Key Insights

The Europe Non-Destructive Testing (NDT) Equipment and Services market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. The market size is expected to reach significant figures, driven by the increasing demand for safety and quality assurance across various industries including oil and gas, power and energy, aerospace and defense, automotive and transportation, and construction. Key drivers of this market include stringent regulatory requirements, the need for regular maintenance and inspection of infrastructure, and the rising adoption of advanced NDT technologies such as radiography, ultrasonic, and magnetic particle testing. The market is segmented by type into equipment and services, with both segments witnessing steady growth due to technological advancements and the expansion of end-user industries.

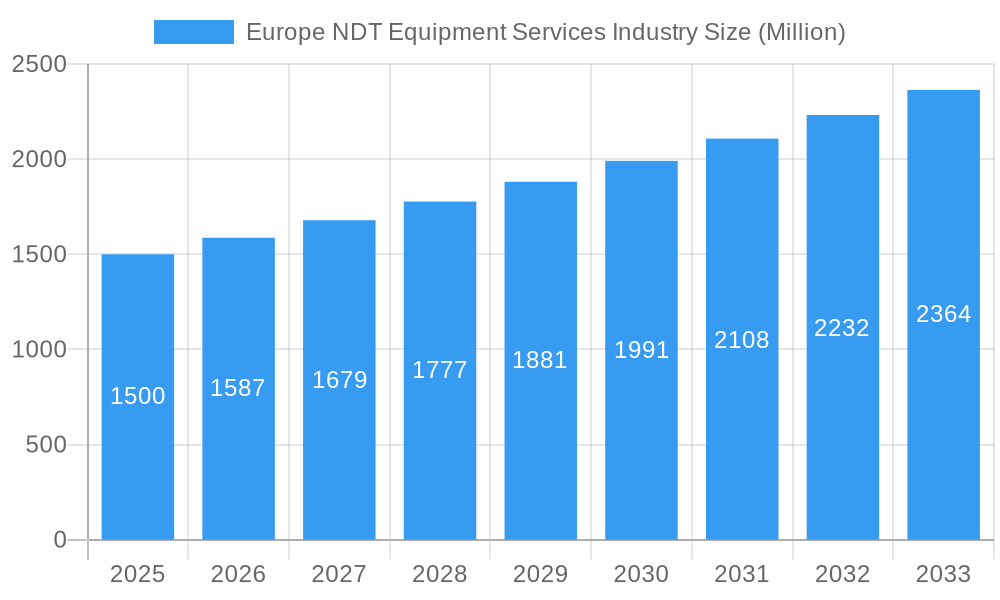

Europe NDT Equipment Services Industry Market Size (In Billion)

Trends in the European NDT market indicate a shift towards digitalization and automation, with a growing preference for portable and handheld NDT devices. This trend is particularly pronounced in countries like Germany, France, and the UK, which are leading in technological innovation and adoption. Despite the positive outlook, the market faces restraints such as high initial costs of advanced NDT equipment and the need for skilled professionals to operate these systems. However, opportunities abound in the form of emerging markets within Eastern Europe and the integration of artificial intelligence and machine learning in NDT processes. Major players in the market, such as Intertek Group PLC, Applus+, and YXLON International GmbH, are focusing on strategic collaborations and innovations to maintain their competitive edge and capitalize on the growing demand for NDT solutions across Europe.

Europe NDT Equipment Services Industry Company Market Share

Europe NDT Equipment Services Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European Non-Destructive Testing (NDT) equipment and services market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report examines market dynamics, growth trends, key players, and future opportunities within this crucial sector. The report segments the market by equipment type, services offered, testing technology, end-user industry, and country, providing a granular understanding of this multifaceted market. The market size is presented in Million units.

Europe NDT Equipment Services Industry Market Dynamics & Structure

The European NDT equipment and services market presents a moderately concentrated landscape, dominated by several key players commanding significant market share. However, a vibrant ecosystem of smaller, specialized firms fuels competition and drives innovation. Market concentration is estimated at [Insert Updated Percentage]% in 2025, with the top five players holding approximately [Insert Updated Percentage]% of the combined market share. A key growth catalyst is technological innovation, fueled by breakthroughs in sensor technology, advanced data analytics, and automation, particularly in areas like AI and machine learning. Regulatory frameworks, including stringent safety and environmental compliance standards, significantly influence market demand, creating both challenges and opportunities for businesses. While alternative testing methods exist, NDT remains the preferred solution for a wide range of critical applications, reinforcing its market position.

- Market Concentration: [Insert Updated Percentage]% in 2025 (estimated). Top 5 players hold approximately [Insert Updated Percentage]% combined market share.

- Technological Innovation: Advancements in AI, machine learning, robotics, and sophisticated data analytics are primary growth drivers.

- Regulatory Framework: Stringent safety and environmental regulations, alongside evolving industry standards, are key market influencers.

- Competitive Landscape: While alternative testing methods exist, NDT maintains its dominance due to its reliability and versatility.

- M&A Activity: An estimated [Insert Updated Number] M&A deals occurred between 2019 and 2024, indicating a trend of market consolidation. The average deal value was approximately [Insert Updated Amount] Million.

- End-user Demographics: The aging infrastructure across many European nations presents a significant and sustained demand for NDT services and equipment.

- Emerging Trends: Growing adoption of cloud-based solutions and digital twin technologies are reshaping the industry landscape.

Europe NDT Equipment Services Industry Growth Trends & Insights

The European NDT equipment and services market exhibited substantial growth during the historical period (2019-2024), achieving a CAGR of [Insert Updated CAGR]%. This expansion is attributable to several factors, including escalating demand from pivotal end-user industries (Oil & Gas, Power & Energy, Aerospace & Defense, Renewable Energy), robust infrastructure development projects, and the widespread adoption of advanced NDT technologies. The market is projected to maintain a strong growth trajectory during the forecast period (2025-2033), with a forecasted CAGR of [Insert Updated CAGR]%. This continued expansion is driven by ongoing investments in infrastructure modernization, increasingly stringent quality control standards across multiple sectors, and the accelerated digitalization of the NDT industry itself. The market penetration of cutting-edge technologies like phased array ultrasonics and digital radiography is steadily rising, further fueling market growth. Evolving consumer preferences, marked by an increased focus on sustainability and digital solutions, are also significantly influencing product development strategies and shaping overall market trends. The market size is anticipated to reach [Insert Updated Market Size] Million by 2033.

Dominant Regions, Countries, or Segments in Europe NDT Equipment Services Industry

The United Kingdom, Germany, and France represent the largest segments within the European NDT market, propelled by robust industrial sectors and substantial infrastructure investment. These nations boast well-established NDT industries, encompassing a significant number of both equipment manufacturers and service providers. The Oil & Gas and Power & Energy sectors are major demand drivers in these regions. Ultrasonic testing technology maintains its dominance due to its versatility and applicability across a broad spectrum of industries. While services are important, the equipment sector generally holds a larger market share.

- Key Drivers: Robust industrial sectors (UK, Germany, France), significant infrastructure development initiatives, stringent regulatory compliance, and the high adoption rate of advanced technologies.

- Dominance Factors: Established NDT industries, a skilled workforce, favorable economic conditions, and high demand from key end-user industries.

- Growth Potential: Continued infrastructure investment, increasing adoption of advanced NDT technologies, and the expansion of the renewable energy sector present substantial growth opportunities across all key regions.

Europe NDT Equipment Services Industry Product Landscape

The European NDT equipment market showcases a diverse range of products, from conventional radiography and ultrasonic systems to advanced phased array and digital radiography technologies. Continuous innovation leads to improved accuracy, portability, and data analysis capabilities. Products are tailored to specific applications within different end-user industries, emphasizing features like ease of use, data integration, and enhanced safety features. Unique selling propositions frequently revolve around speed, accuracy, and reduced operational costs.

Key Drivers, Barriers & Challenges in Europe NDT Equipment Services Industry

Key Drivers: Stringent quality control standards in various industries, increasing demand from infrastructure development projects, advancements in NDT technologies, rising awareness of safety and compliance requirements, and growing demand for predictive maintenance.

Challenges and Restraints: High initial investment costs for advanced NDT equipment, skilled labor shortages, competition from cheaper alternatives in certain markets, and complex regulatory compliance requirements. Supply chain disruptions, particularly concerning specialized components, have impacted market growth (estimated impact: xx Million in lost revenue in 2022).

Emerging Opportunities in Europe NDT Equipment Services Industry

Emerging trends include the increased adoption of digitalization, remote inspection technologies, and AI-powered data analysis for improved defect detection and predictive maintenance. The increasing focus on sustainability presents opportunities for environmentally friendly NDT techniques. Untapped markets lie in smaller countries within Europe and niche applications within specific industrial sectors, for example, renewable energy component testing.

Growth Accelerators in the Europe NDT Equipment Services Industry Industry

Long-term growth is driven by technological breakthroughs in areas like advanced imaging techniques, AI-driven defect analysis, and automation of NDT processes. Strategic partnerships between equipment manufacturers and service providers enhance market reach and service offerings. Market expansion into emerging markets within Europe and beyond is a significant accelerator for long-term growth.

Key Players Shaping the Europe NDT Equipment Services Industry Market

- Intertek Group PLC

- X-RIS SRL

- Logos Imaging LLC

- Applus+

- YXLON International GmbH (COMET Group)

- Teledyne ICM

- Novo DR Ltd

- SAS novup (VisioConsult)

- Zetec Inc

- 3DX-RAY Ltd (Image Scan Holdings Plc)

- Scanna MSC

- GE Measurement and Control

- Bureau Veritas

- List Not Exhaustive

Notable Milestones in Europe NDT Equipment Services Industry Sector

- 2020: Several key players launched advanced phased array ultrasonic testing systems.

- 2021: Increased adoption of digital radiography systems driven by improved image quality and data management capabilities.

- 2022: Several mergers and acquisitions consolidated market share, particularly in the service provider segment.

- 2023: Significant investment in research and development of AI-driven defect analysis software.

In-Depth Europe NDT Equipment Services Industry Market Outlook

The European NDT equipment and services market is poised for sustained growth, driven by technological advancements, increasing demand from key industries, and a heightened awareness of safety and compliance requirements. Strategic partnerships and substantial investments in research and development will continue to shape the market landscape. The integration of cutting-edge technologies such as AI and automation will enhance efficiency, improve accuracy, and open up new avenues for market expansion, ultimately increasing profitability for industry players. The market is expected to experience robust growth across all major segments and geographic regions throughout the forecast period. Increased focus on sustainability and circular economy principles will further influence market dynamics.

Europe NDT Equipment Services Industry Segmentation

-

1. Type

- 1.1. Equipment

- 1.2. Services

-

2. Testing Technology

- 2.1. Radiography

- 2.2. Ultrasonic

- 2.3. Magnetic Particle

- 2.4. Liquid Penetrant

- 2.5. Visual Inspection

- 2.6. Other Technologies

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Power and Energy

- 3.3. Aerospace and Defense

- 3.4. Automotive and Transportation

- 3.5. Construction

- 3.6. Other End-user Industries

Europe NDT Equipment Services Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe NDT Equipment Services Industry Regional Market Share

Geographic Coverage of Europe NDT Equipment Services Industry

Europe NDT Equipment Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulations Mandating Safety Standards

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Aerospace and Defense

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe NDT Equipment Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Testing Technology

- 5.2.1. Radiography

- 5.2.2. Ultrasonic

- 5.2.3. Magnetic Particle

- 5.2.4. Liquid Penetrant

- 5.2.5. Visual Inspection

- 5.2.6. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Power and Energy

- 5.3.3. Aerospace and Defense

- 5.3.4. Automotive and Transportation

- 5.3.5. Construction

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 X-RIS SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logos Imaging LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus+

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 YXLON International GmbH (COMET Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledyne ICM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novo DR Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAS novup (VisioConsult)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zetec Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3DX-RAY Ltd (Image Scan Holdings Plc)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Scanna MSC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GE Measurement and Control

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bureau Veritas*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Europe NDT Equipment Services Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe NDT Equipment Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Testing Technology 2020 & 2033

- Table 3: Europe NDT Equipment Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Testing Technology 2020 & 2033

- Table 7: Europe NDT Equipment Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe NDT Equipment Services Industry?

The projected CAGR is approximately 7.97%.

2. Which companies are prominent players in the Europe NDT Equipment Services Industry?

Key companies in the market include Intertek Group PLC, X-RIS SRL, Logos Imaging LLC, Applus+, YXLON International GmbH (COMET Group), Teledyne ICM, Novo DR Ltd, SAS novup (VisioConsult), Zetec Inc, 3DX-RAY Ltd (Image Scan Holdings Plc), Scanna MSC, GE Measurement and Control, Bureau Veritas*List Not Exhaustive.

3. What are the main segments of the Europe NDT Equipment Services Industry?

The market segments include Type, Testing Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulations Mandating Safety Standards.

6. What are the notable trends driving market growth?

Increasing Investment in Aerospace and Defense.

7. Are there any restraints impacting market growth?

; Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe NDT Equipment Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe NDT Equipment Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe NDT Equipment Services Industry?

To stay informed about further developments, trends, and reports in the Europe NDT Equipment Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence