Key Insights

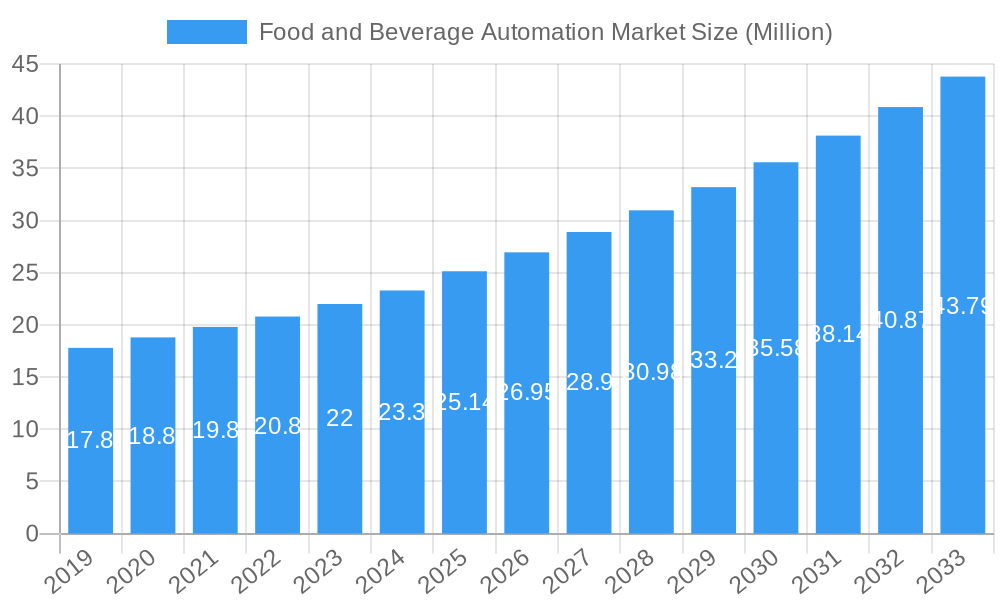

The global Food and Beverage Automation Market is poised for significant expansion, projected to reach USD 25.14 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.40% anticipated through 2033. This upward trajectory is primarily fueled by the escalating demand for enhanced food safety and quality, driven by stringent regulatory frameworks and increasing consumer expectations. The imperative to optimize production efficiency, reduce operational costs, and minimize waste across diverse food processing segments like dairy, bakery, meat, poultry, seafood, and beverages is a key catalyst. Furthermore, the growing adoption of advanced technologies such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning is revolutionizing manufacturing processes, enabling predictive maintenance, real-time monitoring, and improved supply chain management. The increasing need for sophisticated packaging and repackaging solutions to extend shelf life and ensure product integrity also plays a crucial role in market expansion.

Food and Beverage Automation Market Market Size (In Million)

The market's growth is further supported by a broad spectrum of technological advancements within operational technology and software, including Distributed Control Systems (DCS), Manufacturing Execution Systems (MES), Variable-Frequency Drives (VFDs), advanced valves and actuators, and sophisticated sensors and transmitters. These components are instrumental in automating complex food and beverage production lines, from initial processing to intricate sorting, grading, and palletizing operations. Key industry players like Siemens AG, Rockwell Automation Inc., ABB Limited, and Honeywell International Inc. are actively investing in research and development, introducing innovative solutions tailored to the specific needs of the food and beverage industry. While the market presents a promising outlook, potential challenges such as the high initial investment costs for automation systems and the need for skilled labor to operate and maintain these advanced technologies may present some headwinds. Nevertheless, the overwhelming benefits in terms of productivity, consistency, and adherence to global quality standards are expected to drive sustained market growth.

Food and Beverage Automation Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Food and Beverage Automation Market, a dynamic sector poised for significant expansion. Explore critical market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape. With a focus on actionable insights and quantitative data, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving automation needs within the food and beverage industry.

Food and Beverage Automation Market Market Dynamics & Structure

The Food and Beverage Automation Market is characterized by increasing consolidation and rapid technological advancement, driven by the persistent demand for enhanced efficiency, improved product quality, and stringent regulatory compliance. Market concentration is moderate, with key players actively engaged in strategic mergers and acquisitions to expand their product portfolios and geographical reach. Technological innovation is primarily fueled by the pursuit of smarter, more adaptable automation solutions, including AI-powered robotics, advanced sensor technologies, and integrated software platforms. Regulatory frameworks, particularly those related to food safety and traceability, act as both a driver and a constraint, pushing for greater automation to meet compliance standards. Competitive product substitutes are emerging in niche areas, but the core automation solutions remain dominant. End-user demographics show a growing adoption across all segments, with SMEs increasingly seeking cost-effective automation solutions. M&A trends indicate a focus on acquiring companies with specialized expertise in areas like industrial robotics and advanced software solutions.

- Market Concentration: Moderate, with strategic M&A activities driving consolidation.

- Technological Innovation Drivers: AI in robotics, advanced sensor networks, IoT integration, predictive maintenance.

- Regulatory Frameworks: Food safety (HACCP, FSMA), traceability mandates, quality control standards.

- Competitive Product Substitutes: Niche automation tools, manual processes in smaller operations.

- End-User Demographics: Growing adoption across dairy, bakery, meat, beverage, and fruit & vegetable processing.

- M&A Trends: Acquisitions of specialized technology providers and integration solution experts.

Food and Beverage Automation Market Growth Trends & Insights

The Food and Beverage Automation Market is projected for robust growth, driven by a confluence of factors including the increasing global population, rising disposable incomes, and the escalating consumer demand for safe, high-quality food products. The market size is expected to witness substantial expansion from xx million units in 2025 to xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Adoption rates for automation technologies are accelerating across the industry, spurred by the need to address labor shortages, reduce operational costs, and enhance productivity. Technological disruptions such as the integration of artificial intelligence (AI) and machine learning (ML) in automation systems are revolutionizing processing, packaging, and quality control. For instance, AI-powered vision systems are enabling more precise sorting and grading, while ML algorithms are optimizing production schedules and minimizing waste. Consumer behavior shifts towards convenience, personalized products, and increased awareness of food origin and safety are further pushing the demand for traceable and efficient automated processes. The digitalization of manufacturing, often referred to as Industry 4.0, is a key trend, with the implementation of Industrial Internet of Things (IIoT) devices enabling real-time data collection and analysis, leading to smarter decision-making and optimized operations. The adoption of automation is no longer limited to large multinational corporations; small and medium-sized enterprises (SMEs) are increasingly investing in scalable automation solutions to remain competitive. This trend is further amplified by government initiatives promoting industrial modernization and the adoption of advanced manufacturing technologies. The focus on sustainability is also a significant growth driver, as automation can lead to reduced energy consumption and waste generation.

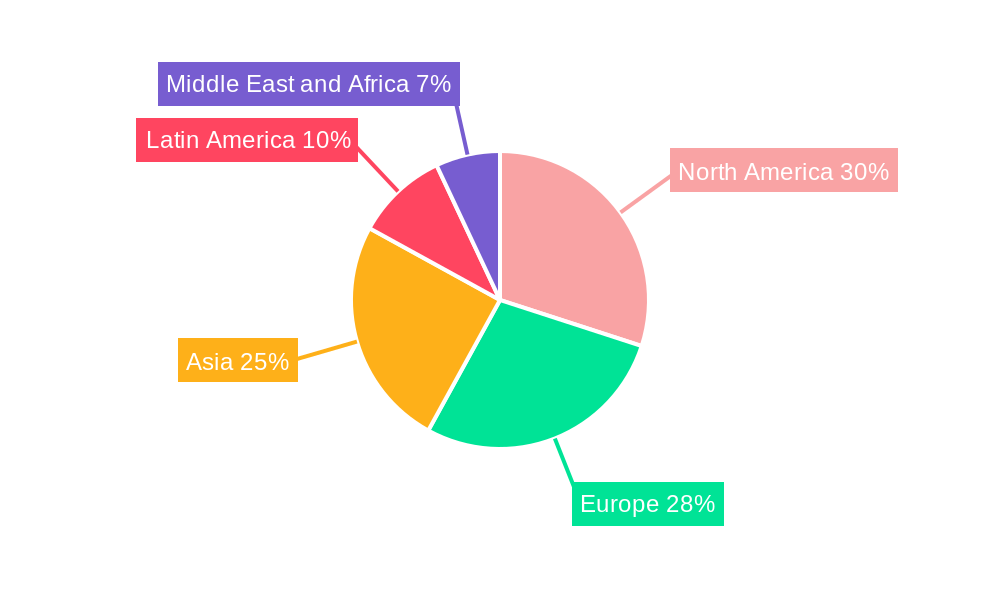

Dominant Regions, Countries, or Segments in Food and Beverage Automation Market

North America, particularly the United States, stands as a dominant region in the Food and Beverage Automation Market. This leadership is attributed to its well-established food processing industry, significant investments in research and development, and a strong regulatory push for enhanced food safety and traceability. The region's robust economic policies and advanced infrastructure provide a fertile ground for the adoption of sophisticated automation technologies.

Within the Operational Technology and Software segment, Distributed Control Systems (DCS) and Manufacturing Execution Systems (MES) are key drivers of market growth. DCS provides centralized control and monitoring of complex industrial processes, crucial for ensuring consistency and efficiency in food production. MES bridges the gap between enterprise resource planning (ERP) systems and the factory floor, offering real-time visibility into production operations, quality management, and performance tracking. The increasing complexity of food processing lines and the demand for granular data analysis contribute to the dominance of these software solutions.

In terms of End Users, the Dairy Processing and Beverages segments are experiencing significant growth. Dairy processing benefits from automation in areas like pasteurization, homogenization, and packaging, demanding high levels of hygiene and precision. The beverage industry, with its high-volume production needs and diverse product lines, relies heavily on automated filling, capping, and labeling systems. The growing consumer demand for specialized dairy products and a wide array of beverages fuels this expansion.

The Packaging and Repackaging application segment is also a major contributor to market growth. Automation in this area ensures product integrity, extends shelf life, and enhances the visual appeal of food and beverage products. High-speed filling, sealing, and labeling machines, along with automated palletizing solutions, are critical for meeting market demands and reducing labor costs.

- Dominant Region: North America (United States)

- Key Drivers: Advanced food processing infrastructure, R&D investments, stringent food safety regulations, favorable economic policies.

- Dominant Operational Technology and Software Segment:

- Distributed Control Systems (DCS): Centralized process control, consistency, efficiency.

- Manufacturing Execution Systems (MES): Real-time production visibility, quality management, performance tracking.

- Dominant End User Segments:

- Dairy Processing: Hygiene, precision in pasteurization, homogenization, packaging.

- Beverages: High-volume production, filling, capping, labeling automation.

- Dominant Application Segment:

- Packaging and Repackaging: Product integrity, shelf-life extension, visual appeal, high-speed operations.

Food and Beverage Automation Market Product Landscape

The Food and Beverage Automation Market is witnessing a surge in product innovations aimed at enhancing efficiency, safety, and flexibility. Advanced Industrial Robotics, particularly collaborative robots (cobots), are gaining traction due to their ability to work alongside human operators, offering increased flexibility in tasks like picking, packing, and palletizing. Sensors and Transmitters are becoming more sophisticated, enabling real-time monitoring of critical parameters such as temperature, humidity, and pH levels with unparalleled accuracy, crucial for maintaining product quality and safety. Variable-frequency Drives (VFDs) are optimizing energy consumption in motor-driven applications, leading to significant cost savings and environmental benefits. The integration of AI and machine learning into Distributed Control Systems (DCS) and Manufacturing Execution Systems (MES) allows for predictive maintenance, optimized process control, and enhanced traceability throughout the supply chain. These advancements are not merely incremental; they represent a paradigm shift towards intelligent, interconnected automation solutions designed to meet the evolving demands of the global food and beverage industry.

Key Drivers, Barriers & Challenges in Food and Beverage Automation Market

The Food and Beverage Automation Market is propelled by several key drivers. The growing global population and rising demand for food products necessitate increased production efficiency, which automation directly addresses. Labor shortages and rising labor costs are compelling manufacturers to invest in automated solutions to maintain productivity and reduce operational expenses. Stringent food safety regulations and the increasing consumer demand for traceability further push the adoption of automated systems that can ensure quality control and provide detailed record-keeping. Technological advancements, including AI, robotics, and IoT, are offering more sophisticated and cost-effective automation options.

However, significant barriers and challenges exist. The initial capital investment required for implementing advanced automation systems can be substantial, posing a hurdle for small and medium-sized enterprises. The complexity of integrating new automation technologies with existing legacy systems can also be a challenge. A shortage of skilled labor capable of operating and maintaining these advanced automated systems is another critical restraint. Furthermore, cybersecurity concerns related to interconnected automated systems need to be adequately addressed to prevent data breaches and operational disruptions. Supply chain disruptions and the availability of critical components can also impact deployment timelines and costs.

Emerging Opportunities in Food and Beverage Automation Market

Emerging opportunities in the Food and Beverage Automation Market are centered around niche applications and advancements in intelligent automation. The demand for personalized and ready-to-eat meals is driving innovation in automated portioning, cooking, and packaging systems. The growth of the plant-based food sector presents a unique opportunity for automation in the processing of alternative proteins, requiring specialized handling and production techniques. Furthermore, the development of more affordable and user-friendly automation solutions for SMEs will unlock significant untapped markets. The increasing focus on sustainability is creating opportunities for automation that optimizes resource utilization, reduces waste, and improves energy efficiency throughout the food production lifecycle. The integration of blockchain technology for enhanced traceability and transparency in the food supply chain, powered by automation, also represents a significant emerging area.

Growth Accelerators in the Food and Beverage Automation Market Industry

Long-term growth in the Food and Beverage Automation Market is being significantly accelerated by continuous technological breakthroughs in areas like artificial intelligence, machine learning, and advanced robotics. The development of collaborative robots (cobots) that can safely work alongside human operators is expanding the scope of automation to more intricate tasks. Strategic partnerships between automation providers and food manufacturers are crucial for co-developing tailored solutions that address specific industry challenges. Market expansion strategies, particularly in emerging economies with rapidly growing food consumption, are opening up new avenues for automation adoption. The increasing government support for industrial modernization and digitalization further acts as a catalyst for sustained growth.

Key Players Shaping the Food and Beverage Automation Market Market

- Honeywell International Inc

- Rexnord Corporation (Regal Rexnord Corporation)

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- GEA Group AG

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- ABB Limited

- Yaskawa Electric Corporation

- Emerson Electric Company

Notable Milestones in Food and Beverage Automation Market Sector

- Mar 2023: ForgeOS integrated with Rockwell's Logix controllers and design and simulation software by Rockwell and READY Robotics. This integration aims to simplify robot integration and reduce industrial automation deployment time to market.

- Jan 2023: Teway Food installed ABB's automated solution, including 10 IRB 6700 robots, 65 IRB 360 delta robots, three IRB 660 robots, and a 3D vision system for product identification and location. This upgrade enhanced their production line to meet increasing demand for compound seasoning, marking TewayFood as the first company in the industry to use 3D vision-assisted robot positioning for feeding production lines.

In-Depth Food and Beverage Automation Market Market Outlook

The future outlook for the Food and Beverage Automation Market is exceptionally bright, fueled by a combination of sustained demand and accelerating technological innovation. Growth accelerators such as the continued integration of AI and ML for predictive analytics and process optimization will drive unprecedented levels of efficiency and product consistency. Strategic collaborations between technology providers and food industry giants will lead to the development of highly specialized and scalable automation solutions. The expanding middle class in emerging economies will further propel demand for automated food processing to meet growing consumption needs. Moreover, an increasing focus on sustainable production practices will drive the adoption of automation technologies that minimize waste and optimize resource utilization, solidifying the market's trajectory towards a more intelligent, efficient, and responsible future.

Food and Beverage Automation Market Segmentation

-

1. Operational Technology and Software

- 1.1. Distributed Control System (DCS)

- 1.2. Manufacturing Execution Systems (MES)

- 1.3. Variable-frequency Drive (VFD)

- 1.4. Valves and Actuators

- 1.5. Electric Motors

- 1.6. Sensors and Transmitters

- 1.7. Industrial Robotics

- 1.8. Other Technologies

-

2. End User

- 2.1. Dairy Processing

- 2.2. Bakery and Confectionary

- 2.3. Meat, Poultry, and Seafood

- 2.4. Fruits and Vegetables

- 2.5. Beverages

- 2.6. Other End Users

-

3. Application

- 3.1. Packaging and Repackaging

- 3.2. Palletizing

- 3.3. Sorting and Grading

- 3.4. Processing

- 3.5. Other Applications

Food and Beverage Automation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Food and Beverage Automation Market Regional Market Share

Geographic Coverage of Food and Beverage Automation Market

Food and Beverage Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Food Safety and Rising Demand for Processed Food

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental and Safety Regulations; Increasing Competition from the Unorganized Sectors

- 3.4. Market Trends

- 3.4.1. Beverages End-user Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 5.1.1. Distributed Control System (DCS)

- 5.1.2. Manufacturing Execution Systems (MES)

- 5.1.3. Variable-frequency Drive (VFD)

- 5.1.4. Valves and Actuators

- 5.1.5. Electric Motors

- 5.1.6. Sensors and Transmitters

- 5.1.7. Industrial Robotics

- 5.1.8. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Dairy Processing

- 5.2.2. Bakery and Confectionary

- 5.2.3. Meat, Poultry, and Seafood

- 5.2.4. Fruits and Vegetables

- 5.2.5. Beverages

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Packaging and Repackaging

- 5.3.2. Palletizing

- 5.3.3. Sorting and Grading

- 5.3.4. Processing

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 6. North America Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 6.1.1. Distributed Control System (DCS)

- 6.1.2. Manufacturing Execution Systems (MES)

- 6.1.3. Variable-frequency Drive (VFD)

- 6.1.4. Valves and Actuators

- 6.1.5. Electric Motors

- 6.1.6. Sensors and Transmitters

- 6.1.7. Industrial Robotics

- 6.1.8. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Dairy Processing

- 6.2.2. Bakery and Confectionary

- 6.2.3. Meat, Poultry, and Seafood

- 6.2.4. Fruits and Vegetables

- 6.2.5. Beverages

- 6.2.6. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Packaging and Repackaging

- 6.3.2. Palletizing

- 6.3.3. Sorting and Grading

- 6.3.4. Processing

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 7. Europe Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 7.1.1. Distributed Control System (DCS)

- 7.1.2. Manufacturing Execution Systems (MES)

- 7.1.3. Variable-frequency Drive (VFD)

- 7.1.4. Valves and Actuators

- 7.1.5. Electric Motors

- 7.1.6. Sensors and Transmitters

- 7.1.7. Industrial Robotics

- 7.1.8. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Dairy Processing

- 7.2.2. Bakery and Confectionary

- 7.2.3. Meat, Poultry, and Seafood

- 7.2.4. Fruits and Vegetables

- 7.2.5. Beverages

- 7.2.6. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Packaging and Repackaging

- 7.3.2. Palletizing

- 7.3.3. Sorting and Grading

- 7.3.4. Processing

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 8. Asia Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 8.1.1. Distributed Control System (DCS)

- 8.1.2. Manufacturing Execution Systems (MES)

- 8.1.3. Variable-frequency Drive (VFD)

- 8.1.4. Valves and Actuators

- 8.1.5. Electric Motors

- 8.1.6. Sensors and Transmitters

- 8.1.7. Industrial Robotics

- 8.1.8. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Dairy Processing

- 8.2.2. Bakery and Confectionary

- 8.2.3. Meat, Poultry, and Seafood

- 8.2.4. Fruits and Vegetables

- 8.2.5. Beverages

- 8.2.6. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Packaging and Repackaging

- 8.3.2. Palletizing

- 8.3.3. Sorting and Grading

- 8.3.4. Processing

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 9. Latin America Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 9.1.1. Distributed Control System (DCS)

- 9.1.2. Manufacturing Execution Systems (MES)

- 9.1.3. Variable-frequency Drive (VFD)

- 9.1.4. Valves and Actuators

- 9.1.5. Electric Motors

- 9.1.6. Sensors and Transmitters

- 9.1.7. Industrial Robotics

- 9.1.8. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Dairy Processing

- 9.2.2. Bakery and Confectionary

- 9.2.3. Meat, Poultry, and Seafood

- 9.2.4. Fruits and Vegetables

- 9.2.5. Beverages

- 9.2.6. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Packaging and Repackaging

- 9.3.2. Palletizing

- 9.3.3. Sorting and Grading

- 9.3.4. Processing

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 10. Middle East and Africa Food and Beverage Automation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 10.1.1. Distributed Control System (DCS)

- 10.1.2. Manufacturing Execution Systems (MES)

- 10.1.3. Variable-frequency Drive (VFD)

- 10.1.4. Valves and Actuators

- 10.1.5. Electric Motors

- 10.1.6. Sensors and Transmitters

- 10.1.7. Industrial Robotics

- 10.1.8. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Dairy Processing

- 10.2.2. Bakery and Confectionary

- 10.2.3. Meat, Poultry, and Seafood

- 10.2.4. Fruits and Vegetables

- 10.2.5. Beverages

- 10.2.6. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Packaging and Repackaging

- 10.3.2. Palletizing

- 10.3.3. Sorting and Grading

- 10.3.4. Processing

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rexnord Corporation (Regal Rexnord Corporation)*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Electric Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schneider Electric SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GEA Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockwell Automation Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yokogawa Electric Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABB Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yaskawa Electric Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Emerson Electric Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Food and Beverage Automation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 3: North America Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 4: North America Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 11: Europe Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 12: Europe Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 19: Asia Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 20: Asia Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 27: Latin America Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 28: Latin America Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2025 & 2033

- Figure 35: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2025 & 2033

- Figure 36: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 2: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Food and Beverage Automation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 6: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 12: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 19: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia and New Zealand Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 27: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2020 & 2033

- Table 31: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food and Beverage Automation Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Food and Beverage Automation Market?

Key companies in the market include Honeywell International Inc, Rexnord Corporation (Regal Rexnord Corporation)*List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, GEA Group AG, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, Yaskawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the Food and Beverage Automation Market?

The market segments include Operational Technology and Software, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Food Safety and Rising Demand for Processed Food.

6. What are the notable trends driving market growth?

Beverages End-user Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Environmental and Safety Regulations; Increasing Competition from the Unorganized Sectors.

8. Can you provide examples of recent developments in the market?

Mar 2023: ForgeOS integrated with Rockwell's Logix controllers and design and simulation software by Rockwell and READY Robotics. The combination will make robot integration easier and reduce industrial automation deployment time to market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food and Beverage Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food and Beverage Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food and Beverage Automation Market?

To stay informed about further developments, trends, and reports in the Food and Beverage Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence