Key Insights

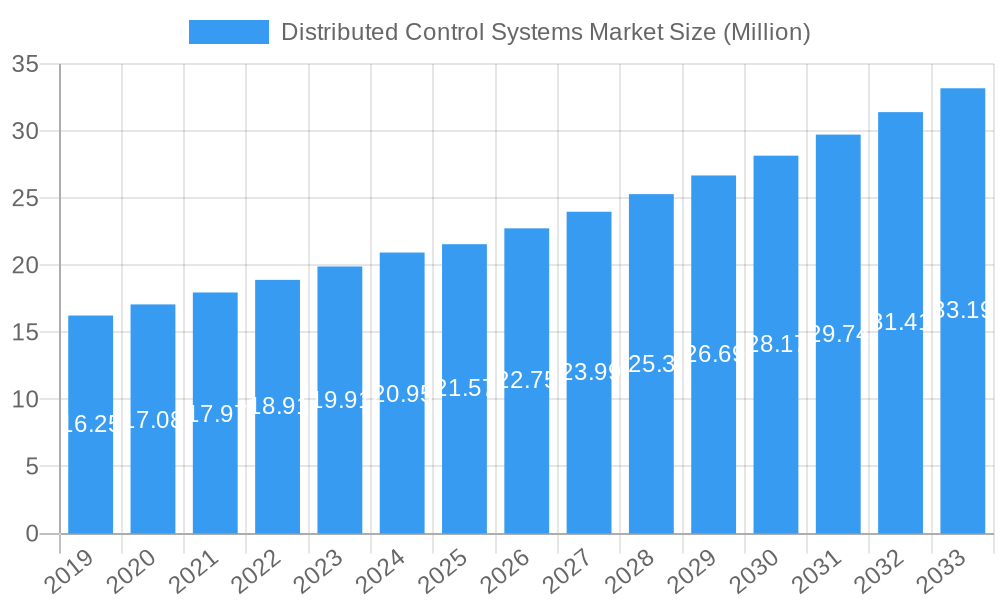

The global Distributed Control Systems (DCS) market is poised for robust expansion, projected to reach a substantial USD 21.57 billion by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.28% anticipated from 2019 to 2033. Key drivers fueling this expansion include the increasing demand for automation and operational efficiency across various industrial sectors, the growing need for real-time data monitoring and control for enhanced decision-making, and the continuous advancements in DCS technology, such as the integration of AI and IoT capabilities. Industries like Power Generation, Oil & Gas, and Chemicals are at the forefront of adopting these sophisticated control systems to optimize production processes, improve safety standards, and reduce environmental impact. The trend towards Industry 4.0 and smart manufacturing further propels the market as businesses seek to create more connected and intelligent operational environments.

Distributed Control Systems Market Market Size (In Million)

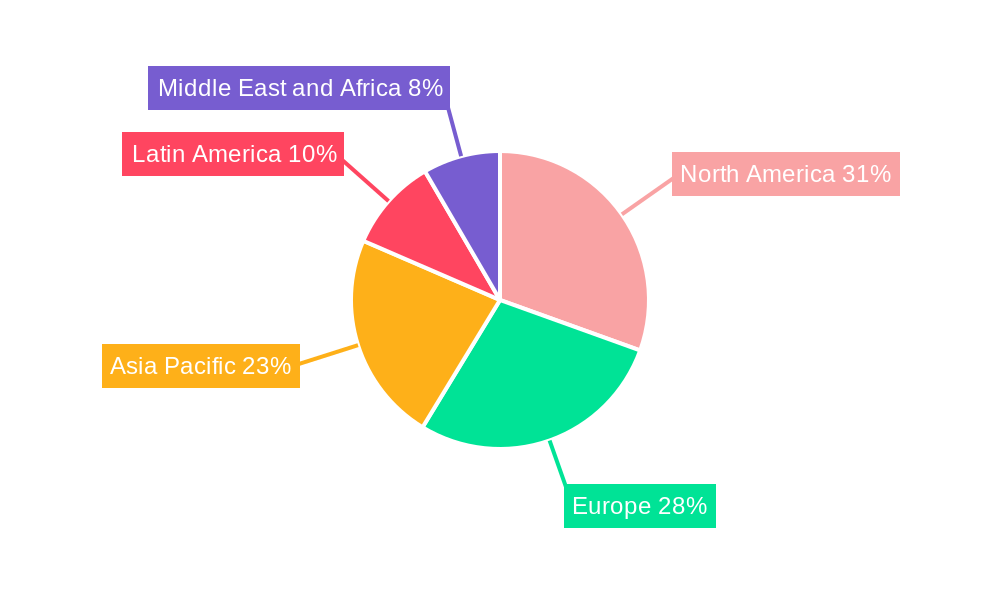

The DCS market's trajectory is characterized by a dynamic interplay of growth drivers and certain restraining factors. While the inherent benefits of DCS in improving process control, reducing downtime, and ensuring product quality are undeniable, challenges such as the high initial investment cost, the need for skilled personnel for implementation and maintenance, and concerns regarding cybersecurity in interconnected systems present hurdles. However, the persistent focus on enhancing operational safety, regulatory compliance, and the drive for energy efficiency are expected to outweigh these restraints. Geographically, North America and Europe are anticipated to maintain significant market shares due to their well-established industrial base and early adoption of advanced technologies. The Asia Pacific region, driven by rapid industrialization and increasing investments in manufacturing and infrastructure, is expected to exhibit the fastest growth rate. The market is segmented into Hardware, Software, and Services, with each segment contributing uniquely to the overall value chain, from foundational infrastructure to advanced analytical tools and ongoing support.

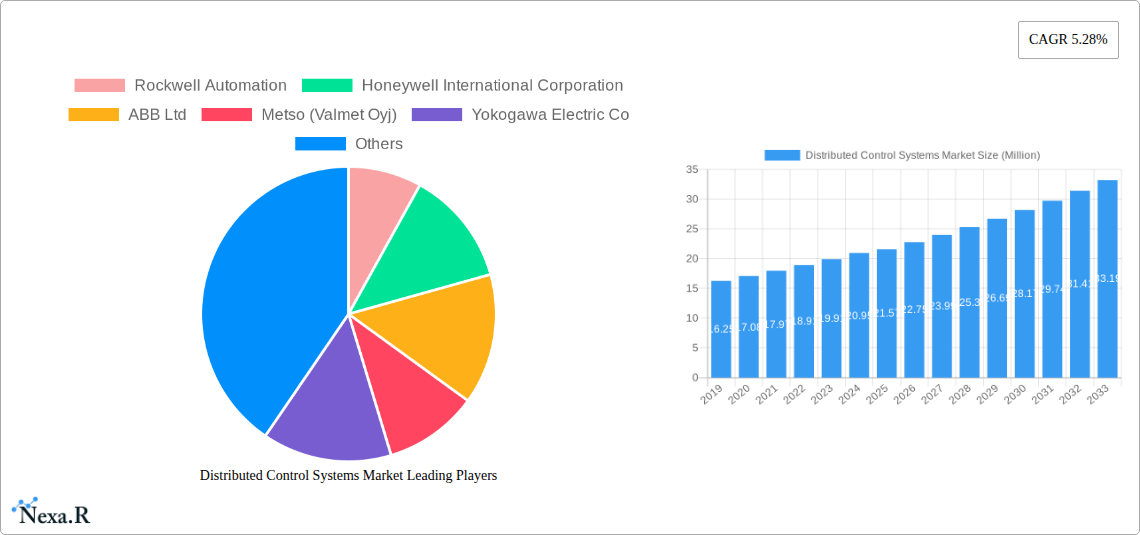

Distributed Control Systems Market Company Market Share

Distributed Control Systems Market: Comprehensive Industry Analysis & Future Outlook (2019-2033)

This in-depth report offers a critical examination of the global Distributed Control Systems (DCS) market, a vital component driving automation and operational efficiency across diverse industrial sectors. Delving into intricate market dynamics, growth trajectories, and the competitive landscape, this analysis provides actionable insights for stakeholders. The study encompasses a detailed market breakdown by component (Hardware, Software, Services) and end-user vertical (Power Generation, Oil & Gas, Chemicals, Refining, Mining & Metals, Paper and Pulp, and Other End-User Verticals). With a comprehensive historical analysis (2019-2024), a robust base year (2025), and an extensive forecast period (2025-2033), this report is your definitive guide to understanding the current state and future potential of the DCS market.

Distributed Control Systems Market Market Dynamics & Structure

The global Distributed Control Systems (DCS) market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Technological innovation is the primary driver, fueled by the escalating demand for enhanced operational efficiency, real-time data acquisition, and stringent safety compliance. The increasing adoption of Industry 4.0 principles, including the Industrial Internet of Things (IIoT) and artificial intelligence (AI), is further accelerating this innovation. Regulatory frameworks, particularly concerning industrial safety and environmental protection, are also shaping market development, often mandating advanced control systems for compliance. Competitive product substitutes, while present in niche applications, struggle to match the integrated capabilities and scalability of comprehensive DCS solutions. End-user demographics are shifting towards industries with higher automation needs, such as advanced manufacturing and smart grids, driving demand for sophisticated DCS. Mergers and acquisitions (M&A) trends indicate a consolidation of market power, with key players strategically acquiring smaller entities to expand their product portfolios and geographical reach.

- Market Concentration: A notable degree of concentration exists, with key players like Siemens AG, Honeywell International Corporation, ABB Ltd, and Emerson Electric Company holding substantial market influence.

- Technological Innovation Drivers: The pursuit of operational excellence, predictive maintenance, cybersecurity enhancements, and integration with IIoT platforms are paramount.

- Regulatory Frameworks: Stringent safety standards (e.g., IEC 61508) and environmental regulations globally necessitate advanced control and monitoring capabilities.

- Competitive Product Substitutes: While basic automation controllers exist, they lack the comprehensive functionality and scalability of full DCS for complex industrial processes.

- End-User Demographics: A growing emphasis on process optimization and data-driven decision-making across all industrial sectors is a key demographic shift.

- M&A Trends: Strategic acquisitions are focused on expanding capabilities in areas like cybersecurity, advanced analytics, and specialized industry solutions.

Distributed Control Systems Market Growth Trends & Insights

The global Distributed Control Systems (DCS) market is poised for robust growth, projected to witness a significant expansion in market size and adoption rates over the forecast period. This ascent is primarily attributed to the pervasive digital transformation initiatives across industries, leading to an increased reliance on integrated automation solutions. The market size is expected to grow from an estimated $18,500.00 Million in 2025 to $26,700.00 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.7%. Technological disruptions, including the integration of AI and machine learning for predictive maintenance and process optimization, are revolutionizing DCS capabilities. The evolution of DCS from solely control systems to intelligent platforms that provide comprehensive data analytics and decision support is a key trend. Consumer behavior shifts are also influencing market dynamics, with a growing demand for more agile, scalable, and secure automation solutions that can adapt to evolving production needs and market demands. The increasing focus on energy efficiency and sustainability is further driving the adoption of DCS in sectors like power generation and chemicals, where precise control over processes can lead to significant resource savings. The penetration of DCS in emerging economies is also on the rise, as these regions invest heavily in industrial modernization and infrastructure development. The historical data from 2019-2024 indicates a steady upward trend, providing a strong foundation for the projected growth. The adoption rates for advanced DCS functionalities, such as integrated cybersecurity and cloud-based analytics, are particularly accelerating, signifying a maturation of the market towards more sophisticated applications. The push for increased uptime and reduced operational costs across all end-user verticals is a constant impetus for DCS implementation. Furthermore, the increasing complexity of industrial processes necessitates sophisticated control mechanisms offered by DCS.

Dominant Regions, Countries, or Segments in Distributed Control Systems Market

The North America region is currently the dominant force in the global Distributed Control Systems (DCS) market, driven by its advanced industrial infrastructure, strong emphasis on technological innovation, and a significant presence of key end-user industries such as Oil & Gas, Chemicals, and Power Generation. The United States, in particular, leads this regional dominance due to substantial investments in smart manufacturing, automation technologies, and stringent safety regulations that necessitate sophisticated control systems. The robust economic policies supporting industrial growth and the presence of major DCS vendors like Rockwell Automation, Honeywell International Corporation, and Emerson Electric Company further solidify North America's leading position. The market share in this region is estimated to be around 32.00% in 2025.

Among the segments, Component: Hardware holds a significant market share within the DCS ecosystem, representing the foundational element for any control system. This segment is projected to account for approximately 45.00% of the total market value in 2025. The demand for robust, reliable, and increasingly powerful hardware components, including processors, I/O modules, and human-machine interfaces (HMIs), remains consistently high across all end-user verticals. The continuous evolution of hardware capabilities, enabling faster processing speeds, enhanced connectivity, and greater resilience to harsh industrial environments, ensures its sustained dominance.

The End-User Vertical: Oil & Gas is another critical driver of DCS market growth, consistently ranking as a top-performing sector. The inherent complexity and hazardous nature of oil and gas extraction, refining, and transportation processes necessitate highly sophisticated and secure control systems. DCS plays a pivotal role in ensuring operational safety, optimizing production yields, and adhering to strict environmental regulations within this industry. The ongoing global demand for energy, coupled with significant investments in exploration and production, particularly in North America and the Middle East, underscores the enduring importance of DCS in this vertical. This sector is estimated to contribute around 25.00% to the overall market value in 2025.

- Dominant Region: North America, driven by the United States, leads in market share due to advanced industrialization and technological adoption.

- Key Drivers: Robust economic policies, significant investments in automation, stringent safety regulations, and the presence of leading DCS vendors.

- Market Share (Estimated 2025): 32.00%

- Dominant Component Segment: Hardware, forming the backbone of DCS, continues to lead in market value.

- Key Drivers: Demand for reliable, high-performance components; integration of new technologies; and durability in industrial environments.

- Market Share (Estimated 2025): 45.00%

- Dominant End-User Vertical: Oil & Gas, due to the complex and safety-critical nature of its operations.

- Key Drivers: Need for operational safety, production optimization, environmental compliance, and ongoing energy demand.

- Market Share (Estimated 2025): 25.00%

Distributed Control Systems Market Product Landscape

The Distributed Control Systems (DCS) product landscape is marked by continuous innovation, with vendors focusing on enhancing system intelligence, cybersecurity, and integration capabilities. Current offerings emphasize modularity, scalability, and interoperability to cater to diverse industrial needs. Key product innovations include advanced diagnostic tools for predictive maintenance, robust cybersecurity features to protect against evolving threats, and seamless integration with cloud platforms for remote monitoring and data analytics. Performance metrics are consistently improving, with faster processing speeds, expanded I/O capacities, and enhanced reliability in extreme environments. Unique selling propositions often revolve around specific industry solutions, such as those tailored for petrochemical processing, advanced power plant operations, or intricate mining operations. The trend towards software-defined DCS, offering greater flexibility and ease of configuration, is also a significant aspect of the current product landscape, enabling faster deployment and adaptation to changing operational requirements.

Key Drivers, Barriers & Challenges in Distributed Control Systems Market

Key Drivers: The primary forces propelling the Distributed Control Systems (DCS) market include the escalating demand for enhanced operational efficiency and productivity across industries, driven by the adoption of Industry 4.0 principles and IIoT technologies. The continuous need for improved process control, real-time data analytics, and advanced safety features to meet stringent regulatory requirements is also a significant catalyst. Furthermore, the growing focus on energy efficiency and sustainability in sectors like Power Generation and Chemicals necessitates sophisticated control systems, thereby driving market growth. The digital transformation initiatives by major industries globally are also a crucial growth accelerator.

Barriers & Challenges: Despite the robust growth, the DCS market faces several challenges. High initial implementation costs can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). The complexity of integrating new DCS with legacy systems often leads to increased project timelines and operational disruptions. A shortage of skilled personnel capable of designing, implementing, and maintaining advanced DCS solutions poses another substantial challenge. Cybersecurity threats remain a constant concern, requiring continuous investment in robust security measures. Supply chain disruptions, as experienced in recent years, can impact the availability and cost of critical hardware components.

Emerging Opportunities in Distributed Control Systems Market

Emerging opportunities in the Distributed Control Systems (DCS) market lie in the increasing adoption of AI and machine learning for predictive maintenance and autonomous operations. The expansion of DCS into niche applications within the "Other End-User Verticals" segment, such as water and wastewater treatment, and smart agriculture, presents untapped market potential. The growing demand for cybersecurity solutions specifically tailored for industrial control systems also offers a significant growth avenue. Furthermore, the development of more energy-efficient and sustainable DCS solutions aligns with global environmental initiatives and presents opportunities for market differentiation. The shift towards edge computing and decentralized control architectures for enhanced responsiveness and reduced latency is also an evolving opportunity.

Growth Accelerators in the Distributed Control Systems Market Industry

Several catalysts are accelerating the long-term growth of the Distributed Control Systems (DCS) market. Technological breakthroughs in areas like advanced sensor technology, high-speed networking, and robust data analytics platforms are continuously enhancing DCS capabilities. Strategic partnerships between DCS vendors and IIoT providers, cybersecurity firms, and AI specialists are fostering the development of integrated and intelligent solutions. Market expansion strategies, including increasing penetration in emerging economies and developing tailored solutions for specific regional industrial needs, are also contributing significantly to sustained growth. The growing awareness among end-users regarding the long-term benefits of DCS, such as reduced operational costs and improved safety, further fuels adoption.

Key Players Shaping the Distributed Control Systems Market Market

- Rockwell Automation

- Honeywell International Corporation

- ABB Ltd

- Metso (Valmet Oyj)

- Yokogawa Electric Co

- Siemens AG

- Omron Corporation

- Toshiba International

- Schneider Electric

- Azbil Corporation

- Mitsubishi Motors Corporation

- Novatech Llc (Weir Group)

- Emerson Electric Company

Notable Milestones in Distributed Control Systems Market Sector

- May 2023: Emerson announced the enhancement of perimeter security for its DeltaV distributed control system (DCS) with the introduction of the new NextGen Smart Firewall, a purpose-built control system firewall designed for easy installation and maintenance across all industries.

- May 2022: ABB secured a new contract with DS Smith for their Kemsley Mill in the UK, supporting the vision of highly automated, connected, and secure operations. This collaboration involves the ABB Ability System 800xA distributed control system (DCS) and paper machine drives upgrade across PM3, PM4, and PM6, at a facility with an annual production capacity exceeding 840,000 tons.

In-Depth Distributed Control Systems Market Market Outlook

The Distributed Control Systems (DCS) market is set for continued expansion, driven by the relentless pursuit of industrial automation and operational optimization. Growth accelerators, including the pervasive integration of AI, IIoT, and robust cybersecurity solutions, will shape the future landscape. Strategic partnerships and market expansion into underserved regions will unlock new revenue streams. The increasing demand for sustainable and energy-efficient industrial processes will further fuel the adoption of advanced DCS. The outlook is highly positive, with continuous innovation promising more intelligent, agile, and secure control systems that are indispensable for the modern industrial era. The market is poised to evolve beyond traditional control functions, becoming a central hub for data-driven decision-making and operational excellence.

Distributed Control Systems Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-User Vertical

- 2.1. Power Generation

- 2.2. Oil & Gas

- 2.3. Chemicals

- 2.4. Refining

- 2.5. Mining & Metals

- 2.6. Paper and Pulp

- 2.7. Other End-User Verticals

Distributed Control Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. South Africa

- 5.3. Rest of Middle East

Distributed Control Systems Market Regional Market Share

Geographic Coverage of Distributed Control Systems Market

Distributed Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Energy Demand from Major Emerging Economies; Growing Adoption for Smart Applications and Iot Technologies; Modernization of Existing DCS Solutions will Contribute to the Growth Of Service Sector

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Alternative Technologies in the Field of Process Automation

- 3.4. Market Trends

- 3.4.1. Services Constitute a Considerable Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Power Generation

- 5.2.2. Oil & Gas

- 5.2.3. Chemicals

- 5.2.4. Refining

- 5.2.5. Mining & Metals

- 5.2.6. Paper and Pulp

- 5.2.7. Other End-User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.2.1. Power Generation

- 6.2.2. Oil & Gas

- 6.2.3. Chemicals

- 6.2.4. Refining

- 6.2.5. Mining & Metals

- 6.2.6. Paper and Pulp

- 6.2.7. Other End-User Verticals

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.2.1. Power Generation

- 7.2.2. Oil & Gas

- 7.2.3. Chemicals

- 7.2.4. Refining

- 7.2.5. Mining & Metals

- 7.2.6. Paper and Pulp

- 7.2.7. Other End-User Verticals

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.2.1. Power Generation

- 8.2.2. Oil & Gas

- 8.2.3. Chemicals

- 8.2.4. Refining

- 8.2.5. Mining & Metals

- 8.2.6. Paper and Pulp

- 8.2.7. Other End-User Verticals

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.2.1. Power Generation

- 9.2.2. Oil & Gas

- 9.2.3. Chemicals

- 9.2.4. Refining

- 9.2.5. Mining & Metals

- 9.2.6. Paper and Pulp

- 9.2.7. Other End-User Verticals

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Distributed Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 10.2.1. Power Generation

- 10.2.2. Oil & Gas

- 10.2.3. Chemicals

- 10.2.4. Refining

- 10.2.5. Mining & Metals

- 10.2.6. Paper and Pulp

- 10.2.7. Other End-User Verticals

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rockwell Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metso (Valmet Oyj)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yokogawa Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Omron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toshiba International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Azbil Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mitsubishi Motors Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Novatech Llc (Weir Group)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Emerson Electric Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Rockwell Automation

List of Figures

- Figure 1: Global Distributed Control Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 5: North America Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 6: North America Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 11: Europe Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 12: Europe Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 17: Asia Pacific Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 18: Asia Pacific Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 23: Latin America Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 24: Latin America Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Distributed Control Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Distributed Control Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Distributed Control Systems Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 29: Middle East and Africa Distributed Control Systems Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 30: Middle East and Africa Distributed Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Distributed Control Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 3: Global Distributed Control Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 6: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 11: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: UK Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 19: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 25: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 26: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Mexico Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Distributed Control Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 31: Global Distributed Control Systems Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 32: Global Distributed Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: UAE Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Distributed Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Distributed Control Systems Market?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Distributed Control Systems Market?

Key companies in the market include Rockwell Automation, Honeywell International Corporation, ABB Ltd, Metso (Valmet Oyj), Yokogawa Electric Co, Siemens AG, Omron Corporation, Toshiba International, Schneider Electric, Azbil Corporation, Mitsubishi Motors Corporation, Novatech Llc (Weir Group), Emerson Electric Company.

3. What are the main segments of the Distributed Control Systems Market?

The market segments include Component, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Energy Demand from Major Emerging Economies; Growing Adoption for Smart Applications and Iot Technologies; Modernization of Existing DCS Solutions will Contribute to the Growth Of Service Sector.

6. What are the notable trends driving market growth?

Services Constitute a Considerable Market Share.

7. Are there any restraints impacting market growth?

Growing Availability of Alternative Technologies in the Field of Process Automation.

8. Can you provide examples of recent developments in the market?

May 2023: Emerson announced that it is improving perimeter security for the DeltaV distributed control system (DCS) with its new NextGen Smart Firewall, a purpose-built control system firewall designed to provide easy-to-install and easy-to-maintain perimeter security for all industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Distributed Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Distributed Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Distributed Control Systems Market?

To stay informed about further developments, trends, and reports in the Distributed Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence