Key Insights

The Philippine data center market is experiencing significant expansion, driven by the escalating demand for digital services, cloud adoption, and the burgeoning e-commerce sector. The increasing digitalization of businesses and government initiatives promoting technological advancement are key growth catalysts. Growing smartphone penetration and internet access are generating substantial data volumes, bolstering the demand for secure and efficient data storage and processing, thereby increasing the need for colocation services. Strategic investments in digital infrastructure and the tech sector are further fueling this growth.

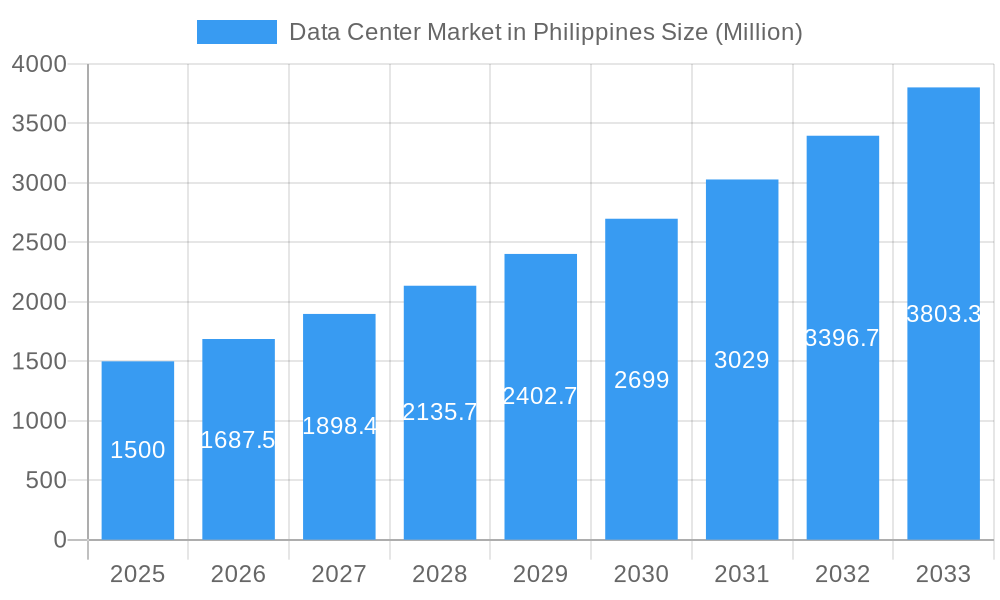

Data Center Market in Philippines Market Size (In Million)

The market features a diverse range of colocation types and data center sizes to meet varied end-user requirements. Hyperscale and wholesale colocation are becoming increasingly important due to the growing presence of global cloud providers and the substantial data processing needs of sectors like BFSI, cloud, and e-commerce. Metro Manila is the primary growth region, supported by its robust infrastructure and business concentration. However, other regions are emerging as significant growth areas with expanding digital connectivity to Tier 2 and Tier 3 cities. Challenges such as high energy costs, the need for skilled IT talent, and regulatory navigation persist. Nevertheless, strong market drivers and strategic investments by key players like Space DC, NTT Ltd., and STT GDC Pte Ltd. are positioning the Philippines as a vital data center hub in Southeast Asia.

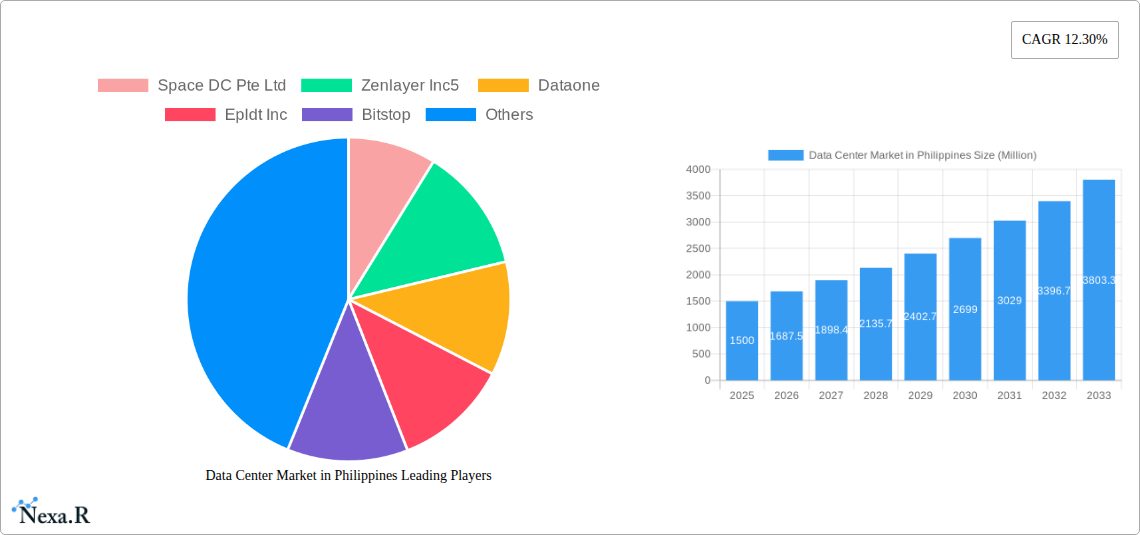

Data Center Market in Philippines Company Market Share

This report provides an in-depth analysis of the Philippine Data Center Market, offering critical insights into its current status, growth trajectory, and future potential. We examine key segments, technological advancements, and competitive dynamics to equip stakeholders with actionable intelligence. Our comprehensive coverage includes the Historical Period (2019-2024), Base Year (2025), and Forecast Period (2025-2033), presenting a complete view of market evolution. The market size is projected to reach $1043.5 billion by 2025, with a CAGR of 8.61%.

Data Center Market in Philippines Market Dynamics & Structure

The Philippine data center market is characterized by a dynamic interplay of growing demand, evolving technological landscapes, and strategic investments. Market concentration is moderately fragmented, with key players actively expanding their footprint. Technological innovation is primarily driven by the escalating need for cloud computing, artificial intelligence, and big data analytics, pushing for higher density and more efficient infrastructure. Regulatory frameworks are gradually maturing, aiming to foster an environment conducive to foreign investment and digital transformation, though some challenges persist. Competitive product substitutes are emerging, including edge computing solutions, but core data center services remain paramount. End-user demographics are increasingly diverse, with significant contributions from BFSI, Cloud, E-Commerce, and Telecom sectors. Mergers and acquisitions (M&A) trends are evident, signaling consolidation and strategic partnerships to gain market share and enhance service offerings. The total market value is projected to reach over XX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

- Market Concentration: Moderately fragmented with increasing consolidation.

- Technological Innovation Drivers: Cloud adoption, AI/ML, Big Data, IoT.

- Regulatory Frameworks: Evolving policies for data localization and digital infrastructure development.

- Competitive Product Substitutes: Edge computing, hybrid cloud solutions.

- End-User Demographics: Growing demand from BFSI, Cloud, E-Commerce, Telecom, and Government.

- M&A Trends: Strategic acquisitions and joint ventures for capacity expansion and service diversification.

Data Center Market in Philippines Growth Trends & Insights

The Philippine data center market is poised for substantial growth, driven by a confluence of factors including burgeoning digital transformation initiatives, increasing internet penetration, and the government's push for digitalization across various sectors. The market size is projected to experience a significant expansion, moving from an estimated XX Million in 2025 to over XX Million by 2033, representing a robust CAGR of XX%. Adoption rates for colocation services, particularly hyperscale and wholesale models, are accelerating as businesses seek scalable and reliable infrastructure solutions. Technological disruptions, such as the advancements in liquid cooling and AI-powered infrastructure management, are further shaping the market by enabling greater efficiency and higher densities. Consumer behavior shifts towards increased online activity, e-commerce, and digital content consumption are directly fueling the demand for advanced data processing and storage capabilities.

- Market Size Evolution: From XX Million in 2025 to over XX Million by 2033.

- CAGR: XX% during the forecast period (2025-2033).

- Adoption Rates: High and increasing for hyperscale and wholesale colocation.

- Technological Disruptions: Focus on efficiency, density, and sustainability through advancements in cooling and AI management.

- Consumer Behavior Shifts: Driving demand for robust digital infrastructure due to increased online engagement.

Dominant Regions, Countries, or Segments in Data Center Market in Philippines

The NCR (Metro Manila) region stands as the undisputed leader in the Philippine data center market, commanding a significant majority of the market share. This dominance is attributed to its status as the economic and commercial hub, housing a dense concentration of enterprises across BFSI, E-Commerce, and Telecom sectors. The availability of critical infrastructure, a skilled workforce, and proximity to major business operations make it the primary destination for data center investments.

Within the segments, Hyperscale colocation is witnessing the most rapid growth, driven by the expansion plans of global cloud providers and large enterprises requiring massive capacity. Wholesale colocation also holds a substantial market share, catering to organizations with dedicated space and power requirements.

The Tier 3 data center segment is currently the most prevalent, offering a balance of reliability and cost-effectiveness. However, there is a growing demand for Tier 4 facilities for mission-critical applications, particularly within the BFSI and Government sectors.

The Cloud end-user segment is a major growth engine, with an increasing number of businesses migrating their operations to cloud platforms. This is closely followed by E-Commerce and BFSI, which are heavily reliant on robust and secure data center infrastructure to support their digital services and transactions.

- Dominant Region: NCR (Metro Manila) due to its economic and business centrality.

- Key Segments Driving Growth: Hyperscale and Wholesale Colocation.

- Predominant Tier Type: Tier 3, with increasing demand for Tier 4.

- Leading End Users: Cloud, E-Commerce, and BFSI.

- Market Share (NCR): Estimated XX% of the total Philippine data center market.

- Growth Potential (Hyperscale): Projected to grow at a CAGR of XX% during the forecast period.

Data Center Market in Philippines Product Landscape

The Philippine data center product landscape is evolving to meet the demands for higher performance, increased density, and enhanced energy efficiency. Innovations are focused on advanced cooling technologies, including liquid cooling solutions, to manage the heat generated by high-performance computing and AI workloads. Power distribution units (PDUs) and uninterruptible power supply (UPS) systems are being optimized for greater reliability and modularity. Furthermore, software-defined networking (SDN) and hyperconverged infrastructure (HCI) are becoming integral components, enabling greater flexibility and agility in data center operations. The market is seeing a rise in modular and prefabricated data center solutions, offering faster deployment times and scalability for businesses.

Key Drivers, Barriers & Challenges in Data Center Market in Philippines

Key Drivers: The Philippine data center market is propelled by the rapid adoption of digital technologies, including cloud computing, AI, and IoT, driving demand for scalable and reliable infrastructure. Government initiatives supporting digitalization and smart city development are creating a favorable environment. The burgeoning e-commerce sector and the increasing digitalization of the BFSI industry are also significant growth accelerators. Furthermore, foreign direct investment in the technology sector is contributing to capacity expansion and technological upgrades.

Barriers & Challenges: Key challenges include the high cost of electricity and the need for sustainable energy solutions. Regulatory complexities and evolving data localization laws can pose hurdles for operators. Supply chain disruptions, particularly for specialized equipment, can impact deployment timelines. Moreover, the availability of skilled IT professionals for data center operations and maintenance remains a critical concern. Fierce competition among existing and new market entrants can also exert pressure on pricing.

Emerging Opportunities in Data Center Market in Philippines

Emerging opportunities in the Philippine data center market lie in the development of edge data centers to support low-latency applications, particularly in remote areas and for IoT deployments. The growing demand for specialized colocation services, such as managed services and disaster recovery solutions, presents a significant avenue for growth. Furthermore, the increasing adoption of renewable energy sources for data center operations offers opportunities for green data center development. The expansion of the government's digital infrastructure projects and the continuous growth of the BPO sector will also fuel demand for data center services.

Growth Accelerators in the Data Center Market in Philippines Industry

Several catalysts are accelerating the growth of the Philippine data center industry. The increasing adoption of hybrid and multi-cloud strategies by enterprises necessitates robust and interconnected data center facilities. Strategic partnerships between hyperscalers and local data center providers are crucial for expanding capacity and reach. Investments in advanced connectivity, including fiber optic networks, are vital for improving performance and reducing latency. The government's commitment to attracting foreign investment in the digital infrastructure sector, coupled with initiatives to promote digital skills development, will further fuel long-term growth.

Key Players Shaping the Data Center Market in Philippines Market

- Space DC Pte Ltd

- Zenlayer Inc

- Dataone

- Epltd Inc

- Bitstop

- VSTECS Phils Inc

- STT GDC Pte Ltd

- GTI Corporation

- NTT Ltd

Notable Milestones in Data Center Market in Philippines Sector

- October 2022: Zenlayer entered into a joint venture with Megaport to strengthen and expand its presence globally. The partnership is aimed at providing enhanced services such as improved network connectivity, real time provisioning, and on demand private connectivity for its clients around the globe.

- August 2022: ePLDT has partnered with Abra State Institute of Science and Technology (ASIST) for offering smart campus digitalization solutions to provide better learning experience to students.

- June 2022: BNS has been certified and included in the list of Cybersecurity Assessment provider by DICT.

In-Depth Data Center Market in Philippines Market Outlook

The future outlook for the Philippine data center market is exceptionally bright, driven by sustained digital transformation and increasing demand for data-intensive services. Growth accelerators such as the expansion of hyperscale cloud providers, the development of advanced colocation offerings, and the government's unwavering support for digital infrastructure development will continue to shape the market. Strategic investments in renewable energy and the focus on building resilient and secure data center facilities will further enhance the Philippines' position as a key digital hub in Southeast Asia. The market is set to witness further innovation in cooling technologies, automation, and edge computing, ensuring its continued evolution and growth in the coming years.

Data Center Market in Philippines Segmentation

-

1. Hotspot

- 1.1. NCR (Metro Manila)

- 1.2. Rest of Philippines

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

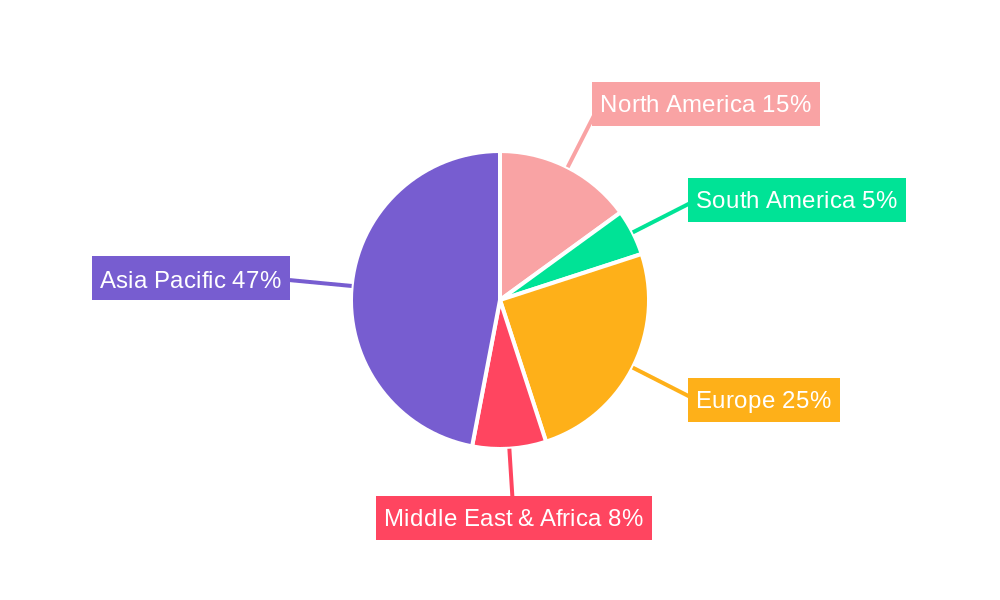

Data Center Market in Philippines Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Center Market in Philippines Regional Market Share

Geographic Coverage of Data Center Market in Philippines

Data Center Market in Philippines REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth of Smart Devices; Increasing number of Data Breaches

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness about Cyberattacks

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Market in Philippines Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. NCR (Metro Manila)

- 5.1.2. Rest of Philippines

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North America Data Center Market in Philippines Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 6.1.1. NCR (Metro Manila)

- 6.1.2. Rest of Philippines

- 6.2. Market Analysis, Insights and Forecast - by Data Center Size

- 6.2.1. Large

- 6.2.2. Massive

- 6.2.3. Medium

- 6.2.4. Mega

- 6.2.5. Small

- 6.3. Market Analysis, Insights and Forecast - by Tier Type

- 6.3.1. Tier 1 and 2

- 6.3.2. Tier 3

- 6.3.3. Tier 4

- 6.4. Market Analysis, Insights and Forecast - by Absorption

- 6.4.1. Non-Utilized

- 6.5. Market Analysis, Insights and Forecast - by Colocation Type

- 6.5.1. Hyperscale

- 6.5.2. Retail

- 6.5.3. Wholesale

- 6.6. Market Analysis, Insights and Forecast - by End User

- 6.6.1. BFSI

- 6.6.2. Cloud

- 6.6.3. E-Commerce

- 6.6.4. Government

- 6.6.5. Manufacturing

- 6.6.6. Media & Entertainment

- 6.6.7. Telecom

- 6.6.8. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 7. South America Data Center Market in Philippines Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 7.1.1. NCR (Metro Manila)

- 7.1.2. Rest of Philippines

- 7.2. Market Analysis, Insights and Forecast - by Data Center Size

- 7.2.1. Large

- 7.2.2. Massive

- 7.2.3. Medium

- 7.2.4. Mega

- 7.2.5. Small

- 7.3. Market Analysis, Insights and Forecast - by Tier Type

- 7.3.1. Tier 1 and 2

- 7.3.2. Tier 3

- 7.3.3. Tier 4

- 7.4. Market Analysis, Insights and Forecast - by Absorption

- 7.4.1. Non-Utilized

- 7.5. Market Analysis, Insights and Forecast - by Colocation Type

- 7.5.1. Hyperscale

- 7.5.2. Retail

- 7.5.3. Wholesale

- 7.6. Market Analysis, Insights and Forecast - by End User

- 7.6.1. BFSI

- 7.6.2. Cloud

- 7.6.3. E-Commerce

- 7.6.4. Government

- 7.6.5. Manufacturing

- 7.6.6. Media & Entertainment

- 7.6.7. Telecom

- 7.6.8. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 8. Europe Data Center Market in Philippines Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 8.1.1. NCR (Metro Manila)

- 8.1.2. Rest of Philippines

- 8.2. Market Analysis, Insights and Forecast - by Data Center Size

- 8.2.1. Large

- 8.2.2. Massive

- 8.2.3. Medium

- 8.2.4. Mega

- 8.2.5. Small

- 8.3. Market Analysis, Insights and Forecast - by Tier Type

- 8.3.1. Tier 1 and 2

- 8.3.2. Tier 3

- 8.3.3. Tier 4

- 8.4. Market Analysis, Insights and Forecast - by Absorption

- 8.4.1. Non-Utilized

- 8.5. Market Analysis, Insights and Forecast - by Colocation Type

- 8.5.1. Hyperscale

- 8.5.2. Retail

- 8.5.3. Wholesale

- 8.6. Market Analysis, Insights and Forecast - by End User

- 8.6.1. BFSI

- 8.6.2. Cloud

- 8.6.3. E-Commerce

- 8.6.4. Government

- 8.6.5. Manufacturing

- 8.6.6. Media & Entertainment

- 8.6.7. Telecom

- 8.6.8. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 9. Middle East & Africa Data Center Market in Philippines Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 9.1.1. NCR (Metro Manila)

- 9.1.2. Rest of Philippines

- 9.2. Market Analysis, Insights and Forecast - by Data Center Size

- 9.2.1. Large

- 9.2.2. Massive

- 9.2.3. Medium

- 9.2.4. Mega

- 9.2.5. Small

- 9.3. Market Analysis, Insights and Forecast - by Tier Type

- 9.3.1. Tier 1 and 2

- 9.3.2. Tier 3

- 9.3.3. Tier 4

- 9.4. Market Analysis, Insights and Forecast - by Absorption

- 9.4.1. Non-Utilized

- 9.5. Market Analysis, Insights and Forecast - by Colocation Type

- 9.5.1. Hyperscale

- 9.5.2. Retail

- 9.5.3. Wholesale

- 9.6. Market Analysis, Insights and Forecast - by End User

- 9.6.1. BFSI

- 9.6.2. Cloud

- 9.6.3. E-Commerce

- 9.6.4. Government

- 9.6.5. Manufacturing

- 9.6.6. Media & Entertainment

- 9.6.7. Telecom

- 9.6.8. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 10. Asia Pacific Data Center Market in Philippines Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 10.1.1. NCR (Metro Manila)

- 10.1.2. Rest of Philippines

- 10.2. Market Analysis, Insights and Forecast - by Data Center Size

- 10.2.1. Large

- 10.2.2. Massive

- 10.2.3. Medium

- 10.2.4. Mega

- 10.2.5. Small

- 10.3. Market Analysis, Insights and Forecast - by Tier Type

- 10.3.1. Tier 1 and 2

- 10.3.2. Tier 3

- 10.3.3. Tier 4

- 10.4. Market Analysis, Insights and Forecast - by Absorption

- 10.4.1. Non-Utilized

- 10.5. Market Analysis, Insights and Forecast - by Colocation Type

- 10.5.1. Hyperscale

- 10.5.2. Retail

- 10.5.3. Wholesale

- 10.6. Market Analysis, Insights and Forecast - by End User

- 10.6.1. BFSI

- 10.6.2. Cloud

- 10.6.3. E-Commerce

- 10.6.4. Government

- 10.6.5. Manufacturing

- 10.6.6. Media & Entertainment

- 10.6.7. Telecom

- 10.6.8. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space DC Pte Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zenlayer Inc5

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dataone

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Epldt Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bitstop

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VSTECS Phils Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 STT GDC Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GTI Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NTT Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Space DC Pte Ltd

List of Figures

- Figure 1: Global Data Center Market in Philippines Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Data Center Market in Philippines Revenue (billion), by Hotspot 2025 & 2033

- Figure 3: North America Data Center Market in Philippines Revenue Share (%), by Hotspot 2025 & 2033

- Figure 4: North America Data Center Market in Philippines Revenue (billion), by Data Center Size 2025 & 2033

- Figure 5: North America Data Center Market in Philippines Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 6: North America Data Center Market in Philippines Revenue (billion), by Tier Type 2025 & 2033

- Figure 7: North America Data Center Market in Philippines Revenue Share (%), by Tier Type 2025 & 2033

- Figure 8: North America Data Center Market in Philippines Revenue (billion), by Absorption 2025 & 2033

- Figure 9: North America Data Center Market in Philippines Revenue Share (%), by Absorption 2025 & 2033

- Figure 10: North America Data Center Market in Philippines Revenue (billion), by Colocation Type 2025 & 2033

- Figure 11: North America Data Center Market in Philippines Revenue Share (%), by Colocation Type 2025 & 2033

- Figure 12: North America Data Center Market in Philippines Revenue (billion), by End User 2025 & 2033

- Figure 13: North America Data Center Market in Philippines Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Data Center Market in Philippines Revenue (billion), by Country 2025 & 2033

- Figure 15: North America Data Center Market in Philippines Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America Data Center Market in Philippines Revenue (billion), by Hotspot 2025 & 2033

- Figure 17: South America Data Center Market in Philippines Revenue Share (%), by Hotspot 2025 & 2033

- Figure 18: South America Data Center Market in Philippines Revenue (billion), by Data Center Size 2025 & 2033

- Figure 19: South America Data Center Market in Philippines Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 20: South America Data Center Market in Philippines Revenue (billion), by Tier Type 2025 & 2033

- Figure 21: South America Data Center Market in Philippines Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: South America Data Center Market in Philippines Revenue (billion), by Absorption 2025 & 2033

- Figure 23: South America Data Center Market in Philippines Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: South America Data Center Market in Philippines Revenue (billion), by Colocation Type 2025 & 2033

- Figure 25: South America Data Center Market in Philippines Revenue Share (%), by Colocation Type 2025 & 2033

- Figure 26: South America Data Center Market in Philippines Revenue (billion), by End User 2025 & 2033

- Figure 27: South America Data Center Market in Philippines Revenue Share (%), by End User 2025 & 2033

- Figure 28: South America Data Center Market in Philippines Revenue (billion), by Country 2025 & 2033

- Figure 29: South America Data Center Market in Philippines Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe Data Center Market in Philippines Revenue (billion), by Hotspot 2025 & 2033

- Figure 31: Europe Data Center Market in Philippines Revenue Share (%), by Hotspot 2025 & 2033

- Figure 32: Europe Data Center Market in Philippines Revenue (billion), by Data Center Size 2025 & 2033

- Figure 33: Europe Data Center Market in Philippines Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 34: Europe Data Center Market in Philippines Revenue (billion), by Tier Type 2025 & 2033

- Figure 35: Europe Data Center Market in Philippines Revenue Share (%), by Tier Type 2025 & 2033

- Figure 36: Europe Data Center Market in Philippines Revenue (billion), by Absorption 2025 & 2033

- Figure 37: Europe Data Center Market in Philippines Revenue Share (%), by Absorption 2025 & 2033

- Figure 38: Europe Data Center Market in Philippines Revenue (billion), by Colocation Type 2025 & 2033

- Figure 39: Europe Data Center Market in Philippines Revenue Share (%), by Colocation Type 2025 & 2033

- Figure 40: Europe Data Center Market in Philippines Revenue (billion), by End User 2025 & 2033

- Figure 41: Europe Data Center Market in Philippines Revenue Share (%), by End User 2025 & 2033

- Figure 42: Europe Data Center Market in Philippines Revenue (billion), by Country 2025 & 2033

- Figure 43: Europe Data Center Market in Philippines Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East & Africa Data Center Market in Philippines Revenue (billion), by Hotspot 2025 & 2033

- Figure 45: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Hotspot 2025 & 2033

- Figure 46: Middle East & Africa Data Center Market in Philippines Revenue (billion), by Data Center Size 2025 & 2033

- Figure 47: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 48: Middle East & Africa Data Center Market in Philippines Revenue (billion), by Tier Type 2025 & 2033

- Figure 49: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Tier Type 2025 & 2033

- Figure 50: Middle East & Africa Data Center Market in Philippines Revenue (billion), by Absorption 2025 & 2033

- Figure 51: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Absorption 2025 & 2033

- Figure 52: Middle East & Africa Data Center Market in Philippines Revenue (billion), by Colocation Type 2025 & 2033

- Figure 53: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Colocation Type 2025 & 2033

- Figure 54: Middle East & Africa Data Center Market in Philippines Revenue (billion), by End User 2025 & 2033

- Figure 55: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by End User 2025 & 2033

- Figure 56: Middle East & Africa Data Center Market in Philippines Revenue (billion), by Country 2025 & 2033

- Figure 57: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Country 2025 & 2033

- Figure 58: Asia Pacific Data Center Market in Philippines Revenue (billion), by Hotspot 2025 & 2033

- Figure 59: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Hotspot 2025 & 2033

- Figure 60: Asia Pacific Data Center Market in Philippines Revenue (billion), by Data Center Size 2025 & 2033

- Figure 61: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 62: Asia Pacific Data Center Market in Philippines Revenue (billion), by Tier Type 2025 & 2033

- Figure 63: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Tier Type 2025 & 2033

- Figure 64: Asia Pacific Data Center Market in Philippines Revenue (billion), by Absorption 2025 & 2033

- Figure 65: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Absorption 2025 & 2033

- Figure 66: Asia Pacific Data Center Market in Philippines Revenue (billion), by Colocation Type 2025 & 2033

- Figure 67: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Colocation Type 2025 & 2033

- Figure 68: Asia Pacific Data Center Market in Philippines Revenue (billion), by End User 2025 & 2033

- Figure 69: Asia Pacific Data Center Market in Philippines Revenue Share (%), by End User 2025 & 2033

- Figure 70: Asia Pacific Data Center Market in Philippines Revenue (billion), by Country 2025 & 2033

- Figure 71: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Center Market in Philippines Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 2: Global Data Center Market in Philippines Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 3: Global Data Center Market in Philippines Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 4: Global Data Center Market in Philippines Revenue billion Forecast, by Absorption 2020 & 2033

- Table 5: Global Data Center Market in Philippines Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 6: Global Data Center Market in Philippines Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Global Data Center Market in Philippines Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Data Center Market in Philippines Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 9: Global Data Center Market in Philippines Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 10: Global Data Center Market in Philippines Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 11: Global Data Center Market in Philippines Revenue billion Forecast, by Absorption 2020 & 2033

- Table 12: Global Data Center Market in Philippines Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 13: Global Data Center Market in Philippines Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Data Center Market in Philippines Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Data Center Market in Philippines Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 19: Global Data Center Market in Philippines Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 20: Global Data Center Market in Philippines Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 21: Global Data Center Market in Philippines Revenue billion Forecast, by Absorption 2020 & 2033

- Table 22: Global Data Center Market in Philippines Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 23: Global Data Center Market in Philippines Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Global Data Center Market in Philippines Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Argentina Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Data Center Market in Philippines Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 29: Global Data Center Market in Philippines Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 30: Global Data Center Market in Philippines Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 31: Global Data Center Market in Philippines Revenue billion Forecast, by Absorption 2020 & 2033

- Table 32: Global Data Center Market in Philippines Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 33: Global Data Center Market in Philippines Revenue billion Forecast, by End User 2020 & 2033

- Table 34: Global Data Center Market in Philippines Revenue billion Forecast, by Country 2020 & 2033

- Table 35: United Kingdom Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Germany Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: France Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Spain Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Nordics Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global Data Center Market in Philippines Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 45: Global Data Center Market in Philippines Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 46: Global Data Center Market in Philippines Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 47: Global Data Center Market in Philippines Revenue billion Forecast, by Absorption 2020 & 2033

- Table 48: Global Data Center Market in Philippines Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 49: Global Data Center Market in Philippines Revenue billion Forecast, by End User 2020 & 2033

- Table 50: Global Data Center Market in Philippines Revenue billion Forecast, by Country 2020 & 2033

- Table 51: Turkey Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Israel Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: GCC Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: North Africa Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Africa Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East & Africa Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Global Data Center Market in Philippines Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 58: Global Data Center Market in Philippines Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 59: Global Data Center Market in Philippines Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 60: Global Data Center Market in Philippines Revenue billion Forecast, by Absorption 2020 & 2033

- Table 61: Global Data Center Market in Philippines Revenue billion Forecast, by Colocation Type 2020 & 2033

- Table 62: Global Data Center Market in Philippines Revenue billion Forecast, by End User 2020 & 2033

- Table 63: Global Data Center Market in Philippines Revenue billion Forecast, by Country 2020 & 2033

- Table 64: China Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 65: India Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Japan Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 67: South Korea Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: ASEAN Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 69: Oceania Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Data Center Market in Philippines Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Market in Philippines?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the Data Center Market in Philippines?

Key companies in the market include Space DC Pte Ltd, Zenlayer Inc5 , Dataone, Epldt Inc, Bitstop, VSTECS Phils Inc, STT GDC Pte Ltd, GTI Corporation, NTT Ltd.

3. What are the main segments of the Data Center Market in Philippines?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1043.5 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growth of Smart Devices; Increasing number of Data Breaches.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Lack of Awareness about Cyberattacks.

8. Can you provide examples of recent developments in the market?

October 2022: Zenlayer entered into a joint venture with Megaport to strengthen and expand its presence globally. The partnership is aimed at providing enhanced services such as improved network connectivity, real time provisioning, and on demand private connectivity for its clients around the globe.August 2022: ePLDT has partnered with Abra State Institute of Science and Technology (ASIST) for offering smart campus digitalization solutions to provide better learning experience to students.June 2022: BNS has been caertified and included in the list of Cybersecurity Assessment provider by DICT.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Market in Philippines," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Market in Philippines report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Market in Philippines?

To stay informed about further developments, trends, and reports in the Data Center Market in Philippines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence