Key Insights

The GNSS-Enabled Consumer Device Market is projected for substantial growth, reaching an estimated $335.04 billion by 2025, with a compelling CAGR of 11.17% from 2025 to 2033. This expansion is fueled by the increasing integration of Global Navigation Satellite System (GNSS) technology into consumer electronics. Key drivers include the rising demand for fitness trackers, advancements in smartphone location services, and the growing popularity of wearables. The widespread adoption of smartwatches, fitness bands, and personal tracking devices, all reliant on GNSS for accurate positioning, significantly contributes to market expansion. Furthermore, the increasing utility of low-power asset trackers and sophisticated navigation features in personal vehicles are also propelling market momentum.

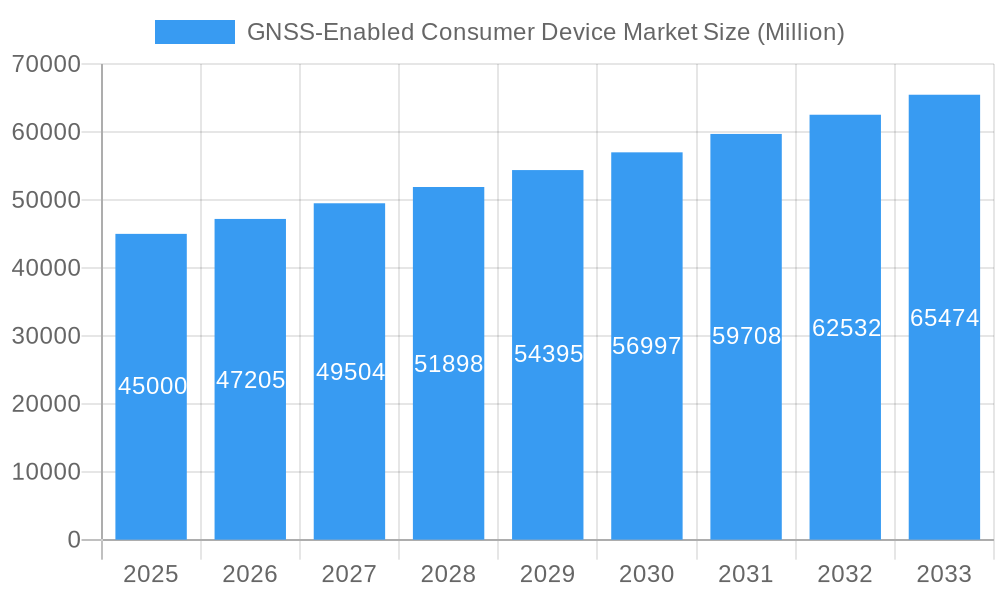

GNSS-Enabled Consumer Device Market Market Size (In Billion)

Evolving consumer preferences, such as the growing interest in outdoor activities requiring precise location tracking, are shaping the market. Ongoing miniaturization and power efficiency improvements in GNSS chips enable seamless integration into a wider range of devices. Potential restraints include the initial cost of advanced GNSS devices and data privacy concerns. Despite these challenges, continuous innovation is expected from leading companies such as Samsung Electronics, Apple Inc., and Garmin Ltd. The Asia Pacific region is anticipated to lead market growth due to its large consumer base and rapid technological adoption.

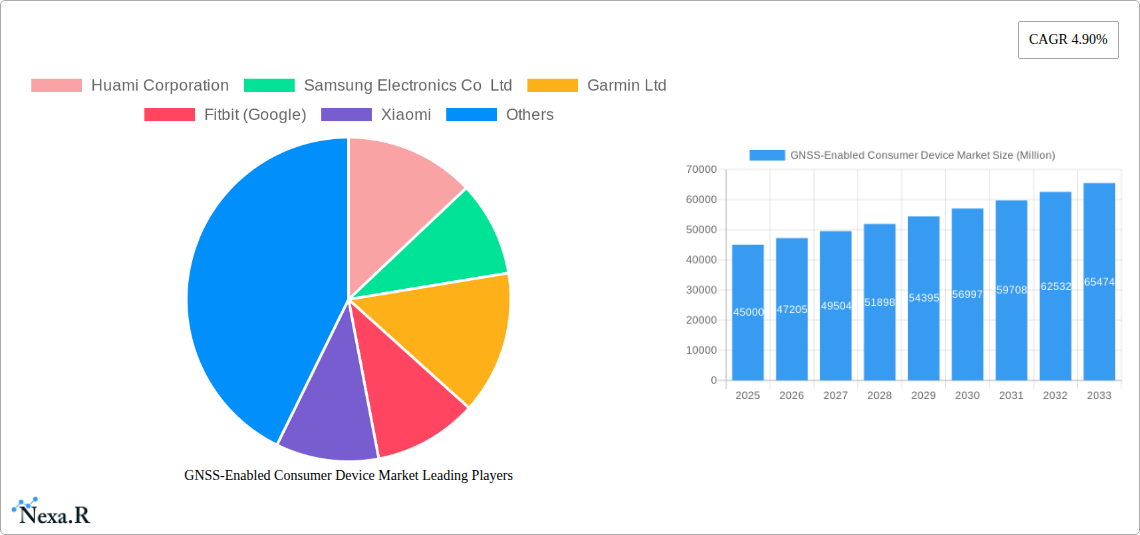

GNSS-Enabled Consumer Device Market Company Market Share

This report provides an in-depth analysis of the GNSS-enabled consumer device market, a sector experiencing rapid expansion driven by the ubiquitous integration of satellite navigation technology into everyday gadgets. From smartphones and wearables to personal tracking devices and low-power asset trackers, GNSS (Global Navigation Satellite System) is a fundamental enabler of connectivity, convenience, and enhanced user experiences. This report forecasts the market's trajectory, with a base year of 2025, providing critical insights for industry professionals, investors, and innovators seeking to capitalize on the burgeoning opportunities in this dynamic space.

GNSS-Enabled Consumer Device Market Market Dynamics & Structure

The GNSS-enabled consumer device market is characterized by a moderate to high level of concentration, with dominant players such as Apple Inc, Samsung Electronics Co Ltd, Garmin Ltd, and Xiaomi holding significant market share. Technological innovation is the primary driver, fueled by advancements in miniaturization, power efficiency, and multi-constellation support (GPS, GLONASS, Galileo, BeiDou), enabling more accurate and reliable positioning across diverse environments. Regulatory frameworks, particularly those pertaining to data privacy and security, are evolving and will shape future product development and market access. Competitive product substitutes, while less direct, include Wi-Fi triangulation and cellular triangulation, though GNSS offers superior accuracy and global coverage for many applications. End-user demographics are broad, encompassing tech-savvy millennials and Gen Z, fitness enthusiasts, outdoor adventurers, and increasingly, older adults seeking safety and tracking solutions. Mergers and acquisitions (M&A) are expected to continue as larger technology companies seek to integrate GNSS capabilities into their expanding ecosystems. For instance, Google's acquisition of Fitbit (Google) highlights the strategic importance of wearable technology with integrated positioning. The market exhibits a CAGR of XX% from 2019 to 2024.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Technological Innovation Drivers: Miniaturization, power efficiency, multi-constellation support, enhanced accuracy in urban canyons and indoors.

- Regulatory Frameworks: Focus on data privacy (GDPR, CCPA), chipset standards, and spectrum allocation.

- Competitive Substitutes: Wi-Fi triangulation, cellular triangulation (limited accuracy and coverage).

- End-User Demographics: Wide range from young, active users to elderly individuals and logistics professionals.

- M&A Trends: Strategic acquisitions to enhance product portfolios and expand market reach. The estimated M&A deal volume in the last three years is $XX billion.

GNSS-Enabled Consumer Device Market Growth Trends & Insights

The global GNSS-enabled consumer device market is poised for significant expansion, driven by the ever-increasing demand for location-aware functionalities across a multitude of applications. Market size is projected to grow from an estimated $XX billion in 2025 to $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This robust growth is underpinned by several key trends. Firstly, the rapid adoption of wearables like smartwatches and fitness trackers, which heavily rely on GNSS for activity tracking, navigation, and safety features, is a primary catalyst. The increasing prevalence of health and wellness consciousness among consumers worldwide further bolsters the demand for these devices.

Secondly, the proliferation of smartphones, which are now standard-issue GNSS receivers, ensures a massive installed base for location-based services. Apps for navigation, ride-sharing, location-based gaming, and augmented reality are continuously evolving, driving deeper engagement with GNSS capabilities. The personal tracking devices segment, including pet trackers and child locators, is also experiencing substantial growth due to rising concerns for safety and security. Furthermore, the emerging market for low-power asset trackers, particularly within the logistics and supply chain industries, presents a significant untapped potential for GNSS technology, offering real-time visibility and inventory management.

Technological disruptions, such as the development of advanced GNSS chipsets with improved accuracy, lower power consumption, and enhanced resilience to interference, are continuously pushing the boundaries of what's possible. The integration of GNSS with other sensors, like inertial measurement units (IMUs) and barometers, creates highly accurate and sophisticated positioning solutions, even in challenging environments. Consumer behavior is shifting towards an expectation of seamless and intuitive location-based experiences, driving manufacturers to innovate and integrate these features more prominently. The market penetration of GNSS-enabled consumer devices is expected to reach XX% by 2033, signifying its integral role in modern life.

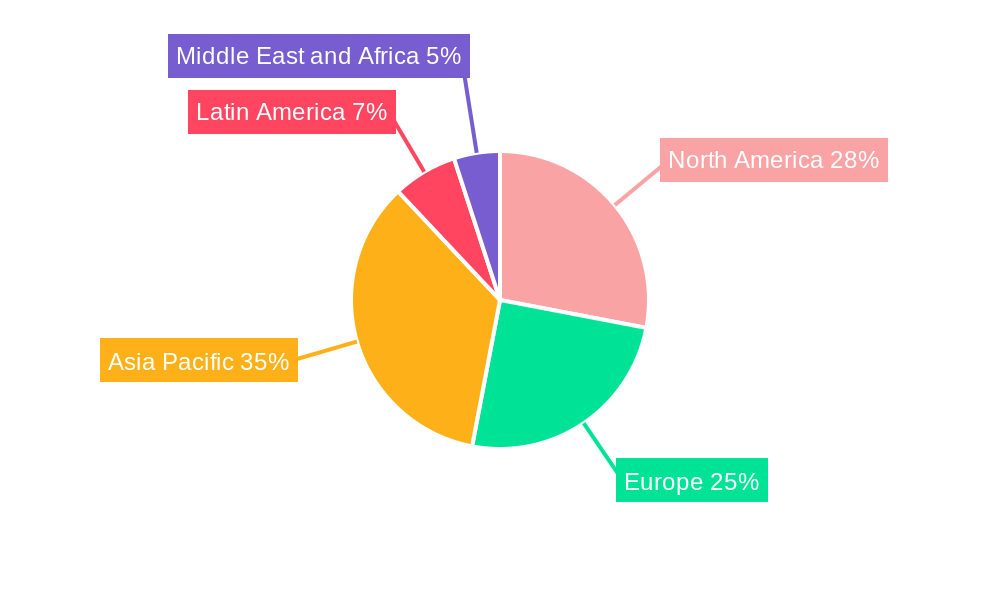

Dominant Regions, Countries, or Segments in GNSS-Enabled Consumer Device Market

The Asia Pacific region is emerging as the dominant force in the GNSS-enabled consumer device market, driven by a confluence of rapid economic growth, a burgeoning middle class with increasing disposable income, and a strong manufacturing base for consumer electronics. Countries like China and India, with their massive populations and high adoption rates for smartphones and wearables, are key contributors to this regional dominance. The widespread availability of affordable GNSS-enabled devices in these markets, coupled with growing consumer interest in fitness tracking, smart home integration, and location-based services, fuels sustained demand.

Within the Device Type segmentation, Smartphones, Tablets & Wearables collectively represent the largest and fastest-growing segment. This is attributed to the inherent GNSS capabilities built into most smartphones, making them the primary gateway for location-based services. The wearable segment, in particular, is experiencing exponential growth due to enhanced features like advanced health monitoring, GPS tracking for sports, and emergency SOS functionalities. For instance, the market share of this combined segment is estimated to be XX% in 2025.

- Dominant Region: Asia Pacific (China, India, South Korea, Japan).

- Key Drivers: High population, rising disposable incomes, strong manufacturing capabilities, rapid urbanization, government initiatives supporting digital infrastructure.

- Market Share (Asia Pacific): XX% in 2025, projected to reach YY% by 2033.

- Growth Potential: Driven by increasing adoption of IoT devices and smart cities initiatives.

- Dominant Segment: Smartphones, Tablets & Wearables.

- Key Drivers: Ubiquitous smartphone penetration, growing popularity of smartwatches and fitness trackers for health and fitness, integration with other connected devices.

- Market Share (Smartphones, Tablets & Wearables): XX% in 2025, projected to reach YY% by 2033.

- Growth Potential: Continuous innovation in wearable technology and the expansion of location-based applications.

- Key Countries Driving Growth:

- China: Largest consumer market, strong domestic brands, rapid technological adoption.

- United States: High per capita spending, strong demand for premium wearables and advanced tracking devices, early adoption of new technologies.

- India: Rapidly growing smartphone user base, increasing affordability of GNSS-enabled devices, growing awareness of health and safety features.

GNSS-Enabled Consumer Device Market Product Landscape

The GNSS-enabled consumer device market is characterized by a diverse and rapidly evolving product landscape. At its core lies the integration of advanced GNSS chipsets, such as those from Broadcom, Qualcomm, and MediaTek, offering multi-constellation support for enhanced accuracy and reliability. This enables sophisticated functionalities across various device categories. Smartphones leverage GNSS for navigation, geotagging photos, and location-based gaming. Tablets utilize it for mapping and educational applications. The wearables segment, a significant growth area, incorporates GNSS for precise fitness tracking, route mapping, and fall detection in smartwatches and activity bands. Personal tracking devices, including pet trackers and child locators, offer peace of mind through real-time location monitoring. Furthermore, the burgeoning low-power asset trackers provide critical visibility for goods in transit, rental equipment, and other movable assets, often with extended battery life and robust connectivity. Unique selling propositions revolve around accuracy, power efficiency, miniaturization, and seamless integration with cloud-based services and companion mobile applications. Technological advancements include enhanced indoor positioning capabilities, improved signal acquisition in challenging environments, and the integration of GNSS with augmented reality overlays.

Key Drivers, Barriers & Challenges in GNSS-Enabled Consumer Device Market

Key Drivers:

- Increasing Demand for Location-Based Services: The pervasive use of smartphones and wearables for navigation, fitness tracking, ride-sharing, and augmented reality applications fuels the need for accurate GNSS positioning.

- Growth of the Internet of Things (IoT): GNSS is crucial for the tracking and management of connected devices, from smart home appliances to industrial sensors and logistics assets.

- Advancements in GNSS Technology: Miniaturization of chipsets, improved power efficiency, and multi-constellation support enhance device performance and enable new applications.

- Growing Health and Fitness Consciousness: The popularity of smartwatches and fitness trackers with integrated GPS drives demand for accurate activity and route tracking.

- Safety and Security Concerns: Personal tracking devices for children and the elderly, as well as asset trackers for high-value goods, are driven by increasing safety imperatives.

Barriers & Challenges:

- Signal Interference and Multipath Effects: Urban canyons, dense foliage, and indoor environments can degrade GNSS signal accuracy, requiring sophisticated algorithms and supplementary positioning technologies.

- Power Consumption: While improving, GNSS receivers can still contribute significantly to device battery drain, necessitating careful power management strategies.

- Regulatory Hurdles and Spectrum Allocation: Evolving regulations regarding data privacy, security, and the allocation of radio frequency spectrum for GNSS services can impact market entry and product development.

- High Development Costs: Developing advanced GNSS hardware and software, including robust algorithms for signal processing and error correction, can be costly.

- Supply Chain Disruptions: Geopolitical events and component shortages can affect the availability and pricing of essential GNSS chipsets and related components. The impact of recent supply chain disruptions on market growth is estimated to be XX%.

Emerging Opportunities in GNSS-Enabled Consumer Device Market

Emerging opportunities within the GNSS-enabled consumer device market are abundant, driven by evolving consumer needs and technological advancements. The integration of GNSS with emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) presents a significant avenue for innovation, enabling predictive navigation, context-aware recommendations, and personalized user experiences. The expansion of the low-power asset tracker market into new sectors such as smart agriculture, wildlife tracking, and personal safety for lone workers offers substantial growth potential. Furthermore, the development of next-generation GNSS receivers with enhanced indoor positioning capabilities and reduced susceptibility to jamming and spoofing will unlock new applications in retail, logistics, and smart city environments. The growing demand for accurate and reliable positioning in augmented reality (AR) and virtual reality (VR) applications also presents a fertile ground for GNSS innovation.

Growth Accelerators in the GNSS-Enabled Consumer Device Market Industry

The long-term growth of the GNSS-enabled consumer device market is being accelerated by several key factors. Technological breakthroughs in GNSS chipset design, leading to smaller form factors, lower power consumption, and increased accuracy, are continuously enabling new product categories and enhancing existing ones. Strategic partnerships between GNSS technology providers, device manufacturers, and application developers are fostering innovation and expanding the ecosystem of location-based services. For example, collaborations between chipset manufacturers and smartphone brands are crucial for integrating cutting-edge GNSS capabilities into mass-market devices. Market expansion strategies, particularly in emerging economies, are also contributing significantly to growth as the adoption of smartphones and wearables continues to rise globally. The ongoing development and deployment of new GNSS constellations and augmentation systems (e.g., SBAS, GBAS) will further enhance accuracy and reliability, driving increased adoption across all segments.

Key Players Shaping the GNSS-Enabled Consumer Device Market Market

- Apple Inc

- Samsung Electronics Co Ltd

- Garmin Ltd

- Fitbit (Google)

- Xiaomi

- Huawei Technologies Co Ltd

- Fossil Group Inc

- Huami Corporation

Notable Milestones in GNSS-Enabled Consumer Device Market Sector

- 2021: Launch of Apple Watch Series 7 with enhanced GPS accuracy and battery life.

- 2021: Garmin expands its rugged outdoor watch lineup with improved multi-band GNSS support for enhanced precision.

- 2022: Samsung unveils its latest flagship smartphones with advanced GNSS capabilities, supporting multiple satellite constellations for superior location performance.

- 2022: Fitbit (Google) introduces new wearable models with integrated GPS, focusing on advanced health and fitness tracking features.

- 2023: Xiaomi launches new smart home devices incorporating GNSS for advanced location-aware functionalities and asset tracking.

- 2023: Increased adoption of low-power GNSS chipsets in compact asset trackers for logistics and supply chain management.

- 2024: Advancements in RTK (Real-Time Kinematic) technology begin to trickle into high-end consumer devices for centimeter-level accuracy.

- 2024: Growing integration of GNSS with AI/ML for predictive navigation and personalized location-based services in smartphones and wearables.

In-Depth GNSS-Enabled Consumer Device Market Market Outlook

The outlook for the GNSS-enabled consumer device market remains exceptionally strong, driven by its integral role in powering the connected world. Future growth will be significantly propelled by ongoing technological advancements in chipset design, emphasizing ultra-low power consumption and heightened accuracy, even in challenging signal environments. The expanding ecosystem of IoT devices, where precise location data is paramount for asset tracking, smart logistics, and autonomous systems, will continue to be a major growth accelerator. Furthermore, the increasing integration of GNSS with augmented reality and artificial intelligence promises to unlock novel and immersive user experiences, driving demand for sophisticated location intelligence. Strategic collaborations between industry leaders and emerging innovators will foster a dynamic environment for product development and market expansion, particularly in nascent but high-potential markets. The market is set to witness a substantial increase in adoption across all segments, solidifying GNSS as a fundamental technology for consumer electronics in the coming years.

GNSS-Enabled Consumer Device Market Segmentation

-

1. Device Type

- 1.1. Smartphones

- 1.2. Tablets & Wearables

- 1.3. Personal Tracking Devices

- 1.4. Low-Power Asset Trackers

- 1.5. Other Device Types

GNSS-Enabled Consumer Device Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

GNSS-Enabled Consumer Device Market Regional Market Share

Geographic Coverage of GNSS-Enabled Consumer Device Market

GNSS-Enabled Consumer Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Wearables and tracking devices are boosting the GNSS market

- 3.2.2 whilst smartphone shipments are maturing

- 3.3. Market Restrains

- 3.3.1 Algorithms

- 3.3.2 Mathematical and Other Complexities Associated with the Gesture Recognition Technology

- 3.4. Market Trends

- 3.4.1. The Smartphones Segment is Expected to Considerably Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Smartphones

- 5.1.2. Tablets & Wearables

- 5.1.3. Personal Tracking Devices

- 5.1.4. Low-Power Asset Trackers

- 5.1.5. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Smartphones

- 6.1.2. Tablets & Wearables

- 6.1.3. Personal Tracking Devices

- 6.1.4. Low-Power Asset Trackers

- 6.1.5. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Smartphones

- 7.1.2. Tablets & Wearables

- 7.1.3. Personal Tracking Devices

- 7.1.4. Low-Power Asset Trackers

- 7.1.5. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Smartphones

- 8.1.2. Tablets & Wearables

- 8.1.3. Personal Tracking Devices

- 8.1.4. Low-Power Asset Trackers

- 8.1.5. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Latin America GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Smartphones

- 9.1.2. Tablets & Wearables

- 9.1.3. Personal Tracking Devices

- 9.1.4. Low-Power Asset Trackers

- 9.1.5. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Middle East and Africa GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Smartphones

- 10.1.2. Tablets & Wearables

- 10.1.3. Personal Tracking Devices

- 10.1.4. Low-Power Asset Trackers

- 10.1.5. Other Device Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Huami Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Electronics Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Garmin Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fitbit (Google)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xiaomi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huawei Technologies Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fossil Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apple Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Huami Corporation

List of Figures

- Figure 1: Global GNSS-Enabled Consumer Device Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global GNSS-Enabled Consumer Device Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 4: North America GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 5: North America GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: North America GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 12: Europe GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 13: Europe GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 20: Asia Pacific GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 21: Asia Pacific GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Asia Pacific GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Asia Pacific GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 28: Latin America GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 29: Latin America GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: Latin America GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: Latin America GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Latin America GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 36: Middle East and Africa GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 37: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: Middle East and Africa GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Middle East and Africa GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 6: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 7: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 10: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 11: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 14: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 15: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 18: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 19: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 22: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 23: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GNSS-Enabled Consumer Device Market?

The projected CAGR is approximately 11.17%.

2. Which companies are prominent players in the GNSS-Enabled Consumer Device Market?

Key companies in the market include Huami Corporation, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit (Google), Xiaomi, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Samsung.

3. What are the main segments of the GNSS-Enabled Consumer Device Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 335.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Wearables and tracking devices are boosting the GNSS market. whilst smartphone shipments are maturing.

6. What are the notable trends driving market growth?

The Smartphones Segment is Expected to Considerably Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Algorithms. Mathematical and Other Complexities Associated with the Gesture Recognition Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GNSS-Enabled Consumer Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GNSS-Enabled Consumer Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GNSS-Enabled Consumer Device Market?

To stay informed about further developments, trends, and reports in the GNSS-Enabled Consumer Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence