Key Insights

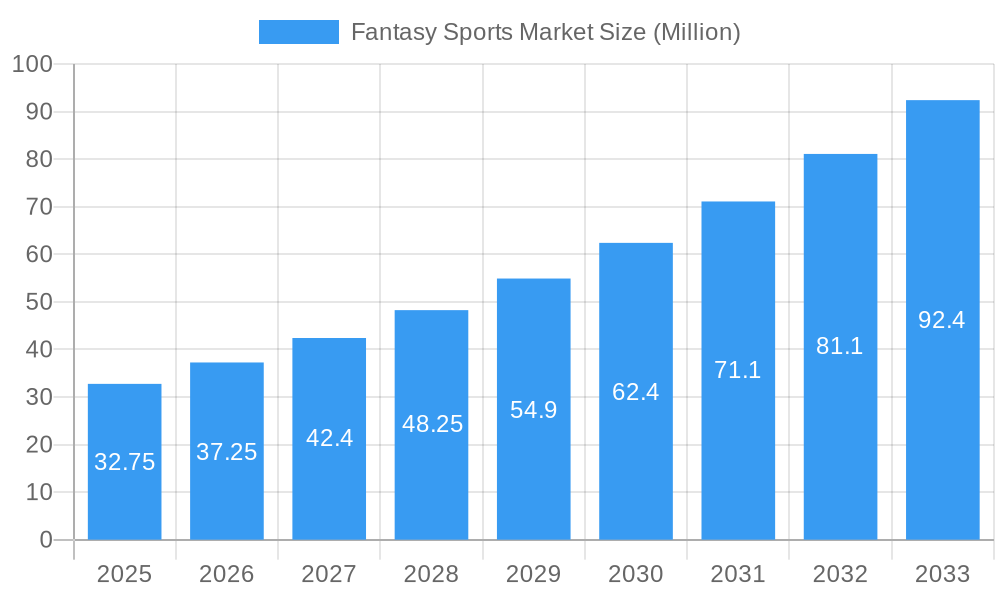

The global Fantasy Sports Market is poised for significant expansion, projected to reach an impressive $32.75 million in value. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 13.83% over the forecast period of 2025-2033. The surge in popularity can be attributed to several key drivers, including the increasing accessibility of digital platforms, the widespread adoption of smartphones, and a growing global interest in sports. The rise of mobile applications has been instrumental in democratizing access to fantasy sports, allowing a broader demographic to engage with their favorite games and athletes. This trend is particularly evident among younger demographics (under 25 years) and the 25-40 year old segment, who are more inclined to participate in individual and team competitions. Furthermore, advancements in data analytics and real-time updates enhance the immersive experience for users, making fantasy sports a compelling form of entertainment and a social activity. The market's evolution is also being shaped by innovative gamification features and the integration of social networking capabilities, fostering a vibrant and engaged user community.

Fantasy Sports Market Market Size (In Million)

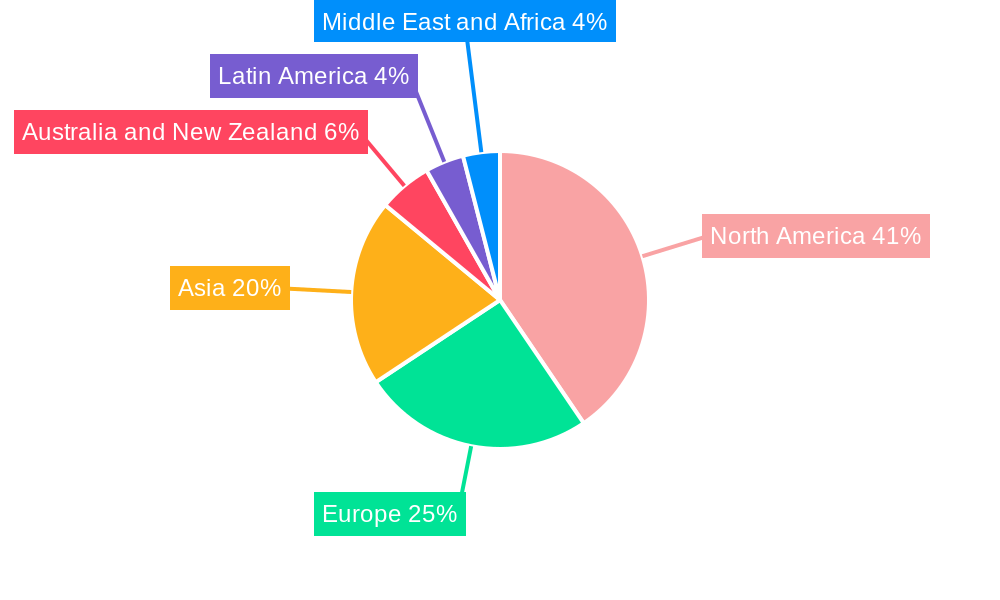

The fantasy sports landscape is characterized by diverse segmentation, catering to a wide array of sports enthusiasts. Football, baseball, cricket, basketball, and car racing represent dominant sport types, attracting millions of participants worldwide. The platform landscape is dominated by websites and mobile applications, reflecting the digital-first nature of this market. Geographically, North America currently leads in market share, driven by the established popularity of fantasy leagues for major sports like American football and baseball. However, significant growth is anticipated in other regions, particularly Asia, with the burgeoning popularity of cricket and football, and Europe, as interest in various sports leagues intensifies. Restraints, such as regulatory uncertainties in certain regions and the potential for market saturation, are being actively addressed through evolving business models and innovative product offerings. The competitive landscape features a mix of established players like Flutter Entertainment PLC, DraftKings Inc., and FanDuel Group, alongside emerging innovators like Sorare SAS and Sleeper (Blitz Studios Inc.), all vying to capture a larger share of this dynamic and rapidly expanding market.

Fantasy Sports Market Company Market Share

This in-depth report provides a strategic analysis of the global Fantasy Sports Market, projecting its trajectory from 2019 to 2033. We delve into critical market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, and emerging opportunities. The report leverages extensive data, including a base year of 2025 and a forecast period of 2025-2033, offering actionable insights for industry professionals, investors, and stakeholders. With a focus on high-traffic keywords like "fantasy sports," "daily fantasy sports (DFS)," "fantasy football," "fantasy baseball," "fantasy cricket," and "online sports gaming," this report is optimized for maximum search engine visibility. It explores the intricate parent and child market structures, providing a holistic view of the industry's evolution. All quantitative values are presented in Million Units.

Fantasy Sports Market Market Dynamics & Structure

The fantasy sports market is characterized by a dynamic and evolving structure, shaped by technological innovation, shifting regulatory landscapes, and intense competition. Market concentration is moderate, with a few dominant players like DraftKings Inc., FanDuel Group, and Sleeper (Blitz Studios Inc.) holding significant shares, particularly in North America. However, the emergence of niche platforms and global expansion by companies such as Sorare SAS and Dream Sports Group are fostering a more fragmented yet innovative ecosystem. Technological advancements, especially in mobile application development and data analytics, are crucial drivers, enhancing user experience and enabling sophisticated gameplay.

- Technological Innovation Drivers: AI-powered analytics for player performance prediction, real-time data integration, and seamless mobile integration are key.

- Regulatory Frameworks: Evolving legal landscapes, particularly regarding sports betting and fantasy sports legality in different regions, significantly influence market entry and operational strategies.

- Competitive Product Substitutes: While direct substitutes are limited, traditional sports betting and other forms of online entertainment offer indirect competition for consumer engagement and disposable income.

- End-User Demographics: The market is increasingly appealing to younger demographics (under 25 and 25-40 years) who are digitally native and passionate about sports, driving adoption.

- M&A Trends: Consolidation is evident, with larger players acquiring smaller, innovative companies to expand their user base and product offerings. For instance, the January 2023 announcement of Fantasy Akhada's significant stake sale to GMR Sports (USD 160-175 million) highlights this trend.

Fantasy Sports Market Growth Trends & Insights

The global fantasy sports market is on an impressive growth trajectory, fueled by increasing digitalization, widespread smartphone penetration, and a growing passion for sports entertainment. The market size is projected to witness substantial expansion, driven by evolving consumer behavior and the integration of fantasy sports with broader sports media and betting ecosystems. Adoption rates are soaring, particularly for daily fantasy sports (DFS), which offers more frequent engagement and quicker gratification compared to traditional season-long leagues. Technological disruptions, including advancements in mobile application development and the increasing use of artificial intelligence for predictive analytics, are enhancing user experience and attracting new participants.

Consumer behavior is shifting towards more interactive and engaging forms of sports consumption. Fantasy sports tap into this by allowing fans to become active participants, making educated decisions and experiencing the thrill of managing virtual teams. This deepens their connection with actual sporting events. The growing popularity of sports like cricket, especially in regions like India, is a significant contributor to global market growth. The integration of fantasy sports platforms with live sports broadcasts and social media further amplifies engagement and word-of-mouth marketing.

Metrics such as a projected Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033 underscore the robust expansion anticipated. Market penetration is expected to deepen, particularly in emerging economies where sports viewership is high but engagement options are limited. The convenience of mobile applications, allowing users to participate anytime, anywhere, is a critical factor in driving this penetration. Furthermore, the rise of esports fantasy leagues is opening new avenues for growth, tapping into a rapidly expanding demographic. The fantasy sports market is poised to become an integral part of the digital sports landscape, offering diverse revenue streams from entry fees, advertising, and data monetization.

Dominant Regions, Countries, or Segments in Fantasy Sports Market

The fantasy sports market exhibits distinct regional dominance and segment leadership, driven by a confluence of factors including sports popularity, regulatory environments, and technological adoption. North America, particularly the United States, has historically been the largest and most mature market, owing to the immense popularity of fantasy football, fantasy baseball, and fantasy basketball. Companies like DraftKings Inc., FanDuel Group, and NFL Enterprises LLC have established a strong foothold here, catering to a vast and engaged user base. The legal integration of fantasy sports with sports betting in many U.S. states has further accelerated growth and innovation.

- Dominant Segment - Type: Football: Fantasy football consistently ranks as the most popular segment globally, attracting the largest number of participants and generating significant revenue. Its appeal lies in the extended season, strategic depth, and the passionate fan base for leagues like the NFL.

- Dominant Segment - Platform: Mobile Application: The shift towards mobile-first engagement is undeniable. Mobile applications are the primary platform for accessing fantasy sports due to their convenience, real-time updates, and user-friendly interfaces. Companies like Sleeper (Blitz Studios Inc.) have gained traction with their innovative mobile-centric designs.

- Dominant Segment - Demographics: Between 25 and 40 Years: This demographic represents the core user base, possessing both the disposable income and the digital fluency to engage with complex fantasy sports platforms. They are deeply invested in sports and actively seek interactive ways to consume content.

- Key Drivers of Dominance:

- Sports Popularity: The sheer fan following of specific sports directly correlates with the popularity of their fantasy counterparts.

- Digital Infrastructure & Internet Penetration: Widespread access to high-speed internet and smartphones is fundamental for market growth.

- Regulatory Clarity: Favorable or clearly defined regulations, especially concerning the distinction between fantasy sports and traditional gambling, foster market expansion.

- Media Integration: Seamless integration with sports broadcasts, news outlets (e.g., ESPN Sports Media Ltd, CBS Sports Digital), and social media amplifies engagement.

- Economic Factors: Disposable income and a culture of sports engagement contribute significantly.

The Asia-Pacific region, particularly India, is emerging as a rapidly growing market, driven by the immense popularity of cricket and the rise of domestic players like Dream Sports Group. The accessibility of affordable data plans and smartphones is fueling this expansion. Similarly, Europe is witnessing steady growth, with fantasy football leading the charge, supported by leagues like the Premier League and initiatives from companies like Flutter Entertainment PLC. The fantasy sports market's growth is a global phenomenon, but its pace and dominant segments vary significantly by region.

Fantasy Sports Market Product Landscape

The fantasy sports market product landscape is characterized by continuous innovation aimed at enhancing user engagement and broadening appeal. Core offerings revolve around season-long leagues and daily fantasy sports (DFS), each with unique gameplay mechanics. Innovations include advanced data analytics for player valuation, real-time in-game adjustments, and AI-driven insights to assist users. Unique selling propositions often lie in the user interface, community features, and the availability of niche sports. For instance, Sorare SAS has revolutionized fantasy sports by integrating blockchain technology and Non-Fungible Tokens (NFTs), allowing users to collect, trade, and manage digital player cards, creating a unique blend of fantasy sports and digital collectibles. The development of mobile-first applications by companies like Vauntek Inc (Fantrax) ensures accessibility and on-the-go participation, further diversifying the product offerings within the market.

Key Drivers, Barriers & Challenges in Fantasy Sports Market

Key Drivers: The fantasy sports market is propelled by several key drivers. The increasing digitalization of sports consumption, coupled with widespread smartphone penetration, makes fantasy sports easily accessible. The inherent engaging nature of fantasy sports, transforming passive viewers into active participants, fosters deep user engagement. Furthermore, the convergence of fantasy sports with sports betting, where legally permissible, opens up significant revenue streams and attracts a broader audience. Technological advancements in data analytics and AI enhance gameplay and user experience, while major sporting events consistently draw new participants.

Barriers & Challenges: Despite its growth, the market faces significant barriers and challenges. Regulatory uncertainty and varying legal frameworks across different jurisdictions pose a substantial hurdle for global expansion. The highly competitive nature of the market, with established players and new entrants vying for market share, creates pressure on innovation and pricing. Maintaining user engagement over extended periods, particularly for season-long leagues, can be challenging. Additionally, concerns around data privacy and the responsible gaming aspect of fantasy sports, especially when integrated with betting, require careful management. Supply chain issues are less prevalent in this digital market, but platform stability and technological infrastructure are critical.

Emerging Opportunities in Fantasy Sports Market

Emerging opportunities in the fantasy sports market are diverse and promising. The expansion into new geographic markets, particularly in Asia and South America, where sports viewership is high, presents a significant untapped potential. The growing popularity of esports is creating a fertile ground for fantasy esports leagues, attracting a younger, digitally-native demographic. Innovative product development, such as the integration of augmented reality (AR) or virtual reality (VR) experiences for a more immersive fantasy sports encounter, could also redefine user engagement. Furthermore, the increasing demand for personalized sports content and gamified experiences opens avenues for niche fantasy leagues catering to specific fan bases or sports.

Growth Accelerators in the Fantasy Sports Market Industry

The fantasy sports market industry is experiencing accelerated growth driven by several key catalysts. Technological breakthroughs in real-time data processing and AI-powered analytics are continuously enhancing the sophistication and engagement of fantasy platforms. Strategic partnerships between fantasy sports providers, sports leagues, media companies (e.g., NFL Enterprises LLC, ESPN Sports Media Ltd), and betting operators are expanding reach and integrating fantasy sports into the broader sports ecosystem. Market expansion strategies, including localization efforts and the introduction of new sports, are tapping into diverse fan bases. The increasing adoption of mobile applications for daily fantasy sports (DFS) ensures constant engagement and accessibility, acting as a major growth accelerator.

Key Players Shaping the Fantasy Sports Market Market

- Sleeper (Blitz Studios Inc.)

- Sorare SAS

- Flutter Entertainment PLC

- Vauntek Inc (Fantrax)

- Low6 Limited

- FanDuel Group

- NFL Enterprises LLC

- ESPN Sports Media Ltd

- RealTime Fantasy Sports Inc

- CBS Sports Digital

- Bovada

- DraftKings Inc.

- Dream Sports Group

- Yahoo Fantasy Sports LLC

Notable Milestones in Fantasy Sports Market Sector

- March 2023: DraftKings Inc. announced plans to open its renowned online sportsbook, subject to licensing and regulatory approval in Massachusetts, making it the 21st state to offer online sportsbooks by Boston-based DraftKings, providing access to various bet types and exclusive bonuses.

- January 2023: The fantasy gaming company Fantasy Akhada announced intentions to sell a significant stake to GMR Sports, a GMR Group affiliate, for an estimated USD 160-175 million (INR 1,300-1,400 Crore), with the transaction anticipated to occur in stages.

- May 2022: Swedish website Fotbollskanalen received FSport's flagship fantasy sports product from the gaming and media company FSport. Through a partnership with TV4, FSport will provide its FSportFree product and associated daily fantasy sports platform to the Football Channel, with TV4 advertising the games and allowing participation in free-to-play games.

In-Depth Fantasy Sports Market Market Outlook

The fantasy sports market outlook remains exceptionally bright, with sustained growth expected throughout the forecast period. Growth accelerators will continue to be driven by technological advancements, particularly in AI and data analytics, which will further personalize user experiences and improve prediction accuracy. Strategic partnerships will deepen the integration of fantasy sports with sports betting and media, creating a more comprehensive and engaging sports entertainment ecosystem. Market expansion into developing economies, fueled by increasing internet penetration and a burgeoning sports fan base, will unlock new revenue streams. The continued evolution of mobile applications and the potential integration of emerging technologies like AR/VR will further solidify fantasy sports as a dominant form of digital sports engagement. The market is poised for significant value creation, offering substantial opportunities for innovation and investment.

Fantasy Sports Market Segmentation

-

1. Type

- 1.1. Football

- 1.2. Baseball

- 1.3. Cricket

- 1.4. Basketball

- 1.5. Car Racing

- 1.6. Other Types

-

2. Platform

- 2.1. Website

- 2.2. Mobile Application

-

3. Demographics

- 3.1. Under 25 Years

- 3.2. Between 25 and 40 Years

- 3.3. Above 40 Years

-

4. Application

- 4.1. Individual Competition

- 4.2. Team Competition

Fantasy Sports Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Fantasy Sports Market Regional Market Share

Geographic Coverage of Fantasy Sports Market

Fantasy Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Fan Engagement; Technological Advancements might Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Regulatory Framework; Competition from Traditional Sports Betting

- 3.4. Market Trends

- 3.4.1. Increasing Sports Fan Engagement may Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Football

- 5.1.2. Baseball

- 5.1.3. Cricket

- 5.1.4. Basketball

- 5.1.5. Car Racing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Website

- 5.2.2. Mobile Application

- 5.3. Market Analysis, Insights and Forecast - by Demographics

- 5.3.1. Under 25 Years

- 5.3.2. Between 25 and 40 Years

- 5.3.3. Above 40 Years

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Individual Competition

- 5.4.2. Team Competition

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Football

- 6.1.2. Baseball

- 6.1.3. Cricket

- 6.1.4. Basketball

- 6.1.5. Car Racing

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Website

- 6.2.2. Mobile Application

- 6.3. Market Analysis, Insights and Forecast - by Demographics

- 6.3.1. Under 25 Years

- 6.3.2. Between 25 and 40 Years

- 6.3.3. Above 40 Years

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Individual Competition

- 6.4.2. Team Competition

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Football

- 7.1.2. Baseball

- 7.1.3. Cricket

- 7.1.4. Basketball

- 7.1.5. Car Racing

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Website

- 7.2.2. Mobile Application

- 7.3. Market Analysis, Insights and Forecast - by Demographics

- 7.3.1. Under 25 Years

- 7.3.2. Between 25 and 40 Years

- 7.3.3. Above 40 Years

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Individual Competition

- 7.4.2. Team Competition

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Football

- 8.1.2. Baseball

- 8.1.3. Cricket

- 8.1.4. Basketball

- 8.1.5. Car Racing

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Website

- 8.2.2. Mobile Application

- 8.3. Market Analysis, Insights and Forecast - by Demographics

- 8.3.1. Under 25 Years

- 8.3.2. Between 25 and 40 Years

- 8.3.3. Above 40 Years

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Individual Competition

- 8.4.2. Team Competition

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Football

- 9.1.2. Baseball

- 9.1.3. Cricket

- 9.1.4. Basketball

- 9.1.5. Car Racing

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Website

- 9.2.2. Mobile Application

- 9.3. Market Analysis, Insights and Forecast - by Demographics

- 9.3.1. Under 25 Years

- 9.3.2. Between 25 and 40 Years

- 9.3.3. Above 40 Years

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Individual Competition

- 9.4.2. Team Competition

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Football

- 10.1.2. Baseball

- 10.1.3. Cricket

- 10.1.4. Basketball

- 10.1.5. Car Racing

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Website

- 10.2.2. Mobile Application

- 10.3. Market Analysis, Insights and Forecast - by Demographics

- 10.3.1. Under 25 Years

- 10.3.2. Between 25 and 40 Years

- 10.3.3. Above 40 Years

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Individual Competition

- 10.4.2. Team Competition

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Fantasy Sports Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Football

- 11.1.2. Baseball

- 11.1.3. Cricket

- 11.1.4. Basketball

- 11.1.5. Car Racing

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Platform

- 11.2.1. Website

- 11.2.2. Mobile Application

- 11.3. Market Analysis, Insights and Forecast - by Demographics

- 11.3.1. Under 25 Years

- 11.3.2. Between 25 and 40 Years

- 11.3.3. Above 40 Years

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Individual Competition

- 11.4.2. Team Competition

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Sleeper (Blitz Studios Inc )

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sorare SAS

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Flutter Entertainment PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Vauntek Inc (Fantrax)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Low6 Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 FanDuel Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NFL Enterprises LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ESPN Sports Media Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 RealTime Fantasy Sports Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CBS Sports Digital

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bovada

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 DraftKings Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Dream Sports Group

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Yahoo Fantasy Sports LLC

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Sleeper (Blitz Studios Inc )

List of Figures

- Figure 1: Global Fantasy Sports Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Fantasy Sports Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Fantasy Sports Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Fantasy Sports Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Fantasy Sports Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Fantasy Sports Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Fantasy Sports Market Revenue (Million), by Platform 2025 & 2033

- Figure 8: North America Fantasy Sports Market Volume (K Unit), by Platform 2025 & 2033

- Figure 9: North America Fantasy Sports Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: North America Fantasy Sports Market Volume Share (%), by Platform 2025 & 2033

- Figure 11: North America Fantasy Sports Market Revenue (Million), by Demographics 2025 & 2033

- Figure 12: North America Fantasy Sports Market Volume (K Unit), by Demographics 2025 & 2033

- Figure 13: North America Fantasy Sports Market Revenue Share (%), by Demographics 2025 & 2033

- Figure 14: North America Fantasy Sports Market Volume Share (%), by Demographics 2025 & 2033

- Figure 15: North America Fantasy Sports Market Revenue (Million), by Application 2025 & 2033

- Figure 16: North America Fantasy Sports Market Volume (K Unit), by Application 2025 & 2033

- Figure 17: North America Fantasy Sports Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Fantasy Sports Market Volume Share (%), by Application 2025 & 2033

- Figure 19: North America Fantasy Sports Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Fantasy Sports Market Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Fantasy Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Fantasy Sports Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Fantasy Sports Market Revenue (Million), by Type 2025 & 2033

- Figure 24: Europe Fantasy Sports Market Volume (K Unit), by Type 2025 & 2033

- Figure 25: Europe Fantasy Sports Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe Fantasy Sports Market Volume Share (%), by Type 2025 & 2033

- Figure 27: Europe Fantasy Sports Market Revenue (Million), by Platform 2025 & 2033

- Figure 28: Europe Fantasy Sports Market Volume (K Unit), by Platform 2025 & 2033

- Figure 29: Europe Fantasy Sports Market Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Europe Fantasy Sports Market Volume Share (%), by Platform 2025 & 2033

- Figure 31: Europe Fantasy Sports Market Revenue (Million), by Demographics 2025 & 2033

- Figure 32: Europe Fantasy Sports Market Volume (K Unit), by Demographics 2025 & 2033

- Figure 33: Europe Fantasy Sports Market Revenue Share (%), by Demographics 2025 & 2033

- Figure 34: Europe Fantasy Sports Market Volume Share (%), by Demographics 2025 & 2033

- Figure 35: Europe Fantasy Sports Market Revenue (Million), by Application 2025 & 2033

- Figure 36: Europe Fantasy Sports Market Volume (K Unit), by Application 2025 & 2033

- Figure 37: Europe Fantasy Sports Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Europe Fantasy Sports Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Europe Fantasy Sports Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Fantasy Sports Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Fantasy Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Fantasy Sports Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Fantasy Sports Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Asia Fantasy Sports Market Volume (K Unit), by Type 2025 & 2033

- Figure 45: Asia Fantasy Sports Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Fantasy Sports Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Asia Fantasy Sports Market Revenue (Million), by Platform 2025 & 2033

- Figure 48: Asia Fantasy Sports Market Volume (K Unit), by Platform 2025 & 2033

- Figure 49: Asia Fantasy Sports Market Revenue Share (%), by Platform 2025 & 2033

- Figure 50: Asia Fantasy Sports Market Volume Share (%), by Platform 2025 & 2033

- Figure 51: Asia Fantasy Sports Market Revenue (Million), by Demographics 2025 & 2033

- Figure 52: Asia Fantasy Sports Market Volume (K Unit), by Demographics 2025 & 2033

- Figure 53: Asia Fantasy Sports Market Revenue Share (%), by Demographics 2025 & 2033

- Figure 54: Asia Fantasy Sports Market Volume Share (%), by Demographics 2025 & 2033

- Figure 55: Asia Fantasy Sports Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Asia Fantasy Sports Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Asia Fantasy Sports Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Asia Fantasy Sports Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Asia Fantasy Sports Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Fantasy Sports Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Fantasy Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Fantasy Sports Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Australia and New Zealand Fantasy Sports Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Australia and New Zealand Fantasy Sports Market Volume (K Unit), by Type 2025 & 2033

- Figure 65: Australia and New Zealand Fantasy Sports Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Australia and New Zealand Fantasy Sports Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Australia and New Zealand Fantasy Sports Market Revenue (Million), by Platform 2025 & 2033

- Figure 68: Australia and New Zealand Fantasy Sports Market Volume (K Unit), by Platform 2025 & 2033

- Figure 69: Australia and New Zealand Fantasy Sports Market Revenue Share (%), by Platform 2025 & 2033

- Figure 70: Australia and New Zealand Fantasy Sports Market Volume Share (%), by Platform 2025 & 2033

- Figure 71: Australia and New Zealand Fantasy Sports Market Revenue (Million), by Demographics 2025 & 2033

- Figure 72: Australia and New Zealand Fantasy Sports Market Volume (K Unit), by Demographics 2025 & 2033

- Figure 73: Australia and New Zealand Fantasy Sports Market Revenue Share (%), by Demographics 2025 & 2033

- Figure 74: Australia and New Zealand Fantasy Sports Market Volume Share (%), by Demographics 2025 & 2033

- Figure 75: Australia and New Zealand Fantasy Sports Market Revenue (Million), by Application 2025 & 2033

- Figure 76: Australia and New Zealand Fantasy Sports Market Volume (K Unit), by Application 2025 & 2033

- Figure 77: Australia and New Zealand Fantasy Sports Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: Australia and New Zealand Fantasy Sports Market Volume Share (%), by Application 2025 & 2033

- Figure 79: Australia and New Zealand Fantasy Sports Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Australia and New Zealand Fantasy Sports Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Australia and New Zealand Fantasy Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia and New Zealand Fantasy Sports Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Latin America Fantasy Sports Market Revenue (Million), by Type 2025 & 2033

- Figure 84: Latin America Fantasy Sports Market Volume (K Unit), by Type 2025 & 2033

- Figure 85: Latin America Fantasy Sports Market Revenue Share (%), by Type 2025 & 2033

- Figure 86: Latin America Fantasy Sports Market Volume Share (%), by Type 2025 & 2033

- Figure 87: Latin America Fantasy Sports Market Revenue (Million), by Platform 2025 & 2033

- Figure 88: Latin America Fantasy Sports Market Volume (K Unit), by Platform 2025 & 2033

- Figure 89: Latin America Fantasy Sports Market Revenue Share (%), by Platform 2025 & 2033

- Figure 90: Latin America Fantasy Sports Market Volume Share (%), by Platform 2025 & 2033

- Figure 91: Latin America Fantasy Sports Market Revenue (Million), by Demographics 2025 & 2033

- Figure 92: Latin America Fantasy Sports Market Volume (K Unit), by Demographics 2025 & 2033

- Figure 93: Latin America Fantasy Sports Market Revenue Share (%), by Demographics 2025 & 2033

- Figure 94: Latin America Fantasy Sports Market Volume Share (%), by Demographics 2025 & 2033

- Figure 95: Latin America Fantasy Sports Market Revenue (Million), by Application 2025 & 2033

- Figure 96: Latin America Fantasy Sports Market Volume (K Unit), by Application 2025 & 2033

- Figure 97: Latin America Fantasy Sports Market Revenue Share (%), by Application 2025 & 2033

- Figure 98: Latin America Fantasy Sports Market Volume Share (%), by Application 2025 & 2033

- Figure 99: Latin America Fantasy Sports Market Revenue (Million), by Country 2025 & 2033

- Figure 100: Latin America Fantasy Sports Market Volume (K Unit), by Country 2025 & 2033

- Figure 101: Latin America Fantasy Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: Latin America Fantasy Sports Market Volume Share (%), by Country 2025 & 2033

- Figure 103: Middle East and Africa Fantasy Sports Market Revenue (Million), by Type 2025 & 2033

- Figure 104: Middle East and Africa Fantasy Sports Market Volume (K Unit), by Type 2025 & 2033

- Figure 105: Middle East and Africa Fantasy Sports Market Revenue Share (%), by Type 2025 & 2033

- Figure 106: Middle East and Africa Fantasy Sports Market Volume Share (%), by Type 2025 & 2033

- Figure 107: Middle East and Africa Fantasy Sports Market Revenue (Million), by Platform 2025 & 2033

- Figure 108: Middle East and Africa Fantasy Sports Market Volume (K Unit), by Platform 2025 & 2033

- Figure 109: Middle East and Africa Fantasy Sports Market Revenue Share (%), by Platform 2025 & 2033

- Figure 110: Middle East and Africa Fantasy Sports Market Volume Share (%), by Platform 2025 & 2033

- Figure 111: Middle East and Africa Fantasy Sports Market Revenue (Million), by Demographics 2025 & 2033

- Figure 112: Middle East and Africa Fantasy Sports Market Volume (K Unit), by Demographics 2025 & 2033

- Figure 113: Middle East and Africa Fantasy Sports Market Revenue Share (%), by Demographics 2025 & 2033

- Figure 114: Middle East and Africa Fantasy Sports Market Volume Share (%), by Demographics 2025 & 2033

- Figure 115: Middle East and Africa Fantasy Sports Market Revenue (Million), by Application 2025 & 2033

- Figure 116: Middle East and Africa Fantasy Sports Market Volume (K Unit), by Application 2025 & 2033

- Figure 117: Middle East and Africa Fantasy Sports Market Revenue Share (%), by Application 2025 & 2033

- Figure 118: Middle East and Africa Fantasy Sports Market Volume Share (%), by Application 2025 & 2033

- Figure 119: Middle East and Africa Fantasy Sports Market Revenue (Million), by Country 2025 & 2033

- Figure 120: Middle East and Africa Fantasy Sports Market Volume (K Unit), by Country 2025 & 2033

- Figure 121: Middle East and Africa Fantasy Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 122: Middle East and Africa Fantasy Sports Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 5: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 6: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 7: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global Fantasy Sports Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Fantasy Sports Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 15: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 16: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 17: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 19: Global Fantasy Sports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Fantasy Sports Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 24: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 25: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 26: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 27: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Fantasy Sports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Fantasy Sports Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 34: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 35: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 36: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 37: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Fantasy Sports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Fantasy Sports Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 44: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 45: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 46: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 47: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 48: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 49: Global Fantasy Sports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Fantasy Sports Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 53: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 54: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 55: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 56: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 57: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Fantasy Sports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Fantasy Sports Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Global Fantasy Sports Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Global Fantasy Sports Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 63: Global Fantasy Sports Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 64: Global Fantasy Sports Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 65: Global Fantasy Sports Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 66: Global Fantasy Sports Market Volume K Unit Forecast, by Demographics 2020 & 2033

- Table 67: Global Fantasy Sports Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Fantasy Sports Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Fantasy Sports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Fantasy Sports Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fantasy Sports Market?

The projected CAGR is approximately 13.83%.

2. Which companies are prominent players in the Fantasy Sports Market?

Key companies in the market include Sleeper (Blitz Studios Inc ), Sorare SAS, Flutter Entertainment PLC, Vauntek Inc (Fantrax), Low6 Limited, FanDuel Group, NFL Enterprises LLC, ESPN Sports Media Ltd, RealTime Fantasy Sports Inc, CBS Sports Digital, Bovada, DraftKings Inc, Dream Sports Group, Yahoo Fantasy Sports LLC.

3. What are the main segments of the Fantasy Sports Market?

The market segments include Type, Platform, Demographics, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Fan Engagement; Technological Advancements might Drive the Market Growth.

6. What are the notable trends driving market growth?

Increasing Sports Fan Engagement may Drive the Market Growth.

7. Are there any restraints impacting market growth?

Low Awareness and Regulatory Framework; Competition from Traditional Sports Betting.

8. Can you provide examples of recent developments in the market?

March 2023: DraftKings Inc. announced plans to open its renowned online sportsbook, subject to licensing and regulatory approval in Massachusetts. Massachusetts will be the 21st state in the union to provide an online sportsbook by Boston-based DraftKings. In addition to giving Massachusetts residents access to several bet types, such as same-game parlays, player props, unique odds, boost choices, and more, DraftKings will also offer clients in the state attractive and exclusive bonuses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fantasy Sports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fantasy Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fantasy Sports Market?

To stay informed about further developments, trends, and reports in the Fantasy Sports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence