Key Insights

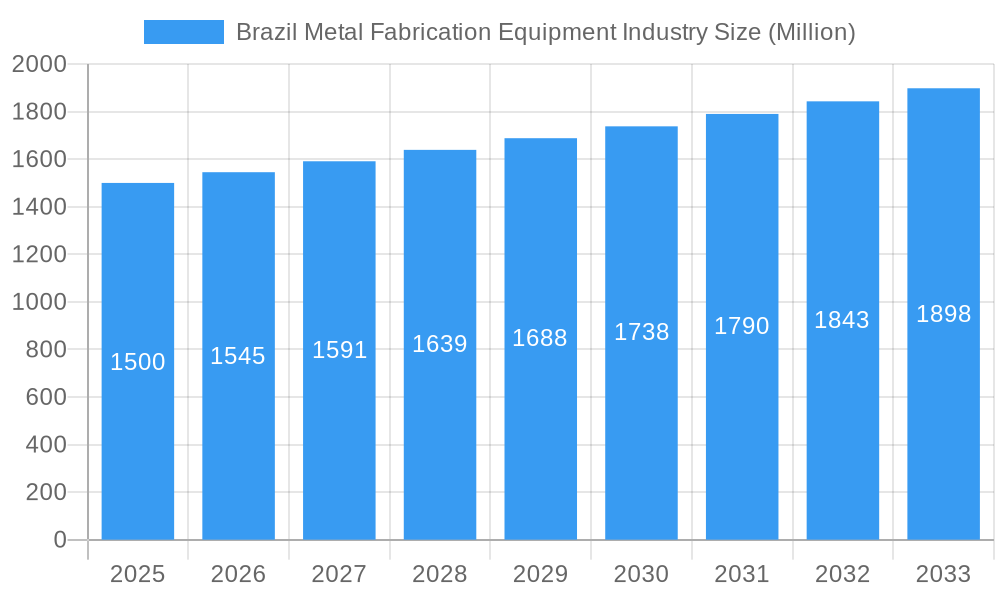

The Brazilian metal fabrication equipment market, projected at $1.3 billion in 2025, is expected to experience significant expansion with a CAGR of 2.86% from 2025 to 2033. Key growth drivers include the robust demand from Brazil's expanding automotive and aerospace industries, coupled with substantial investments in infrastructure development. Furthermore, increasing domestic consumption and a strengthening manufacturing sector contribute to this upward trend. Potential challenges include economic volatility and global supply chain disruptions. The market comprises international leaders such as Amada and DMG Mori, alongside domestic players like BMA Brazil. Segmentation is anticipated across equipment types, end-use industries, and key regions like São Paulo and Minas Gerais.

Brazil Metal Fabrication Equipment Industry Market Size (In Billion)

The forecast for 2025-2033 indicates sustained growth, influenced by macroeconomic factors and government policies. Manufacturers are advised to prioritize technological innovation, automation, and digitalization to meet the demand for customized solutions. Superior after-sales service and local support are vital for customer retention. The outlook for the Brazilian metal fabrication equipment market remains positive, supported by economic expansion and industrial production, with ongoing vigilance regarding economic indicators and global events recommended for precise forecasting.

Brazil Metal Fabrication Equipment Industry Company Market Share

Brazil Metal Fabrication Equipment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil metal fabrication equipment industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. The report delves into parent markets (e.g., manufacturing, construction) and child markets (e.g., sheet metal fabrication, welding equipment) to provide a granular view of market segments. Market values are presented in million units.

Brazil Metal Fabrication Equipment Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Brazilian metal fabrication equipment industry. The market is characterized by a moderate level of concentration, with key players holding xx% of the market share in 2025. Technological innovation, driven by Industry 4.0 initiatives and automation, is a key driver of growth. However, barriers such as high initial investment costs and a skilled labor shortage hinder widespread adoption. Regulatory frameworks, including environmental regulations and safety standards, influence market dynamics. The increasing adoption of advanced materials and alternative manufacturing processes is leading to the emergence of competitive product substitutes.

- Market Concentration: xx% held by top 5 players in 2025.

- Technological Innovation: Focus on automation, robotics, and digitalization.

- Regulatory Framework: Emphasis on safety, environmental compliance, and import/export regulations.

- Competitive Substitutes: Growing adoption of 3D printing and additive manufacturing techniques.

- M&A Activity: xx deals recorded between 2019-2024, with an average deal value of xx million.

- End-User Demographics: Predominantly automotive, construction, and industrial machinery sectors.

Brazil Metal Fabrication Equipment Industry Growth Trends & Insights

The Brazilian metal fabrication equipment market experienced significant growth during the historical period (2019-2024), driven by factors such as infrastructure development, industrial expansion, and government initiatives promoting manufacturing. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing automation adoption across various sectors, rising demand for customized solutions, and the growing need for enhanced efficiency and productivity in manufacturing processes. Technological disruptions, such as the introduction of advanced materials and digital manufacturing technologies, are reshaping the market landscape. Consumer behavior shifts toward sustainable and eco-friendly manufacturing practices also influence market trends.

Dominant Regions, Countries, or Segments in Brazil Metal Fabrication Equipment Industry

The Southeast region of Brazil dominates the metal fabrication equipment market, accounting for xx% of the total market share in 2025. This dominance is attributed to several factors, including the high concentration of manufacturing industries, robust infrastructure, and a skilled workforce. São Paulo, in particular, serves as a key hub for metal fabrication activities. Other regions, such as South and Northeast, are also witnessing gradual growth, driven by investments in infrastructure and industrial development. The automotive and construction segments are the largest consumers of metal fabrication equipment, contributing significantly to the market's overall growth.

- Key Drivers in Southeast Region: Strong industrial base, skilled labor, and well-developed infrastructure.

- Growth Potential in Other Regions: Investments in infrastructure and industrial parks are fostering growth in other regions.

- Dominant Segments: Automotive, construction, and industrial machinery sectors.

- Market Share: Southeast Region (xx%), South Region (xx%), Northeast Region (xx%).

Brazil Metal Fabrication Equipment Industry Product Landscape

The Brazilian market offers a diverse range of metal fabrication equipment, including laser cutting machines, CNC machining centers, bending machines, welding equipment, and press brakes. Product innovations focus on enhancing precision, speed, automation, and integration with digital manufacturing platforms. These advancements are driven by the increasing demand for high-quality, customized products and the need for efficient production processes. Unique selling propositions often involve features like enhanced precision, reduced energy consumption, and user-friendly interfaces.

Key Drivers, Barriers & Challenges in Brazil Metal Fabrication Equipment Industry

Key Drivers: Government initiatives to promote industrialization, infrastructure development, growth in the automotive and construction sectors, increasing automation demand, and the adoption of advanced manufacturing techniques are major drivers.

Key Challenges: High initial investment costs, limited access to financing, skilled labor shortages, fluctuating exchange rates, and import tariffs pose significant challenges. These challenges often result in decreased market penetration and reduced investment in advanced technologies. Supply chain disruptions, particularly during economic downturns, also impact market growth.

Emerging Opportunities in Brazil Metal Fabrication Equipment Industry

Emerging opportunities lie in the increasing demand for customized metal fabrication solutions, the growing adoption of additive manufacturing, and the expansion of the renewable energy sector. Untapped markets in smaller cities and rural areas present potential for growth. The adoption of Industry 4.0 technologies, including IoT and data analytics, offers significant opportunities for enhanced productivity and efficiency.

Growth Accelerators in the Brazil Metal Fabrication Equipment Industry

Long-term growth will be fueled by technological advancements such as AI-powered automation, the adoption of sustainable manufacturing practices, and the increasing demand for lightweight and high-strength materials. Strategic partnerships between equipment manufacturers and end-users, along with government initiatives promoting technological innovation and skill development, will accelerate market expansion.

Key Players Shaping the Brazil Metal Fabrication Equipment Market

- BMA Brazil

- Colfax

- DMG Mori

- Amada

- Shenyang Machine Tool

- Hurco

- Kennametal

- MAG Giddings & Lewis

- List Not Exhaustive

Notable Milestones in Brazil Metal Fabrication Equipment Industry Sector

- 2020: Government launches a program to incentivize adoption of Industry 4.0 technologies in the manufacturing sector.

- 2022: Major player Amada announces expansion of its Brazilian manufacturing facility.

- 2023: New environmental regulations impact the market, requiring manufacturers to adopt cleaner production methods.

- 2024: A significant merger occurs between two key players, leading to increased market consolidation.

In-Depth Brazil Metal Fabrication Equipment Industry Market Outlook

The Brazilian metal fabrication equipment market is poised for continued growth over the forecast period, driven by strong economic fundamentals, government support for industrial development, and the increasing adoption of advanced technologies. Strategic investments in automation, digitalization, and sustainable manufacturing practices will be crucial for players seeking to capitalize on emerging opportunities and maintain a competitive edge. The market presents significant potential for both domestic and international players, particularly those focusing on innovation, customization, and value-added services.

Brazil Metal Fabrication Equipment Industry Segmentation

-

1. Product type

- 1.1. Automatic

- 1.2. Semi - automatic

- 1.3. Manual

-

2. Equipment type

- 2.1. Cutting

- 2.2. Machining

- 2.3. Forming

- 2.4. Welding

- 2.5. Other Equipment Types

-

3. End User industry

- 3.1. Oil and Gas

- 3.2. Manufacturing

- 3.3. Power and Utilities

- 3.4. Construction

- 3.5. Other End-user Industries

Brazil Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Brazil

Brazil Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Brazil Metal Fabrication Equipment Industry

Brazil Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing sector promises a greater boom in the region for the metal fabrication equipment market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Automatic

- 5.1.2. Semi - automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Equipment type

- 5.2.1. Cutting

- 5.2.2. Machining

- 5.2.3. Forming

- 5.2.4. Welding

- 5.2.5. Other Equipment Types

- 5.3. Market Analysis, Insights and Forecast - by End User industry

- 5.3.1. Oil and Gas

- 5.3.2. Manufacturing

- 5.3.3. Power and Utilities

- 5.3.4. Construction

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BMA Brazil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DMG Mori

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amada

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shenyang Machine Tool

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hurco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kennametal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAG Giddings & Lewis*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BMA Brazil

List of Figures

- Figure 1: Brazil Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 2: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Equipment type 2020 & 2033

- Table 3: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by End User industry 2020 & 2033

- Table 4: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 6: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Equipment type 2020 & 2033

- Table 7: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by End User industry 2020 & 2033

- Table 8: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Metal Fabrication Equipment Industry?

The projected CAGR is approximately 2.86%.

2. Which companies are prominent players in the Brazil Metal Fabrication Equipment Industry?

Key companies in the market include BMA Brazil, Colfax, DMG Mori, Amada, Shenyang Machine Tool, Hurco, Kennametal, MAG Giddings & Lewis*List Not Exhaustive.

3. What are the main segments of the Brazil Metal Fabrication Equipment Industry?

The market segments include Product type, Equipment type, End User industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing sector promises a greater boom in the region for the metal fabrication equipment market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Brazil Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence