Key Insights

The Canadian metal fabrication equipment market is poised for significant expansion, with an estimated market size of $6.5 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 1.6% through 2033. This growth is propelled by increasing demand for customized metal components in construction, automotive, and aerospace sectors, alongside advancements in automation and robotics enhancing productivity and precision. Government initiatives supporting industrial modernization and infrastructure development are also fostering a conducive investment climate. Key market players like BTD Manufacturing, Colfax, and Atlas Copco are driving innovation and strategic partnerships. The industry is increasingly adopting advanced technologies such as laser cutting, 3D printing, and automated welding, alongside a growing emphasis on sustainable, energy-efficient equipment.

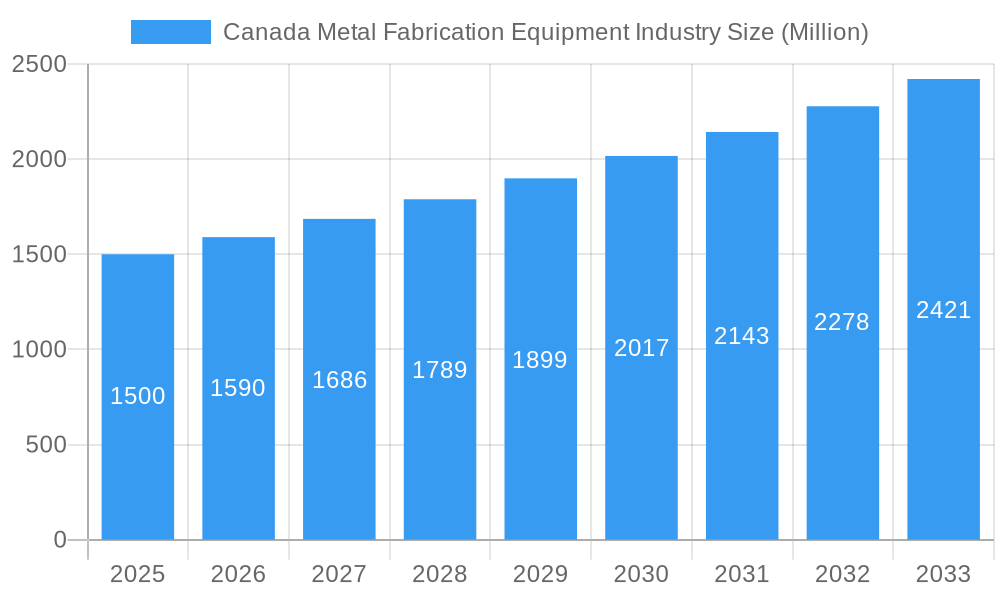

Canada Metal Fabrication Equipment Industry Market Size (In Billion)

The market is segmented by equipment type, material processed, and end-user industry. While specific segment data is proprietary, automated and digitally integrated equipment is expected to capture a substantial share. Regional market distribution aligns with manufacturing hubs, with Ontario and Quebec likely dominating. The sustained demand, coupled with strategic investments by industry leaders, indicates a robust and promising future for the Canadian metal fabrication equipment market.

Canada Metal Fabrication Equipment Industry Company Market Share

Canada Metal Fabrication Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian metal fabrication equipment industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) and leverages proprietary data sources to deliver actionable insights for industry professionals. This report is specifically tailored for investors, manufacturers, suppliers, and anyone seeking a comprehensive understanding of this dynamic market. The parent market is the broader Canadian manufacturing equipment industry, while the child market is specifically metal fabrication equipment.

Canada Metal Fabrication Equipment Industry Market Dynamics & Structure

The Canadian metal fabrication equipment market is characterized by a moderately concentrated landscape, with several major players and a number of smaller, specialized firms. Market concentration is estimated at xx%, with the top five players holding approximately yy% of the market share in 2024. Technological innovation, driven by advancements in automation, robotics, and digitalization, is a key driver of growth. Stringent regulatory frameworks concerning safety and environmental standards significantly impact industry operations. The market faces competition from substitute materials and manufacturing processes, primarily in sectors requiring lower precision or volume. The end-user demographic is diverse, including automotive, aerospace, construction, and energy companies. Recent years have witnessed a moderate level of M&A activity, with a total of xx deals recorded between 2019 and 2024, reflecting consolidation and expansion strategies.

- Market Concentration: xx% (2024), Top 5 players: yy% (2024)

- Key Drivers: Technological innovation (automation, robotics, digitalization), infrastructure development

- Key Restraints: Regulatory compliance costs, competition from substitute materials, skilled labor shortages

- M&A Activity: xx deals (2019-2024)

Canada Metal Fabrication Equipment Industry Growth Trends & Insights

The Canadian metal fabrication equipment market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of $xx million in 2024. This growth is attributed to increased investment in infrastructure projects, particularly in the energy and construction sectors. Adoption rates for advanced technologies like laser cutting and robotic welding have been steadily increasing, driven by improved efficiency and productivity. Technological disruptions, such as the rise of additive manufacturing (3D printing), are gradually impacting the market, albeit at a slower pace than in other regions. Consumer behavior shifts towards greater demand for customized and high-precision fabricated parts are shaping market trends. The forecast period (2025-2033) projects a CAGR of yy%, with the market expected to reach $zz million by 2033. Market penetration of advanced technologies is projected to increase significantly.

Dominant Regions, Countries, or Segments in Canada Metal Fabrication Equipment Industry

Ontario and Quebec are the dominant regions in the Canadian metal fabrication equipment market, accounting for approximately xx% of the total market value in 2024. This dominance is driven by factors including the concentration of manufacturing industries, a well-established supply chain, and supportive government policies aimed at fostering industrial growth. The automotive and aerospace sectors are key drivers in Ontario, while Quebec benefits from a strong presence in the construction and energy industries. The sheet metal fabrication segment holds the largest market share, followed by structural steel fabrication. Future growth potential is strongest in Western Canada, particularly in the energy and resource extraction sectors, fuelled by investment in mining and oil and gas projects.

- Key Drivers (Ontario & Quebec): Strong manufacturing base, established supply chains, government support

- Growth Potential: Western Canada (energy, mining)

Canada Metal Fabrication Equipment Industry Product Landscape

The product landscape is characterized by a wide range of equipment, including laser cutting machines, press brakes, robotic welding systems, and automated material handling solutions. Recent innovations include enhanced precision and speed, improved safety features, and integration with advanced software for process optimization and data analytics. Unique selling propositions often center on productivity enhancements, reduced operating costs, and superior product quality. Technological advancements are primarily focused on improving automation levels, incorporating AI and machine learning for predictive maintenance and process control, and optimizing energy efficiency.

Key Drivers, Barriers & Challenges in Canada Metal Fabrication Equipment Industry

Key Drivers: Increased infrastructure spending, growth in the automotive and aerospace sectors, rising demand for customized metal components, government incentives for technological upgrades.

Key Challenges & Restraints: Supply chain disruptions (material shortages, logistics delays), escalating energy costs, skilled labor shortages, intense competition from foreign manufacturers, and fluctuating exchange rates impacting import/export costs.

Emerging Opportunities in Canada Metal Fabrication Equipment Industry

Emerging opportunities lie in the adoption of Industry 4.0 technologies, including the Internet of Things (IoT) and cloud-based solutions for enhanced connectivity and data analytics. Growth is anticipated in niche sectors like medical device manufacturing and sustainable energy solutions. Furthermore, increased adoption of additive manufacturing technologies, along with a focus on environmentally friendly production methods, presents significant potential.

Growth Accelerators in the Canada Metal Fabrication Equipment Industry

Long-term growth will be driven by technological advancements, particularly in automation and digitalization, leading to increased productivity and efficiency. Strategic partnerships between equipment manufacturers and end-users will facilitate the adoption of advanced technologies and customized solutions. Government initiatives supporting industrial innovation and sustainable manufacturing will also play a critical role. Expansion into new markets, like renewable energy and infrastructure development, will contribute significantly to growth.

Key Players Shaping the Canada Metal Fabrication Equipment Market

- BTD Manufacturing

- Colfax (Colfax Corporation)

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc (Sandvik)

- STANDARD IRON & WIRE WORKS INC

- TRUMPF Canada Inc (TRUMPF)

- Atlas Copco (Atlas Copco)

- AMADA Canada (AMADA)

- DMG MORI Canada (DMG MORI)

- List Not Exhaustive

Notable Milestones in Canada Metal Fabrication Equipment Industry Sector

- February 2022: Arrow Machine and Fabrication Group acquired Steelcraft, expanding its customer base and manufacturing footprint.

- January 2022: Ag Growth International Inc. (AGI) acquired Eastern Fabricators, strengthening its presence in the food processing equipment market.

In-Depth Canada Metal Fabrication Equipment Industry Market Outlook

The Canadian metal fabrication equipment market is poised for sustained growth over the forecast period, driven by technological advancements, infrastructure development, and increasing demand from key end-user sectors. Strategic investments in automation and digitalization, coupled with the adoption of sustainable manufacturing practices, will unlock significant opportunities for market players. Companies focusing on innovation, strategic partnerships, and expansion into new market segments are expected to thrive in this dynamic landscape.

Canada Metal Fabrication Equipment Industry Segmentation

-

1. Service Type

- 1.1. Machining and Cutting

- 1.2. Forming

- 1.3. Welding

- 1.4. Other Service Type

-

2. Product Type

- 2.1. Automatic

- 2.2. Semi-automatic

- 2.3. Manual

-

3. End User Industry

- 3.1. Manufacturing

- 3.2. Power and Utilities

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Other End-user Industries

Canada Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Canada

Canada Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Canada Metal Fabrication Equipment Industry

Canada Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Industry Offers Immense Demand for the Metal Fabrication Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.2. Forming

- 5.1.3. Welding

- 5.1.4. Other Service Type

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.2.3. Manual

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Manufacturing

- 5.3.2. Power and Utilities

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BTD Manufacturing

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komaspec

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matcor Matsu Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandvik Mining and Construction Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STANDARD IRON & WIRE WORKS INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas Copco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMADA Canada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DMG MORI Canada**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BTD Manufacturing

List of Figures

- Figure 1: Canada Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Metal Fabrication Equipment Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Canada Metal Fabrication Equipment Industry?

Key companies in the market include BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, DMG MORI Canada**List Not Exhaustive.

3. What are the main segments of the Canada Metal Fabrication Equipment Industry?

The market segments include Service Type, Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Industry Offers Immense Demand for the Metal Fabrication Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: Arrow Machine and Fabrication Group of Guelph, Ontario, announced the acquisition of Steelcraft, a Kitchener, Ontario, steel design, engineering, and fabrication firm. This acquisition expands Arrow's global customer base and manufacturing footprint. It also further promotes the company's strategy of partnering with leading operator-run machining and fabrication organizations to leverage their collective capabilities, solve customer problems, and develop deeper supply chain interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Canada Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence