Key Insights

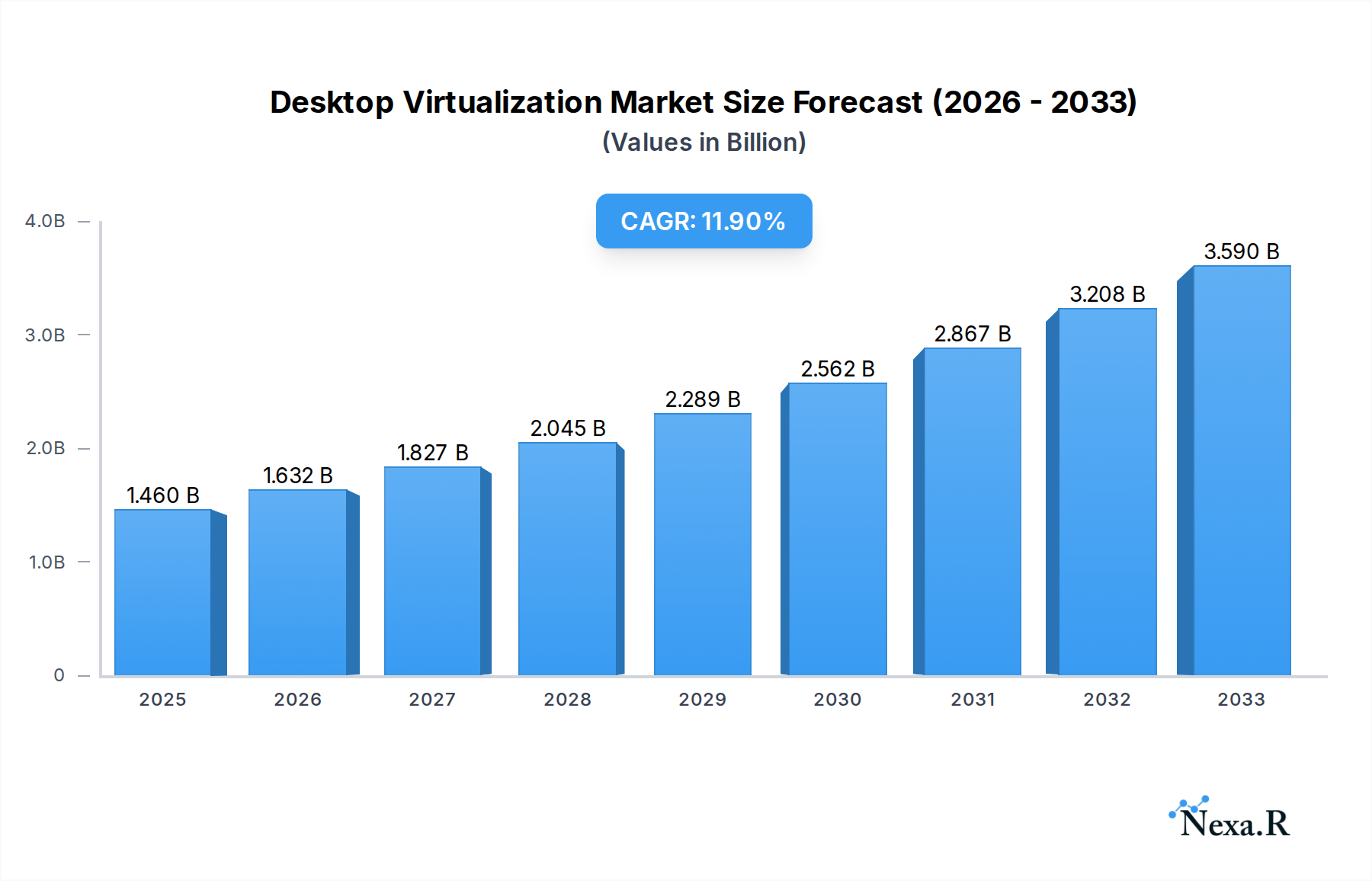

The global Desktop Virtualization Market is poised for significant expansion, projected to reach approximately USD 1.46 Billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 11.79%. This robust growth trajectory underscores the increasing adoption of virtual desktop infrastructure (VDI) solutions across enterprises seeking enhanced flexibility, scalability, and cost-efficiency in their IT operations. Key drivers fueling this market surge include the escalating demand for remote work capabilities, the need for centralized data management and security, and the continuous evolution of cloud computing technologies. Businesses are increasingly recognizing the benefits of VDI in terms of simplified IT administration, improved disaster recovery, and the ability to provide seamless access to applications and data from any device, anywhere.

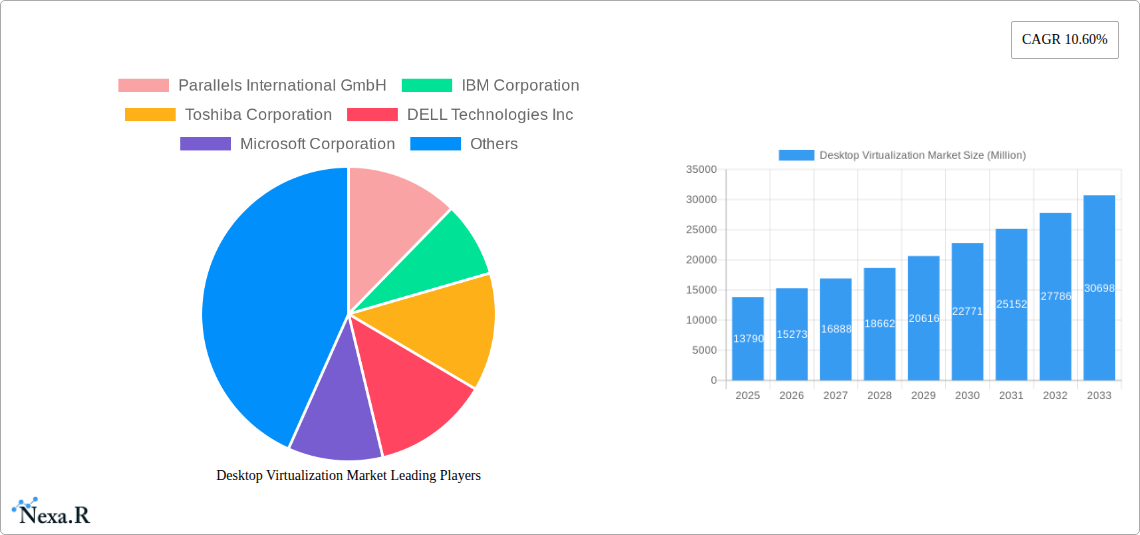

Desktop Virtualization Market Market Size (In Billion)

The market is segmented by platform into Hosted Virtual Desktops (HVD) and Hosted Shared Desktops (HSD), with deployment modes encompassing both on-premise and cloud-based solutions. While on-premise solutions offer greater control, the scalability and accessibility of cloud deployments are driving their adoption, particularly among small and medium-sized enterprises (SMEs). The competitive landscape features established players such as Microsoft Corporation, Citrix Systems Inc., and VMware Inc., alongside innovative companies like Parallels International GmbH and Huawei Technologies Co Ltd. Emerging trends such as the integration of AI and machine learning for enhanced performance and security, alongside the rise of Desktop-as-a-Service (DaaS) models, are further shaping the market's future. Despite strong growth, potential restraints such as high initial implementation costs for some organizations and concerns regarding latency in certain network conditions may influence adoption rates in specific segments.

Desktop Virtualization Market Company Market Share

This in-depth report provides an indispensable analysis of the global Desktop Virtualization Market, offering critical insights for stakeholders navigating this rapidly evolving sector. With a comprehensive study period from 2019 to 2033, including a base and estimated year of 2025, and a detailed forecast period of 2025-2033, this research delves into market dynamics, growth trends, regional dominance, product landscapes, and strategic opportunities. Discover how leading companies like VMware Inc., Microsoft Corporation, and Citrix Systems Inc. are shaping the future of work by enabling secure, scalable, and flexible end-user computing environments. This report is essential for IT leaders, solution providers, investors, and policymakers seeking to capitalize on the burgeoning virtual desktop infrastructure (VDI) market and its sub-segments, including Hosted Virtual Desktop (HVD) and Hosted Shared Desktop (HSD) solutions.

Desktop Virtualization Market Market Dynamics & Structure

The Desktop Virtualization Market is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and a moderately concentrated competitive landscape. Driven by the persistent need for enhanced security, centralized management, and improved employee productivity, the market witnesses continuous technological advancements in areas such as graphics virtualization, AI-powered performance optimization, and seamless integration with cloud services. Regulatory frameworks, particularly concerning data privacy and compliance (e.g., GDPR, CCPA), act as both drivers for adopting secure virtual environments and potential barriers to rapid deployment in certain sectors. The presence of robust cloud desktop solutions and on-premise deployments caters to diverse organizational needs, while competitive product substitutes, such as traditional physical desktops and mobility solutions, necessitate a clear value proposition for VDI. End-user demographics, ranging from small and medium-sized businesses (SMBs) seeking cost-effective scalability to large enterprises prioritizing stringent security and remote work capabilities, significantly influence adoption patterns. Mergers and acquisitions (M&A) remain a key trend, with larger players acquiring innovative startups to expand their portfolios and market reach. For instance, recent M&A activities have focused on consolidating expertise in cloud migration, security, and end-user experience enhancement.

- Market Concentration: Moderately concentrated, with key players holding significant market share, but ample room for niche players and emerging technologies.

- Technological Innovation Drivers: Demand for remote work enablement, cybersecurity enhancement, cost optimization, and centralized IT management.

- Regulatory Frameworks: Increasing focus on data privacy, compliance, and secure remote access policies, influencing deployment strategies.

- Competitive Product Substitutes: Traditional desktops, thin clients, mobile devices, and other remote access solutions.

- End-User Demographics: Diverse, encompassing SMBs to large enterprises across various industries like finance, healthcare, education, and IT.

- M&A Trends: Focus on acquiring technologies for cloud integration, enhanced security, and improved user experience, with an estimated xx number of deals in the historical period.

Desktop Virtualization Market Growth Trends & Insights

The Desktop Virtualization Market is poised for substantial growth, driven by the fundamental shift in how organizations approach end-user computing. The market size is projected to expand significantly, fueled by increasing adoption rates among businesses of all sizes seeking to modernize their IT infrastructure and empower their workforce. Technological disruptions, including the maturation of cloud-based VDI solutions and advancements in hardware acceleration for virtual desktops, are making VDI more accessible and performant than ever before. Consumer behavior shifts, accelerated by the global pandemic, have cemented the demand for flexible work arrangements, making virtual desktop solutions a strategic imperative for business continuity and talent acquisition. The market penetration of VDI is expected to climb steadily as organizations recognize the tangible benefits of centralized management, enhanced security, and reduced IT overhead. The projected Compound Annual Growth Rate (CAGR) for the forecast period underscores the market's robust expansion trajectory. Key insights reveal a growing preference for Desktop as a Service (DaaS) offerings, which abstract away the complexity of infrastructure management and provide a scalable, pay-as-you-go model. Furthermore, the integration of AI and machine learning is enhancing user experience by optimizing resource allocation and predicting potential issues, thereby improving performance and reducing downtime. The evolution of networking technologies, such as 5G, is also playing a crucial role in enabling seamless access to virtual desktops from a wider range of devices and locations, further democratizing access to powerful computing resources.

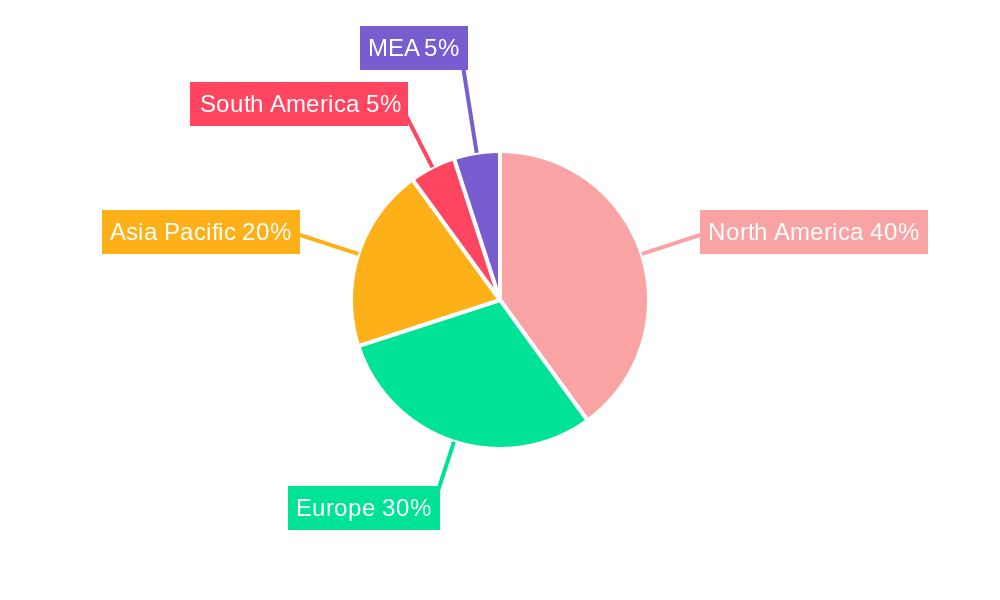

Dominant Regions, Countries, or Segments in Desktop Virtualization Market

North America currently stands as a dominant region in the Desktop Virtualization Market, driven by its early adoption of cloud technologies, a strong presence of large enterprises with significant IT budgets, and a culture that embraces remote work. The United States, in particular, exhibits high market penetration due to its advanced technological infrastructure, stringent data security regulations, and a thriving ecosystem of VDI vendors and solution providers. The country's emphasis on digital transformation and cybersecurity initiatives further propels the adoption of virtual desktop solutions, with a significant portion of the market share attributed to cloud deployment modes.

- North America's Dominance: Characterized by advanced technological adoption and a robust economy, leading the global market.

- United States: A key market player with high adoption rates of virtual desktop infrastructure (VDI), driven by enterprise demand and government initiatives.

- Canada: Following suit with increasing investments in cloud services and remote work solutions.

- Europe's Growing Influence: The region is witnessing steady growth, with a strong focus on data privacy and compliance, influencing the demand for secure HVD and HSD solutions.

- Germany and the UK: Leading adopters due to their established IT sectors and the need for scalable workforces.

- France: Showing increasing interest in DaaS and cloud-based virtual desktops.

- Asia Pacific's Rapid Expansion: This region presents significant growth potential, fueled by the increasing digitalization of economies, a growing SMB sector, and the expansion of IT outsourcing.

- China and India: Emerging as key markets with substantial investments in cloud infrastructure and a growing demand for flexible work solutions.

- Japan and South Korea: Focus on innovation and enterprise-grade solutions, contributing to the market's advancement.

- Key Segment Drivers:

- Cloud Deployment Mode: Rapidly gaining traction due to its scalability, cost-effectiveness, and ease of management, attracting a large share of market revenue.

- Hosted Virtual Desktop (HVD): Preferred by organizations requiring dedicated, personalized desktop experiences with enhanced security and control, especially in regulated industries.

- Hosted Shared Desktop (HSD): Offers a cost-effective solution for delivering standardized desktop environments to a large user base, ideal for task-oriented roles and educational institutions.

- On-Premise Deployment: Remains relevant for organizations with specific security mandates, legacy system requirements, or substantial existing infrastructure investments.

Desktop Virtualization Market Product Landscape

The Desktop Virtualization Market is characterized by a landscape of innovative products designed to enhance end-user computing flexibility, security, and manageability. Leading vendors continuously introduce advancements that optimize performance, simplify deployment, and expand compatibility across diverse hardware and operating systems. Key product innovations include enhanced GPU virtualization for graphics-intensive workloads, AI-driven performance tuning for seamless user experiences, and robust security features such as multi-factor authentication and granular access controls. The integration of VDI with modern management tools and cloud platforms allows for centralized administration, automated provisioning, and simplified patch management. Unique selling propositions often revolve around the ability to deliver a persistent or non-persistent desktop experience tailored to specific user roles, ensuring data security by keeping sensitive information within the data center or cloud. Technological advancements also focus on reducing latency and improving responsiveness for remote users, making VDI a viable alternative to physical desktops for a broad range of applications.

Key Drivers, Barriers & Challenges in Desktop Virtualization Market

The Desktop Virtualization Market is propelled by a confluence of powerful drivers and faced with significant barriers and challenges.

Key Drivers:

- Remote Work Imperative: The sustained demand for flexible work arrangements and business continuity plans is a primary catalyst.

- Enhanced Security & Compliance: VDI centralizes data, reducing endpoint vulnerabilities and simplifying compliance with regulations like GDPR.

- Cost Optimization: Organizations seek to reduce hardware refresh cycles, energy consumption, and IT management overhead.

- Centralized Management: IT departments benefit from simplified deployment, patching, and support for desktops.

- Device Flexibility: Users can access their virtual desktops from various devices, including low-cost thin clients, tablets, and personal computers.

Key Barriers & Challenges:

- Initial Implementation Costs: The upfront investment in infrastructure, software, and expertise can be substantial.

- Performance Concerns: Delivering a consistent, high-performance user experience, especially for graphics-intensive applications, can be challenging.

- Network Dependency: VDI performance is highly reliant on stable and high-bandwidth network connectivity.

- Complexity of Management: While centralized, managing a VDI environment requires specialized skills and ongoing optimization.

- Application Compatibility: Certain legacy applications may not be compatible with virtualized environments without significant remediation.

- Supply Chain Issues: Persistent global supply chain disruptions can impact the availability of hardware components for on-premise deployments.

- Competitive Pressure: Intense competition from cloud providers and alternative endpoint solutions pressures pricing and innovation.

Emerging Opportunities in Desktop Virtualization Market

Emerging opportunities within the Desktop Virtualization Market are abundant, driven by evolving technological capabilities and changing organizational needs. The expansion of Desktop as a Service (DaaS) offerings presents a significant avenue for growth, catering to SMBs and enterprises seeking a managed, scalable, and cost-effective solution without the burden of infrastructure management. The increasing adoption of hybrid cloud strategies also opens doors for VDI solutions that seamlessly integrate on-premise and cloud resources, providing flexibility and cost optimization. Furthermore, the demand for specialized virtual desktop environments for niche industries, such as healthcare (for secure patient data access) and education (for scalable lab environments), represents untapped market potential. The growing trend of bring-your-own-device (BYOD) policies, when combined with robust VDI security, creates opportunities for delivering a consistent and secure user experience across personal devices. The development of more efficient protocols and AI-driven optimizations for graphics-intensive applications will also unlock new use cases and expand the addressable market.

Growth Accelerators in the Desktop Virtualization Market Industry

The Desktop Virtualization Market is experiencing significant growth acceleration fueled by several key factors. The continuous innovation in cloud computing, enabling more scalable and cost-effective virtual desktop infrastructure (VDI) deployments, is a primary accelerator. Strategic partnerships between VDI vendors, cloud providers (e.g., Microsoft Azure, AWS, Google Cloud), and hardware manufacturers are expanding the reach and functionality of VDI solutions. The increasing global acceptance and demand for remote and hybrid work models have made VDI a critical enabler for business continuity and workforce flexibility. Furthermore, the ongoing advancements in networking technologies, such as 5G, are improving the accessibility and performance of virtual desktops for users in diverse geographic locations. The market expansion is also driven by the growing awareness among businesses about the security benefits of centralized data management offered by VDI, particularly in light of escalating cybersecurity threats.

Key Players Shaping the Desktop Virtualization Market Market

- Parallels International GmbH

- Toshiba Corporation

- Ncomputing Inc

- Microsoft Corporation

- Dell Inc

- Huawei Technologies Co Ltd

- Ericom Software Inc

- Citrix Systems Inc

- Red Hat Inc (IBM Corporation)

- Tems Inc

- Vmware Inc

Notable Milestones in Desktop Virtualization Market Sector

- January 2023: VMware revealed a new solution for global retailers to modernize point of sale (POS) and unlock more financial value from their POS devices. VMware Retail POS modernization solutions enable operations, IT, marketing, and security teams to become more agile and responsive to drive critical business, customer, and IT outcomes.

- July 2022: Microsoft announced Azure virtual desktop support for virtual machines with "Trusted Launch" protections. Trusted Launch was Microsoft's phrase for technologies that add protections at the OS boot-up level to block viruses and malware, known as bootkits.

In-Depth Desktop Virtualization Market Market Outlook

The future outlook for the Desktop Virtualization Market is exceptionally promising, driven by sustained demand for digital transformation, enhanced cybersecurity, and flexible work environments. Growth accelerators such as the pervasive adoption of cloud computing, strategic alliances between key market players, and the ongoing evolution of remote work trends will continue to fuel market expansion. The increasing sophistication of virtual desktop solutions, including the integration of AI and improved graphics capabilities, will unlock new application scenarios and broaden the addressable market. Organizations will increasingly leverage VDI to achieve greater agility, reduce operational costs, and empower their workforces with secure, anywhere access to corporate resources. The market is poised for significant growth, particularly in emerging economies, as businesses of all sizes recognize the strategic imperative of modernizing their end-user computing infrastructure. The report's detailed analysis of market dynamics, growth trajectories, and competitive landscapes provides stakeholders with the actionable intelligence needed to capitalize on these burgeoning opportunities.

Desktop Virtualization Market Segmentation

-

1. Desktop delivery platform

- 1.1. Hosted Virtual Desktop (HVD)

- 1.2. Hosted Shared Desktop (HSD)

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

Desktop Virtualization Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Desktop Virtualization Market Regional Market Share

Geographic Coverage of Desktop Virtualization Market

Desktop Virtualization Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Computing; Growth in Automation in Retail

- 3.3. Market Restrains

- 3.3.1. Infrastructure Deployment Constraints

- 3.4. Market Trends

- 3.4.1. Hosted Virtual Desktop Accounts for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 5.1.1. Hosted Virtual Desktop (HVD)

- 5.1.2. Hosted Shared Desktop (HSD)

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 6. North America Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 6.1.1. Hosted Virtual Desktop (HVD)

- 6.1.2. Hosted Shared Desktop (HSD)

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 7. Europe Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 7.1.1. Hosted Virtual Desktop (HVD)

- 7.1.2. Hosted Shared Desktop (HSD)

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 8. Asia Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 8.1.1. Hosted Virtual Desktop (HVD)

- 8.1.2. Hosted Shared Desktop (HSD)

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 9. Australia and New Zealand Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 9.1.1. Hosted Virtual Desktop (HVD)

- 9.1.2. Hosted Shared Desktop (HSD)

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 10. Latin America Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 10.1.1. Hosted Virtual Desktop (HVD)

- 10.1.2. Hosted Shared Desktop (HSD)

- 10.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 11. Middle East and Africa Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 11.1.1. Hosted Virtual Desktop (HVD)

- 11.1.2. Hosted Shared Desktop (HSD)

- 11.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Parallels International GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Toshiba Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ncomputing Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microsoft Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dell Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Huawei Technologies Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ericom Software Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Citrix Systems Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Red Hat Inc (IBM Corporation )

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tems Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Vmware Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Parallels International GmbH

List of Figures

- Figure 1: Global Desktop Virtualization Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 3: North America Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 4: North America Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 5: North America Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 6: North America Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 9: Europe Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 10: Europe Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 11: Europe Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 12: Europe Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 15: Asia Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 16: Asia Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 17: Asia Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 18: Asia Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 21: Australia and New Zealand Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 22: Australia and New Zealand Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 23: Australia and New Zealand Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 24: Australia and New Zealand Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 27: Latin America Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 28: Latin America Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 29: Latin America Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 30: Latin America Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 33: Middle East and Africa Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 34: Middle East and Africa Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 35: Middle East and Africa Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 36: Middle East and Africa Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 2: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 3: Global Desktop Virtualization Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 5: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 6: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 8: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 9: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 11: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 12: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 14: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 15: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 17: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 18: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 20: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 21: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Desktop Virtualization Market?

The projected CAGR is approximately 11.79%.

2. Which companies are prominent players in the Desktop Virtualization Market?

Key companies in the market include Parallels International GmbH, Toshiba Corporation, Ncomputing Inc, Microsoft Corporation, Dell Inc, Huawei Technologies Co Ltd, Ericom Software Inc, Citrix Systems Inc, Red Hat Inc (IBM Corporation ), Tems Inc, Vmware Inc.

3. What are the main segments of the Desktop Virtualization Market?

The market segments include Desktop delivery platform, Deployment Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Computing; Growth in Automation in Retail.

6. What are the notable trends driving market growth?

Hosted Virtual Desktop Accounts for Significant Market Share.

7. Are there any restraints impacting market growth?

Infrastructure Deployment Constraints.

8. Can you provide examples of recent developments in the market?

January 2023 - VMware revealed a new solution for global retailers to modernize point of sale (POS) and unlock more financial value from their POS devices. VMware Retail POS modernization solutions enable operations, IT, marketing, and security teams to become more agile and responsive to drive critical business, customer, and IT outcomes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Desktop Virtualization Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Desktop Virtualization Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Desktop Virtualization Market?

To stay informed about further developments, trends, and reports in the Desktop Virtualization Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence