Key Insights

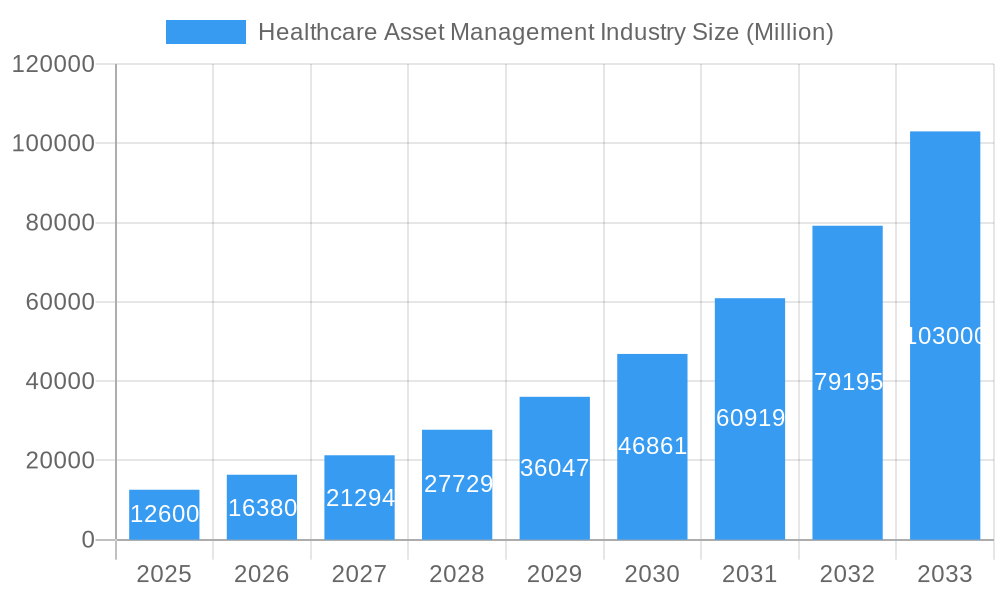

The Healthcare Asset Management market is poised for exceptional growth, projected to reach a substantial market size of approximately $12,600 million by 2025, and further expanding to an estimated $20,160 million by 2033. This impressive trajectory is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of 30.00%. Key growth drivers include the increasing demand for real-time visibility and utilization of high-value medical equipment, the urgent need to optimize supply chain operations within healthcare facilities, and the growing emphasis on patient safety and staff efficiency. The market is witnessing a significant shift towards sophisticated solutions that integrate IoT, RFID, and AI technologies for enhanced asset tracking, inventory management, and predictive maintenance. Applications like Staff Management and Equipment Tracking are at the forefront, driven by the critical need to reduce operational costs, minimize asset loss, and improve patient care outcomes.

Healthcare Asset Management Industry Market Size (In Billion)

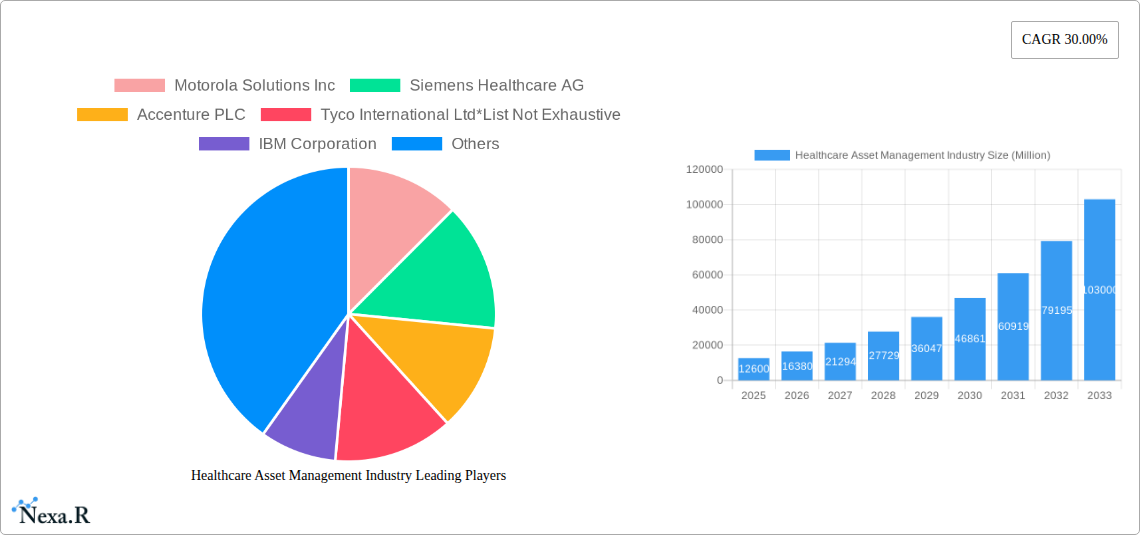

The competitive landscape is dynamic, featuring established players such as Motorola Solutions Inc., Siemens Healthcare AG, and GE Healthcare Inc., alongside innovative firms like AiRISTA Flow Inc. and CenTrak Inc. These companies are actively developing and deploying advanced healthcare asset management systems to cater to hospitals, clinics, laboratories, and pharmaceutical companies. Restraints, such as the initial high cost of implementation and concerns regarding data security and privacy, are being steadily addressed through technological advancements and robust regulatory frameworks. Emerging trends highlight the integration of asset management with broader healthcare IT ecosystems, predictive analytics for asset lifecycle management, and the increasing adoption of cloud-based solutions for scalability and accessibility. The market is expected to see robust expansion across North America and Europe, with significant growth potential in the Asia Pacific region, driven by rapid healthcare infrastructure development and increasing adoption of advanced technologies.

Healthcare Asset Management Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Healthcare Asset Management industry, encompassing its current market dynamics, future growth trajectory, and competitive landscape. Designed for industry professionals, investors, and decision-makers, this report provides actionable insights to navigate the complexities of healthcare asset tracking, management, and optimization. With a focus on high-traffic keywords like "healthcare asset management," "medical device tracking," "RFID healthcare," "IoT in healthcare," and "hospital asset tracking solutions," this report aims to maximize search engine visibility and attract a targeted audience. We delve into both parent and child markets, providing a holistic view of the industry's evolution.

Healthcare Asset Management Industry Market Dynamics & Structure

The Healthcare Asset Management industry is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing demand for operational efficiency. Market concentration varies across regions and specific asset management applications, with key players continuously investing in advanced solutions. Technological innovation is a primary driver, fueled by the integration of IoT, AI, and advanced analytics to enhance real-time visibility and predictive maintenance of critical healthcare assets. Regulatory compliance, such as HIPAA and GDPR, mandates robust data security and privacy measures, influencing the adoption of secure asset management systems. Competitive product substitutes, ranging from manual tracking methods to sophisticated software platforms, present both opportunities and challenges. End-user demographics, particularly the growing prevalence of hospitals and clinics seeking to optimize resource allocation, are shaping market demand. Mergers and acquisitions (M&A) are a significant trend, with companies like Crothall Healthcare acquiring ABM's clinical engineering organization in March 2022, consolidating market share and expanding service offerings. This trend indicates a mature market where strategic consolidation is key to sustained growth.

- Market Concentration: Moderately consolidated with regional variations.

- Technological Innovation Drivers: IoT, AI, RFID, RTLS, cloud computing, predictive analytics.

- Regulatory Frameworks: HIPAA, GDPR, FDA regulations influencing data security and device management.

- Competitive Product Substitutes: Manual tracking, barcoding, basic inventory systems versus advanced RTLS and AI-powered solutions.

- End-User Demographics: Growing demand from hospitals, clinics, laboratories, and pharmaceutical companies aiming for cost reduction and improved patient care.

- M&A Trends: Increasing strategic acquisitions and partnerships to expand capabilities and market reach.

Healthcare Asset Management Industry Growth Trends & Insights

The global Healthcare Asset Management market is projected for substantial growth, driven by the escalating need for efficient utilization of expensive medical equipment, improved patient safety, and streamlined operational workflows. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% from the base year 2025 to 2033, with an estimated market size reaching USD 7,500 Million by 2033. This growth is underpinned by a rising adoption rate of advanced asset management technologies, including Real-Time Location Systems (RTLS), RFID, and IoT-enabled devices. These technologies are instrumental in providing real-time data on asset location, utilization, and maintenance status, thereby minimizing asset loss, reducing equipment downtime, and enhancing patient care delivery. Technological disruptions, such as the advent of AI-powered predictive analytics for equipment maintenance, are revolutionizing how healthcare facilities manage their assets. Furthermore, shifts in consumer behavior, with an increasing emphasis on patient outcomes and cost-effectiveness, are pushing healthcare providers to adopt more sophisticated asset management strategies. The transition from traditional, often paper-based, inventory management to digital, automated systems is a significant trend. The report quantifies this evolution by projecting the market size from USD 3,000 Million in 2025 to an anticipated USD 7,500 Million by 2033. Market penetration of RTLS solutions, for instance, is expected to grow significantly, moving from approximately 25% in 2025 to over 50% by 2033, especially within hospital settings. The integration of mobile health (mHealth) applications with asset management platforms further enhances accessibility and real-time monitoring capabilities, contributing to the overall market expansion.

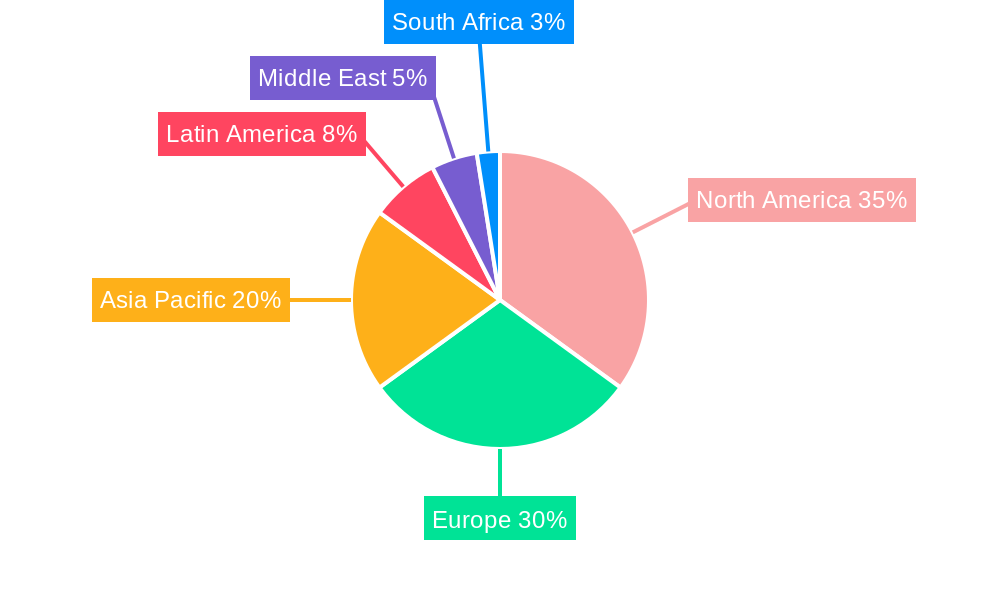

Dominant Regions, Countries, or Segments in Healthcare Asset Management Industry

North America, particularly the United States, stands as the dominant region in the Healthcare Asset Management industry, driven by its advanced healthcare infrastructure, high adoption rate of cutting-edge technologies, and significant government spending on healthcare innovation. The region's market share is estimated to be around 35% of the global market in 2025, projected to reach USD 2,625 Million. Key drivers include robust reimbursement policies, the presence of leading healthcare providers and technology vendors, and stringent regulatory requirements for patient safety and data security. The Hospital/Clinic end-user segment is the primary revenue contributor, accounting for an estimated 60% of the market in 2025, valued at USD 1,800 Million. This dominance is attributed to the sheer volume of assets within these facilities, the critical need for efficient patient tracking, staff management, and equipment utilization to optimize patient care and reduce operational costs. Within applications, Equipment Tracking is a leading segment, representing approximately 30% of the market, valued at USD 900 Million, due to the high cost of medical devices and the imperative to minimize loss and ensure availability. The Staff Management application also holds a significant share, around 25%, valued at USD 750 Million, as hospitals strive to optimize workforce deployment and improve response times. The presence of major market players like GE Healthcare Inc. and Siemens Healthcare AG further solidifies North America's leading position. The region's focus on value-based care models incentivizes the adoption of technologies that enhance efficiency and patient outcomes, directly benefiting the healthcare asset management sector. Furthermore, ongoing investments in expanding healthcare facilities and upgrading existing infrastructure contribute to the sustained growth of this segment.

Healthcare Asset Management Industry Product Landscape

The product landscape of the Healthcare Asset Management industry is evolving rapidly, with a strong emphasis on integrated, intelligent solutions. Innovations are centered around RFID tags, RTLS sensors, IoT platforms, and AI-driven analytics software. These products offer enhanced accuracy in tracking medical equipment, staff, and patients, leading to improved workflow efficiency and reduced risk of loss. Key performance metrics include real-time location accuracy (often within meters or even sub-meter precision), battery life of tracking devices, data processing speeds, and integration capabilities with existing hospital information systems (HIS) and electronic health records (EHR). Unique selling propositions revolve around reducing equipment downtime, preventing theft, improving patient flow, and ensuring the availability of critical medical devices.

Key Drivers, Barriers & Challenges in Healthcare Asset Management Industry

Key Drivers:

- Technological Advancements: The proliferation of IoT, AI, and RTLS technologies enables real-time tracking and proactive management of healthcare assets, significantly enhancing operational efficiency and patient safety.

- Cost Containment Pressures: Healthcare organizations are under immense pressure to reduce operational costs, making efficient asset utilization and inventory management a priority.

- Regulatory Compliance: Stringent regulations regarding patient safety and data security mandate robust asset management systems to ensure compliance and minimize liability.

- Increasing Complexity of Healthcare Operations: The growing number of specialized medical devices and the need for seamless patient care pathways necessitate sophisticated asset management solutions.

Barriers & Challenges:

- High Initial Investment Costs: Implementing advanced healthcare asset management systems can require substantial upfront capital, posing a barrier for smaller healthcare facilities.

- Integration Complexity: Integrating new asset management systems with existing legacy IT infrastructure can be challenging and time-consuming.

- Data Security and Privacy Concerns: Ensuring the security and privacy of sensitive patient and asset data is paramount and requires robust cybersecurity measures.

- Resistance to Change: Overcoming organizational inertia and ensuring staff adoption of new technologies can be a significant hurdle.

Emerging Opportunities in Healthcare Asset Management Industry

Emerging opportunities in the Healthcare Asset Management industry lie in the expansion of predictive maintenance powered by AI, enabling proactive identification of equipment failures before they occur. The integration of blockchain technology for secure and transparent tracking of high-value medical assets and pharmaceuticals presents another significant avenue. Furthermore, the growing demand for telehealth and remote patient monitoring services creates opportunities for asset management solutions that can track portable medical devices used in homecare settings. The untapped potential in emerging economies, where healthcare infrastructure is rapidly developing, also offers substantial growth prospects.

Growth Accelerators in the Healthcare Asset Management Industry Industry

Several catalysts are accelerating the growth of the Healthcare Asset Management industry. The ongoing digital transformation within healthcare, driven by government initiatives and technological advancements, is a primary accelerator. Strategic partnerships between technology providers and healthcare organizations, aimed at developing tailored asset management solutions, are crucial. Market expansion strategies, focusing on underserved regions and niche applications like specialized clinics and laboratories, are also driving growth. The increasing emphasis on a patient-centric approach, where asset availability directly impacts patient outcomes, further fuels the demand for advanced management systems.

Key Players Shaping the Healthcare Asset Management Industry Market

- Motorola Solutions Inc

- Siemens Healthcare AG

- Accenture PLC

- Tyco International Ltd

- IBM Corporation

- AiRISTA Flow Inc

- CenTrak Inc

- Sonitor Technologies Inc

- INFOR INC

- GE Healthcare Inc

- Stanley Security Solutions Inc

- Zebra Technologies Corporation

Notable Milestones in Healthcare Asset Management Industry Sector

- March 2022: Crothall Healthcare's Healthcare Technology Solutions (HTS) division acquired ABM's clinical engineering organization. This strategic move consolidated expertise in managing the entire lifecycle of medical devices within hospitals, enhancing Crothall's operational capabilities and market presence.

- March 2022: Sodexo partnered with University Hospitals to deliver comprehensive primary care and community-based services. This collaboration underscored the growing trend of integrated service management, including resource and construction management, technical healthcare control, and patient diet and retail food management, indirectly impacting asset utilization and efficiency.

In-Depth Healthcare Asset Management Industry Market Outlook

The future outlook for the Healthcare Asset Management industry is exceptionally promising, driven by continuous technological innovation and the unwavering demand for operational excellence in healthcare. The projected market growth signifies a robust adoption of smart, connected asset management solutions. Strategic opportunities will arise from further integration of AI for predictive analytics, enhancing resource allocation and minimizing downtime. Expansion into emerging markets and the development of specialized solutions for niche healthcare segments will also be key growth accelerators. The industry is poised to play a pivotal role in shaping the future of efficient, safe, and cost-effective healthcare delivery globally.

Healthcare Asset Management Industry Segmentation

-

1. Application

- 1.1. Staff Management

- 1.2. Equipment Tracking

- 1.3. Patient Tracking

- 1.4. Supply Chain Management

-

2. End User

- 2.1. Hospital/Clinic

- 2.2. Laboratory

- 2.3. Pharmaceutical

Healthcare Asset Management Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. UAE

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Healthcare Asset Management Industry Regional Market Share

Geographic Coverage of Healthcare Asset Management Industry

Healthcare Asset Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand with Increasing Concerns of Drug Counterfeiting; Need to Increase Efficiency in Healthcare Institutions; Growing Concerns for Patient Safety

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation

- 3.4. Market Trends

- 3.4.1. Demand with Increasing Concerns of Drug Counterfeiting

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Staff Management

- 5.1.2. Equipment Tracking

- 5.1.3. Patient Tracking

- 5.1.4. Supply Chain Management

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinic

- 5.2.2. Laboratory

- 5.2.3. Pharmaceutical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. UAE

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Staff Management

- 6.1.2. Equipment Tracking

- 6.1.3. Patient Tracking

- 6.1.4. Supply Chain Management

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinic

- 6.2.2. Laboratory

- 6.2.3. Pharmaceutical

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Staff Management

- 7.1.2. Equipment Tracking

- 7.1.3. Patient Tracking

- 7.1.4. Supply Chain Management

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinic

- 7.2.2. Laboratory

- 7.2.3. Pharmaceutical

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Staff Management

- 8.1.2. Equipment Tracking

- 8.1.3. Patient Tracking

- 8.1.4. Supply Chain Management

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinic

- 8.2.2. Laboratory

- 8.2.3. Pharmaceutical

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Staff Management

- 9.1.2. Equipment Tracking

- 9.1.3. Patient Tracking

- 9.1.4. Supply Chain Management

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital/Clinic

- 9.2.2. Laboratory

- 9.2.3. Pharmaceutical

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Staff Management

- 10.1.2. Equipment Tracking

- 10.1.3. Patient Tracking

- 10.1.4. Supply Chain Management

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital/Clinic

- 10.2.2. Laboratory

- 10.2.3. Pharmaceutical

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. UAE Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Staff Management

- 11.1.2. Equipment Tracking

- 11.1.3. Patient Tracking

- 11.1.4. Supply Chain Management

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Hospital/Clinic

- 11.2.2. Laboratory

- 11.2.3. Pharmaceutical

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Motorola Solutions Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens Healthcare AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Accenture PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tyco International Ltd*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 IBM Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AiRISTA Flow Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CenTrak Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sonitor Technologies Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 INFOR INC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 GE Healthcare Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Stanley Security Solutions Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Zebra Technologies Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global Healthcare Asset Management Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: Latin America Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Latin America Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: UAE Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 33: UAE Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: UAE Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: UAE Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: UAE Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: UAE Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: India Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Brazil Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Argentina Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 31: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Asset Management Industry?

The projected CAGR is approximately 23.42%.

2. Which companies are prominent players in the Healthcare Asset Management Industry?

Key companies in the market include Motorola Solutions Inc, Siemens Healthcare AG, Accenture PLC, Tyco International Ltd*List Not Exhaustive, IBM Corporation, AiRISTA Flow Inc, CenTrak Inc, Sonitor Technologies Inc, INFOR INC, GE Healthcare Inc, Stanley Security Solutions Inc, Zebra Technologies Corporation.

3. What are the main segments of the Healthcare Asset Management Industry?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand with Increasing Concerns of Drug Counterfeiting; Need to Increase Efficiency in Healthcare Institutions; Growing Concerns for Patient Safety.

6. What are the notable trends driving market growth?

Demand with Increasing Concerns of Drug Counterfeiting.

7. Are there any restraints impacting market growth?

Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation.

8. Can you provide examples of recent developments in the market?

March 2022 - Crothall Healthcare's Healthcare Technology Solutions (HTS) division acquired ABM's clinical engineering organization. Whereas The Clinical Engineering group of ABM will be under the control of Crothall's Healthcare Technology Solution business, which will use its knowledge and expertise to enhance operations, as the entire lifecycle of medical devices in a hospital is managed and overseen by Crothall Healthcare.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare Asset Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare Asset Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare Asset Management Industry?

To stay informed about further developments, trends, and reports in the Healthcare Asset Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence