to specific industry verticals. Technological advancements are continually refining performance metrics, such as accuracy in prediction, speed of processing, and the explainability of AI decision-making.

Key Drivers, Barriers & Challenges in Cloud AI Industry

The Cloud AI Industry is propelled by several key drivers, including the escalating need for data-driven decision-making, the demand for enhanced operational efficiency, and the pursuit of personalized customer experiences. Technological advancements in machine learning algorithms, the increasing availability of big data, and the cost-effectiveness of cloud computing are also significant catalysts. The expansion of cloud infrastructure globally further facilitates the widespread adoption of AI solutions.

However, the industry faces considerable barriers and challenges. Data privacy concerns and regulatory hurdles, particularly concerning the ethical use of AI and algorithmic bias, pose significant restraints. The shortage of skilled AI professionals, the complexity of integrating AI systems with existing IT infrastructure, and the high initial investment for some advanced AI solutions can also impede growth. Furthermore, the cybersecurity risks associated with cloud-based AI platforms require constant vigilance.

Emerging Opportunities in Cloud AI Industry

Emerging opportunities within the Cloud AI Industry are vast and varied. The burgeoning field of generative AI presents immense potential for content creation, code generation, and personalized marketing. The increasing demand for AI-powered sustainability solutions, driven by growing environmental awareness and regulatory pressures, opens new avenues for innovation in areas like carbon footprint monitoring and resource optimization. Furthermore, the expansion of AI into specialized niches, such as AI-driven drug discovery in pharmaceuticals and intelligent transportation systems in the automotive sector, offers significant untapped markets. The continued development of edge AI, enabling localized processing of AI tasks without constant cloud connectivity, also presents opportunities for real-time applications in IoT devices and autonomous systems.

Growth Accelerators in the Cloud AI Industry Industry

Several growth accelerators are actively shaping the future of the Cloud AI Industry. Breakthroughs in AI research, particularly in areas like reinforcement learning and natural language understanding, are continuously expanding the capabilities of AI solutions. Strategic partnerships between cloud providers, AI software vendors, and industry-specific solution developers are crucial for creating comprehensive and tailored offerings that meet diverse business needs. Market expansion strategies, including the penetration of emerging economies and the development of AI solutions for small and medium-sized enterprises (SMEs), are also vital for sustained growth. The increasing maturity of AI governance frameworks and the growing emphasis on responsible AI development will further build trust and encourage wider adoption.

Key Players Shaping the Cloud AI Industry Market

- AIBrain LLC

- Infosys Limited

- Wipro Limited

- SoundHound Inc

- IBM Corporation

- Google LLC

- Salesforce com Inc

- Microsoft Corporation

- Twilio Inc

- Amazon Web Services Inc

- Visenze Pte Ltd

- Cloudminds Technology

Notable Milestones in Cloud AI Industry Sector

- November 2022: ToGL Technology Sdn Bhd and Huawei Technologies (Malaysia) Sdn Bhd formalized their collaboration to create cloud-based digital solutions in Malaysia, integrating modern cloud and AI services.

- November 2022: mCloud Technologies Corp. announced a strategic partnership with Google Cloud, integrating its AssetCare platform with Google Cloud's strength and reach, along with services like Google Earth Engine, to launch three AI-powered sustainability applications.

In-Depth Cloud AI Industry Market Outlook

The future outlook for the Cloud AI Industry remains exceptionally promising, driven by continuous technological innovation and an ever-expanding array of applications. The integration of advanced AI models with robust cloud infrastructure will unlock new levels of automation, personalization, and predictive capability across all economic sectors. Strategic partnerships and collaborations will continue to be pivotal in bringing sophisticated AI solutions to market, addressing complex industry challenges. The increasing focus on responsible AI and data ethics is expected to foster greater trust and accelerate adoption, particularly in sensitive verticals like healthcare and finance. Emerging markets represent significant untapped potential, offering opportunities for rapid growth as digital transformation initiatives gain momentum globally. The industry is poised for sustained, high-impact growth, fundamentally reshaping how businesses operate and interact with their customers.

Cloud AI Industry Segmentation

-

1. Type

- 1.1. Solution

- 1.2. Service

-

2. End-user Vertical

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Automotive

- 2.4. Retail

- 2.5. Government

- 2.6. Education

- 2.7. Other End-user Vertical

Cloud AI Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud AI Industry Regional Market Share

Geographic Coverage of Cloud AI Industry

Cloud AI Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Big Data Volume; Increasing Demand for Virtual Assistants; Growing Adoption of Cloud-based Service and Application

- 3.3. Market Restrains

- 3.3.1. Loss of Control on Security in Case of Attack

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Cloud-based Service and Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud AI Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solution

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Automotive

- 5.2.4. Retail

- 5.2.5. Government

- 5.2.6. Education

- 5.2.7. Other End-user Vertical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cloud AI Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solution

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Automotive

- 6.2.4. Retail

- 6.2.5. Government

- 6.2.6. Education

- 6.2.7. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cloud AI Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solution

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Automotive

- 7.2.4. Retail

- 7.2.5. Government

- 7.2.6. Education

- 7.2.7. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Cloud AI Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solution

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Automotive

- 8.2.4. Retail

- 8.2.5. Government

- 8.2.6. Education

- 8.2.7. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Cloud AI Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solution

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Automotive

- 9.2.4. Retail

- 9.2.5. Government

- 9.2.6. Education

- 9.2.7. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Cloud AI Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solution

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. BFSI

- 10.2.2. Healthcare

- 10.2.3. Automotive

- 10.2.4. Retail

- 10.2.5. Government

- 10.2.6. Education

- 10.2.7. Other End-user Vertical

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AIBrain LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infosys Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wipro Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SoundHound Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Salesforce com Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microsoft Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Twilio Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amazon Web Services Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Visenze Pte Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cloudminds Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 AIBrain LLC

List of Figures

- Figure 1: Global Cloud AI Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cloud AI Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud AI Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Cloud AI Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Cloud AI Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Cloud AI Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Cloud AI Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: North America Cloud AI Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 9: North America Cloud AI Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Cloud AI Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: North America Cloud AI Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Cloud AI Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Cloud AI Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Cloud AI Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Cloud AI Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Cloud AI Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Cloud AI Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Cloud AI Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Cloud AI Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 20: Europe Cloud AI Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 21: Europe Cloud AI Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 22: Europe Cloud AI Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 23: Europe Cloud AI Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Cloud AI Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Cloud AI Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Cloud AI Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Cloud AI Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific Cloud AI Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Cloud AI Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Cloud AI Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Cloud AI Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 32: Asia Pacific Cloud AI Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 33: Asia Pacific Cloud AI Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 34: Asia Pacific Cloud AI Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 35: Asia Pacific Cloud AI Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Cloud AI Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Cloud AI Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Cloud AI Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Cloud AI Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: Latin America Cloud AI Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Latin America Cloud AI Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Latin America Cloud AI Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Latin America Cloud AI Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 44: Latin America Cloud AI Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 45: Latin America Cloud AI Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 46: Latin America Cloud AI Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 47: Latin America Cloud AI Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Cloud AI Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Cloud AI Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Cloud AI Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Cloud AI Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Cloud AI Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Middle East and Africa Cloud AI Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Cloud AI Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Cloud AI Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Middle East and Africa Cloud AI Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 57: Middle East and Africa Cloud AI Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Middle East and Africa Cloud AI Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Middle East and Africa Cloud AI Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Cloud AI Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Cloud AI Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Cloud AI Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud AI Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Cloud AI Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Cloud AI Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Cloud AI Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Cloud AI Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cloud AI Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Cloud AI Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Cloud AI Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Cloud AI Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Cloud AI Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Cloud AI Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Cloud AI Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Cloud AI Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Cloud AI Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Cloud AI Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Cloud AI Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 17: Global Cloud AI Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Cloud AI Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Cloud AI Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Cloud AI Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Cloud AI Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global Cloud AI Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Cloud AI Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Cloud AI Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Cloud AI Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Cloud AI Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Cloud AI Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Cloud AI Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Cloud AI Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Cloud AI Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Cloud AI Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Cloud AI Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Cloud AI Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 34: Global Cloud AI Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Cloud AI Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Cloud AI Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud AI Industry?

The projected CAGR is approximately 32.37%.

2. Which companies are prominent players in the Cloud AI Industry?

Key companies in the market include AIBrain LLC, Infosys Limited, Wipro Limited, SoundHound Inc, IBM Corporation, Google LLC, Salesforce com Inc, Microsoft Corporation, Twilio Inc, Amazon Web Services Inc, Visenze Pte Ltd, Cloudminds Technology.

3. What are the main segments of the Cloud AI Industry?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Big Data Volume; Increasing Demand for Virtual Assistants; Growing Adoption of Cloud-based Service and Application.

6. What are the notable trends driving market growth?

Growing Adoption of Cloud-based Service and Application.

7. Are there any restraints impacting market growth?

Loss of Control on Security in Case of Attack.

8. Can you provide examples of recent developments in the market?

November 2022 - ToGL Technology Sdn Bhd and Huawei Technologies (Malaysia) Sdn Bhd have formalized their collaboration to create cloud-based digital solutions in Malaysia. Modern cloud and artificial intelligence (AI) services and experiences are a part of the cooperation,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud AI Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud AI Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud AI Industry?

To stay informed about further developments, trends, and reports in the Cloud AI Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence