Key Insights

The France Metal Fabrication Equipment market is projected for significant expansion, fueled by surging industrial automation, escalating demand for advanced manufactured goods, and substantial infrastructure investments. With a current market size of 663.3 million, the sector is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 3.5 through the forecast period, beginning with a base year of 2025. This growth is bolstered by the French government's strategic re-industrialization initiatives and investments in advanced manufacturing, attracting both domestic and international investment in cutting-edge fabrication technologies. Demand for precision machinery, advanced welding solutions, and automated bending and cutting equipment is set to rise as French manufacturers aim to boost their global competitiveness. Key consumer sectors, including aerospace, automotive, and renewable energy, will further drive demand for sophisticated metal fabricated components and, consequently, advanced equipment.

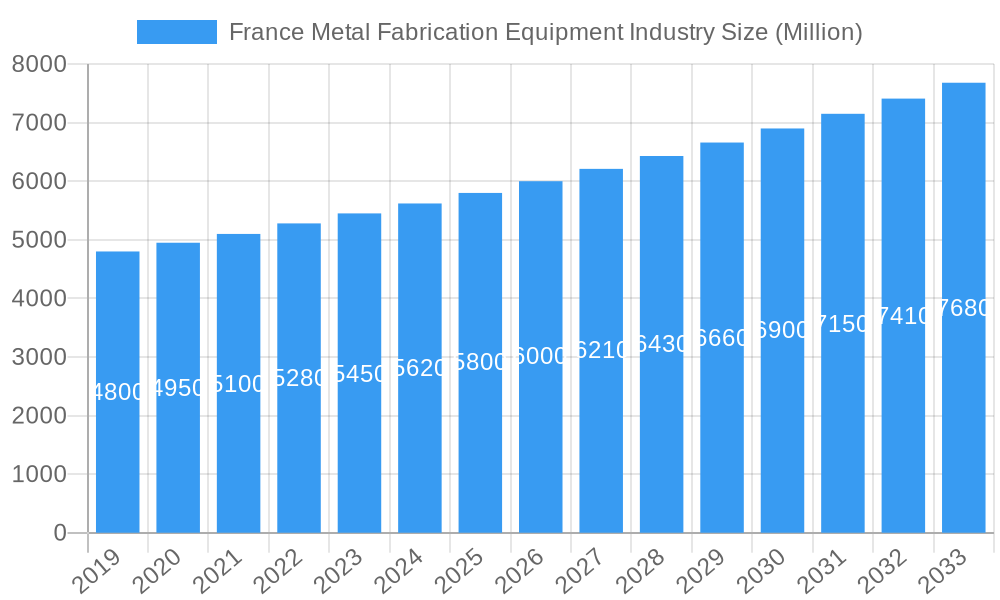

France Metal Fabrication Equipment Industry Market Size (In Million)

The market's historical performance has demonstrated a consistent upward trajectory, establishing a robust foundation for future expansion. The estimated market value for 2025 stands at 663.3 million, with continued growth expected throughout the forecast period. This sustained growth is further propelled by technological advancements leading to more efficient, sustainable, and intelligent fabrication processes. Innovations in additive manufacturing, laser cutting, and robotic automation are poised to transform traditional metal fabrication, unlocking new market opportunities. While Europe is a major global player, France's strong industrial base and commitment to technological adoption make it a significant contributor. The ongoing modernization of manufacturing facilities and the increasing need for specialized metal components across diverse industries will collectively ensure the sustained and dynamic growth of the France Metal Fabrication Equipment market.

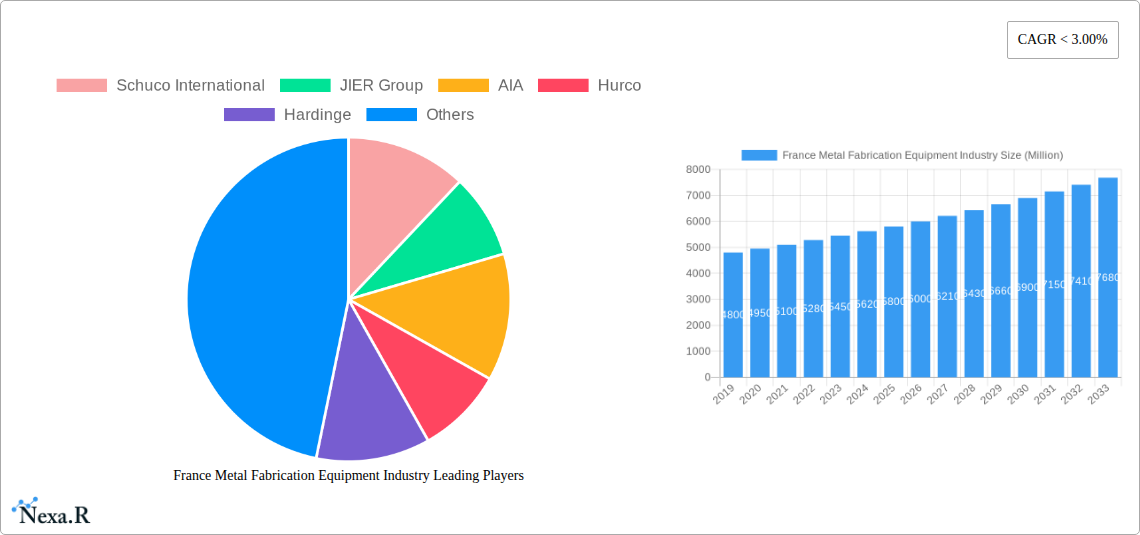

France Metal Fabrication Equipment Industry Company Market Share

France Metal Fabrication Equipment Industry Market Dynamics & Structure

The France metal fabrication equipment industry exhibits a moderate market concentration, with key players like Amada, JIER Group, and Hurco holding significant shares. Technological innovation is a primary driver, propelled by advancements in automation, digitalization, and Industry 4.0 integration, leading to increased demand for advanced automatic and semi-automatic machinery. Regulatory frameworks, particularly those focused on environmental sustainability and worker safety, are shaping product development and adoption rates, favoring energy-efficient and advanced safety features in manual and automated systems. Competitive product substitutes, while present in basic operations, are largely outpaced by the specialized capabilities of modern fabrication equipment. End-user demographics are shifting, with the Manufacturing sector and burgeoning Construction industries demonstrating robust demand for high-precision and high-throughput equipment. Mergers and acquisitions (M&A) activity remains a strategic tool for market consolidation and technological acquisition. Recent M&A deal volumes indicate a trend towards acquiring innovative startups and expanding geographical reach. For example, a significant M&A deal within the past year involved a leading European machinery manufacturer acquiring a specialized robotics integration firm, enhancing their automated solutions portfolio.

- Market Concentration: Moderate, with leading players holding substantial, but not monopolistic, market share.

- Technological Innovation Drivers: Industry 4.0 integration, AI-powered design and operation, advanced robotics, and additive manufacturing integration.

- Regulatory Frameworks: Stringent environmental regulations (e.g., emissions standards) and evolving workplace safety directives.

- Competitive Product Substitutes: Limited for high-precision, high-volume operations; more prevalent in low-end, general-purpose fabrication.

- End-User Demographics: Growing demand from the automotive, aerospace, and renewable energy sectors within Manufacturing, alongside increased infrastructure projects in Construction.

- M&A Trends: Focus on acquiring advanced automation technologies, expanding service offerings, and entering niche market segments.

France Metal Fabrication Equipment Industry Growth Trends & Insights

The France metal fabrication equipment industry is poised for significant expansion, driven by a confluence of economic, technological, and industrial factors. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This growth trajectory is underpinned by increasing investment in industrial modernization and automation across key end-user sectors. The adoption rates of advanced automatic and semi-automatic fabrication equipment are accelerating, as French businesses strive to enhance productivity, reduce labor costs, and improve product quality in a competitive global market. Technological disruptions, such as the integration of artificial intelligence (AI) for predictive maintenance, the proliferation of collaborative robots (cobots), and the increasing sophistication of CNC machining centers, are transforming operational efficiencies. Furthermore, the growing emphasis on sustainable manufacturing practices is spurring demand for energy-efficient equipment and those that minimize material waste.

Consumer behavior shifts are also playing a crucial role. Businesses are increasingly prioritizing flexibility and customization in their manufacturing processes, leading to a higher demand for adaptable and multi-functional metal fabrication machinery. The Manufacturing sector, in particular, is a key beneficiary of these trends, with substantial investments being made in upgrading existing facilities and building new, state-of-the-art production lines. The Construction industry's expansion, fueled by significant infrastructure development projects and a growing demand for prefabricated metal components, is another major growth catalyst. The Oil and Gas sector, while subject to cyclical fluctuations, continues to require specialized, heavy-duty fabrication equipment for exploration and production activities. The Power and Utilities sector's ongoing investment in renewable energy infrastructure, such as wind turbines and solar panel manufacturing, further bolsters demand for advanced metal fabrication solutions. The Other end-user industries, encompassing sectors like medical equipment and defense, also contribute to the overall market growth through their consistent need for high-precision metal components.

Market penetration of advanced fabrication technologies is steadily increasing. While manual equipment still holds a share, particularly in smaller workshops and for specific niche applications, the trend is overwhelmingly towards automation. The anticipated market size in the estimated year of 2025 is approximately $3.2 billion, with projections indicating it could reach over $5.0 billion by 2033. This growth is not merely quantitative but also qualitative, with a focus on 'smart' factories and the integration of digital technologies throughout the fabrication lifecycle. The development of sophisticated software for design, simulation, and production management, coupled with the physical machinery, is creating a more interconnected and efficient industrial ecosystem.

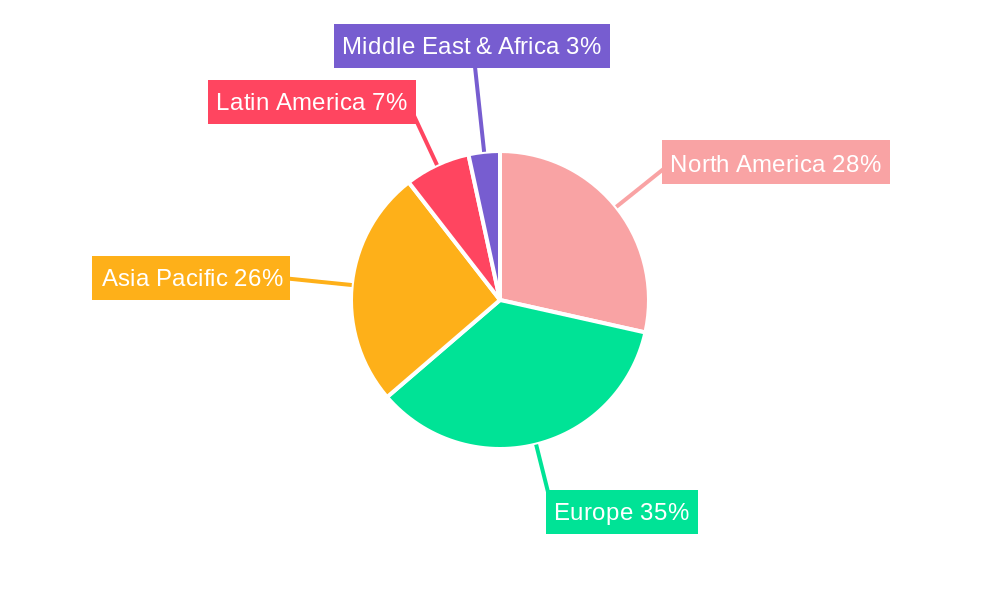

Dominant Regions, Countries, or Segments in France Metal Fabrication Equipment Industry

The Manufacturing end-user industry stands as the dominant segment driving growth within the France metal fabrication equipment market. This sector's extensive use of cutting, bending, welding, and finishing processes across various sub-sectors like automotive, aerospace, and general industrial goods makes it a consistent and substantial consumer of fabrication machinery. The Manufacturing segment is expected to account for approximately 45% of the total market revenue in the estimated year of 2025. This dominance is attributed to several key factors. Firstly, France possesses a strong industrial heritage and a highly skilled workforce adept at operating sophisticated fabrication equipment. Secondly, the French government's continued support for industrial innovation and competitiveness, including grants and tax incentives for automation and technological upgrades, directly benefits this sector. Thirdly, the increasing demand for customized, high-precision metal components from downstream industries such as luxury goods, defense, and advanced electronics fuels the need for versatile and advanced fabrication solutions.

Within the product type segmentation, automatic machinery is emerging as the fastest-growing category, driven by the pursuit of increased efficiency, reduced operational costs, and enhanced safety standards. While semi-automatic equipment still holds a significant market share due to its balance of automation and flexibility, and manual machines cater to specific niche applications and smaller enterprises, the long-term growth trajectory clearly favors fully automated solutions. The projected market share for automatic equipment is expected to reach 55% by 2033, up from an estimated 38% in 2025.

The Construction end-user industry is another significant growth driver, particularly fueled by a surge in infrastructure projects and the increasing adoption of modular construction techniques. The demand for precisely fabricated steel structures, components for bridges, and architectural metalwork is on the rise, creating substantial opportunities for metal fabrication equipment manufacturers. This sector's growth is further propelled by investments in renewable energy infrastructure, such as the fabrication of components for wind turbines and solar farms.

The Oil and Gas sector, while historically a significant consumer, experiences more cyclical demand influenced by global energy prices. However, the need for robust, heavy-duty fabrication equipment for offshore structures, pipelines, and refinery components remains consistent, albeit with a more mature growth rate. The Power and Utilities sector is experiencing renewed investment, particularly in the expansion and modernization of grid infrastructure and the development of renewable energy facilities, which translates to a steady demand for fabrication equipment.

Overall, the Manufacturing sector's broad application base and continuous drive for innovation, coupled with the burgeoning Construction sector's infrastructure and renewable energy needs, positions them as the primary engines of growth in the France metal fabrication equipment market.

France Metal Fabrication Equipment Industry Product Landscape

The product landscape of the France metal fabrication equipment industry is characterized by rapid technological advancement and a focus on integrated solutions. Innovations are predominantly centered around enhancing automation, precision, and efficiency. Advanced CNC machining centers, laser cutting machines with enhanced power and speed, and sophisticated robotic welding systems are at the forefront. These products offer superior performance metrics, including higher throughput rates, tighter tolerances, and reduced material waste. Unique selling propositions often lie in their intelligent features, such as AI-driven process optimization, real-time monitoring capabilities, and seamless integration with digital design and production software (CAD/CAM). The increasing demand for Industry 4.0 compatible equipment, which facilitates data exchange and connectivity, is a key technological advancement driving product development.

Key Drivers, Barriers & Challenges in France Metal Fabrication Equipment Industry

Key Drivers:

- Technological Advancements: Integration of Industry 4.0 principles, AI, robotics, and IoT for smart manufacturing.

- Government Initiatives: Support for industrial modernization, reshoring initiatives, and incentives for automation adoption.

- Demand from Key End-User Industries: Robust growth in Manufacturing (automotive, aerospace) and Construction sectors driving equipment sales.

- Focus on Productivity and Efficiency: Businesses seeking to optimize operations, reduce costs, and improve output quality.

- Growing Demand for Customization and Precision: Advancements enabling complex designs and high-tolerance fabrication.

Barriers & Challenges:

- High Initial Investment Costs: Significant capital required for advanced fabrication equipment, posing a barrier for SMEs.

- Skilled Labor Shortage: Difficulty in finding and retaining qualified personnel to operate and maintain sophisticated machinery.

- Supply Chain Disruptions: Global uncertainties impacting the availability and cost of raw materials and critical components.

- Economic Volatility: Fluctuations in global economic conditions and industrial output can impact investment decisions.

- Intense Competition: Both domestic and international players vying for market share, leading to price pressures.

Emerging Opportunities in France Metal Fabrication Equipment Industry

Emerging opportunities in the France metal fabrication equipment industry lie in several key areas. The increasing adoption of additive manufacturing (3D printing) for metal components presents a significant avenue for growth, especially in specialized applications within aerospace and medical device manufacturing. Furthermore, the development of integrated solutions that combine traditional fabrication methods with advanced digital technologies, such as augmented reality for operator assistance and AI-powered quality control, offers substantial untapped market potential. The growing emphasis on sustainability and the circular economy is also creating demand for equipment that can facilitate efficient material recycling and waste reduction in metal fabrication processes.

Growth Accelerators in the France Metal Fabrication Equipment Industry Industry

Several catalysts are accelerating long-term growth in the France metal fabrication equipment industry. The ongoing digital transformation of manufacturing, with a strong push towards "smart factories" and connected production lines, is a primary driver. Technological breakthroughs in areas like advanced robotics, cobots, and machine learning are enhancing automation capabilities, leading to increased adoption of sophisticated machinery. Strategic partnerships between equipment manufacturers and software providers are creating comprehensive solutions that address the evolving needs of businesses. Moreover, market expansion strategies by key players, including the development of specialized equipment for niche applications and the expansion of after-sales service and support networks, are further bolstering growth.

Key Players Shaping the France Metal Fabrication Equipment Industry Market

- Schuco International

- JIER Group

- AIA

- Hurco

- Hardinge

- Kennametal

- MAG Giddings & Lewis

- Amada

Notable Milestones in France Metal Fabrication Equipment Industry Sector

- 2023 (Q4): Launch of new series of high-speed laser cutting machines by Amada, offering enhanced precision and energy efficiency.

- 2024 (Q1): JIER Group announces significant investment in R&D for advanced robotic welding solutions, aiming to capture growing automation demand.

- 2024 (Q2): Hurco introduces AI-powered adaptive control features in its CNC machining centers, improving cycle times and tool life.

- 2024 (Q3): Kennametal unveils a new line of advanced tooling designed for high-performance metal fabrication applications, supporting increased productivity.

- 2024 (Q4): MAG Giddings & Lewis collaborates with a leading aerospace manufacturer to develop custom fabrication solutions for next-generation aircraft components.

In-Depth France Metal Fabrication Equipment Industry Market Outlook

The outlook for the France metal fabrication equipment industry remains exceptionally positive, driven by strong underlying growth accelerators. The continued push towards Industry 4.0 and the widespread adoption of digital manufacturing technologies will fuel demand for intelligent, connected machinery. Strategic partnerships and a focus on integrated solutions, encompassing both hardware and software, will define market leadership. Furthermore, the growing emphasis on sustainable manufacturing and the circular economy will create new avenues for innovation and market penetration, particularly for equipment that promotes efficiency and resource conservation. Businesses that can effectively leverage technological advancements and adapt to evolving industry needs are well-positioned for substantial growth in the coming years.

France Metal Fabrication Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. End-user industry

- 2.1. Oil and Gas

- 2.2. Manufacturing

- 2.3. Power and Utilities

- 2.4. Construction

- 2.5. Other end-user industries

France Metal Fabrication Equipment Industry Segmentation By Geography

- 1. France

France Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of France Metal Fabrication Equipment Industry

France Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is a Key Trend in Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by End-user industry

- 5.2.1. Oil and Gas

- 5.2.2. Manufacturing

- 5.2.3. Power and Utilities

- 5.2.4. Construction

- 5.2.5. Other end-user industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schuco International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JIER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hurco

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hardinge

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kennametal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAG Giddings & Lewis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amada*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Schuco International

List of Figures

- Figure 1: France Metal Fabrication Equipment Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: France Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: France Metal Fabrication Equipment Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: France Metal Fabrication Equipment Industry Revenue million Forecast, by End-user industry 2020 & 2033

- Table 3: France Metal Fabrication Equipment Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: France Metal Fabrication Equipment Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: France Metal Fabrication Equipment Industry Revenue million Forecast, by End-user industry 2020 & 2033

- Table 6: France Metal Fabrication Equipment Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Metal Fabrication Equipment Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the France Metal Fabrication Equipment Industry?

Key companies in the market include Schuco International, JIER Group, AIA, Hurco, Hardinge, Kennametal, MAG Giddings & Lewis, Amada*List Not Exhaustive.

3. What are the main segments of the France Metal Fabrication Equipment Industry?

The market segments include Product Type, End-user industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 663.3 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is a Key Trend in Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the France Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence