Key Insights

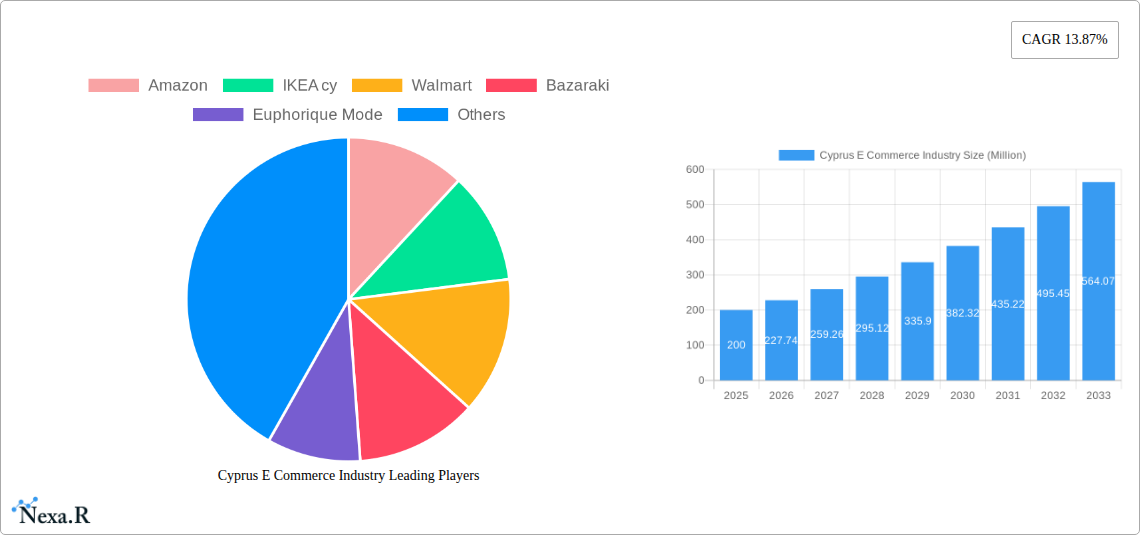

The Cyprus e-commerce market is projected to achieve a Compound Annual Growth Rate (CAGR) of 13.87%, signaling a significant investment opportunity. This growth is fueled by escalating internet and smartphone adoption, a digitally proficient young demographic, and the widespread integration of online payment solutions. Leading international and local e-commerce entities are actively shaping a competitive market landscape. Emerging challenges, such as cybersecurity concerns and logistical complexities, are being addressed to ensure sustained expansion. The market segmentation, likely dominated by consumer goods and apparel, presents specific avenues for new entrants.

Cyprus E Commerce Industry Market Size (In Billion)

The forecast period, from 2025 to 2033, anticipates robust growth, building upon historical data from 2019-2024. With a base year of 2025 and an estimated market size of 1.07 billion, the market's maturation and increasing consumer confidence are foundational for future valuations. The coexistence of global leaders and local enterprises fosters a balanced environment conducive to both established brands and agile startups.

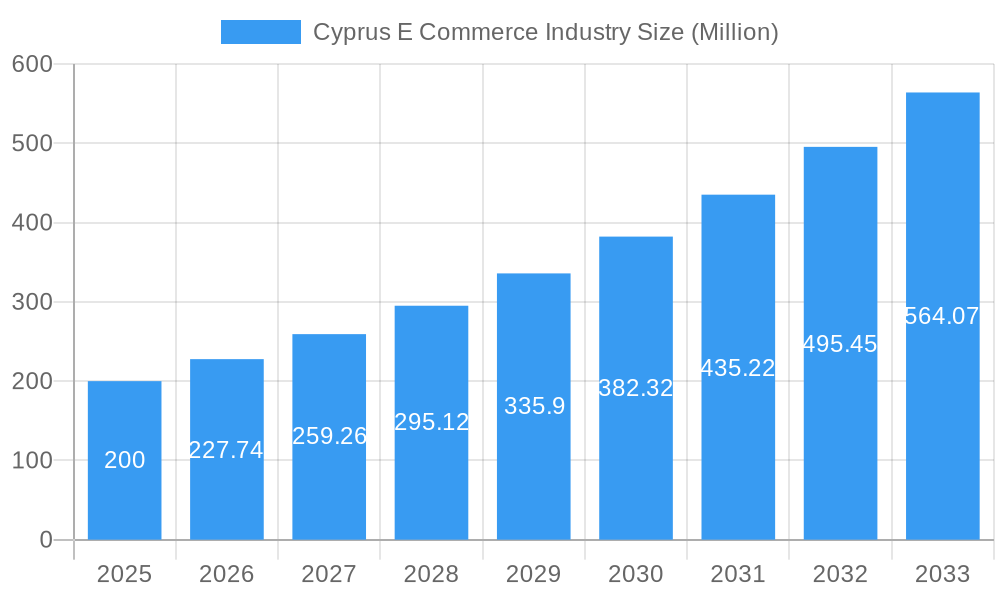

Cyprus E Commerce Industry Company Market Share

Sustained growth in the Cyprus e-commerce sector necessitates strategic investments in digital infrastructure, secure payment systems, and efficient logistics. Enhancing consumer trust through educational initiatives and robust regulatory frameworks will be paramount. Despite its relatively small scale, the market's high growth trajectory and strategic location offer compelling prospects for domestic and international businesses. Continuous development of local platforms, coupled with the expanding influence of global players, guarantees a dynamic and competitive market poised for considerable expansion.

Understanding evolving consumer preferences, adapting to technological advancements, and delivering seamless, secure online shopping experiences are critical differentiators for market success. This comprehensive report offers in-depth analysis of the Cyprus e-commerce market, providing essential insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a specific focus on 2025, the report details market dynamics, growth projections, key participants, and future opportunities within the Cypriot e-commerce ecosystem. Market segmentation by application, including an analysis of parent and child markets, provides a granular understanding of this evolving sector.

Cyprus E-Commerce Industry Market Dynamics & Structure

The Cypriot e-commerce market, valued at €XX million in 2024, is characterized by a moderately concentrated landscape with a few dominant players and numerous smaller businesses. Technological innovation, particularly in mobile commerce and logistics, is a key driver, while regulatory frameworks are continually evolving to adapt to the rapid pace of change. Competitive substitutes include traditional brick-and-mortar retail, but the convenience and reach of online shopping are steadily eroding their market share. The end-user demographic is diverse, spanning age groups and socioeconomic strata, with increasing penetration among older demographics. M&A activity has been moderate, with €XX million worth of deals recorded between 2019 and 2024.

- Market Concentration: High concentration in certain segments (e.g., groceries, fashion), fragmented in others.

- Technological Innovation: Focus on mobile optimization, improved logistics, and personalized shopping experiences.

- Regulatory Framework: Ongoing developments in data privacy, consumer protection, and cross-border e-commerce regulations.

- Competitive Substitutes: Traditional retail stores facing increasing pressure from online channels.

- End-User Demographics: Growing adoption across age groups and socioeconomic backgrounds, driven by increasing internet and smartphone penetration.

- M&A Trends: Moderate activity, primarily focused on consolidation within specific niches (e.g., grocery delivery services).

Cyprus E-Commerce Industry Growth Trends & Insights

The Cypriot e-commerce market experienced significant growth during the historical period (2019-2024), with a CAGR of XX%. This growth is attributed to increased internet and smartphone penetration, rising disposable incomes, and changing consumer behavior favoring convenience and online shopping experiences. Technological disruptions, such as the rise of mobile commerce and social commerce platforms, have further accelerated market expansion. Market penetration is estimated at XX% in 2025, with a projected increase to XX% by 2033. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly slower pace, driven by factors such as increasing digital literacy and infrastructural improvements.

Dominant Regions, Countries, or Segments in Cyprus E-Commerce Industry

The dominant segment within the Cypriot e-commerce market is currently the consumer electronics and fashion sectors which represents XX% of the total market value, followed by groceries and beauty products. This dominance is fueled by several key factors: high demand for these product categories, the availability of established online retailers catering to these segments, and strong e-commerce infrastructure in urban areas. Growth potential exists in niche markets like health and wellness, home improvement, and sustainable products.

- Key Drivers: High demand for convenience, wider selection, and competitive pricing online.

- Market Share: Consumer electronics and fashion currently holds the largest market share, with a projected continued dominance.

- Growth Potential: Untapped potential in niche segments, particularly those catering to specific demographic needs and preferences.

Cyprus E-Commerce Industry Product Landscape

The Cypriot e-commerce market offers a diverse range of products, reflecting the demands of a growing and increasingly sophisticated consumer base. Innovation is driven by personalization, improved user experience, and the integration of emerging technologies such as AI and machine learning for enhanced product recommendations and customer service. Many companies leverage unique selling propositions like faster shipping, exclusive online deals, and loyalty programs to attract and retain customers.

Key Drivers, Barriers & Challenges in Cyprus E-Commerce Industry

Key Drivers: Increasing internet and smartphone penetration, rising disposable incomes, and government support for digital transformation. The growing popularity of online marketplaces like Bazaraki further boosts the sector.

Challenges: Limited logistics infrastructure in rural areas, high shipping costs, concerns about online security, and regulatory uncertainty related to data privacy and cross-border e-commerce pose significant obstacles. These factors impede the market's full potential and impact businesses operating within the sector. Furthermore, competition from international players like Amazon and Asos presents a considerable challenge to local businesses.

Emerging Opportunities in Cyprus E-Commerce Industry

Emerging opportunities lie in niche market segments (e.g., sustainable products, personalized experiences), cross-border e-commerce expansion within the EU, and the growth of mobile-first e-commerce. The integration of augmented reality and virtual reality technologies into online shopping experiences also presents a significant opportunity.

Growth Accelerators in the Cyprus E-Commerce Industry

Sustained growth hinges on infrastructure development, particularly in logistics and payment systems; government initiatives supporting digital literacy and e-commerce adoption; and increased collaboration between businesses and logistics providers to improve delivery times and reduce costs.

Notable Milestones in Cyprus E-Commerce Industry Sector

- October 2021: Massimo Dutti launched its online store in Cyprus.

- March 2022: Alphamega Hypermarkets' e-shop experienced significant growth, gaining 25,000 new customers and achieving sales almost equal to its offline store.

In-Depth Cyprus E-Commerce Industry Market Outlook

The Cyprus e-commerce market is poised for continued growth, driven by favorable demographics, technological advancements, and supportive government policies. Strategic investments in infrastructure, digital literacy programs, and innovative business models will be crucial to unlocking the market's full potential and fostering a thriving digital economy. The focus on niche segments and tailored consumer experiences will further enhance the market’s growth trajectory in the coming years.

Cyprus E Commerce Industry Segmentation

-

1. B2C E-Commerce

- 1.1. Beauty & Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion & Apparel

- 1.4. Food & Beverage

- 1.5. Furniture & Home

- 1.6. Others (Toys, DIY, Media, etc.)

- 2. B2B E-Commerce

Cyprus E Commerce Industry Segmentation By Geography

- 1. Cyprus

Cyprus E Commerce Industry Regional Market Share

Geographic Coverage of Cyprus E Commerce Industry

Cyprus E Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Significant Growth in E-Commerce is Expected due to digital transformation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cyprus E Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Beauty & Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion & Apparel

- 5.1.4. Food & Beverage

- 5.1.5. Furniture & Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cyprus

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IKEA cy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Walmart

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bazaraki

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Euphorique Mode

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ramon Flip

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Epic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 eBay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Asos

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vision Scalper

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Cyprus E Commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Cyprus E Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Cyprus E Commerce Industry Revenue billion Forecast, by B2C E-Commerce 2020 & 2033

- Table 2: Cyprus E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 3: Cyprus E Commerce Industry Revenue billion Forecast, by B2B E-Commerce 2020 & 2033

- Table 4: Cyprus E Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 5: Cyprus E Commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Cyprus E Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Cyprus E Commerce Industry Revenue billion Forecast, by B2C E-Commerce 2020 & 2033

- Table 8: Cyprus E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 9: Cyprus E Commerce Industry Revenue billion Forecast, by B2B E-Commerce 2020 & 2033

- Table 10: Cyprus E Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 11: Cyprus E Commerce Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Cyprus E Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyprus E Commerce Industry?

The projected CAGR is approximately 9.33%.

2. Which companies are prominent players in the Cyprus E Commerce Industry?

Key companies in the market include Amazon, IKEA cy, Walmart, Bazaraki, Euphorique Mode, Ramon Flip, Epic, eBay, Asos, Vision Scalper.

3. What are the main segments of the Cyprus E Commerce Industry?

The market segments include B2C E-Commerce , B2B E-Commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Significant Growth in E-Commerce is Expected due to digital transformation.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

In March 2022, Alphamega Hypermarkets' e-shop, which was launched in 2021 has seen significant growth gaining 25000 new customers and recording a huge sale which was almost equal to its offline store.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyprus E Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyprus E Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyprus E Commerce Industry?

To stay informed about further developments, trends, and reports in the Cyprus E Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence