Key Insights

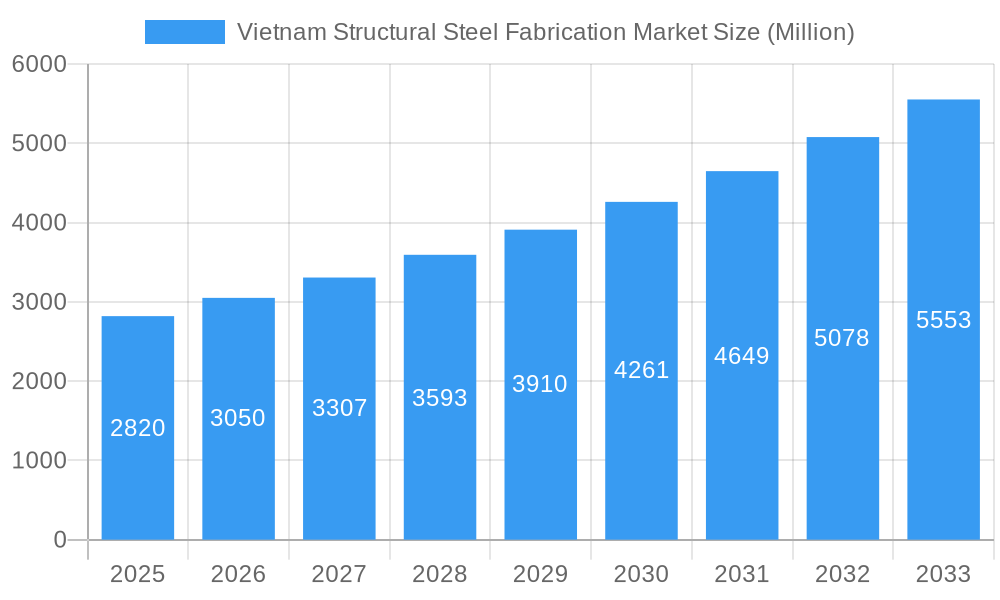

The Vietnam structural steel fabrication market is experiencing robust growth, projected to reach \$2.82 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.21% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Vietnam's rapid infrastructure development, fueled by significant government investment in construction projects like highways, bridges, and industrial parks, creates a substantial demand for steel structures. Secondly, the burgeoning manufacturing and industrial sectors are contributing to the increased need for warehouses, factories, and other industrial buildings, all reliant on steel fabrication. The rising urbanization trend further fuels market growth, with increased construction of high-rise buildings and residential complexes in major cities like Ho Chi Minh City and Hanoi. Finally, the improving economic conditions and growing foreign direct investment in Vietnam are bolstering the construction industry and subsequently the demand for steel fabrication services. Increased adoption of pre-engineered building (PEB) systems is also a noteworthy trend, offering faster construction times and cost efficiency, thereby driving market growth.

Vietnam Structural Steel Fabrication Market Market Size (In Billion)

However, the market also faces challenges. Fluctuations in steel prices, a global commodity, can impact profitability and project costs. Competition among numerous fabrication companies in Vietnam, including both domestic and international players, can lead to price pressures. Moreover, ensuring consistent quality and adherence to safety standards across the diverse range of companies involved in structural steel fabrication presents an ongoing challenge. To mitigate these challenges, companies are increasingly focusing on technological advancements, quality control measures, and building strong supplier relationships to ensure consistent project delivery and maintain their market share. The market's continued growth will depend on the ongoing support of government infrastructure initiatives, the stability of steel prices, and the ability of companies to adapt to evolving market demands and technological innovations.

Vietnam Structural Steel Fabrication Market Company Market Share

Vietnam Structural Steel Fabrication Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Vietnam structural steel fabrication market, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends through 2033. It segments the market to provide granular insights and identifies key opportunities for growth. This report is crucial for industry professionals, investors, and anyone seeking to understand the complexities and potential of this dynamic market.

Vietnam Structural Steel Fabrication Market Dynamics & Structure

The Vietnam structural steel fabrication market is characterized by a moderately concentrated landscape, with several key players vying for market share. While precise market share data for individual companies remains unavailable (xx%), the dominance of several large players such as Zamil Steel Buildings Vietnam Company Limited, PEB Steel, and Atad Steel Structure Corporation is evident. Technological innovation, driven by demand for sustainable and efficient construction methods, is a key market driver. However, challenges such as regulatory frameworks, the availability of competitive product substitutes (e.g., concrete), and end-user demographics (e.g., preference for specific building types) influence market growth. The recent period has seen limited M&A activity (xx deals in the last 5 years), likely reflecting the current economic climate.

- Market Concentration: Moderately concentrated, with several dominant players.

- Technological Innovation: Focus on lightweight steel, prefabricated components, and sustainable practices.

- Regulatory Framework: Government policies and building codes significantly impact demand.

- Competitive Substitutes: Concrete and other construction materials offer alternative options.

- End-User Demographics: Construction sector dynamics (residential, commercial, industrial) drive demand.

- M&A Activity: Relatively low activity in recent years (xx deals).

Vietnam Structural Steel Fabrication Market Growth Trends & Insights

The Vietnam structural steel fabrication market exhibited a CAGR of xx% during 2019-2024. Market size reached xx million units in 2024, and is projected to reach xx million units in 2025. The forecast period (2025-2033) anticipates continued growth, driven by factors including expanding infrastructure projects, rising urbanization, and a growing construction sector. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and advanced fabrication techniques, are further stimulating market expansion. However, fluctuating steel prices, economic downturns, and shifts in consumer preferences related to building materials pose challenges to consistent growth. The market penetration rate of structural steel in construction is currently estimated at xx%, with potential for further expansion into new segments and applications. The projected CAGR for 2025-2033 is xx%.

Dominant Regions, Countries, or Segments in Vietnam Structural Steel Fabrication Market

The Southern region of Vietnam currently dominates the structural steel fabrication market, driven by higher concentration of construction projects and economic activity in urban centers such as Ho Chi Minh City. Key growth drivers include:

Robust Infrastructure Development: Government investments in transportation, energy, and industrial infrastructure.

Urbanization and Population Growth: Increased demand for residential and commercial buildings.

Foreign Direct Investment (FDI): Significant influx of FDI in manufacturing and industrial sectors.

Favorable Economic Policies: Government incentives supporting infrastructure development and construction activities.

While the Northern region lags in market share, it exhibits substantial growth potential as economic development accelerates. The industrial segment contributes a substantial portion to the overall market, surpassing the residential sector (xx% vs. xx%).

Vietnam Structural Steel Fabrication Market Product Landscape

The market offers a range of products, including H-beams, I-beams, channels, angles, and other structural steel components. Innovation is focused on developing lighter, stronger, and more sustainable steel products, alongside prefabricated modules that reduce on-site construction time and costs. Unique selling propositions often highlight quality, precision, cost-effectiveness, and adherence to international standards.

Key Drivers, Barriers & Challenges in Vietnam Structural Steel Fabrication Market

Key Drivers:

- Infrastructure Development: Government initiatives promoting infrastructure projects.

- Urbanization: Rapid urbanization driving demand for residential and commercial construction.

- Industrial Growth: Expanding manufacturing and industrial sectors need more facilities.

Key Challenges:

- Fluctuating Steel Prices: Global market volatility impacting production costs.

- Regulatory Hurdles: Complex regulations and permitting processes.

- Supply Chain Disruptions: Logistical challenges impacting material availability.

- Competition: Intense competition from both domestic and international players. (estimated impact on profit margins: xx%)

Emerging Opportunities in Vietnam Structural Steel Fabrication Market

- Prefabricated Steel Structures: Witnessing a significant surge in demand driven by the need for faster construction timelines, enhanced cost-efficiency, and improved on-site safety. Prefabricated solutions are increasingly being adopted across industrial, commercial, and residential projects.

- Sustainable Steel Fabrication: A growing emphasis on eco-friendly practices, including the adoption of energy-efficient manufacturing processes, the utilization of recycled steel content, and the development of materials with a lower carbon footprint. This aligns with Vietnam's national sustainability goals.

- Specialized Steel Applications: Significant expansion into high-value, niche markets. This includes the fabrication of complex steel components for offshore oil and gas platforms, the development of advanced structural systems for supertall skyscrapers, and the creation of specialized steel frameworks for renewable energy infrastructure (e.g., wind turbines).

- Digitalization and Automation: The integration of Industry 4.0 technologies such as Building Information Modeling (BIM), robotic welding, and automated cutting systems are becoming crucial for improving precision, reducing waste, and boosting overall fabrication efficiency.

- Infrastructure Development Boom: Government initiatives and foreign investment in large-scale infrastructure projects, including transportation networks (airports, highways, bridges), industrial parks, and logistics hubs, are creating substantial demand for structural steel.

Growth Accelerators in the Vietnam Structural Steel Fabrication Market Industry

The Vietnam structural steel fabrication market is poised for significant acceleration driven by a confluence of factors. Technological advancements, encompassing the adoption of sophisticated design software, advanced welding techniques, and automated production lines, are enhancing efficiency and product quality. Furthermore, strategic partnerships forged between raw material suppliers, steel fabricators, engineering firms, and construction companies are streamlining the supply chain and fostering collaborative innovation. The market's expansion into new geographic regions within Vietnam, catering to developing economic zones, alongside the exploration of innovative product designs that offer superior performance and aesthetic appeal, will be key. Crucially, substantial investment in advanced manufacturing technologies and skilled workforce training will underpin long-term, robust expansion, enabling fabricators to meet increasingly complex project demands and international standards.

Key Players Shaping the Vietnam Structural Steel Fabrication Market Market

- Zamil Steel Buildings Vietnam Company Limited

- PEB Steel

- Atad Steel Structure Corporation

- Universal Vietnam Steel Buildings Company Limited

- Tri Viet Steel

- Kirby Southeast Asia Co Ltd

- Metalic Vietnam Co LTD

- PMB STEEL

- Dai Dung Metallic Manufacture Construction And Trade Corporation

Notable Milestones in Vietnam Structural Steel Fabrication Market Sector

- November 2022: A pivotal Memorandum of Understanding (MOU) was inked between the esteemed Hanoi University of Civil Engineering (HUCE) and PEB Steel. This collaboration aims to significantly bolster civil engineering education and cultivate a highly skilled workforce, directly benefiting the structural steel fabrication sector through enhanced research and development and talent acquisition.

- January 2023: The Vietnamese steel industry encountered headwinds due to a tightening of real estate regulations. This regulatory shift led to a noticeable contraction in demand for steel products and prompted production adjustments by major industry players, including the prominent Hoa Phat Group. This period highlighted the market's sensitivity to policy changes and the need for diversified demand drivers.

- Q2 2023: Several leading structural steel fabricators reported a substantial increase in inquiries and secured new contracts for industrial building projects and logistics centers, indicating a resilient demand from the manufacturing and supply chain sectors despite broader economic fluctuations.

- Late 2023: Significant investment was announced by both domestic and international firms into upgrading fabrication facilities with advanced machinery and digital management systems, signaling a proactive approach to enhancing competitiveness and meeting future project requirements.

In-Depth Vietnam Structural Steel Fabrication Market Outlook

The Vietnam structural steel fabrication market is poised for robust growth over the next decade. Continued infrastructure development, urbanization, and industrial expansion will drive demand. Strategic investments in technology, sustainable practices, and workforce development will be crucial for companies to capitalize on the market's potential. The focus on prefabricated steel structures and sustainable solutions presents significant opportunities for innovation and market leadership.

Vietnam Structural Steel Fabrication Market Segmentation

-

1. End-User Industry

- 1.1. Manufacturing

- 1.2. Power and Energy

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-User Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

Vietnam Structural Steel Fabrication Market Segmentation By Geography

- 1. Vietnam

Vietnam Structural Steel Fabrication Market Regional Market Share

Geographic Coverage of Vietnam Structural Steel Fabrication Market

Vietnam Structural Steel Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization; Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Rapid Urbanization; Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Increase In Infrastructure Activities is boosting the production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Structural Steel Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Energy

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zamil Steel Buildings Vietnam Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PEB Steel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atad Steel Structure Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Universal Vietnam Steel Buildings Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tri Viet Steel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kirby Southeast Asia Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Metalic Vietnam Co LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PMB STEEL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dai Dung Metallic Manufacture Construction And Trade Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Zamil Steel Buildings Vietnam Company Limited

List of Figures

- Figure 1: Vietnam Structural Steel Fabrication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Structural Steel Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Structural Steel Fabrication Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Vietnam Structural Steel Fabrication Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Vietnam Structural Steel Fabrication Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Vietnam Structural Steel Fabrication Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: Vietnam Structural Steel Fabrication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Vietnam Structural Steel Fabrication Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Vietnam Structural Steel Fabrication Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Vietnam Structural Steel Fabrication Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 9: Vietnam Structural Steel Fabrication Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Vietnam Structural Steel Fabrication Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Vietnam Structural Steel Fabrication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Vietnam Structural Steel Fabrication Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Structural Steel Fabrication Market?

The projected CAGR is approximately 8.21%.

2. Which companies are prominent players in the Vietnam Structural Steel Fabrication Market?

Key companies in the market include Zamil Steel Buildings Vietnam Company Limited, PEB Steel, Atad Steel Structure Corporation, Universal Vietnam Steel Buildings Company Limited, Tri Viet Steel, Kirby Southeast Asia Co Ltd, Metalic Vietnam Co LTD, PMB STEEL, Dai Dung Metallic Manufacture Construction And Trade Corporation.

3. What are the main segments of the Vietnam Structural Steel Fabrication Market?

The market segments include End-User Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization; Infrastructure Development.

6. What are the notable trends driving market growth?

Increase In Infrastructure Activities is boosting the production.

7. Are there any restraints impacting market growth?

Rapid Urbanization; Infrastructure Development.

8. Can you provide examples of recent developments in the market?

January 2023: Vietnam's steel industry is going through a rough stretch as tighter regulations related to real estate are choking demand for new buildings. Hoa Phat Group, the largest steelmaker in Southeast Asia, suspended operation of four blast furnaces in Vietnam in autumn 2022. Other Vietnamese steelmakers using electric furnaces have also been forced to cut production sharply.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Structural Steel Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Structural Steel Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Structural Steel Fabrication Market?

To stay informed about further developments, trends, and reports in the Vietnam Structural Steel Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence