Key Insights

The Indian steel fabrication market is set for significant growth, projected to reach $3.38 billion by 2024, with a CAGR of 4.37% from 2024 to 2033. This expansion is driven by robust government infrastructure initiatives in smart cities, transportation, and renewable energy. The manufacturing sector, a key economic driver, fuels demand for complex steel structures, supported by industrial automation. The power and energy sectors, coupled with the construction industry, also contribute to market momentum. Emerging trends like advanced fabrication technologies (robotic welding, 3D printing) and sustainable design are reshaping the landscape. The "Make in India" initiative promotes domestic manufacturing, fostering a self-reliant and competitive steel fabrication ecosystem.

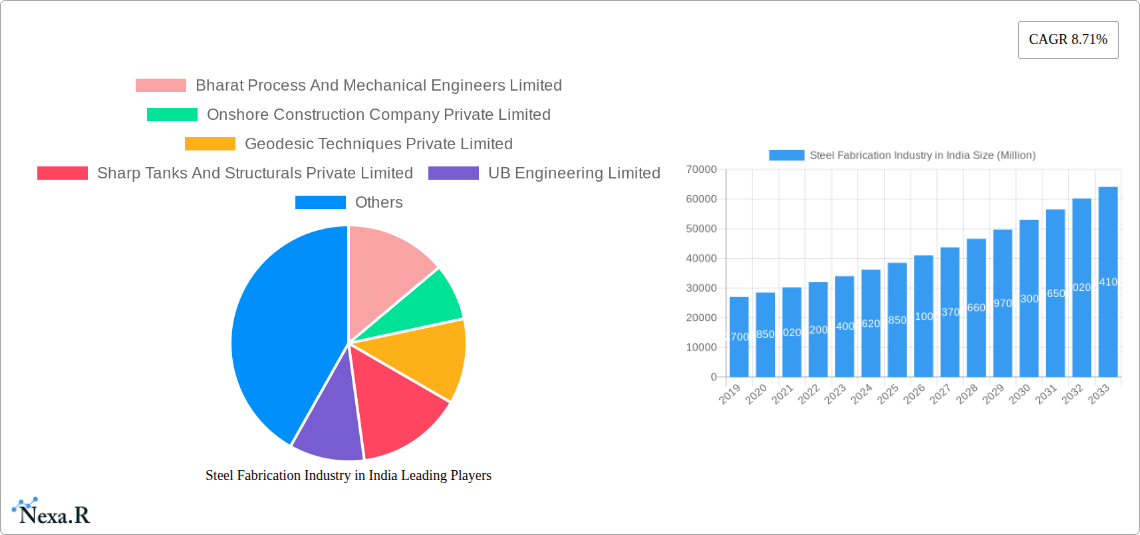

Steel Fabrication Industry in India Market Size (In Billion)

The market is evolving towards sophisticated fabrication techniques and specialized products beyond traditional steel sections. While overall demand is strong, challenges include fluctuating raw material prices and skilled labor availability. However, large-scale projects and government commitment to industrial growth are expected to mitigate these restraints. The increasing complexity of construction and infrastructure demands high-precision, custom steel fabrication. The oil and gas sector continues to require specialized fabricated components. The market's segmentation by product and end-user highlights its versatility across various economic activities. Leading companies are investing in capacity and technology, positioning India as a global leader in steel fabrication.

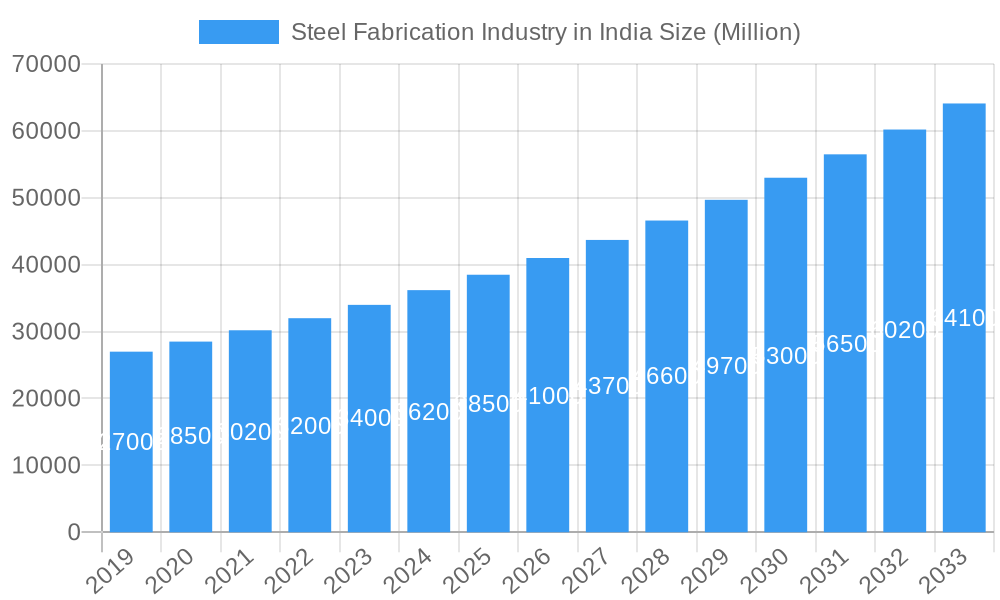

Steel Fabrication Industry in India Company Market Share

Here is a compelling, SEO-optimized report description for the Steel Fabrication Industry in India, incorporating high-traffic keywords and detailed insights as requested:

Steel Fabrication Industry in India Market Dynamics & Structure

The Indian steel fabrication industry exhibits a moderate market concentration, with key players strategically investing in technological innovation to enhance efficiency and product offerings. Government initiatives aimed at boosting infrastructure development and manufacturing output are significant drivers, while evolving regulatory frameworks necessitate adaptability. Competition arises from both domestic fabrication specialists and the potential for imported fabricated steel products, impacting pricing and market share. End-user industries like Construction, Manufacturing, and Oil & Gas are crucial, each with distinct demand patterns. Mergers & Acquisitions (M&A) trends indicate a drive towards consolidation and capability enhancement, as exemplified by recent strategic moves.

- Market Concentration: Dominated by a blend of large, established entities and a significant number of Small and Medium-sized Enterprises (SMEs).

- Technological Innovation: Driven by the adoption of advanced welding techniques, automation in cutting and shaping, and the use of specialized steel alloys for improved performance and durability.

- Regulatory Frameworks: Influenced by building codes, environmental regulations, and quality standards, ensuring safety and compliance.

- Competitive Product Substitutes: While steel remains dominant, composite materials and other structural alternatives pose indirect competition in niche applications.

- End-User Demographics: Demand is largely shaped by the growth trajectories of the Construction (infrastructure, real estate), Manufacturing (automotive, machinery), Power & Energy (renewable energy infrastructure, power plants), and Oil & Gas sectors.

- M&A Trends: Focused on acquiring downstream capabilities, expanding product portfolios, and capturing synergies across operations.

Steel Fabrication Industry in India Growth Trends & Insights

The Indian steel fabrication market is projected for robust expansion, driven by a confluence of factors including government investments in infrastructure, increasing urbanization, and the 'Make in India' initiative. The market size is expected to witness substantial growth, fueled by higher adoption rates of prefabricated steel structures in construction and the increasing demand for customized fabrication solutions across various industrial segments. Technological disruptions, such as the integration of Building Information Modeling (BIM) for design and fabrication, are streamlining project lifecycles and reducing lead times. Shifts in consumer behavior, particularly the growing preference for faster project completion and sustainable building materials, are further accelerating market penetration. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period, reaching an estimated value of INR 6,80,000 Million by 2033. The base year market size is estimated at INR 3,25,000 Million.

Dominant Regions, Countries, or Segments in Steel Fabrication Industry in India

The Construction end-user industry is a paramount driver of growth within the Indian steel fabrication market. This segment's dominance is intrinsically linked to the nation's ambitious infrastructure development agenda, including the construction of smart cities, highways, airports, and metro rail networks. The sheer volume of projects requiring structural steel components, ranging from heavy sectional steel for bridges and large industrial buildings to light sectional steel for residential and commercial complexes, solidifies its leading position. Economic policies promoting private sector participation in infrastructure and housing, coupled with increased urbanization, continuously fuel demand.

- Construction: This segment accounts for an estimated 45% of the total market demand.

- Key Drivers: Government spending on infrastructure, rapid urbanization, housing sector growth, and industrial expansion.

- Market Share: Holds the largest share due to the pervasive use of steel in virtually all construction projects.

- Growth Potential: Continues to be a high-growth area with significant investment in large-scale public and private projects.

Another significant segment is Manufacturing, encompassing a diverse range of industries that rely heavily on fabricated steel for machinery, equipment, and industrial structures. The Power and Energy sector, particularly with the push for renewable energy infrastructure like solar panel mounting structures and wind turbine towers, also presents substantial demand. The Oil and Gas sector requires specialized fabrication for pipelines, platforms, and processing facilities, albeit with more cyclical demand. The Other End-user Industries, including defense, railways, and ship-building, also contribute to the overall market dynamism.

- Manufacturing: Estimated at 25% market share, driven by industrial growth and equipment demand.

- Power and Energy: Approximately 15% market share, bolstered by renewable energy projects and power plant construction.

- Oil and Gas: Around 10% market share, characterized by project-specific demand for critical infrastructure.

- Other End-user Industries: Remaining 5%, representing specialized fabrication needs.

Within Product Types, Heavy Sectional Steel fabrication is crucial for large-scale infrastructure projects, while Light Sectional Steel is indispensable for commercial and residential buildings. The continuous demand across these product categories ensures a balanced growth trajectory for the industry.

Steel Fabrication Industry in India Product Landscape

The product landscape in Indian steel fabrication is characterized by a strong emphasis on structural integrity, durability, and increasingly, sustainability. Innovations are centered on enhancing the load-bearing capacity of fabricated steel structures, improving corrosion resistance through advanced coatings and galvanization techniques, and optimizing designs for faster erection times. Applications range from massive industrial sheds, bridges, and power plant structures utilizing heavy sectional steel, to the production of lighter, yet robust, components for commercial buildings, warehouses, and prefabricated housing units from light sectional steel. The performance metrics are rigorously evaluated against national and international standards, ensuring safety and longevity in diverse environmental conditions.

Key Drivers, Barriers & Challenges in Steel Fabrication Industry in India

Key Drivers:

- Government Infrastructure Push: Significant public and private investment in roads, railways, ports, and smart cities.

- 'Make in India' Initiative: Encouraging domestic manufacturing and reducing import dependence.

- Urbanization and Real Estate Growth: Continuous demand for residential, commercial, and industrial buildings.

- Renewable Energy Expansion: Growing need for fabricated structures for solar and wind power projects.

- Technological Advancements: Adoption of modern fabrication techniques for efficiency and quality.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the cost of steel and other raw materials impact profitability.

- Skilled Labor Shortage: Difficulty in finding and retaining skilled welders, fabricators, and engineers.

- Intense Competition: Presence of numerous players leading to price pressures.

- Logistical Challenges: Ensuring timely and cost-effective transportation of large fabricated components.

- Stringent Quality and Safety Standards: Maintaining compliance with evolving regulations requires continuous investment.

- Capital Investment: High upfront costs for advanced machinery and infrastructure.

Emerging Opportunities in Steel Fabrication Industry in India

Emerging opportunities lie in the growing demand for prefabricated and modular steel structures, offering faster construction times and reduced on-site labor requirements. The expansion of the renewable energy sector, particularly in solar and wind power, presents a substantial market for specialized steel fabrication. Furthermore, the increasing focus on sustainable construction practices opens avenues for fabrication using recycled steel and environmentally friendly coatings. The development of specialized steel alloys for high-performance applications in sectors like defense and aerospace also represents an untapped market potential.

Growth Accelerators in the Steel Fabrication Industry in India Industry

Long-term growth in the Indian steel fabrication industry will be significantly accelerated by sustained government focus on infrastructure development, coupled with the robust expansion of manufacturing and renewable energy sectors. Strategic partnerships and joint ventures, both domestic and international, will foster the adoption of cutting-edge technologies and improve operational efficiencies. Market expansion strategies, including a greater focus on export markets and the development of value-added fabricated products, will further propel growth. Investments in research and development for innovative materials and fabrication processes will also act as key catalysts.

Key Players Shaping the Steel Fabrication Industry in India Market

- Bharat Process And Mechanical Engineers Limited

- Onshore Construction Company Private Limited

- Geodesic Techniques Private Limited

- Sharp Tanks And Structurals Private Limited

- UB Engineering Limited

- Space Chem Engineers Private Limited

- Arun Fabricators

- Indhya Engineering Associates

- DD Erectors

- John Erectors Private Limited

Notable Milestones in Steel Fabrication Industry in India Sector

- April 2023: AM Mining, a joint venture between Arcelor Mittal Luxembourg and Nippon Steel Corporation, Japan, acquired Indian Steel Corpn for INR 897 crore, likely enhancing downstream capabilities and broadening its product portfolio.

- November 2022: AM Mining India completed the acquisition of Uttam Galva Steels. AM Mining India, a joint venture between ArcelorMittal and Nippon Steel, is poised to benefit from this integration.

In-Depth Steel Fabrication Industry in India Market Outlook

The outlook for the Indian steel fabrication industry is exceptionally positive, driven by a confluence of strong fundamental growth drivers. Sustained government impetus on infrastructure development, alongside the burgeoning manufacturing and renewable energy sectors, will continue to fuel demand for fabricated steel products. Strategic technological advancements, including automation and digital fabrication, will enhance efficiency and competitiveness. Furthermore, a growing emphasis on sustainability and the adoption of innovative materials will shape future market trends. The industry is well-positioned to capitalize on the nation's economic growth, offering significant opportunities for expansion and value creation.

Steel Fabrication Industry in India Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Energy

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

Steel Fabrication Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

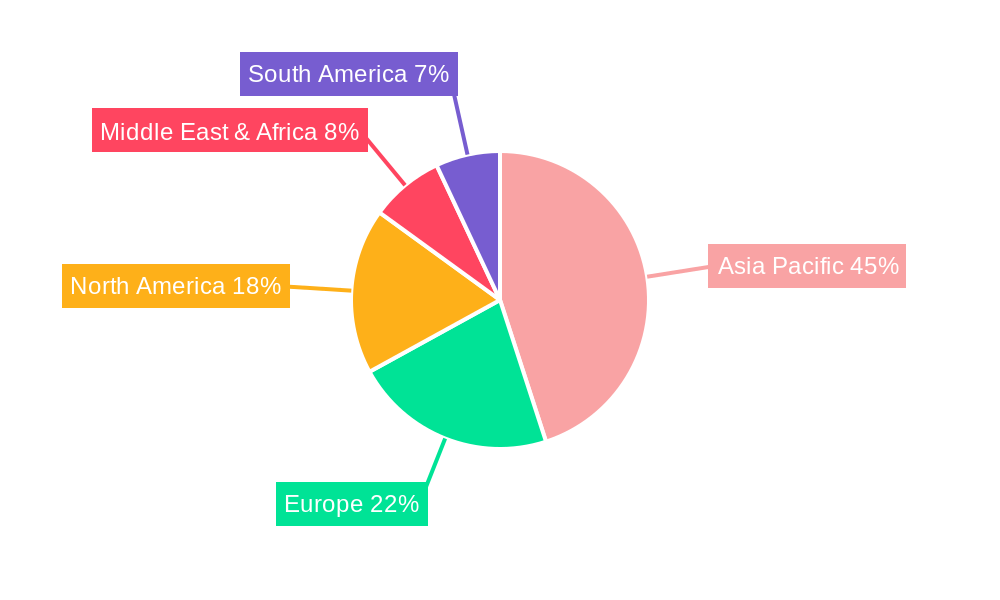

Steel Fabrication Industry in India Regional Market Share

Geographic Coverage of Steel Fabrication Industry in India

Steel Fabrication Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- 3.4. Market Trends

- 3.4.1. Rising Demand for Pre-engineered Buildings and Components

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Energy

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Manufacturing

- 6.1.2. Power and Energy

- 6.1.3. Construction

- 6.1.4. Oil and Gas

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Heavy Sectional Steel

- 6.2.2. Light Sectional Steel

- 6.2.3. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. South America Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Manufacturing

- 7.1.2. Power and Energy

- 7.1.3. Construction

- 7.1.4. Oil and Gas

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Heavy Sectional Steel

- 7.2.2. Light Sectional Steel

- 7.2.3. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Manufacturing

- 8.1.2. Power and Energy

- 8.1.3. Construction

- 8.1.4. Oil and Gas

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Heavy Sectional Steel

- 8.2.2. Light Sectional Steel

- 8.2.3. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Middle East & Africa Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Manufacturing

- 9.1.2. Power and Energy

- 9.1.3. Construction

- 9.1.4. Oil and Gas

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Heavy Sectional Steel

- 9.2.2. Light Sectional Steel

- 9.2.3. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Asia Pacific Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Manufacturing

- 10.1.2. Power and Energy

- 10.1.3. Construction

- 10.1.4. Oil and Gas

- 10.1.5. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Heavy Sectional Steel

- 10.2.2. Light Sectional Steel

- 10.2.3. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bharat Process And Mechanical Engineers Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Onshore Construction Company Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Geodesic Techniques Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sharp Tanks And Structurals Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UB Engineering Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Space Chem Engineers Private Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arun Fabricators

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Indhya Engineering Associates

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DD Erectors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 John Erectors Private Limited**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bharat Process And Mechanical Engineers Limited

List of Figures

- Figure 1: Global Steel Fabrication Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: South America Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: South America Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 27: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Steel Fabrication Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 39: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Steel Fabrication Industry in India?

The projected CAGR is approximately 4.37%.

2. Which companies are prominent players in the Steel Fabrication Industry in India?

Key companies in the market include Bharat Process And Mechanical Engineers Limited, Onshore Construction Company Private Limited, Geodesic Techniques Private Limited, Sharp Tanks And Structurals Private Limited, UB Engineering Limited, Space Chem Engineers Private Limited, Arun Fabricators, Indhya Engineering Associates, DD Erectors, John Erectors Private Limited**List Not Exhaustive.

3. What are the main segments of the Steel Fabrication Industry in India?

The market segments include End-user Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India.

6. What are the notable trends driving market growth?

Rising Demand for Pre-engineered Buildings and Components.

7. Are there any restraints impacting market growth?

Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India.

8. Can you provide examples of recent developments in the market?

April 2023: AM Mining, a joint venture between Arcelor Mittal Luxembourg and Nippon Steel Corporation, Japan to acquire Indian Steel Corpn for INR 897 crore. The acquisition of Indian Steel Corporation will likely enhance downstream capabilities and broaden its product portfolio as the company looks to capitalize on market opportunities presented by the steel industry, especially in high-value-added steel production besides capturing synergies across downstream operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Steel Fabrication Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Steel Fabrication Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Steel Fabrication Industry in India?

To stay informed about further developments, trends, and reports in the Steel Fabrication Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence