Key Insights

The contract manufacturing market, currently valued at $0.68 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing complexity of electronics and the rising demand for specialized manufacturing capabilities are pushing original equipment manufacturers (OEMs) to outsource production to contract manufacturers (CMs). This allows OEMs to focus on core competencies like research and development and marketing, while leveraging the CMs' expertise in cost-effective, large-scale production. Furthermore, the global shift towards automation and Industry 4.0 technologies is fueling market expansion, as CMs invest in advanced technologies to enhance efficiency and precision. Geographical diversification, especially towards regions with lower labor costs and supportive government policies, is also a prominent trend. However, challenges remain, including fluctuating raw material prices, geopolitical instability impacting supply chains, and increasing pressure to meet stringent environmental regulations. The competitive landscape is dominated by major players such as Hon Hai Precision Industry, Flextronics International, and Jabil, who continuously strive to enhance their service offerings and technological capabilities to retain market share.

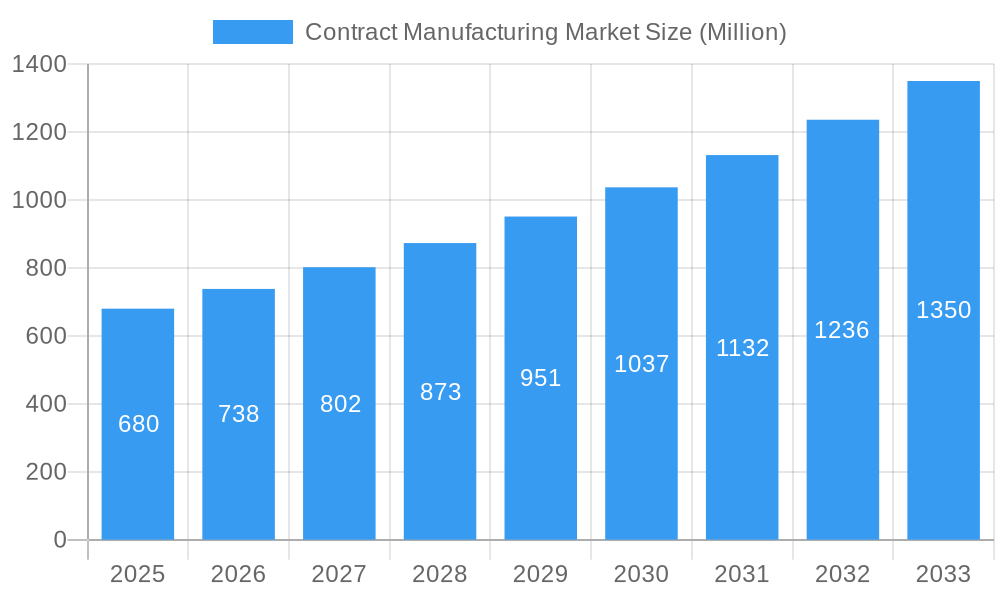

Contract Manufacturing Market Market Size (In Million)

The market's Compound Annual Growth Rate (CAGR) of 8.70% from 2025 to 2033 suggests a significant expansion in market size over the forecast period. This growth is anticipated to be relatively consistent across regions, with adjustments reflecting variations in economic development and industrialization levels. The segmentation of the market (though not provided in the initial data) likely includes categories based on product type (e.g., electronics, automotive parts, medical devices), manufacturing process (e.g., surface mount technology, injection molding), and service offerings (e.g., design, procurement, assembly, testing). The ongoing trend of nearshoring and reshoring, driven by concerns about supply chain resilience and geopolitical risks, will significantly shape the regional distribution of the market in the coming years, potentially leading to a shift in market share among different geographic locations.

Contract Manufacturing Market Company Market Share

Contract Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Contract Manufacturing market, encompassing market dynamics, growth trends, regional insights, and key player strategies. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report delves into the parent market of Manufacturing and the child market of Contract Manufacturing Services, offering granular insights for informed decision-making. Market values are presented in million units.

Contract Manufacturing Market Dynamics & Structure

The Contract Manufacturing market exhibits a moderately concentrated structure, with several major players commanding significant market share. Technological innovation, particularly in automation and Industry 4.0 technologies, acts as a primary growth driver. Stringent regulatory frameworks, varying across regions, influence manufacturing practices and compliance costs. The market faces competition from in-house manufacturing capabilities and alternative outsourcing models. End-user demographics, including industries like pharmaceuticals, electronics, and medical devices, significantly impact market demand. The market has witnessed a moderate level of M&A activity in recent years, with strategic acquisitions aimed at expanding geographic reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on automation, AI, and Industry 4.0 driving efficiency gains and cost reduction.

- Regulatory Frameworks: Stringent regulations, particularly in pharmaceuticals and medical devices, impact compliance costs.

- Competitive Substitutes: In-house manufacturing and alternative outsourcing models pose competitive challenges.

- End-User Demographics: Strong demand from electronics, pharmaceuticals, and medical devices sectors.

- M&A Trends: Moderate M&A activity, driven by expansion and technological acquisition strategies. Approximate deal volume: xx deals in 2024.

Contract Manufacturing Market Growth Trends & Insights

The Contract Manufacturing market has exhibited robust and consistent expansion throughout the historical period (2019-2024), achieving a Compound Annual Growth Rate (CAGR) of approximately XX%. This sustained growth is primarily propelled by the escalating trend of outsourcing production activities by companies across various industries, coupled with significant technological advancements that are continuously enhancing manufacturing efficiency and driving down costs. The increasing demand from a diverse array of end-use sectors, including electronics, pharmaceuticals, automotive, and consumer goods, further fuels this expansion. The adoption rates of cutting-edge manufacturing technologies, such as advanced robotics, artificial intelligence (AI) in process optimization, and 3D printing (additive manufacturing), are accelerating, enabling manufacturers to achieve greater precision, speed, and flexibility. Shifting consumer behaviors, characterized by a strong preference for personalized products and a demand for shorter product lifecycles, also play a pivotal role in driving the market's growth. Consequently, the market penetration of contract manufacturing services is anticipated to reach an impressive XX% by the year 2033. Technological disruptions, particularly those driven by AI-powered optimization and comprehensive automation solutions, are fundamentally reshaping the industry landscape, leading to unprecedented levels of operational efficiency and substantial reductions in production costs. The contract manufacturing market is projected to maintain its impressive growth trajectory throughout the forecast period (2025-2033), with an expected CAGR of approximately XX%.

Dominant Regions, Countries, or Segments in Contract Manufacturing Market

Asia-Pacific dominates the Contract Manufacturing market, driven by a large manufacturing base, lower labor costs, and strong government support for industrial development. China and India are key contributors to this regional dominance. North America follows as a significant market, characterized by high technological advancement and stringent regulatory standards. Europe exhibits a steady growth trajectory, with a focus on specialized manufacturing sectors.

- Asia-Pacific: Dominant region due to low labor costs, established manufacturing base, and favorable government policies.

- North America: Significant market driven by technological advancement and strong demand from various sectors.

- Europe: Steady growth driven by specialized manufacturing capabilities and focus on high-value products.

- Key Drivers: Favorable government policies (tax incentives, infrastructure development), low labor costs (Asia-Pacific), technological advancements (North America), and strong domestic demand.

Contract Manufacturing Market Product Landscape

The Contract Manufacturing market offers a diverse range of services, including electronics manufacturing, pharmaceutical manufacturing, and medical device manufacturing. Product innovation focuses on enhancing efficiency, reducing costs, and improving quality through the integration of advanced technologies. Key performance metrics include production yield, defect rates, and lead times. Unique selling propositions include flexible manufacturing capabilities, specialized expertise, and compliance with stringent industry regulations.

Key Drivers, Barriers & Challenges in Contract Manufacturing Market

Key Drivers:

- Increasing outsourcing by companies focusing on core competencies.

- Technological advancements leading to automation and efficiency gains.

- Growing demand from various end-use sectors like electronics, pharmaceuticals, and medical devices.

Key Challenges & Restraints:

- Geopolitical risks and supply chain disruptions impacting sourcing and logistics.

- Stringent regulatory compliance requirements increasing operational costs.

- Intense competition from established players and new entrants. Estimated impact: xx% reduction in profit margins for smaller players in 2024.

Emerging Opportunities in Contract Manufacturing Market

- The burgeoning growth in specialized and niche markets, such as personalized medicine, advanced biopharmaceuticals, and eco-friendly sustainable manufacturing solutions.

- Strategic expansion into rapidly developing emerging economies that present significant untapped potential and high growth prospects.

- Continuous development and integration of innovative manufacturing technologies, including but not limited to advanced 3D printing, additive manufacturing, and novel material science applications.

- The increasing demand for end-to-end solutions, encompassing design, prototyping, production, and supply chain management, offered by contract manufacturers.

- Opportunities arising from supply chain resilience initiatives, where companies are diversifying their manufacturing bases through contract manufacturing partnerships.

Growth Accelerators in the Contract Manufacturing Market Industry

Key drivers propelling the contract manufacturing industry include groundbreaking technological advancements in automation, artificial intelligence (AI) for predictive maintenance and quality control, and robotics, which are collectively contributing to significant improvements in operational efficiency and substantial cost reductions. The formation of strategic partnerships and collaborations between contract manufacturers and leading technology providers is instrumental in fostering a culture of innovation and in broadening the spectrum of specialized services offered to clients. Furthermore, the proactive market expansion into emerging economies and previously underserved sectors presents lucrative growth avenues. The increasing complexity of products and the need for specialized expertise are also compelling businesses to leverage the capabilities of contract manufacturers. The growing focus on supply chain diversification and risk mitigation strategies is further solidifying the role of contract manufacturing in the global industrial landscape.

Key Players Shaping the Contract Manufacturing Market Market

- Hon Hai Precision Industry Co Ltd

- Flextronics International Ltd

- Jabil Inc

- Celestica Inc

- Kinpo Group

- Shenzhen Kaifa Technology Co Ltd

- Benchmark Electronics Inc

- Universal Scientific Industrial Co Ltd

- Venture Corporation Limited

- Wistron Coporation

- List Not Exhaustive

Notable Milestones in Contract Manufacturing Market Sector

- August 2024: Eckert & Ziegler successfully secured a multi-year contract with Telix Pharmaceuticals for the crucial European supply of Lu-177, a vital component for an ongoing Phase III clinical trial. This significant agreement underscores the escalating demand for highly specialized and reliable contract manufacturing services within the dynamic pharmaceutical sector, particularly for radiopharmaceuticals.

- August 2024: Salt Medical strategically established a new, state-of-the-art manufacturing facility in Ireland. This expansion of their global footprint is a testament to the continued robust investment and significant growth within the specialized segment of medical device contract manufacturing, signaling confidence in the sector's future.

- July 2024: A leading automotive contract manufacturer announced a major investment in advanced automation and AI-driven quality inspection systems to enhance production capacity and quality for a major electric vehicle manufacturer, highlighting the trend towards higher-tech manufacturing.

- June 2024: A contract electronics manufacturer reported a substantial increase in demand for high-mix, low-volume production runs, driven by the rapid innovation cycles in the consumer electronics and IoT device markets.

In-Depth Contract Manufacturing Market Market Outlook

The Contract Manufacturing market is poised for continued growth driven by technological innovation, strategic partnerships, and expansion into new markets. Future market potential is particularly strong in emerging economies and specialized sectors like personalized medicine and sustainable manufacturing. Strategic opportunities lie in leveraging advanced technologies to enhance efficiency, develop innovative solutions, and expand service offerings to meet evolving customer demands. The market is expected to witness further consolidation, with larger players acquiring smaller companies to enhance their scale and capabilities.

Contract Manufacturing Market Segmentation

-

1. Service Type

- 1.1. Manufacturing Services

- 1.2. Design Services

- 1.3. Post Manufacturing Services

-

2. End-user Vertical

- 2.1. Electronics

- 2.2. Pharmaceuticals and Healthcare

- 2.3. Automotive

- 2.4. Consumer Goods

- 2.5. Other End-user Verticals

-

3. Contract Type

- 3.1. Long-term Contract

- 3.2. Short-term Contract

Contract Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Contract Manufacturing Market Regional Market Share

Geographic Coverage of Contract Manufacturing Market

Contract Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency; Globalization and Market Expansion

- 3.3. Market Restrains

- 3.3.1. Cost Efficiency; Globalization and Market Expansion

- 3.4. Market Trends

- 3.4.1. Electronics Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Manufacturing Services

- 5.1.2. Design Services

- 5.1.3. Post Manufacturing Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Electronics

- 5.2.2. Pharmaceuticals and Healthcare

- 5.2.3. Automotive

- 5.2.4. Consumer Goods

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Contract Type

- 5.3.1. Long-term Contract

- 5.3.2. Short-term Contract

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Manufacturing Services

- 6.1.2. Design Services

- 6.1.3. Post Manufacturing Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Electronics

- 6.2.2. Pharmaceuticals and Healthcare

- 6.2.3. Automotive

- 6.2.4. Consumer Goods

- 6.2.5. Other End-user Verticals

- 6.3. Market Analysis, Insights and Forecast - by Contract Type

- 6.3.1. Long-term Contract

- 6.3.2. Short-term Contract

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Manufacturing Services

- 7.1.2. Design Services

- 7.1.3. Post Manufacturing Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Electronics

- 7.2.2. Pharmaceuticals and Healthcare

- 7.2.3. Automotive

- 7.2.4. Consumer Goods

- 7.2.5. Other End-user Verticals

- 7.3. Market Analysis, Insights and Forecast - by Contract Type

- 7.3.1. Long-term Contract

- 7.3.2. Short-term Contract

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Manufacturing Services

- 8.1.2. Design Services

- 8.1.3. Post Manufacturing Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Electronics

- 8.2.2. Pharmaceuticals and Healthcare

- 8.2.3. Automotive

- 8.2.4. Consumer Goods

- 8.2.5. Other End-user Verticals

- 8.3. Market Analysis, Insights and Forecast - by Contract Type

- 8.3.1. Long-term Contract

- 8.3.2. Short-term Contract

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Manufacturing Services

- 9.1.2. Design Services

- 9.1.3. Post Manufacturing Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Electronics

- 9.2.2. Pharmaceuticals and Healthcare

- 9.2.3. Automotive

- 9.2.4. Consumer Goods

- 9.2.5. Other End-user Verticals

- 9.3. Market Analysis, Insights and Forecast - by Contract Type

- 9.3.1. Long-term Contract

- 9.3.2. Short-term Contract

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Latin America Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Manufacturing Services

- 10.1.2. Design Services

- 10.1.3. Post Manufacturing Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Electronics

- 10.2.2. Pharmaceuticals and Healthcare

- 10.2.3. Automotive

- 10.2.4. Consumer Goods

- 10.2.5. Other End-user Verticals

- 10.3. Market Analysis, Insights and Forecast - by Contract Type

- 10.3.1. Long-term Contract

- 10.3.2. Short-term Contract

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Middle East and Africa Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Manufacturing Services

- 11.1.2. Design Services

- 11.1.3. Post Manufacturing Services

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Electronics

- 11.2.2. Pharmaceuticals and Healthcare

- 11.2.3. Automotive

- 11.2.4. Consumer Goods

- 11.2.5. Other End-user Verticals

- 11.3. Market Analysis, Insights and Forecast - by Contract Type

- 11.3.1. Long-term Contract

- 11.3.2. Short-term Contract

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hon Hai Precision Industry Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Flextronics International Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Jabil Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Celestica Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kinpo Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shenzhen Kaifa Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Benchmark Electronics Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Universal Scientific Industrial Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Venture Corporation Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wistron Coporation*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hon Hai Precision Industry Co Ltd

List of Figures

- Figure 1: Global Contract Manufacturing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Contract Manufacturing Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 5: North America Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: North America Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 9: North America Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: North America Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 12: North America Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 13: North America Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 14: North America Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 15: North America Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: North America Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 20: Europe Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 21: Europe Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 23: Europe Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 24: Europe Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 25: Europe Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 26: Europe Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 27: Europe Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 28: Europe Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 29: Europe Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 30: Europe Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 31: Europe Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Europe Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 36: Asia Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 37: Asia Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Asia Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 39: Asia Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 40: Asia Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 41: Asia Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 42: Asia Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 43: Asia Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 44: Asia Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 45: Asia Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 46: Asia Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 47: Asia Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Asia Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 52: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 53: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 57: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 60: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 61: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 62: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 63: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 68: Latin America Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 69: Latin America Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 70: Latin America Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 71: Latin America Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 72: Latin America Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 73: Latin America Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 74: Latin America Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 75: Latin America Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 76: Latin America Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 77: Latin America Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 78: Latin America Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 79: Latin America Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Latin America Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 84: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 85: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 86: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 87: Middle East and Africa Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 88: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 89: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 90: Middle East and Africa Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 91: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 92: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 93: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 94: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 95: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 97: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 3: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 6: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 7: Global Contract Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Contract Manufacturing Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 11: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 13: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 14: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 15: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 19: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 22: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 23: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 27: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 30: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 31: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 33: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 34: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 35: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 36: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 37: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 38: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 39: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 41: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 42: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 43: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 44: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 45: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 46: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 47: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 50: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 51: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 52: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 53: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 54: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 55: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Market?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the Contract Manufacturing Market?

Key companies in the market include Hon Hai Precision Industry Co Ltd, Flextronics International Ltd, Jabil Inc, Celestica Inc, Kinpo Group, Shenzhen Kaifa Technology Co Ltd, Benchmark Electronics Inc, Universal Scientific Industrial Co Ltd, Venture Corporation Limited, Wistron Coporation*List Not Exhaustive.

3. What are the main segments of the Contract Manufacturing Market?

The market segments include Service Type, End-user Vertical, Contract Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency; Globalization and Market Expansion.

6. What are the notable trends driving market growth?

Electronics Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Cost Efficiency; Globalization and Market Expansion.

8. Can you provide examples of recent developments in the market?

August 2024: Eckert & Ziegler and Telix Pharmaceuticals Limited (Telix) announced a significant multi-year agreement. Under this contract, Eckert & Ziegler will act as the European contract manufacturing organization (CMO) for Telix's ProstACT GLOBAL Phase III study. The contract ensures the supply for the entire European patient base from Eckert & Ziegler's state-of-the-art facility in Berlin. Eckert & Ziegler will supply the essential starting material: their high-purity, non-carrier-added GMP-grade Lutetium-177 (Lu-177).August 2024: Salt Medical, a Contract Development and Manufacturing Organization (CDMO) focusing on medical device manufacturing, is set to debut at Claregalway Corporate Park in Co. Galway. Salt Medical boasts a distinguished international platform in the medical device arena, bolstered by a robust global research and development (R&D) and manufacturing network. While the company has established R&D and manufacturing hubs in Ireland, it also sources raw materials and precision components, complemented by large-scale manufacturing operations in both the United States and the Asia-Pacific region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Market?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence