Key Insights

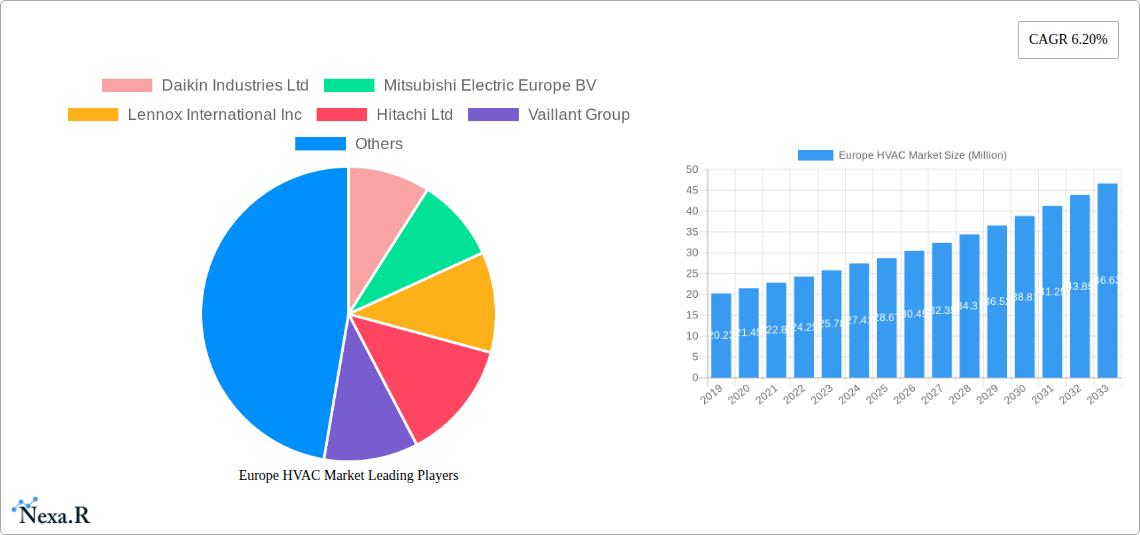

The European HVAC (Heating, Ventilation, and Air Conditioning) market is poised for significant growth, with a projected market size of $28.67 million and a Compound Annual Growth Rate (CAGR) of 6.20% over the forecast period of 2025-2033. This robust expansion is primarily driven by increasing demand for energy-efficient solutions, stringent environmental regulations pushing for greener technologies, and a rising awareness among consumers and businesses about the importance of indoor air quality and thermal comfort. The ongoing renovation and retrofitting of existing buildings, particularly in the residential and commercial sectors, are also contributing substantially to market momentum. Furthermore, technological advancements leading to smarter, more connected HVAC systems, including IoT-enabled devices and advanced control mechanisms, are enhancing operational efficiency and user experience, thereby stimulating market adoption.

Europe HVAC Market Market Size (In Million)

The market's growth trajectory is further bolstered by ongoing infrastructure development across major European economies and a growing preference for advanced heating and cooling technologies that offer both comfort and cost savings. However, the market faces certain restraints, including the high initial investment cost associated with sophisticated HVAC systems and the availability of skilled labor for installation and maintenance, which can sometimes pose challenges. Despite these hurdles, the strong emphasis on sustainability, coupled with government incentives for energy-efficient upgrades, is expected to outweigh the restraints. Key segments driving this growth include air conditioning equipment, with a notable surge in demand for Variable Refrigerant Flow (VRF) systems and Air Handling Units, and heating equipment, where heat pumps are gaining significant traction due to their eco-friendly operation. The residential and commercial end-user industries are expected to be the largest contributors to market revenue.

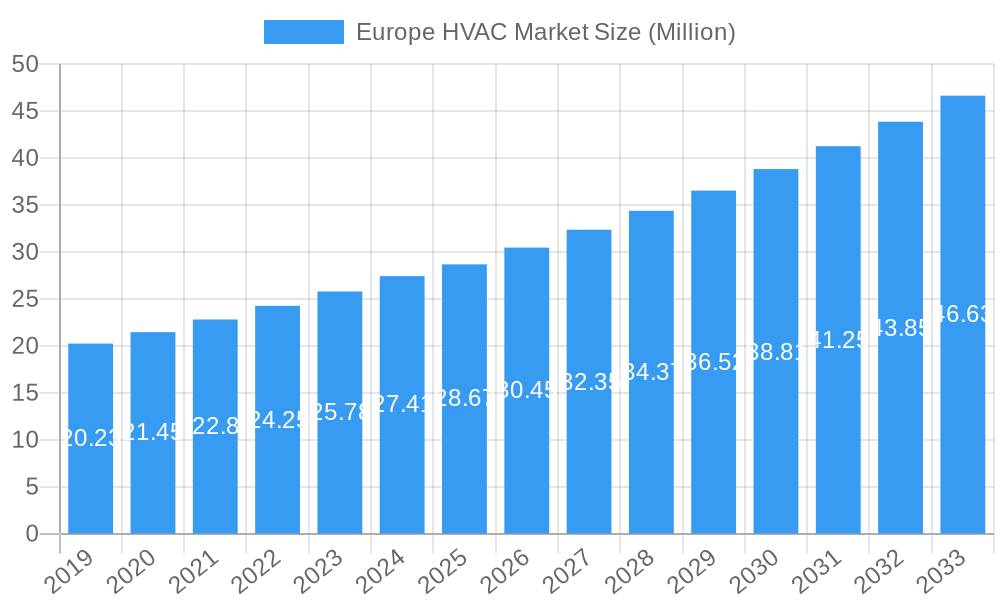

Europe HVAC Market Company Market Share

Here's a compelling, SEO-optimized report description for the Europe HVAC Market:

Europe HVAC Market: In-Depth Analysis, Growth Trends & Future Outlook (2019-2033)

Dive deep into the dynamic Europe HVAC market with our comprehensive report, covering market dynamics, growth trends, regional analysis, product landscape, key drivers, challenges, opportunities, and competitive intelligence. This report provides an unparalleled view of the heating, ventilation, and air conditioning (HVAC) sector in Europe, crucial for understanding energy efficiency solutions, sustainable building technologies, and climate control innovations. Leveraging extensive data from 2019 to 2033, with a deep dive into the base year 2025 and a detailed forecast period of 2025–2033, this analysis is essential for industry professionals, investors, and policymakers. Explore critical segments like Air Conditioning/Ventilation Equipment (Single Split/Multi-Splits, Variable Refrigerant Flow (VRF), Air Handling Units, Chillers, Fans Coils, Packaged and Rooftops, Other Air Conditioning/Ventilation Equipment) and Heating Equipment (Boilers/Radiators/Furnace, Heat Pumps), alongside their impact across Residential, Commercial, and Industrial end-user industries. Understand the strategic moves of major players like Daikin Industries Ltd, Mitsubishi Electric Europe BV, Lennox International Inc, Hitachi Ltd, Vaillant Group, Carrier Corporation, Ariston Thermo SpA, Robert Bosch GmbH, Danfoss A/S, Panasonic Corporation, and BDR Thermea Group. This report delivers actionable insights into market concentration, technological advancements, regulatory frameworks, and M&A activities, providing a roadmap for success in the evolving European HVAC landscape.

Europe HVAC Market Market Dynamics & Structure

The Europe HVAC market is characterized by a moderate to high level of concentration, with leading global players holding significant market shares. This concentration is driven by substantial capital investment requirements for research and development, manufacturing, and distribution networks. Technological innovation serves as a primary driver, fueled by stringent EU regulations mandating higher energy efficiency standards and the increasing adoption of smart home and building technologies. Regulatory frameworks, such as the Ecodesign Directive and the Energy Performance of Buildings Directive, are continuously pushing for the development and deployment of low-carbon and renewable heating and cooling solutions, particularly heat pumps and advanced ventilation systems. Competitive product substitutes are emerging, notably in the renewable energy integration space, where solar thermal systems and geothermal solutions are beginning to compete with traditional HVAC offerings. End-user demographics are shifting, with a growing demand for personalized comfort, lower energy bills, and a reduced environmental footprint across all sectors. Mergers and acquisitions (M&A) are a key trend, as companies seek to consolidate market positions, expand their product portfolios, and gain access to new technologies and geographic regions. For instance, the acquisition of Viessmann Climate Solutions by Carrier Corporation signifies a major consolidation in the intelligent climate and energy solutions space.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized regional players, with top companies accounting for approximately 60-70% of the market value.

- Technological Innovation Drivers: EU emissions targets, smart building integration, IoT connectivity, and the demand for integrated renewable energy solutions.

- Regulatory Frameworks: Ecodesign, Energy Performance of Buildings Directive, F-Gas Regulation, and national subsidies for energy-efficient upgrades.

- Competitive Product Substitutes: Solar thermal, geothermal systems, biomass heating, and advanced insulation technologies.

- End-User Demographics: Increasing urbanization, aging building stock requiring retrofits, and a rising middle class demanding higher comfort levels and sustainability.

- M&A Trends: Focus on acquiring companies with expertise in heat pumps, smart controls, and digital energy management solutions.

Europe HVAC Market Growth Trends & Insights

The Europe HVAC market is poised for robust growth, driven by a confluence of factors including increasing environmental consciousness, stringent government policies promoting energy efficiency, and the rapid adoption of smart technologies. The market size is projected to expand significantly over the forecast period, transitioning from an estimated value of xx Million units in 2025 to substantial figures by 2033. This expansion is underpinned by a growing demand for both heating and cooling solutions, with a discernible shift towards electrification of heating through heat pumps. Adoption rates for high-efficiency systems, such as Variable Refrigerant Flow (VRF) systems and advanced heat pumps, are accelerating across residential and commercial sectors. Technological disruptions are a constant, with advancements in inverter technology, smart thermostats, and integration with building management systems (BMS) enhancing performance and user experience. Consumer behavior is evolving, with a greater emphasis on long-term operational cost savings, indoor air quality, and the environmental impact of their heating and cooling choices. The historical period (2019-2024) has witnessed a steady upward trajectory, and the base year 2025 sets a strong foundation for the accelerated growth anticipated in the coming decade.

The forecast period (2025–2033) will witness a compound annual growth rate (CAGR) of approximately 5.5% to 6.5%, driven by deep retrofitting initiatives in existing buildings and the construction of new energy-efficient structures. The push for decarbonization is a paramount growth accelerator, encouraging the replacement of fossil fuel-based heating systems with electric alternatives, predominantly air-to-water and air-to-air heat pumps. The commercial segment, encompassing offices, retail spaces, and hospitality, is experiencing increased demand for sophisticated HVAC systems that offer precise temperature control, ventilation, and energy management capabilities, often integrated with IoT platforms for remote monitoring and optimization. The industrial sector, while traditionally focused on process heating and cooling, is also seeing a growing emphasis on energy efficiency and emission reduction, driving investments in specialized HVAC solutions. The residential sector, spurred by government incentives and a rising awareness of indoor air quality and climate change, is a key driver, particularly for the adoption of highly efficient split and multi-split air conditioning units and modern heating systems. The integration of HVAC systems with renewable energy sources like solar photovoltaic (PV) is becoming a standard expectation, further boosting the market.

Dominant Regions, Countries, or Segments in Europe HVAC Market

The Heating Equipment segment, particularly Heat Pumps, is emerging as a dominant force driving market growth across the Europe HVAC market. This surge is propelled by a strong political will and substantial financial incentives across numerous European nations aimed at decarbonizing building heating. Countries like Germany, France, the UK, and the Scandinavian nations are at the forefront of this transition. The Residential end-user industry is the primary beneficiary and driver of this trend, as homeowners increasingly opt for heat pumps to replace older, less efficient, and fossil fuel-dependent boilers and furnaces.

Dominant Segment: Heating Equipment, with a significant emphasis on Heat Pumps.

- Market Share: Expected to capture over 35-40% of the overall HVAC market value by 2030.

- Key Drivers: EU Green Deal, national climate targets, rising energy prices for fossil fuels, and growing consumer awareness of environmental impact.

- Growth Potential: High, driven by mandatory phase-outs of fossil fuel boilers in new constructions and extensive renovation programs.

Leading Region: Western Europe, encompassing Germany, France, the United Kingdom, and the Benelux countries, is the most significant market.

- Market Size: Accounts for approximately 45-50% of the total European HVAC market revenue.

- Key Drivers: Strong economic development, high disposable incomes, stringent building energy codes, and a mature market for advanced HVAC technologies.

- Growth Potential: Sustained growth driven by retrofitting of existing building stock and a strong emphasis on sustainable construction.

Dominant Country: Germany is projected to be the largest single market within Europe.

- Market Share: Consistently holds the largest share, estimated at 15-20% of the European market.

- Key Drivers: Ambitious climate protection goals, significant government subsidies for heat pumps and energy-efficient renovations, and a large housing stock requiring upgrades.

- Growth Potential: Exceptional, driven by federal and regional funding programs and a strong consumer preference for sustainable living.

The Air Conditioning/Ventilation Equipment segment, especially Single Split/Multi-Splits and Variable Refrigerant Flow (VRF) systems, continues to be a robust market, particularly in Southern Europe due to warmer climates and in commercial applications across all regions for improved indoor air quality and comfort. The Commercial end-user industry remains a significant contributor, with businesses investing in sophisticated HVAC systems for office buildings, retail outlets, and data centers to ensure optimal operating conditions and energy efficiency. Industrial applications, while smaller in volume, are crucial for specialized temperature and humidity control in manufacturing processes.

Europe HVAC Market Product Landscape

The Europe HVAC market is characterized by a relentless pursuit of energy efficiency and sustainability, leading to innovative product designs and enhanced performance metrics. Key innovations include the widespread adoption of inverter technology in air conditioning units, enabling precise temperature control and reduced energy consumption. Heat pumps, particularly air-to-water and air-to-air models, are at the forefront, leveraging advanced refrigerants and intelligent control systems to achieve higher Coefficients of Performance (COP) and Seasonal Coefficients of Performance (SCOP). Variable Refrigerant Flow (VRF) systems are gaining traction for their ability to provide simultaneous heating and cooling, catering to the diverse climate needs within larger buildings. Furthermore, smart connectivity is becoming standard, allowing for remote monitoring, predictive maintenance, and integration with Building Management Systems (BMS), enhancing user convenience and operational efficiency.

Key Drivers, Barriers & Challenges in Europe HVAC Market

Key Drivers:

- Stringent Environmental Regulations: EU directives pushing for reduced carbon emissions and enhanced energy efficiency in buildings.

- Growing Demand for Energy Efficiency: Rising energy costs and consumer awareness are driving the adoption of lower-consumption HVAC systems.

- Government Incentives and Subsidies: Financial support for retrofitting and the installation of renewable heating and cooling solutions.

- Technological Advancements: Innovations in heat pump technology, smart controls, and IoT integration.

- Increasing Urbanization and Building Renovations: The need to upgrade existing infrastructure and construct new energy-efficient buildings.

Barriers & Challenges:

- High Initial Cost of Advanced Systems: Heat pumps and VRF systems can have a higher upfront investment compared to traditional options, impacting consumer adoption.

- Supply Chain Disruptions and Material Shortages: Global supply chain issues can lead to production delays and increased component costs.

- Skilled Labor Shortage: A lack of trained installers and maintenance technicians for complex HVAC systems.

- Grid Capacity Limitations: The increased demand for electricity from heat pumps could strain existing power grids in certain regions.

- Consumer Awareness and Education: Overcoming misconceptions and educating consumers about the benefits and proper operation of newer technologies.

Emerging Opportunities in Europe HVAC Market

Emerging opportunities in the Europe HVAC market are predominantly centered around the decarbonization of heating and cooling. The significant potential for retrofitting the vast existing building stock with high-efficiency heat pumps represents a major growth avenue. Furthermore, the integration of HVAC systems with renewable energy sources, such as solar photovoltaic (PV) and battery storage, offers a compelling proposition for enhanced energy independence and cost savings. The development of smart and connected HVAC solutions that offer predictive maintenance, energy optimization, and seamless integration with smart home ecosystems is another key area of opportunity. There's also a growing niche for specialized HVAC solutions for sectors like data centers and the burgeoning electric vehicle charging infrastructure, requiring precise climate control.

Growth Accelerators in the Europe HVAC Market Industry

Several catalysts are accelerating long-term growth in the Europe HVAC market. Technological breakthroughs, particularly in the efficiency and cost-effectiveness of heat pumps, are a primary driver. Strategic partnerships between HVAC manufacturers, energy utilities, and technology providers are fostering integrated energy solutions. Market expansion strategies focusing on installer training and consumer education are crucial for overcoming adoption barriers. The continuous innovation in refrigerants with lower global warming potential (GWP) also supports sustainable growth. The increasing focus on indoor air quality (IAQ) post-pandemic is also driving demand for advanced ventilation and air purification technologies integrated within HVAC systems.

Key Players Shaping the Europe HVAC Market Market

- Daikin Industries Ltd

- Mitsubishi Electric Europe BV

- Lennox International Inc

- Hitachi Ltd

- Vaillant Group

- Carrier Corporation

- Ariston Thermo SpA

- Robert Bosch GmbH

- Danfoss A/S

- Panasonic Corporation

- BDR Thermea Group

Notable Milestones in Europe HVAC Market Sector

- March 2024: Daikin announced the acquisition of BKF Klima in Denmark to drive the region's carbon reduction efforts and expand installer upskilling opportunities. The company will also open two new facilities, a Daikin Installer Training Center and a Daikin Experience Center for consumers, at Daikin's new offices in Brondby, Denmark. This strategic acquisition will enable Daikin to further leverage its extensive research and development expertise in low-carbon HVAC solutions for the region.

- January 2024: Carrier acquired Viessmann Climate Solutions from the Viessmann Group. Through this acquisition, the company will strengthen its position in intelligent climate and energy solutions. The acquisition of Viessmann Climate Solutions strengthens Carrier’s position as a digitally enabled, end-to-end scalable, sustainable energy solutions provider that addresses all renewable, cooling, heating, solar PV, battery storage, and energy management requirements for the home.

In-Depth Europe HVAC Market Market Outlook

The Europe HVAC market outlook is exceptionally positive, characterized by strong growth momentum fueled by an unwavering commitment to sustainability and energy efficiency. Key growth accelerators, including government incentives, rapid technological innovation in heat pumps and smart controls, and the pressing need to decarbonize the built environment, will continue to propel market expansion. The strategic acquisitions and investments by major players underscore the sector's dynamic nature and future potential. Opportunities in retrofitting existing buildings, integrating renewable energy, and enhancing indoor air quality will shape the market landscape, offering significant potential for companies that can innovate and adapt to evolving consumer demands and regulatory requirements. The transition towards electric heating and intelligent climate solutions is set to redefine the European HVAC sector for the foreseeable future.

Europe HVAC Market Segmentation

-

1. Equipment

-

1.1. By Air Conditioning/Ventilation Equipment

- 1.1.1. Single Split/Multi-Splits

- 1.1.2. Variable Refrigerant Flow (VRF)

- 1.1.3. Air Handling Units

- 1.1.4. Chillers

- 1.1.5. Fans Coils

- 1.1.6. Packaged and Rooftops

- 1.1.7. Other Air Conditioning/Ventilation Equipment

-

1.2. By Heating Equipment

- 1.2.1. Boilers/Radiators/Furnace

- 1.2.2. Heat Pumps

-

1.1. By Air Conditioning/Ventilation Equipment

-

2. End User Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Europe HVAC Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe HVAC Market Regional Market Share

Geographic Coverage of Europe HVAC Market

Europe HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Regulations Like Incentives for Saving Energy Through Tax Credit Programs; Increasing Demand for Energy-efficient Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Implementation

- 3.4. Market Trends

- 3.4.1. The Commercial Segment is to be the Fastest-growing End-user Verticals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HVAC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. By Air Conditioning/Ventilation Equipment

- 5.1.1.1. Single Split/Multi-Splits

- 5.1.1.2. Variable Refrigerant Flow (VRF)

- 5.1.1.3. Air Handling Units

- 5.1.1.4. Chillers

- 5.1.1.5. Fans Coils

- 5.1.1.6. Packaged and Rooftops

- 5.1.1.7. Other Air Conditioning/Ventilation Equipment

- 5.1.2. By Heating Equipment

- 5.1.2.1. Boilers/Radiators/Furnace

- 5.1.2.2. Heat Pumps

- 5.1.1. By Air Conditioning/Ventilation Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Daikin Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Electric Europe BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lennox International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vaillant Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carrier Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ariston Thermo SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danfoss A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BDR Thermea Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Daikin Industries Ltd

List of Figures

- Figure 1: Europe HVAC Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe HVAC Market Share (%) by Company 2025

List of Tables

- Table 1: Europe HVAC Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 2: Europe HVAC Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 3: Europe HVAC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe HVAC Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 5: Europe HVAC Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: Europe HVAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe HVAC Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HVAC Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe HVAC Market?

Key companies in the market include Daikin Industries Ltd, Mitsubishi Electric Europe BV, Lennox International Inc, Hitachi Ltd, Vaillant Group, Carrier Corporation, Ariston Thermo SpA, Robert Bosch GmbH, Danfoss A/S, Panasonic Corporatio, BDR Thermea Group.

3. What are the main segments of the Europe HVAC Market?

The market segments include Equipment, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations Like Incentives for Saving Energy Through Tax Credit Programs; Increasing Demand for Energy-efficient Devices.

6. What are the notable trends driving market growth?

The Commercial Segment is to be the Fastest-growing End-user Verticals.

7. Are there any restraints impacting market growth?

; High Cost of Implementation.

8. Can you provide examples of recent developments in the market?

March 2024: Daikin announced the acquisition of BKF Klima in Denmark to drive the region's carbon reduction efforts and expand installer upskilling opportunities. The company will also open two new facilities, a Daikin Installer Training Center and a Daikin Experience Center for consumers, at Daikin's new offices in Brondby, Denmark. This strategic acquisition will enable Daikin to further leverage its extensive research and development expertise in low-carbon HVAC solutions for the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HVAC Market?

To stay informed about further developments, trends, and reports in the Europe HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence