Key Insights

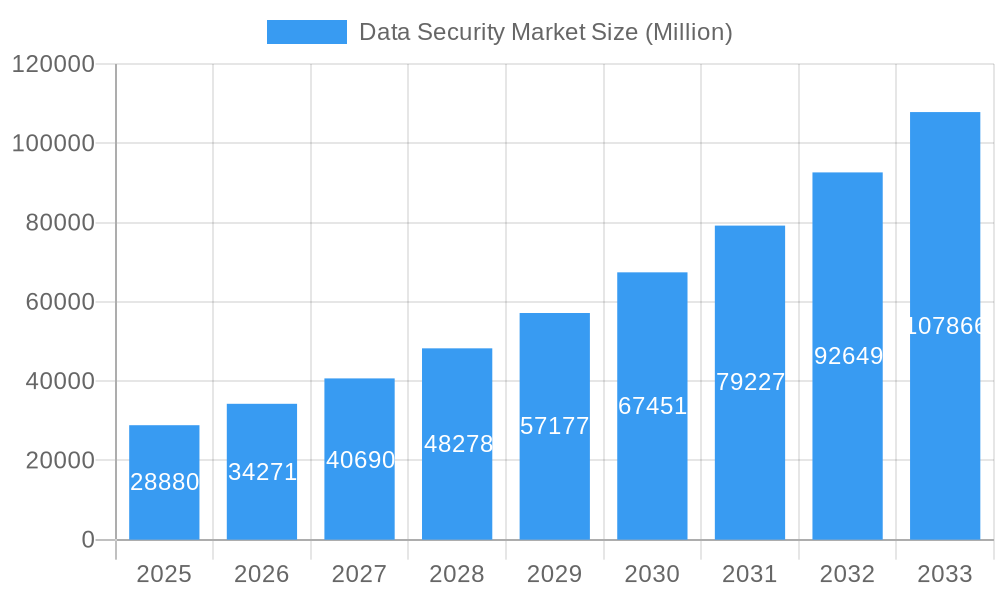

The global Data Security Market is poised for robust expansion, projected to reach $28.88 Billion by 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 18.78% over the forecast period of 2025-2033. This significant growth is primarily fueled by escalating data volumes across all industries, the increasing sophistication of cyber threats, and a heightened regulatory landscape demanding stringent data protection measures. Organizations are prioritizing investments in comprehensive data security solutions to safeguard sensitive information, maintain customer trust, and ensure business continuity. Key drivers include the proliferation of cloud computing, the adoption of remote work models, and the growing use of Big Data analytics, all of which create new attack vectors and necessitate advanced security protocols. The market is witnessing a strong demand for integrated solutions encompassing encryption, access management, threat detection, and data loss prevention.

Data Security Market Market Size (In Billion)

The competitive landscape is characterized by innovation and strategic collaborations among leading players. Segmentation analysis reveals substantial growth opportunities across various deployment models, with cloud-based solutions gaining significant traction due to their scalability and cost-effectiveness. Small and medium-sized enterprises (SMEs) are increasingly adopting robust data security measures to compete effectively and comply with regulations, while large enterprises continue to invest heavily in advanced security infrastructure. Key end-user industries such as Banking, Financial Services, and Insurance (BFSI), Healthcare, and Retail are at the forefront of data security adoption due to the highly sensitive nature of the data they handle. While the market presents immense opportunities, potential restraints include the high cost of implementation for certain advanced solutions and a shortage of skilled cybersecurity professionals. Addressing these challenges through accessible solutions and talent development will be crucial for sustained market growth.

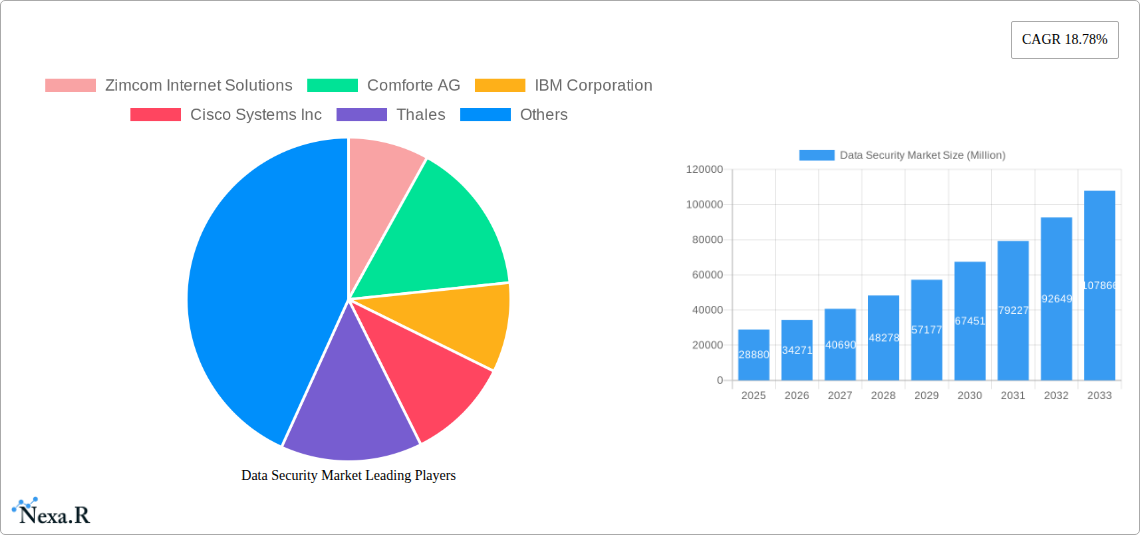

Data Security Market Company Market Share

Gain a competitive edge with an in-depth exploration of the global Data Security Market. This report provides critical insights into market dynamics, growth trajectories, dominant segments, and key players, empowering strategic decision-making for businesses navigating the evolving threat landscape.

Data Security Market Market Dynamics & Structure

The global Data Security Market is characterized by a dynamic interplay of technological advancements, stringent regulatory frameworks, and an ever-increasing volume of sensitive data. Market concentration varies across segments, with established players like IBM Corporation and Microsoft Corporation holding significant sway in enterprise solutions, while specialized providers are emerging in niche areas. Technological innovation is a primary driver, fueled by the escalating sophistication of cyber threats, the widespread adoption of cloud computing, and the growing demand for advanced analytics and AI-powered security solutions. Regulatory mandates, such as GDPR and CCPA, are instrumental in shaping market demand, compelling organizations to invest in robust data protection measures. Competitive product substitutes are constantly emerging, ranging from encryption software to data loss prevention (DLP) tools and identity and access management (IAM) solutions. End-user demographics are diverse, spanning all industries, with a pronounced focus on sectors handling highly sensitive information like Banking, Financial Services and Insurance (BFSI), Healthcare, and Government. Mergers and acquisitions (M&A) activity is on the rise as larger entities seek to expand their portfolios and acquire cutting-edge technologies, further consolidating the market. Innovation barriers include the high cost of R&D, the need for specialized talent, and the complexity of integrating disparate security systems. The market is projected to witness significant growth in the coming years, driven by the relentless pursuit of data integrity and confidentiality.

- Market Concentration: Fragmented in emerging solutions, consolidated in enterprise-level platforms.

- Technological Innovation Drivers: AI/ML for threat detection, advanced encryption, zero-trust architecture.

- Regulatory Frameworks: GDPR, CCPA, HIPAA, NIS2 Directive mandating enhanced data protection.

- Competitive Product Substitutes: Encryption tools, DLP solutions, IAM platforms, security information and event management (SIEM).

- End-User Demographics: BFSI, Healthcare, Government, IT & Telecommunications, Retail, Manufacturing.

- M&A Trends: Strategic acquisitions for portfolio expansion and technology integration.

- Innovation Barriers: High R&D costs, talent scarcity, integration complexities.

Data Security Market Growth Trends & Insights

The Data Security Market is poised for substantial expansion, driven by a confluence of escalating cyber threats, evolving compliance landscapes, and the pervasive digitalization of businesses worldwide. The market size is projected to grow from an estimated US$ 38,500 Million in 2025 to US$ 80,250 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.7% during the forecast period. This robust growth trajectory is underpinned by several key factors. Firstly, the increasing volume and complexity of cyberattacks, including ransomware, phishing, and data breaches, are compelling organizations across all sectors to prioritize data security investments. The financial and reputational damage resulting from a data breach often far outweighs the cost of proactive security measures, making robust data protection a business imperative. Secondly, the growing adoption of cloud computing and the Internet of Things (IoT) expands the attack surface, necessitating sophisticated cloud security solutions and IoT device security protocols. Organizations are increasingly relying on cloud-based data security services for scalability, flexibility, and cost-effectiveness. Thirdly, stringent data privacy regulations globally are forcing businesses to implement comprehensive data security strategies to avoid hefty fines and maintain customer trust. Compliance with regulations like GDPR, CCPA, and others has become a significant driver for market growth, encouraging investments in data encryption, access control, and data loss prevention. Consumer behavior is also shifting, with individuals becoming more aware of data privacy concerns and demanding greater protection for their personal information. This heightened awareness translates into increased pressure on businesses to demonstrate robust security practices. Technological disruptions, such as the advent of quantum-resistant encryption and advanced anomaly detection systems, are further shaping the market, offering new paradigms for data protection. The transition towards remote and hybrid work models has also necessitated a re-evaluation of security perimeters, driving demand for endpoint security and secure remote access solutions. The IT and Telecommunications sector, along with BFSI and Healthcare, are expected to lead in adoption rates due to the highly sensitive nature of the data they handle and the critical need for uninterrupted service availability.

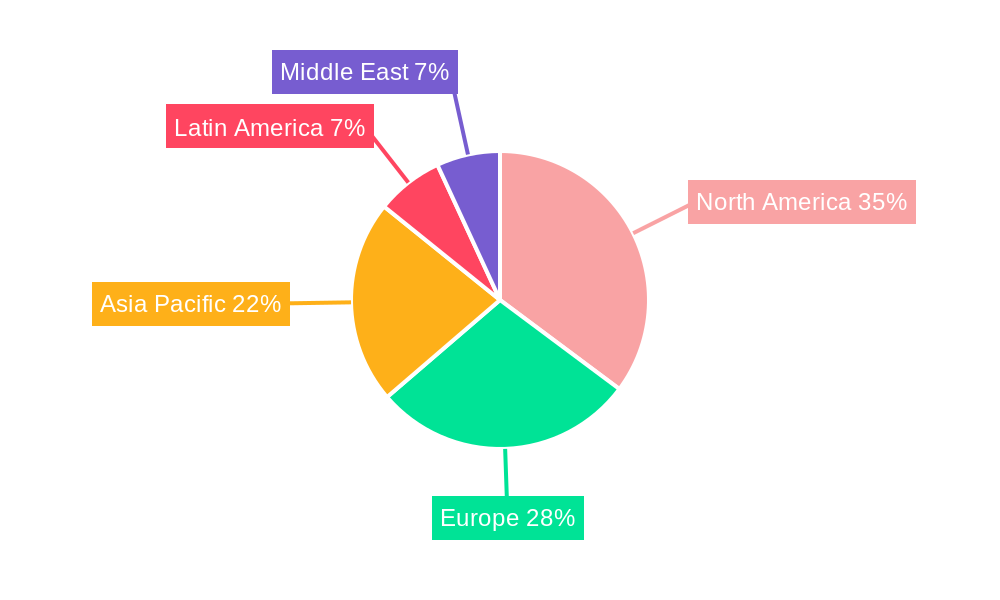

Dominant Regions, Countries, or Segments in Data Security Market

The North America region is expected to dominate the Data Security Market throughout the forecast period, driven by a combination of factors including a mature technological infrastructure, high levels of digital adoption, significant investments in cybersecurity by both private and public sectors, and a strong regulatory environment. The United States, in particular, stands out as a leading country due to the presence of major technology companies, a robust startup ecosystem focused on cybersecurity innovation, and a proactive approach to addressing cyber threats. The Banking, Financial Services, and Insurance (BFSI) industry is a significant segment within the Data Security Market, consistently driving demand for advanced solutions. This dominance stems from the critical need to protect sensitive financial data, comply with strict financial regulations, and maintain customer trust. BFSI institutions are prime targets for sophisticated cyberattacks, making them early adopters of cutting-edge data security technologies.

- Dominant Region: North America, led by the United States.

- Key Drivers: High cybersecurity spending, advanced technological adoption, stringent regulatory frameworks, presence of tech giants.

- Market Share Potential: Estimated to hold over 35% of the global market by 2033.

- Dominant End-user Industry: Banking, Financial Services, and Insurance (BFSI).

- Key Drivers: High value of sensitive data, stringent regulatory compliance, continuous threat landscape, customer trust imperative.

- Growth Potential: Projected CAGR of over 10% within the BFSI segment.

- Dominant Component: Solutions are projected to exhibit stronger growth compared to Services, although both are crucial.

- Key Drivers for Solutions: Increasing adoption of AI-powered threat intelligence, advanced encryption technologies, cloud-native security platforms, and data masking solutions.

- Market Share within Solutions: Encryption, DLP, and IAM are expected to capture the largest share.

- Dominant Deployment: Cloud deployment models are gaining significant traction.

- Key Drivers for Cloud: Scalability, cost-effectiveness, flexibility, ease of integration, and the growing trend of cloud migration across industries.

- Growth Potential: Cloud deployment is expected to grow at a CAGR of over 11%.

- Dominant Organization Size: Large Enterprises continue to be the primary consumers of advanced data security solutions.

- Key Drivers for Large Enterprises: Greater data volumes, larger attack surfaces, higher regulatory compliance burdens, and more substantial security budgets.

- Market Share: Estimated to account for over 60% of the total market revenue.

- Dominant Country within Asia Pacific: China and India are expected to show remarkable growth due to increasing digitalization and government initiatives for data protection.

- Key Drivers: Rapid digitalization, growing e-commerce, increasing cloud adoption, and evolving data privacy laws.

Data Security Market Product Landscape

The Data Security Market is characterized by continuous innovation in product offerings. Companies are developing advanced encryption technologies, including homomorphic encryption and post-quantum cryptography, to secure data at rest, in transit, and in use. Data Loss Prevention (DLP) solutions are becoming more sophisticated, employing AI to accurately identify and prevent sensitive data exfiltration across various channels. Identity and Access Management (IAM) systems are evolving to incorporate multi-factor authentication (MFA), biometric authentication, and continuous authentication for enhanced user verification. Cloud access security brokers (CASBs) are crucial for monitoring and securing cloud application usage. Furthermore, solutions focused on data governance, privacy management, and compliance automation are gaining prominence as organizations grapple with complex regulatory requirements. The emphasis is on integrated platforms that offer comprehensive protection rather than siloed tools.

Key Drivers, Barriers & Challenges in Data Security Market

Key Drivers:

- Escalating Cyber Threats: The persistent and evolving nature of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), is the primary catalyst for data security market growth.

- Stringent Regulatory Compliance: Growing data privacy regulations globally (e.g., GDPR, CCPA) mandate robust data protection, forcing organizations to invest heavily in security measures.

- Digital Transformation and Cloud Adoption: The shift to cloud computing and the proliferation of digital services expand the attack surface, necessitating enhanced cloud security solutions.

- Increasing Data Volumes and Value: Businesses are generating and storing unprecedented amounts of data, making it a highly attractive target for cybercriminals.

- Remote Work and BYOD Policies: The widespread adoption of remote work and bring-your-own-device (BYOD) policies necessitates more comprehensive endpoint and network security.

Barriers & Challenges:

- Talent Shortage: A significant global shortage of skilled cybersecurity professionals limits the ability of organizations to implement and manage complex security solutions.

- Cost of Implementation: Advanced data security solutions can be expensive, posing a challenge for small and medium-sized enterprises (SMEs) with limited budgets.

- Integration Complexity: Integrating new security solutions with existing IT infrastructure can be complex and time-consuming.

- Evolving Threat Landscape: The rapid pace of change in cyber threats requires constant adaptation and investment in updated security technologies.

- Insider Threats: Malicious or negligent actions by internal employees remain a significant challenge to data security.

- Supply Chain Vulnerabilities: Weaknesses in third-party vendor security can create entry points for attackers.

Emerging Opportunities in Data Security Market

The Data Security Market is ripe with emerging opportunities. The increasing demand for Zero Trust Architecture implementation presents a significant growth avenue, as organizations move away from traditional perimeter-based security. The rise of AI and Machine Learning in cybersecurity offers opportunities for predictive threat intelligence, anomaly detection, and automated response systems. The burgeoning IoT ecosystem requires specialized security solutions to protect connected devices and the vast amounts of data they generate. Furthermore, there's a growing need for privacy-enhancing technologies (PETs) beyond basic encryption, such as differential privacy and federated learning, to enable data analysis while preserving individual privacy. Untapped markets in developing economies, as they undergo digital transformation, also represent a substantial opportunity.

Growth Accelerators in the Data Security Market Industry

Several key factors are accelerating the growth of the Data Security Market. Technological breakthroughs in areas like AI-driven threat detection, quantum-resistant encryption, and blockchain for data integrity are creating new solutions and enhancing existing ones. Strategic partnerships and collaboration between security vendors and cloud service providers are crucial for offering integrated and comprehensive security solutions. The increasing focus on data governance and privacy-by-design principles by organizations is driving demand for proactive security measures. Moreover, government initiatives and funding for cybersecurity research and development are fostering innovation and market expansion. The growing awareness of the long-term economic and reputational damage of data breaches is acting as a powerful accelerator for increased investment in robust data security.

Key Players Shaping the Data Security Market Market

- Zimcom Internet Solutions

- Comforte AG

- IBM Corporation

- Cisco Systems Inc

- Thales

- Microsoft Corporation

- Checkpoint Software Technologies Ltd

- Lepide USA Inc

- 101 Data Solutions

- Oracle Corporation

- Varonis Systems Inc

Notable Milestones in Data Security Market Sector

- July 2022: Trellix achieved Amazon Web Services (AWS) Security Competency status in the Data security and protection category, highlighting its advanced capabilities in cloud security and threat response.

- June 2022: Comforte AG partnered with M² Business Consulting GmbH to assist large enterprises in the DACH region in adapting to emerging IT more rapidly and securely, focusing on secure data analytics and privacy standards.

In-Depth Data Security Market Market Outlook

The future of the Data Security Market is exceptionally promising, driven by persistent cybersecurity threats and evolving regulatory landscapes. Key growth accelerators include the widespread adoption of AI and machine learning for advanced threat detection and response, the development of quantum-resistant encryption to safeguard against future cryptographic vulnerabilities, and the increasing integration of zero-trust security models across enterprise infrastructures. Strategic partnerships between technology providers and cloud service providers will continue to expand the reach and effectiveness of cloud-native security solutions. Furthermore, the growing emphasis on data governance and privacy-by-design principles will foster a proactive approach to security, moving beyond reactive measures. As businesses worldwide continue their digital transformation journeys, the demand for comprehensive, scalable, and intelligent data security solutions will only intensify, presenting substantial opportunities for innovation and market expansion.

Data Security Market Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premises

-

3. Organization Size

- 3.1. Small and Medium Enterprises

- 3.2. Large Enterprises

-

4. End-user Industry

- 4.1. Retail

- 4.2. Healthcare

- 4.3. Manufacturing

- 4.4. Banking, Financial Services and Insurance

- 4.5. Government

- 4.6. IT & Telecommunications

- 4.7. Other End-user Industries

Data Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Data Security Market Regional Market Share

Geographic Coverage of Data Security Market

Data Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digitization Trends and Digital Data Production; Increase in Data Security Technologies

- 3.3. Market Restrains

- 3.3.1. Identifying and Analyzing Sensitive Information and Costly Installation

- 3.4. Market Trends

- 3.4.1. Data Security Technologies As the Greatest Asset

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Retail

- 5.4.2. Healthcare

- 5.4.3. Manufacturing

- 5.4.4. Banking, Financial Services and Insurance

- 5.4.5. Government

- 5.4.6. IT & Telecommunications

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Data Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premises

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium Enterprises

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Retail

- 6.4.2. Healthcare

- 6.4.3. Manufacturing

- 6.4.4. Banking, Financial Services and Insurance

- 6.4.5. Government

- 6.4.6. IT & Telecommunications

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Data Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premises

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium Enterprises

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Retail

- 7.4.2. Healthcare

- 7.4.3. Manufacturing

- 7.4.4. Banking, Financial Services and Insurance

- 7.4.5. Government

- 7.4.6. IT & Telecommunications

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Data Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premises

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium Enterprises

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Retail

- 8.4.2. Healthcare

- 8.4.3. Manufacturing

- 8.4.4. Banking, Financial Services and Insurance

- 8.4.5. Government

- 8.4.6. IT & Telecommunications

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Data Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premises

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium Enterprises

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Retail

- 9.4.2. Healthcare

- 9.4.3. Manufacturing

- 9.4.4. Banking, Financial Services and Insurance

- 9.4.5. Government

- 9.4.6. IT & Telecommunications

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Data Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premises

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium Enterprises

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Retail

- 10.4.2. Healthcare

- 10.4.3. Manufacturing

- 10.4.4. Banking, Financial Services and Insurance

- 10.4.5. Government

- 10.4.6. IT & Telecommunications

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zimcom Internet Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Comforte AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Checkpoint Software Technologies Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lepide USA Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 101 Data Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Varonis Systems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Zimcom Internet Solutions

List of Figures

- Figure 1: Global Data Security Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 7: North America Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 8: North America Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 17: Europe Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 18: Europe Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Pacific Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Asia Pacific Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Pacific Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 27: Asia Pacific Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Asia Pacific Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 33: Latin America Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Latin America Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Latin America Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Latin America Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 37: Latin America Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Latin America Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 45: Middle East Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 46: Middle East Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 47: Middle East Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 48: Middle East Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 49: Middle East Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East Data Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Data Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 14: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 19: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 24: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 29: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Security Market?

The projected CAGR is approximately 18.78%.

2. Which companies are prominent players in the Data Security Market?

Key companies in the market include Zimcom Internet Solutions, Comforte AG, IBM Corporation, Cisco Systems Inc, Thales, Microsoft Corporation, Checkpoint Software Technologies Ltd, Lepide USA Inc, 101 Data Solutions, Oracle Corporation*List Not Exhaustive, Varonis Systems Inc.

3. What are the main segments of the Data Security Market?

The market segments include Component, Deployment, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digitization Trends and Digital Data Production; Increase in Data Security Technologies.

6. What are the notable trends driving market growth?

Data Security Technologies As the Greatest Asset.

7. Are there any restraints impacting market growth?

Identifying and Analyzing Sensitive Information and Costly Installation.

8. Can you provide examples of recent developments in the market?

July 2022 - Trellix has achieved Amazon Web Services (AWS) Security Competency status in the Data security and protection category by developing a solution that identifies and responds to millions of malicious objects and URLs daily. This designation honors Trellix's extensive technical expertise and proven success in assisting customers in enhancing their security, especially in the cloud sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Security Market?

To stay informed about further developments, trends, and reports in the Data Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence