Key Insights

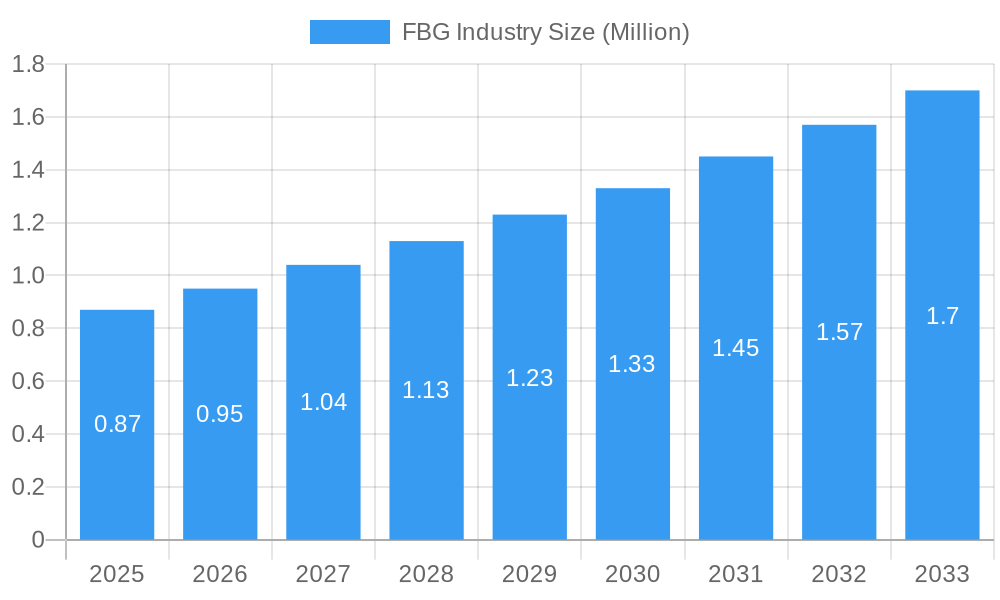

The Fiber Bragg Grating (FBG) market is poised for significant expansion, with a current market size of $0.76 million projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.83%. This impressive growth trajectory, observed over the study period from 2019 to 2033, indicates a strong and sustained demand for FBG technologies across various industries. The primary drivers of this market growth include the increasing need for high-performance sensing solutions in critical sectors such as aerospace, telecommunications, and energy. Advancements in manufacturing techniques, coupled with the inherent advantages of FBG sensors, such as their immunity to electromagnetic interference, compact size, and multiplexing capabilities, are further fueling this upward trend. The market's dynamism is also shaped by emerging applications in structural health monitoring, advanced infrastructure development, and the burgeoning digital transformation initiatives across industries, all of which rely heavily on precise and reliable sensing data.

FBG Industry Market Size (In Million)

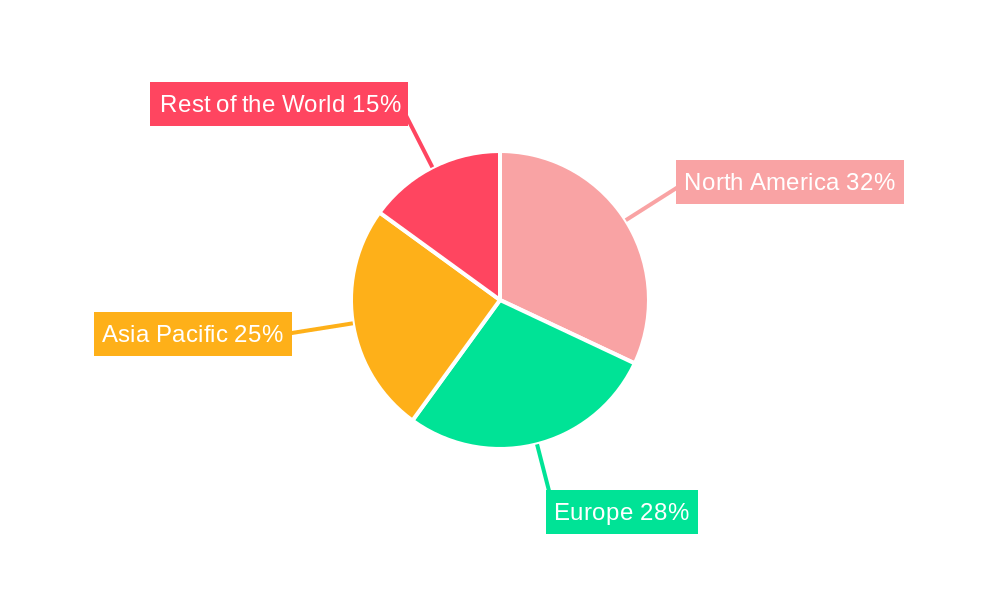

The FBG market is segmented into distinct sensor types, with Temperature Sensors, Strain Sensors, and Pressure Sensors emerging as key contributors to market value. The demand for these specialized sensors is predominantly driven by end-user industries including Telecommunication, Aerospace, Construction and Infrastructure, Energy and Power, and Mining. While the market presents substantial growth opportunities, certain restraints, such as the initial high cost of implementation for some advanced FBG systems and the need for specialized technical expertise for deployment and maintenance, may present challenges. However, ongoing innovation and economies of scale are expected to mitigate these factors. Geographically, North America and Europe are anticipated to remain dominant markets, with Asia Pacific exhibiting the fastest growth rate due to rapid industrialization and increasing investments in advanced infrastructure and technology.

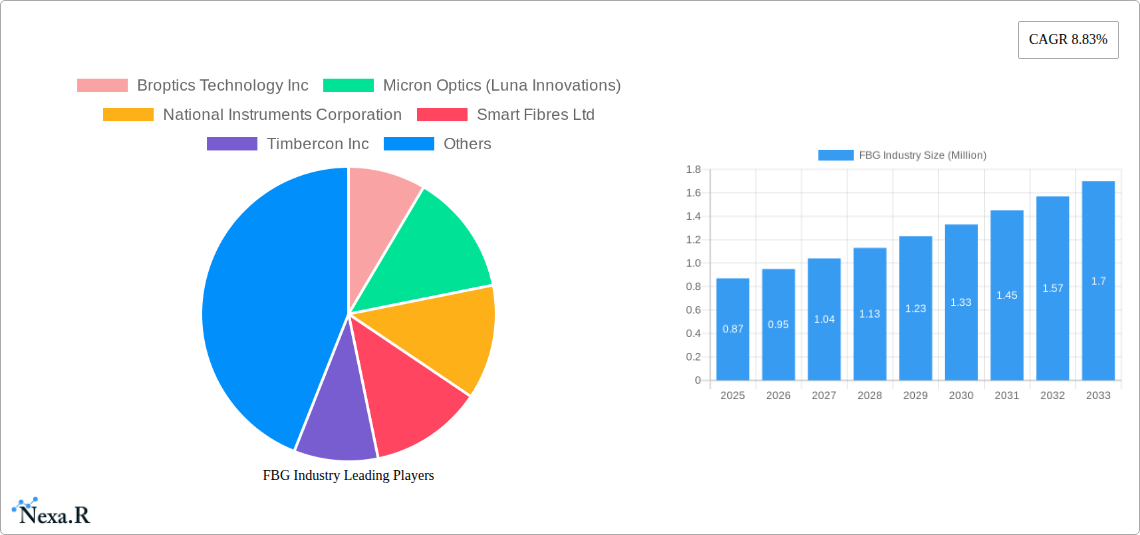

FBG Industry Company Market Share

Here's a comprehensive, SEO-optimized report description for the FBG Industry, designed for maximum visibility and engagement.

Gain unparalleled insights into the dynamic Fiber Bragg Grating (FBG) industry with this in-depth market research report. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study offers a holistic view of market trends, growth drivers, competitive landscapes, and future opportunities. Essential for industry professionals, investors, and strategists seeking to capitalize on the burgeoning demand for advanced sensing solutions.

FBG Industry Market Dynamics & Structure

The Fiber Bragg Grating (FBG) industry is characterized by a moderately concentrated market structure, with key players continually investing in research and development to maintain their competitive edge. Technological innovation stands as a paramount driver, pushing the boundaries of sensing accuracy and durability across diverse applications. Regulatory frameworks, particularly those promoting industrial safety, environmental monitoring, and critical infrastructure resilience, are increasingly influencing FBG sensor adoption. While direct competitive product substitutes are limited in their ability to replicate the unique advantages of FBG technology, advancements in other sensor types present a nuanced competitive landscape. End-user demographics are expanding rapidly, driven by sectors demanding high-performance, robust, and miniaturized sensing solutions. Mergers and acquisitions (M&A) trends are indicative of consolidation efforts and strategic expansions, aiming to broaden product portfolios and market reach. For instance, the market has witnessed several strategic partnerships and smaller acquisitions over the historical period (2019-2024) aimed at integrating specialized FBG manufacturing capabilities or expanding into new geographical markets. The global FBG market size is projected to see significant growth, with estimations suggesting a valuation of over $700 Million by 2025.

- Market Concentration: Moderate, with a few dominant players and a growing number of niche manufacturers.

- Technological Innovation: Driven by advancements in grating fabrication, multiplexing techniques, and integration with data analytics platforms.

- Regulatory Impact: Favorable regulations in aerospace, energy, and infrastructure sectors are boosting demand.

- Competitive Substitutes: While direct substitutes are scarce, other sensing technologies present indirect competition.

- End-User Demographics: Expanding across telecommunications, aerospace, construction, energy, and mining.

- M&A Trends: Strategic acquisitions and partnerships to enhance technological capabilities and market penetration.

FBG Industry Growth Trends & Insights

The FBG sensor market is poised for substantial growth, driven by an escalating demand for precise, reliable, and durable sensing solutions across a multitude of industries. This growth is underpinned by increasing adoption rates in critical sectors such as telecommunications, aerospace, and energy, where performance and safety are paramount. The market size of FBG sensors is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period (2025-2033). Technological disruptions, including the development of advanced fabrication techniques and novel multiplexing methods, are enhancing the capabilities and affordability of FBG sensors, further accelerating their integration into mainstream applications. Consumer behavior shifts, particularly the growing emphasis on smart infrastructure, predictive maintenance, and industrial automation, are creating new avenues for FBG sensor deployment. The demand for FBG optical sensors is projected to reach well over $1.5 Billion by 2033. The increasing need for real-time structural health monitoring in aging infrastructure and advanced diagnostic tools in the aerospace sector are key contributors to this positive outlook.

Dominant Regions, Countries, or Segments in FBG Industry

The global FBG market is experiencing robust growth, with several regions and segments demonstrating significant leadership. North America, particularly the United States, is a dominant force due to its strong presence in the aerospace, defense, and telecommunications sectors, coupled with substantial government investments in infrastructure development and advanced manufacturing. The demand for FBG temperature sensors is particularly high in the energy and power sector for monitoring critical equipment and in industrial processes. In Europe, countries like Germany and France are leading the charge, driven by stringent safety regulations, a focus on energy efficiency (as evidenced by France's ambitious Energy Efficiency Plan), and a mature industrial base. Asia-Pacific is emerging as a high-growth region, fueled by rapid industrialization, massive infrastructure projects in countries like China and India, and a burgeoning telecommunications sector. The FBG strain sensor market is seeing considerable traction in construction and infrastructure for structural health monitoring and in the aerospace sector for aircraft integrity assessment.

- Dominant Segment (Type): Strain Sensors and Temperature Sensors are currently the largest segments, driven by widespread applications in structural health monitoring and industrial process control.

- Strain Sensors: Crucial for civil engineering, aerospace, and automotive applications, providing real-time stress and strain data.

- Temperature Sensors: Essential for monitoring critical infrastructure, industrial processes, and in the energy sector.

- Dominant Segment (End-user Industry): Telecommunications and Aerospace continue to be significant drivers, with Construction and Infrastructure and Energy and Power showing rapid growth potential.

- Telecommunications: FBG's role in optical fiber networks and sensing for infrastructure integrity.

- Aerospace: Critical for structural health monitoring, engine performance, and safety systems.

- Construction and Infrastructure: Monitoring bridges, buildings, and tunnels for long-term stability.

- Energy and Power: Ensuring the safety and efficiency of power plants, pipelines, and renewable energy installations.

FBG Industry Product Landscape

The FBG industry is defined by continuous product innovation, focusing on enhanced performance, miniaturization, and integrated functionalities. Key product developments include ultra-high precision gratings with improved signal-to-noise ratios, novel multiplexing schemes for deploying a high density of sensors along a single fiber, and robust packaging for extreme environmental conditions. Applications span from precise temperature and strain measurements to pressure and acceleration sensing, catering to specialized needs across diverse industries. Unique selling propositions often revolve around the intrinsic advantages of FBG technology: immunity to electromagnetic interference, lightweight and compact design, and suitability for remote and harsh environments. Technological advancements are also geared towards simplifying FBG sensor interrogation systems and enabling seamless data integration with advanced analytics and IoT platforms, further expanding their utility.

Key Drivers, Barriers & Challenges in FBG Industry

Key Drivers:

- Growing demand for structural health monitoring (SHM): Essential for infrastructure, aerospace, and automotive industries to ensure safety and reduce maintenance costs.

- Advancements in telecommunications: FBG's role in optical fiber networks and its increasing application in distributed sensing for network integrity.

- Energy efficiency initiatives: Government and industry focus on optimizing energy consumption and monitoring critical energy infrastructure.

- Increasing need for precision and reliability: Harsh environments and critical applications necessitate sensors with high accuracy and durability.

- Technological advancements in fabrication: Improved manufacturing processes leading to higher performance and cost-effectiveness.

Barriers & Challenges:

- High initial cost of implementation: Compared to some traditional sensing technologies, FBG systems can have a higher upfront investment.

- Specialized knowledge for deployment and maintenance: Interrogation and data interpretation require specific expertise, posing a barrier for some smaller enterprises.

- Competition from established sensing technologies: While FBG offers unique advantages, other sensor types remain prevalent in certain applications.

- Supply chain complexities: Ensuring consistent availability of high-quality FBG components and specialized fabrication services.

- Standardization efforts: Ongoing development of industry standards can sometimes lag behind rapid technological evolution.

Emerging Opportunities in FBG Industry

Emerging opportunities within the FBG industry are largely driven by the expansion of smart technologies and the increasing demand for intelligent infrastructure. The growth of the Industrial Internet of Things (IIoT) presents a significant avenue, as FBG sensors can provide crucial real-time data for predictive maintenance, process optimization, and remote monitoring of industrial assets. The renewable energy sector, particularly in wind turbines and solar farms, offers substantial potential for FBG-based structural monitoring and environmental sensing. Furthermore, advancements in healthcare and biomedical applications, such as minimally invasive surgical tools and patient monitoring systems, are opening new frontiers for FBG technology. The development of FBG-based distributed sensing for large-scale infrastructure projects and the integration of FBG with artificial intelligence for advanced data analysis represent further untapped markets.

Growth Accelerators in the FBG Industry Industry

Several catalysts are propelling the long-term growth of the FBG industry. Technological breakthroughs in grating inscription techniques, such as femtosecond laser writing, are enabling the creation of more complex and higher-performance gratings, pushing the boundaries of sensing capabilities. Strategic partnerships between FBG manufacturers, system integrators, and end-users are crucial for developing tailored solutions and accelerating market penetration. Market expansion strategies, including entry into emerging economies and diversification into new application areas like smart cities and advanced materials testing, are also key growth drivers. The continuous drive for miniaturization and integration into existing systems without compromising performance is a fundamental aspect of this ongoing growth trajectory.

Key Players Shaping the FBG Industry Market

- Broptics Technology Inc

- Micron Optics (Luna Innovations)

- National Instruments Corporation

- Smart Fibres Ltd

- Timbercon Inc

- ITF Technologies

- HBM Inc (An HBK Company)

- FBGS International NV

- Technica Optical Components LLC

- Advanced Optics Solutions (AOS) GmbH

Notable Milestones in FBG Industry Sector

- October 2022: The French government unveiled its ambitious Energy Efficiency Plan, aiming for a 10% reduction in energy consumption by 2024 and a significant step towards carbon neutrality by 2050. This initiative directly boosts the demand for FBG sensors for energy management and monitoring.

- March 2022: The ANGELA Consortium successfully delivered a flight-ready landing gear system to Airbus Helicopters for the RACER high-speed compound helicopter. This system incorporated FBG sensors for advanced detection of hard landings, showcasing the critical role of FBG technology in aerospace safety.

In-Depth FBG Industry Market Outlook

The Fiber Bragg Grating (FBG) market outlook is exceptionally positive, fueled by the ongoing digital transformation and the imperative for enhanced safety and efficiency across critical industries. Growth accelerators include the persistent innovation in sensing technologies, the expanding adoption of smart infrastructure, and increasing government initiatives supporting energy efficiency and structural integrity. Strategic collaborations and the development of integrated sensing solutions that leverage AI and machine learning for data analysis are set to unlock new market potential. The inherent advantages of FBG sensors—their robustness, precision, and immunity to electromagnetic interference—position them as indispensable components in the future of industrial monitoring, aerospace applications, and advanced telecommunications networks, promising sustained market expansion and significant investment opportunities.

FBG Industry Segmentation

-

1. Type

- 1.1. Temperature Sensor

- 1.2. Strain Sensor

- 1.3. Pressure Sensor

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Telecommunication

- 2.2. Aerospace

- 2.3. Construction and Infrastructure

- 2.4. Energy and Power

- 2.5. Mining

- 2.6. Other End-user Industries

FBG Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

FBG Industry Regional Market Share

Geographic Coverage of FBG Industry

FBG Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage in the Aircraft; Built-in Calibration Artifacts and Longer Lifetime

- 3.3. Market Restrains

- 3.3.1. Thermal and Transverse Strain Sensitivity

- 3.4. Market Trends

- 3.4.1. Aerospace to be Among the Fastest Growing End User for FBG Sensors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global FBG Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Temperature Sensor

- 5.1.2. Strain Sensor

- 5.1.3. Pressure Sensor

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Telecommunication

- 5.2.2. Aerospace

- 5.2.3. Construction and Infrastructure

- 5.2.4. Energy and Power

- 5.2.5. Mining

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America FBG Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Temperature Sensor

- 6.1.2. Strain Sensor

- 6.1.3. Pressure Sensor

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Telecommunication

- 6.2.2. Aerospace

- 6.2.3. Construction and Infrastructure

- 6.2.4. Energy and Power

- 6.2.5. Mining

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe FBG Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Temperature Sensor

- 7.1.2. Strain Sensor

- 7.1.3. Pressure Sensor

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Telecommunication

- 7.2.2. Aerospace

- 7.2.3. Construction and Infrastructure

- 7.2.4. Energy and Power

- 7.2.5. Mining

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific FBG Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Temperature Sensor

- 8.1.2. Strain Sensor

- 8.1.3. Pressure Sensor

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Telecommunication

- 8.2.2. Aerospace

- 8.2.3. Construction and Infrastructure

- 8.2.4. Energy and Power

- 8.2.5. Mining

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World FBG Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Temperature Sensor

- 9.1.2. Strain Sensor

- 9.1.3. Pressure Sensor

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Telecommunication

- 9.2.2. Aerospace

- 9.2.3. Construction and Infrastructure

- 9.2.4. Energy and Power

- 9.2.5. Mining

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Broptics Technology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Micron Optics (Luna Innovations)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 National Instruments Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Smart Fibres Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Timbercon Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ITF Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 HBM Inc (An HBK Company)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FBGS International NV

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Technica Optical Components LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Advanced Optics Solutions (AOS) GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Broptics Technology Inc

List of Figures

- Figure 1: Global FBG Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America FBG Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America FBG Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America FBG Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America FBG Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America FBG Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America FBG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe FBG Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe FBG Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe FBG Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe FBG Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe FBG Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe FBG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific FBG Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific FBG Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific FBG Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific FBG Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific FBG Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific FBG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World FBG Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World FBG Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World FBG Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World FBG Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World FBG Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World FBG Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global FBG Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global FBG Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global FBG Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global FBG Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global FBG Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global FBG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global FBG Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global FBG Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global FBG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global FBG Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global FBG Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global FBG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global FBG Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global FBG Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global FBG Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the FBG Industry?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the FBG Industry?

Key companies in the market include Broptics Technology Inc, Micron Optics (Luna Innovations), National Instruments Corporation, Smart Fibres Ltd, Timbercon Inc, ITF Technologies, HBM Inc (An HBK Company), FBGS International NV, Technica Optical Components LLC, Advanced Optics Solutions (AOS) GmbH.

3. What are the main segments of the FBG Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage in the Aircraft; Built-in Calibration Artifacts and Longer Lifetime.

6. What are the notable trends driving market growth?

Aerospace to be Among the Fastest Growing End User for FBG Sensors.

7. Are there any restraints impacting market growth?

Thermal and Transverse Strain Sensitivity.

8. Can you provide examples of recent developments in the market?

October 2022: The French government unveiled its ambitious Energy Efficiency Plan, with the objective of achieving a 10% reduction in energy consumption by 2024. The government's comprehensive set of measures is expected to result in a substantial reduction of approximately 50 terawatt hours (TWh) annually. This initiative marks a crucial initial stride toward achieving carbon neutrality by 2050, necessitating a 40% decrease in energy consumption. As a result, the demand for Fiber Bragg Grating (FBG) sensors is set to rise, bolstering growth in the sensor market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "FBG Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the FBG Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the FBG Industry?

To stay informed about further developments, trends, and reports in the FBG Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence