Key Insights

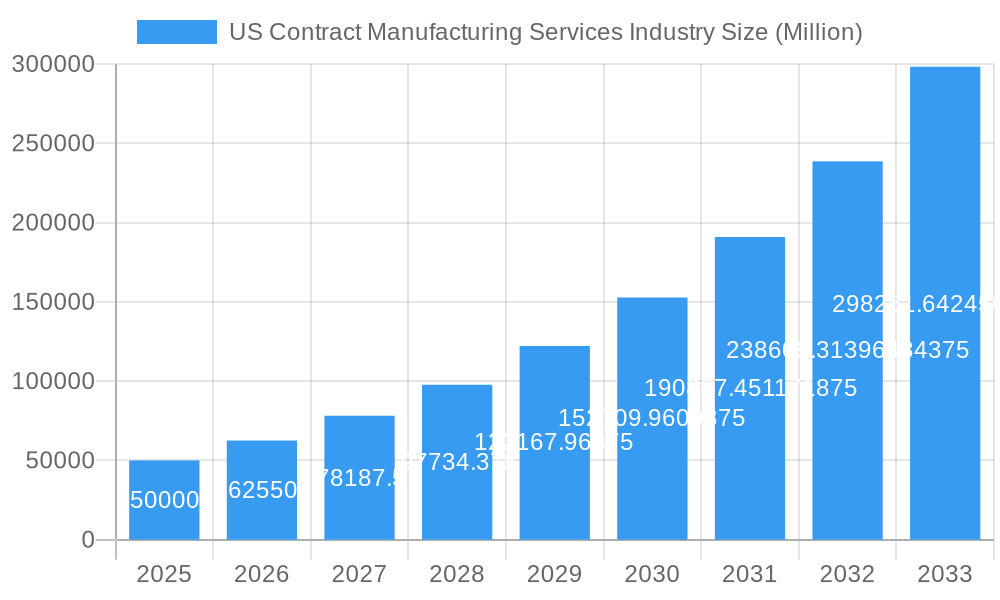

The US contract manufacturing services (CMS) industry is experiencing robust growth, fueled by several key factors. The increasing demand for outsourced manufacturing solutions across diverse sectors, including pharmaceuticals, food and beverages, and cosmetics, is a primary driver. Companies are increasingly focusing on core competencies and outsourcing non-core functions like manufacturing to reduce operational costs, improve efficiency, and gain access to specialized expertise. This trend is further amplified by the rising complexity of product development and regulatory compliance, particularly in sectors like pharmaceuticals. The industry's growth trajectory indicates a significant expansion in the coming years. Considering a CAGR of 25.10% and a 2025 market size (let's assume, based on industry averages and the provided CAGR, a reasonable estimate would be $50 billion USD), the market is expected to exceed $100 billion USD by 2033. This substantial growth is anticipated across all segments, driven by technological advancements, increasing adoption of automation in manufacturing processes, and the ongoing trend towards globalization of supply chains.

US Contract Manufacturing Services Industry Market Size (In Billion)

However, the CMS industry also faces challenges. Competition is intense, with both large multinational corporations and smaller, specialized contract manufacturers vying for market share. Maintaining consistent quality and meeting stringent regulatory requirements across diverse sectors remains a crucial concern. Moreover, supply chain disruptions and fluctuations in raw material prices pose ongoing risks to profitability and timely delivery. Nonetheless, the long-term outlook for the US CMS industry remains positive, fueled by continuous innovation, the rising adoption of advanced manufacturing technologies, and the sustained demand for outsourced manufacturing capabilities across various industries. This presents significant opportunities for established players as well as new entrants who can effectively address the evolving needs of their clients in a dynamic and competitive market environment.

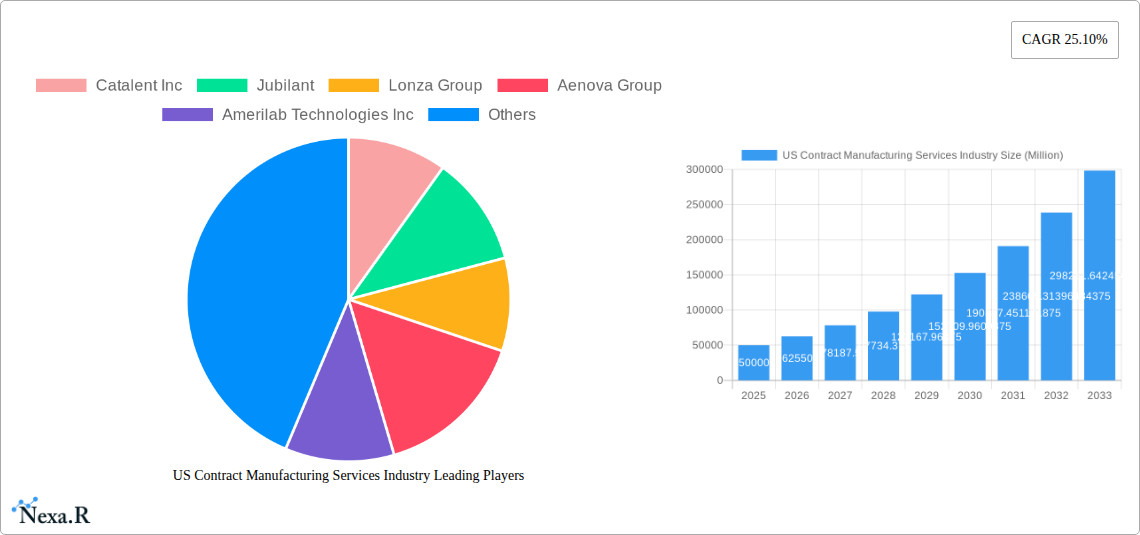

US Contract Manufacturing Services Industry Company Market Share

US Contract Manufacturing Services Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the US Contract Manufacturing Services (CMS) industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Contract Manufacturing) and child markets (Pharmaceuticals, Food & Beverage, Cosmetics, etc.), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Market Size (in Million USD): xx (2019), xx (2024), xx (2025), xx (2033) (Projected values)

US Contract Manufacturing Services Industry Market Dynamics & Structure

The US CMS industry is characterized by a moderately concentrated market structure, with a few large players holding significant market share, but numerous smaller niche players also contributing. Technological innovation, particularly in automation and digitalization, is a major driver, alongside stringent regulatory frameworks (e.g., FDA regulations for pharmaceuticals). Competitive product substitutes exist depending on the specific segment (e.g., in-house manufacturing), and end-user demographics are diverse, spanning various industries. Mergers and acquisitions (M&A) activity remains substantial, driven by consolidation and expansion strategies.

- Market Concentration: High, with the top 5 players holding approximately xx% market share in 2025 (projected).

- Technological Innovation: Focus on automation, AI, and data analytics driving efficiency and reducing costs. Barriers to innovation include high capital investment and regulatory compliance.

- Regulatory Frameworks: Stringent regulations, particularly within pharmaceuticals and food & beverage, significantly impact operational costs and strategies.

- M&A Activity: xx deals recorded in 2019-2024, with an average deal value of xx million USD. Consolidation expected to continue.

- End-User Demographics: Diverse, including pharmaceutical, food & beverage, cosmetics, and other consumer goods companies.

US Contract Manufacturing Services Industry Growth Trends & Insights

The US CMS market has witnessed consistent growth over the past years, driven by several factors. Increasing outsourcing by companies seeking cost optimization and focus on core competencies is a key trend. Technological disruptions, such as advanced automation and AI-powered solutions, are enhancing efficiency and flexibility. Changing consumer behavior, particularly the demand for customized products and faster delivery times, is also driving growth. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration is projected to increase from xx% in 2025 to xx% by 2033.

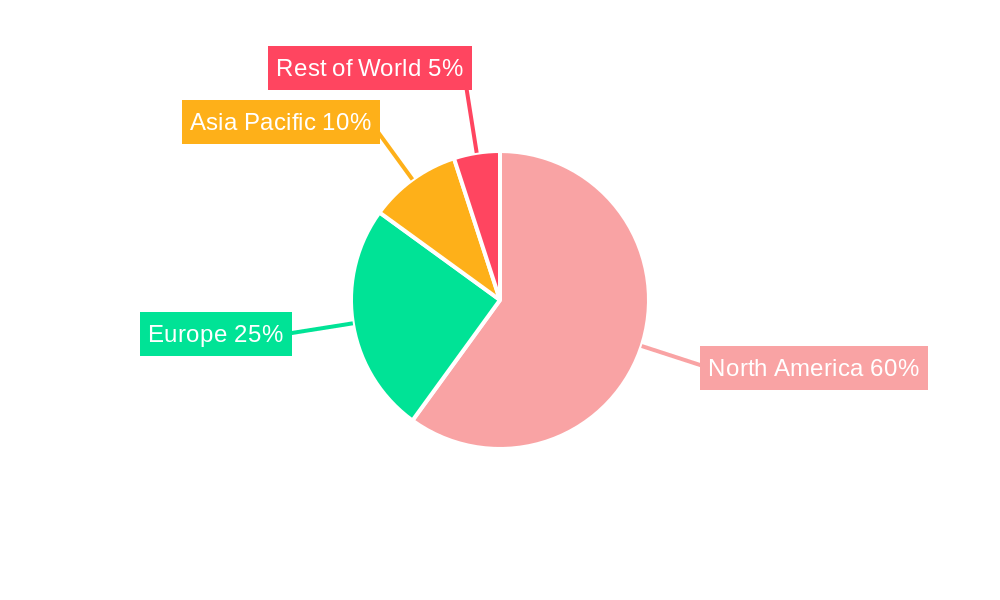

Dominant Regions, Countries, or Segments in US Contract Manufacturing Services Industry

The Northeast and West Coast regions dominate the US CMS market due to established industrial clusters and proximity to key consumer markets. California, New York, and Pennsylvania are leading states. The pharmaceutical segment constitutes the largest portion of the market, followed by food and beverage.

- Key Drivers:

- Developed infrastructure and skilled labor pool in key regions.

- Strong regulatory frameworks encouraging high-quality manufacturing.

- High concentration of end-user companies in specific regions.

- Market Share & Growth Potential:

- Northeast region holds approximately xx% market share (projected 2025).

- Pharmaceutical segment anticipated to grow at xx% CAGR during the forecast period.

US Contract Manufacturing Services Industry Product Landscape

The product landscape is diverse, ranging from basic contract manufacturing services to highly specialized solutions. Innovations focus on customized packaging, improved efficiency, and sustainable practices. Key performance metrics include production speed, quality control, and cost-effectiveness. Unique selling propositions often center on specialized expertise in particular industries, advanced technology utilization, or superior customer service.

Key Drivers, Barriers & Challenges in US Contract Manufacturing Services Industry

Key Drivers:

- Growing demand for outsourced manufacturing from diverse industries.

- Technological advancements leading to higher efficiency and cost reductions.

- Favorable government policies and incentives for domestic manufacturing.

Key Challenges:

- Supply chain disruptions (e.g., material shortages, transportation delays) causing production delays and increased costs. Quantifiable impact: xx% increase in lead times in 2022.

- Stringent regulatory compliance costs, especially in pharmaceuticals.

- Intense competition from both domestic and international players.

Emerging Opportunities in US Contract Manufacturing Services Industry

- Growth in niche markets like personalized medicine and sustainable packaging.

- Expansion into emerging technologies like 3D printing and additive manufacturing.

- Increased demand for contract manufacturing services in emerging economies.

Growth Accelerators in the US Contract Manufacturing Services Industry Industry

Technological breakthroughs such as advanced automation and AI will significantly accelerate market growth. Strategic partnerships between CMS providers and technology companies will enhance efficiency and innovation. Expansion into new geographic markets and diversification into new product categories will also fuel growth.

Key Players Shaping the US Contract Manufacturing Services Industry Market

- Catalent Inc

- Jubilant

- Lonza Group

- Aenova Group

- Amerilab Technologies Inc

- Bernet Food & Beverage

- Big Brands LLC

- Delamaine Fine Foods Limited

- Brooklyn Bottling

- CSD Co-Packers

- Southeast Bottling & Beverages

- G3 Enterprises

- Western Innovations

- Niagara Bottling and Robinsons Breweries

- KIK Custom Products

- Sensible Organics

- Colep

- Cosmetic Essence LLC

- Formula Cap

Notable Milestones in US Contract Manufacturing Services Industry Sector

- July 2021: Catalent Inc launched GPEx lightning, a next-generation cell line development technology, shortening drug development timelines by three months.

- May 2022: Lonza and Israel Biotech Fund collaborated on a framework agreement to support biologics and small molecule development and manufacturing, facilitating Lonza's access to the Israeli market.

In-Depth US Contract Manufacturing Services Industry Market Outlook

The US CMS industry is poised for continued growth, driven by technological advancements, increasing outsourcing trends, and the expansion of niche markets. Strategic partnerships and investments in automation will be crucial for maintaining competitiveness. The market presents significant opportunities for companies to capitalize on the growing demand for efficient, high-quality contract manufacturing services.

US Contract Manufacturing Services Industry Segmentation

-

1. pharmaceutical

- 1.1. Current Market Scenario and growth influencers

- 1.2. Market B

-

1.3. Active P

- 1.3.1. Small molecule

- 1.3.2. Large Molecule

- 1.3.3. High Potency API (HPAPI)

-

1.4. Finished

- 1.4.1. Solid Dose Formulation

- 1.4.2. Liquid Dose Formulation

- 1.4.3. Injectable Dose Formulation

- 1.5. Secondary Packaging

-

2. Food processing & manufacturing

- 2.1. Market Breakdown - by Service Type

- 2.2. Current Market Scenario and growth influencers

-

2.3. Food Manufacturing Services

- 2.3.1. Convenience Foods

- 2.3.2. Bakery Products

- 2.3.3. Confectionary Products

- 2.3.4. Dairy Products

- 2.3.5. Research & Development

- 2.3.6. Food Packaging Services

-

3. Beverage

- 3.1. Current Market Scenario and growth influencers

-

3.2. Market B

- 3.2.1. Beer

- 3.2.2. Carbonated Drinks & Fruit-based Beverages

- 3.2.3. Bottled Water

- 3.2.4. Others (Sport Drinks)

-

4. Personal Care

- 4.1. Current Market Scenario and growth influencers

-

4.2. Market Breakdown - by Type

- 4.2.1. Skin Care

- 4.2.2. Hair Care

- 4.2.3. Make up & Color Cosmetics

- 4.2.4. Others

US Contract Manufacturing Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Contract Manufacturing Services Industry Regional Market Share

Geographic Coverage of US Contract Manufacturing Services Industry

US Contract Manufacturing Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers

- 3.3. Market Restrains

- 3.3.1. Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers

- 3.4. Market Trends

- 3.4.1. Growth of Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 5.1.1. Current Market Scenario and growth influencers

- 5.1.2. Market B

- 5.1.3. Active P

- 5.1.3.1. Small molecule

- 5.1.3.2. Large Molecule

- 5.1.3.3. High Potency API (HPAPI)

- 5.1.4. Finished

- 5.1.4.1. Solid Dose Formulation

- 5.1.4.2. Liquid Dose Formulation

- 5.1.4.3. Injectable Dose Formulation

- 5.1.5. Secondary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 5.2.1. Market Breakdown - by Service Type

- 5.2.2. Current Market Scenario and growth influencers

- 5.2.3. Food Manufacturing Services

- 5.2.3.1. Convenience Foods

- 5.2.3.2. Bakery Products

- 5.2.3.3. Confectionary Products

- 5.2.3.4. Dairy Products

- 5.2.3.5. Research & Development

- 5.2.3.6. Food Packaging Services

- 5.3. Market Analysis, Insights and Forecast - by Beverage

- 5.3.1. Current Market Scenario and growth influencers

- 5.3.2. Market B

- 5.3.2.1. Beer

- 5.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 5.3.2.3. Bottled Water

- 5.3.2.4. Others (Sport Drinks)

- 5.4. Market Analysis, Insights and Forecast - by Personal Care

- 5.4.1. Current Market Scenario and growth influencers

- 5.4.2. Market Breakdown - by Type

- 5.4.2.1. Skin Care

- 5.4.2.2. Hair Care

- 5.4.2.3. Make up & Color Cosmetics

- 5.4.2.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 6. North America US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 6.1.1. Current Market Scenario and growth influencers

- 6.1.2. Market B

- 6.1.3. Active P

- 6.1.3.1. Small molecule

- 6.1.3.2. Large Molecule

- 6.1.3.3. High Potency API (HPAPI)

- 6.1.4. Finished

- 6.1.4.1. Solid Dose Formulation

- 6.1.4.2. Liquid Dose Formulation

- 6.1.4.3. Injectable Dose Formulation

- 6.1.5. Secondary Packaging

- 6.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 6.2.1. Market Breakdown - by Service Type

- 6.2.2. Current Market Scenario and growth influencers

- 6.2.3. Food Manufacturing Services

- 6.2.3.1. Convenience Foods

- 6.2.3.2. Bakery Products

- 6.2.3.3. Confectionary Products

- 6.2.3.4. Dairy Products

- 6.2.3.5. Research & Development

- 6.2.3.6. Food Packaging Services

- 6.3. Market Analysis, Insights and Forecast - by Beverage

- 6.3.1. Current Market Scenario and growth influencers

- 6.3.2. Market B

- 6.3.2.1. Beer

- 6.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 6.3.2.3. Bottled Water

- 6.3.2.4. Others (Sport Drinks)

- 6.4. Market Analysis, Insights and Forecast - by Personal Care

- 6.4.1. Current Market Scenario and growth influencers

- 6.4.2. Market Breakdown - by Type

- 6.4.2.1. Skin Care

- 6.4.2.2. Hair Care

- 6.4.2.3. Make up & Color Cosmetics

- 6.4.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 7. South America US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 7.1.1. Current Market Scenario and growth influencers

- 7.1.2. Market B

- 7.1.3. Active P

- 7.1.3.1. Small molecule

- 7.1.3.2. Large Molecule

- 7.1.3.3. High Potency API (HPAPI)

- 7.1.4. Finished

- 7.1.4.1. Solid Dose Formulation

- 7.1.4.2. Liquid Dose Formulation

- 7.1.4.3. Injectable Dose Formulation

- 7.1.5. Secondary Packaging

- 7.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 7.2.1. Market Breakdown - by Service Type

- 7.2.2. Current Market Scenario and growth influencers

- 7.2.3. Food Manufacturing Services

- 7.2.3.1. Convenience Foods

- 7.2.3.2. Bakery Products

- 7.2.3.3. Confectionary Products

- 7.2.3.4. Dairy Products

- 7.2.3.5. Research & Development

- 7.2.3.6. Food Packaging Services

- 7.3. Market Analysis, Insights and Forecast - by Beverage

- 7.3.1. Current Market Scenario and growth influencers

- 7.3.2. Market B

- 7.3.2.1. Beer

- 7.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 7.3.2.3. Bottled Water

- 7.3.2.4. Others (Sport Drinks)

- 7.4. Market Analysis, Insights and Forecast - by Personal Care

- 7.4.1. Current Market Scenario and growth influencers

- 7.4.2. Market Breakdown - by Type

- 7.4.2.1. Skin Care

- 7.4.2.2. Hair Care

- 7.4.2.3. Make up & Color Cosmetics

- 7.4.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 8. Europe US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 8.1.1. Current Market Scenario and growth influencers

- 8.1.2. Market B

- 8.1.3. Active P

- 8.1.3.1. Small molecule

- 8.1.3.2. Large Molecule

- 8.1.3.3. High Potency API (HPAPI)

- 8.1.4. Finished

- 8.1.4.1. Solid Dose Formulation

- 8.1.4.2. Liquid Dose Formulation

- 8.1.4.3. Injectable Dose Formulation

- 8.1.5. Secondary Packaging

- 8.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 8.2.1. Market Breakdown - by Service Type

- 8.2.2. Current Market Scenario and growth influencers

- 8.2.3. Food Manufacturing Services

- 8.2.3.1. Convenience Foods

- 8.2.3.2. Bakery Products

- 8.2.3.3. Confectionary Products

- 8.2.3.4. Dairy Products

- 8.2.3.5. Research & Development

- 8.2.3.6. Food Packaging Services

- 8.3. Market Analysis, Insights and Forecast - by Beverage

- 8.3.1. Current Market Scenario and growth influencers

- 8.3.2. Market B

- 8.3.2.1. Beer

- 8.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 8.3.2.3. Bottled Water

- 8.3.2.4. Others (Sport Drinks)

- 8.4. Market Analysis, Insights and Forecast - by Personal Care

- 8.4.1. Current Market Scenario and growth influencers

- 8.4.2. Market Breakdown - by Type

- 8.4.2.1. Skin Care

- 8.4.2.2. Hair Care

- 8.4.2.3. Make up & Color Cosmetics

- 8.4.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 9. Middle East & Africa US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 9.1.1. Current Market Scenario and growth influencers

- 9.1.2. Market B

- 9.1.3. Active P

- 9.1.3.1. Small molecule

- 9.1.3.2. Large Molecule

- 9.1.3.3. High Potency API (HPAPI)

- 9.1.4. Finished

- 9.1.4.1. Solid Dose Formulation

- 9.1.4.2. Liquid Dose Formulation

- 9.1.4.3. Injectable Dose Formulation

- 9.1.5. Secondary Packaging

- 9.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 9.2.1. Market Breakdown - by Service Type

- 9.2.2. Current Market Scenario and growth influencers

- 9.2.3. Food Manufacturing Services

- 9.2.3.1. Convenience Foods

- 9.2.3.2. Bakery Products

- 9.2.3.3. Confectionary Products

- 9.2.3.4. Dairy Products

- 9.2.3.5. Research & Development

- 9.2.3.6. Food Packaging Services

- 9.3. Market Analysis, Insights and Forecast - by Beverage

- 9.3.1. Current Market Scenario and growth influencers

- 9.3.2. Market B

- 9.3.2.1. Beer

- 9.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 9.3.2.3. Bottled Water

- 9.3.2.4. Others (Sport Drinks)

- 9.4. Market Analysis, Insights and Forecast - by Personal Care

- 9.4.1. Current Market Scenario and growth influencers

- 9.4.2. Market Breakdown - by Type

- 9.4.2.1. Skin Care

- 9.4.2.2. Hair Care

- 9.4.2.3. Make up & Color Cosmetics

- 9.4.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 10. Asia Pacific US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 10.1.1. Current Market Scenario and growth influencers

- 10.1.2. Market B

- 10.1.3. Active P

- 10.1.3.1. Small molecule

- 10.1.3.2. Large Molecule

- 10.1.3.3. High Potency API (HPAPI)

- 10.1.4. Finished

- 10.1.4.1. Solid Dose Formulation

- 10.1.4.2. Liquid Dose Formulation

- 10.1.4.3. Injectable Dose Formulation

- 10.1.5. Secondary Packaging

- 10.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 10.2.1. Market Breakdown - by Service Type

- 10.2.2. Current Market Scenario and growth influencers

- 10.2.3. Food Manufacturing Services

- 10.2.3.1. Convenience Foods

- 10.2.3.2. Bakery Products

- 10.2.3.3. Confectionary Products

- 10.2.3.4. Dairy Products

- 10.2.3.5. Research & Development

- 10.2.3.6. Food Packaging Services

- 10.3. Market Analysis, Insights and Forecast - by Beverage

- 10.3.1. Current Market Scenario and growth influencers

- 10.3.2. Market B

- 10.3.2.1. Beer

- 10.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 10.3.2.3. Bottled Water

- 10.3.2.4. Others (Sport Drinks)

- 10.4. Market Analysis, Insights and Forecast - by Personal Care

- 10.4.1. Current Market Scenario and growth influencers

- 10.4.2. Market Breakdown - by Type

- 10.4.2.1. Skin Care

- 10.4.2.2. Hair Care

- 10.4.2.3. Make up & Color Cosmetics

- 10.4.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Catalent Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jubilant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lonza Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aenova Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amerilab Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bernet Food & Beverage

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Big Brands LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Delamaine Fine Foods Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brooklyn Bottling

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSD Co-Packers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Southeast Bottling & Beverages

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 G3 Enterprises

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Western Innovations

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Niagara Bottling and Robinsons Breweries

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KIK Custom Products

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sensible Organics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Colep

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Cosmetic Essence LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Formula Cap*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Catalent Inc

List of Figures

- Figure 1: Global US Contract Manufacturing Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 3: North America US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 4: North America US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 5: North America US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 6: North America US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 7: North America US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 8: North America US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 9: North America US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 10: North America US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 13: South America US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 14: South America US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 15: South America US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 16: South America US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 17: South America US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 18: South America US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 19: South America US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 20: South America US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 23: Europe US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 24: Europe US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 25: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 26: Europe US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 27: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 28: Europe US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 29: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 30: Europe US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 33: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 34: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 35: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 36: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 37: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 38: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 39: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 40: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 43: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 44: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 45: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 46: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 47: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 48: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 49: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 50: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 2: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 3: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 4: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 5: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 7: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 8: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 9: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 10: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 15: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 16: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 17: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 18: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 23: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 24: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 25: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 26: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 37: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 38: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 39: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 40: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 48: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 49: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 50: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 51: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Contract Manufacturing Services Industry?

The projected CAGR is approximately 25.10%.

2. Which companies are prominent players in the US Contract Manufacturing Services Industry?

Key companies in the market include Catalent Inc, Jubilant, Lonza Group, Aenova Group, Amerilab Technologies Inc, Bernet Food & Beverage, Big Brands LLC, Delamaine Fine Foods Limited, Brooklyn Bottling, CSD Co-Packers, Southeast Bottling & Beverages, G3 Enterprises, Western Innovations, Niagara Bottling and Robinsons Breweries, KIK Custom Products, Sensible Organics, Colep, Cosmetic Essence LLC, Formula Cap*List Not Exhaustive.

3. What are the main segments of the US Contract Manufacturing Services Industry?

The market segments include pharmaceutical, Food processing & manufacturing, Beverage, Personal Care.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers.

6. What are the notable trends driving market growth?

Growth of Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs.

7. Are there any restraints impacting market growth?

Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers.

8. Can you provide examples of recent developments in the market?

May 2022 - Lonza and Israel Biotech Fund Collaborated Framework Agreement to Support Biologics and Small Molecules Development and Manufacture for Portfolio Companies which Facilitate Access to Israeli Market for Lonza.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Contract Manufacturing Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Contract Manufacturing Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Contract Manufacturing Services Industry?

To stay informed about further developments, trends, and reports in the US Contract Manufacturing Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence