Key Insights

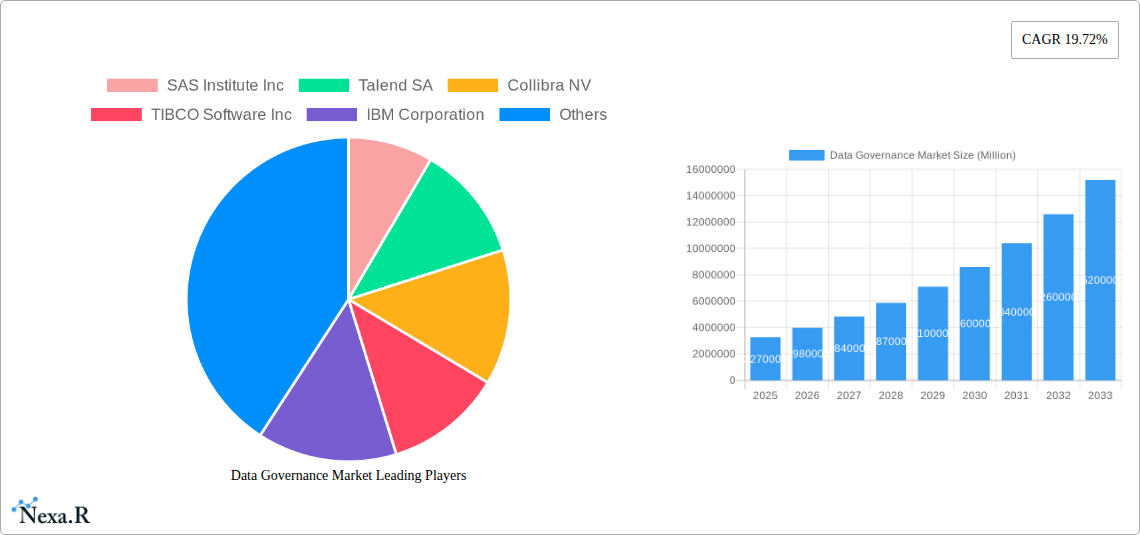

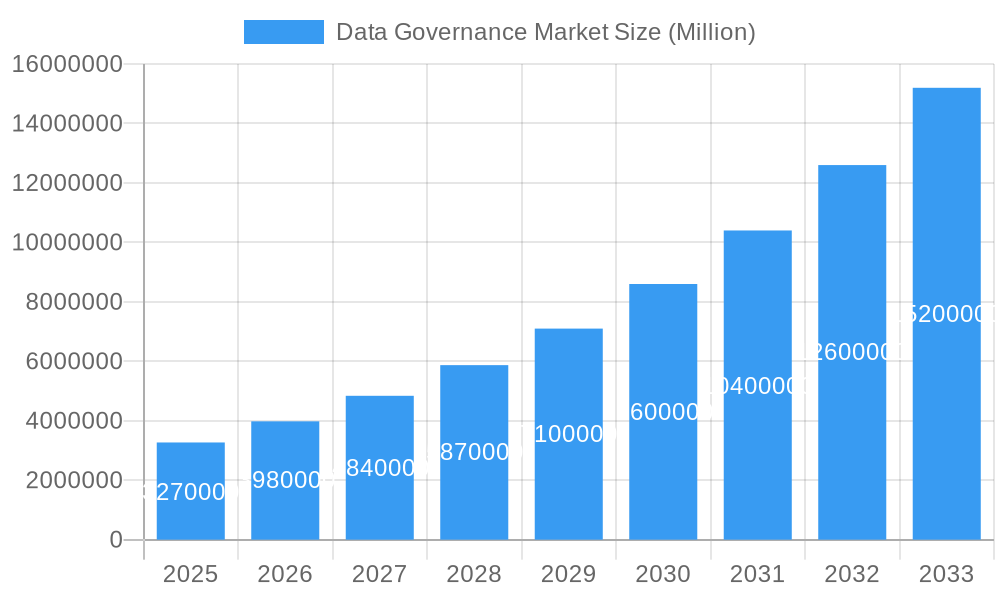

The Data Governance Market is experiencing robust expansion, projected to reach 3.27 Million in value. This growth is fueled by an impressive 19.72% Compound Annual Growth Rate (CAGR) expected over the forecast period of 2025-2033. This significant market trajectory underscores the escalating importance of managing and controlling data assets effectively across diverse industries. The increasing volume, velocity, and variety of data, coupled with stringent regulatory compliance demands such as GDPR and CCPA, are primary drivers. Organizations are recognizing data governance not just as a compliance necessity, but as a strategic imperative for enhancing data quality, improving decision-making, mitigating risks, and unlocking new business opportunities. The market's expansion is also supported by the growing adoption of advanced analytics, artificial intelligence, and machine learning, which rely heavily on well-governed data for accurate insights.

Data Governance Market Market Size (In Million)

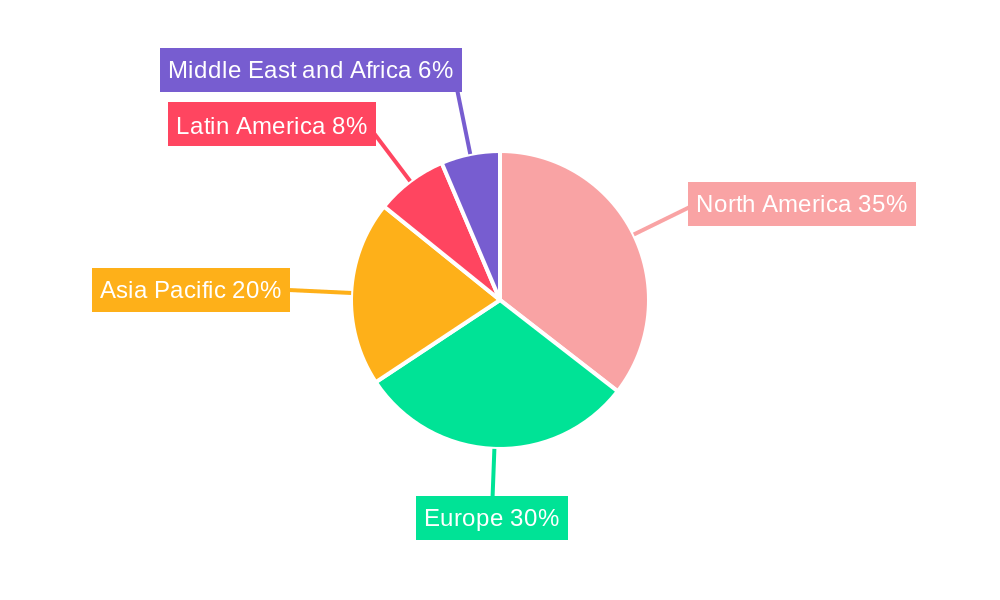

The market segmentation reveals a dynamic landscape. Cloud deployment models are increasingly favored due to their scalability and flexibility, though on-premise solutions remain relevant for organizations with specific security or regulatory concerns. Large-scale businesses are major adopters, investing heavily in comprehensive data governance solutions. However, Small and Medium-sized Businesses (SMBs) are also showing increased adoption, driven by more accessible and cost-effective cloud-based offerings. Software and service components are both crucial, with a growing demand for integrated solutions that combine advanced software capabilities with expert consulting and implementation services. Key business functions benefiting from data governance include Operations and IT, Legal, and Finance, all of which depend on accurate and reliable data. The IT and Telecom, Healthcare, Retail, Defense, and BFSI sectors are leading the charge in adopting data governance solutions, reflecting the critical nature of data in these industries. While North America and Europe currently dominate the market, the Asia Pacific region is anticipated to exhibit the fastest growth due to rapid digital transformation and increasing data privacy awareness.

Data Governance Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Data Governance market, offering critical insights into market dynamics, growth trends, regional dominance, and the competitive landscape. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study is designed to equip industry professionals with actionable intelligence for strategic decision-making. The report delves into key segments including Deployment (Cloud, On-premise), Organization Size (Large-scale Business, Small- and Medium-scale Business), Component (Software, Service), Business Function (Operation and IT, Legal, Finance, Other Business Functions), and End-user Industry (IT and Telecom, Healthcare, Retail, Defense, BFSI, Other End-user Industries). Values are presented in millions of units, and all predictions are based on robust market research.

Data Governance Market Market Dynamics & Structure

The Data Governance market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing data complexity. Market concentration is moderate, with established players and emerging startups vying for market share. Key drivers of technological innovation include the escalating volume and variety of data generated, the growing demand for data-driven decision-making, and the need for robust data security and compliance. Regulatory frameworks such as GDPR, CCPA, and HIPAA are significant catalysts, compelling organizations to implement stringent data governance policies and solutions. Competitive product substitutes are evolving, with cloud-based solutions and AI-powered platforms gaining traction. End-user demographics are shifting towards greater data literacy and awareness of data governance benefits across all organizational sizes. Mergers and acquisitions (M&A) trends indicate a consolidation of the market, with larger players acquiring innovative startups to enhance their portfolios and expand their reach.

- Market Concentration: Moderate, with a mix of large enterprises and niche players.

- Technological Innovation Drivers: Big Data, AI/ML, cloud computing, advanced analytics.

- Regulatory Frameworks: GDPR, CCPA, HIPAA, and industry-specific compliance mandates.

- Competitive Product Substitutes: Growing adoption of integrated data management platforms and specialized governance tools.

- End-User Demographics: Increasing adoption across all sectors and organizational sizes.

- M&A Trends: Strategic acquisitions by major vendors to enhance AI capabilities and cloud offerings.

Data Governance Market Growth Trends & Insights

The global Data Governance market is poised for significant expansion, driven by an increasing realization of data's strategic importance across all industries. The market size is projected to evolve from approximately $12,000 million in 2024 to over $35,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025-2033). Adoption rates are accelerating as organizations recognize the critical need to manage, secure, and leverage their data effectively. Technological disruptions, particularly the advent of generative AI and advanced machine learning techniques, are reshaping data governance strategies, enabling more automated and intelligent data management processes. Consumer behavior shifts, influenced by privacy concerns and the demand for personalized experiences, are further pushing organizations towards robust data governance. The market penetration of data governance solutions is expected to deepen significantly, moving from an estimated 25% in 2024 to over 60% by 2033, particularly in sectors like BFSI, Healthcare, and IT & Telecom. The increasing complexity of data ecosystems, coupled with a growing regulatory burden, necessitates sophisticated data governance frameworks to ensure data quality, integrity, and compliance, thereby fostering sustained market growth. The continuous innovation in data management technologies and the growing demand for data-driven insights are propelling the market forward.

Dominant Regions, Countries, or Segments in Data Governance Market

The IT and Telecom end-user industry segment is a dominant force in the Data Governance market, driven by the sheer volume of data generated, the critical need for real-time data analysis, and stringent regulatory requirements within these sectors. This segment is expected to contribute significantly to market growth, holding an estimated market share of over 18% by 2025. The Cloud deployment model is also emerging as a key growth accelerator, with an anticipated market share of approximately 55% in 2025. Cloud-based data governance solutions offer scalability, flexibility, and cost-effectiveness, making them attractive to organizations of all sizes.

- Dominant Segment Drivers:

- End-user Industry: IT and Telecom: High data volumes, rapid innovation, need for real-time analytics, cybersecurity imperatives.

- Deployment: Cloud: Scalability, agility, reduced infrastructure costs, enhanced accessibility for distributed teams.

- Organization Size: Large-scale Business: Greater data complexity, higher regulatory exposure, significant investment capacity for advanced governance solutions.

- Component: Software: Increasing demand for automated data discovery, cataloging, quality management, and policy enforcement tools.

- Business Function: Operation and IT: Central to ensuring data integrity for daily operations and IT infrastructure management.

- Region: North America: Early adoption of advanced technologies, robust regulatory environment, strong presence of key market players, and significant R&D investment.

North America, particularly the United States, is a leading region due to its early adoption of advanced technologies, stringent regulatory frameworks, and the presence of major technology corporations that are key drivers of data governance adoption. Europe, with its strong emphasis on data privacy (e.g., GDPR), also represents a significant and growing market. The BFSI sector, due to the sensitive nature of financial data and strict compliance mandates, is another key industry demonstrating high adoption rates. The growth potential in these segments is further bolstered by ongoing digital transformation initiatives and the increasing reliance on data for strategic decision-making, with market share projections indicating sustained leadership.

Data Governance Market Product Landscape

The Data Governance market is witnessing rapid product innovation focused on enhancing automation, intelligence, and user-friendliness. Key advancements include the integration of AI and machine learning for automated data discovery, classification, and policy enforcement, significantly reducing manual effort. Solutions are increasingly offering robust data cataloging capabilities, enabling comprehensive data lineage tracking and a unified view of data assets. Performance metrics are improving with faster data profiling, quality assessment, and real-time monitoring. Unique selling propositions often lie in the ability to provide end-to-end data lifecycle management, seamless integration with existing data infrastructures, and advanced security features. Technological advancements are also enabling better collaboration between data stewards, IT professionals, and business users, fostering a culture of data accountability.

Key Drivers, Barriers & Challenges in Data Governance Market

Key Drivers:

- Increasing Data Volumes & Complexity: The exponential growth of data, encompassing structured, semi-structured, and unstructured formats, necessitates robust governance for effective management and utilization.

- Stringent Regulatory Compliance: Evolving data privacy laws (e.g., GDPR, CCPA) mandate strong data governance frameworks to avoid penalties and maintain customer trust.

- Demand for Data-Driven Insights: Organizations are increasingly relying on data for strategic decision-making, requiring high-quality, trustworthy data.

- Technological Advancements: AI, ML, and automation are enabling more efficient and intelligent data governance solutions.

Barriers & Challenges:

- High Implementation Costs: Initial investment in software, hardware, and skilled personnel can be substantial, particularly for small and medium-sized businesses.

- Organizational Resistance to Change: Lack of data literacy, ingrained data silos, and reluctance to adopt new processes can hinder adoption.

- Integration Complexity: Integrating data governance tools with diverse legacy systems and data platforms can be challenging.

- Talent Shortage: A scarcity of skilled data governance professionals, including data stewards and data architects, poses a significant constraint.

Emerging Opportunities in Data Governance Market

Emerging opportunities in the Data Governance market are centered around the integration of advanced AI and ML capabilities for predictive governance, enabling proactive identification and mitigation of data risks. The expansion of data governance into emerging technologies like IoT and blockchain presents new frontiers for managing vast, distributed datasets. Furthermore, the growing demand for data ethics and responsible AI practices is creating a niche for specialized governance solutions that ensure fairness and transparency in AI algorithms. The increasing focus on data monetization strategies also necessitates robust governance to ensure data quality and compliance, opening avenues for service providers to offer tailored solutions. The untapped potential in specific industries like manufacturing and public sector organizations also represents significant growth opportunities.

Growth Accelerators in the Data Governance Market Industry

Several catalysts are driving the long-term growth of the Data Governance market. Technological breakthroughs, particularly in areas of AI-driven automation and advanced analytics for data quality and security, are significantly enhancing the value proposition of governance solutions. Strategic partnerships between software vendors, cloud providers, and consulting firms are expanding market reach and offering integrated solutions to a broader customer base. Market expansion strategies, including penetration into new geographical regions and industry verticals that are currently underserved, are also key growth accelerators. The increasing awareness of data as a strategic asset, coupled with the imperative for regulatory compliance and the pursuit of competitive advantage through data-driven insights, will continue to fuel demand for comprehensive data governance.

Key Players Shaping the Data Governance Market Market

- SAS Institute Inc

- Talend SA

- Collibra NV

- TIBCO Software Inc

- IBM Corporation

- Informatica Inc

- Microsoft Corporation

- Symantec Corporation (Norton Lifelock)

- Alation Inc

- Varonis Systems Inc

- Oracle Corporation

- Alfresco Software Inc

- SAP SE

Notable Milestones in Data Governance Market Sector

- June 2023: Oracle announced its plans to develop powerful, generative AI services for organizations across the world. The company will provide native generative AI services to help organizations automate end-to-end business processes, improve decision-making, and enhance customer experiences, in collaboration with Cohere, a leading AI platform for enterprise. This move is expected to enhance data governance needs for AI model development and deployment.

- May 2023: Informatica announced significant innovations to its AI-Powered Intelligent Data Management Cloud (IDMC) at Informatica World 2023. The enhancements across data engineering, MDM applications, and data governance are expected to help enterprises reduce costs, maximize resources, and improve productivity, while accelerating time to value. These advancements further solidify Informatica's position in the data governance space.

In-Depth Data Governance Market Market Outlook

The future outlook for the Data Governance market remains exceptionally strong, fueled by ongoing digital transformation and the increasing strategic importance of data. Growth accelerators such as the pervasive integration of AI and ML into governance solutions, coupled with the expansion into nascent markets and industries, will continue to propel market expansion. Strategic partnerships and collaborative initiatives will foster innovation and broaden access to advanced data governance capabilities. The persistent need for regulatory compliance, enhanced data security, and the pursuit of data-driven competitive advantages will ensure sustained demand for comprehensive and intelligent data governance frameworks. The market is on track to become an indispensable component of enterprise IT infrastructure, enabling organizations to unlock the full potential of their data assets securely and responsibly.

Data Governance Market Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Organization Size

- 2.1. Large-scale Business

- 2.2. Small- and Medium-scale Business

-

3. Component

- 3.1. Software

- 3.2. Service

-

4. Business Function

- 4.1. Operation and IT

- 4.2. Legal

- 4.3. Finance

- 4.4. Other Business Functions

-

5. End-user Industry

- 5.1. IT and Telecom

- 5.2. Healthcare

- 5.3. Retail

- 5.4. Defense

- 5.5. BFSI

- 5.6. Other End-user Industries

Data Governance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Data Governance Market Regional Market Share

Geographic Coverage of Data Governance Market

Data Governance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Regulatory and Compliance Mandates; Growth of Data Volume

- 3.3. Market Restrains

- 3.3.1. Varying Structure of Regulatory Policies and Data Address Validation

- 3.4. Market Trends

- 3.4.1. Healthcare Sector Expected to Exhibit Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Governance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large-scale Business

- 5.2.2. Small- and Medium-scale Business

- 5.3. Market Analysis, Insights and Forecast - by Component

- 5.3.1. Software

- 5.3.2. Service

- 5.4. Market Analysis, Insights and Forecast - by Business Function

- 5.4.1. Operation and IT

- 5.4.2. Legal

- 5.4.3. Finance

- 5.4.4. Other Business Functions

- 5.5. Market Analysis, Insights and Forecast - by End-user Industry

- 5.5.1. IT and Telecom

- 5.5.2. Healthcare

- 5.5.3. Retail

- 5.5.4. Defense

- 5.5.5. BFSI

- 5.5.6. Other End-user Industries

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Data Governance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large-scale Business

- 6.2.2. Small- and Medium-scale Business

- 6.3. Market Analysis, Insights and Forecast - by Component

- 6.3.1. Software

- 6.3.2. Service

- 6.4. Market Analysis, Insights and Forecast - by Business Function

- 6.4.1. Operation and IT

- 6.4.2. Legal

- 6.4.3. Finance

- 6.4.4. Other Business Functions

- 6.5. Market Analysis, Insights and Forecast - by End-user Industry

- 6.5.1. IT and Telecom

- 6.5.2. Healthcare

- 6.5.3. Retail

- 6.5.4. Defense

- 6.5.5. BFSI

- 6.5.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Data Governance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large-scale Business

- 7.2.2. Small- and Medium-scale Business

- 7.3. Market Analysis, Insights and Forecast - by Component

- 7.3.1. Software

- 7.3.2. Service

- 7.4. Market Analysis, Insights and Forecast - by Business Function

- 7.4.1. Operation and IT

- 7.4.2. Legal

- 7.4.3. Finance

- 7.4.4. Other Business Functions

- 7.5. Market Analysis, Insights and Forecast - by End-user Industry

- 7.5.1. IT and Telecom

- 7.5.2. Healthcare

- 7.5.3. Retail

- 7.5.4. Defense

- 7.5.5. BFSI

- 7.5.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Data Governance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large-scale Business

- 8.2.2. Small- and Medium-scale Business

- 8.3. Market Analysis, Insights and Forecast - by Component

- 8.3.1. Software

- 8.3.2. Service

- 8.4. Market Analysis, Insights and Forecast - by Business Function

- 8.4.1. Operation and IT

- 8.4.2. Legal

- 8.4.3. Finance

- 8.4.4. Other Business Functions

- 8.5. Market Analysis, Insights and Forecast - by End-user Industry

- 8.5.1. IT and Telecom

- 8.5.2. Healthcare

- 8.5.3. Retail

- 8.5.4. Defense

- 8.5.5. BFSI

- 8.5.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Data Governance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large-scale Business

- 9.2.2. Small- and Medium-scale Business

- 9.3. Market Analysis, Insights and Forecast - by Component

- 9.3.1. Software

- 9.3.2. Service

- 9.4. Market Analysis, Insights and Forecast - by Business Function

- 9.4.1. Operation and IT

- 9.4.2. Legal

- 9.4.3. Finance

- 9.4.4. Other Business Functions

- 9.5. Market Analysis, Insights and Forecast - by End-user Industry

- 9.5.1. IT and Telecom

- 9.5.2. Healthcare

- 9.5.3. Retail

- 9.5.4. Defense

- 9.5.5. BFSI

- 9.5.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Data Governance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large-scale Business

- 10.2.2. Small- and Medium-scale Business

- 10.3. Market Analysis, Insights and Forecast - by Component

- 10.3.1. Software

- 10.3.2. Service

- 10.4. Market Analysis, Insights and Forecast - by Business Function

- 10.4.1. Operation and IT

- 10.4.2. Legal

- 10.4.3. Finance

- 10.4.4. Other Business Functions

- 10.5. Market Analysis, Insights and Forecast - by End-user Industry

- 10.5.1. IT and Telecom

- 10.5.2. Healthcare

- 10.5.3. Retail

- 10.5.4. Defense

- 10.5.5. BFSI

- 10.5.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Talend SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Collibra NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TIBCO Software Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Informatica Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Symantec Corporation (Norton Lifelock)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Varonis Systems Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Alfresco Software Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SAP SE

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Data Governance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Governance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Data Governance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Data Governance Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America Data Governance Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Data Governance Market Revenue (Million), by Component 2025 & 2033

- Figure 7: North America Data Governance Market Revenue Share (%), by Component 2025 & 2033

- Figure 8: North America Data Governance Market Revenue (Million), by Business Function 2025 & 2033

- Figure 9: North America Data Governance Market Revenue Share (%), by Business Function 2025 & 2033

- Figure 10: North America Data Governance Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Data Governance Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Data Governance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Data Governance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Data Governance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Data Governance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Data Governance Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 17: Europe Data Governance Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 18: Europe Data Governance Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Europe Data Governance Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Europe Data Governance Market Revenue (Million), by Business Function 2025 & 2033

- Figure 21: Europe Data Governance Market Revenue Share (%), by Business Function 2025 & 2033

- Figure 22: Europe Data Governance Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Data Governance Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Data Governance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Data Governance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Data Governance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Asia Pacific Data Governance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Asia Pacific Data Governance Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Asia Pacific Data Governance Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Asia Pacific Data Governance Market Revenue (Million), by Component 2025 & 2033

- Figure 31: Asia Pacific Data Governance Market Revenue Share (%), by Component 2025 & 2033

- Figure 32: Asia Pacific Data Governance Market Revenue (Million), by Business Function 2025 & 2033

- Figure 33: Asia Pacific Data Governance Market Revenue Share (%), by Business Function 2025 & 2033

- Figure 34: Asia Pacific Data Governance Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Data Governance Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Asia Pacific Data Governance Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Data Governance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America Data Governance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 39: Latin America Data Governance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 40: Latin America Data Governance Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 41: Latin America Data Governance Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 42: Latin America Data Governance Market Revenue (Million), by Component 2025 & 2033

- Figure 43: Latin America Data Governance Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Latin America Data Governance Market Revenue (Million), by Business Function 2025 & 2033

- Figure 45: Latin America Data Governance Market Revenue Share (%), by Business Function 2025 & 2033

- Figure 46: Latin America Data Governance Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Latin America Data Governance Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Latin America Data Governance Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Latin America Data Governance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Data Governance Market Revenue (Million), by Deployment 2025 & 2033

- Figure 51: Middle East and Africa Data Governance Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 52: Middle East and Africa Data Governance Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 53: Middle East and Africa Data Governance Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 54: Middle East and Africa Data Governance Market Revenue (Million), by Component 2025 & 2033

- Figure 55: Middle East and Africa Data Governance Market Revenue Share (%), by Component 2025 & 2033

- Figure 56: Middle East and Africa Data Governance Market Revenue (Million), by Business Function 2025 & 2033

- Figure 57: Middle East and Africa Data Governance Market Revenue Share (%), by Business Function 2025 & 2033

- Figure 58: Middle East and Africa Data Governance Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Data Governance Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 60: Middle East and Africa Data Governance Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Data Governance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Governance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Data Governance Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Data Governance Market Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Global Data Governance Market Revenue Million Forecast, by Business Function 2020 & 2033

- Table 5: Global Data Governance Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Data Governance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Data Governance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Data Governance Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: Global Data Governance Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Data Governance Market Revenue Million Forecast, by Business Function 2020 & 2033

- Table 11: Global Data Governance Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Data Governance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Data Governance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Data Governance Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 15: Global Data Governance Market Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Global Data Governance Market Revenue Million Forecast, by Business Function 2020 & 2033

- Table 17: Global Data Governance Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Data Governance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Data Governance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global Data Governance Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 21: Global Data Governance Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Data Governance Market Revenue Million Forecast, by Business Function 2020 & 2033

- Table 23: Global Data Governance Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Data Governance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Data Governance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 26: Global Data Governance Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 27: Global Data Governance Market Revenue Million Forecast, by Component 2020 & 2033

- Table 28: Global Data Governance Market Revenue Million Forecast, by Business Function 2020 & 2033

- Table 29: Global Data Governance Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Data Governance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Data Governance Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 32: Global Data Governance Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 33: Global Data Governance Market Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Global Data Governance Market Revenue Million Forecast, by Business Function 2020 & 2033

- Table 35: Global Data Governance Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Data Governance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Governance Market?

The projected CAGR is approximately 19.72%.

2. Which companies are prominent players in the Data Governance Market?

Key companies in the market include SAS Institute Inc, Talend SA, Collibra NV, TIBCO Software Inc, IBM Corporation, Informatica Inc, Microsoft Corporation, Symantec Corporation (Norton Lifelock), Alation Inc, Varonis Systems Inc , Oracle Corporation, Alfresco Software Inc, SAP SE.

3. What are the main segments of the Data Governance Market?

The market segments include Deployment, Organization Size, Component, Business Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Regulatory and Compliance Mandates; Growth of Data Volume.

6. What are the notable trends driving market growth?

Healthcare Sector Expected to Exhibit Significant Growth Rate.

7. Are there any restraints impacting market growth?

Varying Structure of Regulatory Policies and Data Address Validation.

8. Can you provide examples of recent developments in the market?

June 2023 - Oracle announced its plans to develop powerful, generative AI services for organizations across the world. The company will provide native generative AI services to help organizations automate end-to-end business processes, improve decision-making, and enhance customer experiences, in collaboration with Cohere, a leading AI platform for enterprise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Governance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Governance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Governance Market?

To stay informed about further developments, trends, and reports in the Data Governance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence