Key Insights

Finland's telecommunications market, though modest in global scale, is characterized by advanced technology and steady expansion. The projected Compound Annual Growth Rate (CAGR) of 2.5% indicates sustained development. Key growth drivers include escalating demand for high-speed internet, propelled by the widespread adoption of smart devices and increasing reliance on digital services across consumer and enterprise sectors. The ongoing rollout of 5G networks serves as a significant catalyst, promising enhanced speeds and reduced latency, essential for nascent technologies like the Internet of Things (IoT) and autonomous systems. Market consolidation is a prevailing trend, with major operators such as Telia, Elisa, and DNA expected to reinforce their dominance, driven by substantial capital requirements for network modernization and the pursuit of operational efficiencies. Potential limitations include Finland's relatively smaller population base and intensified competition among established providers. Based on a market size of $6.1 billion in the base year 2025, the market is poised for continued growth, reflecting an industry shaped by innovation and strategic alliances.

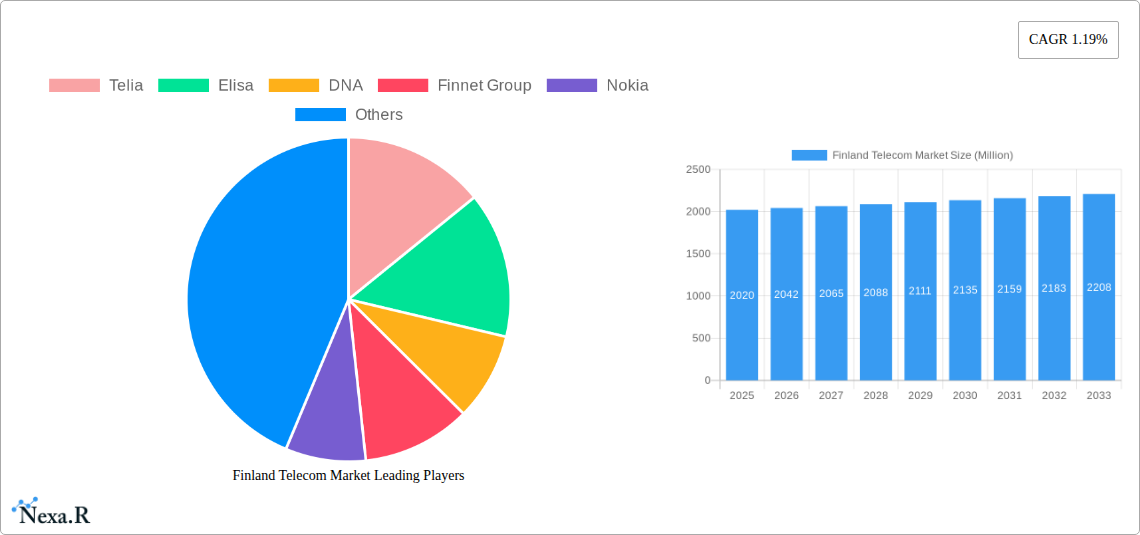

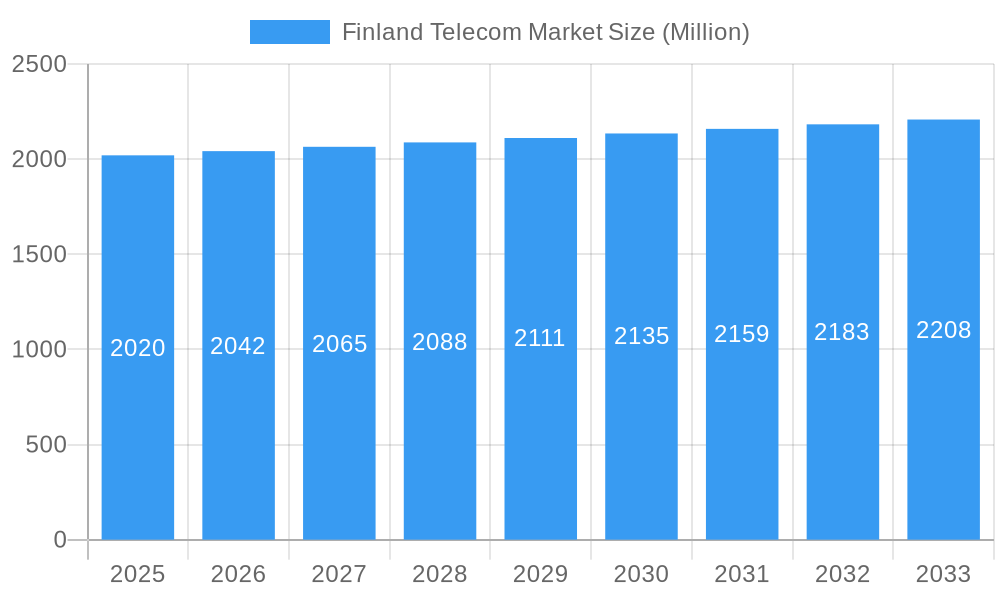

Finland Telecom Market Market Size (In Billion)

The competitive environment features dominant players including Telia, Elisa, and DNA, who are actively investing in infrastructure enhancements to secure their market positions. Smaller entities, such as Finnet Group, S1 Networks Oy, and Setera, likely concentrate on specialized market segments or unique service offerings to maintain relevance. Nokia's significant role underscores Finland's prowess in telecom equipment manufacturing, further emphasizing the sector's technological orientation. Future expansion will be contingent upon successful 5G implementation, the introduction of novel services, and sustained investment in digital infrastructure. The burgeoning Internet of Things (IoT) sector and the advancement of smart city initiatives are anticipated to be pivotal for driving future growth and reinforcing Finland's leadership in Northern European telecommunications.

Finland Telecom Market Company Market Share

Finland Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Finland telecom market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data and insights to offer invaluable intelligence for industry professionals, investors, and strategic decision-makers. The report delves into the parent market of Telecommunications and the child market of Fixed and Mobile Telecommunications in Finland.

Keywords: Finland Telecom Market, Finnish Telecom Industry, Telecom Market Finland, Telecommunications Finland, Mobile Telecom Finland, Fixed Line Telecom Finland, 5G Finland, 6G Finland, Telia Finland, Elisa Finland, DNA Finland, Telecom Market Analysis, Telecom Market Forecast, Telecom Industry Trends

Finland Telecom Market Dynamics & Structure

The Finnish telecom market is characterized by a moderately concentrated structure, with key players like Telia, Elisa, and DNA dominating market share. Technological innovation, particularly in 5G and the emerging 6G landscape, is a primary growth driver. Stringent regulatory frameworks influence market competition and infrastructure development. The market also faces competition from substitute technologies, like VoIP services. End-user demographics, notably increasing mobile penetration and digital adoption rates, shape demand patterns. M&A activity has been relatively moderate in recent years, with a predicted xx million units in deal volume during the historical period.

- Market Concentration: High, with Telia, Elisa, and DNA holding a combined market share of approximately xx%.

- Technological Innovation: Driven by 5G rollout and ongoing research into 6G technologies. Innovation barriers include high investment costs and regulatory complexities.

- Regulatory Framework: Stringent regulations influence spectrum allocation, network deployment, and pricing strategies.

- Competitive Substitutes: VoIP and OTT communication services pose a competitive threat.

- End-User Demographics: High mobile penetration and growing demand for high-speed data services.

- M&A Trends: Moderate activity in the historical period (2019-2024), with predicted xx million units in deal value. Forecasted increase in M&A activity in the coming years.

Finland Telecom Market Growth Trends & Insights

The Finnish telecom market experienced a steady growth trajectory during the historical period (2019-2024), driven by factors such as increasing smartphone penetration, rising data consumption, and the expansion of 5G networks. The market size is estimated at xx million units in 2025. The adoption rate of 5G technology has been relatively high, although challenges remain in ensuring ubiquitous coverage. Technological disruptions, particularly the evolution towards 6G, will continue to shape the market landscape. Consumer behavior is shifting towards greater demand for data-intensive services, including streaming and cloud-based applications. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), resulting in a market size of xx million units by 2033. Market penetration of mobile broadband is approaching saturation, while growth is driven by the adoption of newer technologies like 5G and IoT.

Dominant Regions, Countries, or Segments in Finland Telecom Market

The Finnish telecom market is largely homogenous, with no significant regional disparities in growth or adoption. However, urban areas generally exhibit higher mobile penetration and faster adoption of new technologies. Growth is driven by factors including robust digital infrastructure, supportive government policies, and a high level of digital literacy among the population.

- Key Drivers:

- Strong digital infrastructure.

- Supportive government policies promoting digitalization.

- High level of digital literacy amongst the population.

- Investment in 5G network infrastructure.

Finland Telecom Market Product Landscape

The Finnish telecom market offers a diverse range of products and services, including mobile voice and data services, fixed broadband, IPTV, and enterprise solutions. The emphasis is on high-speed data services, enhanced network reliability, and innovative value-added services. Technological advancements, especially in 5G and IoT, are leading to the development of new applications and service offerings. Key innovations include advanced network slicing technologies, edge computing capabilities, and improved cybersecurity solutions.

Key Drivers, Barriers & Challenges in Finland Telecom Market

Key Drivers:

- Growing demand for high-speed data services.

- Increased adoption of smartphones and mobile devices.

- Government initiatives promoting digitalization and 5G rollout.

- Investment in advanced network technologies.

Challenges & Restraints:

- High capital expenditures required for network infrastructure upgrades.

- Intense competition among existing players.

- Challenges in ensuring ubiquitous 5G coverage, particularly in rural areas.

- Regulatory hurdles related to spectrum allocation and network deployment.

Emerging Opportunities in Finland Telecom Market

- Growth in IoT applications and services across various sectors.

- Expansion of 5G and the development of 6G technologies.

- Opportunities in the enterprise and B2B telecom sector.

- Demand for advanced cybersecurity and data privacy solutions.

Growth Accelerators in the Finland Telecom Market Industry

Long-term growth in the Finnish telecom market will be fueled by sustained investments in 5G and the eventual deployment of 6G networks, strategic partnerships to drive innovation and market expansion, and the development of new applications and services leveraging advanced technologies like IoT and AI.

Notable Milestones in Finland Telecom Market Sector

- February 2024: Finland initiated a global collaboration to accelerate 6G technology research, highlighting the importance of advanced connectivity for economic growth.

- June 2024: Elisa launched a project deploying battery and PV systems at its base towers, aiming for virtual power plant optimization utilizing locally produced solar energy.

In-Depth Finland Telecom Market Market Outlook

The Finnish telecom market is poised for continued growth, driven by technological advancements, rising data consumption, and ongoing investments in infrastructure. The deployment of 5G and the future development of 6G networks will create significant opportunities for both established players and new entrants. Strategic partnerships and innovative service offerings will be crucial for success in this dynamic market. The market shows strong potential for future growth, particularly in areas such as IoT, cloud computing, and advanced cybersecurity.

Finland Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Finland Telecom Market Segmentation By Geography

- 1. Finland

Finland Telecom Market Regional Market Share

Geographic Coverage of Finland Telecom Market

Finland Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Rising Demand for 5G

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Finland Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Finland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elisa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DNA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Finnet Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nokia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tele

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Digita

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 S1 Networks Oy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Setera International Oy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Setera Oy*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Telia

List of Figures

- Figure 1: Finland Telecom Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Finland Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Finland Telecom Market Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Finland Telecom Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Finland Telecom Market Revenue billion Forecast, by Services 2020 & 2033

- Table 4: Finland Telecom Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finland Telecom Market?

The projected CAGR is approximately 2.5%.

2. Which companies are prominent players in the Finland Telecom Market?

Key companies in the market include Telia, Elisa, DNA, Finnet Group, Nokia, Tele, Digita, S1 Networks Oy, Setera International Oy, Setera Oy*List Not Exhaustive.

3. What are the main segments of the Finland Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for 5G.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

February 2024: Finland urged a global collaboration to advance research into 6G technologies. Acknowledging the critical role of advanced connectivity in fostering economic growth and sustainability, Finland invited international public and private entities to collaborate with its established research coalition in the field of 6G.June 2024: Elisa, a telecoms specialist, is rolling out battery and PV systems at its base towers in Finland. These systems will enable the implementation of virtual power plant (VPP) optimization, specifically focusing on locally produced solar energy. This initiative comes on the heels of a trial deployment conducted by Elisa in collaboration with Åland Islands' telecoms provider, Ålcom, and the local solar PV company, Solel Åland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finland Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finland Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finland Telecom Market?

To stay informed about further developments, trends, and reports in the Finland Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence