Key Insights

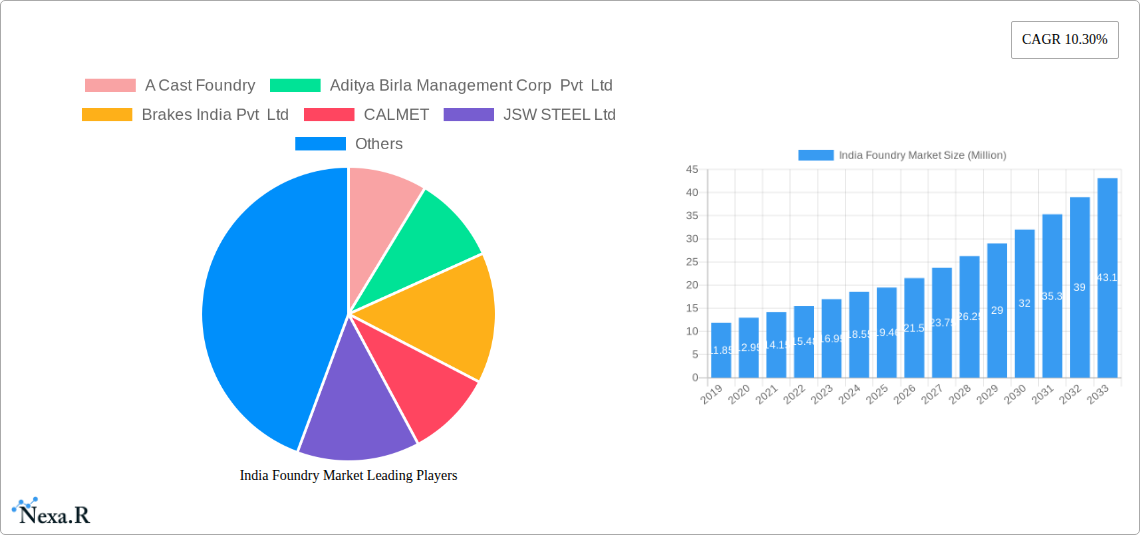

The Indian foundry market is poised for substantial growth, projected to reach a market size of approximately INR 19.46 billion by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 10.30%, indicating a dynamic and expanding industry. Key drivers fueling this growth include the burgeoning automotive sector, which demands a significant volume of castings for components like engine blocks, cylinder heads, and chassis parts. The ever-increasing demand from the electrical and construction industries, for applications ranging from power infrastructure to building components, further bolsters the market. Additionally, the industrial machinery segment, a cornerstone of India's manufacturing prowess, continues to rely heavily on high-quality castings for its diverse equipment. The market is segmented across various casting types, including Gray Iron Casting, Non-ferrous Casting, Ductile Iron Casting, Steel Casting, and Malleable Casting, each catering to specific industrial needs and performance requirements.

India Foundry Market Market Size (In Million)

The positive market trajectory is further supported by prevailing trends such as technological advancements in casting processes, leading to improved efficiency, higher precision, and the development of lighter and stronger castings. The increasing adoption of automation and advanced simulation software in foundries is also contributing to enhanced product quality and reduced lead times. While the market exhibits strong growth potential, certain restraints need to be considered. These include fluctuating raw material prices, particularly for metals like iron and aluminum, which can impact profitability. Stringent environmental regulations and the need for substantial capital investment in upgrading facilities to meet these standards also present challenges. However, the inherent demand from a rapidly industrializing nation like India, coupled with a strong manufacturing base and government initiatives promoting domestic production, is expected to outweigh these restraints, ensuring a promising future for the Indian foundry market. Prominent players such as JSW STEEL Ltd, Larsen and Toubro Ltd, and Electrosteel Castings Ltd are actively shaping the market landscape.

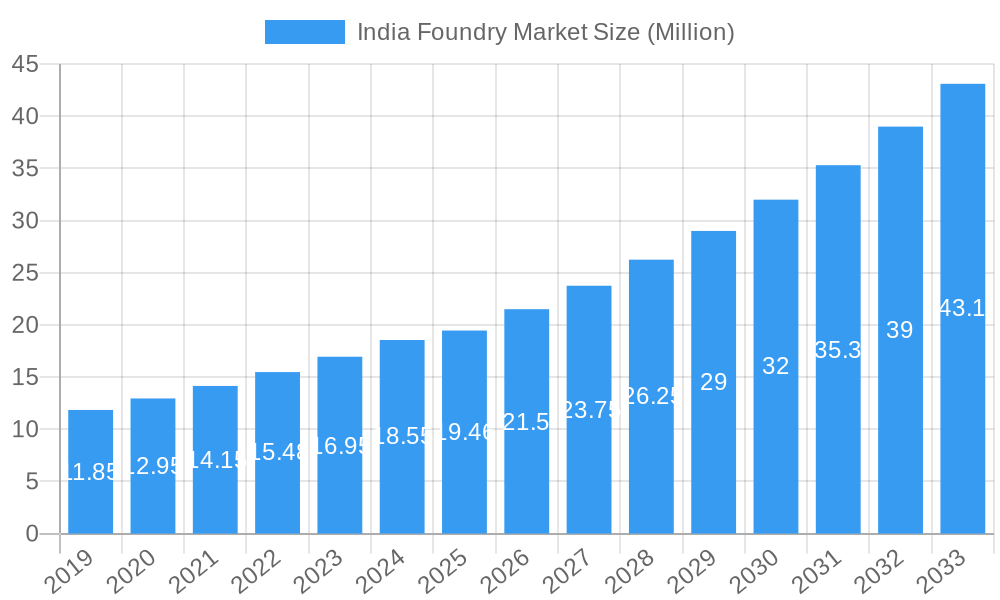

India Foundry Market Company Market Share

India Foundry Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the India Foundry Market, offering critical insights into its current landscape and projected trajectory. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the strategic initiatives of leading players. The report is meticulously structured to aid industry professionals in making informed strategic decisions, understanding competitive positioning, and identifying avenues for sustainable growth in the rapidly evolving Indian foundry sector. With a focus on high-traffic keywords and a detailed examination of parent and child markets, this report is optimized for maximum search engine visibility and delivers actionable intelligence. All values are presented in Million Units.

India Foundry Market Market Dynamics & Structure

The India Foundry Market is characterized by a moderately fragmented structure, with a mix of large integrated players and numerous small and medium-sized enterprises (SMEs). Technological innovation is a significant driver, fueled by the demand for higher quality, precision castings across various end-user industries. The government's "Make in India" initiative and production-linked incentive (PLI) schemes are playing a crucial role in bolstering domestic manufacturing, thereby influencing the foundry sector's growth. Regulatory frameworks, particularly concerning environmental compliance and safety standards, are becoming more stringent, necessitating investment in advanced technologies and sustainable practices. Competitive product substitutes, such as advanced polymer composites and additive manufacturing, are beginning to emerge, particularly in niche applications, but traditional metal castings continue to dominate due to their cost-effectiveness and material properties. End-user demographics are shifting, with a growing demand from the automotive sector for lightweight and high-strength components, and from the infrastructure and construction industries for durable materials. Mergers and acquisitions (M&A) are a key trend, as larger companies seek to consolidate their market share, acquire new technologies, and expand their product portfolios.

- Market Concentration: Moderately fragmented with key players holding significant, but not dominant, market share.

- Technological Innovation Drivers: Demand for precision, lightweight components, automation, and energy-efficient processes.

- Regulatory Frameworks: Increasing focus on environmental sustainability (emission controls, waste management) and quality certifications.

- Competitive Product Substitutes: Growing influence of additive manufacturing and advanced composites in specialized applications.

- End-User Demographics: Strong reliance on automotive, followed by infrastructure, industrial machinery, and electrical sectors.

- M&A Trends: Strategic acquisitions for capacity expansion, technology acquisition, and market consolidation.

India Foundry Market Growth Trends & Insights

The India Foundry Market is poised for robust growth, driven by a confluence of factors including increasing industrialization, infrastructure development, and the burgeoning automotive sector. The market size has seen a consistent upward trajectory, with projections indicating a sustained Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This growth is underpinned by the increasing adoption of advanced casting technologies such as gravity die casting and investment casting, which offer superior precision and surface finish, catering to the evolving needs of high-tech industries. Technological disruptions, including the integration of Artificial Intelligence (AI) for process optimization and predictive maintenance, are enhancing operational efficiency and product quality. Consumer behavior shifts are evident, with a greater emphasis on durability, performance, and sustainability in component manufacturing. The automotive industry, a primary consumer of castings, is witnessing a surge in demand for components used in electric vehicles (EVs) and for lightweighting initiatives to improve fuel efficiency. Furthermore, the expansion of the construction sector, particularly in urban infrastructure projects and affordable housing, is creating substantial demand for cast iron pipes, fittings, and structural components. The electrical and industrial machinery segments also contribute significantly, with a growing need for specialized castings in power generation, transmission, and manufacturing equipment. The report projects the India Foundry Market to reach an estimated value of XXX Million Units by 2033.

Dominant Regions, Countries, or Segments in India Foundry Market

The India Foundry Market's dominance is significantly influenced by the concentration of industrial activity and the specific demands of various end-user segments. Among the end-user segments, the Automotive sector stands out as the leading driver of market growth. This is attributed to India's position as a major global automotive hub, with a continuous increase in vehicle production and a growing demand for complex engine parts, chassis components, and suspension systems that rely heavily on high-quality castings. The increasing penetration of Electric Vehicles (EVs) is also creating new opportunities for specialized castings for battery enclosures, motor housings, and lightweight structural components.

Within the Type of casting, Steel Casting and Gray Iron Casting are expected to continue their dominance, owing to their widespread application in automotive, infrastructure, and general engineering industries. Steel castings are crucial for high-strength applications, while gray iron finds extensive use in engine blocks, brake drums, and pipes.

Geographically, the western and southern regions of India are expected to remain the most dominant due to the presence of established manufacturing clusters, automotive production facilities, and a robust industrial ecosystem. States like Gujarat, Maharashtra, Tamil Nadu, and Karnataka are major contributors to the foundry market's output and consumption.

- Leading End-User Segment: Automotive, driven by high vehicle production volumes and increasing demand for complex and lightweight components, including those for EVs.

- Dominant Casting Types: Steel Casting and Gray Iron Casting, due to their versatility and widespread application across key industries.

- Key Geographic Hubs: Western and Southern India, housing major manufacturing and automotive hubs, leading in both production and consumption.

- Key Drivers of Dominance:

- Automotive Sector: Strong manufacturing base, increasing domestic and export demand, shift towards EVs.

- Infrastructure Development: Government focus on building and upgrading infrastructure, leading to demand for pipes, fittings, and structural castings.

- Industrial Machinery Growth: Expansion of manufacturing capabilities across various sectors.

- Technological Advancements: Adoption of sophisticated casting techniques for improved quality and precision.

- Skilled Workforce Availability: Access to a skilled labor pool in manufacturing regions.

India Foundry Market Product Landscape

The India Foundry Market is characterized by a diverse product landscape catering to a wide array of industrial applications. Key product innovations are focused on enhancing the performance, durability, and efficiency of castings. This includes the development of high-strength steel alloys for automotive and aerospace applications, corrosion-resistant non-ferrous castings for marine and chemical industries, and wear-resistant ductile iron castings for heavy machinery and construction equipment. Applications range from critical engine components, transmission parts, and brake systems in the automotive sector, to pipes, valves, and fittings in the construction and water management sectors. Industrial machinery benefits from specialized castings for pumps, gears, and machine tools, while the electrical sector utilizes castings for enclosures and structural components in power generation and distribution equipment. Unique selling propositions often revolve around achieving tighter tolerances, improved surface finish, and enhanced material properties through advanced molding and melting technologies.

Key Drivers, Barriers & Challenges in India Foundry Market

Key Drivers:

- Robust Automotive Production: India's position as a global automotive manufacturing hub is a primary growth driver.

- Infrastructure Development: Government initiatives and private investments in infrastructure projects fuel demand for casting products.

- "Make in India" Initiative: Government policies promoting domestic manufacturing and reducing import reliance.

- Technological Advancements: Adoption of automation, AI, and advanced casting techniques for improved efficiency and quality.

- Growing Export Potential: Indian foundries are increasingly competitive in the global market.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of iron ore, steel scrap, and other raw materials impact profitability.

- Environmental Regulations: Stringent environmental compliance requirements necessitate significant capital investment in pollution control.

- Skilled Labor Shortage: A persistent challenge in finding and retaining skilled labor for specialized foundry operations.

- Energy Costs: High and volatile energy prices affect operational costs significantly.

- Intense Competition: A fragmented market with numerous players leads to price pressures.

- Supply Chain Disruptions: Global and domestic supply chain disruptions can impact the availability of raw materials and equipment.

- Technological Adoption Gap: SMEs may face challenges in adopting advanced and capital-intensive technologies.

Emerging Opportunities in India Foundry Market

Emerging opportunities in the India Foundry Market are largely driven by technological evolution and changing industry demands. The rapidly expanding Electric Vehicle (EV) segment presents a significant avenue for growth, requiring specialized lightweight castings for battery packs, motor housings, and structural components. The aerospace sector, with its stringent quality requirements, offers opportunities for foundries specializing in high-precision, exotic alloy castings. Furthermore, the increasing focus on sustainable manufacturing and circular economy principles is creating demand for foundries that can utilize recycled materials and implement energy-efficient processes. The adoption of additive manufacturing (3D printing) for casting patterns and even direct metal printing for complex prototypes and small-batch production also presents an innovative opportunity for niche applications. The growth of renewable energy sectors, such as wind and solar power, will also drive demand for specialized castings for turbines and supporting structures.

Growth Accelerators in the India Foundry Market Industry

Several catalysts are expected to accelerate the growth of the India Foundry Market. Strategic partnerships and collaborations between established players and technology providers are crucial for the adoption of Industry 4.0 solutions, including automation, IoT, and AI, which will enhance productivity and quality. Expansion into new geographic markets, both domestically and internationally, through increased export capacities, will also drive growth. The continued government support through policies like the PLI schemes and infrastructure development projects will provide a stable demand environment. Investment in research and development (R&D) to develop advanced materials and casting processes tailored to emerging sectors like EVs and aerospace will further propel the market forward. Capacity expansion by key players to meet the growing demand from both domestic and international clients will be a significant growth accelerator.

Key Players Shaping the India Foundry Market Market

- A Cast Foundry

- Aditya Birla Management Corp Pvt Ltd

- Brakes India Pvt Ltd

- CALMET

- JSW STEEL Ltd

- Larsen and Toubro Ltd

- Ashok Iron Works Pvt Ltd

- Gujarat Metal Cast Industries Pvt Ltd

- Electrosteel Castings Ltd

- Menon and Menod Ltd

Notable Milestones in India Foundry Market Sector

- September 2023: Kirloskar Ferrous Industries Limited (KFIL) acquired Oliver Engineering Pvt. Ltd., a ferrous casting and machining company with a capacity of 28,000 MT per annum, strengthening KFIL's position in the ferrous casting segment and expanding its product offerings.

- February 2023: Hindustan Aeronautics Limited and Bharat Forge Limited entered into an agreement to develop and produce aerospace-grade steel alloys, signaling a significant step forward in the domestic production of high-performance materials for the aviation sector.

- January 2023: Bharat Forge Ltd's step-down subsidiary, J S Auto Cast Foundry India Private Ltd., acquired the SEZ Unit at SIPCOT, Erode from Indo Shell Mould Ltd. (ISML), enhancing JS Auto's casting capabilities, product range, and market reach.

In-Depth India Foundry Market Market Outlook

The India Foundry Market is projected to witness sustained growth, fueled by strong demand from the automotive sector, increasing infrastructure investments, and supportive government policies. The ongoing shift towards electric vehicles and the need for lightweight, high-performance components present a significant opportunity for innovation and expansion. Foundries that embrace advanced manufacturing technologies, focus on sustainability, and develop specialized casting solutions for emerging industries are well-positioned for success. Strategic collaborations, capacity expansions, and a continued focus on export markets will be crucial for capitalizing on the vast potential within the Indian foundry landscape. The market's outlook is robust, driven by India's burgeoning industrial economy and its increasing integration into global supply chains.

India Foundry Market Segmentation

-

1. End-user

- 1.1. Automotive

- 1.2. Electrical and Construction

- 1.3. Industrial Machinery

- 1.4. Other End-Users

-

2. Type

- 2.1. Gray Iron Casting

- 2.2. Non-ferrous Casting

- 2.3. Ductile Iron Casting

- 2.4. Steel Casting

- 2.5. Malleable Casting

India Foundry Market Segmentation By Geography

- 1. India

India Foundry Market Regional Market Share

Geographic Coverage of India Foundry Market

India Foundry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters

- 3.4. Market Trends

- 3.4.1. Growing Automobile Sector is Driving the Foundry Market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Foundry Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Automotive

- 5.1.2. Electrical and Construction

- 5.1.3. Industrial Machinery

- 5.1.4. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Gray Iron Casting

- 5.2.2. Non-ferrous Casting

- 5.2.3. Ductile Iron Casting

- 5.2.4. Steel Casting

- 5.2.5. Malleable Casting

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A Cast Foundry

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aditya Birla Management Corp Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brakes India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CALMET

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSW STEEL Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Larsen and Toubro Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashok Iron Works Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gujarat Metal Cast Industries Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrosteel Castings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Menon and Menod Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 A Cast Foundry

List of Figures

- Figure 1: India Foundry Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Foundry Market Share (%) by Company 2025

List of Tables

- Table 1: India Foundry Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: India Foundry Market Volume Billion Forecast, by End-user 2020 & 2033

- Table 3: India Foundry Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: India Foundry Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: India Foundry Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Foundry Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Foundry Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: India Foundry Market Volume Billion Forecast, by End-user 2020 & 2033

- Table 9: India Foundry Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Foundry Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: India Foundry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Foundry Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Foundry Market?

The projected CAGR is approximately 10.30%.

2. Which companies are prominent players in the India Foundry Market?

Key companies in the market include A Cast Foundry, Aditya Birla Management Corp Pvt Ltd, Brakes India Pvt Ltd, CALMET, JSW STEEL Ltd, Larsen and Toubro Ltd, Ashok Iron Works Pvt Ltd, Gujarat Metal Cast Industries Pvt Ltd, Electrosteel Castings Ltd, Menon and Menod Ltd **List Not Exhaustive.

3. What are the main segments of the India Foundry Market?

The market segments include End-user, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.46 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters.

6. What are the notable trends driving market growth?

Growing Automobile Sector is Driving the Foundry Market in India.

7. Are there any restraints impacting market growth?

4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters.

8. Can you provide examples of recent developments in the market?

September 2023: Kirloskar Ferrous Industries Limited (KFIL), one of the leading castings and pig iron manufacturers in India, announced the acquisition of Oliver Engineering Pvt. Ltd. Oliver Engineering is engaged in the business of ferrous casting and machining with its manufacturing facility located in Village Sandharsi, Tehsil Rajpura, State Punjab. Its present castings capacity is 28,000 MT per annum. KFIL also produces various grades of pig iron such as SG iron grade, basic steel grade, and foundry grade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Foundry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Foundry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Foundry Market?

To stay informed about further developments, trends, and reports in the India Foundry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence