Key Insights

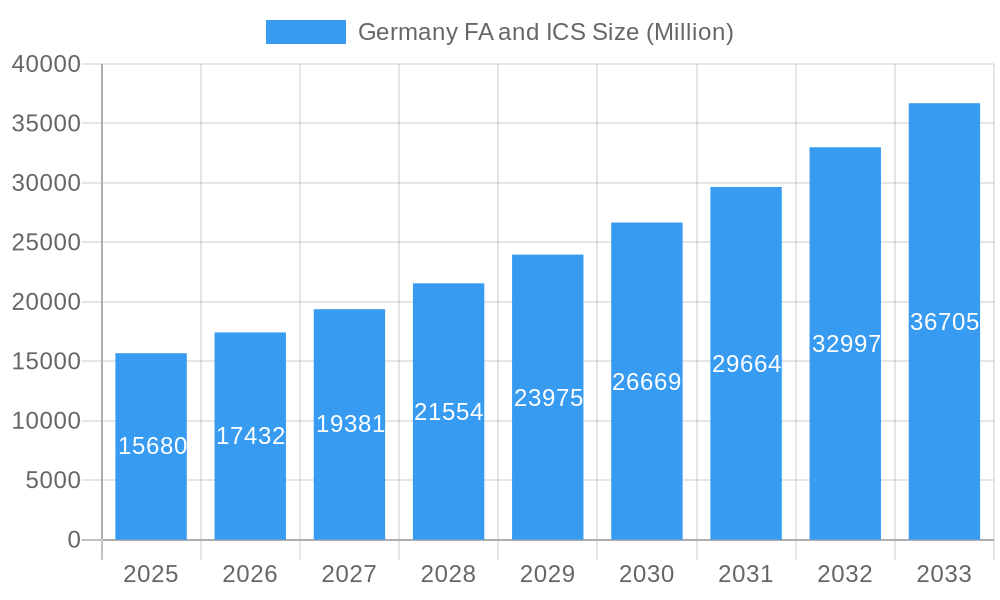

The German Factory Automation (FA) and Industrial Control Systems (ICS) market is poised for significant expansion, projected to reach approximately USD 15,680 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.66%. This substantial growth is fueled by several key drivers, including the increasing adoption of Industry 4.0 principles, which emphasize smart manufacturing and interconnected systems. The German manufacturing sector's strong commitment to innovation and efficiency necessitates advanced automation solutions to maintain its competitive edge. Furthermore, escalating investments in digitalization across industries like automotive, chemical, and pharmaceuticals are propelling the demand for sophisticated ICS and FA components. The trend towards enhanced operational efficiency, predictive maintenance, and improved product quality, all achievable through advanced automation, underpins this market's upward trajectory. Emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Industrial Internet of Things (IIoT) are further accelerating the integration of intelligent solutions, creating a dynamic and evolving market landscape.

Germany FA and ICS Market Size (In Billion)

Despite the overwhelmingly positive outlook, certain restraints could temper the pace of growth. The high initial investment costs associated with implementing comprehensive FA and ICS solutions can be a barrier for small and medium-sized enterprises (SMEs). Additionally, a shortage of skilled personnel capable of deploying, managing, and maintaining these complex systems presents a significant challenge. Cybersecurity concerns also remain a critical factor, as the increasing interconnectedness of industrial systems creates vulnerabilities that require stringent security measures. However, the inherent benefits of improved productivity, reduced operational costs, and enhanced safety are expected to outweigh these challenges, driving continued adoption. The market is segmented across various Industrial Control Systems, including Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), and Supervisory Control and Data Acquisition (SCADA), as well as essential Field Devices like Machine Vision and Industrial Robotics, catering to a diverse range of end-user industries.

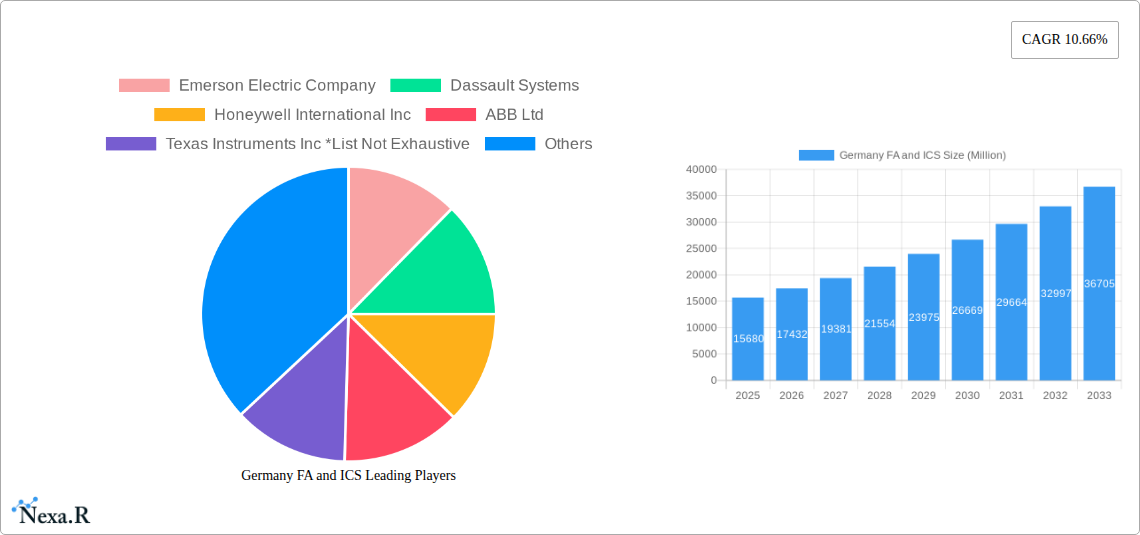

Germany FA and ICS Company Market Share

Comprehensive Report: Germany Factory Automation (FA) and Industrial Control Systems (ICS) Market Analysis (2019-2033)

This in-depth report provides a detailed analysis of the Germany Factory Automation (FA) and Industrial Control Systems (ICS) market, encompassing its current dynamics, historical trends, and future projections. With a study period of 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report leverages robust market intelligence to offer actionable insights for industry stakeholders.

Germany FA and ICS Market Dynamics & Structure

The German Factory Automation (FA) and Industrial Control Systems (ICS) market is characterized by a dynamic and evolving landscape, driven by strong industrial output and a consistent push for digital transformation. Market concentration is moderate, with a few dominant players alongside a robust ecosystem of specialized solution providers. Technological innovation is a primary driver, fueled by Industry 4.0 initiatives, the integration of AI and IoT in industrial processes, and the increasing demand for smart manufacturing solutions. Regulatory frameworks, particularly concerning cybersecurity for critical infrastructure and environmental standards, play a significant role in shaping market adoption and product development. Competitive product substitutes are abundant, ranging from legacy systems to advanced integrated solutions, creating a competitive environment where value, performance, and future-proofing are key differentiators. End-user demographics are diverse, with significant demand originating from the automotive, chemical, and manufacturing sectors. Mergers and Acquisitions (M&A) trends indicate a consolidation within larger players seeking to broaden their technology portfolios and market reach, while smaller firms focus on niche specialization.

- Market Concentration: Moderate, with a mix of global leaders and specialized regional players.

- Key Innovation Drivers: Industry 4.0, AI integration, IoT adoption, cybersecurity advancements.

- Regulatory Influence: Cybersecurity standards (e.g., NIS Directive), environmental regulations, occupational safety.

- Competitive Landscape: Intense competition driven by technological advancements and price pressures.

- M&A Trends: Strategic acquisitions to enhance capabilities and market share.

- End-User Demand: Strong from automotive, chemical, power, and manufacturing sectors.

Germany FA and ICS Growth Trends & Insights

The Germany FA and ICS market is projected to experience sustained growth, driven by the nation's robust manufacturing base and its commitment to digital innovation. The market size evolution will be shaped by the increasing adoption of advanced automation technologies across various industries. Adoption rates for solutions like Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), and Supervisory Control and Data Acquisition (SCADA) systems continue to rise as companies seek to optimize production efficiency, reduce operational costs, and enhance product quality. Technological disruptions, including the advancement of edge computing for real-time data processing, the proliferation of industrial IoT (IIoT) platforms, and the integration of artificial intelligence and machine learning for predictive maintenance and process optimization, are fundamentally reshaping the market. Consumer behavior shifts are evident as German industries prioritize sustainability, energy efficiency, and enhanced worker safety, directly influencing the demand for specific FA and ICS solutions. The market penetration of sophisticated automation technologies is expected to deepen, moving beyond large enterprises to encompass a broader spectrum of medium-sized businesses.

The CAGR for the Germany FA and ICS market is estimated at xx% from 2025 to 2033. Market penetration for advanced ICS solutions is projected to reach xx% by 2033, indicating a significant shift towards digitalized operations. The parent market, encompassing all industrial automation and control technologies, is expected to grow at a CAGR of xx% during the forecast period, with the Germany FA and ICS market contributing significantly as a mature yet innovative segment. The child markets, focusing on specific components like sensors and robotics, will experience varying growth rates, influenced by their direct integration into broader FA and ICS solutions. For instance, the machine vision segment is anticipated to grow at a CAGR of xx% due to its critical role in quality control and inspection within automated production lines. Similarly, industrial robotics are expected to see a CAGR of xx%, driven by the need for increased precision and repetitive task automation. The adoption of PLCs and DCS, foundational ICS technologies, will remain strong, with a projected CAGR of xx% and xx% respectively, as they form the backbone of many industrial control architectures. SCADA systems will also witness steady growth, with a CAGR of xx%, as they enable centralized monitoring and control of geographically dispersed operations. The report estimates the total market size for Germany FA and ICS to reach approximately $xx Billion in 2025, with a projected growth to $xx Billion by 2033. This growth will be fueled by investments in smart factories, operational efficiency improvements, and the ongoing digital transformation initiatives across key German industries. The increasing demand for energy-efficient solutions and advanced safety systems will further propel market expansion.

Dominant Regions, Countries, or Segments in Germany FA and ICS

Within Germany, the Bavaria region is a dominant force in the Factory Automation (FA) and Industrial Control Systems (ICS) market, acting as a significant driver of growth and innovation. This dominance is underpinned by a powerful industrial ecosystem, particularly in sectors like automotive manufacturing, advanced engineering, and technology development. The presence of major automotive hubs, including Munich and Ingolstadt, necessitates sophisticated FA and ICS solutions for assembly lines, powertrain production, and autonomous driving technology development. These industries require advanced Programmable Logic Controllers (PLCs) for intricate process control, Supervisory Control and Data Acquisition (SCADA) systems for real-time monitoring and management of complex operations, and sophisticated Human Machine Interfaces (HMIs) for intuitive operator interaction.

Furthermore, Bavaria's strong emphasis on research and development, coupled with a high concentration of universities and research institutions, fosters a climate conducive to technological advancements in automation. This leads to a higher adoption rate of cutting-edge technologies, including Product Lifecycle Management (PLM) and Manufacturing Execution Systems (MES), which are crucial for optimizing the entire product development and manufacturing lifecycle. The Chemical and Petrochemical sector, also prominent in certain Bavarian areas, relies heavily on robust DCS and specialized safety systems to manage complex and hazardous processes, further boosting the demand for comprehensive ICS solutions. The "Other End-user Industries" also contribute significantly, encompassing a wide range of specialized manufacturing and high-tech applications.

- Dominant Segment - Industrial Control Systems (ICS): Specifically, Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) are paramount, forming the core of automation in Germany's manufacturing prowess. Their market share within the overall FA and ICS landscape in Bavaria is estimated at xx%.

- Key Economic Policies: Government initiatives supporting Industry 4.0, digitalization, and advanced manufacturing directly benefit the FA and ICS sector in Bavaria.

- Infrastructure: Excellent logistical infrastructure, including transportation networks and high-speed internet, facilitates the implementation and integration of sophisticated FA and ICS solutions.

- Market Share: Bavaria accounts for an estimated xx% of the total German FA and ICS market revenue.

- Growth Potential: The continued expansion of the automotive industry, coupled with investments in sustainable manufacturing and smart factories, ensures strong growth potential for FA and ICS solutions in the region.

- Child Market Dominance: Within Field Devices, Sensors & Transmitters, driven by the need for precise data acquisition in complex manufacturing environments, show exceptional growth, with an estimated xx% market share in Bavaria.

Germany FA and ICS Product Landscape

The Germany FA and ICS product landscape is defined by a commitment to precision, reliability, and integration. Companies are continuously innovating to develop solutions that enhance operational efficiency and enable smart manufacturing. This includes the development of advanced PLC platforms with enhanced processing power and connectivity, sophisticated DCS for seamless plant-wide control, and intuitive HMI touchscreens for improved user experience. In the field devices segment, innovations in machine vision systems offer unparalleled accuracy in quality inspection, while advancements in industrial robotics provide greater dexterity and collaborative capabilities. Sensors and transmitters are becoming more intelligent, offering predictive diagnostics and enhanced data accuracy. The integration of these components into comprehensive PLM and MES solutions allows for end-to-end visibility and control over the manufacturing process, from design to delivery. These products are designed to meet stringent German and EU standards for safety, cybersecurity, and environmental compliance, ensuring robust performance in demanding industrial settings.

Key Drivers, Barriers & Challenges in Germany FA and ICS

Key Drivers: The German FA and ICS market is propelled by several key drivers. The overarching push towards Industry 4.0 and smart manufacturing remains the most significant catalyst, encouraging the adoption of interconnected and intelligent automation solutions. High labor costs incentivize companies to invest in automation to improve productivity and reduce reliance on manual labor. Stringent quality standards and the need for precision in German manufacturing necessitate advanced control systems and field devices. Government initiatives and funding supporting digitalization and technological upgrades further bolster market growth.

Barriers & Challenges: Despite its strengths, the market faces certain barriers and challenges. The high initial investment cost for implementing advanced FA and ICS solutions can be a significant hurdle, particularly for small and medium-sized enterprises (SMEs). Cybersecurity concerns are paramount, as interconnected systems are vulnerable to sophisticated threats, requiring robust security measures and constant vigilance. Skills gap in the workforce, with a shortage of trained personnel to operate and maintain these complex systems, presents a considerable challenge. Integration complexity of new systems with legacy infrastructure can also be a technical and logistical barrier, impacting the seamless adoption of new technologies. Supply chain disruptions, as seen in recent global events, can also affect the availability and cost of critical components, impacting project timelines and budgets.

Emerging Opportunities in Germany FA and ICS

Emerging opportunities in the German FA and ICS sector lie in the growing demand for sustainable manufacturing solutions, driven by stringent environmental regulations and corporate sustainability goals. The integration of AI and machine learning for predictive maintenance and process optimization presents a significant avenue for enhanced operational efficiency. The expansion of IIoT platforms to enable seamless data exchange between devices and systems opens up new possibilities for real-time analytics and decision-making. Furthermore, the increasing focus on cybersecurity solutions tailored for industrial environments offers a lucrative niche. The development and adoption of collaborative robots (cobots) in conjunction with advanced safety systems are also creating new application areas, particularly in sectors requiring human-robot interaction.

Growth Accelerators in the Germany FA and ICS Industry

Several catalysts are accelerating the growth of the Germany FA and ICS industry. Technological breakthroughs in areas such as AI-powered analytics, edge computing, and advanced sensor technology are enabling more sophisticated and efficient automation. Strategic partnerships between technology providers, system integrators, and end-users are crucial for developing tailored solutions and facilitating wider adoption. Market expansion strategies, including the development of modular and scalable solutions, are making advanced automation more accessible to a broader range of businesses. The increasing emphasis on energy efficiency and resource optimization within industrial processes also acts as a significant growth accelerator, driving demand for intelligent control systems.

Key Players Shaping the Germany FA and ICS Market

- Emerson Electric Company

- Dassault Systems

- Honeywell International Inc

- ABB Ltd

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Autodesk Inc

- Robert Bosch GmbH

- Rockwell Automation Inc

Notable Milestones in Germany FA and ICS Sector

- March 2021: BP and SABIC (Saudi Basic Industries Corp.) signed an agreement for a joint venture at a chemical complex in Gelsenkirchen, Germany, focusing on increasing the production of certified circular products from mixed plastics, reducing fossil resource reliance in petrochemical plants.

- July 2020: K+S, an international mining company, implemented an AP Sensing Linear Heat Detection (LHD) solution for early fire detection at a salt production site in Germany.

In-Depth Germany FA and ICS Market Outlook

The Germany FA and ICS market outlook is exceptionally positive, driven by continuous technological advancements and a strong commitment to industrial modernization. Growth accelerators such as the widespread adoption of AI for predictive maintenance, the increasing integration of IIoT platforms for enhanced data analytics, and the development of more advanced and cost-effective sensors will continue to shape the market. Strategic partnerships aimed at creating end-to-end automation solutions and the expansion of these solutions into new industrial applications will further fuel market growth. The robust demand for energy-efficient and sustainable manufacturing processes will also be a significant factor, positioning Germany at the forefront of the global industrial automation revolution and offering substantial future market potential.

Germany FA and ICS Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Manufacturing Execution System (MES)

- 1.1.6. Human Machine Interface (HMI)

- 1.1.7. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Industrial Robotics

- 1.2.3. Electric Motors

- 1.2.4. Safety Systems

- 1.2.5. Sensors & Transmitters

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverage

- 2.5. Automotive and Transportation

- 2.6. Pharmaceutical

- 2.7. Other End-user Industries

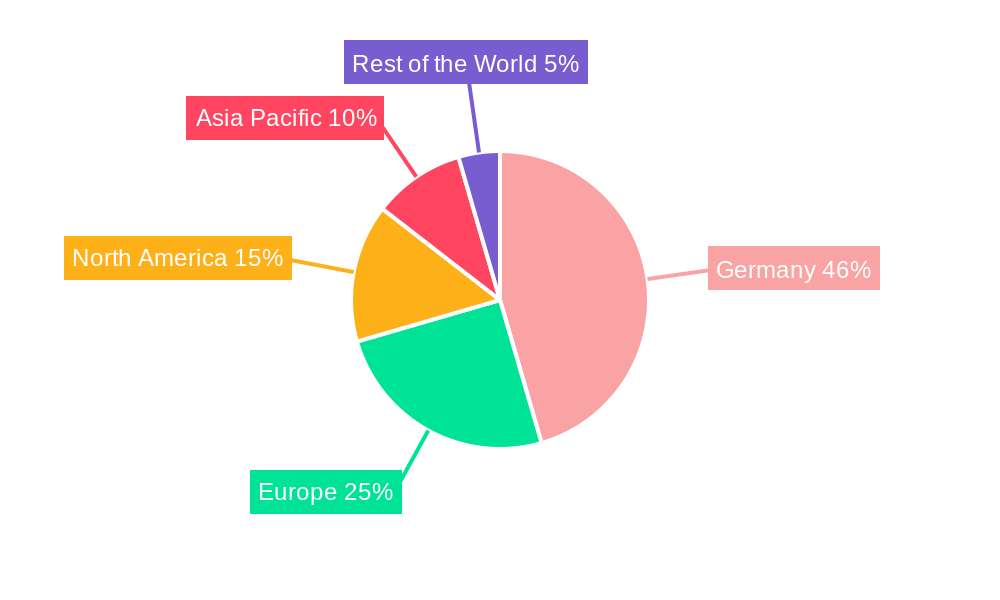

Germany FA and ICS Segmentation By Geography

- 1. Germany

Germany FA and ICS Regional Market Share

Geographic Coverage of Germany FA and ICS

Germany FA and ICS REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gaining Prominence for Automation Technologies; Increasing Focus Towards Cost Optimization and Business Process Improvement

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Electric Motors Segment is Observing Significant Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Manufacturing Execution System (MES)

- 5.1.1.6. Human Machine Interface (HMI)

- 5.1.1.7. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Industrial Robotics

- 5.1.2.3. Electric Motors

- 5.1.2.4. Safety Systems

- 5.1.2.5. Sensors & Transmitters

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverage

- 5.2.5. Automotive and Transportation

- 5.2.6. Pharmaceutical

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Emerson Electric Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ABB Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Texas Instruments Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autodesk Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rockwell Automation Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Emerson Electric Company

List of Figures

- Figure 1: Germany FA and ICS Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany FA and ICS Share (%) by Company 2025

List of Tables

- Table 1: Germany FA and ICS Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Germany FA and ICS Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Germany FA and ICS Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Germany FA and ICS Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Germany FA and ICS Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Germany FA and ICS Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany FA and ICS?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Germany FA and ICS?

Key companies in the market include Emerson Electric Company, Dassault Systems, Honeywell International Inc, ABB Ltd, Texas Instruments Inc *List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Autodesk Inc, Robert Bosch GmbH, Rockwell Automation Inc.

3. What are the main segments of the Germany FA and ICS?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Gaining Prominence for Automation Technologies; Increasing Focus Towards Cost Optimization and Business Process Improvement.

6. What are the notable trends driving market growth?

Electric Motors Segment is Observing Significant Increase.

7. Are there any restraints impacting market growth?

; High Initial Investment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

March 2021 - BP and SABIC (Saudi Basic Industries Corp.), Riyadh, Saudi Arabia, signed an agreement to jointly work at the Gelsenkirchen, Germany, a chemical complex. The companies say the new collaboration will help to increase the production of certified circular products that take used mixed plastics to make feedstock, reducing the number of fossil resources required in the petrochemical plants at the site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany FA and ICS," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany FA and ICS report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany FA and ICS?

To stay informed about further developments, trends, and reports in the Germany FA and ICS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence